The global gene synthesis market is estimated to be valued at USD 1,089.3 million in 2025 and is projected to reach USD 6,203.6 million by 2035, registering a compound annual growth rate of 19% over the forecast period.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1,089.3 million |

| Projected Market Size in 2035 | USD 6,203.6 million |

| CAGR (2025 to 2035) | 19% |

The gene synthesis market has evolved into a cornerstone of molecular biology and synthetic biology workflows, supporting applications spanning drug discovery, vaccine development, metabolic engineering, and genetic diagnostics.

Advances in DNA synthesis chemistry, error correction technologies, and automation platforms have significantly reduced the cost per base pair, improving turnaround times and enabling large-scale projects that were previously cost-prohibitive.

Increased investments in cell and gene therapy pipelines, coupled with funding for synthetic biology start-ups, have sustained robust demand for synthetic constructs tailored for CRISPR-based editing, protein engineering, and pathway optimization. Regulatory frameworks governing the ethical use and biosafety of synthetic genes are being progressively refined, providing clearer pathways for commercialization.

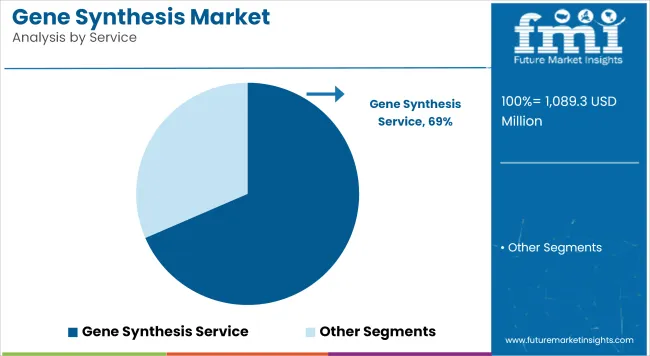

Service Analysis

Gene Synthesis Service holds a revenue share of 68.5%, underscoring their critical role in research and industrial applications. The segment’s growth has been driven by increasing demand for tailor-made gene constructs that support drug target validation, vaccine antigen design, and metabolic pathway engineering.

Service providers have differentiated offerings by integrating error correction protocols, automation-enabled high-throughput workflows, and fast delivery times. Biotechnology and pharmaceutical companies have favored outsourcing gene synthesis to accelerate development timelines and reduce internal resource constraints.

Over the forecast period, the segment is expected to maintain a dominant position, supported by advances in bioinformatics-driven design, reductions in synthesis costs, and partnerships enabling end-to-end solutions that integrate synthesis with cloning and expression services.

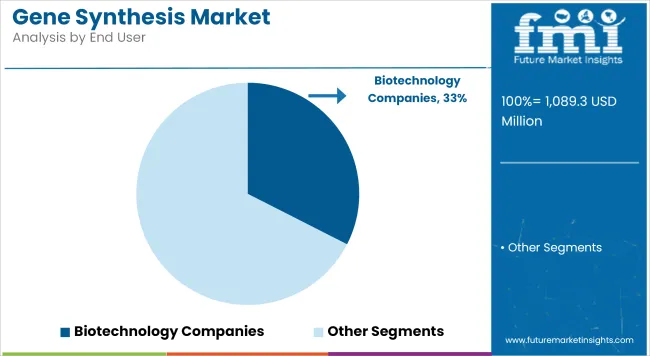

End User Analysis

Biotechnology Companies is accounting for 32.5% revenue share, which reflects their pivotal role in driving demand for synthetic DNA constructs. The segment’s expansion has been fueled by robust investment in gene therapy, CAR-T development, microbial strain engineering, and protein therapeutics pipelines.

Companies have leveraged gene synthesis to design optimized sequences, de-risk production workflows, and accelerate time to proof-of-concept. The proliferation of venture funding in synthetic biology start-ups has further strengthened the segment’s contribution.

Regulatory ambiguity, biosafety, and IP issues

The lack of globally harmonized regulations for synthetic gene production and distribution raises moral dilemmas related to biosecurity and dual-use technologies and interfere with cross-border control of gene-edited constructs. Differing quality standards may also promote variability in the reproducibility of research.

The Intellectual Property Rights disputes surrounding synthetic gene sequences and oligo assembling technologies could restrict collaborations among entities and slow product development. According to WHO, biosafety and governance challenges must be addressed to foster equitable, just, and secure practices of gene synthesis all over the globe.

Growth of synthetic biology, development of therapeutic agents, and design using AI

This increases the growing demand for fast, accurate, scalable gene synthesis services by applications in synthetic biology across healthcare-related industries and agriculture-biotechnology and industrial biotech. Promotional areas include custom gene libraries for antibody discovery, synthetic vaccine design, and biosynthetic pathway optimization.

These technologies are incorporated within gene synthesis pipelines being used for codon optimization, error minimization, and de novo genome design. The use of engineered, synthetic DNA for therapeutic development and preparedness strategies in the long run through pandemics above all demonstrate the strategic value gene synthesis holds in the global security arena.

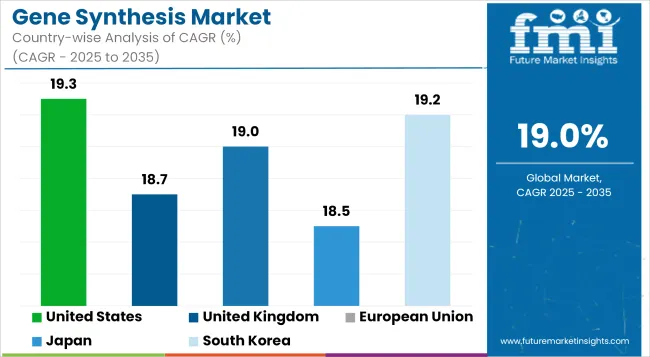

The gene synthesis market in the United States is enjoying strong growth propelled by significant demand in synthetic biology, personalized medicine, and other biologics development. Gene synthesis is most commonly used to construct vaccines, enzyme engineering applications, and CRISPR-based therapeutics in most academic research institutes, biotechnological companies, and pharmaceutical corporations.

As the OECD puts it, the USA leads the world in genomics R&D investment, bolstered by initiatives from NIH, DARPA, and others to boost speed and yield in gene-based solutions. For example, custom genes benefit from cloud-based ordering platforms and automation in DNA assembly, which increases accessibility and lowers turnaround times.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 19.3% |

The gene synthesis market in the UK is rapidly expanding through strong academic-industry collaboration and support for bio-innovation under the UK Life Sciences Vision. More applications of gene synthesis include the development of vaccines, agricultural biotechnology, and research in cell therapies.

According to OECD, public investment in synthetic biology hubs is facilitating the development of new products, especially in areas such as antimicrobial resistance and green bio-manufacturing. Demand for high-throughput DNA synthesis for gene editing and metabolic pathway engineering boosts growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 18.7% |

The emergence of the European gene synthesis market is characterized by contribution from Germany, France, and the Netherlands, where interlinked biotech clusters contribute to developing industrial enzymes, biopharmaceuticals, and sustainable materials.

According to UN, Horizon Europe funding is providing resources for genomic engineering and gene circuit design, enhancing opportunities for innovations at both academic and commercial levels. The direction taken by the green biotechnology shift and climate-friendly solutions further increases the demand for synthetic gene pathways. Biosecurity and ethical standards for the European Union also set the guide in safe and responsible expansion of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 19.0% |

Japan's gene synthesis market is stabilizing and growing. Applications are in regenerative medicine, vaccine development, and agricultural biotechnology. Synthetic genes are used for stem cell research and the generation of therapeutic proteins at both universities and life sciences companies.

At present, as reported by OECD, such government support for genomic medicine along with domestic biotech capabilities is expected to result in positive growth for automated gene synthesis services. An increase in the availability of biopharmaceutical start-ups is heralding promising new demand for scalable DNA synthesis, which they require for rapid prototyping and precision medicine pipelines.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 18.5% |

South Korea's advanced market in gene synthesis is now witnessing a rapid expansion, primarily due to the growing applications of mRNA therapeutics, gene editing, and microbial engineering. The Korean Bio economy 2030 Strategy has laid down the most important pillars for gene and cell therapies and is expected to drive investments in DNA synthesis infrastructure.

According to OECD, public-private partnerships are producing efficacious new solutions in synthetic biology, particularly with respect to cancer treatments, enzyme production, and vaccine development. Providing high-throughput synthesis capacity, developing customizable gene libraries for both academic and industrial users.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 19.2% |

The competitive landscape is defined by firms investing in automation, proprietary synthesis chemistries, and bioinformatics platforms to reduce error rates and improve delivery speed. Leading players are forming collaborations with pharma and biotech companies to offer integrated solutions spanning design, synthesis, and downstream applications such as cloning and expression.

Additionally, investments are being channelled into cloud-based platforms that streamline ordering and sequence tracking, as well as into AI tools that optimize codon usage and functional design. These strategies are expected to sustain strong competition and drive differentiation over the coming years.

Key Development

In 2024, Twist Bioscience has launched Twist Multiplexed Gene Fragments (MGFs). These pools of directly synthesized double-stranded DNA, up to 500 base pairs, enable high-throughput screening applications with no limit on sequence number.

In 2024, GenScript Biotech has launched GenScript FLASH Gene service, their ultra-fast sequence-to-plasmid (S2P) offering. This new service addresses the urgent need for rapid, high-quality, and cost-efficient delivery of gene constructs, showcasing GenScript's continued innovation in synthetic biology.

The overall market size for the gene synthesis market was approximately USD 1,089.3 million in 2025.

The gene synthesis market is expected to reach approximately USD 6,203.6 million by 2035.

The demand for gene synthesis is rising due to increasing adoption of synthetic biology techniques, advancements in DNA synthesis technologies, and growing applications in drug discovery.

The top 5 countries driving the development of the gene synthesis market are the United States, China, Germany, Japan, and the United Kingdom.

Custom gene synthesis services and adoption by biotech & pharmaceutical companies are expected to command significant shares over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Generator Bushing Market Size and Share Forecast Outlook 2025 to 2035

Gene Editing Tool Market Forecast and Outlook 2025 to 2035

Genetic Analyzers Market Size and Share Forecast Outlook 2025 to 2035

General Intelligent Decision-Making Service Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

General Purpose DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

Generative AI in Packaging Market Size and Share Forecast Outlook 2025 to 2035

Generative AI In Chemical Market Size and Share Forecast Outlook 2025 to 2035

Generator Sales Market Size and Share Forecast Outlook 2025 to 2035

Generic Injectable Market Report - Growth, Demand & Forecast 2025 to 2035

Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Generative AI in Logistics Market Size and Share Forecast Outlook 2025 to 2035

General Surgery Devices Market Insights – Demand and Growth Forecast 2025 to 2035

Gene Prediction Tools Market Insights – Demand and Growth Forecast 2025 to 2035

Gene Therapy in CNS Disorder Market Analysis by Indication, Type, End User, and Region through 2035

Generalized Anxiety Disorder Treatment Market Insights by Drug Class, Therapies, Distribution Channel, and Region 2035

General Purpose Electronic Test and Measurement Instruments Market Analysis and Forecast by Product, End Use, and Region Through 2035

Generalized Myasthenia Gravis Management Market - Growth & Treatment Advances 2025 to 2035

Generative AI Market Analysis - Trends & Forecast 2025 to 2035

Genetically Modified Food Market Analysis by Type, Trait, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA