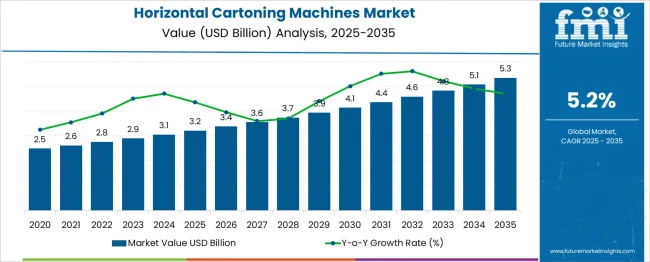

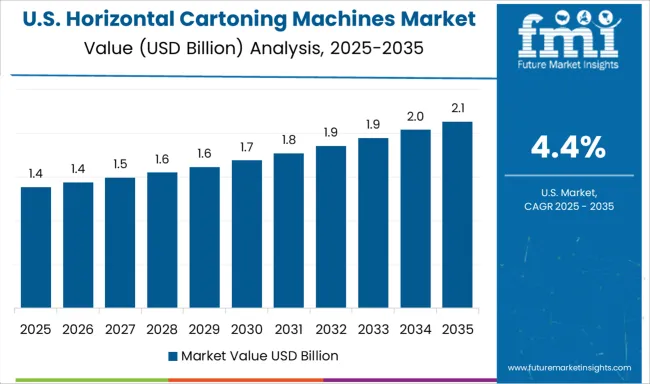

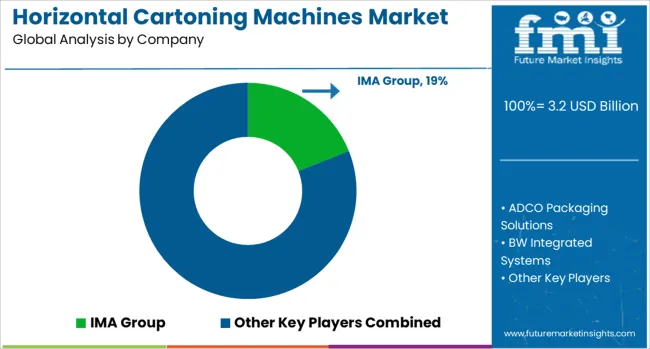

The Horizontal Cartoning Machines Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 5.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period. Year-on-year (YoY) growth analysis of the provided data reveals a stable yet modest upward trajectory, characteristic of a mature packaging machinery segment with consistent end-user demand. From 2025 to 2027, YoY growth remains in the 5.5%–5.9% range, supported by ongoing automation adoption in food, beverage, and pharmaceutical packaging lines. Between 2028 and 2030, annual absolute gains increase from USD 0.2 billion to USD 0.3 billion, while percentage growth averages 5.1%, showing steady demand without major cyclical volatility. In the latter phase (2031–2035), annual increments rise slightly in absolute terms, from USD 0.2–0.3 billion to USD 0.4 billion, yet percentage growth softens marginally toward 4.8–5.0%, reflecting the compounding effect of a larger market base. This pattern suggests a balanced expansion, driven by capacity upgrades, machine replacement cycles, and the shift toward higher-speed, flexible cartoning systems to handle diverse SKU formats. The YoY analysis indicates a predictable and low-volatility growth path, making the segment attractive for equipment manufacturers and investors seeking stable revenue streams in industrial automation, with opportunities concentrated in emerging markets and high-spec machine segments.

| Metric | Value |

|---|---|

| Horizontal Cartoning Machines Market Estimated Value in (2025 E) | USD 3.2 billion |

| Horizontal Cartoning Machines Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The horizontal cartoning machines market is viewed as a specialized yet steadily expanding category across its parent industries. It is assessed at about 2.8% of the global packaging machinery market, reflecting demand from automated packaging lines. Within the food and beverage packaging equipment sector a share of approximately 3.5% is evaluated, driven by requirements for high throughput cartoning. In the pharmaceutical packaging machinery market around 4.2% is calculated supported by compliance and precision needs. Within the consumer goods packaging systems segment about 3.0% is observed reflecting use in cosmetics and household products. In the e commerce fulfillment and distribution equipment market a contribution of roughly 2.1% is estimated as cartoning is integrated into automated order processing operations. Trends in this market have been shaped by increased demand for machines offering flexible format handling and quick changeover capabilities. Innovations have been focused on integration of vision systems and servo motion controls to improve accuracy and speed. Interest has increased in servo driven cartoners with tool free change parts and remote diagnostics support. The Asia Pacific region has been observed to show the fastest adoption while Europe has maintained demand for high performance precision machines under regulatory scrutiny. Strategic initiatives have included collaborations between machinery vendors and systems integrators to deliver modular cartoning platforms that feature predictive maintenance, adaptive motion control and seamless integration with warehouse and production line systems.

The horizontal cartoning machines market is gaining traction due to increasing automation in secondary packaging, demand for higher throughput rates, and rising safety and hygiene requirements in regulated industries. As consumer goods and pharmaceutical manufacturers aim to streamline operations, reduce labor dependency, and ensure consistent packaging quality, horizontal cartoners have emerged as a preferred solution.

Advancements in servo-driven mechanisms and intelligent control systems have improved efficiency, enabling format flexibility and minimizing changeover time. Additionally, the shift toward sustainable and customizable carton designs is driving adoption across end-use sectors, with demand particularly strong in pharmaceuticals, cosmetics, and food packaging.

The market outlook remains positive as investments in smart packaging lines and integration with upstream/downstream systems continue to grow.

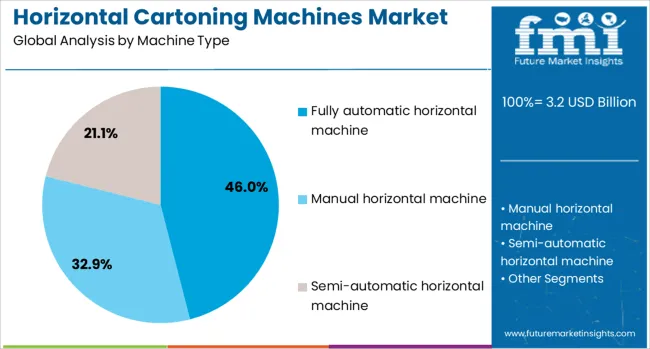

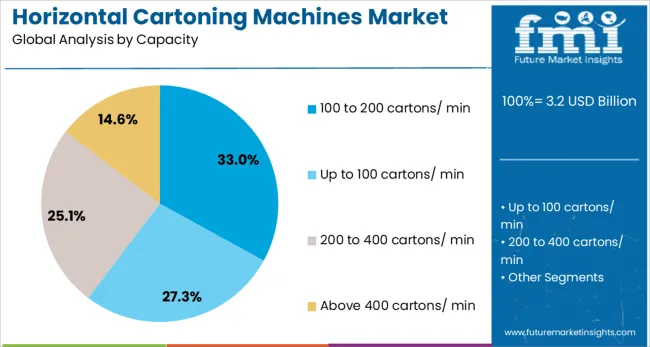

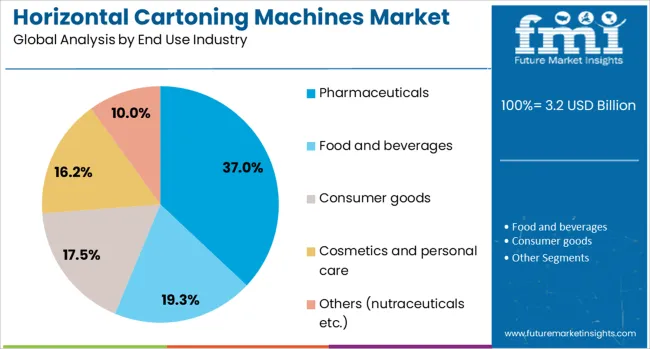

The horizontal cartoning machines market is segmented by machine type, capacity, end use industry, and distribution channel and geographic regions. By machine type of the horizontal cartoning machines market is divided into Fully automatic horizontal machine, Manual horizontal machine, and Semi-automatic horizontal machine. In terms of capacity of the horizontal cartoning machines market is classified into 100 to 200 cartons/ min, Up to 100 cartons/ min, 200 to 400 cartons/ min, and Above 400 cartons/ min. Based on end use industry of the horizontal cartoning machines market is segmented into Pharmaceuticals, Food and beverages, Consumer goods, Cosmetics and personal care, and Others (nutraceuticals etc.). By distribution channel of the horizontal cartoning machines market is segmented into Direct sales and Indirect sales. Regionally, the horizontal cartoning machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

By machine type, fully automatic horizontal machines are projected to dominate the market with a 46.00% share in 2025. These machines offer high-speed, precise operation and require minimal human intervention, making them ideal for large-scale manufacturers prioritizing production efficiency and consistency.

Their ability to handle various carton sizes, shapes, and materials, coupled with integration capabilities for barcoding, leaflet insertion, and tamper-evidence features, has solidified their leadership in automated packaging environments.

Their widespread adoption is also supported by enhanced safety features, compact footprint, and compatibility with cleanroom protocols—especially in pharmaceutical and food industries.

In terms of capacity, the 100 to 200 cartons per minute segment is expected to hold a 33.00% market share in 2025. This capacity range offers an optimal balance between speed, flexibility, and equipment cost, making it attractive to mid-to-large-scale manufacturers across diverse industries.

Machines in this category can manage multiple SKU changeovers efficiently and provide consistent performance with minimal downtime. The segment's relevance is growing in settings where throughput requirements are high but ultra-high-speed automation may not be justified.

Additionally, the 100–200 CPM range supports seamless integration into semi-automated lines without significant layout modification.

By end-use industry, pharmaceuticals are projected to lead the horizontal cartoning machines market with a 37.00% share in 2025. This dominance stems from stringent regulatory requirements, demand for precision, and the need for tamper-proof, traceable packaging.

Cartoning machines are critical in maintaining compliance with Good Manufacturing Practices (GMP) by automating leaflet insertion, serialization, and vision inspection processes. The pharmaceutical sector also requires consistent carton sealing and batch control, which horizontal cartoners deliver with high reliability.

As global pharmaceutical production continues to expand—driven by aging populations and increased healthcare access—demand for high-performance cartoning systems will remain elevated in this segment.

Horizontal cartoning machines have been increasingly adopted in food, beverage, pharmaceutical, and personal care packaging lines due to their high-speed operation, versatility, and precision in product loading. These machines form, fill, and close cartons in a horizontal orientation, accommodating a wide variety of product shapes and sizes. Growth has been driven by the need for consistent packaging quality, increased production throughput, and reduced manual handling. Manufacturers have been integrating advanced automation, servo-driven systems, and quick changeover features to meet diverse industry requirements.

Food and beverage manufacturers have been relying on horizontal cartoning machines to package items such as confectionery, frozen goods, ready-to-eat meals, and bottled beverages. The ability to operate at high speeds with precise product placement has enabled efficient handling of large production runs. Carton sealing technologies, including hot-melt adhesive and tuck-in closures, have been selected based on product type and distribution requirements. In dairy and confectionery segments, horizontal machines have been preferred for their capability to handle multipack formats. Companies in North America, Europe, and Asia have expanded investments in automated cartoning lines to reduce labor dependency and maintain consistent quality during peak production seasons. The combination of high-speed packaging and reduced downtime has positioned horizontal cartoning machines as an essential component in competitive food and beverage manufacturing environments.

The pharmaceutical industry has been a significant adopter of horizontal cartoning machines due to strict packaging standards and the need for precise, contamination-free product handling. These machines have been used for packaging blister packs, bottles, vials, and medical devices with integrated leaflet insertion. Tamper-evident sealing, serialization, and vision inspection systems have been incorporated to ensure compliance with regulatory requirements. Compact machine designs have been valued by pharmaceutical manufacturers seeking to optimize production floor space. Suppliers in Germany, Switzerland, and Italy have been at the forefront of producing high-precision models for global pharmaceutical brands. The reliability, cleanroom compatibility, and traceability features of horizontal cartoning machines have made them indispensable for companies prioritizing safety, accuracy, and packaging integrity in the healthcare sector.

Horizontal cartoning machines have benefited from advancements in automation, robotics, and digital controls, which have enhanced speed, flexibility, and overall equipment effectiveness. Servo-driven systems have enabled smoother operation and quicker changeovers between carton sizes. Integrated robotics have been applied for product collation, loading, and orientation, reducing manual intervention. Touchscreen interfaces, programmable logic controllers, and real-time performance monitoring have improved operator control and maintenance scheduling. Machine learning algorithms have been explored to optimize feeding systems and reduce misfeeds. Manufacturers in the United States, Japan, and Europe have focused on developing modular designs that allow production scalability. The combination of automation and intelligent controls has significantly increased output while minimizing waste, making advanced horizontal cartoning machines a preferred choice for high-volume, quality-driven production facilities.

The adoption of horizontal cartoning machines has been limited by high initial investment costs and the need for substantial floor space, particularly in small and mid-sized manufacturing operations. While these machines offer high-speed performance, the cost of acquisition and installation can be prohibitive for businesses with lower production volumes. Additionally, changeover time and operator training requirements can delay full integration into existing lines. In some cases, vertical cartoning machines or semi-automatic alternatives have been chosen for cost-sensitive applications. Maintenance expenses, including replacement of wear parts and software upgrades, have added to the total cost of ownership. Without targeted financing options, compact machine models, and streamlined installation solutions, adoption among small-scale manufacturers may remain slower compared to larger, capital-intensive production environments.

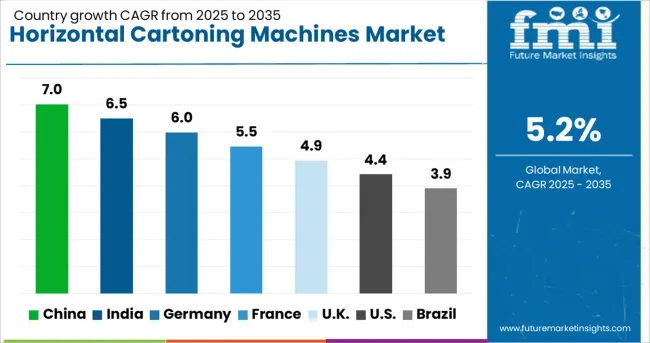

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The horizontal cartoning machines market is expected to grow at a global CAGR of 5.2% between 2025 and 2035, driven by automation in packaging lines, demand for high-speed cartoning solutions, and expansion in food, beverage, and pharmaceutical industries. China leads with a 7.0% CAGR, supported by large-scale packaging machinery production and adoption across fast-moving consumer goods sectors. India follows at 6.5%, fueled by growth in packaged food manufacturing and pharmaceutical exports. Germany, at 6.0%, benefits from advanced engineering capabilities and high-precision machinery exports. The UK, projected at 4.9%, sees growth from investments in automated packaging for premium retail products. The USA, at 4.4%, reflects steady adoption in healthcare and consumer goods packaging. The report provides insights for 40+ countries, with the five below highlighted for their strategic role and growth outlook.

China is projected to grow at a CAGR of 7.0% from 2025 to 2035 in the horizontal cartoning machines market, supported by its position as one of the largest global hubs for consumer goods and industrial manufacturing. The country’s robust food processing sector, strong pharmaceutical production, and rapidly growing cosmetics industry are key demand drivers. Domestic producers such as Ruian Xinyuan Packaging Machinery, Shanghai Kuko Packing Machinery, and Zhongya Packaging are not only supplying local industries but also increasing exports to Southeast Asia and Africa. The shift toward fully automated packaging lines is being accelerated by labor cost pressures and the need for consistent output quality. Advancements in servo-driven technology, modular machine designs, and real-time performance monitoring are enhancing operational efficiency across production floors.

India is expected to achieve a CAGR of 6.5% from 2025 to 2035, driven by the expansion of FMCG, personal care, and pharmaceutical manufacturing clusters across the country. The growth of regional brands in packaged food, oral care, and over-the-counter medicines is creating consistent demand for flexible, mid-speed cartoners. Leading Indian companies such as U-Pack Engineers and Parle Global Technologies are developing cost-effective models with quick size adjustments to cater to small and medium enterprises. Additionally, the increasing penetration of organized retail and e-commerce packaging requirements is influencing machine specifications, with a preference for systems that can handle various carton shapes and sizes. Collaborations with European and Japanese technology partners are helping domestic manufacturers incorporate advanced automation features while maintaining affordability for local buyers.

Germany is forecasted to grow at a CAGR of 6.0% from 2025 to 2035, supported by its reputation for precision engineering and high-value industrial machinery exports. German manufacturers such as IWK Verpackungstechnik, Schubert, and Uhlmann Pac-Systeme are at the forefront of integrating robotic handling and advanced vision inspection into horizontal cartoning lines. The pharmaceutical sector remains the largest buyer, demanding machines capable of high-speed, compliance-ready packaging for blister packs, vials, and medical devices. In the food sector, premium chocolate, confectionery, and bakery producers rely on German-engineered cartoners for delicate product handling. Industry 4.0 features, such as predictive maintenance, data analytics, and remote monitoring, are becoming standard offerings to meet the evolving needs of advanced manufacturing plants.

The United Kingdom is projected to record a CAGR of 4.9% from 2025 to 2035, with strong demand from premium food, beverage, and healthcare packaging sectors. British manufacturers such as Mpac Group and Jacob White Packaging are innovating with quick-changeover designs that allow rapid adaptation between short-run product lines, seasonal packaging, and promotional campaigns. The UK’s growing ready-to-eat meal sector is driving the adoption of compact cartoners capable of handling a variety of portion sizes. There is also increasing demand for export-ready machinery from markets such as Australia, New Zealand, and the Middle East, where British engineering has strong brand recognition. The focus on packaging aesthetics and shelf appeal is pushing manufacturers to design machines that deliver precise folding, gluing, and alignment.

The United States is expected to post a CAGR of 4.4% from 2025 to 2035, driven by the expansion of personal care, nutraceutical, frozen food, and premium beverage packaging. American manufacturers such as ADCO Manufacturing, PMI Cartoning, and Bradman Lake Inc. (US operations) are increasingly focusing on modular cartoning systems that can be reconfigured for new product launches with minimal downtime. User-friendly human-machine interfaces (HMIs), tool-less changeovers, and integrated quality inspection systems are now considered essential for competitive advantage. The growing adoption of eco-friendly carton materials is influencing the design of machines capable of handling lighter-weight board without compromising on speed or carton integrity. The need to cater to high-volume retail distribution as well as small-batch, specialty products is shaping investment decisions among manufacturers.

The horizontal cartoning machines market is led by global packaging equipment specialists and regional machinery producers serving the food, beverage, pharmaceutical, personal care, and household goods industries. IMA Group and Marchesini Group dominate with high-speed, fully automated systems designed for pharmaceutical blister packs, cosmetics, and premium food products, supported by global service networks.

BW Integrated Systems and Mpac Group provide versatile machines capable of handling diverse carton styles, integrating seamlessly into large-scale production lines. ADCO Packaging Solutions, Econocorp, and Serpa Packaging Solution cater to medium- to high-volume manufacturers with modular, quick-changeover equipment suited for frequent product variations. Elite Packaging Machinery, Infinity Automated Solutions, and Jacob White Packaging target mid-market and regional customers with durable, operator-friendly solutions emphasizing cost-efficiency. Mespack and Omori Machinery offer advanced horizontal cartoners with integrated sealing, printing, and inspection systems, appealing to brands requiring high packaging integrity and traceability. Nichrome and SaintyCo serve both domestic and export markets with competitively priced machines backed by installation and training services. ShineBen Machinery focuses on compact cartoning machines for small-scale production and niche applications. Competitive strategies include partnerships with end-user industries for customized automation solutions, investment in digital control systems for improved precision, and expansion of after-sales service hubs in growth markets. Entry into this sector is challenged by high engineering and manufacturing costs, the need for proven mechanical reliability, and established relationships between leading suppliers and multinational FMCG and pharmaceutical companies.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 Billion |

| Machine Type | Fully automatic horizontal machine, Manual horizontal machine, and Semi-automatic horizontal machine |

| Capacity | 100 to 200 cartons/ min, Up to 100 cartons/ min, 200 to 400 cartons/ min, and Above 400 cartons/ min |

| End Use Industry | Pharmaceuticals, Food and beverages, Consumer goods, Cosmetics and personal care, and Others (nutraceuticals etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | IMA Group, ADCO Packaging Solutions, BW Integrated Systems, Econocorp, Elite Packaging Machinery, Infinity Automated Solutions, Jacob White Packaging, Marchesini Group, Mespack, Mpac Group, Nichrome, Omori Machinery, SaintyCo, Serpa Packaging Solution, and ShineBen Machinery |

The global horizontal cartoning machines market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the horizontal cartoning machines market is projected to reach USD 5.3 billion by 2035.

The horizontal cartoning machines market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in horizontal cartoning machines market are fully automatic horizontal machine, manual horizontal machine and semi-automatic horizontal machine.

In terms of capacity, 100 to 200 cartons/ min segment to command 33.0% share in the horizontal cartoning machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Horizontal Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Horizontal Strapping Machine Market Trends and Forecast 2025 to 2035

Horizontal Flow Wrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Horizontal Form Fill Seal (HFFS) Machines Market Size and Share Forecast Outlook 2025 to 2035

Cartoning Machines Market from 2025 to 2035

Top Loading Cartoning Machine Market from 2024 to 2034

Lathe Machines Market

Sorter Machines Market Demand & Automation Innovations 2024 to 2034

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Sleeving Machines Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Spinning Machines Market Size and Share Forecast Outlook 2025 to 2035

Knitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Stamping Machines Market Growth and Outlook 2025 to 2035

Twist Tie Machines Market Size and Share Forecast Outlook 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flake Ice Machines Market - Industry Growth & Market Demand 2025 to 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Ice Maker Machines Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA