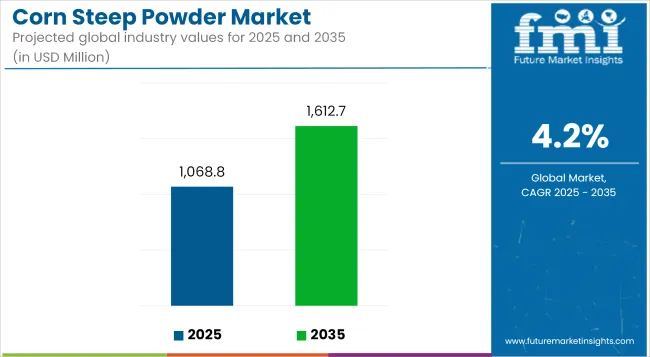

The global corn steep powder market is projected to rise from a valuation of USD 1,068.8 million in 2025 to USD 1,612.7 million by 2035, expanding at a steady CAGR of 4.2% throughout the forecast period. This moderate yet consistent growth outlook is being shaped by rising awareness of functional plant-based nutrition in animal feed and industrial fermentation.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1,068.8 Million |

| Projected Market Size in 2035 | USD 1,612.7 Million |

| CAGR (2025 to 2035) | 4.2% |

As the industry moves toward bio-based input sourcing and circular agro-economy models, corn steep powder has been increasingly positioned as a sustainable by-product from the wet milling of corn with rich profiles of amino acids, lactic acid, and micronutrients.

The current market is experiencing positive demand patterns from sectors such as feed additives, bio-fertilizers, and microbial fermentation media. The food-grade variant continues to see increased uptake in enzyme production and organic food processing due to its emulsification and stabilization properties.

At the same time, industrial-grade variants are increasingly deployed in fermentation and biocatalysis sectors. Growth has been modestly restrained by fluctuating corn prices and variable yields across North America and Latin America, affecting procurement strategies for large-volume processors.

Meanwhile, pricing pressure from alternative hydrolysates and concerns regarding mycotoxin residues in sub-standard powder qualities have necessitated tighter supplier screening. Market players have been expanding into hybrid distribution formats-offering bulk bags for B2B and smaller packs for high-value niche applications.

Over the next decade, demand for bio-fermentation media is expected to widen, enhancing usage of corn steep powder across antibiotic and probiotic production. Fertilizer-grade variants are also projected to gain traction as agrochemical restrictions push farmers toward organic alternatives.

By 2035, food-grade corn steep powder is likely to witness heightened application in gluten-free formulations and sports nutrition premixes. Global players are anticipated to integrate vertical sourcing models to offset cost volatility and ensure consistent raw material supply. Long-term growth is expected to be supported by regulatory tailwinds for sustainable agriculture and clean-label ingredient sourcing.

Pharmaceutical fermentation media is projected to account for approximately 9.2% of the global corn steep powder market in 2025. This share reflects a steadily rising demand for natural nitrogen sources in microbial culture applications, particularly within antibiotic, vaccine, and enzyme production workflows.

Corn steep powder's high solubility, rich amino acid profile, and buffering capacity make it an optimal bio-fermentation substrate, especially in penicillin and cephalosporin manufacturing. As biologic-based drugs and active pharmaceutical ingredients (APIs) continue gaining traction, leading manufacturers are reconfiguring upstream bioprocesses toward cost-effective, bio-based inputs.

The European Medicines Agency (EMA) and the USA FDA have not issued direct guidelines for corn steep powder but support its use in media formulation, provided microbial consistency and raw material traceability are maintained through GMP protocols. Companies such as Merck KGaA and Thermo Fisher Scientific are investing in scalable, non-animal derived fermentation systems, including corn steep powder-inclusive platforms.

In parallel, microbial feed optimization strategies from CDMOs (e.g., Lonza) increasingly rely on corn-derived hydrolysates to reduce batch variation. Strategic sourcing partnerships with corn processors such as GPC and Tate & Lyle are further reinforcing supply reliability. As biosimilars and recombinant protein demand expands globally, this segment is expected to witness persistent institutional and commercial adoption.

Aquaculture feed application is estimated to constitute nearly 7.6% of the global corn steep powder market in 2025. Its relevance stems from its functional amino acid contribution and organic acid load, particularly beneficial for aquatic species such as tilapia, shrimp, and catfish.

Used as a partial substitute for fish meal and soybean meal, corn steep powder enhances feed palatability and nutrient digestibility while offering a sustainable and cost-efficient protein source. As the global aquafeed market seeks lower-carbon inputs with minimal anti-nutritional factors, CSP-based formulations are gaining traction in Latin America and Southeast Asia.

The European Feed Manufacturers' Federation (FEFAC) and FAO recommend fermentation by-products like corn steep liquor as viable inputs in non-ruminant feed under strict quality and traceability norms. Feed producers such as Skretting and BioMar have initiated limited trials with CSP inclusion rates ranging from 1% to 5% in high-protein grower diets.

While mycotoxin risks remain a concern, increasing reliance on near-infrared spectroscopy (NIRS) and third-party mycotoxin screening is enabling safe inclusion. With tightening marine ingredient availability and environmental pressures on fishmeal use, CSP is expected to play a complementary role in functional, antibiotic-free aquafeeds over the forecast period.

Price Volatility, Regulatory Compliance, and Alternative Protein Sources

The corn steep powder market faces challenges across the agribusiness supply chain but is primarily impacted by the uncertainties of climate compared to raw material price fluctuations, as evident in trade behaviours often dictated through supply & demand factors. Corn steep powder, sourced from the byproduct of corn wet milling services, is commonly employed in fermentation, animal feed, and organic fertilizers. However, cost instability can arise due to supply chain disruptions.

Moreover, adherence to food safety regulations, organic certifications, and animal feed standards (which require compliance with FDA, EFSA, and FSSAI) also further contributes to high operating costs for the manufacturers. Another obstacle is increasing rivalry from alternative protein and nitrogen sources, including soy-based hydrolysates, yeast extracts, and synthetic fertilizers. These may provide cost benefits and superior solubility in certain applications.

Growth in Fermentation Industry, Organic Agriculture, and Sustainable Feed Solutions

Growth in the corn steep powder market is a strong opportunity due to increasing demand for corn steep powder in bio-based fermentation, organic fertilizers, and sustainable animal feed solutions. Corn steep powder is a nitrogen, amino acids, and soluble proteins rich source of nutritional substance, which plays an essential role in microbial fermentation for antibiotics, probiotics, and biochemical.

Moreover, the rising preference for organic farming and eco-sustainable agricultural practices is further propelling the demand for corn-based biofertilizers as it minimizes the dependency on synthetic chemicals. The growth of this market is also supported by the presence of sustainable aqua feed and livestock feed solutions, which enable manufacturers to reduce their reliance on traditional protein sources in favor of cheaper, nutrient-dense ingredients.

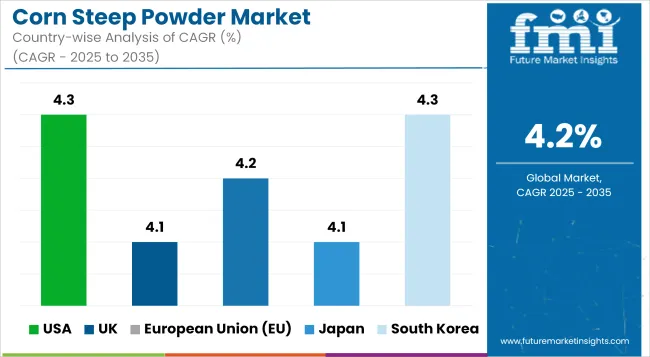

In the USA, the corn steep powder market has seen stable growth, accumulating with the use of Corn step powder in animal feed, fermentation & biofuel. The growing use of natural and proteinaceous feed additives in livestock farming is driving market growth. Furthermore, its application as a nitrogen source in biochemical fermentation for antibiotics and enzymes also benefited driving growth in the pharmaceuticals and biotechnology sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.3% |

In the United Kingdom, the corn steep powder market is expanding due to growing demand for sustainable and nutrient-rich feed ingredients. The increasing adoption of natural protein sources in animal nutrition and aquaculture, along with advancements in fermentation-based bioprocessing, is driving market growth. Additionally, government initiatives promoting sustainable agriculture are influencing demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.1% |

Growing demand for cornsteep powder in food processing, animal feed, and biopharmaceutical applications is driving the growth of its market in the European Union. Corn steep powder is widely used as a rapidly absorbed nutrient source for fermentation-based products such as amino acids, enzymes, and organic acids. Tighter regulations that favor sustainable and plant-based feed ingredients are other market trends.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.2% |

The Japanese corn steep powder market is experiencing a moderate growth rate, attributed to its rising application in the fields of biotechnology, fermentation, and specialty feed formulations. Market expansion is further supported by the country’s focus on high-value agricultural inputs; moreover, microbial fermentation systems for food and pharmaceutical applications are contributing to the market growth. Ongoing research in this area and the continued need for sustainable bioprocessing underpins demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

South Korea is the dominant player in the corn steep powder market due to corn steep powder's increasing application in animal feed and the desire for aquaculture and fermentation-base industries in the region. Market growth is aided by the expanding biopharmaceutical industry as well as the rising need for nature-deriving protein sources such as feed additives. Government programs that promote agricultural sustainability and biotechnology research are also driving demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

The corn-steep powder market is poised to grow globally during the forecast period owing to rising demand for natural fermentation nutrients, animal feed supplements, and plant-based protein sources. This includes AI-driven fermentation process optimization, sustainable corn by-product utilization, and high-protein nutrient formulations to improve bioavailability, solubility, and industrial applications.

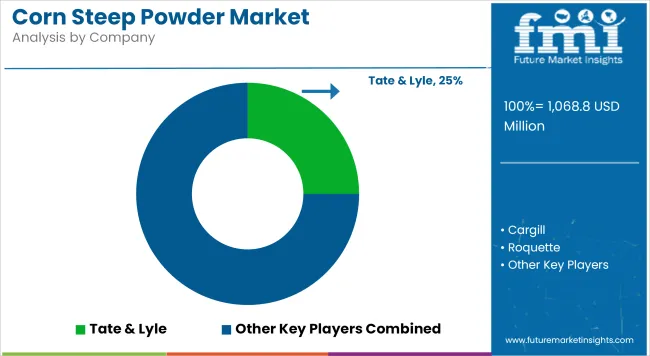

The market comprises agriculture ingredient suppliers, bio-based fermentation product manufacturers, and animal feed companies, each driving tech innovations in corn steep powder production, AI-based quality control, and sustainable corn fractionation.

The overall market size for corn steep powder market was USD 1,068.8 Million in 2025.

Corn steep powder market is expected to reach USD 1,612.7 Million in 2035.

The demand for corn steep powder is expected to rise due to its increasing use as a natural nutrient source in animal feed, fermentation processes, and agricultural applications, along with growing demand for sustainable and plant-based protein alternatives.

The top 5 countries which drives the development of corn steep powder market are USA, UK, Europe Union, Japan and South Korea.

Organic Vegan Powder and Butter & Caramel Flavors to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corn-Based Plastics for Packaging Market Size and Share Forecast Outlook 2025 to 2035

Corn Flour Market Size and Share Forecast Outlook 2025 to 2035

Cornstarch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Corneal Ulcer Treatment Market Size, Growth, and Forecast for 2025 to 2035

Corn Puff Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corn Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Corner Pads Market Insights - Growth & Demand 2025 to 2035

Powder Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Powder Dispenser Market Analysis by Product Type, Size, Dispensing Mode, End-use Industry, and Region through 2025 to 2035

Corn Wet Milling Services Market Size, Growth, and Forecast for 2025 to 2035

Corn Sweeteners Market Outlook - Growth, Demand & Forecast 2025 to 2035

Corn Protein Market Outlook - Growth, Demand & Forecast 2025 to 2035

Corn Fiber Market Trends - Functional Fibers & Industry Demand 2025 to 2035

Analysis and Growth Projections for Powder Induction and Dispersion Systems Business

Corn and Callus Remover Market Insights-Size, trends and Forecast 2025-2035

Leading Providers & Market Share in Powder Packing Machines

Key Players & Market Share in Powder Dispenser Manufacturing

Powder Injection Molding Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA