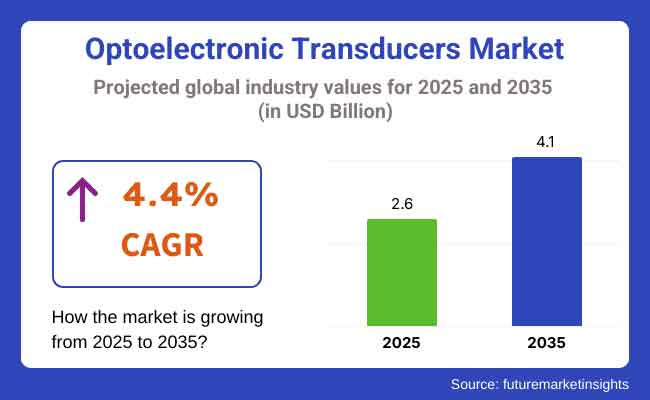

The optoelectronic transducers market is poised for steady growth, driven by increasing demand in industrial automation, telecommunications, and consumer electronics. With a market value projected at USD 2.6 billion in 2025, the sector is expected to witness a CAGR of 4.4%, reaching approximately USD 4.1 billion by 2035.

Advancements in photonic technologies, the rising adoption of fiber optics, and the integration of optoelectronics in smart devices are key factors fueling market expansion. Additionally, growing applications in automotive LiDAR systems and medical diagnostics further contribute to market growth.

The growing demand for high-speed, reliable, and energy-efficient optoelectronic transducers is shaping the industry’s future. With increasing reliance on optical communication networks, advanced imaging systems, and automotive sensing technologies, optoelectronics is becoming a cornerstone for next-generation applications.

The rapid evolution of smart cities, IoT-enabled devices, and high-performance computing is further fueling market adoption. Additionally, the transition toward automation in industrial processes and biomedical applications is expected to propel long-term growth. These factors position the optoelectronic transducers market as a key player in technological advancements across multiple industries.

Optoelectronic transducers play a crucial role in converting light signals into electrical signals and vice versa, making them essential in various high-tech industries. The increasing need for high-speed data transmission has propelled the demand for fiber-optic communication networks.

The rise of Industry 4.0 and automation technologies has expanded their usage in sensors, imaging systems, and precision manufacturing. The healthcare sector is also witnessing higher adoption of optoelectronic transducers in medical imaging and diagnostic equipment. Regulatory initiatives supporting energy-efficient optoelectronic components are further driving innovation and investment in the sector.

The expansion of fiber-optic communication networks and 5G infrastructure is significantly driving demand for optoelectronic transducers. Optical sensors and laser diodes are increasingly used in smart devices and industrial automation, enhancing precision and energy efficiency. Moreover, innovations in miniaturized optoelectronics are enabling their integration into wearable healthcare devices and biomedical imaging applications.

Automotive advancements, particularly in LiDAR-based autonomous vehicles, are another major driver. The increasing investment in quantum computing and photonic technologies is also expected to revolutionize optoelectronics, offering new capabilities in high-speed data processing and secure communication systems.

North America holds a significant share of the optoelectronic transducers market, driven by advancements in fiber-optic networks, automation, and semiconductor technologies. The United States leads the region, with major investments in optical communication infrastructure supporting the rapid rollout of 5G and next-generation internet services. Additionally, the presence of key market players and research institutions in optoelectronics and photonics accelerates innovation.

The increasing adoption of LiDAR-based autonomous vehicle technologies and medical imaging solutions is further fueling market expansion. Government initiatives promoting energy-efficient photonic components, along with growing defense applications in optical sensing and infrared imaging, contribute to regional growth. The rise of smart factories and Industry 4.0 implementation is also expected to sustain demand for high-performance optoelectronic components.

Europe’s optoelectronic transducers market is growing steadily due to the strong presence of the automotive, industrial automation, and telecommunications industries. Germany, France, and the United Kingdom are leading contributors, with substantial investments in high-speed fiber-optic networks and advanced sensor technologies. The region’s stringent energy regulations and emphasis on sustainable optoelectronics are driving the development of energy-efficient LEDs and photonic components.

The automotive sector, particularly in Germany, is witnessing high demand for optoelectronic transducers in LiDAR and ADAS applications. Additionally, healthcare applications, including optical biosensors and imaging solutions, are gaining traction. The European Union's funding for photonics research, coupled with the expansion of smart city initiatives, is expected to boost the market further.

Asia-Pacific is the fastest-growing region in the optoelectronic transducers market, driven by rapid industrialization, expanding telecommunications infrastructure, and increasing consumer electronics production. China, Japan, and South Korea dominate the regional market, benefiting from government support for the semiconductor and photonics industries. The growing adoption of 5G networks and high-speed internet services is propelling demand for fiber-optic communication systems.

Consumer electronics manufacturers are integrating advanced optoelectronic components into smartphones, cameras, and wearables, further boosting market growth. The automotive sector is also witnessing significant adoption of optoelectronic transducers in electric and autonomous vehicles. Additionally, the healthcare industry is leveraging optoelectronic technologies for medical imaging, diagnostics, and biosensing applications. The region's strong manufacturing base ensures competitive pricing and continuous innovation.

The optoelectronic transducers market in the rest of the world is experiencing moderate growth, with increasing adoption in Latin America, the Middle East, and Africa. In Latin America, Brazil and Mexico are witnessing rising demand for fiber-optic networks and industrial automation solutions. Government initiatives in smart city development and renewable energy projects are also driving optoelectronic applications. The Middle East is seeing growth in optoelectronics for defense, aerospace, and telecommunications, with major investments in photonic sensor technologies.

In Africa, improvements in healthcare infrastructure and expanding internet connectivity are creating opportunities for optoelectronic transducers in medical imaging and fiber-optic communication. The overall market expansion in these regions is supported by the increasing penetration of advanced technologies and global investment in digital transformation.

High Initial Costs and Complex Integration

The adoption of optoelectronic transducers faces challenges due to their high initial costs and complex integration into existing systems. Advanced optoelectronic components, such as laser diodes and high-performance photodetectors, require sophisticated manufacturing processes, leading to elevated production costs. This makes them expensive for small and medium enterprises (SMEs) and cost-sensitive industries.

Additionally, integrating optoelectronic transducers with conventional electronic systems demands specialized expertise and infrastructure, further increasing costs. Industries that rely on legacy systems may find it difficult to transition to optoelectronic-based solutions without incurring significant operational expenses. These factors slow down widespread adoption, particularly in emerging markets where affordability and accessibility remain key concerns for businesses and consumers.

Supply Chain Disruptions and Semiconductor Shortages

Global supply chain disruptions and semiconductor shortages pose significant challenges to the optoelectronic transducers market. The market relies on critical raw materials such as gallium arsenide (GaAs) and indium phosphide (InP), which are subject to fluctuating availability and geopolitical tensions. The ongoing semiconductor crisis has resulted in extended lead times and increased production costs for optoelectronic components.

Moreover, disruptions in manufacturing hubs, particularly in Asia, impact the supply chain, causing delays in product delivery and limiting market growth. The dependence on a few key suppliers for semiconductor wafers and photonic chips exacerbates the risk of supply chain instability. Addressing these challenges requires strategic diversification of supply sources and investment in local manufacturing capabilities.

Growth in Quantum Photonics and AI-Driven Optoelectronics

The emergence of quantum photonics and AI-driven optoelectronics presents significant opportunities for market growth. Quantum photonics enables ultra-secure communication, high-speed data processing, and advanced computing applications. Governments and tech companies are investing heavily in quantum technologies, opening new markets for optoelectronic transducers in computing, cryptography, and precision sensing.

Additionally, AI-driven optoelectronics are enhancing imaging, automation, and real-time data analysis in industrial and medical applications. AI-powered optical sensors are improving decision-making in autonomous vehicles and robotics. The convergence of optoelectronics with machine learning algorithms is driving innovations in smart healthcare, adaptive lighting, and intelligent surveillance. These advancements are expected to create new revenue streams and expand the applications of optoelectronic transducers across various industries.

Advancements in Energy-Efficient and Miniaturized Optoelectronics

The push for energy-efficient and miniaturized optoelectronic transducers is unlocking new market opportunities. With growing concerns over energy consumption, industries are investing in low-power, high-efficiency optoelectronic components such as LEDs, photodetectors, and optical sensors.

These advancements are particularly relevant for smart cities, IoT devices, and wearable electronics, where energy conservation is a priority. Additionally, the miniaturization of optoelectronics is enabling their integration into compact medical devices, AR/VR headsets, and next-generation smartphones.

As technology advances, manufacturers are developing ultra-compact, high-performance optoelectronic transducers that offer superior functionality while reducing energy costs. These trends are expected to drive significant market expansion, catering to the increasing demand for sustainable and intelligent optoelectronic solutions.

The optoelectronic transducers market experienced significant growth from 2020 to 2024, driven by increasing applications in telecommunications, consumer electronics, automotive technologies, and industrial automation. The demand surged due to advancements in photonic sensors, LED-based communication systems, and biomedical imaging. Key factors influencing the market included the adoption of smart technologies, miniaturization of components, and growing investments in fiber-optic networks.

Looking ahead to the period from 2025 to 2035, the market is expected to witness accelerated expansion with the integration of artificial intelligence (AI) and quantum computing in optoelectronics. Emerging trends such as photonic integrated circuits (PICs), quantum computing, and next-generation LiDAR sensors will further revolutionize the industry. Sustainability concerns and regulatory shifts toward energy-efficient solutions will also shape the landscape, prompting innovations in material science and manufacturing techniques.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulations focused on the safety and standardization of optoelectronic components in the telecommunication and automotive industries. |

| Technological Advancements | Development of high-speed photodetectors, silicon photonics, and OLED displays. |

| Industry-Specific Demand | Telecommunications, automotive LiDAR, and consumer electronics (displays, cameras). |

| Sustainability & Circular Economy | The initial focus is on reducing hazardous materials in photonic components. |

| Market Growth Drivers | Demand for high-speed data transmission, rapid expansion of 5G networks, and advancements in LiDAR for autonomous vehicles. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter mandates on energy efficiency, reduced carbon footprint, and compliance with sustainable material usage. |

| Technological Advancements | Rise of photonic integrated circuits (PICs), AI-enhanced optical sensors, and quantum dot technology. |

| Industry-Specific Demand | Growth in biomedical imaging, space exploration optics, and AR/VR applications. |

| Sustainability & Circular Economy | Emphasis on the recyclability of optoelectronic components and advancements in biodegradable semiconductors. |

| Market Growth Drivers | Expansion of quantum communication networks, rise of neuromorphic computing, and increasing adoption of smart photonic sensors in IoT applications. |

The USA optoelectronic transducers market is witnessing steady growth, driven by increasing demand for high-speed fiber-optic communication, LiDAR applications in autonomous vehicles, and advancements in medical imaging technologies. Government investments in semiconductor manufacturing and defense-related optoelectronics further enhance market potential. Additionally, the rising adoption of optoelectronic sensors in smart cities and industrial automation is fueling expansion. With these factors, the USA market is expected to grow at a CAGR of 4.7% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

The UK optoelectronic transducers market is growing due to its focus on smart infrastructure, industrial automation, and renewable energy technologies. The country’s transition to energy-efficient lighting and increasing demand for photonics-based healthcare solutions are key contributors to market expansion. Additionally, government-backed initiatives in quantum optics and photonics research are accelerating innovation. Given these trends, the UK market is projected to expand at a CAGR of 4.3% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

The European Union's optoelectronic transducers market is expanding due to strong investments in photonics R&D, the push for semiconductor self-sufficiency, and the rapid adoption of green energy technologies. The region's automotive industry, particularly in EVs and ADAS, heavily relies on optoelectronics for sensing and communication. Additionally, the medical sector is seeing increased adoption of biosensors and imaging solutions. With these growth drivers, the EU market is forecast to grow at a CAGR of 4.5% from 2025 to 2035.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.5% |

Japan’s optoelectronic transducers market benefits from its leadership in precision electronics, advanced display technologies, and semiconductor innovation. The country’s expertise in miniaturized optoelectronic components fuels demand in consumer electronics, medical imaging, and automotive applications. Japan's role in developing high-performance laser technologies and optical sensors further strengthens its market position. Given these factors, Japan’s optoelectronic transducers market is set to grow at a CAGR of 4.2% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

South Korea's optoelectronic transducers market is expanding rapidly, supported by its dominance in OLED and micro-LED development, along with growing demand in semiconductor manufacturing and smart factories. The country’s leadership in 5G infrastructure, AI-driven automation, and advanced consumer electronics further drives market growth. Additionally, increased adoption of optical sensors in defense and aerospace strengthens the industry. With these strong market drivers, South Korea’s optoelectronic transducers market is expected to grow at a CAGR of 4.6% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

LEDs Dominate the Market Due to Energy Efficiency and Expanding Applications

Light Emitting Diodes (LEDs) are the leading component in the optoelectronic transducers market, driven by their superior energy efficiency, longer lifespan, and decreasing costs. Their adoption has surged in general lighting, automotive applications, and display technologies. Governments worldwide are pushing LED adoption through energy regulations and sustainability initiatives, further fueling growth.

Additionally, advancements in micro-LED and organic LED (OLED) technologies enhance their demand in high-resolution displays and medical imaging. Asia-Pacific, particularly China and India, remains a key growth hub due to government incentives for LED manufacturing and increasing urbanization. With continuous innovations, LEDs will further dominate the market, particularly in smart lighting and next-generation display applications.

Image Sensors Gain Traction with Growing Demand for Smart Imaging and Surveillance

Image sensors hold a strong position in the optoelectronic transducers market due to rising demand in smartphones, automotive ADAS (Advanced Driver Assistance Systems), security surveillance, and medical diagnostics. The transition from CCD to CMOS image sensors has enhanced performance while reducing power consumption, boosting their adoption across industries.

The surge in AI-driven facial recognition, 3D imaging, and industrial automation further strengthens demand. Moreover, the expansion of smart cities and IoT-based monitoring systems accelerates image sensor integration. North America and Europe drive market adoption due to increasing security concerns, while Asia-Pacific benefits from strong smartphone manufacturing hubs. Future growth will be fueled by developments in quantum-dot and event-based image sensors, improving imaging in low-light conditions.

Telecommunication Leads Due to Fiber Optics and 5G Deployment

The telecommunication sector is the largest application segment for optoelectronic transducers, primarily due to increasing global 5G deployment and fiber-optic communication networks. Laser diodes, LEDs, and photodetectors play a crucial role in optical fiber transmission, enabling high-speed data transfer with minimal signal loss. The growing demand for high-bandwidth internet, cloud computing, and data centers further accelerates adoption.

Technological advancements, including silicon photonics and wavelength-division multiplexing, enhance efficiency in optical communication systems. The Asia-Pacific region, led by China, Japan, and South Korea, is at the forefront of telecom expansion, driving demand for optoelectronic components. As digital transformation continues, optoelectronics will remain indispensable in next-generation telecommunication infrastructures.

Consumer Electronics Continues to Expand with Smart Devices and Display Innovations

Consumer electronics is a key application segment for optoelectronic transducers, fueled by the widespread use of LEDs, laser diodes, and image sensors in smartphones, TVs, AR/VR devices, and wearables. Innovations in OLED and micro-LED technology enhance display quality, while advancements in biometric sensors and facial recognition increase the integration of image sensors in mobile devices.

The rise of smart home devices, including voice-controlled lighting and AI-driven security cameras, further boosts demand. Asia-Pacific, particularly China, South Korea, and Taiwan, dominates production due to a strong semiconductor and display manufacturing ecosystem. As demand for high-performance, energy-efficient electronics grows, optoelectronic transducers will remain critical to technological advancements.

The Optoelectronic Transducers Market is witnessing rapid growth, driven by increasing demand in telecommunications, automotive, healthcare, and consumer electronics. Technological advancements in fiber-optic communication, LiDAR, infrared sensors, and CMOS image sensors are key factors shaping the competitive landscape.

Leading companies, including Hamamatsu Photonics, Vishay Intertechnology, Sony Corporation, and Rohm Semiconductor, dominate the market with strong R&D investments and innovative product portfolios. Market consolidation is evident through strategic mergers, acquisitions, and collaborations, while emerging players focus on niche applications such as wearable sensors and smart city solutions.

The expansion of 5G networks, autonomous vehicles, and AI-driven imaging further propels industry growth, making the sector highly dynamic with increasing competition and continuous technological evolution.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Hamamatsu Photonics | 15-20% |

| Vishay Intertechnology | 10-14% |

| ON Semiconductor | 8-12% |

| Sony Corporation | 6-10% |

| Rohm Semiconductor | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Hamamatsu Photonics | Develops high-performance photomultiplier tubes, infrared sensors, and LiDAR components for industrial and scientific applications. |

| Vishay Intertechnology | Specializes in optocouplers, photodetectors, and high-speed infrared emitters for automotive and industrial automation. |

| ON Semiconductor | Provides CMOS image sensors, SiPM (Silicon Photomultipliers), and high-sensitivity photodetectors for medical and automotive applications. |

| Sony Corporation | Focuses on high-resolution CMOS image sensors for consumer electronics, surveillance, and professional imaging. |

| Rohm Semiconductor | Manufactures laser diodes, photodiodes, and infrared components with a focus on energy-efficient optoelectronic solutions. |

Key Company Insights

Hamamatsu Photonics

Hamamatsu Photonics is a global leader in high-performance optoelectronic components, catering to industrial, scientific, and medical applications. The company has a strong focus on photonic sensing and quantum optics, driving advancements in spectroscopy, imaging, and precision measurement technologies.

Their infrared and ultraviolet (UV) sensor portfolio is expanding, targeting security, biomedical, and industrial automation applications. With significant investment in R&D, Hamamatsu continues to enhance LiDAR, photodetector, and photomultiplier tube technologies, positioning itself at the forefront of innovation in the optoelectronic industry.

Vishay Intertechnology

Vishay Intertechnology specializes in a broad range of infrared and visible-light optoelectronic components, serving key industries such as automotive, industrial automation, and IoT. The company focuses on developing motion detection and optical sensing solutions for smart home applications and autonomous systems.

Vishay is also investing in low-power, high-efficiency optoelectronic solutions, ensuring compatibility with next-generation wireless and sensor networks. With a strategic emphasis on miniaturization and energy efficiency, Vishay aims to strengthen its presence in compact, high-performance optoelectronic solutions.

ON Semiconductor

ON Semiconductor is a major player in image sensing and LiDAR solutions, driving innovation in ADAS (Advanced Driver Assistance Systems) and autonomous vehicle technology. The company offers a robust portfolio of high-dynamic-range (HDR) image sensors, catering to the automotive, security, and industrial markets.

With increasing demand for AI-powered imaging solutions, ON Semiconductor is integrating machine learning-based enhancements in its products. Additionally, its advancements in low-light and high-speed image processing are setting new standards for next-generation vision-based applications.

Sony Corporation

Sony Corporation dominates the CMOS image sensor market, supplying high-resolution imaging solutions for smartphones, security cameras, and automotive vision systems. The company has made significant investments in AI-powered image processing and automation, focusing on hyperspectral and low-light imaging.

With continued expansion into autonomous driving and industrial robotics, Sony is pushing the boundaries of advanced imaging technologies. Their latest innovations in stacked CMOS sensors and ultra-low power imaging are solidifying their position as a leading force in the optoelectronic sector.

Rohm Semiconductor

Rohm Semiconductor is a specialist in miniaturized laser diodes and infrared emitters, catering to compact and energy-efficient device applications. The company is focusing on high-efficiency sensors for energy management and wearable technologies, addressing the increasing demand for smart medical devices and IoT connectivity.

Rohm is also actively partnering with automotive and industrial manufacturers, ensuring seamless integration of its optoelectronic components into next-generation automation and power management systems. Their advancements in low-power photodetectors and precision optical sensors are helping drive sustainable growth in the industry.

In terms of Material, the industry is divided into Lead Magnesium Niobate (PMN) Optoelectronic Transducers, Lead Titanate (PT) Optoelectronic Transducers, Lead Zinc Titanates (PZT) Optoelectronic Transducers

In terms of Application, the industry is divided into Underwater Acoustic Optoelectronic Transducers, Ultrasonic Optoelectronic Transducers, Optoelectronic Transducers for Standard Signal Source, Optoelectronic Transducers for Sensing and Measurement, Optoelectronic Transducers for Electro-Acoustic Transducers

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Optoelectronic Transducers market is projected to reach USD 2.6 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 4.4% over the forecast period.

By 2035, the Optoelectronic Transducers market is expected to reach USD 4.1 billion.

The LED segment is expected to dominate the market, due to its high energy efficiency, longer lifespan, compact size, and increasing adoption in automotive, display, and communication applications, driving overall market growth.

Key players in the Optoelectronic Transducers market include Hamamatsu Photonics, Vishay Intertechnology, ON Semiconductor, Sony Corporation, Rohm Semiconductor.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Component, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Device Material, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Device Material, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Component, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Device Material, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Device Material, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Component, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Device Material, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Device Material, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Component, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Device Material, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by Device Material, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Component, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Device Material, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by Device Material, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Component, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Device Material, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Device Material, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Component, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Device Material, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by Device Material, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Component, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Device Material, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Device Material, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Device Material, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Component, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Device Material, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Device Material, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Device Material, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Device Material, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Component, 2023 to 2033

Figure 22: Global Market Attractiveness by Device Material, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Device Material, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Component, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Device Material, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Device Material, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Device Material, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Device Material, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Component, 2023 to 2033

Figure 46: North America Market Attractiveness by Device Material, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Device Material, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Component, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Device Material, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Device Material, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Device Material, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Device Material, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Device Material, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Device Material, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Component, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Device Material, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by Device Material, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Device Material, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Device Material, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Component, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Device Material, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Device Material, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Component, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Device Material, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Device Material, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Device Material, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Device Material, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Component, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Device Material, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Component, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Device Material, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Component, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Device Material, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Device Material, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Device Material, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Device Material, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Component, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Device Material, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Device Material, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Component, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Device Material, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by Device Material, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Device Material, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Device Material, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Device Material, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Component, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Device Material, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Component, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Device Material, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Device Material, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Device Material, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Device Material, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Component, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Device Material, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Optoelectronic Development Tools Market

Automotive Optoelectronics Market Trends - Growth & Forecast 2025 to 2035

Ceramic Transducers Market Growth - Trends & Forecast 2025 to 2035

Blood Pressure Transducers Market Size and Share Forecast Outlook 2025 to 2035

Electro-pneumatic Transducers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA