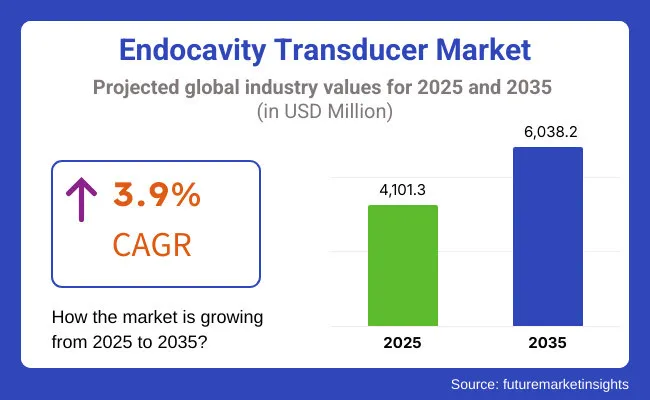

The global endocavity transducer market is estimated to be valued at USD 4,101.3 million in 2025 and is projected to reach USD 6,038.2 million by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

The global endocavity transducer market is experiencing sustained growth driven by increasing utilization of minimally invasive diagnostic imaging across gynaecology, urology, and prostate oncology. Rising prevalence of prostate and cervical cancers, coupled with broader access to early diagnostic screenings, is expanding procedural volume in both high- and middle-income countries. The shift towards outpatient and ambulatory imaging services is propelling demand for portable and high-resolution endocavity probes.

Technological innovation in high-frequency imaging, wider field-of-view, and improved ergonomics are enhancing diagnostic accuracy and operator comfort, creating a strong value proposition for replacement and upgrade cycles. Regulatory approvals for transducers compatible with next-gen ultrasound consoles have accelerated the adoption of newer systems in developed markets.

Moreover, expanding public health screening initiatives and reimbursement for transrectal and transvaginal ultrasound procedures are reinforcing institutional demand. As health systems push for earlier, faster, and more patient-friendly diagnostics, the endocavity transducer market is expected to exhibit stable double-digit growth, especially with strong vendor R&D alignment toward AI-compatible and ergonomic probe designs.

Leading manufacturers shaping the endocavity transducer market include GE HealthCare, Canon Medical Systems, Siemens Healthineers, Philips, BK Medical, Esaote, and Samsung Medison. These companies are focused on enhancing transducer image resolution, reducing cross-contamination risks with single-use sheaths, and developing ergonomic, low-profile probe designs to improve patient comfort. In March 2025, Canon Medical Systems launched the Aplio i800 Prism Edition Endocavity Probe, featuring extended field-of-view and elastography integration for enhanced prostate and gynecologic evaluations.

On the occasion, Toshio Takiguchi, CEO of Canon Medical, commented: “Our Prism Edition platform reflects Canon’s commitment to diagnostic clarity and clinician confidence. The new endocavity probe brings more precision to pelvic imaging while reinforcing our minimally invasive vision”.The launch signifies a trend where precision imaging, patient-centric ergonomics, and cross-modality compatibility drive procurement decisions across hospitals and specialty clinics, especially in oncology and fertility diagnostics.

North America dominates the endocavity transducer market, led by the USA, where early adoption of diagnostic ultrasound and a high procedural volume in gynaecology, fertility, and urology drive sustained demand. The USA continues to expand outpatient imaging capacity, with major health systems integrating point-of-care ultrasound into OB-GYN and urologic oncology workflows. Private and academic hospitals are replacing legacy systems with newer high-resolution 3D endocavity probes to support precision biopsy planning and prostate mapping.

Favourable CMS reimbursement for diagnostic ultrasound further encourages technology refresh cycles. Vendors actively collaborate with urologists and radiologists to develop specialty-focused probes, enhancing clinical accuracy and procedural efficiency in a value-conscious healthcare ecosystem.

Europe shows strong growth potential, especially across Germany, France, and the Nordics, where national health systems support early cancer screening and fertility treatments. Increasing procedural uptake for prostate imaging and transvaginal assessments in women’s health is creating steady demand for ergonomic and sterilization-friendly probe designs.

European healthcare providers are prioritizing infection prevention and ergonomic compliance, which is pushing demand for disposable sheath-compatible and compact probe models. EU regulations are also steering procurement preferences towards devices with CE-certified multi-modality integration and real-time elasticity assessment.

Endocavity transducers are anticipated to dominate the market in 2025, contributing approximately 48.4% of the total revenue. This dominance has been attributed to their pivotal role in high-resolution imaging of pelvic and prostate regions, enabling early disease detection. The increasing preference for minimally invasive diagnostics has propelled their adoption across gynaecological, urological, and reproductive health evaluations.

Furthermore, technological advancements such as 3D/4D imaging and higher frequency ranges have enhanced diagnostic accuracy, leading to greater clinician confidence and wider usage. The segment’s growth has also been supported by the rising global burden of pelvic diseases and reproductive disorders, necessitating precise internal examinations. The improved patient comfort, faster imaging capabilities, and enhanced transducer ergonomics have also contributed to broader integration across outpatient and emergency care units.

The obstetrics and gynaecology segment is projected to account for the highest share of 52.6% in the application landscape by 2025. The segment’s growth has been fuelled by the increasing demand for early-stage fetal monitoring, fertility evaluations, and uterine health diagnostics. The reliability of endocavity ultrasound in visualizing reproductive anatomy, even in early gestational stages, has made it a preferred diagnostic modality.

Rising awareness of prenatal screening, coupled with favourable reimbursement for maternal health procedures in many developed nations, has further encouraged adoption. In developing regions, growing investments in women’s health and mobile ultrasound accessibility have broadened reach. Additionally, improvements in transducer probe flexibility and reduced patient discomfort have enhanced procedural uptake, particularly in gynaecological cancer screenings and IVF assessments.

Hospitals are expected to hold the largest end-user share in 2025, accounting for approximately 43.6% of total market revenue. This dominance has been driven by the availability of capital-intensive imaging infrastructure and skilled professionals capable of handling advanced diagnostic equipment. Endocavity transducers have been widely adopted in hospital settings due to their utility in acute care, emergency diagnostics, and inpatient reproductive imaging. The growing caseload of patients requiring pelvic assessments, prostate evaluations, and gynaecological imaging has contributed to sustained demand in tertiary and multispecialty hospitals.

Furthermore, the ability of hospitals to integrate transducers with advanced ultrasound platforms, including portable and cart-based systems, has facilitated procedural efficiency and diagnostic throughput. Favourable procurement policies, bundled purchasing agreements, and infrastructure expansion in public and private hospital networks have also influenced segment leadership.

Premium prices of endocavity transducer is a major challenge

The considerable challenge facing the Endocavity Transducer Market is the unaffordability of high-end advanced ultrasound systems and transducers. High-frequency-based 3D/4D imaging transducers provide the highest standard of activeness, but they are quite costly. Most young clinics and healthcare centers in developing areas cannot afford to be able to buy these high-end devices, restricting their usage.

On top of that, high maintenance and replacement costs have become financial burdens. In order to ensure complete patient safety, specific sterilization has to be done on endocavity transducers and proper handling, but usually common usage leads to wearing out and therefore needs increasing replacement cost.

It is, however, the higher cost this cost puts up to the access barriers to the market impeding penetration in price-sensitive regions where budgets for health care are lower. While manufacturers are putting in effort towards the development of low-cost solutions, affordability remains a challenge that stands between many health care providers across the world and high-quality diagnostic device imaging.

Growing adoption of portable and wireless probes present lucrative growth opportunity

There's a big chance for growth in the Endocavity Transducer Market due to adoption of portable and wireless probes. More folks are using portable and wireless ultrasound systems. The old machines are heavy and pricey. This makes them hard to use in smaller clinics or remote areas.

Now, with new tech and smart imaging, ultrasound systems are getting smaller, cheaper, and easier to use. Portable endocavity transducers allow quick check-ups anywhere, especially in rural spots. This change fits well with the rise of telemedicine. Doctors can do ultrasound scans in real-time without needing bulky machines.

As companies make more affordable, battery-powered transducers that connect to the cloud, there’s a nice chance to reach places that need care. This could help catch diseases earlier and improve health for many people around the world.

Advancing Endocavity Imaging: Trends Shaping the Future of Ultrasound Diagnostics

Endocavity transducers find their development new directions as medical practitioners look to advanced imaging technology for minimally invasive diagnosis. This demand for ultrasound imaging of very high accuracy motivates manufacturers to build transducers with greater detection of gynecological, urological, and colorectal conditions.

The 3D and 4D endocavity transducers are being widely accepted by medical facilities, which ultimately allow more accurate images and the betterment of the diagnosis for the patient. While AI imaging solutions are increasingly automating the entire process of diagnosis, thus increasing accuracy, manual intervention is reducing.

In this regard, manufacturers are also developing such transducers that aim for patient comfort by being ergonomically designed and less painful during procedures such as transvaginal/transrectal ultrasound. The focus on infection control in hospitals has also led to an increasing demand for disposable covers for the transducers.

The market is now embracing more precise, user-friendly, and more accurate imaging technologies, which surely enhances healthcare outcomes for patients globally, considering the increase in prostate and cervical cancer cases.

The endocavity transducer market in the USA is growing. This is mainly due to more people facing gynecological and urological issues. Also, new ultrasound technology is making a difference.

Here are some reasons for this growth

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.0% |

Market Outlook

Germany's endocavity transducer market is poised for steady growth with a well-developed healthcare system and continuous research on medical imaging technologies.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.5% |

Market Outlook

China's market for endocavity transducers is set for a huge leap forward, backed by rising health expenditure and enhanced concern for the early diagnosis of urology and gynecology diseases.

Factors in Market Growth

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.3% |

India's endocavity transducer market is witnessing strong growth, driven by rising disease awareness and enhanced healthcare infrastructure.

Growth Inducers of the Market

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.5% |

Brazil's market for endocavity transducers is growing fast. This is happening because there are more healthcare investments and a bigger push for early diagnosis of issues in women's and men's health.

Here are some reasons for the growth

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.7% |

The endocavity transducer market is really competitive right now. There’s a big demand for better ultrasound imaging in areas like urology, gynecology, and prostate cancer checks. Companies are focusing on high-frequency transducer tech, comfortable designs, and AI imaging to keep up.

The market is influenced by established medical imaging companies, ultrasound technology companies, and new-age healthcare device innovators, each driving the dynamic space of endocavity ultrasound solutions.

The global endocavity transducer industry is projected to witness CAGR of 3.9% between 2025 and 2035.

The global endocavity transducer market stood at USD 3,956.6 million in 2024.

The global endocavity transducer market is anticipated to reach USD 6,038.2 million by 2035 end.

China is expected to show a CAGR of 5.3% in the assessment period.

The key players operating in the global endocavity transducer industry are GE Healthcare, Koninklijke Philips N.V., Siemens Healthineers, Fujifilm Holdings Corporation, Canon Medical Systems Corporation, Mindray Medical International Limited, Toshiba Medical Systems, Hitachi Medical Systems, Providian Medical, Samsung Medison, Esaote S.p.A. and others

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Voltage Transducer Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Transducers Market Growth - Trends & Forecast 2025 to 2035

Antenna, Transducer, and Radome (ATR) Market Size and Share Forecast Outlook 2025 to 2035

AC Voltage Transducer Market Size and Share Forecast Outlook 2025 to 2035

Blood Pressure Transducers Market Size and Share Forecast Outlook 2025 to 2035

Optoelectronic Transducers Market Growth – Trends & Forecast 2025 to 2035

Electro-pneumatic Transducers Market

Automotive Closed Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Open Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA