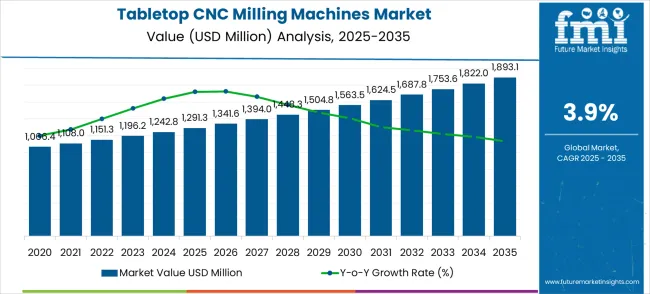

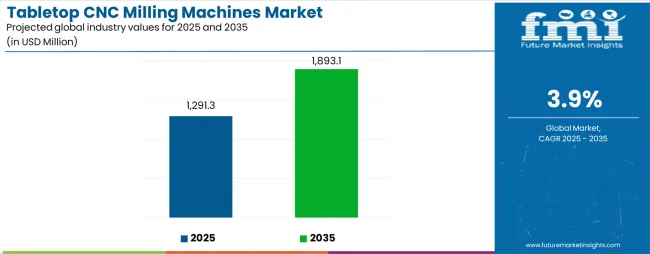

The tabletop CNC milling machines market is expected to reach from USD 1,291.3 million in 2025 to USD 1,893.1 million by 2035, reflecting a CAGR of 3.9%. Comparing the early and late stages of the growth curve highlights differences in adoption dynamics and market drivers. In the early phase, 2025 to 2028, growth is relatively rapid as small and medium-sized manufacturers, prototyping labs, and educational institutions adopt tabletop CNC machines for cost-effective, precise machining. Key drivers include rising demand for compact, flexible production solutions, ease of use, and integration with digital design tools. Early adopters benefit from improved operational efficiency and faster turnaround times, creating a noticeable upward slope in the growth curve.

In the later phase, 2030 to 2035, growth continues but at a slightly steadier pace as the market matures. Replacement demand, incremental adoption in new regions, and gradual penetration into specialized industries sustain expansion. Technological enhancements, such as improved precision, automation, and software integration, contribute to continued uptake but do not accelerate growth as sharply as in the early stage. The comparison between early and late growth phases indicates that initial adoption drives a strong foundation, while subsequent growth relies on market maturity, regional expansion, and product innovation, resulting in a smoother, sustained upward trajectory for the decade.

The tabletop CNC milling machines market is segmented into educational and training institutions (38%), prototyping and product development (27%), small-scale manufacturing units (18%), hobbyist and DIY users (10%), and specialty industrial applications (7%). Educational institutions lead adoption due to the growing focus on practical engineering training and hands-on manufacturing experience. Prototyping and product development sectors rely on tabletop CNC mills for rapid iteration, precision, and reduced production costs. Small-scale manufacturing units adopt them for compact, efficient, and flexible production solutions. Hobbyists and DIY users leverage these machines for creative projects and skill development. Specialty industrial applications include tool-making, custom parts fabrication, and precision component prototyping.

Key trends include integration of user-friendly software, compact automation, and high-precision spindle systems. Manufacturers are innovating with lightweight, durable, and energy-efficient models suitable for limited-space environments. Expansion into educational labs, makerspaces, and small-scale industrial prototyping is accelerating adoption. Collaborations between CNC suppliers and institutions or startups enable customized solutions for specific machining requirements. Focus on accuracy, operational efficiency, and affordability continues to drive global market growth.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,291.3 million |

| Market Forecast Value (2035) | USD 1,893.1 million |

| Forecast CAGR (2025-2035) | 3.9% |

Market expansion is being supported by the rapid advancement of accessible manufacturing technologies across developing economies and the corresponding need for compact and user-friendly CNC solutions for educational and small-scale production applications. Modern educational and workshop environments require precise machining capabilities and ease of operation to ensure optimal learning outcomes and project success. The superior accessibility and affordability characteristics of tabletop CNC milling machines make them essential tools in demanding educational environments where hands-on learning is critical.

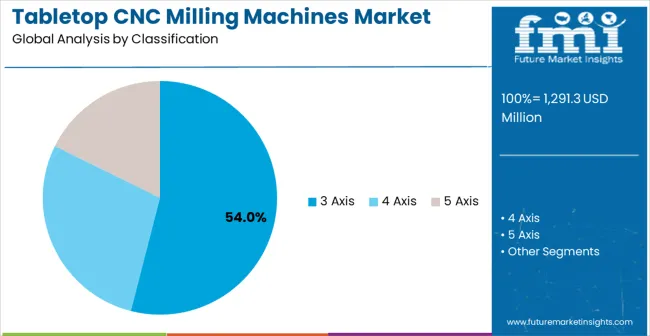

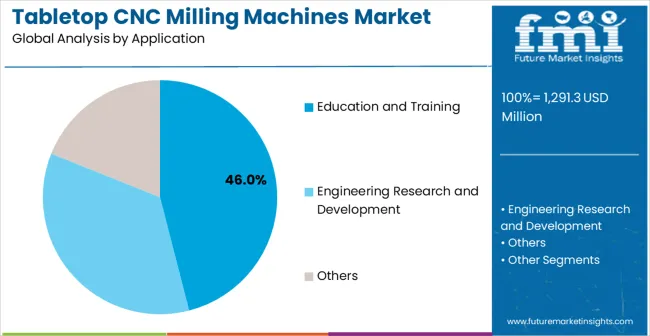

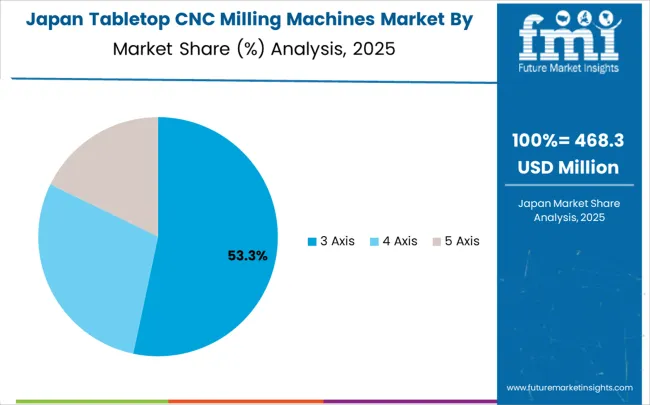

The market is segmented by product type, application, and region. By product type, the market is divided into 3 axis, 4 axis, and 5 axis configurations. Based on application, the market is categorized into education and training, engineering research and development, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

3 Axis configurations are projected to account for 54% of the tabletop CNC milling machines market in 2025. This leading share is supported by the increasing demand for cost-effective and user-friendly machining solutions in educational applications and growing requirements for accessible entry-level CNC capabilities. 3 Axis machines provide excellent balance of functionality and simplicity, making them the preferred choice for educational institutions, maker spaces, and small workshop applications. The segment benefits from technological advancements that have improved the precision and reliability of 3 axis tabletop systems while maintaining affordability and ease of operation.

Modern 3 axis tabletop CNC machines incorporate advanced stepper motors, precision linear guides, and user-friendly control software that enable professional-quality machining results with minimal operator expertise requirements. These innovations have significantly improved educational value while reducing total cost of ownership through simplified maintenance and elimination of complex programming requirements. The education and hobbyist sectors particularly drive demand for 3 axis solutions, as these markets require accessible technology to facilitate learning and creative projects while complying with budget constraints.

The small manufacturing sector increasingly adopts 3 axis tabletop systems for prototyping and small-batch production to meet cost-effective manufacturing requirements. Accessibility initiatives and educational technology programs further accelerate market adoption, as 3 axis systems provide professional capabilities while maintaining user-friendly operation and competitive pricing.

Education and training applications are expected to represent 46% of tabletop CNC milling machines demand in 2025. This significant share reflects the critical role of hands-on learning in technical education and the need for accessible CNC solutions capable of supporting comprehensive educational programs in diverse learning environments. Educational institutions require effective and safe CNC systems for student training, skill development, and project-based learning. The segment benefits from ongoing expansion of STEM education programs in developing countries and increasing technology integration requirements demanding enhanced manufacturing education systems in academic facilities.

Educational applications demand exceptional ease of use and safety features to ensure student learning success and instructor confidence. These applications require machines capable of handling various materials, educational curricula, and diverse skill levels while maintaining safe and reliable operation in classroom environments. The growing priority on technical education standards, particularly in engineering and manufacturing programs, drives consistent demand for high-quality educational CNC solutions. Emerging education markets in Asia-Pacific, Latin America, and European regions contribute significantly to market growth as educational institutions invest in modern manufacturing technologies to improve student outcomes and program competitiveness.

The trend toward maker education and interdisciplinary learning creates opportunities for specialized tabletop CNC systems equipped with enhanced educational features and curriculum integration capabilities. The segment also benefits from increasing workforce development programs and technical training initiatives driven by growing demand for skilled manufacturing technicians and engineers.

The tabletop CNC milling machines market is advancing steadily due to increasing educational technology adoption and growing recognition of accessible manufacturing technology importance. The market faces challenges including limited precision compared to industrial systems, need for specialized training and support, and varying application requirements across different user segments. Standardization efforts and safety certification programs continue to influence machine quality and market development patterns.

The growing deployment of connected manufacturing capabilities and digital workflow integration is enabling remote monitoring and cloud-based project sharing capabilities in tabletop CNC installations. Smart sensors and automated quality control systems provide real-time machining feedback while optimizing cutting parameters and extending tool life. These technologies are particularly valuable for educational institutions that require reliable performance monitoring and comprehensive usage analytics for program evaluation.

Modern tabletop CNC manufacturers are incorporating intuitive software interfaces and educational curriculum integration features that improve learning outcomes while reducing the complexity barrier for new users through simplified programming and enhanced safety systems. Integration of CAD/CAM software packages and educational content libraries enables comprehensive learning experiences and significant educational value compared to traditional manual machining approaches. Advanced safety features and enclosed designs also support development of more classroom-appropriate and regulations-compliant CNC systems for demanding educational environments.

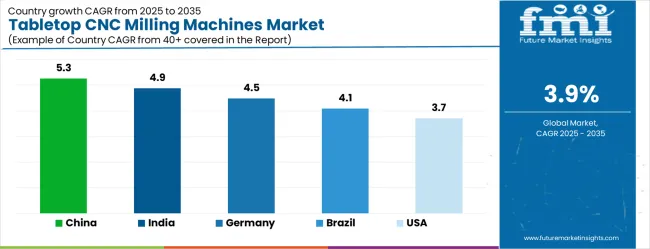

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| Brazil | 4.1% |

| United States | 3.7% |

| United Kingdom | 3.3% |

| Japan | 2.9% |

The tabletop CNC milling machines market is growing steadily, with China leading at a 5.3% CAGR through 2035, driven by massive educational technology expansion, maker movement development, and technical education program growth. India follows at 4.9%, supported by rising STEM education investments and increasing adoption of accessible manufacturing technologies in educational and small manufacturing applications. Germany records strong growth at 4.5%, prioritizing precision engineering, educational excellence, and advanced manufacturing training capabilities. Brazil grows steadily at 4.1%, integrating tabletop CNC systems into expanding educational infrastructure and technical training facilities. The United States shows moderate growth at 3.7%, focusing on educational technology innovation and maker space development improvements. The United Kingdom maintains steady expansion at 3.3%, supported by technical education programs. Japan demonstrates stable growth at 2.9%, prioritizing technological innovation and manufacturing education excellence.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The tabletop CNC milling machines systems market in China is projected to exhibit the highest growth rate with a CAGR of 5.3% through 2035, driven by rapid educational technology expansion and massive technical education program development across academic sectors. The country's growing vocational schools and expanding maker spaces are creating significant demand for accessible CNC systems. Major educational institutions are establishing comprehensive manufacturing education installations to support large-scale technical training operations and meet national skill development standards.

China's technical education sector continues expanding rapidly, with major investments in vocational training programs, maker space development, and manufacturing skills education. The country's focus on advanced manufacturing development drives substantial demand for educational CNC solutions that prepare students for modern manufacturing careers and support industrial development goals.

The tabletop CNC milling machines systems market in India is expanding at a CAGR of 4.9%, supported by increasing STEM education investments across academic sectors and growing adoption of accessible manufacturing technologies in educational and small manufacturing applications. The country's expanding technical education programs are driving demand for affordable CNC systems capable of supporting diverse educational requirements. Educational facilities are investing in tabletop technologies to improve practical learning experiences and comply with modern education standards.

India's educational development initiatives and skill development programs create significant opportunities for tabletop CNC applications. The country's growing focus on technical education and manufacturing skills drives demand for accessible CNC solutions that support student learning and workforce development goals.

Demand for tabletop CNC milling machines systems in Germany is projected to grow at a CAGR of 4.5%, supported by the country's focus on educational excellence and advanced manufacturing training capabilities. German educational institutions are implementing high-quality tabletop CNC systems that meet stringent educational standards and technical training requirements. The market is characterized by focus on precision engineering education, advanced training methods, and compliance with comprehensive educational regulations.

Germany's advanced technical education sector and manufacturing training excellence capabilities drive demand for high-quality tabletop CNC solutions. The country's prioritizing on practical education, technological innovation, and manufacturing skills creates focus for advanced educational CNC technologies that meet demanding training specifications.

The tabletop CNC milling machines market in Brazil is growing at a CAGR of 4.1%, driven by expanding educational infrastructure and increasing technical training facility development across academic sectors. The country's growing vocational education initiatives are investing in accessible CNC systems to improve technical education quality and student outcomes in developing manufacturing programs. Educational facilities are adopting tabletop CNC technologies to support growing technical education requirements and industry collaboration needs.

Brazil's expanding educational infrastructure and technical training development create substantial opportunities for tabletop CNC applications. The country's growing focus on practical education and manufacturing skills drives investments in accessible CNC solutions that enhance educational competitiveness and student preparation.

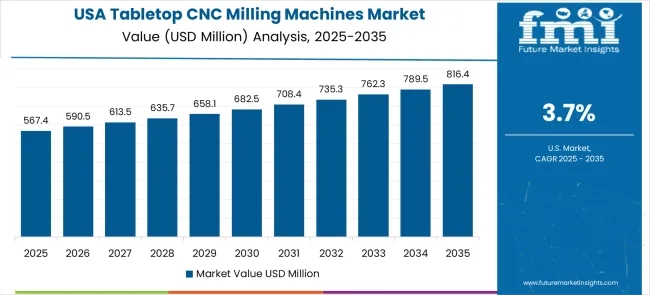

Demand for tabletop CNC milling machines systems in the United States is expanding at a CAGR of 3.7%, driven by ongoing educational technology innovation and increasing prioritizing on maker space development solutions. Educational institutions are upgrading existing manufacturing education programs with advanced technologies that provide improved learning experiences and enhanced student engagement. The market benefits from educational technology adoption and curriculum modernization programs across multiple educational sectors.

The United States market focus educational innovation, maker culture advancement, and STEM education improvement in tabletop CNC applications. Advanced educational technology development activities drive the adoption of next-generation CNC systems that offer superior educational value and student engagement capabilities.

Demand for tabletop CNC milling machines systems in the United Kingdom is projected to grow at a CAGR of 3.3%, supported by ongoing technical education programs and educational facility upgrades. Educational operators are investing in reliable tabletop CNC systems that provide consistent learning experiences and meet educational compliance requirements. The market is characterized by focus on educational effectiveness, student safety, and technical skill development across diverse educational applications.

The United Kingdom's focus on technical education and manufacturing skills development drives demand for high-quality tabletop CNC solutions. Technical education initiatives and educational enhancement programs are supporting adoption of tabletop CNC systems that meet contemporary educational and safety standards.

Demand for tabletop CNC milling machines systems in Japan is expanding at a CAGR of 2.9%, driven by the country's focus on technological innovation and manufacturing education excellence. Japanese manufacturers are developing advanced tabletop CNC technologies that incorporate precision engineering and education-optimized design principles. The market benefits from focus on quality, reliability, and continuous improvement in educational manufacturing technology performance.

Japan's technological leadership and manufacturing education expertise drive the development of advanced tabletop CNC solutions.

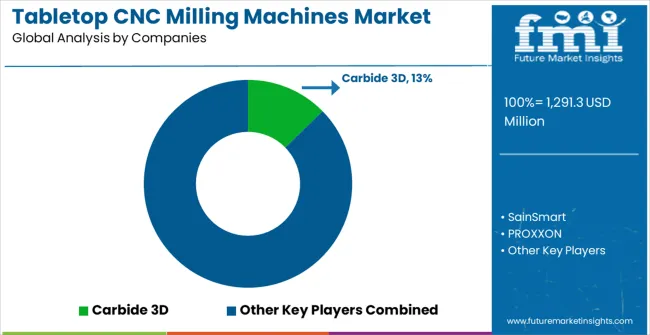

The tabletop CNC milling machines market is defined by competition among established manufacturing equipment companies, specialized educational technology providers, and emerging maker-focused CNC manufacturers. Companies are investing in advanced control technologies, user interface innovation, standardized safety systems, and educational support capabilities to deliver accessible, reliable, and cost-effective tabletop CNC solutions. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

Carbide 3D, operating globally, offers comprehensive tabletop CNC solutions with focus on user-friendly design, reliability, and educational support services. SainSmart, multinational provider, delivers accessible CNC systems with focus on affordability and maker community integration capabilities. PROXXON, specialized manufacturer, provides precision tabletop CNC solutions for educational and professional applications with focus on quality and durability. Penta Machine offers comprehensive CNC technologies with standardized procedures and technical service support.

Datron AG provides advanced tabletop CNC systems with focus on precision and professional-grade capabilities. JET Tools, Tormach deliver specialized CNC solutions with focus on educational and small manufacturing applications. Onefinity, BobsCNC, OpenBuilds offer comprehensive tabletop CNC technologies for maker and educational environments with established manufacturing and service capabilities.

Roland DG, Bantam Tools, Makera provide advanced tabletop CNC systems with educational focus, regional manufacturing capabilities, and specialized expertise across educational technology and accessible manufacturing sectors.

The tabletop CNC milling machines market underpins manufacturing education excellence, maker culture advancement, accessible production capabilities, and technical skill development. With educational technology mandates, stricter safety requirements, and demand for user-friendly manufacturing systems, the sector must balance cost accessibility, educational effectiveness, and safety compliance. Coordinated contributions from governments, industry bodies, OEMs/technology integrators, suppliers, and investors will accelerate the transition toward education-optimized, safety-enhanced, and technology-integrated tabletop CNC systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,291.3 million |

| Product Type | 3 Axis, 4 Axis, 5 Axis |

| Application | Education and Training, Engineering Research and Development, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | Carbide 3D, SainSmart, PROXXON, Penta Machine, Datron AG, JET Tools, Tormach, Onefinity, BobsCNC, OpenBuilds, Roland DG, Bantam Tools, Makera |

| Additional Attributes | Dollar sales by product type and application segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established manufacturers and emerging suppliers, buyer preferences for user-friendly versus high-precision systems, integration with educational technology and maker space infrastructure, innovations in control software and safety systems for enhanced accessibility and educational effectiveness, and adoption of connected manufacturing solutions with embedded curriculum support and remote monitoring capabilities for improved educational outcomes. |

The global high current ion implanter market is estimated to be valued at USD 690.7 million in 2025.

The market size for the high current ion implanter market is projected to reach USD 1,114.5 million by 2035.

The high current ion implanter market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in high current ion implanter market are low energy and medium energy.

In terms of application, semiconductors segment to command 65.0% share in the high current ion implanter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tabletop Pizza Oven Market Size and Share Forecast Outlook 2025 to 2035

Tabletop Tape Dispensers Market

CNC Slitting Lathes Market Size and Share Forecast Outlook 2025 to 2035

CNC Abovefloor Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

CNC Industrial Paper Cutter Market Size and Share Forecast Outlook 2025 to 2035

CNC Controller Market Size and Share Forecast Outlook 2025 to 2035

CNC Tool Storage System Market

CNC Plasma Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

Desktop CNC Milling Machines Market Size and Share Forecast Outlook 2025 to 2035

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in Woodworking CNC Tools

Lathe Machines Market

Sorter Machines Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Bandsaw Machines Market Growth - Trends & Forecast 2025 to 2035

Wrapping Machines for Handkerchiefs Market Size and Share Forecast Outlook 2025 to 2035

Sleeving Machines Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Spinning Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA