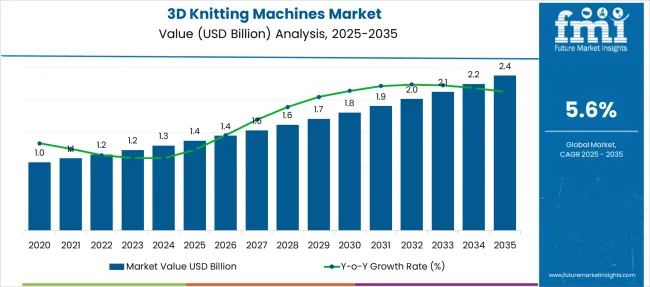

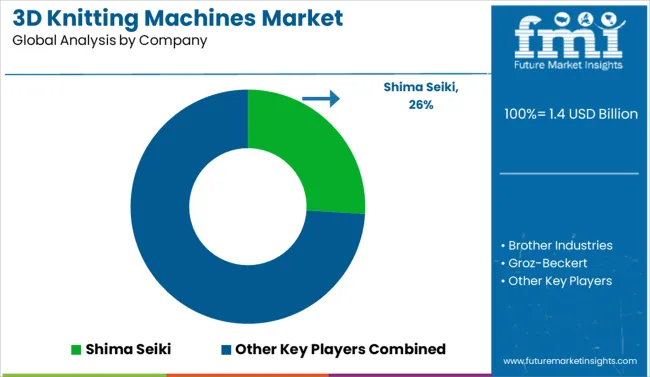

The 3D Knitting Machines Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.4 billion by 2035 at a CAGR of 5.6% over the forecast period. The 3D knitting machines market marks an absolute dollar gain of USD 1.4 billion.

The implied CAGR of 5.6% highlights a moderate yet consistent growth path. Year-on-year increments during the initial years are modest, averaging USD 100 million. The growth shows gradual adoption as capital investment barriers and machine learning-driven automation mature. However, post-2030 projections indicate a slightly accelerated uptake, with annual gains shifting toward USD 200 million. The gain analysis shows intensified penetration in apparel prototyping, smart textiles, and customized fashion manufacturing.

Textile machinery market is a significant parent market to 3D knitting machines market, valued at approximately USD 78 billion in 2025, where 3D knitting holds a 1.3% share. The share is projected to reach 2.0% by 2035, indicating gradual but consistent penetration as automated production becomes more prominent. Another key parent category is apparel manufacturing equipment, estimated at USD 30 billion in 2025, where 3D knitting accounts for 3.3% share, supported by the growing adoption of seamless garment manufacturing and rapid prototyping capabilities. The technical textiles machinery segment, valued near USD 10 billion, shows the highest relative contribution at 10%.

The industrial automation and robotics market exceeds USD 200 billion, and 3D knitting holds a negligible share of less than 0.01%, yet remains strategically significant due to integration with AI-driven design platforms and predictive maintenance systems. Although the segment’s absolute value is modest, a CAGR of 5.6% outperforms most parent categories.

| Metric | Value |

|---|---|

| 3D Knitting Machines Market Estimated Value in (2025E) | USD 1.4 billion |

| 3D Knitting Machines Market Forecast Value in (2035F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The 3D knitting machines market remains driven by sustainable manufacturing, customization capabilities, and operational efficiency in the textile industry. Manufacturers are increasingly investing in 3D knitting technologies to reduce material waste, shorten production cycles, and meet the growing appetite for on-demand production.

The ability of these machines to produce complex, seamless designs with minimal labor intervention has positioned them favorably in the apparel and industrial sectors. Future expansion is expected to be underpinned by innovations in machine precision, integration of smart controls, and the transition of brands toward circular production models.

Strong emphasis on reducing environmental impact and delivering personalized products is paving the way for broader adoption across diverse end-use industries, consolidating the market’s growth prospects.

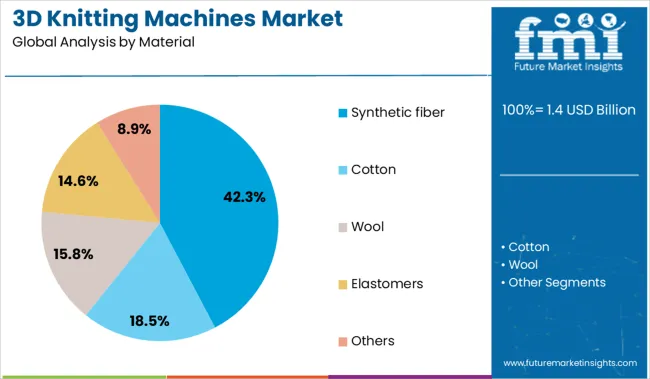

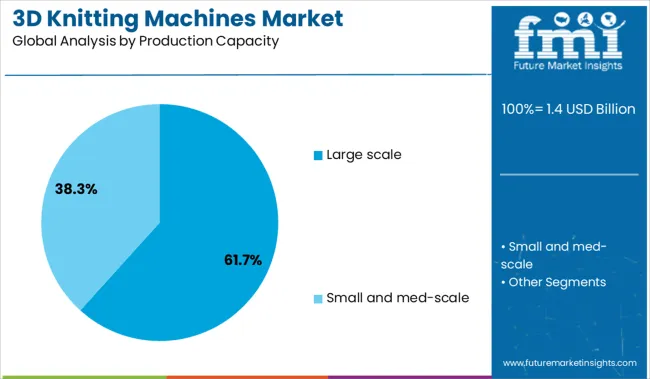

The market has been analyzed based on detailed segmentation across material types, production capacities, applications, distribution channels, and geographic regions. Materials are categorized into synthetic fiber, cotton, wool, elastomers, and other variants. Production capacity is classified as large-scale or small to medium-scale operations, reflecting the presence of both high-volume manufacturers and niche players.

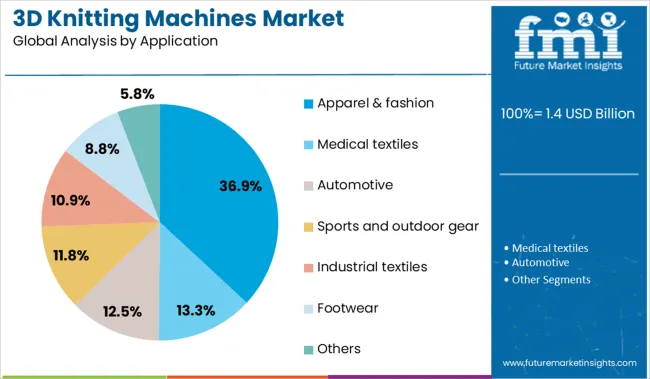

Application areas include apparel and fashion, medical textiles, automotive, sports and outdoor gear, industrial textiles, footwear, and other specialized sectors. Distribution occurs through direct sales channels as well as indirect sales networks. Geographically, the market consists of North America, Latin America, Western Europe, Eastern Europe, the Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

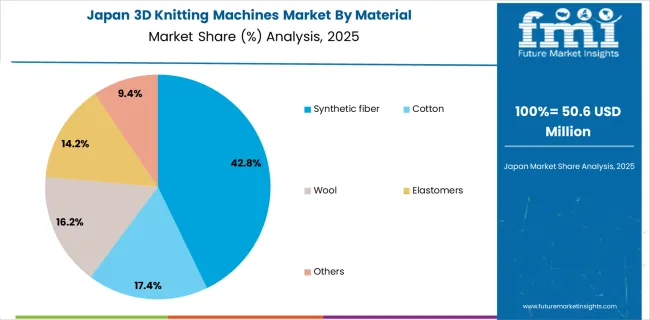

By material, synthetic fiber is anticipated to hold 42.3% of the market revenue in 2025, making it the leading material segment. High durability, flexibility, and cost-effectiveness of synthetic fibers drive the segmental growth.

The ability of synthetic fibers to support intricate designs and maintain structural integrity under high-speed operations has reinforced their preference among manufacturers. Advancements in synthetic yarns, offering enhanced breathability and recyclability, have further bolstered their adoption.

Demand for synthetic fiber is also supported by their widespread availability and compatibility with automated knitting settings, enabling consistent quality output and operational efficiency in mass and customized production environments.

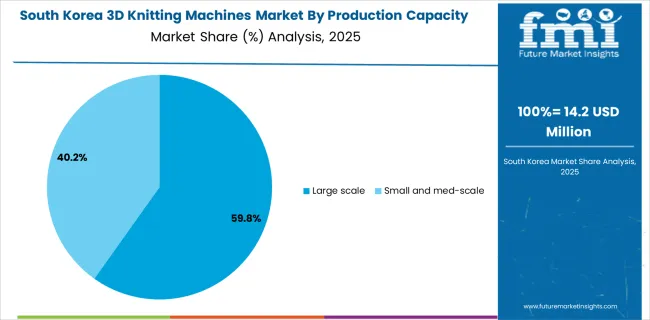

By production capacity, the large-scale segment is projected to account for 61.7% of the total market revenue in 2025, establishing it as the dominant segment. This leadership has been underpinned by the ability of large-scale operations to achieve economies of scale, optimize resource utilization, and fulfill bulk orders efficiently.

Manufacturers operating at a large scale have invested heavily in advanced 3D knitting infrastructure, enabling high throughput and consistency. Their capacity to manage substantial production volumes while maintaining flexibility for customization has strengthened their position.

Availability of a skilled workforce, capital resources, and integration of smart factory technologies have allowed large-scale facilities to meet rising global demand while adhering to sustainability and quality standards.

Based on application, apparel and fashion segment is expected to capture 36.9% of the market revenue in 2025, ranking it as the leading application segment. This prominence is driven by the industry’s rapid shift toward sustainable and customized clothing solutions, which 3D knitting machines are uniquely positioned to deliver.

The capability to produce seamless, form-fitting garments with reduced material wastage has made these machines highly attractive to designers and brands focusing on eco-conscious and innovative collections. Consumer demand for personalization, quick turnaround times, and novel textures has further propelled adoption in this segment.

The fashion industry’s strong focus on integrating technology-driven processes for competitive differentiation has reinforced apparel and fashion as the primary driver of 3D knitting machine deployment globally.

On-demand manufacturing and mass customization are becoming dominant trends as fashion and sportswear industries move toward zero-inventory models. The integration of multi-material capabilities for producing smart textiles and wearable fabrics is expanding applications beyond apparel, reaching sectors like medical and automotive. Regional localization of production units is gaining momentum to shorten lead times and reduce logistical complexities, creating new opportunities for compact modular machines.

The 3D knitting machines market is being influenced by a rising preference for personalized products, particularly in fashion and sportswear. These machines enable seamless, on-demand production without the need for extensive inventories, allowing brands to respond quickly to consumer trends. The capability to create complex patterns and designs directly from digital models enhances creative flexibility while reducing material waste. This adaptability also attracts manufacturers in sectors like automotive interiors and technical textiles. The convenience of automated knitting processes further positions these machines as a cost-efficient solution for high-value customized production. As e-commerce and direct-to-consumer models expand globally, the relevance of 3D knitting technology in fulfilling individualized demand is expected to intensify.

AI-driven systems allow optimization of knitting processes, error detection, and design precision, while IoT connectivity facilitates real-time monitoring and remote operation. These capabilities support greater efficiency, reduced downtime, and predictive maintenance. Additionally, digital twins and simulation software are being adopted to enhance prototyping speed and minimize production errors. This digital transformation aligns with manufacturers’ goals to achieve higher productivity and quality output while cutting operational costs. The incorporation of these technologies is creating new business models, including smart factories, and positioning 3D knitting machines as a core component of Industry 4.0 initiatives worldwide.

Upfront cost associated with purchasing advanced equipment remains a key restraint in the 3D knitting machines market. These machines often require a large financial outlay, making them less accessible for small and medium-sized enterprises. Beyond initial costs, ongoing expenses for maintenance and periodic upgrades further increase the financial burden. Operational complexity adds another layer of challenge, as running these machines demands specialized skills in programming and digital design. This creates a dependency on trained professionals, which can be scarce in emerging markets. Adoption rates slow down for companies with limited budgets or insufficient technical expertise, despite the evident long-term benefits of the technology.

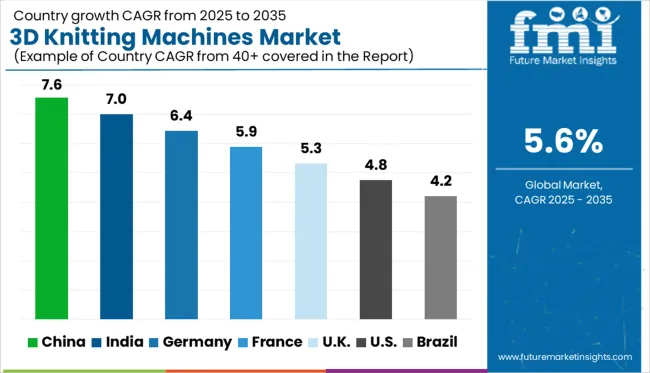

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| US | 4.8% |

| Brazil | 4.2% |

The 3D knitting machines market is projected to expand at a CAGR of 5.6% from 2025 to 2035, led by automated garment production, seamless pattern replication, and a shift toward low-waste textile solutions. China, part of BRICS, leads with 7.6% CAGR, supported by government-backed flatbed adoption and bulk factory deployment. India, also within BRICS, follows growth at 7% CAGR, driven by domestic knitwear hubs upgrading to programmable systems.

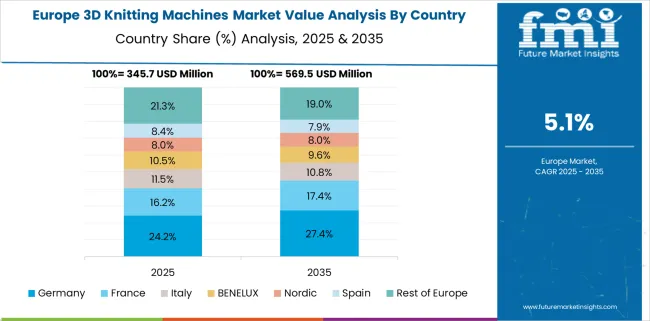

Germany, a core OECD economy, posts 6.4%, with technical textile manufacturers focused on multi-gauge integration. France records 5.9%, emphasizing compact smart-knit machines for designer and export markets. The United Kingdom, part of the OECD, grows at 5.3%, shaped by premium wool knit automation and digital fashion integration.

The report includes an analysis of over 40 countries, with five profiled below for reference.

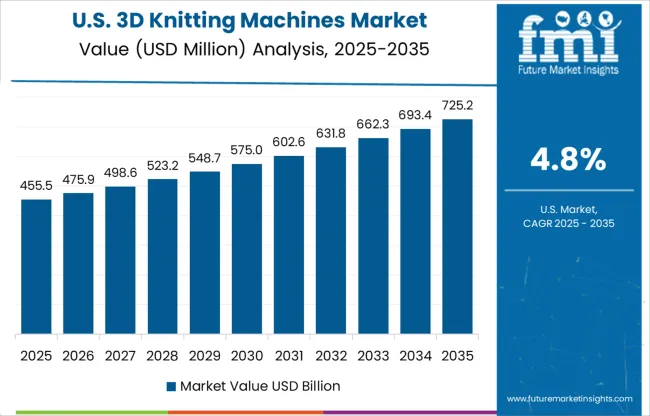

Sales for 3D knitting machines in the United States are projected to expand at a CAGR of 4.8% between 2025 and 2035. On-demand manufacturing is prioritized across footwear uppers, activewear, and technical textiles. Textile hubs are deploying multi-gauge, AI-integrated machines that minimize post-processing and reduce sampling iterations. High uptake has been recorded among industrial uniform producers and performance-oriented apparel startups. Configurations supporting rapid pattern switching and programmable yarn tension are preferred in distributed production environments. Custom small-batch deployment is also scaling within university R&D programs and collaborative prototyping labs.

Adoption of 3D knitting machines in India is projected to grow at a CAGR of 7.0% through 2035. Emerging product categories, such as seamless school uniforms and digitally patterned ethnic stoles, are driving purchase behavior. Demand flows through fashion clusters in Tamil Nadu and Gujarat, where programmable flatbeds are replacing manual looms. Machines tailored for mid-range pricing and customization flexibility are gaining volume across regional OEMs. Low-waste design support, electronic needle control, and simplified user interfaces are influencing procurement decisions, particularly among exporters aligned with EU specifications.

Demand for 3D knitting machines in China is forecast to grow at a CAGR of 7.6% from 2025 to 2035. Government procurement initiatives are accelerating machine adoption across automated knitwear zones in eastern provinces. Policy incentives are supporting technology upgrades that embed AI-based stitch controls, real-time pattern editing, and yarn-saving optimization. Regulatory guidelines for energy-efficient production have boosted preference for servo-controlled flatbeds integrated with simulation software. Garment OEMs are aligning procurement with national textile modernization directives and digital infrastructure mandates.

Germany is projected to record a CAGR of 6.4% in the 3D knitting machines market during the forecast period. Significant investments are directed toward medical textiles, aerospace-grade components, and automotive interiors. Research clusters in Baden-Württemberg work closely with machine makers to pioneer composite knitting methods. A rare development in this market is the adoption of digital twin systems for virtual testing, which reduces material waste and accelerates design validation. Germany is also advancing in conductive yarn integration for IoT-enabled textiles, aiming at safety systems and medical monitoring solutions.

Demand for 3D knitting machines in the United Kingdom is expected to grow at a CAGR of 5.3% through 2035. Boutique design studios, fashion-tech labs, and heritage woolen brands are adopting modular flatbeds to support digital-first collections and circular production models. Design flexibility and cloud-linked patterning are influencing equipment decisions across creative clusters in Scotland and London. Apparel firms focused on resource-efficient workflows are choosing machines capable of multi-fabric configurations, fast transition cycles, and reduced operator dependency. Integration with 3D visual sampling software is now embedded across commercial deployments.

The 3D knitting machines market in Japan is valued at USD 50.6 million in 2025. Growth is supported by automation, precision engineering, and high-end textile manufacturing. Key demand comes from seamless garment production for apparel and sportswear, along with growing adoption in technical textiles for automotive and medical applications. Manufacturers in Japan are investing in AI-enabled design platforms, energy-efficient machinery, and predictive maintenance tools to strengthen efficiency and competitiveness. The market outlook remains quality-oriented, driven by innovation and integration with smart factory models rather than volume-based expansion.

Demand if South Korea is likely to translate to a valuation of USD 14.2 million in 2025. While small in growth scale, South Korea is highly strategic because the country serves as a hub for performance-driven textiles and rapid fashion cycles. South Korean manufacturers are not competing on volume but on technical superiority. Integration of AI-enabled pattern generation and real-time defect detection is reshaping production workflows, making 3D knitting a critical enabler for lean manufacturing. A significant trend is the alignment of these machines with South Korea’s strong e-commerce apparel sector, where quick response manufacturing is essential. Partnerships between machine suppliers and premium sportswear brands are accelerating technology upgrades. Over the next decade, market expansion will likely hinge on energy-efficient knitting solutions and predictive maintenance adoption, aimed at reducing downtime and operational costs.

The 3D knitting machines industry is characterized by significant entry barriers, primarily driven by proprietary automation technologies and integrated software solutions. Shima Seiki stands out as a technological leader in flat knitting automation. Brother Industries and Stoll compete strongly with precision-based digital knitting systems designed for seamless apparel and technical textiles. European companies such as Groz-Beckert, Karl Mayer, and Santoni maintain a stronghold through advanced needle technology and circular knitting systems, catering to high-performance fabric applications.

Chinese manufacturers, including Jiangsu Gomor, Qianglong, and Tongtai Intelligent, are rapidly expanding their presence with cost-efficient smart knitting platforms, supported by IoT capabilities and large-scale production advantages. Market competition increasingly revolves around automation compatibility, yarn flexibility, and customization for performance wear and technical fabrics. Emerging threats from 3D textile printing and additive manufacturing pose long-term substitution risks. Strategic sustainability depends on innovation in digital design integration, smart production, and proprietary processes, though cost pressures from Chinese players continue to reshape pricing strategies. Future growth is expected to rely on AI-enabled knitting, modular systems, and platform-based solutions that enhance design-to-production efficiency.

In June 2025, Shima Seiki released its APEXFiz® Design Sox software, a sock-focused CAD module that enables realistic 3D virtual sampling and cost-efficient design. It integrates seamlessly with Lonati S.p.A. knitting systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Material | Synthetic fiber, Cotton, Wool, Elastomers, and Others |

| Production Capacity | Large scale and Small and med-scale |

| Application | Apparel & fashion, Medical textiles, Automotive, Sports and outdoor gear, Industrial textiles, Footwear, and Others |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shima Seiki, Brother Industries, Groz-Beckert, Jiangsu Gomor Textile Technology Co Ltd, Karl Mayer, Santoni, Steiger, Stoll, Tongxiang Qianglong Machinery Co Ltd, and Zhejiang Tongtai Intelligent Technology Co Ltd |

| Additional Attributes | Dollar sales of 3D knitting machines are segmented by machine type-whole garment, seamless, and warp knitting-while demand grows for automation and lightweight, sensor-integrated outputs. OEMs and vertically integrated manufacturing partners are enabling turnkey production lines. Adoption is accelerating in sportswear and automotive textiles, particularly across Europe and Asia-Pacific, where material efficiency and waste reduction serve as primary differentiators. |

The global 3D knitting machines market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the 3D knitting machines market is projected to reach USD 2.4 billion by 2035.

The 3D knitting machines market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in 3D knitting machines market are synthetic fiber, cotton, wool, elastomers and others.

In terms of production capacity, large scale segment to command 61.7% share in the 3D knitting machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Mapping and Modeling Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Personalized Masks Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Packaging Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Clear Dental Aligners Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA