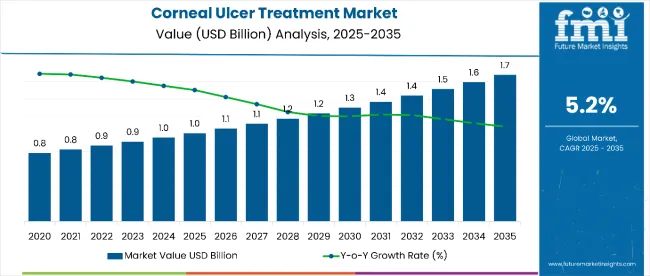

The corneal ulcer treatment market is poised to be valued at USD 1 billion in 2025 and projected to reach USD 1.7 billion by 2035, growing at a CAGR of 5.2% during the forecast period.

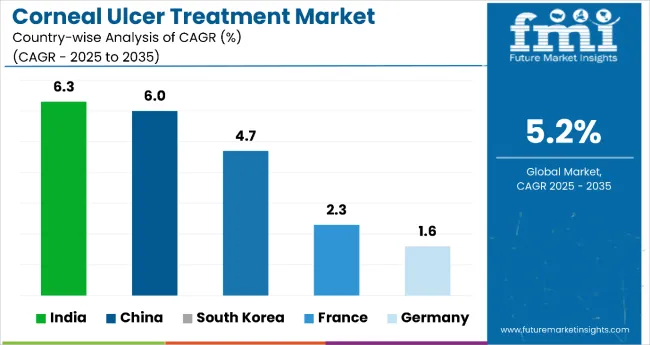

India is anticipated to be the fastest-growing market, with a CAGR of 6.3%, driven by a high prevalence of eye diseases and increasing access to eye care programs. Meanwhile, the United States is expected to remain the largest revenue-generating country, owing to its advanced healthcare infrastructure and ongoing ophthalmic research investments.

Rising awareness campaigns and national initiatives focused on preventable blindness are also boosting early diagnosis and treatment uptake. Increased penetration of affordable generic drugs and availability of hospital-based pharmacies are further supporting market accessibility in emerging economies.

Growth in the corneal ulcer treatment market is driven by several key factors. A surge in ocular trauma cases especially in agricultural and industrial settings along with rising prevalence of microbial infections, is escalating demand for treatment. The aging global population, particularly in low- and middle-income regions, is more prone to eye infections and complications, further fueling the market.

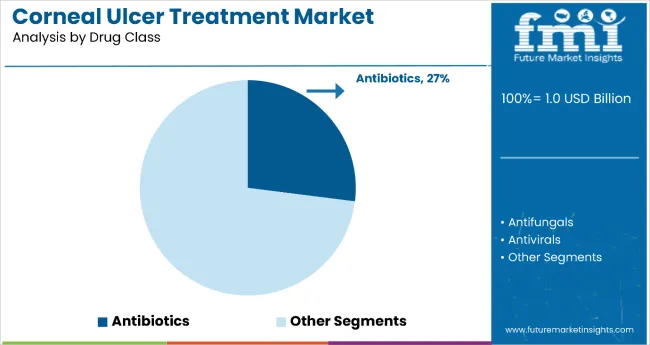

The dominant use of antibiotics, which account for over 76% of the drug class segment, continues due to their high efficacy against bacterial keratitis. However, barriers such as high costs and regulatory hurdles are limiting widespread adoption of advanced treatments, including bioengineered corneal implants and regenerative therapies.

Looking forward, the next decade will witness a transition toward personalized and regenerative eye care. Innovations like AI-driven diagnostics, stem cell therapies, and bioengineered corneas are expected to improve treatment outcomes and reduce long-term complications.

Supportive government initiatives, global eye health campaigns, and increased investment in ophthalmic research will be crucial in addressing treatment gaps. With continued R&D, greater access to specialized care, and technological breakthroughs, the corneal ulcer treatment market is set to enter a phase of sustained innovation and expansion through 2035.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1 billion |

| Projected Value (2035F) | USD 1.7 billion |

| Value-based CAGR (2025 to 2035) | 5.20% |

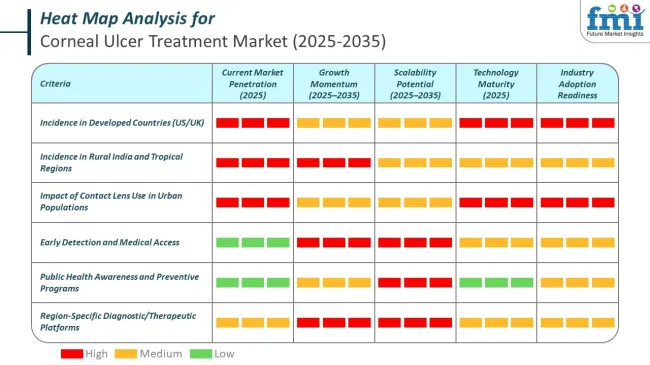

Corneal ulcers represent a significant cause of ocular morbidity worldwide, with incidence rates heavily influenced by environmental, occupational, and behavioral risk factors. Data from the United States, United Kingdom, and rural India highlight stark contrasts in disease burden, particularly between developed and developing regions.

The below table presents the expected CAGR for the global corneal ulcer treatment market over several semi-annual periods spanning from 2024 to 2034. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 6.2%, followed by a slightly lower growth rate of 5.9% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.2% |

| H2 (2024 to 2034) | 5.9% |

| H1 (2025 to 2035) | 5.2% |

| H2 (2025 to 2035) | 4.7% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 5.2% in the first half and increase moderately at 4.7% in the second half. In the first half (H1) the market witnessed a decrease of 100.00 BPS while in the second half (H2), the market witnessed an increase of 120.00 BPS.

The corneal ulcer treatment market is segmented by drug class, form, route of administration, indication, distribution channel, and region. By drug class, key segments include antibiotics, antifungals, antivirals, anti-amoebic drugs, corticosteroids, and NSAIDs. By form, the market is categorized into tablets, eye drops/ointments, and vials.

In terms of route of administration, the segments include oral, topical, and injectable methods. The market is further segmented by indication into bacterial keratitis, fungal keratitis, viral keratitis, and Acanthamoeba keratitis.

Based on distribution channel, the market comprises hospital pharmacies, retail pharmacies, drug stores, and online pharmacies. Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The antibiotics segment is projected to remain the most lucrative in the corneal ulcer treatment market, accounting for the highest share among all drug classes, growing at a CAGR of 5.1%. This consistent dominance is underpinned by the prevalence of bacterial keratitis as the leading cause of corneal ulcers and the immediate need for empirical antibiotic treatment in clinical protocols. Furthermore, the wide availability of broad-spectrum formulations, low manufacturing cost, and strong clinical evidence base continue to reinforce its utilization.

In comparison, segments like antivirals and antifungals address narrower indications and exhibit more modest growth due to their more specific use cases and relatively lower incidence rates. Anti-amoebic drugs remain niche due to limited case volume, while corticosteroids and NSAIDs are primarily adjunctive in nature. As the frontline treatment with universal application across geographies and patient profiles, antibiotics maintain both high volume and value leadership.

| Drug Class Segment | CAGR (2025 to 2035) |

|---|---|

| Antibiotics | 5.1% |

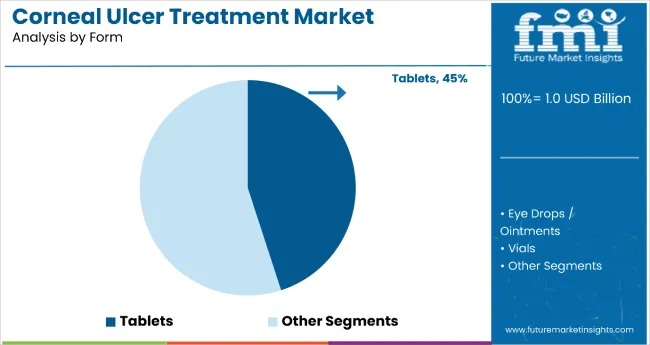

The eye drops/ointments segment is positioned as the most lucrative within the form category of the corneal ulcer treatment market, registering a CAGR of 5.3%. This growth is fueled by the dominance of topical administration in ophthalmology, owing to its direct delivery to the infection site, ease of use, cost efficiency, and patient compliance.

Moreover, the widespread use of antibiotic and antiviral eye drops in both hospital and outpatient settings ensures continued demand volume. Tablets and vials while important serve more specialized or severe cases.

Tablets are generally prescribed as part of systemic therapy for deep tissue infections or in cases where topical administration is inadequate. Vials, typically used for injectables, cater to hospitalized patients and account for a smaller, lower-frequency use segment. As such, while all forms contribute to the continuum of care, eye drops/ointments command the highest penetration and commercial viability, securing their lead through the next decade.

| Form Segment | CAGR (2025 to 2035) |

|---|---|

| Eye Drops/Ointments | 5.3% |

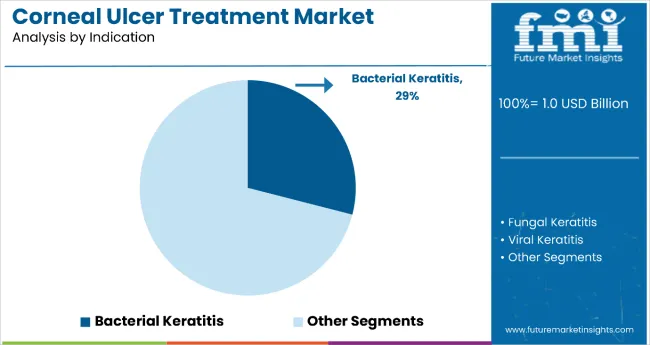

Bacterial keratitis stands out as the most lucrative segment in the corneal ulcer treatment market, registering a CAGR of 5.4%. The dominance of this segment is driven by the high global prevalence of bacterial corneal ulcers, particularly in regions with significant exposure to trauma, poor hygiene, or improper contact lens usage.

This condition accounts for the majority of corneal ulcer cases reported in both developed and developing economies, thus attracting the largest share of therapeutic interventions. Other indications like fungal keratitis and viral keratitis are comparatively less frequent.

Fungal keratitis tends to occur in tropical and rural agricultural settings, while viral keratitis is more chronic and recurrent, often managed with antivirals over longer durations. Acanthamoeba keratitis, though severe, is rare and limited in scope. Given its clinical urgency, volume of diagnosis, and universal treatment protocols, bacterial keratitis remains the top priority indication segment from both a market and clinical standpoint.

| Indication Segment | CAGR (2025 to 2035) |

|---|---|

| Bacterial Keratitis | 5.4% |

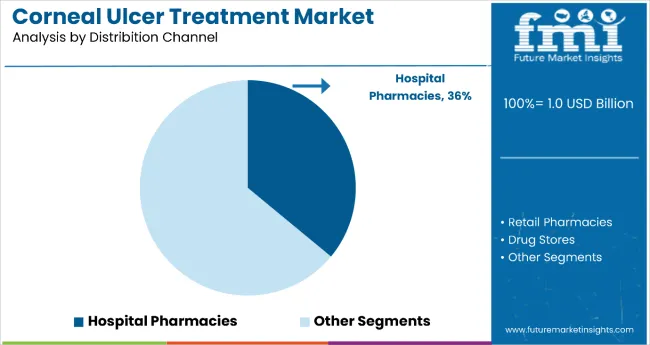

Among all distribution channels in the corneal ulcer treatment market, hospital pharmacies are expected to retain the highest market share and emerge as the most lucrative segment, growing at a CAGR of 5.4%, accounting for around 36.3% of the global market.

This leadership is driven by the acute and often emergency nature of corneal ulcers, which are typically diagnosed and treated in clinical or inpatient settings. Hospital pharmacies are tightly integrated with ophthalmology departments and offer rapid access to potent antibiotics, antivirals, and corticosteroids under expert supervision.

Retail pharmacies are expected to grow steadily but may face constraints due to limited access to advanced therapies and lack of specialist involvement. Drug stores will likely see muted growth due to their over-the-counter nature and limited product scope. Online pharmacies, while growing in volume, remain restricted by prescription requirements and patient trust issues in ocular therapies.

| Distribution Channel Segment | Share |

|---|---|

| Hospital Pharmacies | 36% |

Aging is associated with a certain weakening of corneal repair abilities, as well as an increased prevalence of chronic diseases like diabetes and autoimmune diseases. Such conditions predispose elderly people to infections, injuries, and delayed healing, which are major causes of the onset of corneal ulcers.

According to World Health Organization by 2030, it is estimated that 1 in 6 people world-wide will be aged 60 years or over. Moreover, 80% of geriatric people will be living in low- and middle-income countries by 2050, making healthy ageing a truly global priority.

This segment also includes the most substantial population of healthcare consumers- older adults. In terms of ophthalmic care, for instance, impairment of the patient's ability to see affects quality of life significantly. There will, thus, be a considerable burden from the need for urgent, effective treatment of corneal ulcers so that complications, including irreversible loss of vision, do not develop.

The needs of the geriatric population are fueling innovative therapeutic options, such as personalized medication, advanced drug delivery devices, and minimally invasive surgical techniques. Its growing demand will remain the most important driver for the increase in the corneal ulcer treatment market from around the world.

The corneal ulcer treatment market is growing with higher investments in R&D ophthalmic therapies. More innovations in the form of drugs having new molecular entities and biotechnology applications on genetic engineering and biomaterials are some of the others.

There are huge investments into innovative treatments of corneal infections. Merck & Co. Inc. agreed to buy Eyebiotech Ltd., a private biotechnology company focusing on ophthalmology, for as much as USD 3 billion. The buyout agreement is comprised of an upfront payment of USD 1.3 billion, with USD 1.7 billion more to be made in developmental, regulatory and commercial milestones.

The strategic move will not only strengthen Merck's pipeline of the treatment of diseases affecting the retina but also potentially expand its portfolio using a promising candidate from EyeBio called Restoret directed against DME and NVAMD conditions.

Biotechnology corporations also involve themselves in the genetic engineering and biomaterials activities in the process of developing new drugs for corneal ulcers.

Tissue engineering further led to the development of the bioengineered cornea tissue that might be a short-term solution in the shortage of human donors of cornea worldwide. Bioengineered corneas offer a wide alternative as substitutes in replacing any partial layers or the entire corneal thickness of ulcers.

Global initiatives for eye health improvement spur the growth of the market for corneal ulcer treatment. These programs focus on prevention, early disease diagnostics, and treatment pathways for various key indications, such as corneal ulcers, sponsored by international organizations, governments, and non-profit organizations.

The efforts made together promote greater awareness and increase access to state-of-the-art diagnostic and therapeutic solutions, thus exponentially expanding the market.

In the management of corneal ulcers, the American Academy of Ophthalmology has played a role in the spread of updated clinical practices.

In April 2023, the AAO published insights into current corneal ulcer management, emphasizing timely diagnosis, appropriate culturing, and the use of both traditional and emerging treatment modalities, such as antibiotics, steroids, and advanced procedures, like corneal cross-linking, to improve patient outcomes.

The efforts were amplified with the new initiatives by focusing attention on integration into universal health coverage. Examples of these are, for example, the World Report 2019 from the World Health Organization which highlighted, in addition to corneal ulcers, issues like these to be targeted through equitable access to eye care.

The adoption of innovative solutions of regenerative medicine and therapies involving stem cells in treating corneal ulcers faces severe barriers to mainstream market diffusion due to a number of key factors. Among these is the high cost related to research and development of such advanced therapies.

Besides, the regulatory challenges impede further the use of these therapies. The development of new therapies requires extensive analysis & stringent regulatory frameworks for safety and efficacy.

Such a process is often time-consuming and expensive, which may further discourage smaller firms or startups from entering into the market. Moreover, the lack of uniformity in regulatory standards across regions contributes to additional challenges toward global commercialization.

Other important challenges include skepticism on the part of healthcare professionals and patients. Most clinicians are cautious about trying new therapies because of a lack of substantial clinical data, long-term efficacy, and risks involved.

This is further worsen by a lack of comprehensive training programs aimed towards making clinicians and surgeons more familiar with such advanced therapy modalities. Correspondingly, many patients would prefer traditional treatments over experimental newer treatments due to uncertainty about results and costs.

Reimbursement issues also have a vital role in making the circle of adoption limited. Many insurance providers are hesitant to reimburse high-cost, newer therapies, thus leaving the patient with considerable out-of-pocket expenses.

Tier 1 companies comprise market leaders with a market share of 38.5% in global market. These companies are industry leaders with advanced technological capabilities, extensive research and development efforts, and strong financial resources.

They offer a wide array of neurological products that monitor several health metrics-from simple measures complex neurological conditions and disease activity pattern. Prominent companies in tier 1 include Pfizer Inc., Allergen plc, Bayer AG and Teva Pharmaceutical Industries Ltd.

Tier 2 companies include mid-size players with revenue of USD 50 to 100 million having presence in specific regions and highly influencing the local market and holds around 24.5% market share. The corneal ulcer treatment market is contributed to by tier 2 companies that have growing influence in the market.

A significant number of tier 2 companies focus on cost-effective solutions and strategic collaborations that increase their market reach. They invest in developing unique features and enhancing user experience with the sole aim of capturing segments of the market. Prominent companies in tier 2 include Sun Pharmaceutical Industries Ltd., Baxter International Inc., Fresenius Kabi.

Finally, Tier 3 companies, such as Mallinckrodt Pharmaceuticals and Dr Reddy’s Pharmaceuticals. They specialize in specific products and cater to niche markets, adding diversity to the industry.

Overall, while Tier 1 companies are the primary drivers of the market, Tier 2 and 3 companies also make significant contributions, ensuring the corneal ulcer treatment sales remains dynamic and competitive.

The section below covers the industry analysis for the corneal ulcer treatment market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and MEA, is provided.

The United States is anticipated to remain at the forefront in North America, with higher market share through 2034. In South Asia & Pacific, India is projected to witness a CAGR of 6.3% by 2034.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| China | 6.0% |

| India | 6.3% |

| USA | 1.5% |

| South Korea | 4.7% |

| Canada | 2.6% |

| Spain | 3.2% |

| Germany | 1.6% |

| France | 2.3% |

China corneal ulcer treatment market is expected to grow at a CAGR of 6.0% between 2024 and 2034. Currently, China remains supreme in the East Asian region holding maximum revenue share, and the trend is expected to continue during the forecast period.

Rise in Ophthalmic disease with high incidence of infections & traumatic conditions has led to the demand for corneal ulcer treatment in the recent years.

Most people working in agriculture and manufacturing have an increased risk of suffering from corneal trauma, hence leading to infections. Corneal ulcers are also increasingly being developed by improper usage contact lens among youths and also by aging population who are susceptible to dry eye syndrome.

China's healthcare infrastructure has also developed rapidly, providing greater accessibility to diagnosis and treatment. The government is particularly emphasizing eye health through "Healthy China 2030." Local production of cheap medicines and innovative treatments has led the country to become a key market in the corneal ulcer treatment market.

United States is the leading country in the treatment market of corneal ulcers due to its vast and active engagement in the oculars therapeutic eye care campaign. The United States has also developed a healthcare infrastructure in that guarantees early diagnosis and cure ocular diseases through the invention of public health programs with colossal public awareness campaigns.

Entities such as AAO (American Academy of Ophthalmology) and the Prevent Blindness Initiative are responsible and vital sources for public education relating to the risk of eye infections.

Besides this, there is much money spent by the USA government and private institutions on research and development related to advanced therapies like antimicrobial agents, biologics, and innovative surgical methods for the effective treatment of corneal ulcers.

The FDA regulatory agencies provide avenues for speedy approval of new treatments hence boost competition. All these developments, supplemented by superior healthcare technology and professional ophthalmologists, continue to strengthen the status of the United States as leaders in the regional market for treatments for corneal ulcers.

India’s corneal ulcer treatment market is poised to exhibit a CAGR of 6.3% between 2024 and 2034. Currently, it holds the highest share in the Asia Pacific market, and the trend is expected to continue during the forecast period.

The key factor driving India's market leadership in South Asia corneal ulcer treatment is a high disease burden as well as the growth in government-led and private eye care programs. The country records a considerable prevalence of corneal ulcers, majorly because of factors such as ocular trauma in agricultural and industrial workers, infections that have arisen from poor hygiene, and misuse of contact lenses.

Rural areas constitute a significant portion of the demands for effective treatment options in eye injuries caused by soil, plant debris, or exposure to chemicals.

Government initiative toward eye health in India: The NPCBVI (National Programme for Control of Blindness and Visual Impairment) has come forward with an initiative on controlling avoidable blindness, mainly with corneal disease management. Some NGOs that cater to affordable treatments are the Aravind Eye Care System and Sankara Nethralaya.

With increased access to healthcare, rising awareness, and the presence of cost-effective generic medicines, India continues to be a key player in the regional corneal ulcer treatment market.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1 billion |

| Projected Market Size (2035) | USD 1.7 billion |

| CAGR (2025 to 2035) | 5.20% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2035 to 2035 |

| Report Parameter | Revenue in USD billion |

| Drug Classes Analyzed | Antibiotics, Antifungals, Antivirals, Anti-amoebic Drugs, Corticosteroids, NSAIDs |

| Forms Analyzed | Tablets, Eye Drops/Ointments, Vials |

| Routes of Administration | Oral, Topical, Injectable |

| Indications | Bacterial Keratitis, Fungal Keratitis, Viral Keratitis, Acanthamoeba Keratitis |

| Distribution Channels | Hospital Pharmacies, Retail Pharmacies, Drug Stores, Online Pharmacies |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Apple Inc., Koninklijke Philips N.V., Fitbit Inc., OMRON Corporation, Medtronic, GE Healthcare, Abbott Laboratories, Garmin Ltd., Dexcom Inc., Masimo Corporation. |

| Additional Attributes | High prevalence in geriatric population, Increased R&D in ophthalmic therapies, Limited adoption of novel therapies |

| Customization and Pricing | Available upon request |

In terms of drug type, the industry is divided into antibiotics, antifungals, antivirals, anti-amoebic drugs, corticosteroids and NSAIDs.

In terms of form, the industry is segregated into tablets, eye drops / ointments and vials.

In the terms of route of administration, the market is segmented into oral, topical and injectable.

In the terms of indication, the market is segmented into bacterial keratitis, fungal keratitis, viral keratitis and acanthamoeba keratitis.

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia and Middle East and Africa (MEA) have been covered in the report.

The corneal ulcer treatment market is projected to reach USD 1 billion in 2025, driven by rising cases of bacterial keratitis and increased demand for effective ophthalmic care.

India is anticipated to be the fastest-growing country in the corneal ulcer treatment market, with a CAGR of 6.3% between 2025 and 2035 due to its high disease burden and expanding eye care programs.

Antibiotics hold the largest market share in the corneal ulcer treatment space, accounting for nearly 27% of the total revenue in 2025, and are projected to grow at a CAGR of 5.1% through 2035.

Oral administration is the most common route, making up over 38% of market value in 2025 due to its direct application to the eye, high efficacy, and patient compliance.

Hospital pharmacies dominate the market, holding a 36% share in 2025 and projected to grow at a CAGR of 5.4% by 2035, due to their central role in acute care and access to specialist treatments.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corneal Edema Treatment Market

Fuchs Endothelial Corneal Dystrophy (FECD) Market Size and Share Forecast Outlook 2025 to 2035

Ulcerated Necrobiosis Lipoidica Management Market Trends - Growth & Forecast 2025 to 2035

Ulcerative Colitis Treatment Market Size and Share Forecast Outlook 2025 to 2035

Venous Ulcer Treatment Market Overview - Growth, Trends & Forecast 2025 to 2035

At-home Ulcer Testing Market Size and Share Forecast Outlook 2025 to 2035

Pressure Ulcer Detection Devices Market Trends – Growth & Forecast 2025 to 2035

The Vascular Ulcer Treatment Market Is Segmented by Ulcer Type, Treatment and Distribution Channel from 2025 To 2035

Decubitus Ulcer Treatment Market Growth – Innovations & Forecast 2023-2033

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA