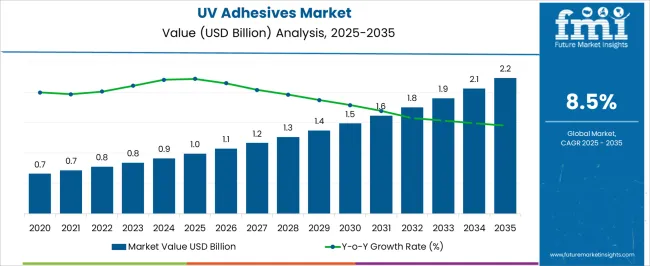

The UV adhesives market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period. The UV adhesives market is expected to experience steady expansion in the first five-year block, increasing from USD 1 billion in 2025 to USD 1.5 billion by 2030. This growth has been reinforced by the rising demand for fast-curing, high-strength bonding solutions across multiple industrial applications, including electronics assembly, automotive components, and medical device manufacturing.

From an industry perspective, the adoption of UV-curable adhesives is being accelerated due to their precision, reduced curing time, and compatibility with diverse substrates. The incremental growth highlights that stakeholders are increasingly valuing productivity enhancements and process efficiency, making UV adhesives a preferred choice over conventional bonding methods. The steady progression over the five-year period underscores that the market is maturing while still offering substantial opportunities for product differentiation and specialized formulations. Between 2025 and 2030, the market trajectory reflects a consistent upward movement, with annual values rising from USD 1 billion to USD 1.5 billion.

The growth pattern indicates that manufacturers focusing on customizable formulations, improved chemical resistance, and ease of integration into automated production lines are likely to capture significant market share. The five-year block demonstrates that UV adhesives are becoming integral to precision manufacturing processes, where reliability and speed are prioritized. The market’s expansion is not just a result of broader industrial demand but also a reflection of strategic product positioning, emphasizing cost-effectiveness, operational efficiency, and enhanced performance. By 2030, the UV adhesives market is expected to be recognized as a critical segment within the adhesives industry, attracting investment and competitive activity from leading suppliers.

| Metric | Value |

|---|---|

| UV Adhesives Market Estimated Value in (2025 E) | USD 1.0 billion |

| UV Adhesives Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The UV adhesives market constitutes a notable segment within its parent markets, driven by its rapid curing capabilities and precision bonding. Within the broader adhesives and sealants market, UV adhesives account for approximately 5–10% of the total market share, reflecting their specialized applications in various industries. In the industrial adhesives market, UV adhesives represent around 8–12%, as they are increasingly utilized in manufacturing processes requiring quick and reliable bonding solutions.

The electronic assembly materials market sees UV adhesives comprising about 15–20%, particularly in applications such as component assembly and encapsulation, where their fast curing and minimal thermal impact are advantageous. In the medical device adhesives market, UV adhesives hold a share of approximately 10–15%, owing to their use in assembling devices that demand high precision and biocompatibility. The packaging adhesives market, especially in sectors like food and beverage, cosmetics, and pharmaceuticals, has UV adhesives constituting around 5–8%, driven by the need for efficient and clean bonding processes.

Despite challenges such as the need for UV light exposure and equipment costs, the market share distribution indicates a clear trend towards the adoption of UV adhesives in specialized applications.

Demand has been reinforced by the adhesives’ rapid curing capabilities, strong adhesion properties, and compatibility with diverse substrates, which have positioned them as a preferred choice in specialized production environments. Market expansion is being further supported by the shift toward solvent-free and environmentally compliant adhesive solutions, aligning with regulatory trends and sustainability goals. Technological advancements in UV curing equipment and formulation chemistry are enhancing performance characteristics, enabling stronger market penetration in high-value sectors.

In developed markets, adoption is being driven by innovation in electronics and medical devices, while emerging economies are experiencing accelerated uptake through industrial automation and infrastructure investments. Over the forecast period, continued research and development, improved production efficiency, and expansion of application scope are expected to sustain revenue growth and strengthen competitive positioning for market leaders.

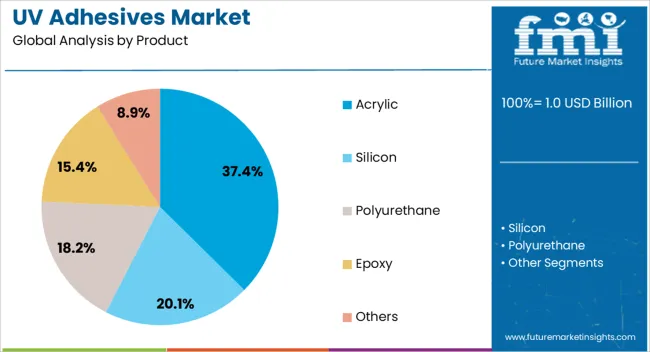

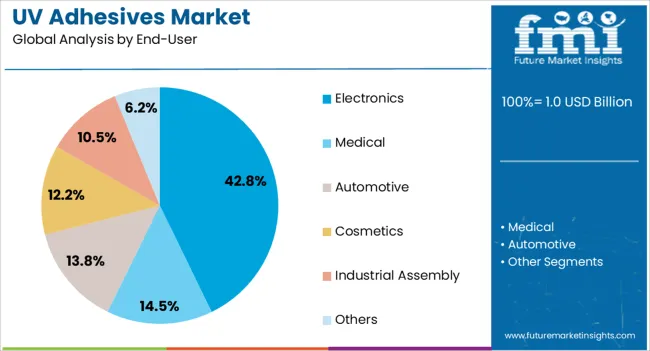

The uv adhesives market is segmented by product, end-user, and geographic regions. By product, uv adhesives market is divided into Acrylic, Silicon, Polyurethane, Epoxy, and Others. In terms of end-user, uv adhesives market is classified into Electronics, Medical, Automotive, Cosmetics, Industrial Assembly, and Others. Regionally, the uv adhesives industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The acrylic segment, holding 37.40% of the product category, has established itself as the leading formulation due to its superior bonding strength, versatility, and resistance to environmental factors. Its dominance has been reinforced by widespread adoption in applications requiring high optical clarity and strong mechanical performance.

The segment benefits from compatibility with a broad range of substrates, including plastics, metals, and glass, making it a preferred choice for manufacturers seeking flexible yet durable bonding solutions. Production advancements have enhanced curing speed and minimized shrinkage, improving efficiency in assembly lines and precision manufacturing.

Regulatory compliance with low-VOC and solvent-free requirements has further boosted its acceptance in environmentally conscious markets. As technological developments in electronics, automotive components, and optical devices progress, the acrylic UV adhesive segment is expected to maintain a strong growth trajectory, supported by its balance of performance, cost-efficiency, and adaptability to evolving end-user requirements.

The electronics segment, accounting for 42.80% of the end-user category, has maintained its lead due to the increasing integration of UV adhesives in advanced device assembly and component protection. The need for high-precision bonding, thermal stability, and moisture resistance in miniaturized electronic components is driving demand. The segment benefits from strong alignment with trends in wearable technology, consumer electronics, and high-speed communication devices, where reliability and production efficiency are critical.

UV adhesives offer rapid curing times that support just-in-time manufacturing processes, reducing production bottlenecks and enhancing throughput. Additionally, their ability to bond sensitive materials without excessive heat exposure has made them essential in semiconductor packaging and optical component manufacturing.

Continuous innovation in adhesive formulations to improve conductivity, thermal management, and chemical resistance is expected to reinforce their role in next-generation electronics production. With sustained global demand for high-performance electronics, the segment is positioned for long-term growth and deeper market integration.

The UV adhesives market is growing due to rising demand from electronics, automotive, and medical sectors. Opportunities exist in renewable energy, optical devices, and specialized industrial applications. Trends highlight fast-curing, low-shrinkage, and environmentally friendly formulations, while high costs and substrate limitations pose challenges. Overall, the market is expected to expand steadily as manufacturers focus on innovation, precision bonding, and efficiency-driven solutions in advanced industrial applications.

The UV adhesives market is witnessing robust demand due to increasing adoption in electronics, automotive, and medical device manufacturing. Their fast curing properties, strong bonding capabilities, and precision application make them ideal for assembling smartphones, wearables, automotive components, and medical equipment. The demand is further driven by miniaturization of devices and the need for lightweight, durable bonding solutions. Manufacturers are increasingly integrating UV adhesives into automated assembly lines, highlighting their efficiency in high-volume production processes and reinforcing steady market growth across industrial sectors.

Opportunities in the UV adhesives market are expanding as industries explore novel applications in renewable energy, healthcare, and optical devices. Solar panel assembly, flexible electronics, and medical device manufacturing increasingly rely on UV-curable adhesives for precise and reliable bonding. Growing investments in electric vehicles, optical lenses, and wearable technologies create further avenues for market expansion. Companies offering customized formulations for specific substrates and operational conditions can capitalize on these opportunities, strengthening their presence in niche, high-value industrial segments.

A key trend in the market is the development of fast-curing, low-shrinkage, and environmentally friendly UV adhesives. Manufacturers are focusing on formulations that minimize VOC emissions, improve energy efficiency, and enhance substrate compatibility. Integration with automation systems and robotics is increasingly common to support high-speed production and precision assembly. These trends reflect the emphasis on operational efficiency, sustainability-conscious manufacturing, and superior performance, positioning UV adhesives as a critical enabler of advanced industrial assembly processes across electronics, automotive, and healthcare sectors.

The UV adhesives market faces challenges related to high material costs, specialized curing equipment, and substrate limitations. Certain applications require expensive UV light sources and precise process controls to ensure proper adhesion and avoid defects. Some substrates, such as opaque or thick materials, are less compatible with UV curing, limiting versatility. Additionally, competition from traditional adhesives and epoxy-based alternatives presents market pressure. Overcoming these challenges requires continuous R&D, cost-effective production methods, and enhanced technical support to facilitate broader adoption across diverse industrial applications.

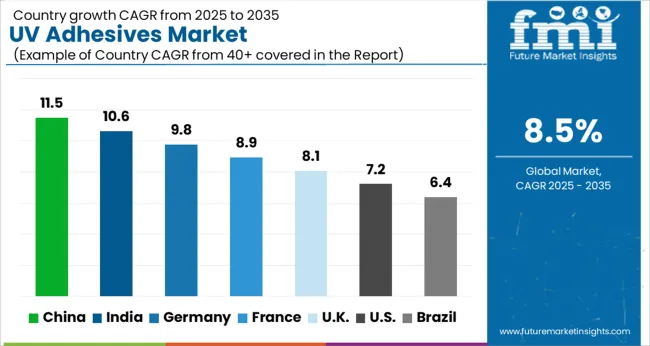

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

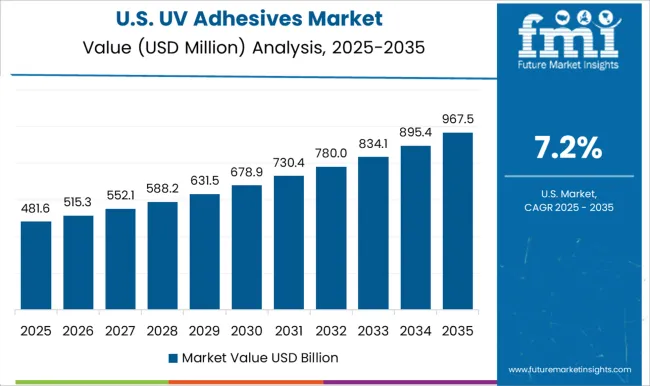

| USA | 7.2% |

| Brazil | 6.4% |

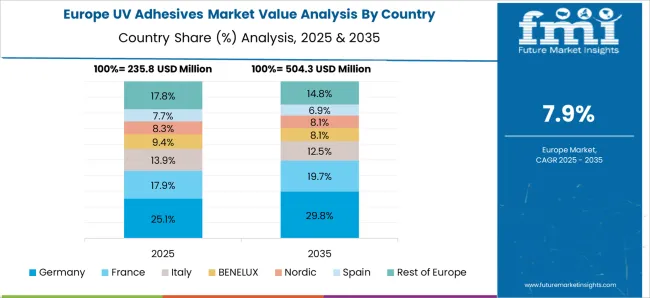

The global UV adhesives market is projected to grow at a CAGR of 8.5% from 2025 to 2035. China leads with a growth rate of 11.5%, followed by India at 10.6% and Germany at 9.8%. The United Kingdom is expected to expand at 8.1%, while the United States shows steady growth at 7.2%. Rising demand for high-performance adhesives in electronics, automotive, healthcare, and packaging applications is driving global adoption. Emerging markets like China and India are experiencing rapid industrial expansion, increased manufacturing activities, and growing use of UV-curable technologies. Mature markets such as the USA, UK, and Germany focus on enhancing production efficiency, product reliability, and regulatory compliance. These trends underscore the increasing penetration of UV adhesives across industries worldwide. This report includes insights on 40+ countries; the top markets are shown here for reference.

The UV adhesives market in China is projected to grow at a CAGR of 11.5%, the highest globally. Growing electronics, automotive, and packaging industries are driving demand for UV-curable adhesives. Manufacturers are adopting high-performance adhesives for bonding, sealing, and coating applications. Industrial automation and precision manufacturing in China further support the adoption of UV adhesives. The market benefits from increasing investments in local production capacities and R&D initiatives to improve adhesive properties and curing efficiency. Consumer demand for durable, lightweight, and environmentally friendly adhesives is also accelerating market expansion. China’s combination of rapid industrialization, technological integration, and strong supply chain infrastructure positions it as a key driver of global UV adhesives market growth.

The UV adhesives market in India is expected to expand at a CAGR of 10.6%. Rapid growth in electronics, automotive, and packaging sectors is encouraging adoption of UV-curable adhesives. Domestic manufacturers are enhancing production capabilities and integrating advanced adhesive formulations for diverse industrial applications. Increasing awareness of efficient bonding solutions and the need for precise, quick-curing adhesives is boosting demand. India’s expanding industrial base, coupled with investments in modern manufacturing facilities, is supporting wider adoption. International adhesive suppliers are collaborating with Indian players to introduce high-performance UV adhesive products. Rising focus on production efficiency and product reliability positions India as a fast-growing market in the Asia-Pacific region.

The UV adhesives market in Germany is projected to grow at a CAGR of 9.8%. German industries emphasize precision manufacturing, quality assurance, and regulatory compliance, encouraging adoption of UV adhesives. Sectors such as automotive, electronics, and healthcare are increasingly relying on UV-curable adhesives for bonding, sealing, and coating applications. R&D investments in improving curing speed, durability, and performance enhance product competitiveness. Environmental standards and energy efficiency considerations further drive interest in UV adhesives over conventional solutions. Distribution through industrial suppliers and partnerships with technology providers strengthens market growth. Germany’s focus on innovation and high-quality manufacturing ensures strong adoption and steady expansion in the European UV adhesives market.

The UV adhesives market in the United Kingdom is forecast to grow at a CAGR of 8.1%. Rising demand in electronics, automotive, and medical device sectors supports UV adhesive adoption. Manufacturers are increasingly deploying UV-curable adhesives for efficient bonding, rapid curing, and high-quality finishes. Investments in advanced adhesive technologies, coupled with collaboration with international suppliers, enhance product accessibility and performance. UK industries are adopting UV adhesives to reduce production time, improve reliability, and meet regulatory requirements. While the market growth is moderate compared to Asia, the UK continues to strengthen its position in Europe through technology integration, high-quality standards, and innovative adhesive solutions.

The UV adhesives market in the United States is expected to expand at a CAGR of 7.2%. USA industries, particularly electronics, automotive, and packaging, are increasingly using UV-curable adhesives for rapid curing, precise bonding, and long-lasting durability. Manufacturers focus on developing high-performance, environmentally compliant adhesives that meet strict industry regulations. Distribution through industrial suppliers, e-commerce, and direct partnerships enhances product availability nationwide. Continuous demand for operational efficiency, product reliability, and innovation in adhesive applications drives adoption. While growth is slower than in China or India, the USA remains a critical contributor to global UV adhesives demand due to large-scale manufacturing, strong industrial base, and technological expertise.

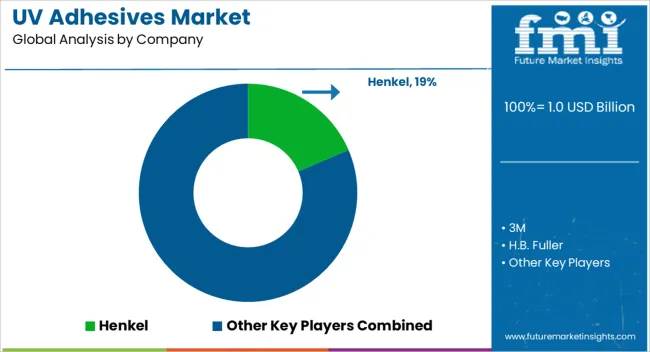

The UV adhesives market is being defined by leading chemical and materials companies focusing on high-performance bonding solutions across industrial, electronics, and medical applications. Henkel, 3M, and H.B. Fuller lead with formulations offering rapid curing, high strength, and chemical resistance, showcased in brochures highlighting efficiency, reliability, and precision. Permabond Engineering Adhesives and BASF SE differentiate through specialized UV-curable adhesives designed for electronics assembly, optical components, and industrial bonding. DowDuPont (Dow Corning) emphasizes hybrid solutions that combine UV curing with silicone or epoxy systems to meet demanding application requirements.

Other notable players, including Epoxy Technology Inc., Cartell UK Ltd, and Panacol-Elosol GmbH, focus on niche applications, offering adhesives tailored for medical devices, optics, and industrial manufacturing. DELO Industrial Adhesives, Excelitas Technologies Corp, and Dymax Corporation provide integrated solutions emphasizing fast curing, precise application, and compatibility with automated production lines. Brochures consistently highlight adhesion strength, process efficiency, and versatility across substrates. Market competition is driven by technological differentiation, reliability, and the ability to deliver UV adhesive solutions that improve manufacturing speed, reduce defects, and support high-volume production in diverse industrial segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.0 Billion |

| Product | Acrylic, Silicon, Polyurethane, Epoxy, and Others |

| End-User | Electronics, Medical, Automotive, Cosmetics, Industrial Assembly, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Henkel, 3M, H.B. Fuller, Permabond Engineering Adhesives, BASF SE, DowDuPont (Dow Corning), Epoxy Technology Inc, Cartell UK Ltd, Panacol-Elosol GmbH, DELO Industrial Adhesives, Excelitas Technologies Corp, and Dymax Corporation |

| Additional Attributes | Dollar sales by adhesive type (acrylic, epoxy, polyurethane) and application (electronics, medical devices, automotive, optical) are key metrics. Trends include rising demand for fast-curing and high-strength adhesives, growth in precision bonding applications, and adoption in advanced manufacturing processes. Regional adoption, technological advancements, and industry-specific requirements are driving market growth. |

The global UV adhesives market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the UV adhesives market is projected to reach USD 2.2 billion by 2035.

The UV adhesives market is expected to grow at an 8.5% CAGR between 2025 and 2035.

The key product types in UV adhesives market are acrylic, silicon, polyurethane, epoxy and others.

In terms of end-user, electronics segment to command 42.8% share in the UV adhesives market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UV-C Sterilizing Conveyors Market Analysis - Size and Share Forecast Outlook 2025 to 2035

UV Curable Resin and Formulated Products Market Size and Share Forecast Outlook 2025 to 2035

UV Stabilized Films Market Size and Share Forecast Outlook 2025 to 2035

UV Absorbers Market Size and Share Forecast Outlook 2025 to 2035

UV Cured Coatings Market Size and Share Forecast Outlook 2025 to 2035

UV-Protecting Polymers Market Size and Share Forecast Outlook 2025 to 2035

UV-C LED Market Size and Share Forecast Outlook 2025 to 2035

UV and Light Sensitive Packaging Market Size and Share Forecast Outlook 2025 to 2035

UV-Blocking Transparent Film Market Size and Share Forecast Outlook 2025 to 2035

UV Curable Coatings Market Size and Share Forecast Outlook 2025 to 2035

UVI Stretch Films Market Size and Share Forecast Outlook 2025 to 2035

UV Protected Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

UVC Disinfection Product Market Report – Demand, Trends & Forecast 2025–2035

Uveal Melanoma Treatment Market – Growth & Forecast 2025 to 2035

UV LED Printers Market Growth - Trends & Forecast 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

UV LED Market by Technology, Application, and Region – Growth, Trends, and Forecast through 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

Market Share Insights of UV Stabilized Films Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA