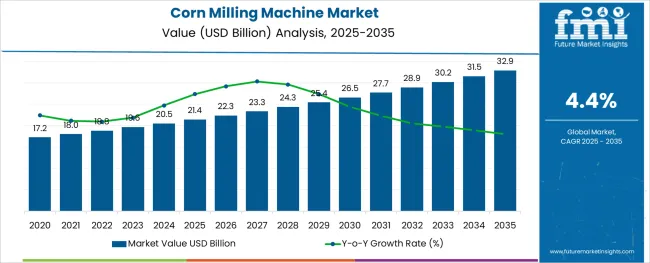

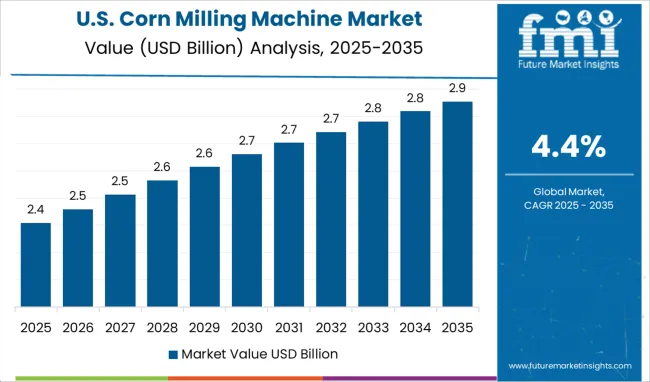

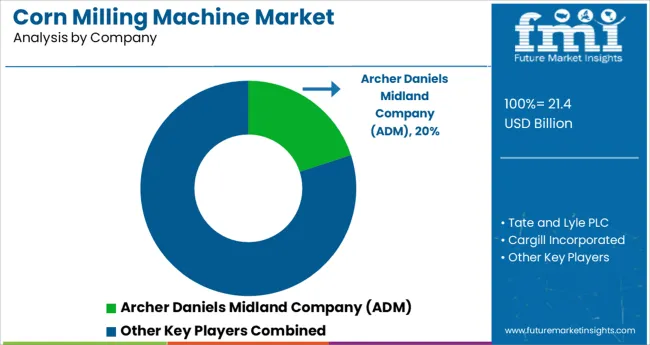

The Corn Milling Machine Market is estimated to be valued at USD 21.4 billion in 2025 and is projected to reach USD 32.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

The corn milling machine market is witnessing consistent growth as rising demand for processed corn products, technological advancements in milling machinery, and increasing investments in food processing infrastructure converge to drive adoption. Enhanced efficiency, energy savings, and improved yield rates offered by modern machines are motivating both new installations and upgrades across regions.

Growth is further supported by expanding applications of corn derivatives in food, industrial, and biofuel sectors, which are fostering capacity expansion and innovation. Future opportunities are expected to stem from the integration of automation, precision control systems, and sustainability-focused designs that reduce waste and optimize water and energy usage.

The combination of operational efficiency and alignment with sustainability initiatives is creating favorable conditions for market expansion and long-term adoption.

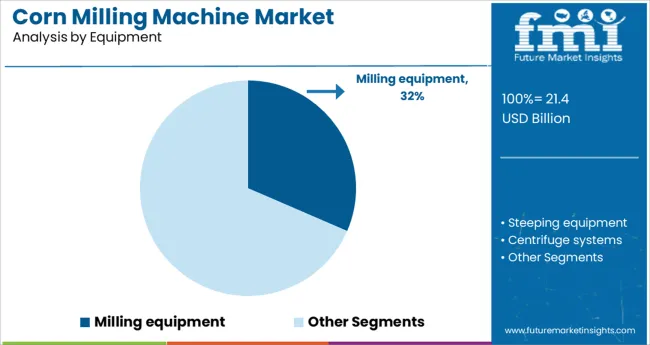

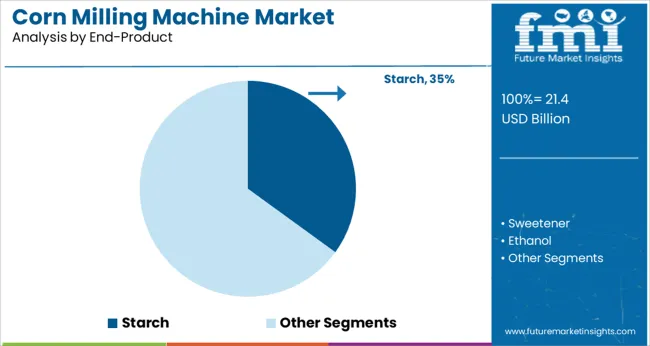

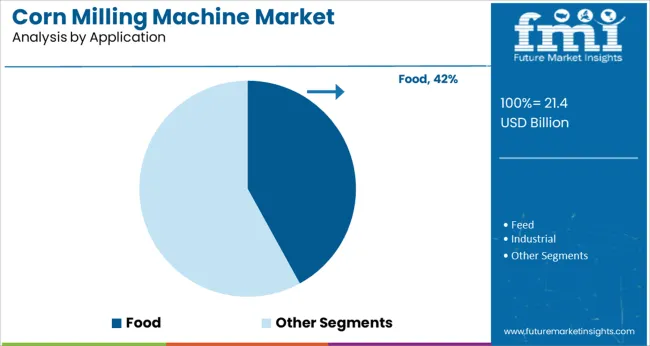

The market is segmented by Equipment, End-Product, Application, and Source and region. By Equipment, the market is divided into Milling equipment, Steeping equipment, Centrifuge systems, Washing & filtration systems, and Other (heating and cooling systems, dryers and other utility equipment). In terms of End-Product, the market is classified into Starch, Sweetener, Ethanol, Corn gluten meal and gluten feed, and Others (corn oil, proteins, corn germ meal, and steep oil). Based on Application, the market is segmented into Food, Feed, and Industrial. By Source, the market is divided into Dent Corn and Waxy Corn. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Equipment, End-Product, Application, and Source and region. By Equipment, the market is divided into Milling equipment, Steeping equipment, Centrifuge systems, Washing & filtration systems, and Other (heating and cooling systems, dryers and other utility equipment). In terms of End-Product, the market is classified into Starch, Sweetener, Ethanol, Corn gluten meal and gluten feed, and Others (corn oil, proteins, corn germ meal, and steep oil). Based on Application, the market is segmented into Food, Feed, and Industrial. By Source, the market is divided into Dent Corn and Waxy Corn. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by equipment, milling equipment is projected to command 31.5% of the total market revenue in 2025, establishing itself as the leading equipment category. This leadership has been reinforced by its central role in delivering high-quality corn flour, grits, and meal with optimal efficiency and consistency.

Advancements in design have enabled greater throughput, reduced downtime, and minimized energy consumption, which have been key factors driving its widespread adoption. The ability of modern milling equipment to handle a variety of corn types while maintaining product uniformity has enhanced its appeal across diverse production environments.

Furthermore, the segment’s prominence has been supported by its compatibility with automated control systems and its adaptability to both large-scale and specialized production lines, ensuring its continued preference among processors.

Segmented by end product, starch is anticipated to account for 35.0% of market revenue in 2025, maintaining its leading position. This dominance has been attributed to the extensive use of corn starch in the food, pharmaceutical, textile, and paper industries, which has created sustained demand for dedicated milling solutions optimized for starch extraction.

The ability of specialized machinery to maximize starch yield while minimizing impurities has been a decisive factor in this segment’s growth. Continued innovations aimed at improving extraction efficiency, reducing water consumption, and enhancing product quality have further reinforced its market leadership.

Processors have increasingly prioritized equipment that delivers superior starch recovery and supports integration with downstream processing, consolidating this segment’s significance in driving overall market revenues.

When segmented by application, the food sector is projected to hold 42.0% of the total market revenue in 2025, securing its position as the largest application segment. This prominence has been fueled by the growing global demand for corn-based food products such as tortillas, snacks, cereals, and bakery ingredients, which has intensified investment in efficient milling machinery.

The ability of advanced equipment to meet stringent food safety standards while delivering high output and consistent quality has been central to its adoption in the food industry. Moreover, consumer preferences for gluten-free and plant-based alternatives have expanded the application of corn-derived products, further driving investments in food-focused milling solutions.

The food segment’s leadership has also been strengthened by its alignment with evolving dietary trends, regulatory compliance requirements, and the sector’s capacity for high-volume, standardized production.

The China corn milling machine market is valued at USD 21.4 million as of 2025. By 2035, the China market is expected to reach a valuation of 3659.77 million, thereby growing at an above-average anticipated CAGR of 8.7%.

If we compare the historical CAGR (2020 to 2025) of the China corn milling machine market with the anticipated CAGR, not much growth is observed. But the point to watch out for is that the scope of usage has surely increased, which is visible in the numbers. The historical CAGR was 8.1%, while the anticipated CAGR is 8.7%

Based on a research study, the leather industry was valued at USD 20.5 billion from January 2024 to July 2024. These figures suggest potential gains for the corn milling machine market. The purest form of corn that is obtained after the corn is processed inside an electric corn grinder machine is utilized by the leather industry.

The corn-based leathers are being increasingly employed because of the high durability associated with them. Apart from that, Chinese manufacturers have also opined that corn-based leathers are gaining traction because of the smoothness and elasticity associated with them.

The United Kingdom corn milling machine market is valued at USD 1039.80 as of 2025. The United Kingdom market is expected to grow at a CAGR of 4.6% during the forecast period and is anticipated to hold a valuation of USD 32.90 million by 2035.

While the historic CAGR (2020 to 2025) was valued at 3.9%, the anticipated CAGR for the forecast period stands at USD 4.6%. This certainly showcases huge growth opportunities in the United Kingdom market. The finest form of corn that is obtained from the corn processing equipment is used for preparing corn-based spirits, which are mainly used as part of cocktails. The owners of casinos, restaurants, and pubs are of the view that the consumers are generally awestruck by the grassy and vegetal nature of these corn-based cocktails.

Based on the survey conducted by FMI, it was found that Asia Pacific is the fastest-growing chewing gum market, and the market is expected to grow at a CAGR of 7% during the forecast period.

Corn syrup that is being used for manufacturing the chewing gums is obtained after thorough processing of corn in the corn milling machine. This is well expected to increase the demand for corn milling equipment during the forecast period.

On comparing the historical CAGR with the anticipated CAGR, we see that the market is expected to grow at a considerable rate during the forecast period. The historic CAGR was 3.2%, and the anticipated CAGR was 4.4%.

An increase in the production of corn syrup, along with the increased usage of corn in food starch and ethanol, is expected to increase the corn milling machine market share.

Simple operation

One of the biggest drivers of the adoption of corn machines is that they are simple to operate and do not require any technical specialization.

Low energy consumption

The investors are particularly interested in making use of corn milling machines because of the fact that the energy consumption is much lower than expected. This helps manufacturers achieve considerable cost-cutting.

Low maintenance cost

The maintenance cost associated with the corn milling machine is quite low. Apart from that, the installation of these machines is quite easy as well, which motivates businessmen to invest the required amount for the corn milling machines.

Low production efficiency

The quantity of end products obtained from the use of the corn milling machine is quite less. Because of this, these machines need to be put into operation on a continuous basis to produce the required output at a given point in time. This might challenge the demand for corn milling machines during the forecast period.

The short life of spare parts

The spare parts have a short lifespan. Thus, they have to be replaced on a consistent basis, as a result of which the companies need to undergo unnecessary expenditures. This as well might hamper the growth of the corn milling machine market.

Being a rich source of protein, fiber, and Vitamin C, nutritionists and doctors always recommend the optimum consumption of corn.

Apart from that, certain multivitamin capsules contain some amount of corn that has been processed from a corn milling machine. Thus, the increased usage of corn in the healthcare sector presents huge opportunities for the corn milling machine market.

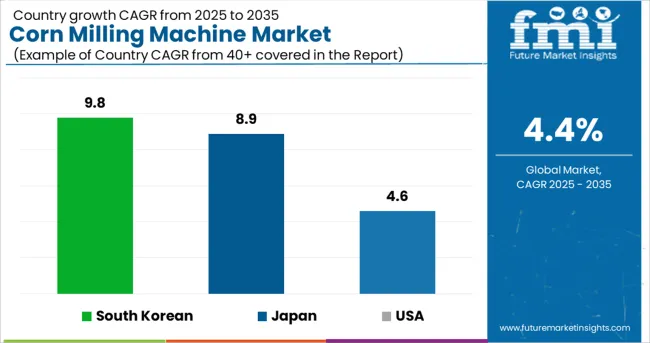

The USA corn milling machine market is expected to grow at a CAGR of 4.6% during the period 2025 to 2035. As of 2025, the market is valued at USD 32.9 million, and by 2035, the market is expected to reach a valuation of USD 9228.09 million.

While the historic CAGR (2020 to 2025) stood at 3.5%, the expected CAGR for the forecast period is 4.6%. The statistics depict a decent jump, and all this is attributed to the key players from other sectors realizing the importance of corn.

The healthcare sector in the USA is expected to reach a valuation of USD 6.2 trillion by 2035. The healthcare sector in the USA has been making use of the fine forms of corn that is obtained from corn milling machine.

Being an excellent source of manganese, Zinc, Phosphorous, and many other nutrients makes corn an integral part of a lot of multi-vitamin tablets and syrups.

In 2024, the bakery products market in Europe was valued at close to USD 140 billion.

The manufacturers in Europe are of the view that the usage of processed corn for livestock feed for industrial purposes has yielded positive results.

Apart from that, flint corn, after being processed by corn milling machines, is being used for the preparation of hominy and grits. Flint corn is known to possess high nutritional value because of which the manufacturers make use of them after getting them processed through milling machines.

Moreover, bakery product manufacturers are increasingly making use of masa harina for making tortillas, as these are easy to digest.

Thus, the different ways of making use of fine corn obtained from corn milling machines for bakery products present huge prospects for the market going ahead.

The Japan corn milling machine market is expected to grow at a robust CAGR of 10.1% during the forecast period. The corn milling machine market in Japan has a valuation of USD 21.4 million as of 2025, and by 2035, the market is expected to reach a valuation of USD 3594.55 million.

The historical CAGR (2020 to 2025) for the Japanese market was 8.9%. An increase from 8.9% to the proposed 10.1% speaks volumes about the market.

In 2024, the Japan sealant and adhesives market was valued at USD 3 billion, and it is expected that the market would continue to progress.

In a bid to offer innovative solutions, the adhesives market is making use of unique methods to provide seamless adhesiveness.

The corn germs that are the leftovers from the corn milling machine market are used to increase adhesiveness. Moreover, cornstarch is used to activate the stickiness of the industrial glues. Apart from glue sticks, the fine corn particles that are obtained from the corn milling machines are also used in glue sticks and plywood glues.

The South Korean corn milling machine market is expected to hold a valuation of USD 32.9 million by 2035. The corn milling machine market in South Korea is valued at USD 549.33 million as of 2025, and the market is expected to grow at a CAGR of sturdy 10.6% during the forecast period.

The historical CAGR (2020 to 2025) for the market was 9.8%. An increase in the value is definitely a good sign for the market.

The chemical market in South Korea is valued at close to USD 10 billion. The South Korean chemical industry has been into producing ethanol from corn.

The versatile and biodegradable nature of these fine corn particles has literally caught the eyeballs of manufacturers from the chemical sector. Moreover, the biodegradable polymers that are obtained from corn are gradually replacing synthetic chemicals in certain areas of the South Korean chemical market.

Owing to its renewable and environment-friendly properties, the corn particles that are obtained from corn milling machines are being utilized for manufacturing chemicals for biomedicine and drug delivery systems.

According to FMI analysis, the starch segment is expected to have the highest market share. The CAGR of the segment during the forecast period is expected to be 4.5%, and the historical CAGR (2020 to 2025) for the segment was 3.7%.

Starch is being increasingly used for consumption purposes in gravies, sauces, casseroles, etc. Being a source of potassium, nutritionists prescribe certain people to consume them in moderation.

The centrifuge systems segment is expected to have the highest market share during the forecast period. The segment is expected to surge with a CAGR of 5.7% during the forecast period, while the historical CAGR (2020 to 2025) was 4.9%.

The centrifuge systems are known to perform the most crucial task of separating the corn from the germs. Moreover, the system has to be replaced on a regular basis, as its operational life is quite less.

The corn milling machine market is currently dominated by key players who have been serving the niche for decades altogether. They have been contributing to the market growth by developing innovative solutions and by implementing the latest technologies.

The start-up ecosystem is relatively quiet, and there is not much happening in this space. But, with diverse sectors understanding the importance of utilizing the processed corn that is obtained from corn milling machines, the market seems to have a bright future ahead.

If aspiring entrepreneurs are falling short of funds, they can take the help of venture capitalists and angel investors, and all they require is a brilliant idea to receive funding from them. So, this virtually untapped market has a lot to offer.

The key players in the corn milling machine market are investing heavily in the Research and Development to develop technologically advanced corn milling machines. Apart from that, they are also investing in developing strategic partnerships with key players from other niches to invest in knowledge sharing and technology sharing.

Some of the recent developments are

Cargill Incorporate, Agrana Beteiligungs-AG, The Roquette Feres, and Bunge Limited are taking every possible measure to serve the end customers with the best possible products and services Bunge Limited has a diverse and talented team who makes Bunge the most innovative and dynamic company in the industry. They have always strived for excellence by being agile, innovative, and efficient.

The team is consistently looking for ways to bring an innovative portfolio of products to those who need it the most. Moreover, Bunge has always been into improving its integrated operations to provide the highest level of quality and safety to food, thereby bringing together consumer demands and science to meet customer needs.

On 13th October’22, Olleco and Bunge agreed to a joint venture to create a full life cycle oil collection business in Europe.

Roquette is a global leader in plant-based ingredients and a pioneer of plant proteins. In collaboration with its customers and partners, the company has been addressing current and future societal challenges by providing the best quality ingredients for food, nutrition, and health markets. These enable healthier lifestyles and are critical components of life-saving medicines.

Roquette is committed to reducing greenhouse gas emissions by 25% between 2024 and 2035. The company has been putting sustainable development at the heart of every concern.

On 13th October’22, Roquette launched a new line of organic pea ingredients to address consumer demand. These ingredients are produced at its plant in Portage la Prairie and are supported by a network of organic pea growers from Canada.

Cargill Incorporate and Agrana Beteiligungs-AG has been providing food, agriculture, financial, and industrial products, and services to the world. Along with farmers and customers, they put into application the wide experience that they have accumulated over the past 155 years.

The company has nearly 155,000 employees across 70 countries who are committed to feeding the world in a responsible way.

On 10th January’22, Cargill opened its first Food Innovation Center in India to address the growing consumer demand for healthy, nutritious food solutions.

The global corn milling machine market is estimated to be valued at USD 21.4 billion in 2025.

It is projected to reach USD 32.9 billion by 2035.

The market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types are milling equipment, steeping equipment, centrifuge systems, washing & filtration systems and other (heating and cooling systems, dryers and other utility equipment).

starch segment is expected to dominate with a 35.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corn-Based Plastics for Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corn Flour Market Size and Share Forecast Outlook 2025 to 2035

Cornstarch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corneal Ulcer Treatment Market Size, Growth, and Forecast for 2025 to 2035

Corner Pads Market Insights - Growth & Demand 2025 to 2035

Corn Steep Powder Market Size, Growth, and Forecast for 2025 to 2035

Corn Sweeteners Market Outlook - Growth, Demand & Forecast 2025 to 2035

Corn Protein Market Outlook - Growth, Demand & Forecast 2025 to 2035

Corn Fiber Market Trends - Functional Fibers & Industry Demand 2025 to 2035

Corn and Callus Remover Market Insights-Size, trends and Forecast 2025-2035

Corn Silage Market Analysis – Growth, Trends & Forecast 2024-2034

Corn Co-Products Market

Corn-Based Protein Market

Corneal Edema Treatment Market

Corn Puff Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corn Wet Milling Services Market Size, Growth, and Forecast for 2025 to 2035

Popcorn Making Cart Market Growth - Demand & Forecast 2025 to 2035

Popcorn Market Trends – Growth, Demand & Flavored Innovations

Popcorn Makers Market

Popcorn Containers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA