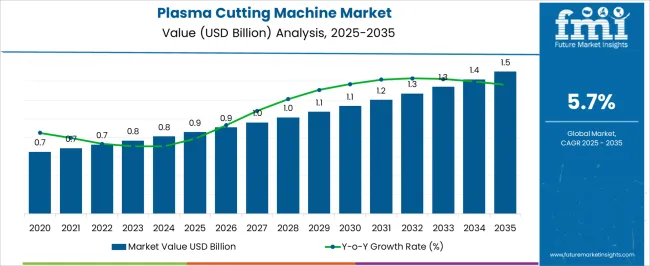

The plasma cutting machine market is estimated to be valued at USD 0.9 billion in 2025 and is projected to reach USD 1.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period. This rise creates an absolute dollar opportunity of USD 600 million over the ten-year period. The opportunity is best understood when broken into two distinct phases. The first five years, from 2025 to 2030, contribute an estimated USD 270 million, with the market advancing from USD 900 million to around USD 1,170 million. This phase is characterized by steady adoption in fabrication workshops, small-scale industrial units, and expanding usage in automotive and construction sectors.

The second phase, covering 2030 to 2035, contributes a larger USD 330 million, taking the market from USD 1,170 million to USD 1,500 million. This stronger contribution in the latter half reflects the scaling effect of plasma cutting machines being integrated into advanced manufacturing facilities, precision metalworking, and shipbuilding applications. With the gradual transition towards automation and efficiency in metal cutting technologies, growth accelerates as adoption broadens across both emerging and mature economies. The phase-wise difference highlights how incremental gains increase more significantly in later years, showing how compounding adoption and modernization of industrial processes fuel higher value opportunities for plasma cutting machine manufacturers and suppliers.

Manufacturing engineers evaluate plasma cutting specifications based on cutting thickness capacity, edge quality characteristics, and automation integration capabilities when establishing metal processing operations for structural steel fabrication, pressure vessel manufacturing, and precision component production. Equipment selection involves analyzing power source capabilities, torch configuration options, and consumable cost factors while considering cutting speed requirements, material compatibility, and operational environment constraints necessary for optimal cutting performance. Procurement decisions balance initial equipment investment against productivity gains including reduced material waste, improved cutting accuracy, and enhanced throughput rates that influence overall manufacturing efficiency and cost competitiveness.

Production processes require precise plasma arc generation, gas flow control, and motion control systems that ensure consistent cut quality while maintaining consumable life and minimizing heat-affected zone characteristics throughout varying material specifications and cutting applications. Operations coordination involves managing power supply maintenance, consumable replacement scheduling, and cutting program optimization while maintaining safety protocols and environmental compliance requirements. Quality assurance procedures address cut edge inspection, dimensional accuracy verification, and surface finish assessment that validate cutting performance while supporting downstream welding and assembly operations throughout fabrication workflows.

Cross-functional coordination involves cutting operators, programming specialists, and maintenance technicians collaborating to optimize plasma cutting parameters that balance cutting speed with quality requirements while addressing specific material characteristics and production scheduling constraints. Equipment setup encompasses cutting table preparation, material handling coordination, and program verification while coordinating with material procurement, production planning, and quality control functions. Training initiatives address plasma cutting theory, consumable selection, and troubleshooting techniques essential for maintaining cutting quality and maximizing equipment utilization throughout diverse manufacturing applications.

| Metric | Value |

|---|---|

| Plasma Cutting Machine Market Estimated Value in (2025 E) | USD 0.9 billion |

| Plasma Cutting Machine Market Forecast Value in (2035 F) | USD 1.5 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The plasma cutting machine market is experiencing rapid growth, propelled by increasing demand for precision cutting solutions across various industries. The manufacturing sector has been a key driver as companies seek efficient ways to shape metals with minimal waste and high accuracy.

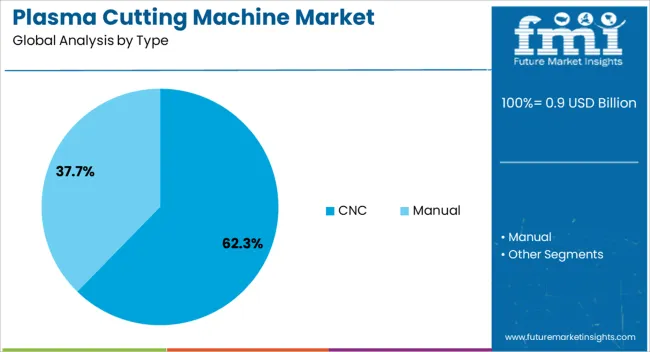

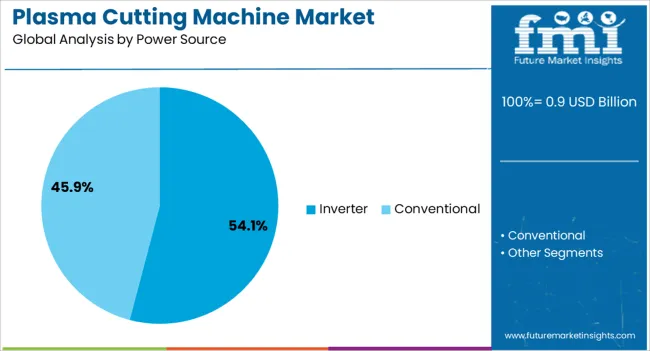

Technological advancements have led to the adoption of CNC plasma cutting machines, which offer automated control and enhanced cutting precision. Additionally, the shift towards inverter power sources has improved machine efficiency and reduced energy consumption, making plasma cutting more accessible and cost-effective.

Rising infrastructure development and expanding automotive and shipbuilding industries have also contributed to the market expansion. As industries continue to modernize their fabrication processes, the plasma cutting machine market is expected to grow steadily. Segmental growth is anticipated to be led by CNC machines due to their automation capabilities, inverter power sources for their efficiency, and manufacturing as the primary end-use sector.

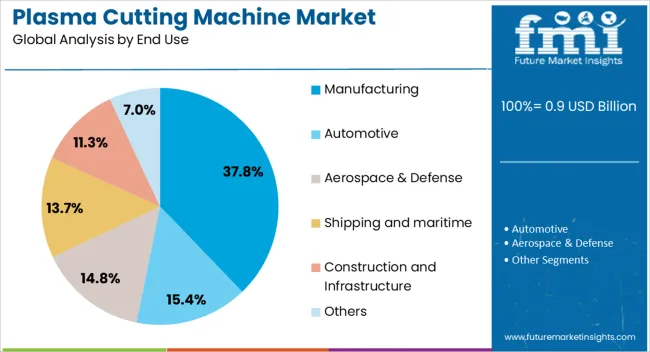

The plasma cutting machine market is segmented by type, power source, end use, distribution channel, and geographic regions. By type, the plasma cutting machine market is divided into CNC and Manual. In terms of power source, the plasma cutting machine market is classified into Inverter and Conventional. Based on end use, the plasma cutting machine market is segmented into Manufacturing, Automotive, Aerospace & Defense, Shipping and maritime, Construction and Infrastructure, and Others.

By distribution channel, the plasma cutting machine market is segmented into Direct sales and Indirect sales. Regionally, the plasma cutting machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The CNC plasma cutting machine segment is projected to account for 62.3% of the market revenue in 2025, securing its position as the dominant machine type. Growth has been driven by the increasing integration of computer numerical control in metal cutting processes, enabling precise and repeatable cuts.

Manufacturers have favored CNC machines for their ability to handle complex designs with minimal operator intervention. The automation features reduce labor costs and improve production speeds, which are critical factors in competitive manufacturing environments.

The rising adoption of Industry 4.0 practices has also supported CNC plasma cutting machine growth. As fabrication demands become more sophisticated, CNC machines are expected to maintain their leading market share.

The inverter power source segment is expected to hold 54.1% of the plasma cutting machine market revenue in 2025, making it the preferred power technology. This segment’s rise is linked to the advantages of inverter-based systems, which include improved energy efficiency, compact size, and enhanced control over cutting parameters.

The ability to provide stable and consistent power supply ensures high-quality cuts and prolongs equipment lifespan. Inverter technology also allows for better portability and reduced maintenance costs compared to traditional transformer-based power sources.

These benefits have encouraged manufacturers and end users to increasingly choose inverter plasma cutting machines. Continued innovation and adoption of inverter technology are projected to sustain this segment’s growth.

The manufacturing segment is projected to contribute 37.8% of the plasma cutting machine market revenue in 2025, retaining its status as the leading end-use sector. Demand from automotive, aerospace, heavy machinery, and metal fabrication industries has driven this growth.

The need for efficient, precise cutting tools that can handle a variety of metals and thicknesses aligns with manufacturing sector priorities to improve productivity and reduce costs. Infrastructure projects and the expansion of manufacturing facilities globally have also increased demand for plasma cutting machines.

As manufacturing continues to evolve with more advanced materials and complex designs, the role of plasma cutting machines is expected to become even more significant in meeting industry needs.

The plasma cutting machine market is driven by increasing demand for precise, cost-effective cutting solutions across industries like manufacturing and metalworking. Opportunities in the expanding industrial sector and trends toward automated, CNC-controlled machines are reshaping the market. However, high initial costs and maintenance requirements may hinder growth. By 2025, overcoming these challenges through innovative pricing and service models will be crucial to sustaining market expansion and ensuring wider adoption.

The plasma cutting machine market is growing due to the increasing demand for precision cutting solutions in industries such as manufacturing, automotive, and construction. Plasma cutting machines offer fast, accurate, and clean cuts on metals, improving efficiency and reducing waste in production processes. As industries seek more cost-effective and efficient manufacturing techniques, the adoption of plasma cutting machines is expected to rise. By 2025, this demand will continue to grow, especially in metal fabrication and heavy-duty applications.

Opportunities in the plasma cutting machine market are expanding in the industrial and metalworking sectors. As metal fabrication demands grow, particularly in automotive, aerospace, and construction industries, the need for high-performance plasma cutting solutions is increasing. Plasma cutters allow for quick and precise metal cutting, making them ideal for complex manufacturing processes. By 2025, these industries will drive demand for more advanced and efficient plasma cutting machines to meet the rising demand for quality metal components.

Emerging trends in the plasma cutting machine market highlight the growing demand for automation and CNC (Computer Numerical Control) plasma cutting systems. These systems provide improved precision, automation, and reduced operator error, making them highly desirable for high-volume production. The integration of CNC technology allows for more complex cuts and designs, increasing efficiency and reducing costs. By 2025, CNC-controlled plasma cutting machines are expected to dominate the market, particularly in industries requiring high throughput and high precision.

Despite growth, challenges related to high initial investment and maintenance costs persist in the plasma cutting machine market. The high upfront cost of purchasing plasma cutting equipment, especially for advanced models with CNC integration, can deter small and medium-sized businesses from adopting these machines. Additionally, the specialized maintenance and repair services required for complex systems add to ongoing costs. By 2025, addressing these financial barriers through more affordable pricing models and improved maintenance support will be key for broader market adoption.

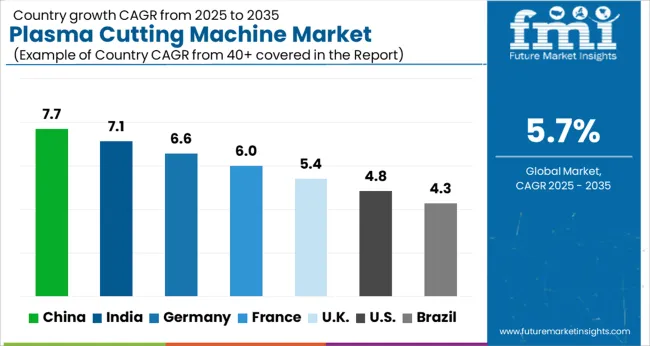

The global plasma cutting machine market is projected to grow at a 5.7% CAGR from 2025 to 2035. China leads with a growth rate of 7.7%, followed by India at 7.1%, and France at 6.0%. The United Kingdom records a growth rate of 5.4%, while the United States shows the slowest growth at 4.8%. These varying growth rates are driven by factors such as increasing demand for precision cutting technologies, rising industrialization, and the growing need for automation in manufacturing processes. Emerging markets like China and India are experiencing higher growth due to rapid industrial expansion, infrastructure development, and demand for advanced cutting solutions, while more mature markets like the USA and the UK see steady growth driven by technological advancements, demand for precision, and adoption of automation solutions in industrial applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

The plasma cutting machine market in China is growing at a strong pace, with a projected CAGR of 7.7%. China’s rapidly expanding industrial sector, particularly in manufacturing, automotive, and metalworking industries, is driving significant demand for plasma cutting machines. The country’s growing focus on automation, efficiency, and precision in manufacturing processes, along with increasing investments in infrastructure and industrialization, further supports market growth. Additionally, China’s emphasis on advanced technologies and modernization of industrial facilities fuels the adoption of cutting-edge plasma cutting machines for both large-scale and small-scale applications.

The plasma cutting machine market in India is projected to grow at a CAGR of 7.1%. India’s growing industrialization and increasing demand for high-precision cutting technologies in manufacturing sectors such as automotive, aerospace, and metal fabrication are driving the market’s expansion. The adoption of automated cutting solutions, coupled with rising investments in infrastructure and manufacturing capabilities, is significantly contributing to the demand for plasma cutting machines. Furthermore, India’s focus on improving its manufacturing competitiveness and meeting international quality standards supports the ongoing growth of the plasma cutting machine market.

The plasma cutting machine market in France is projected to grow at a CAGR of 6.0%. France’s established manufacturing sector, particularly in the automotive, aerospace, and metalworking industries, continues to drive steady demand for plasma cutting machines. The country’s focus on precision and high-quality manufacturing, combined with increasing investments in automation technologies, is fueling the adoption of advanced cutting solutions. Additionally, France’s emphasis on energy efficiency, sustainability, and reducing material waste further supports the growth of the plasma cutting machine market as industries strive to meet environmental standards.

The plasma cutting machine market in the United Kingdom is projected to grow at a CAGR of 5.4%. The UK continues to experience steady demand for plasma cutting machines, driven by the need for high-precision cutting in manufacturing, particularly in the automotive, aerospace, and metal fabrication sectors. The UK is also seeing increased investments in automation and technological advancements in industrial production processes. Furthermore, the country’s focus on sustainability and the reduction of material waste in manufacturing processes is contributing to the continued adoption of plasma cutting technologies that enhance efficiency and precision.

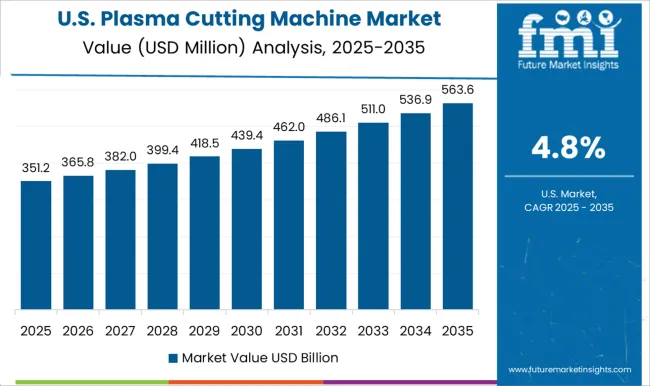

The plasma cutting machine market in the United States is expected to grow at a CAGR of 4.8%. The USA market is driven by strong demand for precision cutting solutions in industries such as automotive, aerospace, and manufacturing. The growing trend of automation in production lines, alongside a focus on reducing operational costs and improving efficiency, supports market growth. Additionally, the USA government’s emphasis on enhancing manufacturing competitiveness and sustainability standards in industrial processes further accelerates the demand for advanced plasma cutting machines, despite slower growth compared to emerging markets.

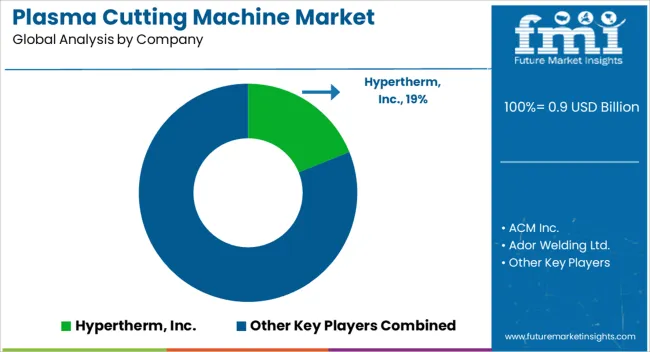

The plasma cutting machine market is highly competitive, with leading players offering innovative solutions to meet the diverse needs of industrial cutting applications across metal fabrication, automotive, aerospace, and construction sectors. Hypertherm Inc. and ESAB Welding & Cutting Products dominate the market with advanced plasma cutting systems known for their precision, speed, and durability. These companies are pioneers in integrating high-definition cutting technologies and automated systems, enabling higher productivity and enhanced material quality.

Lincoln Electric Holdings Inc., Miller Electric Mfg. LLC, and Victor Technologies International Inc. (now part of ESAB) offer comprehensive portfolios of plasma cutting equipment designed for various industrial environments. Their products are valued for their reliability, versatility, and ease of use, catering to both small and large-scale operations.

ACM Inc., AJAN Elektronik San. ve Tic. A.S., and Ermaksan Makina Sanayi ve Ticaret A.S. provide custom plasma cutting solutions, specializing in high-performance machines for precision applications. DAIHEN Corporation and Kjellberg Finsterwalde Plasma und Maschinen GmbH bring expertise in heavy-duty plasma cutters used in demanding industries such as shipbuilding and structural steel fabrication.

Koike Aronson Inc., Komatsu Industries Corp., and Voortman Steel Machinery focus on automated plasma cutting systems for large-scale industrial operations, integrating advanced software and robotic solutions. Overall, competition is defined by cutting-edge technology, energy efficiency, and the ability to meet diverse cutting needs in industrial environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.9 Billion |

| Type | CNC and Manual |

| Power Source | Inverter and Conventional |

| End Use | Manufacturing, Automotive, Aerospace & Defense, Shipping and maritime, Construction and Infrastructure, and Others |

| Distribution channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Hypertherm Inc., ACM Inc., Ador Welding Ltd., AJAN Elektronik San. ve Tic. A.S., C & G Systems Inc., Ermaksan Makina Sanayi ve Ticaret A.S., ESAB Welding & Cutting Products, DAIHEN Corporation, Haco NV, Jinan Huaxia Machinery Equipment Co. Ltd., Kjellberg Finsterwalde Plasma und Maschinen GmbH, Koike Aronson Inc., Komatsu Industries Corp., Lincoln Electric Holdings Inc., Miller Electric Mfg. LLC, Stürmer Maschinen GmbH, Victor Technologies International Inc. (now part of ESAB), Voortman Steel Machinery |

| Additional Attributes | Dollar sales by machine type and application, demand dynamics across automotive, construction, and manufacturing sectors, regional trends in plasma cutting machine adoption, innovation in precision cutting and automation technologies, impact of regulatory standards on safety and emissions, and emerging use cases in robotics and advanced metalworking. |

The global plasma cutting machine market is estimated to be valued at USD 0.9 billion in 2025.

The market size for the plasma cutting machine market is projected to reach USD 1.5 billion by 2035.

The plasma cutting machine market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in plasma cutting machine market are cnc and manual.

In terms of power source, inverter segment to command 54.1% share in the plasma cutting machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

CNC Plasma Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Die Cutting Machine Market

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Laser Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Cutting and Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Cutting Machine Market Size, Growth, and Forecast 2025 to 2035

Laser Cutting Machine Market Growth – Trends & Forecast 2024-2034

Cloth Cutting Machines Market

Fabric Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Wire-cutting EDM Machines Market Size and Share Forecast Outlook 2025 to 2035

Timber Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Cheese Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Global Fabric Cutting Machine Market Share Analysis – Trends & Forecast 2025–2035

Webbing Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Plotter Cutting Machine Market - Size, Share, and Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Pattern Cutting Plotter Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Automatic Die Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA