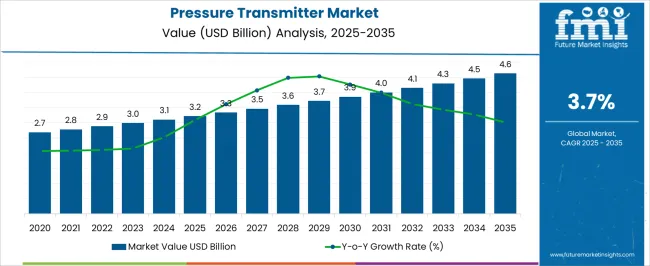

The global pressure transmitter market is projected to grow from USD 3.2 billion in 2025 to USD 4.6 billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.7%. In the early adoption phase (2020–2024), market growth was modest, driven by selective deployment in industrial and process control applications. Adoption was primarily focused on validating performance, reliability, and integration into existing systems. By 2025, as the market reaches USD 3.2 billion, the scaling phase begins.

During this period, manufacturers expand production capacity, and adoption spreads to a broader set of industries, improving market visibility and driving incremental growth. Between 2025 and 2030, scaling accelerates, with market size rising from USD 3.2 billion to approximately USD 3.7–3.9 billion. Wider adoption in manufacturing, energy, and chemical sectors supports steady growth, while supply chains and distribution networks strengthen. The consolidation phase from 2030 to 2035 sees the market reach USD 4.6 billion, with growth stabilizing. By this stage, pressure transmitters are widely used, and standardized practices, mature supply chains, and reliable production ensure predictable deployment. The market transitions from steady expansion to a stable, well-established segment within industrial instrumentation.

| Metric | Value |

|---|---|

| Pressure Transmitter Market Estimated Value in (2025 E) | USD 3.2 billion |

| Pressure Transmitter Market Forecast Value in (2035 F) | USD 4.6 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The pressure transmitter market, growing from USD 3.2 billion in 2025 to USD 4.6 billion by 2035 at a CAGR of 3.7%, exhibits key breakpoints that reflect shifts in adoption and market dynamics. The first significant breakpoint occurs around 2025, when the market reaches USD 3.2 billion. At this stage, adoption moves from limited deployment to broader commercial use across multiple industrial sectors. Increased production capacity, improved reliability, and early adoption success stories build confidence among end-users. This marks the scaling phase, characterized by expanding applications, incremental growth, and strengthened supply chains to support rising demand in process control, energy, and manufacturing industries. A second critical breakpoint occurs between 2030 and 2032, as the market approaches USD 4.1–4.3 billion. By this stage, pressure transmitters are widely adopted, and the market transitions from growth-driven expansion to consolidation. Major manufacturers solidify their positions, while supply chains and distribution networks stabilize. Standardized deployment practices and consistent integration improve operational efficiency. By 2035, reaching USD 4.6 billion, the market reflects full consolidation, with pressure transmitters established as a standard instrument across industrial applications. Mature production, stable adoption, and predictable demand patterns ensure sustained market stability and long-term operational reliability.

The Pressure Transmitter market is witnessing consistent expansion, supported by rising demand for precise pressure measurement in industrial processes and the increasing integration of digital technologies in instrumentation systems. Growing investments in process automation and plant safety have been key enablers of adoption across sectors such as oil and gas, chemicals, power generation, and water treatment.

The ability of modern transmitters to provide continuous, accurate data for real-time decision-making has strengthened their role in operational efficiency and regulatory compliance. Technological advancements, including integration with Industrial Internet of Things platforms and wireless connectivity, have further elevated their value proposition.

Manufacturers are focusing on developing transmitters with enhanced durability, better signal stability, and improved diagnostics to meet the evolving needs of critical applications As industries move towards predictive maintenance and remote monitoring, pressure transmitters are expected to remain a crucial component of smart industrial systems, ensuring long-term growth potential in both mature and emerging markets.

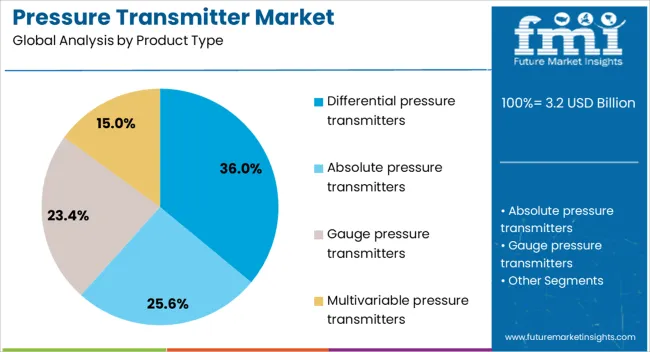

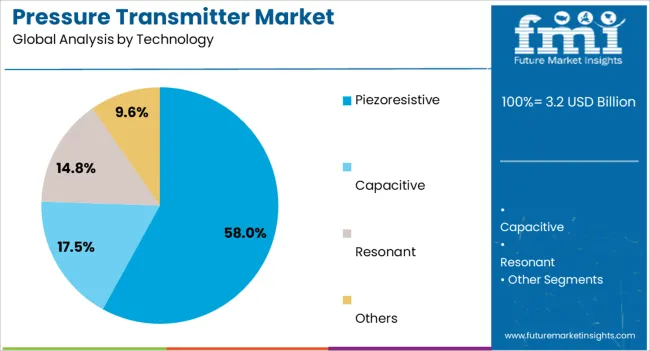

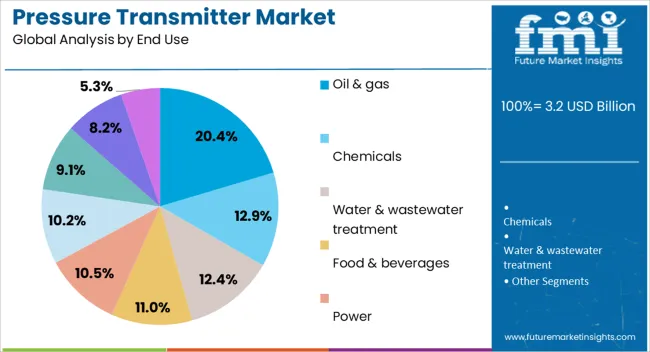

The pressure transmitter market is segmented by product type, technology, end use, and geographic regions. By product type, pressure transmitter market is divided into Differential pressure transmitters, Absolute pressure transmitters, Gauge pressure transmitters, and Multivariable pressure transmitters. In terms of technology, pressure transmitter market is classified into Piezoresistive, Capacitive, Resonant, and Others. Based on end use, pressure transmitter market is segmented into Oil & gas, Chemicals, Water & wastewater treatment, Food & beverages, Power, Pulp & paper, Metals & mining, Pharmaceuticals, and Others. Regionally, the pressure transmitter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The differential pressure transmitters segment is projected to hold 36% of the Pressure Transmitter market revenue share in 2025, making it the leading product type. Its dominance has been driven by its capability to measure pressure differences accurately in challenging industrial environments, which is essential for flow measurement, level monitoring, and filtration control.

The widespread use of differential pressure transmitters in oil and gas, chemical, and power generation sectors has been reinforced by their ability to perform under extreme temperatures and pressures. Their compatibility with advanced digital communication protocols has enabled seamless integration into automated process control systems.

Furthermore, the segment has benefited from increasing demand for energy efficiency and process optimization, as accurate pressure readings directly contribute to reducing operational costs and enhancing safety The proven reliability and adaptability of differential pressure transmitters across diverse applications have sustained their leading market position and are expected to continue supporting their growth trajectory.

The piezoresistive technology segment is expected to account for 58% of the Pressure Transmitter market revenue share in 2025, establishing itself as the leading technology type. This growth has been attributed to the high sensitivity and stability offered by piezoresistive sensors, enabling precise measurement of both static and dynamic pressures.

The technology’s ability to function effectively in harsh industrial conditions, including high vibration and temperature variations, has contributed to its widespread adoption. Piezoresistive transmitters have also gained traction due to their compact design, low power consumption, and strong signal output, making them suitable for integration into modern automation systems.

The increased focus on predictive maintenance and digital process control has further propelled demand, as piezoresistive technology supports advanced diagnostics and remote monitoring capabilities As industries continue to demand higher accuracy and long-term reliability from their instrumentation, piezoresistive pressure transmitters are expected to maintain their leadership in the market.

The oil and gas segment is anticipated to hold 20.40% of the Pressure Transmitter market revenue share in 2025, emerging as the largest end-use industry. This prominence has been supported by the sector’s critical requirement for accurate and reliable pressure monitoring in exploration, production, refining, and transportation operations. Pressure transmitters are extensively deployed in upstream and downstream facilities to ensure operational safety, regulatory compliance, and process optimization.

The segment’s growth has been further driven by increasing investments in offshore drilling, enhanced oil recovery projects, and pipeline infrastructure upgrades. In oil and gas environments, transmitters must operate reliably under extreme conditions, and the integration of advanced sensing technologies has enhanced their performance and durability.

The industry’s transition towards digital oilfield operations and remote asset management has amplified the need for intelligent, networked transmitters These factors collectively reinforce the oil and gas sector’s leading role in driving demand for pressure transmitters worldwide.

The pressure transmitter market is expanding as industries increasingly demand precise, reliable, and real-time pressure measurement for process control, automation, and safety applications. Pressure transmitters are critical across sectors including oil and gas, chemical, water treatment, pharmaceuticals, and power generation. Adoption is driven by the need for operational efficiency, regulatory compliance, and advanced automation. Technological innovations such as digital transmitters, wireless connectivity, and smart diagnostics are further fueling growth.

However, challenges related to installation complexity, calibration, and environmental resilience continue to influence market strategies. Companies delivering robust, versatile, and cost-effective solutions are positioned to capture emerging opportunities.

Pressure transmitters face challenges in maintaining consistent accuracy and reliability under varying operating conditions. Factors such as temperature fluctuations, vibration, corrosion, and pressure surges can affect performance. Ensuring precise calibration and maintaining sensor stability over time are critical for high-value applications, especially in regulated industries. Installation in remote or harsh environments adds complexity, requiring protective housings and specialized materials. In addition, integration with control systems and SCADA networks demands technical expertise and adherence to industry standards. Manufacturers must invest in high-quality components, rigorous testing, and adaptive design to overcome these challenges and deliver reliable pressure measurement solutions.

The pressure transmitter market is trending toward digitalization, smart functionality, and wireless communication. Advanced transmitters offer features such as remote diagnostics, predictive maintenance, and real-time monitoring, which improve operational efficiency and reduce downtime. Wireless and IoT-enabled transmitters simplify installation, reduce cabling requirements, and facilitate integration with process control and automation systems. Smart sensors with embedded analytics provide actionable insights for preventive maintenance and system optimization. Additionally, compact designs and multi-parameter sensing capabilities allow seamless deployment in constrained environments. These trends are driving adoption across industries that require intelligent, connected, and efficient pressure monitoring solutions.

Pressure transmitters offer significant opportunities in industrial automation, energy management, and process optimization. Growing adoption of automated manufacturing, smart factories, and industrial IoT solutions increases demand for accurate pressure monitoring. In energy-intensive industries, pressure transmitters enable optimized flow control, improved energy efficiency, and enhanced safety. Applications in water treatment, chemical processing, and pharmaceuticals provide opportunities for high-precision transmitters that meet regulatory requirements. Expanding usage in renewable energy systems, such as solar and wind, also presents growth potential. Partnerships with system integrators, automation solution providers, and industrial OEMs can facilitate broader adoption and customized deployment in high-value applications.

Market growth for pressure transmitters is restrained by installation and maintenance costs, environmental susceptibility, and limited standardization. High-end transmitters with smart features or specialized materials can be expensive, affecting adoption in cost-sensitive projects. Regular calibration, maintenance, and protective measures are required to ensure long-term reliability, adding operational expenses. Variations in standards and compatibility across industries may complicate integration with existing control systems. Environmental challenges such as extreme temperatures, humidity, or corrosive media can reduce sensor lifespan. Until solutions become more cost-effective, standardized, and resilient, adoption may remain concentrated in industrial, high-precision, and critical process applications.

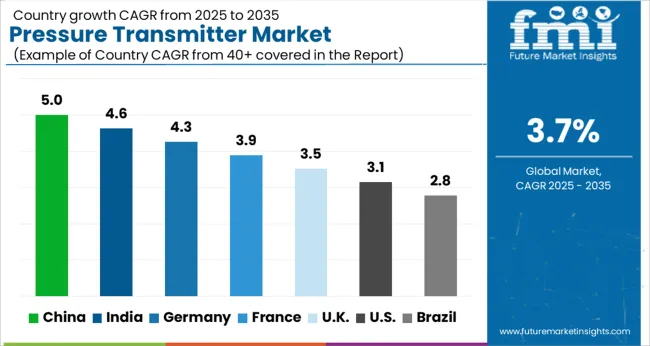

| Country | CAGR |

|---|---|

| China | 5.0% |

| India | 4.6% |

| Germany | 4.3% |

| France | 3.9% |

| UK | 3.5% |

| USA | 3.1% |

| Brazil | 2.8% |

The global pressure transmitter market is projected to grow at a CAGR of 3.7% through 2035, supported by increasing demand across process automation, oil and gas, and industrial instrumentation applications. Among BRICS nations, China has been recorded with 5.0% growth, driven by large-scale production and deployment in industrial and process monitoring systems, while India has been observed at 4.6%, supported by rising utilization in oil and gas and industrial applications. In the OECD region, Germany has been measured at 4.3%, where production and adoption for industrial, process, and instrumentation applications have been steadily maintained. The United Kingdom has been noted at 3.5%, reflecting consistent use in industrial and process monitoring, while the USA has been recorded at 3.1%, with production and utilization across industrial, oil and gas, and automation sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The pressure transmitter market in China is growing at a CAGR of 3.7%, driven by rising demand in process industries, power generation, oil and gas, and chemical sectors. Pressure transmitters are widely used for monitoring fluid and gas pressures in pipelines, industrial equipment, and automated systems. Domestic manufacturers are focusing on improving accuracy, durability, and compatibility with smart automation solutions. Government initiatives promoting industrial modernization, smart manufacturing, and energy efficiency are supporting market growth. Collaborations between research institutes, universities, and industrial firms are enhancing product development, calibration technologies, and sensor integration. Pilot projects in oil refineries, chemical plants, and power stations are demonstrating operational benefits, including improved safety and process optimization. Increasing adoption of automation, real-time monitoring, and predictive maintenance is further supporting steady growth in China’s industrial pressure measurement sector.

Pressure transmitter market in India is expanding at a CAGR of 3.7%, fueled by growth in power generation, chemical processing, oil and gas, and manufacturing industries. Pressure transmitters are essential for real-time monitoring, process control, and safety management in pipelines, tanks, and industrial equipment. Domestic manufacturers are investing in high precision and reliable transmitters compatible with smart automation systems. Government initiatives promoting industrial modernization, renewable energy projects, and energy efficient infrastructure are accelerating adoption. Pilot installations in refineries, chemical plants, and power stations demonstrate operational benefits including improved process efficiency and safety. Collaboration between technical institutes, research centers, and industrial firms is enhancing calibration accuracy, sensor integration, and durability. As automation and digital monitoring expand in India’s industrial sectors, demand for high performance pressure transmitters continues to grow steadily.

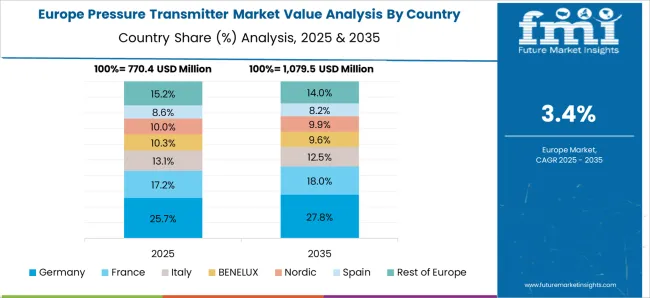

Pressure transmitter market in Germany is recording a CAGR of 4.3%, supported by strong process automation, industrial monitoring, and manufacturing industries. Pressure transmitters are extensively used in chemical plants, refineries, power stations, and industrial pipelines to ensure process control and safety. German manufacturers are investing in high precision, durable, and smart transmitters compatible with Industry 4.0 systems. Pilot projects and industrial trials in automation and energy management demonstrate improved operational efficiency and reduced downtime. Government regulations promoting energy efficiency, environmental safety, and industrial modernization are further encouraging adoption. Collaborations between universities, research institutes, and industrial firms are advancing calibration methods, sensor reliability, and integration with digital control systems. Germany’s advanced industrial sector continues to be a key driver for demand in high performance pressure transmitters.

The United Kingdom is experiencing a CAGR of 3.5% in the pressure transmitter market, driven by demand in chemical processing, power generation, oil and gas, and manufacturing sectors. Pressure transmitters are used for real-time monitoring, process control, and safety management in pipelines, tanks, and industrial equipment. UK manufacturers are focusing on high reliability, precision, and smart automation compatible solutions. Pilot projects in industrial plants, refineries, and energy facilities demonstrate operational improvements and safety benefits. Government programs promoting industrial modernization, automation, and energy efficiency are supporting market growth. Technical collaborations and research initiatives are advancing calibration, sensor integration, and durability. Growing interest in predictive maintenance, smart monitoring, and process optimization continues to support steady adoption of pressure transmitters across the UK industrial sector.

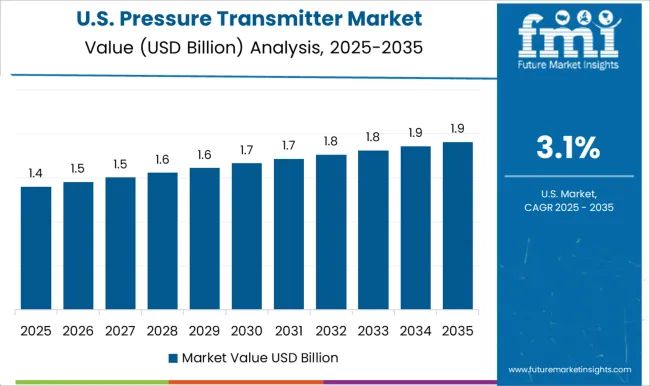

The United States pressure transmitter market is growing at a CAGR of 3.1%, driven by adoption in oil and gas, chemical processing, power generation, and industrial manufacturing sectors. Pressure transmitters are critical for accurate monitoring, process control, and operational safety in pipelines, tanks, and machinery. Domestic manufacturers are focusing on high precision, reliability, and integration with digital and smart automation systems. Pilot projects in industrial plants, refineries, and energy facilities demonstrate benefits in process optimization, safety, and predictive maintenance. Government regulations promoting industrial efficiency, safety standards, and energy conservation are further supporting adoption. Collaboration between universities, technical institutes, and industrial firms is enhancing sensor calibration, integration, and durability. Growing demand for automated monitoring, process optimization, and real-time data collection continues to drive the US market steadily.

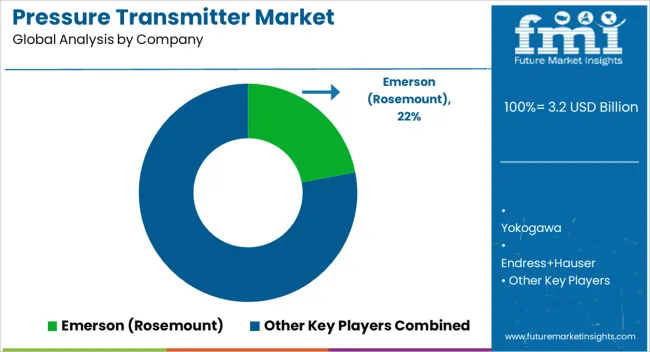

The pressure transmitter market is highly competitive, driven by global industrial automation leaders and specialized instrumentation providers. Emerson (Rosemount) leads with high-precision, reliable transmitters for process industries, emphasizing accuracy, durability, and smart diagnostics. Yokogawa focuses on scalable, integrated solutions for industrial automation, combining advanced sensing with control systems. Endress+Hauser offers a wide portfolio of transmitters tailored for chemical, pharmaceutical, and energy sectors, highlighting robust performance and easy integration. Siemens delivers industrial-grade transmitters with smart connectivity, targeting process optimization and digitalization initiatives. Honeywell integrates pressure sensing into automation and safety systems, emphasizing reliability and long-term performance. ABB provides transmitters for power, process, and industrial applications, combining precision with energy-efficient designs. Other regional and global vendors contribute with specialized, cost-effective solutions, focusing on niche industrial segments or emerging markets. Competition revolves around innovation, reliability, and integration capabilities. Companies invest heavily in R&D to enhance measurement accuracy, temperature stability, and communication protocols. Product brochures and technical documentation play a key role, presenting specifications, performance metrics, and application scenarios in concise, visually compelling formats. Global leaders highlight scalability, system compatibility, and service support, whereas smaller vendors emphasize cost efficiency, customization, and rapid deployment. Marketing materials are designed to convey technical advantages efficiently. Measurement ranges, accuracy, process compatibility, and integration options are showcased to enable informed decision-making. Success in the pressure transmitter market depends not only on sensor performance but also on clearly demonstrating value through concise, informative, and visually persuasive brochures and datasheets, making them essential tools to maintain a competitive edge.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 Billion |

| Product Type | Differential pressure transmitters, Absolute pressure transmitters, Gauge pressure transmitters, and Multivariable pressure transmitters |

| Technology | Piezoresistive, Capacitive, Resonant, and Others |

| End Use | Oil & gas, Chemicals, Water & wastewater treatment, Food & beverages, Power, Pulp & paper, Metals & mining, Pharmaceuticals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Emerson (Rosemount), Yokogawa, Endress+Hauser, Siemens, Honeywell, ABB, and Other regional/global vendors |

| Additional Attributes | Dollar sales in the Pressure Transmitter Market vary by type including gauge, differential, and absolute transmitters, application across oil & gas, chemical, water & wastewater, and power generation industries, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising industrial automation, demand for accurate process control, and increasing adoption of smart instrumentation technologies. |

The global pressure transmitter market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the pressure transmitter market is projected to reach USD 4.6 billion by 2035.

The pressure transmitter market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in pressure transmitter market are differential pressure transmitters, absolute pressure transmitters, gauge pressure transmitters and multivariable pressure transmitters.

In terms of technology, piezoresistive segment to command 58.0% share in the pressure transmitter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pressure Relief Dressing Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Hydraulic Pump Market Size and Share Forecast Outlook 2025 to 2035

Pressure Compensated Pump Market Size and Share Forecast Outlook 2025 to 2035

Pressure Switch Market Forecast Outlook 2025 to 2035

Pressure Reducing Valve Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Volume Loop Systems Market Size and Share Forecast Outlook 2025 to 2035

Pressure Monitoring Extension Tubing Sets Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Labeling Machine Market Size and Share Forecast Outlook 2025 to 2035

Pressure Bandages Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Sensitive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Pressure Gauges Market Size and Share Forecast Outlook 2025 to 2035

Pressure Relief Valve Market Size and Share Forecast Outlook 2025 to 2035

Pressure-Controlled Vacuum Sealers Market Size and Share Forecast Outlook 2025 to 2035

Pressure Sensitive Tapes and Labels Market Size, Share & Forecast 2025 to 2035

Pressure Infusion Bags Market Analysis - Size, Share, and Forecast 2025 to 2035

Pressure Ulcer Detection Devices Market Trends – Growth & Forecast 2025 to 2035

Pressure Cushions Market Trends - Growth, Size & Forecast 2025 to 2035

Pressure Infusion Cuffs Market Growth – Trends & Future Outlook 2024-2034

Pressure Cookers Market

Pressure Calibrator Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA