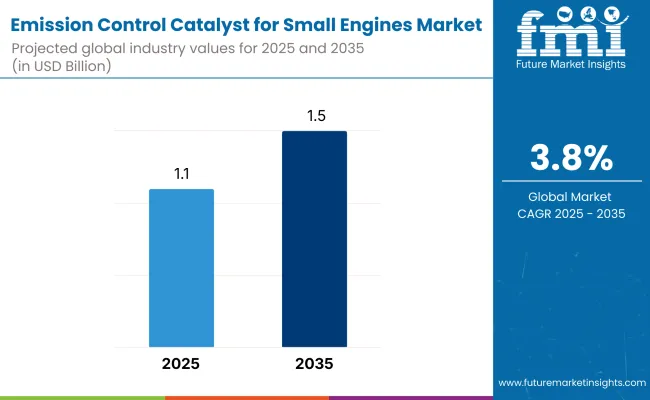

The emission control catalyst for small engines market is expected to grow from USD 1.1 billion in 2025 to USD 1.5 billion by 2035. The market is poised to expand at a CAGR of 3.8% during the forecast period. The emission control catalyst for the small engines market is expected to grow steadily, driven by strict emission norms and the rising use of small engines in lawn equipment, generators, and recreational vehicles.

The market is witnessing steady growth due to tightening emission norms, increasing environmental awareness, and the rising use of non-road small engines. With more emphasis on air quality and pollution control, industries are adopting advanced catalytic technologies to meet regulatory standards. The aging equipment base and extended machinery lifecycles are driving the need for emission upgrades and replacements.

Technological advancements are significantly driving the growth of the market by enhancing catalyst efficiency, durability, and emission reduction performance. Innovations in materials science and coating techniques help meet evolving emission regulations while extending product lifespan.

Growing environmental awareness and stricter global emission norms are accelerating the adoption of cleaner technologies. Increased production of garden and utility equipment and rising demand for low-emission alternatives in residential and commercial applications are further fueling market expansion across both developed and emerging economies.

Stringent government regulations are a key driver in the market. Regulatory bodies like the U.S. Environmental Protection Agency (EPA) and the European Commission mandate strict emission limits for small engines, compelling manufacturers to adopt advanced catalyst technologies. These frameworks enforce compliance through limits on carbon monoxide, hydrocarbons, and nitrogen oxides.

As a result, companies are investing in R&D to develop more efficient, durable, and cost-effective emission control solutions. Advancements in nanotechnology and materials science are further enabling breakthroughs. Compliance pressure is fostering innovation and reshaping the competitive landscape of the market.

The emission control catalyst for small engines market is segmented by product type into diesel-based emission catalysts and gasoline-based emission catalysts; by application into construction, gardening, industrial, small vehicles, refrigerated transportation, and domestic; by end use into original equipment manufacturers (OEM) and retrofit; and by region into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa.

The diesel-based emission catalyst segment is projected to be the most lucrative, registering the fastest CAGR of 4.3% between 2025 and 2035, driven by its extensive application across commercial and industrial equipment where diesel engines dominate. The diesel-based emission catalyst segment is projected to be the most lucrative market, driven primarily by its extensive application across commercial and industrial equipment, where diesel engines dominate.

The segment is reflecting increasing regulatory pressures targeting diesel engine emissions and rising demand for higher-efficiency catalysts capable of reducing nitrogen oxides (NOx) and particulate matter. Diesel engines, particularly in construction and industrial applications, operate under stricter emission norms globally, necessitating advanced catalyst technologies with longer durability and higher conversion rates.

The segment benefits from strong replacement and retrofit demand due to aging fleets and increasing environmental compliance, especially in developed economies. Furthermore, innovation in diesel catalyst formulations and the push towards cleaner diesel technologies further support this segment’s expansion.

Conversely, the gasoline-based emission catalyst segment, while significant, is projected to grow at a slightly lower pace due to a faster shift towards electric alternatives in passenger small vehicles and less stringent emission norms compared to diesel-powered industrial engines. This segment remains crucial in recreational and domestic applications, contributing steady revenue streams without the high-growth dynamics seen in diesel catalysts.

| Product Type Segment | CAGR (2025 to 2035) |

|---|---|

| Diesel-Based Catalyst | 4.3% |

The construction application segment is anticipated to be the most lucrative within the emission control catalyst for small engines market, accounting for an estimated CAGR of 3.8% between 2025 to 2035. The substantial growth is driven by the extensive use of small engines in construction equipment such as compact loaders, mini-excavators, and portable generators, which require advanced emission control catalysts to meet increasingly stringent environmental regulations.

The construction sector’s reliance on diesel-powered machinery, which produces higher emissions compared to gasoline engines, fuels demand for efficient catalysts with enhanced durability and emission reduction capabilities. Additionally, rising infrastructure investments globally, particularly in emerging markets, bolster this segment’s growth.

Retrofit demand is strong, as many construction machines are aging and need emission system upgrades to comply with updated regulations. Furthermore, urbanization and large-scale public infrastructure development projects are increasing the deployment of small engine-powered equipment, accelerating catalyst demand in this segment.

Other applications, including gardening, industrial, small vehicles, refrigerated transportation, and domestic, contribute to the market’s steady expansion but tend to have smaller market shares or slower growth rates. For example, gardening and small vehicles primarily use gasoline engines, facing moderate regulatory pressure, while refrigerated transportation is a niche application with limited volume.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Construction | 3.8% |

The retrofit segment is poised to be the most lucrative in the emission control catalyst for small engines market, with an estimated CAGR OF 4.6%. The retrofit segment’s expansion is primarily driven by the growing need to upgrade and modernize aging small engine fleets to comply with increasingly stringent emission standards globally. In sectors such as construction, industrial, and agriculture, a significant portion of equipment currently in use exceeds the latest emission limits, making retrofitting a cost-effective solution to meet regulatory requirements without full engine replacement.

Moreover, government mandates and incentives in key regions encourage operators to retrofit existing machinery, boosting demand for emission control catalysts designed for aftermarket installation. The retrofit segment benefits from high replacement frequency as catalyst components degrade over time and require renewal to maintain compliance and performance.

While the Original Equipment Manufacturers (OEM) segment commands a substantial share by supplying catalysts integrated into new engines, its growth trajectory is comparatively moderate, influenced by the slower rate of new equipment production and the rise of alternative powertrains. Thus, retrofit remains the prime growth driver in terms of market size and expansion.

| End Use Segment | CAGR (2025 to 2035) |

|---|---|

| Retrofit | 4.6% |

Challenge

Stringent Emission Regulations and Compliance Costs

With more stringent emission standards for products and vehicles worldwide, the Emission Control Catalyst for Small Engines Market are posed to face challenge. The Environmental Protection Agency (EPA), European Union (EURO standards), and China’s National VI regulations are just some of the regulatory bodies that put limits on emission levels on small engines used in lawn equipment, generators, and marine applications. Compliance entails heavy investment into advanced catalytic technologies and, therefore, higher production costs for manufacturers.

Material Cost Fluctuations and Supply Chain Constraints

The markets are beset by the high price of precious metals like platinum, palladium and rhodium - crucial components of emission control catalysts. Fluctuations in raw material costs and supply chain disruptions may influence the cost-effectiveness and accessibility of catalytic solutions for both manufacturers and end-users.

Opportunity

Advancements in Catalyst Technology and Efficiency

Opportunities exist in innovations of emission control catalysts, specifically in the development of high efficiency, low-cost alternatives. Some of them are nanotechnology-based catalysts, improved coating techniques, and hybrid catalytic converters, to enhance their performance at the same time minimize the dependency on such expensive materials.

Rising Demand for Low-Emission and Sustainable Small Engines

The rise of sustainable mobility and small engines that are greener is fueling the need for effective emissions management systems. Emerging opportunities will exist for manufacturers who focus on marrying low-emission catalysts with hybrid and alternative-fuel small engines in the evolving marketplace.

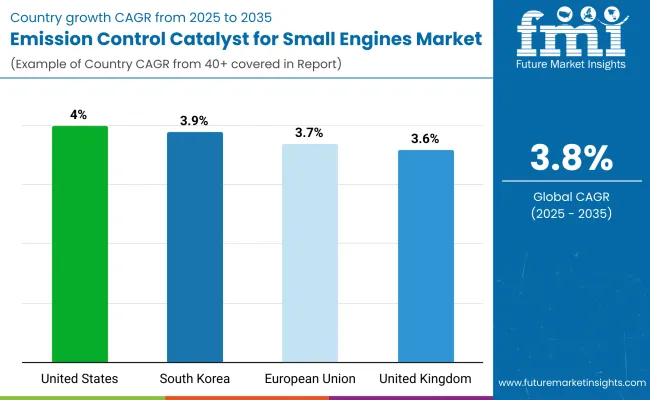

Small engines emission control catalyst market in the USA is growing steadily on the back of stringent emission regulations set by the environmental protection agency (EPA). Demand is being driven by the growing use of catalytic converters in lawnmowers, generators and recreational vehicles to reduce harmful emissions. Moreover, increasing awareness regarding air pollution and government initiatives promoting adoption of cleaner technologies is also driving the growth of global market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.0% |

Euro 5 Emission Standards & Stricter Environment Regulations Fueling Growth in the UK Market. The measures require advanced emission control technologies for small engines (used in gardening, construction, and industrial) Increasing focus on sustainability along with improving air quality also fuels the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.6% |

One of the major regions that holds significant dominance in the emission control catalyst market for small engines is the European Union, owing to the extensive regulations. Advanced catalytic converters are being implemented in parts of mining, agriculture, forestry and industrial units. The market is significantly supported by various EU-backed initiatives aimed at reducing carbon footprints and enhancing overall air quality.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.7% |

As South Koreans experience rising air pollution and a push toward sustainable practices, the market is seeing change. Tightening emission regulations for small engines, coupled with improvements in catalyst technology, are enabling uptake in segments such as landscaping, power tools, and light industrial equipment. Enhanced investments in clean technology also drives the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.9% |

Merchant and environmental regulations are getting stricter, which can be attributed to the negative effects of small engines on the environment and human health, such as air pollution and greenhouse gas emissions, leading to increased demand for emission control catalysts.

Gradual implementation of emission regulations for some categories of small engines Roadblocks to Business Entry in Developing and Emerging Markets, Higher capital requirements and competition in the Small Engine Emission Control Catalyst Market need to be addressed.

Globally, governments are bringing into force strict emission norms, nudging manufacturers to incorporate sophisticated catalytic systems in smaller engines that power lawnmowers, generators, motorcycles and handheld power tools. The development of new catalyst materials such as platinum, palladium, and rhodium, as well as the increasing need to create clean environment friendly engine technologies, are factors driving the market.

The overall market size for emission control catalyst for small engines market was USD 1.1 Billion in 2025.

The emission control catalyst for small engines market is expected to reach USD 1.5 Billion in 2035.

The demand for emission control catalyst for small engines will be driven by increasing OEM adoption, rising retrofit installations, and expanding use in industrial, construction, and small vehicle sectors.

The top 5 countries which drives the development of emission control catalyst for small engines market are USA, European Union, Japan, South Korea and UK

Diesel and Gasoline-Based Emission Catalysts demand supplier to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: MEA Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: MEA Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emissions Management Market Size and Share Forecast Outlook 2025 to 2035

Emission Monitoring Software Market

Emission Monitoring Systems Market

Emission Control Catalyst Market Growth – Trends & Forecast 2024-2034

Motorcycle Emission Control Catalyst Market Growth - Trends & Forecast 2025 to 2035

Zero Emission Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Zero Emission Vehicle Market Growth - Trends & Forecast 2025 to 2035

Marine Emission Control Catalyst Market - Size, Share, and Forecast 2025 to 2035

Optical Emission Spectroscopy Market Report – Trends 2019-2027

Vehicle Emission Testers Market

The Positron Emission Tomography (PET) Scanners Market is segmented by Full-ring PET Scanner and Partial-ring PET Scanner from 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Continuous Emission Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Otoacoustic Emissions Hearing Screener Market Size and Share Forecast Outlook 2025 to 2035

Single-Photon Emission Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Angle-Resolved Photoemission Spectroscopy Market Size and Share Forecast Outlook 2025 to 2035

Control Room Solution Market Size and Share Forecast Outlook 2025 to 2035

Controlled-Release Drug Delivery Technology Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Control Cable Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA