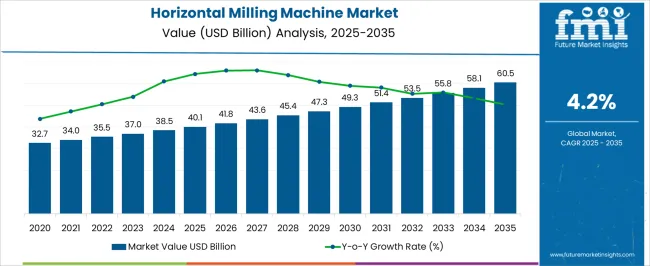

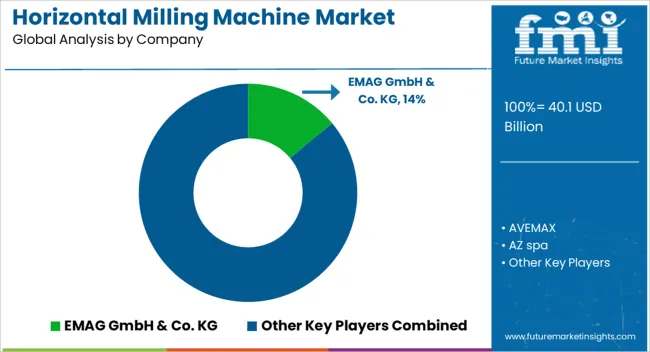

The Horizontal Milling Machine Market is estimated to be valued at USD 40.1 billion in 2025 and is projected to reach USD 60.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| Horizontal Milling Machine Market Estimated Value in (2025 E) | USD 40.1 billion |

| Horizontal Milling Machine Market Forecast Value in (2035 F) | USD 60.5 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The Horizontal Milling Machine market is experiencing consistent growth, driven by increasing demand across industrial automation and manufacturing sectors. The current market landscape reflects a shift toward precision-driven and high-capacity machining tools that enhance operational productivity. Adoption is being supported by advancements in CNC integration, expansion of the automotive and heavy equipment sectors, and increasing investments in smart manufacturing infrastructure.

Strategic moves by machinery manufacturers, as reported in investor briefings and press announcements, are focused on improving tool adaptability and software compatibility to meet evolving industry requirements. Moreover, operational efficiency and the ability to handle complex tasks with minimal human intervention have made horizontal milling machines an attractive choice in both developed and emerging markets.

The future outlook appears promising, as trends such as Industry 4.0 and the push for reduced machining downtime continue to create opportunities Integration with digital twins and predictive maintenance technologies is expected to further accelerate growth and adoption in the coming years.

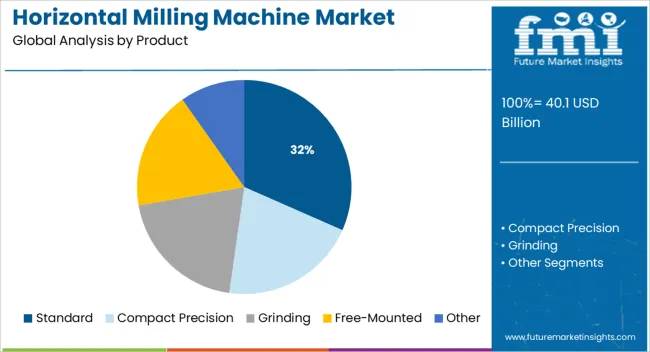

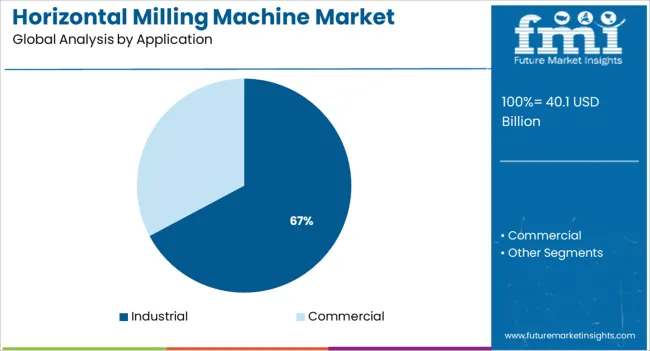

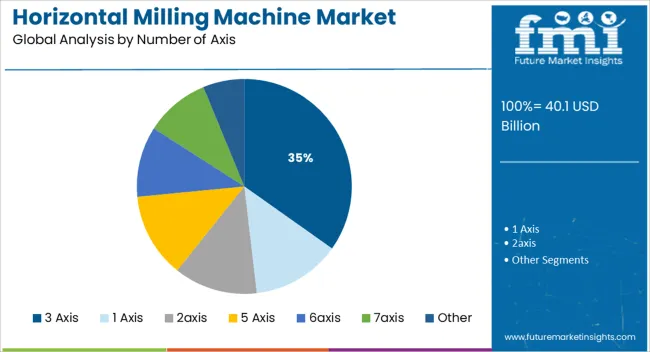

The market is segmented by Product, Application, Number of Axis, and Distribution Channel and region. By Product, the market is divided into Standard, Compact Precision, Grinding, Free-Mounted, and Other. In terms of Application, the market is classified into Industrial and Commercial. Based on Number of Axis, the market is segmented into 3 Axis, 1 Axis, 2axis, 5 Axis, 6axis, 7axis, and Other. By Distribution Channel, the market is divided into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The standard product segment is projected to account for 31.6% of the Horizontal Milling Machine market revenue share in 2025, making it the leading product type. Its strong presence has been supported by widespread use in general-purpose applications and small to medium-scale operations that prioritize reliability and affordability. Companies have increasingly opted for standard machines due to their robust construction, ease of operation, and ability to handle a wide range of materials.

These machines are typically designed for routine milling tasks and offer a cost-effective alternative to custom-built or high-end models, making them suitable for mass adoption across various industries. Equipment manufacturers have emphasized in technical data sheets and product literature that standard horizontal milling machines provide optimal performance in conventional production settings.

Additionally, ease of maintenance and long-term durability have strengthened user confidence, encouraging continued investment The segment’s dominance is expected to remain intact due to consistent demand from fabrication workshops and contract manufacturers seeking reliable and efficient machinery.

The industrial application segment is expected to hold 67.2% of the Horizontal Milling Machine market revenue share in 2025, establishing it as the dominant application segment. Growth within this segment has been driven by the wide-scale adoption of milling machines across sectors such as automotive, aerospace, construction equipment, and general engineering. These industries demand precision, repeatability, and heavy-duty performance, all of which are delivered effectively by horizontal milling solutions.

Companies have highlighted in their operational updates and strategic plans that industrial facilities favor horizontal machines due to their ability to handle large, heavy workpieces with improved chip removal and tool longevity. Additionally, horizontal milling systems are compatible with advanced automation and production lines, making them suitable for high-volume operations.

As manufacturing ecosystems shift toward digitalization and lean production, this segment’s relevance is further enhanced The segment’s leadership position is expected to remain strong due to continued capital expenditure in industrial machinery upgrades and capacity expansions globally.

The 3 Axis segment is projected to hold 34.8% of the Horizontal Milling Machine market revenue share in 2025, making it the leading segment based on the number of axis. This position has been secured due to its suitability for a wide range of machining applications and its cost-effective integration into existing workflows. Technical documentation and manufacturing guides indicate that 3 Axis machines are favored for their ability to efficiently perform milling operations on flat surfaces and geometrically simpler parts.

These machines are often used in job shops and production units where flexibility, simplicity, and affordability are critical. Furthermore, training and operational ease make 3 Axis machines accessible for workforce deployment without extensive technical expertise.

Equipment providers have noted that this axis configuration strikes a balance between functionality and investment cost, attracting consistent demand The segment’s continued dominance is anticipated as it remains a go-to choice for businesses looking to enhance productivity without transitioning to more complex multi-axis systems.

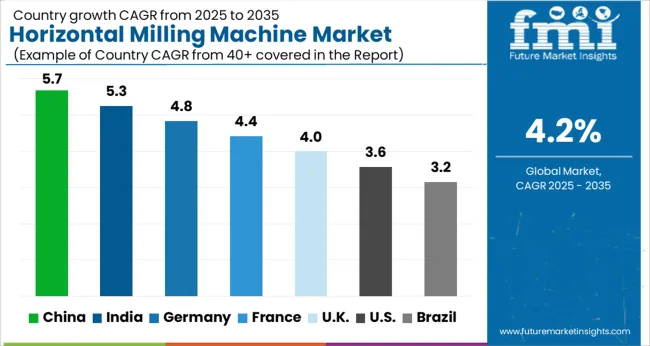

The global demand for horizontal milling machines is projected to grow at a steady CAGR of 4.2% between 2025 and 2035 in comparison to a 2.8% CAGR registered during the historical period from 2020 to 2025.

The rapid growth of manufacturing industries like metal, plastic, automotive, and aerospace across the world is a key factor driving the horizontal milling machine market and the trend is likely to continue during the forecast period.

Horizontal milling machine is one of the most popular types of milling machines used across various metalworking industries. These machines can produce products with high accuracy and repeatability. Further, they are very versatile and can be used for a variety of applications. Thus, the widening application of horizontal milling machines across various industries due to their ability to produce high-quality products will continue to boost the market during the forecast period.

Similarly, the development of newer and more advanced milling machines that offer greater efficiency and productivity benefits is expected to boost the global horizontal milling machine market during the forecast.

A number of influential factors have been identified that are expected to spur growth in the global horizontal milling machine market during the projection period (2025 to 2035). Besides the proliferating aspects prevailing in the market, the analysts at FMI have also analyzed the restraining elements, lucrative opportunities, and upcoming threats that can somehow influence horizontal milling machine sales.

The drivers, restraints, opportunities, and threats (DROTs) identified are as follows:

DRIVERS

RESTRAINTS

OPPORTUNITIES

THREATS

Rising Demand from Automotive and Aerospace Industries Driving the USA Market

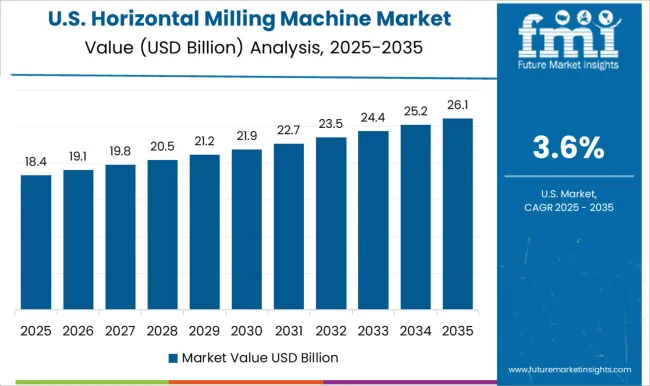

The USA holds around 32.7% share of the global horizontal milling machine market and it is likely to expand at a steady pace during the next ten years. Increasing demand from the automotive and aerospace industries and the growing need for precision machining are some of the key factors driving the USA horizontal milling machine market.

The United States is the largest market for horizontal milling machines in North America, followed by Canada and Mexico. As the automotive industry is the major end-user of horizontal milling machines in the country, increasing demand for electric vehicles and hybrid vehicles will eventually bolster sales of horizontal milling machines during the forecast period.

According to the International Energy Agency (IEA), over 630000 electric vehicles were sold in the USA during the year 2024 and this number is likely to further surge during the next few years. This will in turn create lucrative opportunities for horizontal milling machine manufacturers.

Similarly, the growing adoption of horizontal milling machines across the thriving aerospace industry will further aid in the expansion of the USA horizontal milling machine market.

Increasing Government Support Generating Demand in India Market

As per FMI, the horizontal milling machine market in India is poised to exhibit strong growth during the forecast period owing to the rising government's focus on promoting the manufacturing sector, increasing investments in infrastructure projects, and the growing automotive industry.

Over the years, the Indian government has launched various initiatives such as “Make in India” to transform the country into a global design and manufacturing hub. This has created a conducive environment for the growth of industries like metal, plastic, wood, automotive, etc. driven by this, demand for horizontal milling machines is growing at a steady pace in the country and the trend is likely to continue during the projection period.

Rapid Growth of Metal Industry Boosting Market in China

As the "Make in China" campaign continues to gather steam, the country is emerging as a high-potential market for horizontal milling machines. This is due to a number of factors, including the growing demand for metal industry resources and the rapid growth of the Chinese economy.

Horizontal milling machines are an essential piece of equipment for any metalworking shop. They are versatile tools that can be used to create a variety of parts and products. In recent years, they have become increasingly popular in China due to the rapid expansion of the metalworking industries.

There are a number of reasons why China is an attractive market for horizontal milling machines. First, the country has a rapidly growing economy. This has led to increased demand for all types of manufacturing equipment, including milling machines. Second, China is home to a large number of metal industry resources.

Industrial Segment Likely to Generate the Highest Revenues

Based on application, the global horizontal milling machines market is segmented into commercial and industrial segments. Among these, the industrial segment is likely to generate maximum revenues during the forecast period.

This can be attributed to the rising usage of horizontal milling machines across metal, wood, and plastic industries. Similarly, increasing metalworking operations across the globe along with growing demand for high-precision metal products and parts is expected to boost the growth of the target segment during the projection period.

Key manufacturers of horizontal milling machines include AVEMAX, AZ spa, AHP PLASTIK MAKINA, Boygo, CAMAM, CAZENEUVE, EMISSA, EMAG GmbH&Co.KG, EURACRYL GmbH, GEORG KESEL, Normaco tools OU, TORNOS, and SIBO ENGINEERING among others.

These players are continuously focusing on increasing their customer base by adopting strategies such as new product launches, mergers, acquisitions, partnerships, and collaborations. For instance,

Select the Right Milling Tool for Any Machining Task with Makino and AVEMAX’s Advanced Solutions!

With the growing need for precision machining, the popularity of horizontal milling machines has skyrocketed during the last few decades. Companies use horizontal milling machines to fabricate or manufacture various components or equipment. Various companies develop and supply these machine tools, among which Makino and AVEMAX lead from the forefront.

A world leader in metal cutting and manufacturing technology, Makino has become an ideal destination for users looking to get advanced horizontal milling machines. The company manufactures horizontal machining centers, vertical machining centers, wire EDM and ram EDM machines, and graphite machining centers, among other tools.

With its most accurate and highest quality metal cutting and fabricating tools, Makino helps the world’s businesses transform their business. The company is constantly launching new products to solidify its stance and expand its customer base. For instance, in September 2025 Makino Inc. introduced a800Z, another new high-performance machining center design. The new five-axis horizontal machining center expands upon the best features of the Makino nx-Series four-axis horizontal machining centers by fully integrating a “Z-type” fifth axis. It will be an asset to part and component manufacturers serving market areas including semiconductor, aero structural, industrial equipment, and automotive.

Another leading manufacturer and supplier of horizontal milling machines are AVEMAX. Initially, AVEMAX was the milling machine department of Manford. However, in 2006, it became independent and is now a sister company of Manford.

AVEMAX has become one of the world’s top brands that offer quality milling solutions to various end-use industries. The company continues to focus on producing high-quality products while adhering to the MIT (made in Taiwan) principle of production.

AVEMAX offers a wide range of machine tools like CNC milling machines, CNC vertical machining centers, iPRO Mill, etc. It has become a reliable player for industries to get the right choice of horizontal milling solutions.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 40.1 billion |

| Projected Market Size (2035) | USD 60.5 billion |

| Anticipated Growth Rate (2025 to 2035) | 4.2% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; Middle East & Africa (MEA) |

| Key Countries Covered | The USA, Canada, Mexico, Germany, The UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | Product, Number of Axis, Application, Distribution Channel, Region |

| Key Companies Profiled | AVEMAX; AZ spa; AHP PLASTIK MAKINA; Boygo; CAMAM; CAZENEUVE; EMISSA; EMAG GmbH&Co.KG; EURACRYL GmbH; GEORG KESEL; Normaco tools OU; TORNOS; SIBO ENGINEERING |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global horizontal milling machine market is estimated to be valued at USD 40.1 billion in 2025.

The market size for the horizontal milling machine market is projected to reach USD 60.5 billion by 2035.

The horizontal milling machine market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in horizontal milling machine market are standard, compact precision, grinding, free-mounted and other.

In terms of application, industrial segment to command 67.2% share in the horizontal milling machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Horizontal Cartoning Machines Market Size and Share Forecast Outlook 2025 to 2035

Horizontal Strapping Machine Market Trends and Forecast 2025 to 2035

Horizontal Flow Wrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Horizontal Premade Pouch Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Horizontal Form Fill Seal (HFFS) Machines Market Size and Share Forecast Outlook 2025 to 2035

Large-flow Horizontal Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Milling Machine Market Growth – Trends & Forecast 2025 to 2035

End Milling Machine Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Road Milling Machine Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Rice Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Tree Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Corn Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Maize Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wheat Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Thread Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Corn Wet Milling Services Market Size, Growth, and Forecast for 2025 to 2035

Portable Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Indexable Milling Cutters Market Size and Share Forecast Outlook 2025 to 2035

Universal Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Desktop CNC Milling Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA