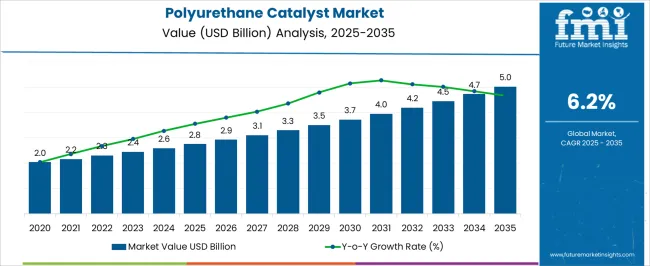

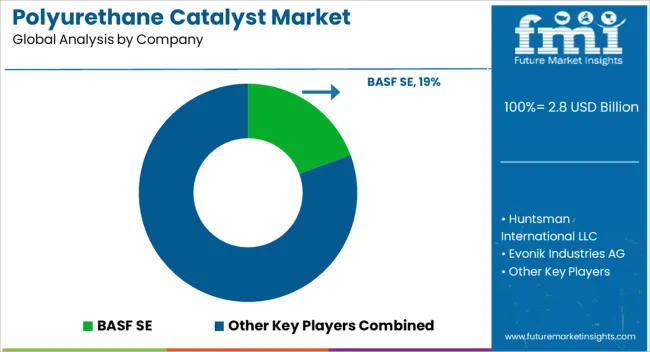

The polyurethane catalyst market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 5.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

The polyurethane catalyst market represents a smaller yet important segment within the broader chemicals and specialty chemicals industries. Within the chemicals market, it holds about 2-3%, as catalysts are just one component of a vast range of chemical applications. The specialty chemicals market sees a larger share of approximately 8-10%, reflecting the growing demand for tailored, high-performance chemical solutions in various sectors, including automotive and construction. The polyurethane market, directly tied to the catalyst sector, captures the largest share, around 12-15%, as catalysts are essential for producing polyurethane foams, coatings, and elastomers.

In the adhesives and sealants market, polyurethane catalysts contribute roughly 5-6%, given the use of polyurethane-based products in bonding and sealing applications. Within the construction chemicals market, the share is approximately 4-5%, driven by the increasing demand for high-performance insulation and flooring solutions. The growth of the polyurethane catalyst market is closely linked to the expanding use of polyurethane in industries such as automotive, construction, and consumer goods, where the need for efficient, durable materials continues to rise. These figures illustrate the market’s crucial role in the production of polyurethane-based products and its direct impact on several high-demand industries.

| Metric | Value |

|---|---|

| Polyurethane Catalyst Market Estimated Value in (2025 E) | USD 2.8 billion |

| Polyurethane Catalyst Market Forecast Value in (2035 F) | USD 5.0 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The polyurethane catalyst market represents a smaller yet important segment within the broader chemicals and specialty chemicals industries. Within the chemicals market, it holds about 2-3%, as catalysts are just one component of a vast range of chemical applications. The specialty chemicals market sees a larger share of approximately 8-10%, reflecting the growing demand for tailored, high-performance chemical solutions in various sectors, including automotive and construction. The polyurethane market, directly tied to the catalyst sector, captures the largest share, around 12-15%, as catalysts are essential for producing polyurethane foams, coatings, and elastomers. In the adhesives and sealants market, polyurethane catalysts contribute roughly 5-6%, given the use of polyurethane-based products in bonding and sealing applications.

Within the construction chemicals market, the share is approximately 4-5%, driven by the increasing demand for high-performance insulation and flooring solutions. The growth of the polyurethane catalyst market is closely linked to the expanding use of polyurethane in industries such as automotive, construction, and consumer goods, where the need for efficient, durable materials continues to rise. These figures illustrate the market’s crucial role in the production of polyurethane-based products and its direct impact on several high-demand industries.

The polyurethane catalyst market is expanding steadily as a result of rising demand for high performance foams, coatings, adhesives, and elastomers across multiple industries. The push for energy efficiency in buildings and appliances is driving the adoption of polyurethane based insulation materials, supported by regulations favoring low VOC and environmentally friendly products.

Advancements in catalyst formulations have enabled improved control over reaction rates, product quality, and material performance, meeting diverse manufacturing requirements. The automotive sector is increasingly integrating polyurethane components for lightweighting and comfort enhancement, further boosting market growth.

As industries continue to seek durable, efficient, and customizable polymer solutions, polyurethane catalysts are positioned as essential enablers of innovation and sustainability in global manufacturing.

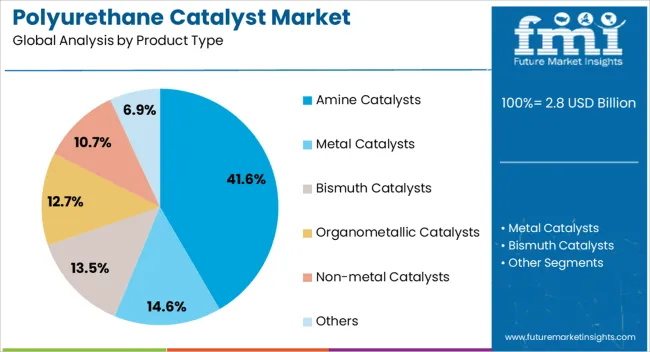

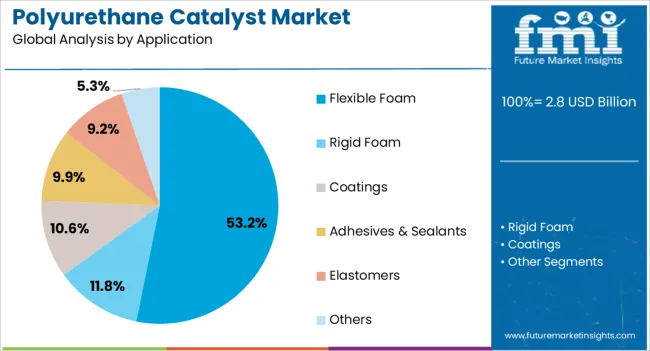

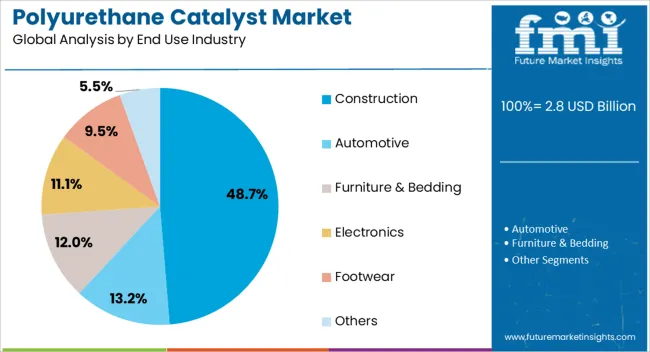

The polyurethane catalyst market is segmented by product type, application, end use industry, and geographic regions. By product type, polyurethane catalyst market is divided into amine catalysts, metal catalysts, bismuth catalysts, organometallic catalysts, non-metal catalysts, and others. In terms of application, polyurethane catalyst market is classified into flexible foam, rigid foam, coatings, adhesives & sealants, elastomers, and others. Based on end use industry, polyurethane catalyst market is segmented into construction, automotive, furniture & bedding, electronics, footwear, and others. Regionally, the polyurethane catalyst industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The amine catalysts segment is projected to account for 41.6% of total market revenue by 2025 within the product type category, making it the leading segment. Growth is supported by their superior ability to control polyurethane foam formation, ensure uniform cell structure, and provide high reactivity for both flexible and rigid foam applications.

These catalysts are widely adopted due to their versatility, cost efficiency, and compatibility with various polyurethane formulations.

Their role in enhancing production throughput and maintaining consistent product quality has solidified their dominance within the product type segment.

The flexible foam segment is expected to represent 53.2% of total market revenue by 2025 within the application category, positioning it as the most significant segment. Its growth is driven by extensive use in furniture, bedding, automotive seating, and packaging solutions, where comfort, resilience, and lightweight properties are critical.

The adaptability of flexible foam in meeting varied design and performance requirements has reinforced its demand.

Additionally, increasing consumer preference for comfort oriented and ergonomically designed products continues to support market share expansion in this application area.

The construction segment is estimated to hold 48.7% of total market revenue by 2025 under the end use industry category, making it the dominant segment. This leadership is attributed to the increasing use of polyurethane based insulation and sealants for energy efficiency, moisture resistance, and durability in buildings.

Government regulations promoting sustainable construction and energy conservation have further accelerated adoption.

The ability of polyurethane materials to provide superior thermal insulation and structural reinforcement has made them a preferred choice in both residential and commercial construction projects, ensuring sustained demand in this segment.

The polyurethane catalyst market is expected to grow steadily as demand for polyurethane in automotive, construction, and consumer goods industries continues to rise. Demand is driven by the increasing need for energy-efficient, durable, and lightweight materials. Opportunities are opening in the development of eco-friendly catalysts and the growth of the polyurethane foam market. Trends indicate an increased use of water-based formulations and demand for high-performance catalysts. Challenges remain around raw material volatility, regulatory pressure, and the complexity of catalyst manufacturing processes.

The demand for polyurethane catalysts is primarily driven by their use in producing polyurethane foams, which are essential for the automotive, construction, and consumer goods sectors. Polyurethane foam is used in automotive seats, insulation, and packaging due to its lightweight, durable, and energy-efficient properties. The growing demand for energy-efficient materials in buildings and homes is also driving the need for high-quality polyurethane. In our opinion, the most significant growth will come from automotive and construction, where polyurethane foams are integral to manufacturing and insulation applications.

Opportunities in the polyurethane catalyst market are emerging as manufacturers develop more eco-friendly catalysts that reduce the environmental impact of polyurethane production. The increasing demand for sustainable products is prompting the development of water-based and low-VOC (volatile organic compound) polyurethane catalysts. Moreover, the growing foam market is opening avenues for higher demand in insulation, packaging, and automotive applications. In our view, companies that focus on producing green catalysts while capitalizing on the expanding polyurethane foam market will be well-positioned for long-term growth.

Trends in the polyurethane catalyst market are shifting toward the use of water-based formulations that reduce environmental impact and meet stricter regulations. These formulations are gaining popularity in consumer goods and construction applications, where low-VOC and non-toxic options are increasingly demanded. High-performance catalysts, which offer faster curing times, better foam structure, and improved insulation properties, are also in demand. From an opinionated standpoint, water-based solutions and high-efficiency catalysts will be key differentiators in the market, as manufacturers focus on providing more effective and environmentally conscious products.

Challenges in the polyurethane catalyst market include raw material volatility, as fluctuations in the prices of key components such as isocyanates and polyols can impact production costs and pricing strategies. Regulatory pressures are another significant challenge, particularly with the increasing emphasis on reducing emissions and hazardous substances in polyurethane products. The complexity of catalyst manufacturing processes and the need for consistent quality control can also pose obstacles. In our view, addressing these challenges requires innovation in catalyst design and more efficient manufacturing processes that align with regulatory demands while controlling costs.

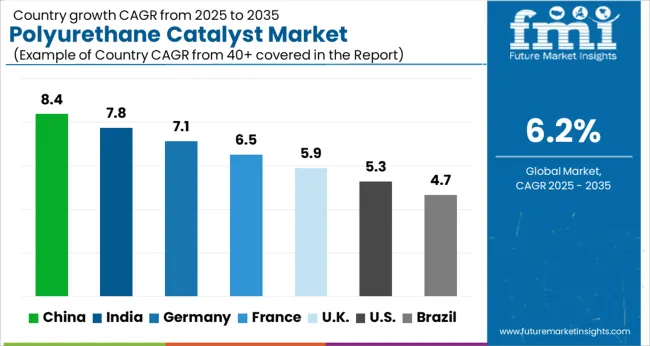

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

The global polyurethane catalyst market is projected to grow at 6.2% from 2025 to 2035. China leads at 8.4%, followed by India 7.8% and Germany 7.1%; the United Kingdom 5.9% and United States 5.3% follow. The demand for polyurethane catalysts is driven by the growth of the automotive, construction, and furniture industries, where polyurethane foams are widely used for insulation, seating, and packaging. The increasing shift towards environmentally friendly and high-performance materials is accelerating growth. The market is also benefiting from the demand for energy-efficient building materials and the rise of green chemistry. Asia is expected to lead in production volume, while Europe and North America will focus on premium catalysts and sustainability. In our view, the market will continue to grow, driven by innovations in catalyst efficiency, performance, and environmental safety. This report spans 40 plus countries, though the leading five are highlighted below.

The polyurethane catalyst market in China is expected to expand at 8.4%. China’s booming manufacturing sector, particularly in the automotive, furniture, and construction industries, is fueling demand for polyurethane catalysts used in flexible and rigid foam production. The growth of the Chinese automotive market, along with the increasing demand for high-performance, energy-efficient insulation materials, is driving the need for polyurethane catalysts. The rise of the furniture industry and the adoption of polyurethane foams in packaging further contribute to market growth. Additionally, the Chinese government’s focus on environmental sustainability and the shift towards low-emission and eco-friendly polyurethane materials are encouraging the use of more efficient and environmentally safe catalysts.

The polyurethane catalyst market in India is projected to grow at 7.8%. The demand for polyurethane catalysts is being driven by the rapid expansion of the construction, automotive, and furniture industries, where polyurethane foams are widely used for insulation, seating, and packaging. The shift towards energy-efficient building materials and the growing adoption of polyurethane in the automotive industry for lightweight components and seating are accelerating growth. Furthermore, the increasing focus on environmentally friendly materials and the rise of green chemistry are pushing the demand for eco-friendly catalysts. India’s growing manufacturing sector, coupled with a rising middle class, is creating significant opportunities for polyurethane catalyst suppliers.

The polyurethane catalyst market in Germany is forecast to rise at 7.1%. Germany’s strong industrial base, particularly in the automotive, construction, and furniture sectors, is driving the demand for polyurethane catalysts. The country’s push for energy-efficient and sustainable materials, especially in building insulation, is spurring the adoption of polyurethane foams, which require high-performance catalysts for their production. Additionally, Germany’s regulatory standards, focusing on low-emission materials and eco-friendly chemicals, are encouraging the use of advanced polyurethane catalysts. Germany’s focus on green chemistry and sustainability will continue to shape the growth of the market, with an emphasis on high-performance, eco-friendly catalysts in polyurethane production.

The polyurethane catalyst market in the UK is expected to expand at 5.9%. The UK’s growing construction industry and demand for energy-efficient buildings are driving the use of polyurethane foams for insulation, which requires high-performance catalysts. The automotive industry’s shift towards lightweight materials and the increasing demand for sustainable and eco-friendly solutions are further accelerating the growth of the market. The rise of green chemistry, coupled with the UK’s regulatory push for low-emission materials, is prompting manufacturers to adopt polyurethane catalysts that comply with environmental standards. As the market moves toward sustainable development, the demand for environmentally friendly catalysts will continue to rise.

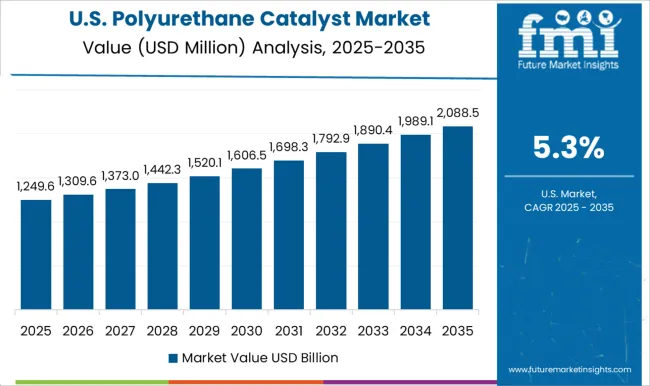

The polyurethane catalyst market in the United States is projected to grow at 5.3%. The USA market is being driven by the increasing demand for polyurethane foams in construction, automotive, and furniture applications. The rise in demand for energy-efficient buildings and sustainable materials, along with the growing adoption of polyurethane in automotive components, is pushing the need for high-performance polyurethane catalysts. The focus on environmentally friendly and low-emission materials is encouraging the development of eco-friendly catalysts that meet regulatory standards. In the USA, the expanding demand for affordable and energy-efficient products will continue to drive the market for polyurethane catalysts in the coming years.

Competition in the polyurethane catalyst market has been driven by how companies present product performance, efficiency, and environmental compatibility in their brochures. BASF SE, Huntsman International, and Evonik Industries lead with brochures that highlight their advanced catalysts for both flexible and rigid polyurethane foam applications, emphasizing faster reaction times, improved foam quality, and energy efficiency. Dow Chemical Company and Momentive Performance Materials focus on offering highly effective catalysts that reduce cycle times, improve foam density, and provide stable, consistent results for industrial and automotive applications.

Wanhua Chemical Group and LANXESS AG present their polyurethane catalysts with an emphasis on environmental safety and compliance with global regulations, highlighting their low-emission products and low toxicity for both manufacturing processes and end-users. Bayer AG, Mitsui Chemicals, and Covestro AG offer solutions that cater to a wide range of polyurethane applications, with brochures that emphasize versatility, cost-effectiveness, and excellent dispersion properties.

Strategy has been executed through clear, detailed brochures that make technical data and market-specific advantages easy to compare. Key specifications such as catalyst activity, reaction rates, and compatibility with various isocyanates and polyols are presented in easy-to-read tables for quick decision-making. Many brochures also emphasize sustainability benefits, such as reduced environmental impact, low-VOC emissions, and alignment with green building certifications.

Companies that highlight superior processing stability, minimal side effects, and long-term performance gains over the lifecycle of products gain a competitive edge. Additionally, after-sales support, technical assistance, and custom formulations are often featured prominently in brochures to strengthen customer trust and loyalty. In this market, the brochure serves as a key tool for buyers to evaluate technical performance, environmental impact, and cost efficiency before selecting the most suitable polyurethane catalyst.

| Items | Values |

|---|---|

| Quantitative Units | USD 2.8 billion |

| Product Type | Amine Catalysts, Metal Catalysts, Bismuth Catalysts, Organometallic Catalysts, Non-metal Catalysts, and Others |

| Application | Flexible Foam, Rigid Foam, Coatings, Adhesives & Sealants, Elastomers, and Others |

| End Use Industry | Construction, Automotive, Furniture & Bedding, Electronics, Footwear, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Huntsman International LLC, Evonik Industries AG, Dow Chemical Company, Momentive Performance Materials Inc., Wanhua Chemical Group Co., Ltd., LANXESS AG, Bayer AG, Mitsui Chemicals, Inc., DIC Corporation, Covestro AG, Carpenter Co., King Industries, Inc., MOFAN POLYURETHANE CO., LTD., Umicore, and Air Products and Chemicals, Inc. |

| Additional Attributes | Dollar sales by catalyst type (amine, metal, organometallic), Dollar sales by application (flexible foam, rigid foam, coatings, adhesives & sealants, elastomers), Trends in low-emission formulations and bio-based catalysts, Role in enhancing foam structure, curing time, and sustainability, Growth driven by construction, automotive, and electronics sectors, Regional demand across Asia Pacific, North America, Europe. |

The global polyurethane catalyst market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the polyurethane catalyst market is projected to reach USD 5.0 billion by 2035.

The polyurethane catalyst market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in polyurethane catalyst market are amine catalysts, metal catalysts, bismuth catalysts, organometallic catalysts, non-metal catalysts and others.

In terms of application, flexible foam segment to command 53.2% share in the polyurethane catalyst market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyurethane Coating Market Size and Share Forecast Outlook 2025 to 2035

Polyurethane (PU) Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Polyurethane Precursor Market Size and Share Forecast Outlook 2025 to 2035

Polyurethane Adhesives Market Trends 2025 to 2035

Polyurethane Foam Market Size & Trends 2025 to 2035

Polyurethane Resins Paints & Coatings Market Growth – Trends & Forecast 2025 to 2035

Market Share Breakdown of Leading Polyurethane Dispersions Manufacturers

Polyurethane Composites Market

Spray Polyurethane Foam Market Size and Share Forecast Outlook 2025 to 2035

Exterior Polyurethane Varnish Market Size and Share Forecast Outlook 2025 to 2035

Waterborne Polyurethane Dispersions Market Size and Share Forecast Outlook 2025 to 2035

Soft Touch Polyurethane Coatings Market Trends 2025 to 2035

Marine-grade Polyurethane Market Size and Share Forecast Outlook 2025 to 2035

Demand for Exterior Polyurethane Varnish in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Exterior Polyurethane Varnish in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Marine-grade Polyurethane in UK Size and Share Forecast Outlook 2025 to 2035

Catalyst Bins Market Insights – Growth & Forecast 2025 to 2035

Biocatalyst Market Size and Share Forecast Outlook 2025 to 2035

Nanocatalysts Market Size and Share Forecast Outlook 2025 to 2035

Titanium Catalyst for Polyester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA