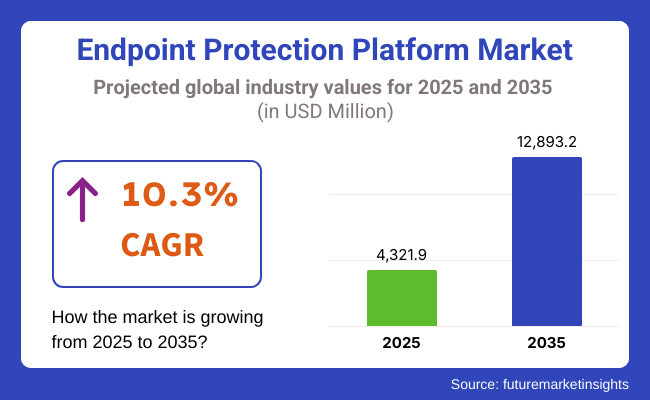

The global Endpoint Protection Platform market is projected to grow significantly, from USD 4,321.9 Million in 2025 to USD 12,893.2 Million by 2035 an it is reflecting a strong CAGR of 10.3%.

The endpoint protection being one of the major facets of the organizations, there is an increasing reliance on external security vendors and partners to augment the functionality. With these integrations, there are risks and the threats evolve, this requires advanced solutions for endpoint security. As remote work and cloud adoption have continued to rise, enterprises have recognized the risk of exposing endpoints to the risks of unauthorized access and malware attacks.

Strict regulations like GDPR in Europe or CCPA in California require companies to deploy robust endpoint security frameworks. Automated security solutions to such compliance requirements require protection for sensitive data, detection of potential threats, and valid access to ensure compliance.

With segments like BFSI, healthcare and it managing massive confidential details, endpoint protection platforms are becoming critical due to the growing urge to avoid breaches and therefore regulatory fines.

With enterprises moving towards digital transformation, they rely on plan cloud services, IT outsourcing and third-party applications. However, these developments bring with them new cybersecurity risks. Digital assets can be secured in distributed IT environments through endpoint protection platforms Businesses now need these solutions to provide real-time threat detection, AI-backed security, and automated response mechanisms to protect their networks from cyber threats.

As cyberattacks become more sophisticated, endpoints have become one of the primary targets for hackers. Organizations need these forms of security to monitor for activity, analyze behavior, and detect and prevent unauthorized use of your technology.

The modern endpoint protection solutions are based on concepts of real-time risk assessment and zero-trust framework that protects the enterprise endpoints from malware, ransomware, and phishing attacks through proactive threat mitigation.

North America dominates the Endpoint Protection Platform market owing to stringent cybersecurity regulation, a high adoption rate of advanced security solutions, and the presence of major security vendors in the region. Other regions like India and Australia are seeing growing demand for endpoint security tools along with their digital economies. The rise of regulatory compliance and a sharp increase in cyber threats are fueling the inescapable adoption of endpoint protection platforms across the globe.

| Company | CrowdStrike Holdings, Inc. |

|---|---|

| Contract/Development Details | Secured a contract with a global retail chain to deploy endpoint protection platforms, aiming to safeguard point-of-sale systems and customer data from cyber threats. |

| Date | March 2024 |

| Contract Value (USD Million) | Approximately USD 40 |

| Renewal Period | 5 years |

| Company | Palo Alto Networks, Inc. |

|---|---|

| Contract/Development Details | Partnered with a healthcare provider to implement endpoint protection solutions, enhancing the security of patient records and compliance with healthcare regulations. |

| Date | August 2024 |

| Contract Value (USD Million) | Approximately USD 35 |

| Renewal Period | 6 years |

Increasing malware, ransomware, and phishing attacks drive demand for endpoint security

With the increase of malware, ransomware, as well as phishing attacks, there is a greater demand for endpoint protection solutions. Cybercriminals are always enhancing their attack tactics, deploying advanced malware to gain access to endpoint vulnerabilities.

Ransomware attacks have also increased during the year with businesses losing financially from data encryption and ransom demands. By 2024, worldwide ransomware damages are predicted to exceed USD 30 billion forcing organizations worldwide to spend on good endpoint protection solutions, including tools with real-time threat detection and response capabilities.

Well, cyber threats are the most dangerous ones one has to face compared to other threats or attacks in a cyber-world today! In February 2024, the USA Cybersecurity and Infrastructure Security Agency (CISA) issued a new directive mandating that all federal agencies must bolster endpoint security with mandatory threat monitoring and automated incident response mechanisms.

Focused on lowering endpoint-based vulnerabilities, which made up 67% of cyber incidents affecting federal networks in 2023, this new guidance marks the first internet protocol the Federal CISO, a role filled by the USA Chief Information Officer, has pushed out. Europe is making similar strides, with the EU Agency for Cybersecurity (ENISA) calling for tighter endpoint security recommendations as part of NIS2 rules.

Shift from on premise solutions to scalable, cloud-native endpoint protection

It is versatile, flexible, and offers real-time threat prevention, so it can be instantaneously deployed in multi-tenant environments. In contrast, traditional endpoint security solutions have limitations such as poor visibility, slow threat response, and costly infrastructure.

However, while traditional endpoint protection (EPPs) is data-based, using AI and automation to support some continuous monitoring, threat detection is slower. At least 75% of enterprises will deploy cloud-based endpoint security solutions to protect distributed workforces and hybrid IT environments by 2025.

Cloud security is also being realized on the part of governments. You can have your key IT services redirected towards the cloud more easily with our Connected UK function to add an extra level of protection and trust. The new framework intends to reverse the 300% increase cloud-based cyberattacks experienced in 2023.

Initiative to allow for financial incentives for SMEs that implement cloud-based endpoint security, to protect them from the rising tide of ransomware, launched by the Australian Signals Directorate (ASD).

Demand for predictive threat intelligence to enhance endpoint protection

With growing sophistication of cyber-attacks, organizations have started adopting predictive threat intelligence proactively to detect and remediate risks before an attack occurs. AI-Powered Systems Enable Predictive Analytics Traditional security solutions tend to be highly reactive in nature, but AI-powered predictive analytics software analyzes massive datasets to identify potential threats within real time.

In fact, the predictive threat intelligence market grew 40% between 2022 and 2026 due to its effectiveness in preventing zero-day attack vectors, malware intrusions, and insider attacks.

National governments are also investing in predictive threat intelligence that can improve national cybersecurity. In January 2024, the European Commission initiated a cybersecurity program, with up to €2 billion allocated for AI-enhanced threat intelligence and endpoint protection research. The move comes in the wake of a 45 percent rise in state-sponsored cyberattacks targeting European financial institutions in 2023.

At the same time, the USA Department of Defense (DoD) is bolstering its endpoint security architecture with the introduction of AI-driven predictive threat detection, which will be mixed into military and government networks, with the intention of cutting cyber intrusions by 60% in five years.

Integrating endpoint protection with existing IT infrastructure and legacy systems will be difficult

The organizations are integrating endpoint protection platforms (EPPs) with their existing IT infrastructure and legacy systems. Most companies are still running legacy systems that are not compatible with modern security solutions.

These legacy environments commonly contain outdated operating systems, proprietary applications, and bespoke software, which makes it challenging for next-gen endpoint security solutions to work properly. This lack of compatibility can cause operational disruptions, system crashes, security gaps and exposing them to cyber threats due to outdated legacy IT frameworks.

Furthermore, heterogeneous IT environments consisting of complex on-premise, cloud, and hybrid systems present challenges for endpoint protection deployment, as well. Diverse infrastructures in organizations need tailored configurations, considerable testing, and more resources for integration. The use of multiple security tools like firewalls, intrusion detection systems, and network monitoring solutions can also contribute to duplicated efforts or conflicting policies resulting in lower effectiveness.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance requirements for endpoint security increased across industries. |

| AI & Threat Intelligence | AI-driven malware detection improved endpoint protection. |

| Cloud & Hybrid Work Environments | Endpoint protection solutions adapted to remote work security needs. |

| Zero Trust & Identity Protection | Integration with zero-trust security models improved access control. |

| Market Growth Drivers | Growth in ransomware attacks and remote workforce security needs. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven endpoint security frameworks autonomously adapt to evolving cyber threats. |

| AI & Threat Intelligence | Quantum-powered endpoint encryption ensures tamper-proof cybersecurity. |

| Cloud & Hybrid Work Environments | AI-powered self-learning security agents dynamically adjust endpoint defenses. |

| Zero Trust & Identity Protection | AI-driven identity verification eliminates credential-based attack risks. |

| Market Growth Drivers | AI-powered, self-adapting security platforms redefine endpoint protection. |

The section highlights the CAGRs of countries experiencing growth in the Endpoint Protection Platform market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 14.7% |

| China | 12.9% |

| Germany | 8.0% |

| Japan | 11.0% |

| United States | 9.2% |

China's government is clamping down on cybersecurity, boosting the appetite for advanced endpoint protection. To adhere to data protection and cyber resilience requirements, businesses are applying stronger their security frameworks, especially with laws like Cybersecurity Law (CSL), Data Security Law (DSL), and Personal Information Protection Law (PIPL) in China.

These regulations require constant monitoring, threat detection as well as data localization, and they are forcing enterprises to establish strong endpoint safety systems (EPPs) to protect against cyber threats. The organizations that do not comply with such regulations may be fined heavily and their operations may stop and/or their business licenses may be revoked, thus investing in security is no longer optional but a must.

More than 90% of China’s large enterprises should reach advanced cybersecurity standards by 2025, Chinese Ministry of Industry and Information Technology (MIIT) announced as part of China’s digital security strategy. The government is also stepping up cybersecurity inspections across sectors like finance, healthcare, and e-commerce, pushing companies to deploy AI-powered endpoint security to identify and thwart advanced attacks.

As cyber espionage and state-sponsored hacking continue to pose major threats, China’s strict policies will also keep nurturing the growing market of endpoint protection solutions, especially in the critical sectors of government agencies, telecom, and financial services.

The fast-paced digital transformation in India is driving the demand for endpoint protection solutions across SMEs and large organizations. As cloud adoption grows, remote work continues and online transactions proliferate, Indian SMEs have emerged as low-hanging fruit for cyber criminals.

Some key initiatives such as Digital India and Cyber Surakshit Bharat have been initiated by the government of India to build secure digital infrastructure and encourage organizations to enhance cybersecurity practices. With migration to cloud platforms and SaaS applications, several SMEs are prone to phishing attacks, insider threats, and ransomware, and it is thus driving demand for advanced endpoint security.

The Indian Ministry of Electronics and Information Technology (MeitY) has recently released a statement reflecting a 25% increase in cyberattacks related to SMEs in 2023, highlighting an even greater need for strong endpoint security frameworks. Consequently, the government launched a cybersecurity awareness initiative for 50,000 SMEs and urged them to adopt AI-powered endpoint protection to minimize risk.

The drive for digital security is likely to experience a boom with India having more than 60 million SMEs adding 30% to the GDP. Along with this, new Data Protection Laws necessitate secure data handling and endpoint monitoring by organizations and drives continued demand for endpoint protection platforms (EPPs) across India’s expanding digital economy.

In the USA, there is a fast transition to zero-trusted security frameworks, which are transforming the endpoint protection platform (EPP) market. As ransomware, phishing and nation-state cyberattacks have proliferated, USA enterprises and government agencies are adopting zero-trust architectures that enforce tight identity verification and continuous monitoring of endpoints.

The USA government enforce zero-trust in its Executive Order on Improving the Nation’s Cybersecurity (EO 14028), driving a shift in endpoint security for federal agencies and contractors.

During 2024, the Cybersecurity and Infrastructure Security Agency (CISA) reported that more than 60% of federal agencies had started deploying zero trust-based endpoint security solutions, with full implementation targeted for 2025.

The Biden Administration also dedicated USD 1.2 billion for zero-trust adoption in critical sectors - measures that further cement the need for endpoint security. USA enterprises are increasingly turning to hybrid, behavior-based solution endpoint protection that are offered by AI to contain insider threats or unauthorized access attempts.

The section contains information about the leading segments in the industry. By Solution, the Services segment is estimated to grow quickly from the period 2025 to 2035. Additionally, by Enterprise Size, Large Enterprise segment hold dominant share in 2025.

| Solution | CAGR (2025 to 2035) |

|---|---|

| Services | 12.2% |

With the rise of cyber tactics, there is a growing demand for organizations to have managed security, including an endpoint protection service. As ransomware attacks, insider threats, and advanced persistent threats (APTs) escalate, companies are seeking managed detection and response (MDR), incident response, and endpoint security consulting services.

Zero Trust security services help organizations detect system vulnerabilities, implement security policies, and facilitate real-time threat mitigation. Demand for additional endpoint security services boosts from governments globally pushing for strong cybersecurity frameworks.

The USA Cybersecurity and Infrastructure Security Agency (CISA) unveiled a USD 1.6 billion investment to increase cybersecurity services for both federal and private-sector organizations. The initiative involves cutting-edge endpoint security monitoring, incident response abilities, and AI-enhanced threat intelligence services.

The European Union Agency for Cybersecurity (ENISA) has similarly issued a regulation that requires organizations managing relevant infrastructure and sensitive data to build out security service frameworks and continuous endpoint security monitoring capability. With businesses facing a shortage of IT skills and seeking economy-effective security solutions, the requirement for endpoint protection services is set to boom even more making it one of the fastest-growing segments of the Endpoint Protection Platform (EPP) market.

| Enterprise Size | Value Share (2025) |

|---|---|

| Large Enterprise | 59.2% |

According to value, large enterprises account for a significant share of the global Endpoint Protection Platform (EPP) market, due to the fact that these organizations have higher cybersecurity budgets, given the large-scale IT infrastructure they need to protect.

Jared Plus: Large enterprise if they are in remote workforces, have thousands of endpoints, cloud based applications they are great risk, thus can bank on endpoint security solution. Large enterprises, therefore, invest heavily in endpoint security platforms involving AI-driven threat detection, zero-trust security frameworks, and compliance-driven security measures.

Government across the globe are implementing stringent cybersecurity laws to urge larger organizations to focus on endpoint protection. For example, China’s Cybersecurity Administration has already required companies with at least 500 employees to implement advanced endpoint security and data protection measures as mandated under the Personal Information Protection Law (PIPL). Last year, the National Institute of Standards and Technology (NIST) updated the set of guidelines related to endpoint security in the United States and mandated enterprises to implement multi-layered endpoint security and real-time monitoring systems.

For instance, large financial institutions and healthcare providers, in particular, are investing in endpoint security platforms-with more than 80% of Fortune 500 companies deploying systems for automated endpoint threat response.

Endpoint Protection Platform (EPP) market outlook is positive and growing rapidly owing to increasing concern about cyber-attacks, malware and ransomware attacks among enterprises. Organizations from different sectors utilize the EPP solution to prevent, detect its main cause and quickly respond to threats.

Competing with well-known cyber security companies are new innovation companies that utilize artificial intelligence ( AI ) and machine learning ( ML ) with complimentary cloud technology security architectures for better end point protection.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Microsoft | 22-27% |

| CrowdStrike | 15-20% |

| Symantec (Broadcom) | 12-18% |

| McAfee | 8-12% |

| Trend Micro | 6-10% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Microsoft | Offers Microsoft Defender for Endpoint, providing AI-powered threat detection, zero-trust security models, and deep integration with Microsoft 365. |

| CrowdStrike | Specializes in cloud-native endpoint protection with its Falcon platform, leveraging AI-driven threat intelligence and automated response capabilities. |

| Symantec (Broadcom) | Provides enterprise-grade EPP solutions with robust malware protection, data loss prevention, and threat analytics. Focuses on hybrid-cloud security. |

| McAfee | Offers cloud and on-premise endpoint protection with strong AI-powered threat detection, encryption, and behavioral analytics. |

| Trend Micro | Delivers multi-layered endpoint security with XDR capabilities, advanced malware protection, and automated attack response. |

Strategic Outlook

Microsoft (22-27%)

Microsoft: Control in EPP space with Microsoft Defender for Endpoint, designed to provide integrated security for Windows, macOS, and Linux. Microsoft strengthens its leadership with AI-powered threat detection, automated response, and seamless integration with Microsoft 365 and Azure. A best-in-breed zero-trust security model combined with continuous enhancements to the AI engine positions them for widespread enterprise adoption.

CrowdStrike (15-20%)

Falcon, issued by a leader in cloud-native endpoint security, CrowdStrike, offers real-time threat intelligence and automated response. However, the organization’s AI-powered behavioral analytics and next-gen attack discovery capabilities keep it at the top of the heap for any organizations aiming for next-gen endpoint security products. The rapid expansion of CrowdStrike in the market and investment in extended detection and response (XDR) solutions validate its competitive strength.

Symantec (Broadcom) (12-18%)

Preventing malware and data loss is what Symantec does, and it does a really good job of it on the enterprise side, powered by advanced analytics through machine learning since the company introduced AI into its security offering. Symantec, which is now owned by Broadcom, remains a leading security solution for hybrid-cloud security, particularly among large enterprises and government organizations.

McAfee (8-12%)

McAfee delivers hybrid cloud and on-premise endpoint protection, against a well-equipped suite of AI-driven threat detection, encryption, and behavioral analytics. It focuses on automated security response and extended detection capabilities that can help organizations defend endpoints against sophisticated cyber threat.

Trend Micro (6-10%)

Trend Micro is an expert in multi-layered endpoint security including extended detection and response (XDR), advanced malware protection, and automated attack remediation. In addition, the company’s focus on AI-powered enterprise cloud and hybrid cloud security positions it as a strong player to provide enterprise protection.

Other Key Players (25-35% Combined)

The market’s competitive landscape features players like Palo Alto Networks, SentinelOne, Sophos, Bitdefender and Check Point Software Technologies. These vendors specialize in specific endpoint security capabilities such as autonomous AI-based protection, behavior-based analytics, and cloud-native security architectures. Their ongoing investment in AI, threat intelligence and XDR solutions bodes for continuing market expansion and diversification.

In terms of solution, the segment is segregated into End point security platform and services.

In terms of Enterprise Size, the segment is segregated into Small & Medium Enterprise and Large Enterprise.

In terms of Industry, it is distributed into Government and Defense, Banking, Financial Services, and Insurance (BFSI), IT and Telecom, Retail and e-Commerce, Energy and Utilities, Manufacturing, Education and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global Endpoint Protection Platform industry is projected to witness CAGR of 10.3% between 2025 and 2035.

The Global Endpoint Protection Platform industry stood at USD 4,321.9 million in 2025.

The Global Endpoint Protection Platform industry is anticipated to reach USD 12,893.2 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 12.3% in the assessment period.

The key players operating in the Global Endpoint Protection Platform Industry Microsoft, CrowdStrike, Symantec (Broadcom), McAfee, Trend Micro, Palo Alto Networks, SentinelOne, Sophos, Bitdefender, Check Point Software Technologies

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Deployment Mode, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Deployment Mode, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Deployment Mode, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Deployment Mode, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Deployment Mode, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Deployment Mode, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Deployment Mode, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Deployment Mode, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Enterprise Size , 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Services, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Deployment Mode, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Deployment Mode, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Deployment Mode, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Deployment Mode, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Global Market Attractiveness by Services, 2023 to 2033

Figure 22: Global Market Attractiveness by Deployment Mode, 2023 to 2033

Figure 23: Global Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 24: Global Market Attractiveness by End User, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Services, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Deployment Mode, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Deployment Mode, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Deployment Mode, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Deployment Mode, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 46: North America Market Attractiveness by Services, 2023 to 2033

Figure 47: North America Market Attractiveness by Deployment Mode, 2023 to 2033

Figure 48: North America Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 49: North America Market Attractiveness by End User, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Services, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Deployment Mode, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Deployment Mode, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Deployment Mode, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Deployment Mode, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Services, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Deployment Mode, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 74: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Services, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Deployment Mode, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Deployment Mode, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Deployment Mode, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Deployment Mode, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 96: Europe Market Attractiveness by Services, 2023 to 2033

Figure 97: Europe Market Attractiveness by Deployment Mode, 2023 to 2033

Figure 98: Europe Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 99: Europe Market Attractiveness by End User, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Services, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Deployment Mode, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Deployment Mode, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Deployment Mode, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Deployment Mode, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Services, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Deployment Mode, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 124: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Services, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Deployment Mode, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Deployment Mode, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Deployment Mode, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Deployment Mode, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Services, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Deployment Mode, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 149: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Services, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Deployment Mode, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Deployment Mode, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Deployment Mode, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Deployment Mode, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Services, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Deployment Mode, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 174: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Services, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Deployment Mode, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Enterprise Size , 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Deployment Mode, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Deployment Mode, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Deployment Mode, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Enterprise Size , 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Enterprise Size , 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Enterprise Size , 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 196: MEA Market Attractiveness by Services, 2023 to 2033

Figure 197: MEA Market Attractiveness by Deployment Mode, 2023 to 2033

Figure 198: MEA Market Attractiveness by Enterprise Size , 2023 to 2033

Figure 199: MEA Market Attractiveness by End User, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Endpoint Detection and Response Market Growth - 2025 to 2035

Endpoint Security Solutions Market

Unified Endpoint Management Market Size and Share Forecast Outlook 2025 to 2035

Flu Protection Kits Market Size and Share Forecast Outlook 2025 to 2035

Eye Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Teleprotection Market Growth – Trends & Forecast 2025 to 2035

ESD Protection Devices Market Insights – Trends & Demand 2023-2033

Fire Protection Materials Market Size and Share Forecast Outlook 2025 to 2035

Fall Protection Market Size and Share Forecast Outlook 2025 to 2035

CBRN Protection Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection System Pipes Market Size and Share Forecast Outlook 2025 to 2035

DDoS Protection Market Size and Share Forecast Outlook 2025 to 2035

Fire Protection Systems for Industrial Cooking Market Growth - Trends & Forecast 2025 to 2035

DDoS Protection & Mitigation Security Market Growth - Trends & Forecast through 2034

Head Protection Equipment Market Growth – Trends & Forecast 2024-2034

Data Protection as a Service (DPaaS) Market

Surge Protection Device Market Size and Share Forecast Outlook 2025 to 2035

Brand Protection Tools Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Share Distribution Among Brand Protection Tools Providers

Market Share Breakdown of Paint Protection Film Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA