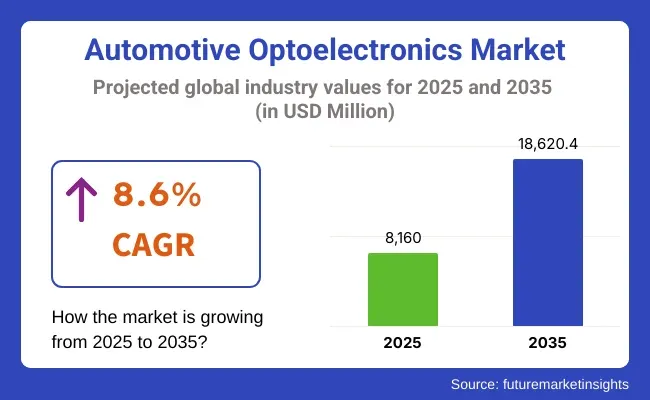

The automotive optoelectronics market is set to grow from USD 8,160 million in 2025 to USD 18,620.4 million by 2035, marking an annual growth rate of 8.6% during this time. Ongoing progress in car automation, more use of electric cars, and the need for better safety features will drive market growth beyond 2035.

From 2025 to 2035, the automotive optoelectronic market is likely to be at a huge peak throughout the forecast period as Vehicles are becoming more and more precise in their cutting-edge electronic systems, including Advanced Driver Assistance Systems (ADAS), autonomous driving technologies, and sophisticated lighting solutions. These applications use optoelectronic components such as LEDs, infrared sensors, laser diodes and image sensors to enhance vehicle safety, efficiency, and convenience.

Demand for advanced safety systems, efficient power usage in lighting, and electronics inside vehicles has led to a healthy growth in the automotive optoelectronics market. Optoelectronic designs are becoming more prevalent in ADAS, infotainment, night vision and ambient lighting applications.

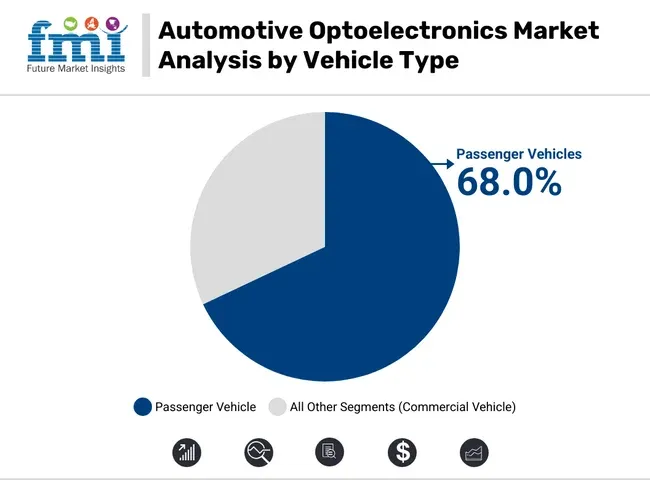

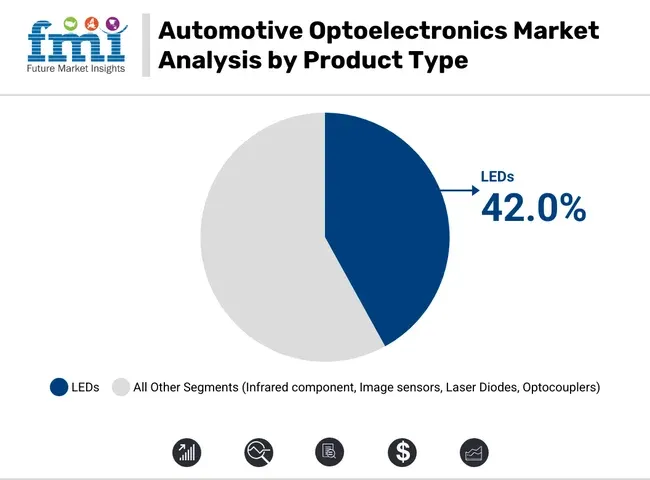

Passenger Vehicles segment to dominate Vehicle Categories; LEDs to lead the Product Types segment, due to the increasing adoption of LEDs in headlights, tail lights, DRLs, and interior illumination.

Passenger Vehicles Dominate with Increasing Focus on Safety and User Experience

Passenger vehicles, by far the largest share of the automotive optoelectronics market that encompasses compact cars to midsize sedans and luxury nameplates, continue to drive growth. This is mainly due to the incorporation of adaptive lighting systems, lane-keeping assist, and 360 camera modules.

Growing electric vehicle (EV) and hybrid vehicle has also been adding to the optoelectronics demand since the platforms heavily depend on low-energy and high-efficiency lighting and sensor systems. Luxury and high-end segments, meanwhile, are stretching the capabilities of vehicle lighting with things like matrix LEDs, LiDAR-enabled lighting, and augmented reality HUDs, helping drive near-term growth.

LEDs Lead the Market as Carmakers Prioritize Energy Efficiency and Design Flexibility

Light Emitting Diodes (LEDs) are the most widely used optoelectronic device, due to their high brightness, low power requirements, long lifetime, and small form factor. These traits render LEDs perfect for adaptive headlights, brake lights, signal indicators, ambient cabin lighting, and infotainment interfaces.

LEDs are not limited to just exterior uses; they are also working their way into dashboard displays, digital instrument clusters, and interior customization systems, which serve aesthetic and functional purposes. As a result, over the next several years, the movement toward smart lighting and vehicle personalization is prone to promote the adoption of LED.

Challenge

High Development Costs and Technological Complexity

The development and integration of advanced optoelectronic components are high-cost and technologically advanced. The complexity and cost associated with ensuring automotive-grade reliability, durability, and compliance with automotive standards may slow the widespread adoption of such technologies, especially among cost-sensitive consumers and markets.

Opportunity

Advancements in Autonomous Vehicles and EVs

The automotive optoelectronic market has great promise due to changes in self-driving and more electric cars. Parts like LiDAR, cameras, and infrared sensors are crucial for self-driving. Also, switching to electric cars needs new lights and screens, boosting demand for these optoelectronic tools even more. Companies that are investing in R&D to improve functionality and affordability of these components are poised to leverage the rising trends.

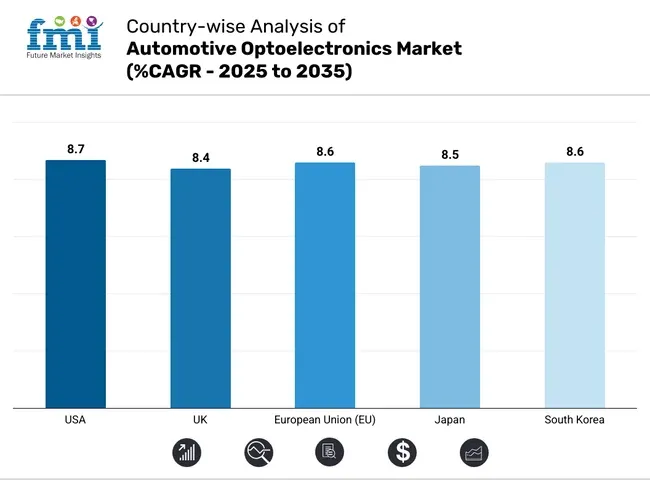

The USA automotive optoelectronics market is growing fast. This is due to the increased use of ADAS, the greater focus on car safety and automation, and the high demand for LED lights and sensors in luxury and electric cars. Rules from NHTSA and SAE set the standards for car lights and self-driving car tech.

Trends include more use of laser LiDAR sensors, growth in cameras and infrared for night vision, and higher demand for energy-saving lights. The USA market is also seeing more money going into making computer chips for cars.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.7% |

In the UK, the automotive optoelectronics market grows due to government pushes for more electric cars, higher demand for smart vehicles, and more focus on road safety and cutting emissions. The Driver and Vehicle Standards Agency (DVSA) sets the rules for car lights and safety gadgets.

Trends show rising use of matrix LED and laser headlights, more sensors for self-driving cars, and a strong focus on lighting inside cars. Research centers and big car brands help drive new ideas and growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.4% |

The automotive optoelectronics market in the EU is seeing better tech due to strict safety rules. More people are using smart lights and driver-help tools. Rich car makers play a big role. The EU and car rules groups watch over car electronics and sensor tech.

Germany, France, and Sweden lead the way. They spend a lot on R&D, have great factories, and need more LiDAR and camera parts. Electric cars and smart, self-driving cars are making things grow more in this area.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.6% |

The automotive optoelectronics market in Japan is growing. Big car companies help this growth. New LED and light tech are on the rise, and more cars have self-driving features. The Ministry of Transport and the Automotive Engineers Society oversee this.

Small optical sensors are a key trend. Smart displays and LiDAR, plus camera modules, are more common in electric and hybrid cars. Japan shines in sensor making and image tech.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.5% |

South Korea’s automotive optoelectronics market is booming. This is thanks to their lead in making semiconductor chips and LEDs. Increasing money is being put into self-driving car parts. More people want better safety systems in cars. The Korea Automobile Testing & Research Institute (KATRI) and the Ministry of Land, Infrastructure, and Transport (MOLIT) guide the rules and plans.

Big trends are seen in the use of cameras and radar to help drivers, luxury cars using OLED lights, and government support for smart travel and electric cars.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.6% |

The automotive optoelectronics market growth is mainly attributed to the growing adoption of advanced safety, comfort, and infotainment technologies in modern automobiles. This comes in line with the automotive industry that is increasingly focused on electrification and self-driving capabilities, which drives the demand for performance sensors, vision systems, and lighting solutions.

Key optoelectronic components such as photonic chips, laser diodes, infrared sensors, energy-efficient LED modules are also vital for ADAS enablement, night vision, lane detection, and adaptive lighting Key Participants with constant investments in R&D programs in the development of their respective technologies in order to improve performance, reduce energy consumption, and demonstrate the compatibility with electronic control systems boost up a voracious growth for connected smart technologies directing the development of next-generation smart vehicles.

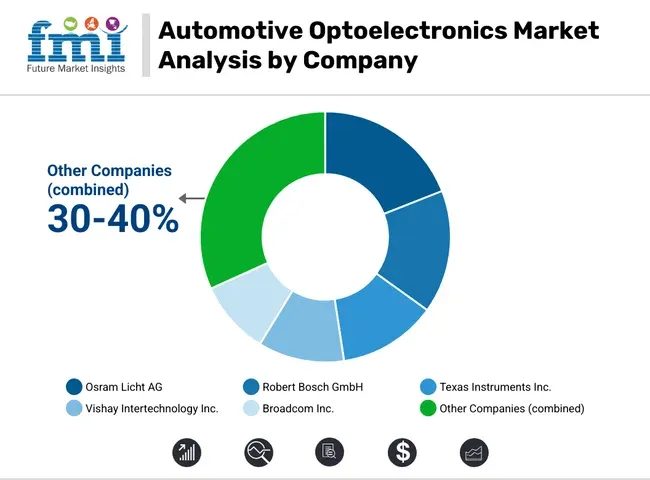

OsramLicht AG (20-24%)

Osram leads in automotive lighting and infrared LED technology, enabling high-performance vision systems and in-cabin sensing.

Robert Bosch GmbH (16-20%)

Bosch integrates optoelectronic sensors into its vehicle automation and safety modules to support advanced autonomous functions.

Texas Instruments Inc. (12-16%)

Texas Instruments delivers analog and embedded processing solutions for optoelectronic applications in next-gen vehicle electronics.

Vishay Intertechnology Inc. (10-14%)

Vishay provides high-efficiency light sensors and photonic components optimized for automotive environments.

Broadcom Inc. (8-12%)

Broadcom specializes in optical ICs and laser technologies critical for vehicle perception systems like LiDAR.

Other Key Players (30-40% Combined)

Numerous global companies contribute to the automotive optoelectronics value chain through lighting modules, optical sensors, and vision-based systems. These include:

The overall market size for the automotive optoelectronics market was USD 8,160 Million in 2025.

The automotive optoelectronics market is expected to reach USD 18,620.4 Million in 2035.

Rising demand for advanced driver-assistance systems (ADAS), increasing adoption of LED lighting and sensor technologies, and growing integration of safety and infotainment features in modern vehicles will drive market growth.

The USA, China, Germany, Japan, and South Korea are key contributors.

The image sensor segment is expected to lead due to its critical role in ADAS, lane departure warning, and autonomous driving technologies.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA