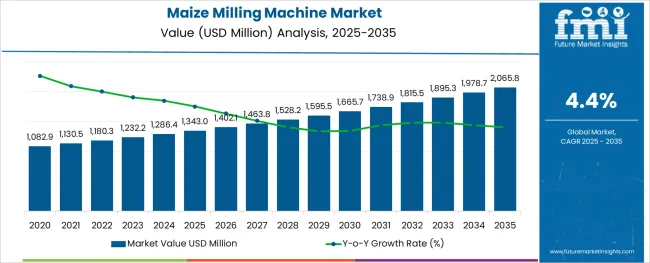

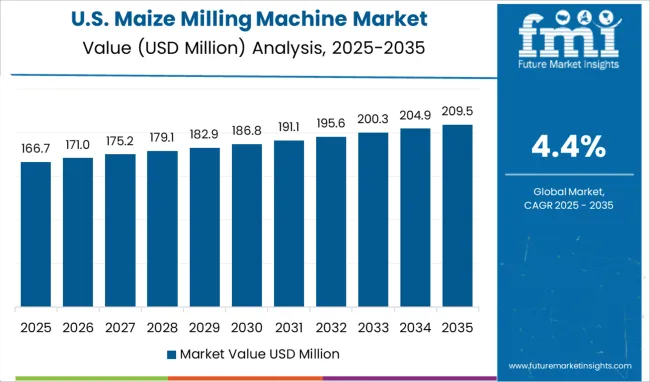

The Maize Milling Machine Market is estimated to be valued at USD 1343.0 million in 2025 and is projected to reach USD 2065.8 million by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

The maize milling machine market is undergoing steady growth as demand for efficient grain processing, improved food security, and higher output quality become central to the food production value chain. Increased investments in agro-processing infrastructure and rising urbanization have contributed to the adoption of advanced milling technologies across key regions.

Enhanced focus on operational efficiency, reduction of post-harvest losses, and consistent flour quality have further propelled the market forward. Future growth is expected to be fueled by modernization initiatives in the milling sector, coupled with supportive government policies promoting value addition in agricultural produce.

Continuous innovation in machinery design and automation capabilities is paving the way for higher productivity and lower operational costs, making the market increasingly attractive to both large enterprises and emerging players.

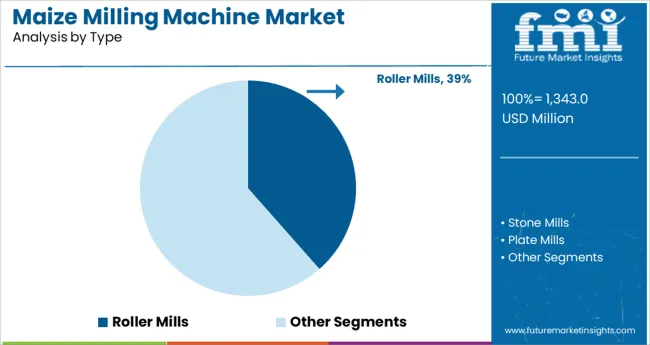

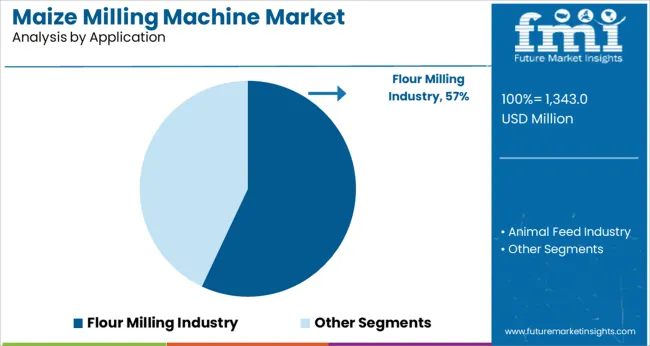

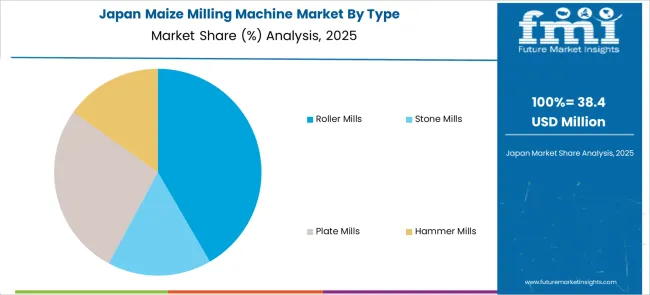

The market is segmented by Type, Application, and Sales Channel and region. By Type, the market is divided into Roller Mills, Stone Mills, Plate Mills, and Hammer Mills. In terms of Application, the market is classified into Flour Milling Industry and Animal Feed Industry. Based on Sales Channel, the market is segmented into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Type, Application, and Sales Channel and region. By Type, the market is divided into Roller Mills, Stone Mills, Plate Mills, and Hammer Mills. In terms of Application, the market is classified into Flour Milling Industry and Animal Feed Industry. Based on Sales Channel, the market is segmented into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type, roller mills are estimated to hold 38.5% of the total market revenue in 2025, positioning them as the leading type segment. This leadership is attributed to the ability of roller mills to deliver superior grinding efficiency and consistent particle size distribution compared to traditional methods.

Their robust construction and adaptability to high-capacity operations have made them the preferred choice in commercial settings where uniformity and hygiene standards are critical. The segment’s prominence has been reinforced by improvements in roller technology, which have enabled precise control over milling parameters, reducing energy consumption and waste.

Additionally, ease of maintenance and scalability of roller mills have supported their continued adoption in industrial-scale maize processing facilities, ensuring reliable performance under demanding operational conditions.

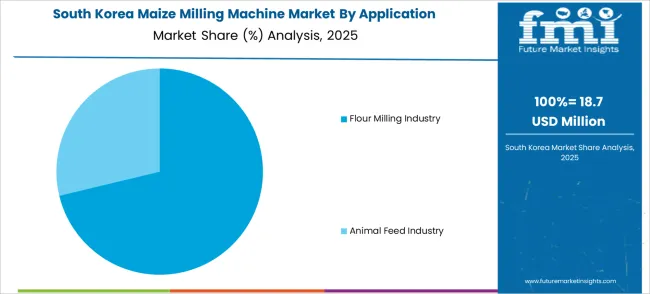

In terms of application, the flour milling industry is projected to contribute 57.0% of the market revenue in 2025, establishing itself as the dominant application segment. This dominance is driven by rising demand for refined maize flour in both domestic and commercial food production.

Growing awareness of food quality and safety standards has pushed the industry to adopt more advanced machinery that ensures cleanliness, efficiency, and consistency in output. The flour milling industry has also benefited from expanding distribution networks and consumer preferences for packaged and branded flour, which require higher production volumes and uniformity.

Investments in upgrading existing facilities and integrating automated milling lines have further strengthened this segment’s leadership. The capacity of modern maize milling machines to handle large-scale production without compromising product integrity has reinforced their indispensability in this application.

Segmenting by sales channel reveals that offline sales are expected to dominate with a 72.5% share of the market revenue in 2025, reflecting the continued reliance on traditional distribution networks. This prominence is supported by the strong preference among buyers for hands-on demonstrations, direct negotiations, and after-sales support that offline channels facilitate.

The complexity and capital-intensive nature of maize milling machinery often require customized solutions and site-specific consultations, which are better addressed through in-person engagement. Additionally, established dealer networks and regional distributors have maintained trust and accessibility, particularly in emerging markets where digital penetration remains limited.

The ability to build long-term relationships, provide maintenance services, and offer immediate technical assistance through offline channels has sustained their dominance despite the gradual growth of online alternatives.

The fine form of maize that is obtained from maize milling equipment is believed to be one of the most important forms of diet for the animal feed market.

Based on the research conducted, the animal feed market holds a mammoth valuation of USD 475,000 million as of 2025 and is expected to grow at a CAGR of nearly 4%.

The key players that are operating in the maize milling machine market are entering into strategic collaborations with the players from the animal feed market to assist them in their business. This is expected to create huge prospects for the market going ahead.

Being a rich source of Vitamin C, Potassium, and Magnesium, corn is being utilized in the medicines prescribed by healthcare experts.

Based on the statistics released by Statista, the healthcare segment holds a volume of close to USD 15,830 million as of 2025 and is expected to grow at a CAGR of nearly 15% during the forecast period.

The stats clearly indicate the fact that the demand for maize milling machines is expected to rise, and not only the healthcare, but the related sectors like pharmaceutical sectors would be indirectly dependent on the maize milling machine going forward.

Finer form of maize is used in the manufacturing of alcoholic drinks.

As on 2025, the global alcoholic drinks market was valued at USD 1600 billion, and during the forecast period, the alcoholic drinks market is expected to grow at a CAGR of nearly 12%.

Manufacturers prefer adding maize for preparing alcoholic drinks as these are a rich source of carbohydrate, and are also responsible for that much loved potent flavor.

The maize milling machine market's historical outlook shows that the market's value expanded from USD 1,028.5 million in 2020 to USD 1,180.3 million in 2025. The observed CAGR (2020 to 2025) is 3.5%.

The major factor driving the growth of the market is the increasing demand for processed food, which has resulted in the need for efficient and modern machines for processing grains. The other factors that are expected to contribute to the growth of the market are the growing population and changing lifestyles.

The valuation of the market is expected to jump from USD 1,232.2 million in 2025 to USD 1,895.3 million by 2035 according to future projections, at an anticipated CAGR of 4.4%.

Minimum human interference

A maize milling machine seamlessly converts maize kernels into flour and owing to minimum labor interference and maximum output, the stakeholders are investing high amounts in these maize grinding machines.

Available in different shapes and sizes

The machines come in different sizes and can be either manual or electric maize milling machines. Thus, based on the business requirement, the manufacturers can go in for the ideal form of maize milling machine.

Fresh supply on demand

A Maize Milling Machine is a great addition to any kitchen, as it assists in creating fresh and nutritious meals.

The maize milling machine market is developing in the USA due to the high demand for corn products. The machines are used to process corn into cornmeal, flour, and other food products. The market is expected to grow due to the increasing demand for corn products in the region.

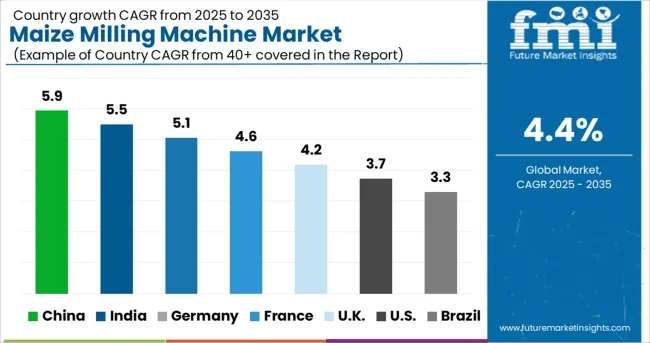

The maize milling machine market in North America receives 34.2% of its total income from the United States.

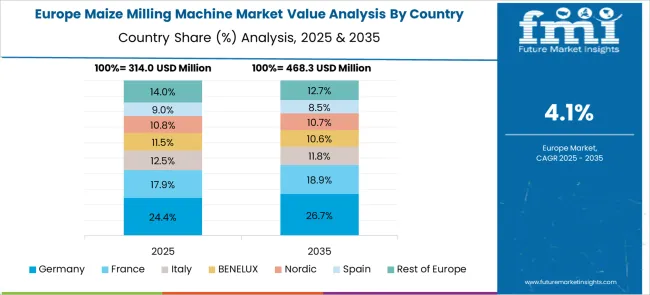

In recent years, the demand for maize milling machines in Europe has been steadily increasing. This is due to the growing popularity of maize as a food source in the region. The market for these machines is expected to continue to grow in the coming years.

There are several factors that are driving this growth. First, the population of Europe is expected to increase in the next few years. This will lead to more people needing access to maize milling machines. Second, the price of maize has been rising in recent years. This has made it more attractive for farmers to grow and sell maize.

The market for maize milling machines is expected to continue to grow in the coming years. This will provide opportunities for manufacturers and suppliers of these machines.

Germany makes for 25.1% of the maize milling machine market of Europe, while the CAGR of the United Kingdom market is expected to be 6.4% over the projection period.

In recent years, the market for Maize Milling Machines in Japan has been growing rapidly. This is due to the increasing demand for maize flour in the region. The majority of maize milling machines are used in commercial maize mills, which are typically large-scale operations.

The expansion of the maize milling machine market in Japan is also being driven by the rising popularity of home-based maize milling machines. These machines are becoming increasingly affordable and easy to use, making them a popular option for small-scale farmers and home cooks alike.

With the continued growth of the maize milling machine market in South Korea, it is expected that there will be an increase in innovation and competition among manufacturers based in South Korea. This will benefit consumers by providing them with more choices and better-quality products.

Moreover, higher consumption of alcoholic beverages in South Korea is expected to further propel the market growth during the forecast period.

India and China are the market leaders in Asia Pacific, and their most recent CAGRs in the Maize Milling Machine market are 6.5% and 6.6%, respectively. Japan contributes 6.6% of the market's overall market share.

The maize milling machine market is set to grow significantly in the coming years. This is largely due to the increasing demand from the animal feed industry. The feed industry is a major user of maize, and as such, the demand for maize milling machines is expected to rise.

There are a number of reasons why the animal feed industry is growing. Firstly, the world population is continuing to increase, which means there is more demand for meat and dairy products. This in turn increases the demand for animal feed. Secondly, the global economy is improving, which means that more people can afford to buy meat and dairy products. This also leads to increased demand for animal feed.

Finally, the animal feed industry is benefiting from new technology. New machines and processes are making it easier and cheaper to produce animal feed.

However, if we talk about the fastest-growing segment, the flour milling industry segment is expected to be the fastest-growing segment during the forecast period.

The online segment has managed to garner the highest market share because of the fact that the options available in the online channel are much more as compared to the offline channel. Apart from that, the online channel has also been providing massive discounts on the milling machines.

Moreover, the end users are particularly adopting online channels because of the fact that the end user does not have to travel to the retail channel, and they can utilize the time in other production processes.

The maize milling machine market is currently dominated by key players, who have been an integral part of this market for decades altogether. If we talk about the start-up space, there is not much happening.

It is important to note that the market has a lot to offer because of the growing population worldwide, who are in need of nutritious food.

Apart from that, massive technological developments coupled with growth in the automation sector are expected to drive a new kind of wave in the market. Aspiring entrepreneurs can make the best use of these advancements, and coupled with a unique idea, they can deliver a lot to the market.

These companies are engaged in intense competition to gain a larger share of the global maize milling machine market. They are investing heavily in research and development activities to introduce innovative products and improve their product offerings. They are also expanding their geographical footprint to gain a larger customer base.

Some of the recent developments are:

CPM, Buhler AG, and Zhengchang have been making massive developments in the maize milling machine market

CPM has been developing products that meet the demands of every conceivable application in the processing industry, and the company has always maintained synonymity with endurance, reliability, and excellence. From grinding and conditioning to size reduction, the solutions have been engineered to meet the demand for every application in the processing industry.

CPM has always laid emphasis on quality and efficiency. The products developed by CPM meet the demand for virtually every application in the processing industry. Apart from that, the company has been top quality customer service and sales through a worldwide network of local agents in almost every country.

Buhler AG has been providing services to billions of people across the globe to cover their basic needs for food and mobility. The company mainly operates on three business pillars: grains and food solutions to ensure safe and healthy food and feed, consumer food solutions that create customer delight, and advanced materials that contribute to the production of energy-efficient vehicles and buildings.

The milling solutions adopted by Buhler AG have been delivering state-of-the-art process technology for transforming raw materials like wheat, oat, corn, etc. into high-grade flour and semolina products. Apart from that, the company has been adopting grain quality and supplies that provide safe processing solutions for grain logistics, cleaning and storage, malting, and brewery and rice. The main aim is to reduce food loss.

Zhengchang has been a market leader in feed machinery and engineering, grain-processing equipment and storage, agro-pastoral feed, and oil. The company has been awarded Keeping Promise & Honoring Contracts enterprise, National Key Hi-tech Enterprise, National Model of Harmonious Labor Relation Enterprise”, Asia Famous Brand, and China Industry Landmark Brand”.

Zhengchang has always worked on the principle of creating value for the customers and has always strived to serve the customers with quality products and services.

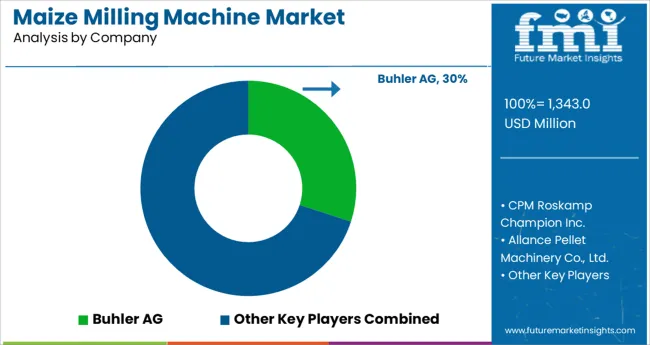

The global maize milling machine market is estimated to be valued at USD 1,343.0 million in 2025.

It is projected to reach USD 2,065.8 million by 2035.

The market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types are roller mills, stone mills, plate mills and hammer mills.

flour milling industry segment is expected to dominate with a 57.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Milling Machine Market Growth – Trends & Forecast 2025 to 2035

End Milling Machine Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Road Milling Machine Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Rice Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Tree Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Corn Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wheat Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Thread Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Corn Wet Milling Services Market Size, Growth, and Forecast for 2025 to 2035

Portable Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Indexable Milling Cutters Market Size and Share Forecast Outlook 2025 to 2035

Universal Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Horizontal Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Desktop CNC Milling Machines Market Size and Share Forecast Outlook 2025 to 2035

Tabletop CNC Milling Machines Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Industrial Food Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA