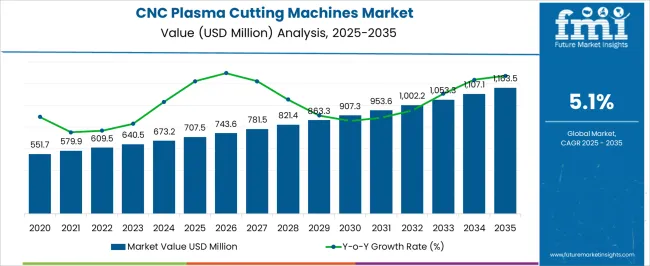

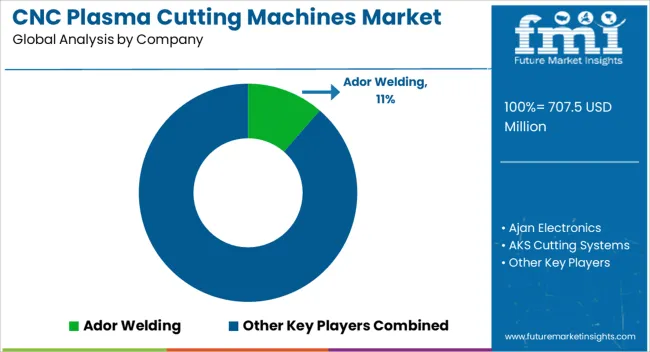

The CNC plasma cutting machines market is estimated to be valued at USD 707.5 million in 2025 and is projected to reach USD 1163.5 million by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. The 10-year growth comparison of the CNC plasma cutting machines market reveals a steady expansion, with market value projected to increase from USD 707.5 million in 2025 to USD 1,163.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.1%. Over the first several years, the market will likely experience consistent growth, with values rising from USD 707.5 million in 2025 to USD 743.6 million in 2026, reaching USD 781.5 million by 2027. This gradual increase suggests a stable demand for CNC plasma cutting machines, driven by industries such as automotive, aerospace, and manufacturing, where precision cutting is essential.

As the market continues to grow through the 2030s, demand for CNC plasma cutting machines is expected to rise further, driven by the ongoing need for efficient, high-quality cutting solutions in industrial production. By 2035, the market is projected to reach USD 1,163.5 million, highlighting a significant increase in adoption across various sectors. This steady upward trajectory reflects the growing reliance on automated systems for precision manufacturing, suggesting that CNC plasma cutting machines will remain a key player in modern production processes.

| Metric | Value |

|---|---|

| CNC Plasma Cutting Machines Market Estimated Value in (2025 E) | USD 707.5 million |

| CNC Plasma Cutting Machines Market Forecast Value in (2035 F) | USD 1163.5 million |

| Forecast CAGR (2025 to 2035) | 5.1% |

The CNC plasma cutting machines market is gaining significant traction, driven by increasing demand for precision metal cutting in manufacturing, construction, shipbuilding, and automotive industries. Rising investments in automation, coupled with advancements in CNC control systems, are enabling higher cutting accuracy, reduced material wastage, and improved operational efficiency. The ability to process a wide range of conductive metals at high speeds while maintaining quality standards is reinforcing adoption.

Manufacturers are increasingly integrating advanced software for design optimization and real-time monitoring, enhancing machine versatility and productivity. The growing emphasis on cost-effective production methods, along with the need to meet tight project timelines, is pushing industries toward CNC plasma systems over conventional cutting methods.

Additionally, technological developments in power sources, torches, and motion control systems are further boosting performance capabilities As global industrialization expands and customization requirements increase, CNC plasma cutting machines are expected to witness sustained demand, with manufacturers focusing on automation integration, energy efficiency, and enhanced operator safety features to strengthen market growth.

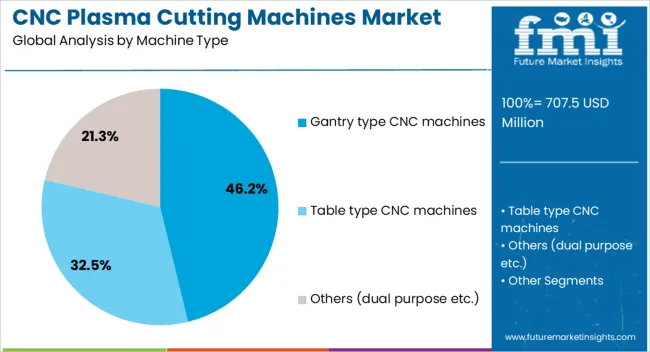

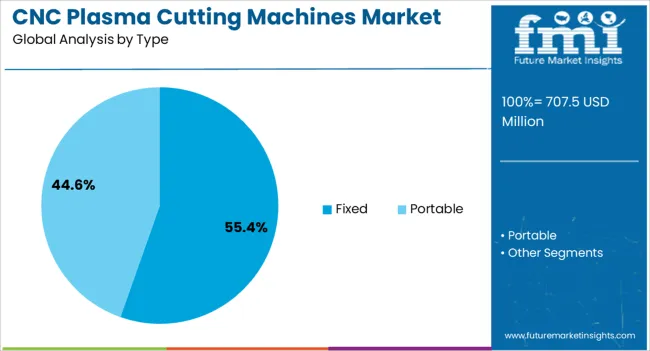

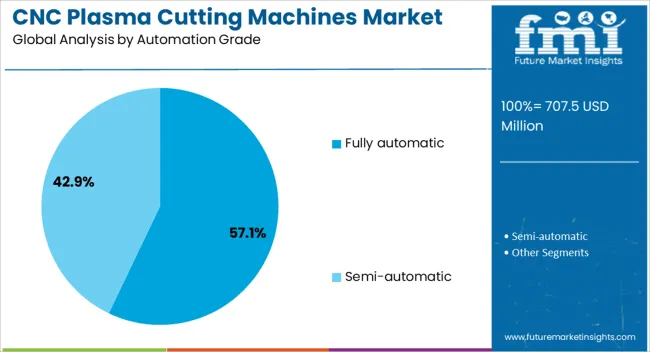

The CNC plasma cutting machines market is segmented by machine type, type, automation grade, application, end use industry, distribution channel, and geographic regions. By machine type, CNC plasma cutting machines market is divided into Gantry type CNC machines, Table type CNC machines, and Others (dual purpose etc.). In terms of type, CNC plasma cutting machines market is classified into Fixed and Portable. Based on automation grade, CNC plasma cutting machines market is segmented into Fully automatic and Semi-automatic. By application, CNC plasma cutting machines market is segmented into Metal working, Wood working, Stone working, and Others (glass working etc.). By end use industry, CNC plasma cutting machines market is segmented into Metal industry, Automotive, Manufacturing, Aerospace & defense, Shipping and maritime, Construction and infrastructure, and Others (energy & power etc.). By distribution channel, CNC plasma cutting machines market is segmented into Direct sales and Indirect sales. Regionally, the CNC plasma cutting machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The gantry type CNC machines segment is projected to hold 46.2% of the CNC plasma cutting machines market revenue share in 2025, positioning it as the leading machine type. This dominance is supported by the segment’s capability to handle large-format materials with high precision, making it suitable for heavy-duty applications in shipbuilding, construction, and industrial fabrication.

The robust structure of gantry systems ensures stability during high-speed cutting operations, enabling consistent performance and reduced maintenance requirements. Their adaptability to various plasma power sources and compatibility with advanced CNC controllers make them a preferred choice for manufacturers seeking operational flexibility.

The ability to integrate multi-torch systems further enhances productivity, allowing simultaneous cutting and reduced cycle times. As industries demand higher throughput and efficiency in large-scale metal processing, gantry type CNC machines continue to maintain their leadership, supported by ongoing technological enhancements in drive systems, positioning accuracy, and automation integration that extend their operational lifespan and cost-effectiveness.

The fixed type segment is expected to account for 55.4% of the CNC plasma cutting machines market revenue share in 2025, making it the dominant type. This leadership is driven by its suitability for applications where consistent positioning and structural rigidity are essential to maintain cutting accuracy. Fixed type machines provide a stable platform for repetitive and high-volume cutting operations, reducing vibration and ensuring precise results over long production runs.

Industries engaged in mass production benefit from the repeatability and durability of fixed setups, which minimize downtime and enhance operational efficiency. The lower maintenance requirements and reduced alignment adjustments further contribute to cost savings for end users.

Growing demand for dependable cutting solutions in automotive manufacturing, steel fabrication, and heavy engineering sectors is reinforcing adoption. Technological improvements in CNC control systems and cutting torch designs are enhancing the efficiency and versatility of fixed-type machines, ensuring their continued preference in high-volume production environments.

The fully automatic segment is anticipated to represent 57.1% of the CNC plasma cutting machines market revenue share in 2025, securing its position as the leading automation grade. Its dominance is attributed to the efficiency gains achieved through reduced manual intervention, enabling faster production cycles and higher accuracy levels. Fully automatic systems integrate advanced software, automated torch height control, material handling solutions, and real-time monitoring to optimize workflow and minimize operator errors.

The capability to execute complex cutting patterns with minimal setup time is appealing to industries where productivity and precision are critical. Adoption is being driven by the growing emphasis on lean manufacturing practices, labor cost reduction, and enhanced workplace safety.

The ability to integrate with enterprise-level production management systems further increases operational transparency and efficiency. As manufacturing sectors worldwide transition toward smart factory concepts, the fully automatic segment is expected to sustain its leadership through continued advancements in automation technology and connectivity features.

The CNC plasma cutting machine market is growing, fueled by rising demand from manufacturing, automotive, and SME sectors. Opportunities exist in smaller-scale industries where affordable, compact models are improving cutting capabilities. Technological advancements are enhancing precision, speed, and cost-efficiency, driving further adoption. However, challenges related to equipment costs and the need for specialized training persist. The market outlook remains positive as industries continue to embrace automation and precision cutting technologies, creating a favorable environment for future growth.

The CNC plasma cutting machines market is witnessing increasing demand from the manufacturing and automotive industries. As production processes become more automated, CNC plasma cutting technology is being used for precision cutting of metals in applications like welding, construction, and automotive parts manufacturing. The ability to cut a wide range of materials with high efficiency and minimal waste is fueling demand. As industries continue to embrace automation, the market for CNC plasma cutting machines is expected to grow steadily.

There is a growing opportunity for CNC plasma cutting machines in small and medium enterprises (SMEs) as businesses seek to improve production capabilities without large capital investments. The availability of affordable, compact models is helping SMEs enhance their cutting precision and operational efficiency. These machines are proving invaluable in smaller-scale industries such as custom fabrication, signage, and sheet metal work. As more SMEs turn to automation to stay competitive, the CNC plasma cutting machine market is well-positioned for expansion in this segment.

Technological advancements in CNC plasma cutting machines are enhancing cutting precision and speed, making them more attractive for industrial use. With developments in software integration, users can achieve higher-quality cuts with improved edge smoothness and minimal post-processing. Additionally, newer plasma cutting machines are offering faster cutting speeds and reduced energy consumption, leading to higher productivity and cost-efficiency. These innovations are contributing to increased adoption, as manufacturers look to streamline operations and reduce waste while achieving better results.

One of the key challenges in the CNC plasma cutting machine market is the high upfront cost of purchasing and installing the equipment. While the long-term benefits, such as improved precision and efficiency, are significant, the initial investment remains a barrier for many small businesses and startups. Additionally, operating these advanced machines requires skilled personnel, which can pose a challenge in regions where training infrastructure is lacking. Overcoming these barriers through financing options and accessible training programs will be crucial for expanding market adoption.

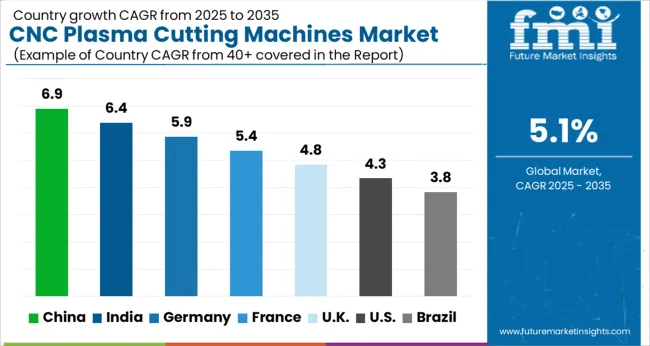

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global CNC plasma cutting machines market is projected to grow at a 5.1% CAGR from 2025 to 2035. China leads with a growth rate of 6.9%, followed by India at 6.4%, and France at 5.4%. The United Kingdom records a growth rate of 4.8%, while the United States shows the slowest growth at 4.3%. The varying growth rates reflect the strategic push toward industrial modernization, automation, and efficiency improvements in manufacturing across these markets. Emerging economies like China and India are seeing higher growth due to rapid industrialization, expansion in manufacturing sectors, and government initiatives. Meanwhile, more mature markets like the USA and the UK continue to see steady growth driven by advanced technology adoption and increased demand for precision cutting solutions in industries such as automotive, aerospace, and metal fabrication. This report includes insights on 40+ countries; the top markets are shown here for reference.

The CNC plasma cutting machines market in China is projected to grow at a CAGR of 6.9%. China’s manufacturing sector, particularly in industries like automotive, aerospace, and metal fabrication, continues to be a key driver for the demand for CNC plasma cutting machines. The country’s rapidly expanding industrial base, along with its focus on automation and upgrading manufacturing technologies, is contributing significantly to market growth. As China’s demand for precision cutting in metalworking applications rises, so does the adoption of advanced CNC plasma cutting machines. Government initiatives to promote industrial modernization and increase manufacturing efficiency are also playing a significant role in fueling the market’s expansion.

The CNC plasma cutting machines market in India is projected to grow at a CAGR of 6.4%. India’s rapidly expanding industrial sector, driven by increasing demand for high-quality metalworking, fabrication, and automotive manufacturing, is creating significant opportunities for CNC plasma cutting machines. The government’s push for industrial development through initiatives like “Make in India” is expected to drive demand for advanced machinery, including CNC plasma cutting systems. As the Indian manufacturing sector grows in sophistication, industries are seeking more efficient, precise, and cost-effective solutions for cutting applications, making CNC plasma cutting machines essential for meeting these demands.

The CNC plasma cutting machines market in France is projected to grow at a CAGR of 5.4%. France’s focus on advancing its manufacturing capabilities in sectors such as automotive, aerospace, and heavy machinery is increasing the demand for CNC plasma cutting machines. The need for precise cutting, especially in high-end metalworking industries, is further propelling the market’s growth. France’s emphasis on automation in manufacturing processes, along with the growing demand for customized, high-quality metal products, is driving the adoption of CNC plasma cutting machines. Additionally, as France focuses on improving manufacturing efficiency, the market for advanced cutting technologies is expected to expand steadily.

The CNC plasma cutting machines market in the United Kingdom is projected to grow at a CAGR of 4.8%. The UK’s manufacturing sector, particularly in industries like automotive, metal fabrication, and construction, continues to experience growth, creating a rising demand for advanced cutting technologies. As the UK moves towards Industry 4.0 and increased automation in manufacturing, there is a growing need for more efficient and precise cutting solutions. CNC plasma cutting machines are being widely adopted to meet these needs. While growth in the UK is steady, ongoing investments in industrial modernization and technological upgrades are expected to sustain the market’s expansion.

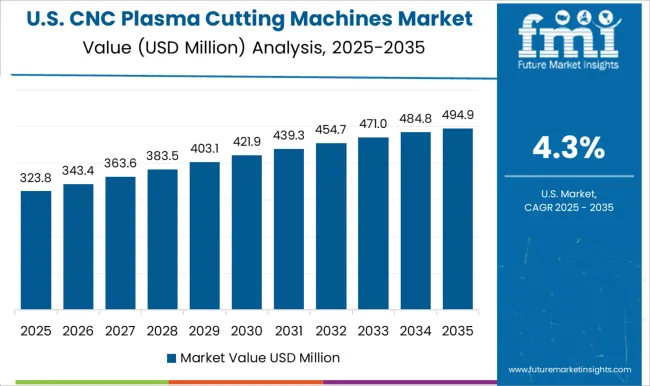

The CNC plasma cutting machines market in the United States is projected to grow at a CAGR of 4.3%. The USA remains a dominant player in the global manufacturing sector, with a strong demand for CNC plasma cutting machines driven by industries such as aerospace, automotive, and metalworking. While growth in the USA is slower compared to emerging markets, there is a continued push toward automation and technological upgrades in manufacturing. The increasing need for precision and efficient cutting solutions, particularly for large-scale metal fabrication projects, is contributing to the steady demand for CNC plasma cutting machines in the USA

Leading companies in the CNC plasma cutting machines market, such as Ador Welding, Ajan Electronics, and AKS Cutting Systems, are driving the evolution of cutting-edge technology by offering machines that combine precision, speed, and versatility. These players focus on delivering reliable and efficient CNC plasma cutting systems that cater to industries like manufacturing, automotive, and metalworking. By integrating advanced software solutions, automation, and high-performance plasma torches, these companies ensure their machines can handle a variety of materials with ease, making them essential tools in heavy-duty production environments. With strong R&D capabilities, companies like Ajan Electronics and Ador Welding are committed to improving cutting efficiency, reducing operational costs, and expanding their global presence through strategic partnerships and a robust distribution network.

Other key players, including Hypertherm, Koike Aronson, and Kinetic, are making significant strides by offering plasma cutting machines that prioritize accuracy and ease of use, catering to both small-scale workshops and large industrial plants. Their innovations focus on providing customizable solutions for various cutting needs, whether it’s for intricate designs or large-scale industrial applications. Companies like Messer, Hornet Cutting Systems, and Zinser Cutting Systems are also enhancing their product offerings by incorporating user-friendly interfaces, real-time diagnostics, and improved energy efficiency. As competition intensifies, manufacturers are focusing on differentiating their products through advanced automation features, faster cutting speeds, and enhanced durability to meet the demands of industries seeking higher productivity and precision in their cutting operations. The market’s growth will depend heavily on technological advancements, cost-effective solutions, and responsive customer service.

| Item | Value |

|---|---|

| Quantitative Units | USD 707.5 Million |

| Machine Type | Gantry type CNC machines, Table type CNC machines, and Others (dual purpose etc.) |

| Type | Fixed and Portable |

| Automation Grade | Fully automatic and Semi-automatic |

| Application | Metal working, Wood working, Stone working, and Others (glass working etc.) |

| End Use Industry | Metal industry, Automotive, Manufacturing, Aerospace & defense, Shipping and maritime, Construction and infrastructure, and Others (energy & power etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ador Welding, Ajan Electronics, AKS Cutting Systems, ALLtra, Daihen, Fengwei, Hildebrand Machinery, Hornet Cutting Systems, Hypertherm, Kinetic, Koike Aronson, Kutavar, Messer, Torchmate, and Zinser Cutting Systems |

| Additional Attributes | Dollar sales by machine type (portable, stationary) and cutting capability (2D, 3D) are key metrics. Trends include increasing demand for automated and high-precision cutting systems, particularly in automotive and manufacturing sectors. Regional demand, advancements in plasma technology, and growing industrial applications are driving market expansion. |

The global CNC plasma cutting machines market is estimated to be valued at USD 707.5 million in 2025.

The market size for the CNC plasma cutting machines market is projected to reach USD 1,163.5 million by 2035.

The CNC plasma cutting machines market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in CNC plasma cutting machines market are gantry type CNC machines, table type CNC machines and others (dual purpose etc.).

In terms of type, fixed segment to command 55.4% share in the CNC plasma cutting machines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CNC Slitting Lathes Market Size and Share Forecast Outlook 2025 to 2035

CNC Abovefloor Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

CNC Industrial Paper Cutter Market Size and Share Forecast Outlook 2025 to 2035

CNC Controller Market Size and Share Forecast Outlook 2025 to 2035

CNC Tool Storage System Market

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

Desktop CNC Milling Machines Market Size and Share Forecast Outlook 2025 to 2035

Tabletop CNC Milling Machines Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Woodworking CNC Tools Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in Woodworking CNC Tools

Plasma Dynamic Air Sterilizer Market Size and Share Forecast Outlook 2025 to 2035

Plasma Bottle Market Size and Share Forecast Outlook 2025 to 2035

Plasma Powder Market Size and Share Forecast Outlook 2025 to 2035

Plasma Separation Tubes Market Trends – Demand & Forecast 2025 to 2035

Competitive Overview of Plasma Bottle Industry Share

Plasma-Derived Drugs Market

Plasma Protein System Market

Plasma-derived Protein Therapies Market

Plasma Lighting Market

Plasma Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA