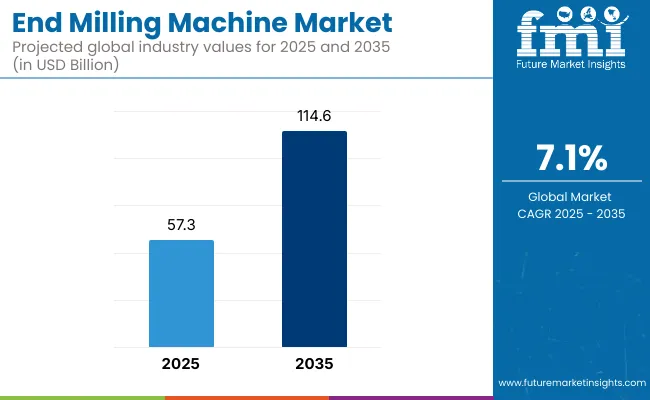

The end milling machine market is anticipated to increase significantly, with an estimated value of USD 57.3 billion in 2025, projected to be approximately USD 114.6 billion in 2035, with a CAGR of 7.1%. The growth is fueled by industrial automation, precision engineering, and mass customization demand. Some of the major drivers in the industry include growth in world manufacturing production.

Owing to growing demand for accuracy parts and increased tolerances, manufacturers are making a switch to high-speed and high-efficiency end milling machines that enable repetitive and sophisticated milling processes to produce constant high-quality output.

CNC-end milling machines are capturing firm hold. Such systems provide programmable control, multi-axis operation, and high repeatability-enabling manufacturers to minimize human effort, improve productivity, and embrace smart factory procedures. CNC machines also minimize the occurrence of errors by human intervention and scrap wastage.

Demand is also being met from the automotive and aerospace industries, which require lightweight, complex components manufactured to micron-level precision. However, the industry is plagued by problems such as prohibitive costs of capital investment, skill shortages, and supply chain discontinuities for high-precision controllers and tooling. Further, small and medium producers may refrain from upgrading due to cost or incompatibility issues with legacy equipment.

Opportunities for expansion are being established in emerging economies, where assembly of cars, manufacturing of consumer electronics, and infrastructure construction are expanding at incredibly rapid rates. Subsidies by governments of local production and export competitiveness are also establishing the need for capital equipment like high-precision milling systems.

Asia Pacific region is the driver led by enormous scale industrial production belts in India, China, South Korea, and Japan. Europe and North America remain dominant as sources of innovation, cutting-edge manufacturing hubs, and high-value production-for-export locations.

The industry is expanding at a rapid rate because of increased demand for precision and efficiency in the production industry. The machines perform precise cuts and shapes, reducing wastage and increasing overall production.

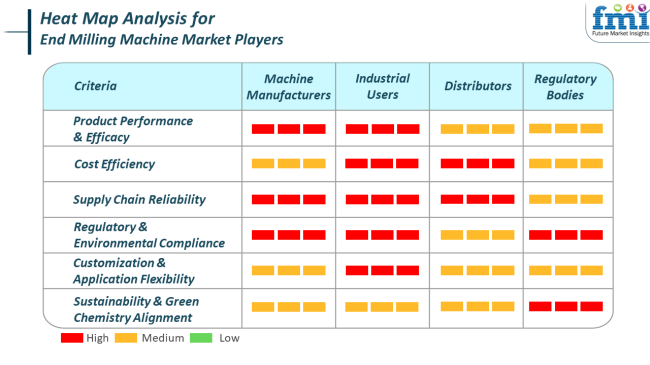

This has led to increasing demand from various industries, including aerospace and electronics.Industrial customers, such as the automotive, aerospace, and electronics industries, are concerned with cost-effective and efficient end milling machine solutions that guarantee maximum performance across different applications. They are looking for materials that are high in efficacy, environmentally friendly, and can be designed to fit the specific operational requirements.

Distributors highlight the need to have a consistent supply chain in order to serve industrial customers. They emphasize offering a broad range of products for use in many applications with timely delivery and competitive prices. The industry is characterized by collaboration among companies to design and use products that meet performance requirements, meet environmental requirements, and are in compliance with evolving industry requirements.

Buying prices of end milling machines went up moderately in the period 2020 to 2024, driven by a resurgence in quality demand across world production following the COVID-19 break. Demand was led by the automobile, aerospace, and overall metalworking industries.

Firms spent money on replacing aging milling machines with CNC-compatible systems, and there was increasing demand for multi-axis machines to maximize production efficiency. However, the issue of shortages of labor and trained operators slowed take-up in small workshops. In this phase, nations like China, Germany, and the USA were key players because they had mature manufacturing environments.

Looking forward from 2025 to 2035, the industry is poised to undergo a shift toward more intelligent, digitally connected equipment. AI-aided toolpath optimization, real-time process monitoring, and predictive maintenance will become the norm.

There will also be a transition towards hybrid milling machines that support additive and subtractive manufacturing. High-speed micro-milling and 5-axis capabilities will become increasingly important as precision engineering demand increases across industries like electric vehicles and medical devices. Also, sustainability objectives will encourage companies to use energy-efficient drives and recyclable machine parts.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The manufacturing industry upturn, modernization of aged equipment, and growth in automotive and aerospace. | Smart factories, precision manufacturing requirements, and demand in the EV and medical device industries. |

| CNC retrofitting, 3-axis and 4-axis machines, elementary automation. | AI-based control systems, real-time analysis, and feedback data incorporation systems. |

| Traditional milling with CNC retrofitting and partial automation. | Hybrid milling (additive-subtractive), energy-efficient designs, and micro-milling for niche industries. |

| Medium to large metal fabricators, automotive parts suppliers, and aerospace workshops. | EV part makers, surgical instrument manufacturers, and smart manufacturing centers. |

| Low sustainability focus. | Greater focus on energy efficiency, component recyclability, and eco-compliant manufacturing facilities. |

| Led by North America, Europe, and East Asia. | Growing in Southeast Asia, Latin America, and Eastern Europe as a result of industrial decentralization. |

The industry is registering high growth supported by increasing requirements for precise parts in industries such as automotive, aerospace, and electronics. There are, however, various risks existing and anticipated to influence it. One such prevailing challenge is the huge amount of capital to invest in buying advanced end milling machines, particularly those equipped with computer numerical control (CNC) ability.

The cost factor can act as a deterrent for small and medium enterprises to invest in the use of these machines, thereby restricting industry growth. Moreover, handling complex milling machines requires experienced technicians. A lack of trained people can result in inefficiencies in operations and more downtime.

Aside from geopolitical tension and economic uncertainty, global supply chain disruptions could impede crucial parts' supply and thus raise production postponements and costs. This again would subject disturbances to the industry, which relies on certain regions for the major components.

While there is as much opportunity for growth in the industry as there is, players must also contend with risk elements in terms of capital-exhausting outlays, shortages of skilled labor, technology of obsolescence, regulatory enforcement, and vulnerability in the supply chain. Consistent success in this competitive enterprise will require precautionary measures against such risk elements.

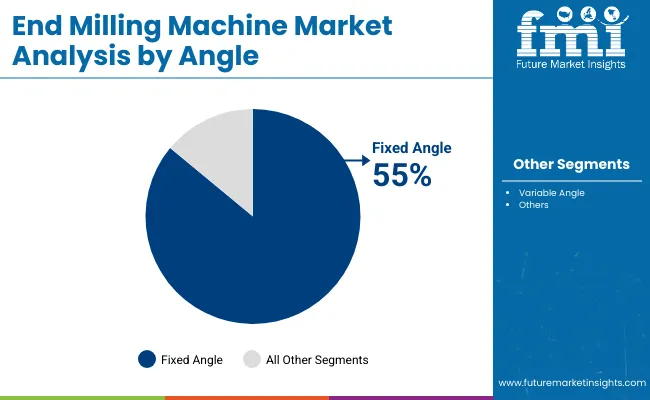

The industry is divided into two categories: Fixed Angle and Variable Angle. Fixed Angle milling machines account for the biggest share of 55% of the industry by 2025, whereas Variable Angle machines are expected to take over the remaining 45% share.

Fixed-angle machines are typically the machines used for general-purpose milling operations where ease of use and reliability are paramount. These machines are very popular in industries such as automotive, aerospace, and general manufacturing because of their high productivity rates in mass production, surface finishing, and contouring of components.

The industry leader in this segment is Mazak Corporation, which has a Variaxis series fixed-angle design that provides high-precision milling for complex parts. Another key industry player, Haas Automation, has made inroads with their VF Series CNC vertical machining centers that provide good, fast fixed-angle milling, particularly in the automotive and heavy manufacturing sectors.

Mitsubishi Heavy Industries has also entered fixed-angle machines with their MVR Series, which is targeted toward the high-precision needs of the automotive and heavy-duty industries.

Variable-angle machines, on the other hand, afford greater flexibility in adjusting the tool angle for more complex and tailor-made operations. Such applications benefit industries with complex designs and high precision, such as aerospace, medical devices, and precision engineering.

The NTX series machines, supplied by companies like DMG Mori, merge variable-angle milling with multitasking and high precision. Control systems such as Siemens' Sinumerik allow flexible variable-angle milling for servicing aerospace and medical devices, which require customization and tighter tolerances.

Makino Milling Machine Co., through their a51nx series, meets the demands of high-precision industries using variable-angle milling for complex and custom parts. These firms are leveraging variable angles to meet the rising demand across multiple industrial sectors for specialized and precise components.

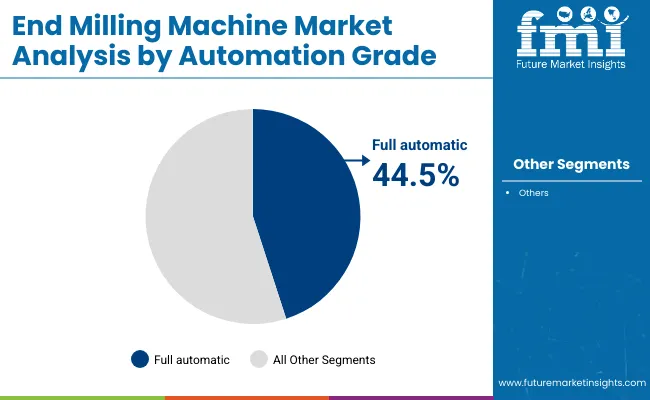

Nevertheless, full-automatic end milling machines will have a cutting-edge industry share of 44.5%, and semi-automatic machines will have 30.5% by the year 2025.

Such applications benefit industries with complex designs and high precision, such as aerospace, medical devices, and precision engineering. The NTX series of machines, supplied by companies like DMG Mori, combine variable-angle milling with multitasking systems and high precision.

Siemens' Sinumerik control systems enable flexible variable-angle milling for aerospace and medical devices that require customization and tighter tolerances. The machines are equipped with advanced control systems, which allow operator-free continuous operation, an important parameter in industries such as manufacturing in automotive, aerospace, and heavy machinery.

Full automation capabilities are being offered by the likes of DMG Mori with its NTX series and Mazak with the Integrex i-200 series. Besides reducing the time for setup and processing, they also ensure great precision and repeatability, which is extremely important for industries that mass produce high-quality components.

Advanced CNC systems integrated into these fully automatic milling machines are also being provided by Siemens and Fanuc to enhance further the productivity of industries involved in manufacturing complex components like turbine blades, engine parts, and medical devices.

On the other hand, semi-automatic machines, while still taking into account a significant chunk of the industry, are boxes that require manual intervention to a larger extent than their fully automated counterparts. Such machines occupy a large industry segment, surpassing smaller owners and medium-sized manufacturers or self-employed individuals who may demand flexible types for manufacturing, especially for low- to medium-volume production or specialized material production.

Haas Automation and Okuma semi-automatic machines combine some degree of automation with flexibility for those businesses that do not want full automation but would like to benefit from better efficiency than the traditional method- manual milling techniques.

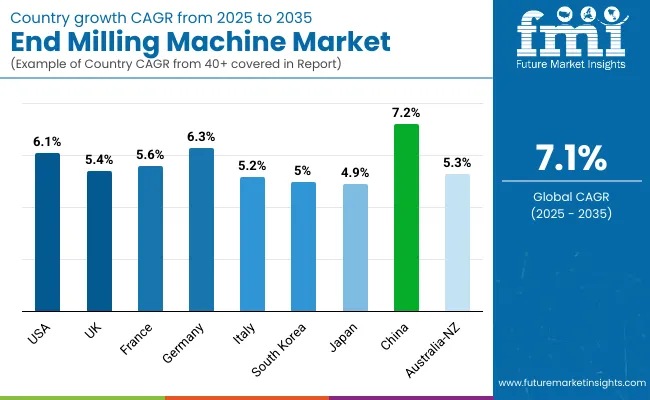

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

| UK | 5.4% |

| France | 5.6% |

| Germany | 6.3% |

| Italy | 5.2% |

| South Korea | 5% |

| Japan | 4.9% |

| China | 7.2% |

| Australia-NZ | 5.3% |

The USA industry will increase at 6.1% CAGR during the study period. The growth is fueled by consistent demand from aerospace, automotive, defense, and metal fabrication industries, which have a high reliance on high precision cutting capabilities. With USA manufacturing facilities shifting to smart factory solutions, the use of CNC end milling machines has become central to manufacturing upgradation.

Increased labor costs and the need for productivity improvements are pushing the move towards automated and multi-axis end milling machines. Further, sound investment in defense modernization and infrastructure is supporting mass manufacturing activities involving strong and responsive milling tools. Demand is also growing in the prototyping and custom part segments, where precision and adaptability are a must.

The UK industry is expected to expand at 5.4% CAGR during the study period. The industry is supported by technological advancements in engineering sectors, including medical devices, automotive components, and precision tools. Domestic manufacturers are increasingly substituting traditional machining equipment with CNC-capable end milling machines to attain competitive lead times and quality levels.

Government initiatives to promote digital manufacturing and take-up of Industry 4.0 are also persuading small and medium-sized businesses to invest in sophisticated machinery. The aerospace sector, especially located in the southwest region of the nation, is still one of the major buyers of high-precision milling systems. Ongoing training programs for the development of skills also allow employees to maintain and operate sophisticated milling equipment effectively.

The French industry will grow at a 5.6% CAGR during the study period. Industrial automation, as well as the need for energy-efficient, cost-saving, and high-capacity machining, is driving growth in the industry. French manufacturing companies are focused on equipping their production lines with digital, as well as robotic, milling systems to drive operational throughput.

Growth is further driven by burgeoning demand from businesses such as railways, aerospace, and automobiles, where there is high precision forming of components required. Applying AI-driven systems to milling machines increases accuracy and reduces downtime, thus becoming more attractive to production houses with tight delivery cycles. Moreover, the nation's investment in advanced vocational training is improving the adoption of technologically advanced manufacturing equipment.

The German industry will register growth at 6.3% CAGR during the study period. Being a hub of engineering excellence and manufacturing innovation, Germany is witnessing a fervent push toward high-performance end milling systems integrated with IoT and AI-based analytics.

The focus of the nation on precision manufacturing, especially in sectors such as automotive, aerospace, and heavy machinery, creates robust demand for advanced milling solutions. German manufacturers are investing heavily in R&D to enhance machine life, toolpath optimization, and energy efficiency.

Increased migration towards electric vehicle manufacturing and eco-friendly industrial processes is also defining demand for special end milling applications. Furthermore, joint efforts between research institutes and industry players are propelling product development and application.

The industry in Italy will register a 5.2% CAGR during the forecast period. Italian industrial firms are improving machining capacity by adding flexible and lightweight milling solutions that are used in materials. Domestic production of furniture, machinery, and auto parts increasingly demands more efficient and accurate component machining.

A move towards quieter, energy-efficient processes is generating a need for newer generation end mill machining. Government promotion of Industry 4.0 and digitization initiatives are giving manufacturers a chance to invest in higher-grade tools and automation systems. Additionally, Italy's large mechanical engineering platform supports end milling innovation and customization for domestic and export purposes.

The South Korean industry is expected to grow at a 5% CAGR during the period of study. Robust electronics and semiconductor sectors and automotive production drive high demand for high-precision machining tools. South Korean factories are incorporating smart milling systems that can respond to complex geometries and changing production needs.

Smart features such as predictive maintenance and real-time data monitoring are being integrated to reduce downtime on machines and increase tool life. Government-supported automation initiatives and investments in smart manufacturing parks are also driving the adoption of CNC end milling machines. Export-oriented industries are seeking lower cycle time precision parts, which assist with even equipment replacement across the lines of manufacture.

Japan's industry is projected to grow at 4.9% CAGR during the study period. Japan's stringent precision and productivity requirements in manufacturing processes create a stable industry for sophisticated end-milling machines.

The country's technical foundation in automation and robotics is helping constant machine tool upgrades in various industries such as electronics, precision instruments, and aerospace. Miniature, high-speed milling machines with noise reduction and energy conservation are gaining popularity.

Producers are aiming at zero-defect manufacturing, which is upgrading the status of CNC-capable end milling systems with feedback control. Although the industry is mature, there remains demand from companies aiming to maintain world-class competitiveness with quality improvement and production optimization.

The Chinese industry will increase by 7.2% CAGR during the years of analysis. High industrialization, growing automotive and construction sectors, and the country's strategic focus on manufacturing modernization are primary drivers of growth.

China is a significant producer and consumer of machine tools, and end milling machines are part of a wide range of industrial processes. With strong support for intelligent manufacturing in national policy frameworks, firms are shifting towards smart, networked, and energy-efficient milling systems.

Local companies are investing in regional as well as export-grade machines, which are available in large numbers and at affordable prices. Furthermore, higher investments in EV manufacturing, high-speed rail, and aerospace are driving demand for precision milling capacity.

The Australia-New Zealand industry will expand at 5.3% CAGR during the study period. Mining, metal fabrication, and construction equipment manufacturing are leading industries driving demand for tough and rugged end-milling machines.

In Australia, the need for domestic production and upkeep of industrial components is necessitating additional mid-sized milling machines. New Zealand's focus on engineering education and skill-based manufacturing allows for the long-term development of sophisticated machining systems.

Both countries are witnessing increased application of CNC and programmable milling machines in small and medium enterprises to improve output quality and production speed. Global supplier access and online marketplaces are also reducing the procurement process to lean.

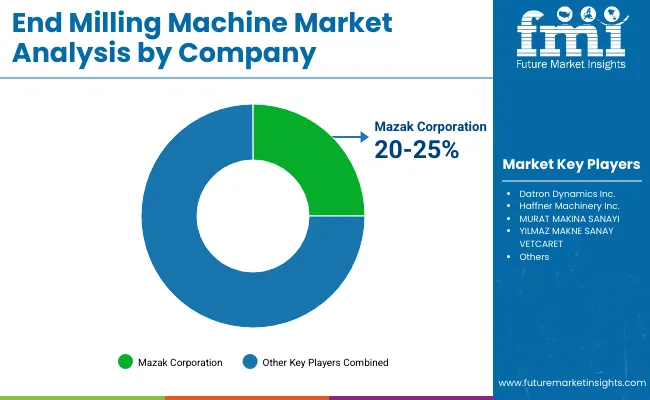

The industry is very competitive, with many established manufacturers concentrating their efforts on precision engineering, automation, as well as multifunctional capabilities. Mazak Corporation, Datron Dynamics Inc. and Haffner Machinery Inc. are examples of such manufacturers that dominate this industry with advanced CNC end milling solutions addressing industrial applications.

These firms focus more on innovation and integrating their current products with smart software and automated features to achieve higher efficiency as well as precision during machining operations.

MURAT MAKINA SANAYI and YILMAZ MAKNE SANAY VETCARET are regionally based small players catering to the local manufacturing industry with low-cost but rigid machines. Their competitive edge lies in client distribution networks and localized maintenance services.

Similarly, Alusmart Machinery and LGF SYSMAC India Pvt Ltd are also involved in providing elemental and multi-purpose milling solutions for aluminum and PVC machining applications, owing to increased demand in the window and door businesses.

Strategic alliances and acquisitions influence a great deal when it comes to expanding the industry. RALC Italia Srl and Normaco - Portable Machining Tools are those that have extended their reach through collaboration with the industrial automation organizations that have control of the industry.

In essence, a lot of competition has been driven by Industry 4.0 achievements, including Internet-of-Things-enabled milling machines. They include the likes of Fabplus Machinery and Rotox GmbH, which have yet to introduce real-time monitoring features to their products.

Geographically, Asia-Pacific constitutes one of the most significant areas for growth, with individuals such as Huayuan Trade Private Limited and TAES Machines currently engaged in budget-conscious manufacturing strategies to compete against Western brands.

Europe and North America still hold popular precision applications: SchtecMakine San. Tic. A.S. and CGS Tools, among others, as they continue to dominate high-precision applications, particularly in aerospace and automotive components manufacturing.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Mazak Corporation | 20-25% |

| Datron Dynamics Inc. | 15-20% |

| Haffner Machinery Inc. | 12-17% |

| MURAT MAKINA SANAYI | 8-12% |

| YILMAZ MAKNE SANAY VETCARET | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Mazak Corporation | Offers high-precision CNC end milling machines with Industry 4.0 integration. |

| Datron Dynamics Inc. | Specializes in compact and high-speed milling solutions for industrial automation. |

| Haffner Machinery Inc. | Provides automated end milling machines for PVC and aluminum applications. |

| MURAT MAKINA SANAYI | Focuses on cost-effective and durable milling solutions for regional manufacturers. |

| YILMAZ MAKNE SANAY VETCARET | Develop multi-functional milling machines with strong regional distribution. |

Key Company Insights

Mazak Corporation (20-25%)

Mazak leads the industry with precision-engineered CNC end milling machines, integrating IoT-based monitoring for enhanced operational efficiency.

Datron Dynamics Inc. (15-20%)

Datron specializes in high-speed, compact milling machines with automation features for precision machining industries.

Haffner Machinery Inc. (12-17%)

Haffner Machinery dominates the PVC and aluminum milling segment with efficient, automated solutions catering to construction and industrial sectors.

MURAT MAKINA SANAYI (8-12%)

MURAT MAKINA offers affordable and durable milling machines, maintaining a strong presence in local markets through distribution partnerships.

YILMAZ MAKNE SANAY VETCARET (5-9%)

YILMAZ MAKNE focuses on multi-functional milling machines, which are growing in adoption in metal fabrication and construction applications.

Other Key Players (30-40% Combined)

By angle, the industry is segmented into variable angle and fixed angle.

By automation grade, the industry is segmented into manual, semi-automatic, and full automatic.

By equipment type, the industry is segmented into portable and stationary.

By application, the industry is segmented into light duty application and heavy duty application.

By region, the industry is segmented into North America, Latin America, Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

The industry is estimated to reach USD 57.3 billion by 2025.

The industry is projected to grow to USD 114.6 billion by 2035, driven by rising demand across industrial and construction sectors.

China is expected to grow at a 7.2% CAGR.

Fixed angle milling machines are leading the industry, widely used for precision cutting in aluminum and metal applications.

Major players include Mazak Corporation, Datron Dynamics Inc., Haffner Machinery Inc., MURAT MAKINA SANAYI, YILMAZ MAKNE SANAY VETCARET, ATech Machine Inc., Huayuan Trade Private Limited, Alusmart Machinery, LGF SYSMAC India Pvt Ltd, TAES Machines, Normaco – Portable Machining Tools, Rotox GmbH, and SchtecMakine San. Tic. A.S.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Endometriosis Treatment Market Size and Share Forecast Outlook 2025 to 2035

End-of-line Packaging Market Size and Share Forecast Outlook 2025 to 2035

End Mill Holders Market Size and Share Forecast Outlook 2025 to 2035

Endocrine Peptides Test Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Protective Barrier Covers Market Size and Share Forecast Outlook 2025 to 2035

Endometrial Cancer Treatment Market Size and Share Forecast Outlook 2025 to 2035

Endovascular Aneurysm Repair (EVAR) Market Size and Share Forecast Outlook 2025 to 2035

End-of-line Packaging Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Endobronchial Ultrasound Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Reprocessing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Endoscopic Probe Disinfection Market Size and Share Forecast Outlook 2025 to 2035

Endovascular Therapy Devices Market Size and Share Forecast Outlook 2025 to 2035

Endoscopic Vessel Harvesting System Market Size, Share, and Forecast 2025 to 2035

Endovenous Laser Therapy Market Size and Share Forecast Outlook 2025 to 2035

Endoscopy Visualization Systems Market Size and Share Forecast Outlook 2025 to 2035

Endoscope Procedure Kits Market Size and Share Forecast Outlook 2025 to 2035

Endoscopy Video Systems Market Size and Share Forecast Outlook 2025 to 2035

Endocrine Testing Market Size and Share Forecast Outlook 2025 to 2035

Endoscopic Ultrasound Needles Market Size and Share Forecast Outlook 2025 to 2035

Endoscopy Fluid Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA