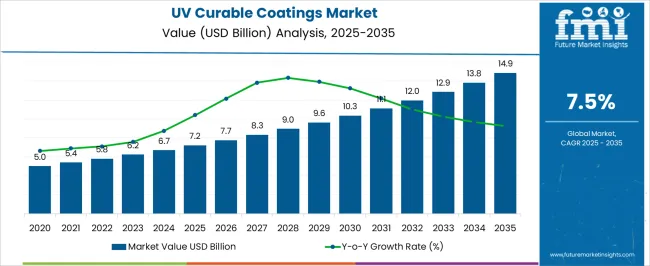

The UV curable coatings market is estimated to be valued at USD 7.2 billion in 2025 and is projected to reach USD 14.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 7.2 billion to USD 10.3 billion, driven by the increasing demand for eco-friendly and energy-efficient coatings in industries such as automotive, electronics, and packaging.

Year-on-year analysis shows steady growth, with values reaching USD 7.7 billion in 2026 and USD 8.3 billion in 2027, supported by advancements in UV curing technology and its applications in high-performance coatings. By 2028, the market is forecasted to reach USD 9.0 billion, advancing to USD 9.6 billion in 2029 and USD 10.3 billion by 2030. Growth will be further fueled by the rising adoption of UV curable coatings in industrial and consumer product applications, driven by their fast curing time, low environmental impact, and improved durability. These dynamics position UV curable coatings as a vital solution in the coatings industry, offering significant growth opportunities in the coming years across various sectors.

Coating formulators evaluate UV curable specifications based on cure speed characteristics, adhesion properties, and substrate compatibility when developing protective finishes for wood furniture, automotive components, and electronic device housings. Material selection involves analyzing photoinitiator systems, oligomer backbone chemistry, and reactive diluent combinations while considering viscosity requirements, pot life limitations, and final film properties necessary for specific application environments. Procurement decisions balance raw material costs against performance advantages including reduced processing time, improved durability characteristics, and environmental compliance benefits that influence manufacturing efficiency and regulatory adherence throughout production operations.

Manufacturing processes require specialized mixing equipment, degassing systems, and quality control procedures that ensure consistent formulation properties while preventing contamination and maintaining photoinitiator stability throughout storage and handling operations. Production coordination involves managing raw material inventory, batch documentation, and testing protocols while maintaining temperature control and light protection necessary for UV coating stability. Quality assurance procedures address viscosity monitoring, cure response testing, and film property validation that confirm coating performance specifications while supporting customer application requirements and regulatory compliance standards.

Cross-functional coordination involves coating chemists, application engineers, and quality control specialists collaborating to optimize formulations that balance cure efficiency with final coating properties while addressing specific customer performance requirements and manufacturing constraints. Application development encompasses substrate preparation protocols, curing equipment specifications, and process parameter optimization while coordinating with equipment manufacturers and end-user facilities. Training programs address formulation principles, application techniques, and troubleshooting procedures essential for maintaining coating quality and achieving optimal curing results throughout diverse manufacturing environments.

| Metric | Value |

|---|---|

| UV Curable Coatings Market Estimated Value in (2025 E) | USD 7.2 billion |

| UV Curable Coatings Market Forecast Value in (2035 F) | USD 14.9 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The UV curable coatings market is expanding steadily as demand grows for fast-curing and environmentally friendly finishing solutions across various industries. Advances in coating technology have made UV curable coatings more versatile and efficient, offering benefits such as low volatile organic compound emissions and rapid curing times.

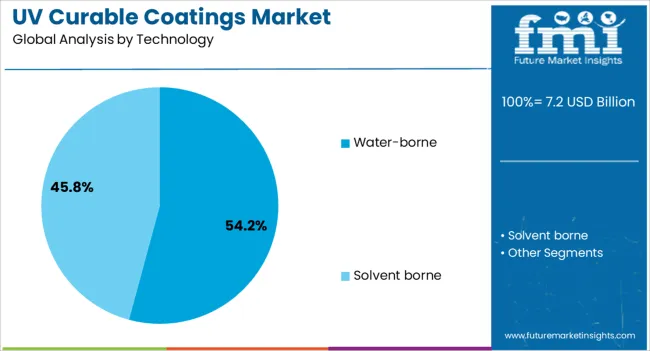

The increasing preference for sustainable water-borne technologies has contributed significantly to market growth by reducing environmental impact while maintaining performance. End-use industries such as furniture and woodworking have driven adoption due to the coatings’ ability to provide durable, high-gloss finishes that enhance product aesthetics and longevity.

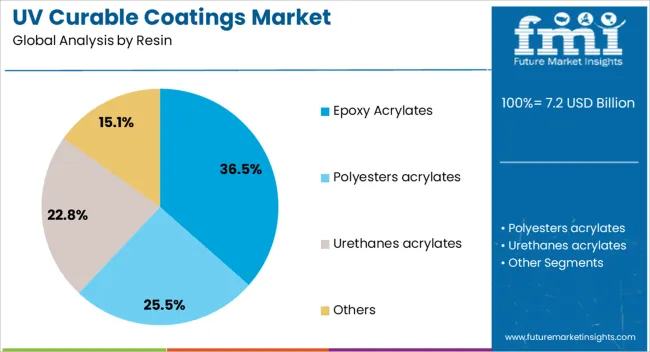

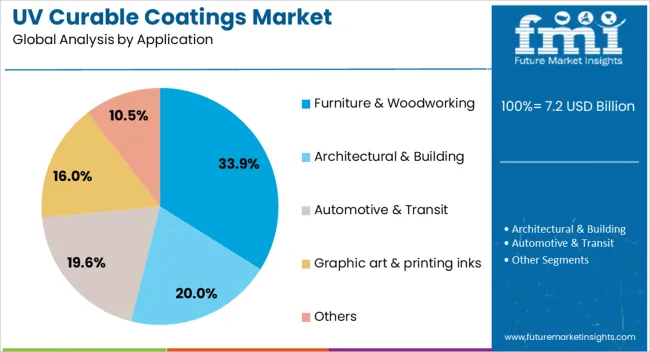

Industry focus on improving production efficiency and reducing downtime has further encouraged the use of UV curable coatings. Market growth is expected to continue as technological innovations and stricter environmental regulations encourage broader use of eco-friendly and high-performance coatings. Segmental growth is anticipated to be led by epoxy acrylates in resin types, water-borne technology as the leading curing method, and furniture and woodworking as a primary application.

The UV curable coatings market is segmented by resin, technology, application, and geographic regions. By resin, the UV curable coatings market is divided into Epoxy Acrylates, Polyesters Acrylates, Urethanes Acrylates, and Others. In terms of technology, the UV curable coatings market is classified into Water-borne and solvent-borne. Based on application, the UV curable coatings market is segmented into Furniture & Woodworking, Architectural & Building, Automotive & Transit, Graphic art & printing inks, and Others. Regionally, the UV curable coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The epoxy acrylates resin segment is projected to hold 36.5% of the UV curable coatings market revenue in 2025, securing its position as the dominant resin type. Growth has been driven by epoxy acrylates’ excellent adhesion, chemical resistance, and mechanical properties, making them ideal for demanding applications.

Their ability to form tough, durable films that withstand wear and environmental exposure has led to their widespread adoption in furniture and woodworking. Formulators have favored epoxy acrylates due to their compatibility with various additives and pigments, enabling tailored performance characteristics.

Additionally, advances in resin synthesis have improved curing speed and film clarity. These advantages position epoxy acrylates as a preferred choice in the expanding UV curable coatings market.

The water-borne technology segment is expected to contribute 54.2% of the market revenue in 2025, maintaining its lead as the preferred UV curing method. This growth has been propelled by increasing environmental regulations aimed at reducing solvent emissions and promoting sustainable manufacturing practices.

Water-borne UV coatings provide an effective solution by combining the environmental benefits of water-based systems with the fast curing times and durability of UV technology. Their ease of application and reduced hazardous waste generation have appealed to coating manufacturers and end users.

Furthermore, improvements in water-borne formulations have enhanced film performance and weather resistance, expanding their use in interior and exterior furniture applications. The water-borne segment is expected to continue growing due to increasing eco-consciousness and regulatory support.

The furniture and woodworking segment is projected to hold 33.9% of the UV curable coatings market revenue in 2025, leading all application sectors. This growth reflects the industry’s demand for high-quality surface finishes that improve both appearance and durability of wooden products.

UV curable coatings offer rapid curing and excellent resistance to scratches and chemicals, which aligns with the requirements of furniture manufacturers and woodworkers seeking to enhance product longevity and consumer appeal. The segment has benefited from trends favoring customized finishes and environmentally friendly coating solutions.

Additionally, expanding production in residential and commercial furniture sectors, coupled with increasing consumer spending on home décor, has further supported market expansion. As manufacturers continue to prioritize efficiency and sustainability, the furniture and woodworking segment is poised to remain a key driver of UV curable coating demand.

The UV curable coatings market is driven by increasing demand for high-performance coatings, particularly in the packaging and automotive sectors. Opportunities are rising in eco-friendly trends like water-based and bio-based coatings. However, challenges such as high raw material costs and equipment investment may hinder market growth. By 2025, overcoming these barriers through more cost-effective solutions and accessible raw materials will be key to sustaining market expansion.

The UV curable coatings market is growing due to the increasing demand for high-performance coatings in industries such as automotive, packaging, and electronics. UV-curable coatings offer advantages like fast curing times, superior durability, and environmental benefits, which make them ideal for a wide range of applications. By 2025, as industries seek more efficient and long-lasting coatings, the market for UV curable coatings is expected to expand, particularly in regions with high industrial output.

Opportunities in the UV curable coatings market are growing in the packaging and automotive sectors. In packaging, the demand for UV coatings is driven by their ability to enhance the appearance and durability of printed materials. The automotive sector also benefits from UV coatings due to their resistance to scratches and UV degradation. By 2025, these sectors are expected to continue driving market growth, with UV curable coatings being increasingly used in both decorative and functional applications.

Emerging trends in the UV curable coatings market include the rising demand for water-based UV coatings and bio-based materials. As industries seek more eco-friendly options, water-based UV coatings are gaining popularity due to their lower volatile organic compound (VOC) emissions. Additionally, the development of bio-based UV curable coatings made from renewable resources is creating new growth opportunities. By 2025, these environmentally conscious trends will shape the market, offering alternatives that meet both performance and regulatory standards.

Despite growth, challenges related to high costs and limited raw material availability persist in the UV curable coatings market. The production of high-quality UV coatings requires specialized raw materials, which can be expensive and subject to supply chain disruptions. Additionally, while the technology provides many benefits, the initial cost of UV curing equipment can deter small manufacturers from adopting the technology. By 2025, addressing these challenges through more affordable raw materials and cost-efficient equipment will be crucial for expanding market reach.

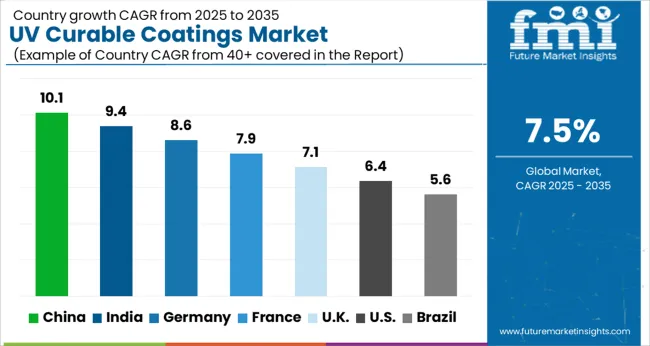

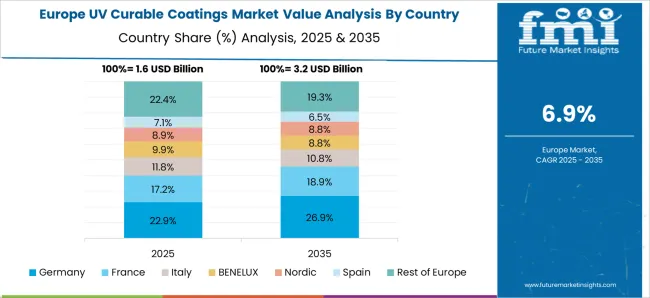

The global UV curable coatings market is projected to grow at a 7.5% CAGR from 2025 to 2035. China leads with a growth rate of 10.1%, followed by India at 9.4%, and France at 7.9%. The United Kingdom records a growth rate of 7.1%, while the United States shows the slowest growth at 6.4%. These varying growth rates are driven by factors such as increasing demand for energy-efficient coatings, environmental regulations promoting low-VOC products, and advancements in the automotive, electronics, and packaging industries. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, infrastructure development, and rising demand for sustainable and high-performance coatings, while more mature markets like the USA and the UK see steady growth driven by the increasing adoption of UV curing technologies in multiple industrial applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

The UV curable coatings market in China is growing rapidly, with a projected CAGR of 10.1%. China’s rapidly expanding industrial sector, particularly in automotive, electronics, and packaging industries, is driving the demand for UV curable coatings. The country’s increasing focus on environmental sustainability and energy efficiency, coupled with stringent regulations on volatile organic compound (VOC) emissions, is accelerating the adoption of UV curable coatings. Additionally, China’s push toward modernizing its manufacturing sector and increasing investments in advanced coating technologies further fuels market growth.

The UV curable coatings market in India is projected to grow at a CAGR of 9.4%. India’s growing demand for environmentally friendly and energy-efficient coatings in various industries, such as automotive, packaging, and electronics, is driving the adoption of UV curable coatings. The country’s expanding manufacturing sector, along with increasing government regulations promoting sustainability, is further accelerating the market’s growth. Additionally, the growing focus on replacing traditional solvent-based coatings with UV curable alternatives, which offer faster drying times and improved performance, is contributing to the growing demand for these coatings in India.

The UV curable coatings market in France is projected to grow at a CAGR of 7.9%. France’s strong industrial base, combined with growing demand for energy-efficient coatings in automotive, packaging, and electronics industries, is driving the adoption of UV curable coatings. The country’s emphasis on sustainability, coupled with EU regulations on VOC emissions and eco-friendly products, is contributing to market growth. Additionally, France’s focus on innovative coating technologies and reducing environmental impacts further accelerates the adoption of UV curable coatings in industrial applications.

The UV curable coatings market in the United Kingdom is projected to grow at a CAGR of 7.1%. The UK market is driven by growing demand for UV curable coatings in the automotive, packaging, and graphic arts industries. The country’s increasing focus on environmental sustainability and the adoption of energy-efficient technologies are contributing to the steady growth of UV curable coatings. Additionally, the UK’s stringent regulations on VOC emissions and its push toward reducing environmental footprints in manufacturing sectors are further boosting the demand for UV curable coatings.

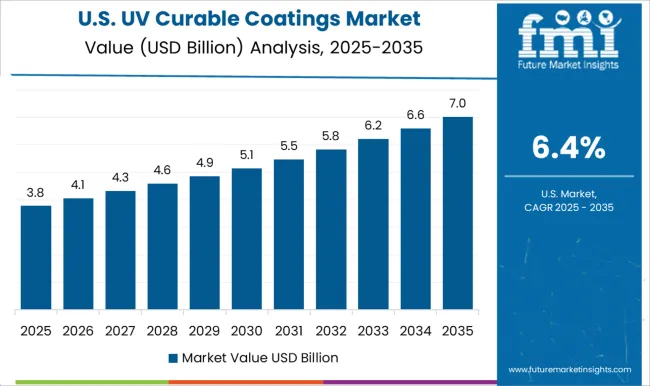

The UV curable coatings market in the United States is expected to grow at a CAGR of 6.4%. The USA continues to experience steady demand for UV curable coatings, driven by the need for high-performance coatings in automotive, packaging, and electronics applications. The growing adoption of sustainable and energy-efficient technologies, coupled with regulations promoting low-VOC coatings, is accelerating the demand for UV curable solutions. Despite slower growth compared to emerging markets, the USA remains a key market due to its emphasis on innovative, high-quality coatings and its established industrial base.

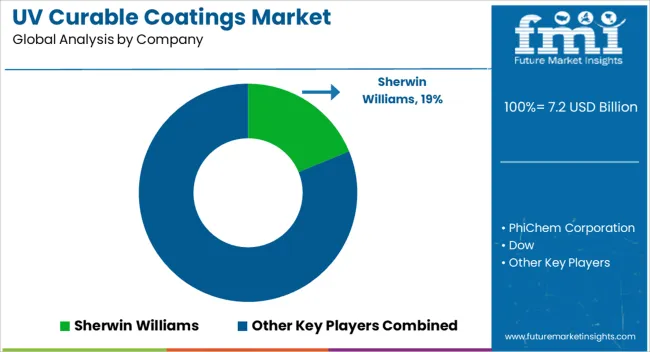

The UV curable coatings market is highly competitive, driven by increasing demand for fast-curing, durable, and high-quality coating solutions across automotive, electronics, packaging, and industrial applications. The Sherwin-Williams Company, AkzoNobel N.V., and Axalta Coating Systems Ltd. dominate the market with extensive portfolios of UV-curable products offering excellent adhesion, chemical resistance, and surface finish. Their expertise in advanced resin systems and global production capabilities enables them to meet diverse industry requirements efficiently.

BASF SE and Dow Inc. play key roles as major suppliers of monomers, oligomers, and photoinitiators used in UV-curable formulations. Their innovations in polymer chemistry and crosslinking technology enhance coating performance, delivering improved hardness, flexibility, and gloss. These companies focus on developing coatings that enable faster processing and higher production throughput.

Ashland Inc. and Dymax Corporation specialize in high-performance UV-curable adhesives and coatings designed for precision applications such as medical devices, electronics, and optical assemblies. Their emphasis on instant curing and superior clarity ensures strong positioning in niche industrial segments.

PhiChem Corporation contributes to market growth through competitively priced UV-curable materials widely used in Asia’s electronics and display manufacturing sectors. Overall, competition centers on formulation innovation, curing efficiency, and quality enhancement to meet the evolving needs of advanced manufacturing industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.2 Billion |

| Resin | Epoxy Acrylates, Polyesters acrylates, Urethanes acrylates, and Others |

| Technology | Water-borne and Solvent borne |

| Application | Furniture & Woodworking, Architectural & Building, Automotive & Transit, Graphic art & printing inks, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

The Sherwin-Williams Company, PhiChem Corporation, Dow Inc., Ashland Inc., BASF SE, Axalta Coating Systems Ltd., AkzoNobel N.V., Dymax Corporation |

| Additional Attributes | Dollar sales by coating type and application, demand dynamics across automotive, electronics, and packaging sectors, regional trends in UV curable coatings adoption, innovation in fast-curing and eco-friendly formulations, impact of regulatory standards on VOC emissions and environmental impact, and emerging use cases in 3D printing and advanced surface treatments. |

The global UV curable coatings market is estimated to be valued at USD 7.2 billion in 2025.

The market size for the UV curable coatings market is projected to reach USD 14.9 billion by 2035.

The UV curable coatings market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in UV curable coatings market are epoxy acrylates, polyesters acrylates, urethanes acrylates and others.

In terms of technology, water-borne segment to command 54.2% share in the UV curable coatings market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UV Curable Resin and Formulated Products Market Size and Share Forecast Outlook 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

UV Cured Coatings Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Radiation Curable Coatings Market Size and Share Forecast Outlook 2025 to 2035

UVC Upper Air Disinfection Unit Market Size and Share Forecast Outlook 2025 to 2035

UVC Surface Disinfection System Market Size and Share Forecast Outlook 2025 to 2035

UV-C Sterilizing Conveyors Market Analysis - Size and Share Forecast Outlook 2025 to 2035

UV Stabilized Films Market Size and Share Forecast Outlook 2025 to 2035

UV Absorbers Market Size and Share Forecast Outlook 2025 to 2035

UV-Protecting Polymers Market Size and Share Forecast Outlook 2025 to 2035

UV-C LED Market Size and Share Forecast Outlook 2025 to 2035

UV Adhesives Market Size and Share Forecast Outlook 2025 to 2035

UV and Light Sensitive Packaging Market Size and Share Forecast Outlook 2025 to 2035

UV-Blocking Transparent Film Market Size and Share Forecast Outlook 2025 to 2035

UVI Stretch Films Market Size and Share Forecast Outlook 2025 to 2035

UV Protected Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

UVC Disinfection Product Market Report – Demand, Trends & Forecast 2025–2035

Uveal Melanoma Treatment Market – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA