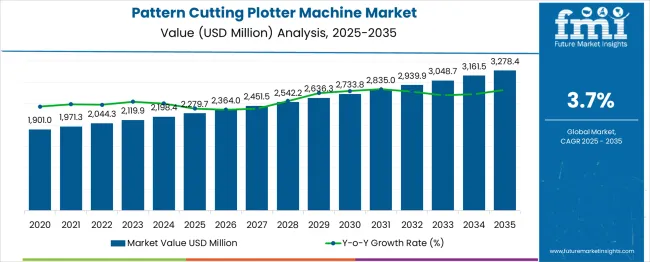

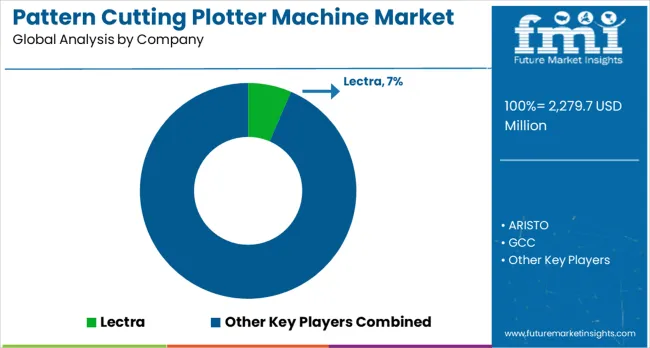

The global pattern cutting plotter machine market is projected to grow from USD 2,279.7 million in 2025 to approximately USD 3,278.4 million by 2035, recording an absolute increase of USD 998.7 million over the forecast period. This translates into a total growth of 43.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.7% between 2025 and 2035. The overall market size is expected to grow by nearly 1.44X during the same period, supported by the rising adoption of automated cutting solutions across textile, automotive, and packaging industries, along with increasing demand for precision cutting technologies in manufacturing processes.

Between 2025 and 2030, the pattern cutting plotter machine market is projected to expand from USD 2,279.7 million to USD 2,733.9 million, resulting in a value increase of USD 454.2 million, which represents 54.5% of the total forecast growth for the decade. This phase of growth will be shaped by increasing automation in manufacturing processes, growing demand for precise cutting solutions in textile and automotive industries, and rising adoption of CNC and auto-nesting technologies. Manufacturers are expanding their product portfolios to address the growing complexity of cutting requirements across diverse materials and applications.

From 2030 to 2035, the market is forecast to grow from USD 2,733.9 million to USD 3,278.4 million, adding another USD 544.7 million, which constitutes 54.5% of the overall ten-year expansion. This period is expected to be characterized by advancement of laser cutting technologies, integration of AI-powered nesting software, and development of multi-functional cutting platforms that can handle diverse materials. The growing adoption of Industry 4.0 principles and smart manufacturing will drive demand for more sophisticated cutting solutions with enhanced connectivity and automation capabilities.

Between 2020 and 2025, the pattern cutting plotter machine market experienced steady expansion from USD 1,970.4 million to USD 2,279.7 million, driven by increasing digitization in manufacturing processes and growing awareness of precision cutting benefits across various industries. The market developed as manufacturers recognized the need for automated cutting solutions to improve efficiency, reduce material waste, and maintain consistent quality standards.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2,279.7 million |

| Forecast Value in (2035F) | USD 3,278.4 million |

| Forecast CAGR (2025 to 2035) | 3.7% |

Market expansion is being supported by the rapid adoption of automated manufacturing processes across textile, automotive, and packaging industries, along with the corresponding need for precision cutting solutions that can handle diverse materials and complex patterns. Modern manufacturing facilities rely on advanced cutting technologies to ensure optimal material utilization, consistent quality, and reduced production time. Even minor improvements in cutting accuracy can result in significant material savings and enhanced product quality.

The growing complexity of product designs and increasing demand for customization are driving the adoption of advanced pattern cutting plotter machines with sophisticated software capabilities. Manufacturers are increasingly requiring cutting solutions that can handle multiple materials, complex geometries, and variable production volumes while maintaining high precision and efficiency. Regulatory requirements for quality standards and environmental considerations regarding material waste are establishing the need for more precise and efficient cutting technologies.

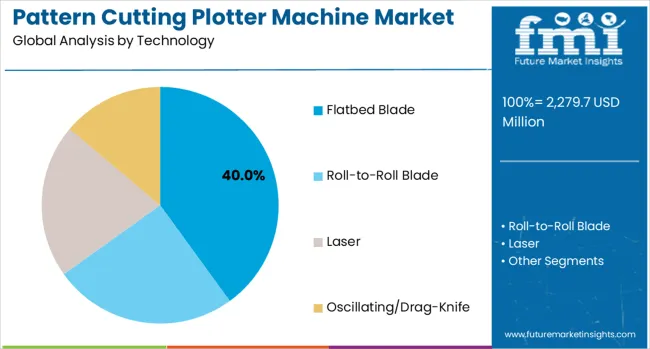

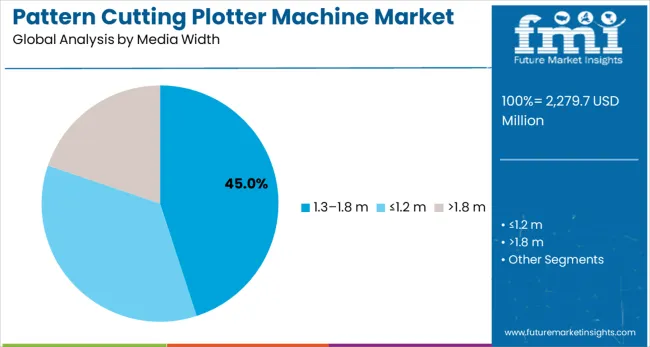

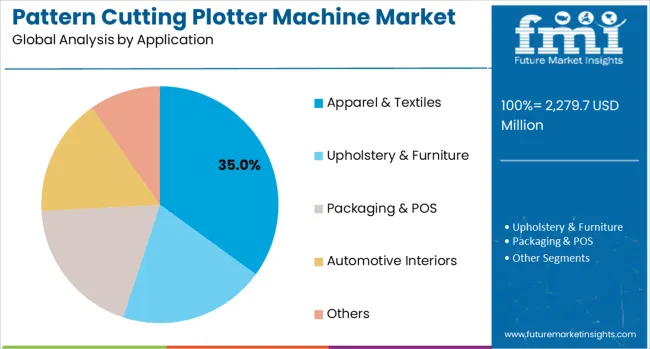

The market is segmented by technology, media width, application, automation level, and region. By technology, the market is divided into flatbed blade, roll-to-roll blade, laser, and oscillating/drag-knife systems. Based on media width, the market is categorized into ≤1.2m, 1.3-1.8m, and >1.8m segments. In terms of application, the market is segmented into apparel & textiles, upholstery & furniture, packaging & POS, automotive interiors, and others. By automation level, the market is classified into manual/assisted and CNC/auto nesting systems. Regionally, the market analysis covers key countries including Brazil, India, Australia, United States, and Italy.

The flatbed blade technology segment is projected to account for 40% of the pattern cutting plotter machine market in 2025, making it the leading technology type. Flatbed blade systems are highly versatile, offering the ability to cut materials ranging from thin fabrics and leather to thicker composites used in automotive and industrial applications. Their adaptability makes them suitable for both small-batch prototyping and high-volume production environments.

The segment continues to benefit from advances in blade design, cutting speed, and automated material handling systems, which improve overall efficiency. Manufacturers value flatbed systems for their ability to deliver consistent, precise cuts, supporting industries where accuracy and repeatability are critical. With broad adoption across apparel, upholstery, packaging, and composites, flatbed blade technology remains the cornerstone of the market, combining durability with cost-effectiveness.

The 1.3–1.8 m media width segment is expected to represent 45% of demand in 2025, underscoring its position as the most widely adopted size range. Machines in this category strike a balance between production capacity and equipment footprint, making them practical for a wide range of manufacturing applications. This width accommodates standard textile rolls and industrial material sheets, meeting the needs of apparel, automotive, and furniture industries.

Manufacturers benefit from efficient material utilization and manageable operating costs within this size range, while also avoiding the higher capital expenditure associated with larger systems. The popularity of 1.3–1.8 m machines reflects their ability to provide versatility across diverse applications while fitting into typical factory floor layouts. Their balance of affordability and performance ensures that this width remains the market’s most practical and dominant segment.

The apparel and textiles segment is projected to contribute 35% of the pattern cutting plotter machine market in 2025, making it the largest end-use category. Garment manufacturing requires extensive cutting operations, from basic apparel production to fashion-driven designs, where precision and speed are crucial. Automated plotter machines reduce labor costs while improving accuracy, enabling manufacturers to handle both mass production and customized orders effectively.

The segment is supported by fast fashion trends, which demand rapid turnaround and flexible production capabilities. Automated cutting also ensures efficient material use, reducing waste in an industry increasingly focused on sustainability. With the textile sector continuing to expand globally, apparel manufacturers remain the primary users of cutting plotter machines, driving sustained demand in this application segment.

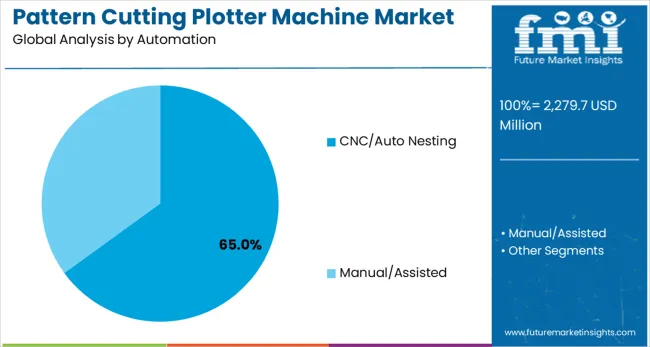

The CNC/auto nesting segment is forecasted to hold 65% of the pattern cutting plotter machine market in 2025, representing the most significant shift toward automation in this industry. Auto nesting software arranges patterns on materials with maximum efficiency, minimizing waste while optimizing production costs. Combined with CNC precision, these systems reduce operator dependency and deliver consistent cutting quality across complex designs.

This segment is further driven by industries such as apparel, automotive interiors, and furniture, where precision, efficiency, and throughput are critical. CNC/auto nesting machines also support scalability, allowing manufacturers to switch between small runs and high-volume production seamlessly. By delivering superior productivity, reduced material costs, and greater accuracy, automated nesting systems have become the industry standard, ensuring continued dominance of this segment.

The pattern cutting plotter machine market is advancing steadily due to increasing automation in manufacturing and growing recognition of precision cutting benefits. However, the market faces challenges including high initial equipment costs, need for skilled operators, and varying material cutting requirements across different industries. Technological advancement efforts and integration of smart manufacturing capabilities continue to influence equipment development and market adoption patterns.

The growing integration of artificial intelligence and advanced nesting software is enabling optimized cutting patterns that maximize material utilization and minimize waste. AI-powered systems can automatically arrange cutting patterns, adjust for material variations, and optimize cutting sequences to improve efficiency. These technologies are particularly valuable for complex cutting operations and variable production requirements where manual optimization would be time-consuming and less effective.

Modern pattern cutting plotter machines are incorporating advanced cutting technologies that can handle diverse materials within a single system, from delicate fabrics to rigid composites. Multi-tool systems with automatic tool changing capabilities enable manufacturers to process various materials without equipment changeover, improving productivity and reducing setup time. Advanced material handling systems also support processing of challenging materials with varying thickness and flexibility characteristics.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.1% |

| India | 5.0% |

| Australia | 4.3% |

| United States | 3.3% |

| Italy | 3.2% |

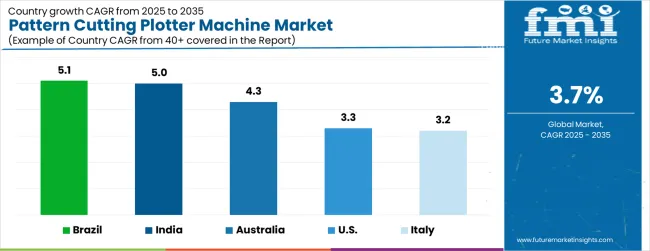

The pattern cutting plotter machine market is growing rapidly, with Brazil leading at a 5.1% CAGR through 2035, driven by expanding textile manufacturing, automotive production growth, and increasing adoption of automated cutting solutions. India follows closely at 5.0%, supported by robust textile industry expansion, rising manufacturing automation, and growing demand for precision cutting technologies. Australia shows strong growth at 4.3%, benefiting from advanced manufacturing initiatives and increasing adoption of smart production technologies. The United States records 3.3% growth, emphasizing technological innovation and manufacturing efficiency improvements. Italy maintains steady growth at 3.2%, focusing on high-quality manufacturing and advanced cutting solutions for luxury goods production.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from pattern cutting plotter machines in Brazil is projected to exhibit the highest growth rate with a CAGR of 5.1% through 2035, driven by rapid expansion of textile and automotive manufacturing sectors and increasing adoption of automated cutting technologies. The country's growing manufacturing base and emphasis on production efficiency are creating significant demand for advanced cutting solutions. Major manufacturers and service providers are establishing comprehensive distribution networks to support the growing population of manufacturing facilities requiring precision cutting capabilities.

Revenue from pattern cutting plotter machines in India is expanding at a CAGR of 5.0%, supported by robust textile industry growth and increasing adoption of automated manufacturing technologies. The country's expanding textile exports and growing domestic demand are driving requirements for efficient cutting solutions that can handle high-volume production with consistent quality. Manufacturing facilities are gradually implementing advanced cutting technologies to improve competitiveness and meet international quality standards.

Revenue from pattern cutting plotter machines in Australia is growing at a CAGR of 4.3%, driven by advanced manufacturing initiatives and increasing adoption of Industry 4.0 technologies across various sectors. The country's emphasis on high-value manufacturing and technological innovation is supporting demand for sophisticated cutting solutions that can handle complex materials and designs. Manufacturing facilities are investing in advanced cutting equipment to enhance productivity and maintain competitive advantages.

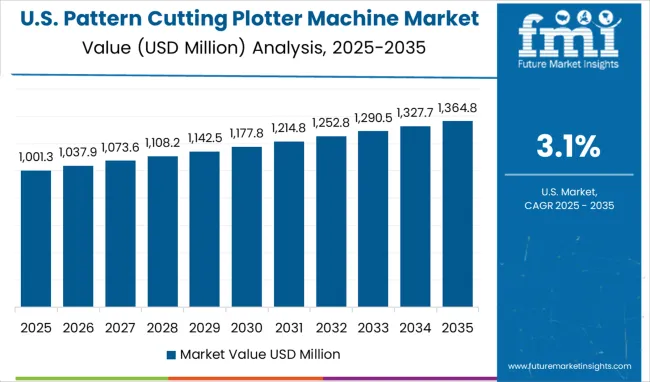

Demand for pattern cutting plotter machines in the USA is projected to grow at a CAGR of 3.1%, supported by continuous innovation in manufacturing technologies and emphasis on production efficiency improvements. American manufacturers are implementing advanced cutting solutions that integrate with existing production systems and provide enhanced capabilities for handling diverse materials and complex cutting requirements. The market benefits from strong research and development activities and collaborative efforts between equipment manufacturers and end-users.

Demand for pattern cutting plotter machines in Italy is expanding at a CAGR of 3.2%, driven by the country's emphasis on high-quality manufacturing and precision production technologies. Italian manufacturers are implementing cutting solutions that meet stringent quality requirements and support production of premium products across fashion, automotive, and furniture sectors. The market is characterized by focus on technological excellence, advanced equipment integration, and compliance with comprehensive quality standards.

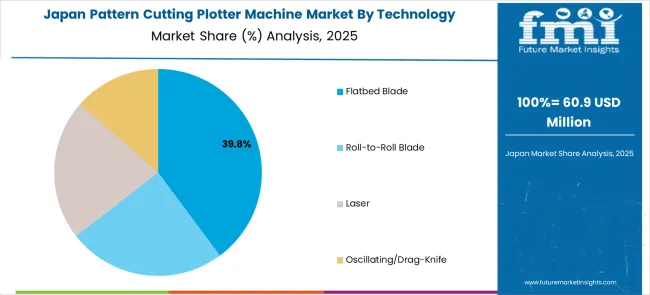

In Japan, the pattern cutting plotter machine market shows strong preference for laser cutting technology, which accounts for 39.8% of total installations in 2025. The high adoption of laser systems reflects Japanese manufacturers' emphasis on precision, automation, and advanced manufacturing capabilities. Blade/knife cutting systems maintain a 30% share, primarily serving traditional textile and automotive applications where mechanical cutting remains preferred. Other cutting technologies contribute 20% of the market, including specialized systems for unique applications and emerging cutting methods.

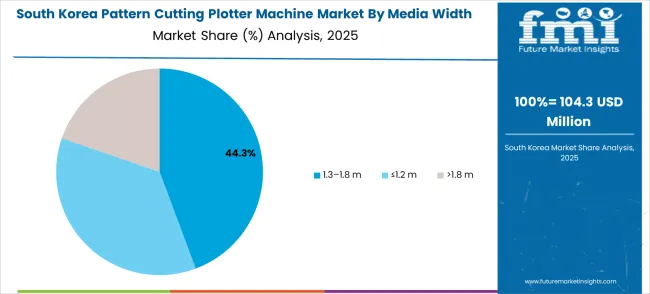

The South Korea pattern cutting plotter machine market in 2025 shows a clear preference for the 1.3–1.8 m media width range, which accounts for 44.3% of market share out of a total valuation of USD 104.3 million. This size category dominates because it aligns with the standard roll widths used in the country’s strong apparel and textile industry, enabling efficient material utilization while maintaining manageable machine footprints for factory settings. Smaller widths (≤1.2 m) and larger systems (>1.8 m) also serve niche applications, but the mid-range offers the most practical balance of productivity, cost, and versatility. As South Korea’s fashion, apparel, and technical textile sectors continue to expand, the 1.3–1.8 m segment is expected to anchor equipment demand.

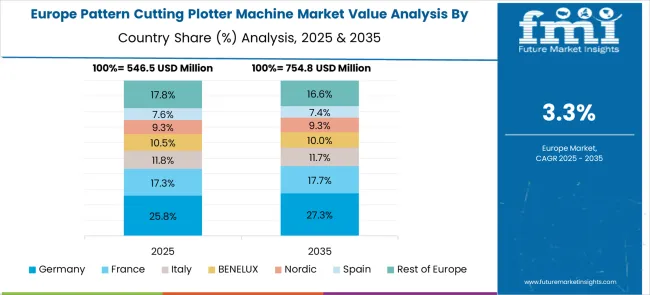

The European pattern cutting plotter machine market demonstrates sophisticated development across major economies with Germany leading through its precision engineering capabilities and advanced manufacturing technology sector, supported by companies like Zünd Systemtechnik and ARISTO pioneering innovative cutting technologies for diverse textile and industrial applications. France shows significant strength through Lectra, leveraging extensive experience in fashion technology and automated cutting solutions for apparel and automotive industries. The UK and Italy exhibit expanding adoption in fashion design and luxury textile applications, driven by industry modernization and precision cutting requirements.

Belgium contributes through Summa's cutting plotter expertise, while other European regions show growing interest in technical textile and industrial material cutting applications. The market benefits from strict quality standards, advanced automation integration, and the region's leadership in textile machinery technology, positioning Europe as a key innovation center for next-generation pattern cutting solutions across apparel manufacturing, automotive upholstery, and technical applications requiring precise material cutting, automated pattern recognition, and high-speed production capabilities supporting diverse industrial and fashion applications worldwide.

The pattern cutting plotter machine market is characterized by competition among established equipment manufacturers, technology innovators, and specialized solution providers. Companies are investing in advanced cutting technologies, software integration, automation capabilities, and service networks to deliver precise, efficient, and cost-effective cutting solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

ARISTO, Germany-based, offers precision cutting solutions with focus on flatbed systems and technical excellence. GCC, Taiwan, provides comprehensive cutting equipment portfolio with emphasis on reliability and cost-effectiveness. Graphtec, Japan, delivers advanced cutting technologies with superior precision and software integration. Kongsberg PCS, Belgium, specializes in high-end cutting systems for demanding applications with focus on automation and productivity.

Lectra, France, emphasizes integrated cutting solutions with comprehensive software packages and industry-specific applications. Mimaki, Japan, offers diverse cutting technologies with focus on digital integration and multi-material capabilities. Roland DG, Japan, provides cutting solutions with emphasis on ease of use and versatility. Summa, Belgium, delivers precision cutting equipment with focus on reliability and performance.

Zünd Systemtechnik, Switzerland, offers premium cutting solutions with advanced automation and modular design concepts. iECHO, China, provides cost-effective cutting systems with growing global presence and expanding technology capabilities.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2,279.7 million |

| Technology | Flatbed Blade, Roll-to-Roll Blade, Laser, Oscillating/Drag-Knife |

| Media Width | ≤1.2m, 1.3-1.8m, >1.8m |

| Application | Apparel & Textiles, Upholstery & Furniture, Packaging & POS, Automotive Interiors, Others |

| Automation Level | Manual/Assisted, CNC/Auto Nesting |

| Regions Covered | Brazil, India, Australia, United States, Italy, Japan, South Korea, and other key markets |

| Key Companies Profiled | ARISTO, GCC, Graphtec, Kongsberg PCS, Lectra, Mimaki, Roland DG, Summa, Zünd Systemtechnik, iECHO |

| Additional Attributes | Dollar sales by cutting technology and machine size, regional demand trends, competitive landscape, buyer preferences for automatic versus semi-automatic systems, integration with CAD/CAM platforms, innovations in precision blades, multi-material capability, and energy-efficient drives |

The global pattern cutting plotter machine market is estimated to be valued at USD 2,279.7 million in 2025.

The market size for the pattern cutting plotter machine market is projected to reach USD 3,278.4 million by 2035.

The pattern cutting plotter machine market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in pattern cutting plotter machine market are flatbed blade, roll-to-roll blade, laser and oscillating/drag-knife.

In terms of media width, 1.3–1.8 m segment to command 45.0% share in the pattern cutting plotter machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Patterned Glass Market

Digital Pattern Generator Market

Needlecraft Patterns Market Analysis - Growth & Demand 2025 to 2035

Cutting Tool Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cutting Boards Market Size and Share Forecast Outlook 2025 to 2035

Cutting Balloons Market Insights – Growth, Demand & Forecast 2025 to 2035

Cutting Fluid Market Growth – Trends & Forecast 2025-2035

Cutting and Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Die Cutting Machine Market

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Wire-cutting EDM Machines Market Size and Share Forecast Outlook 2025 to 2035

Frame Cutting Jib Miner Market Size and Share Forecast Outlook 2025 to 2035

Stone Cutting Saw Blades Market Analysis & Forecast by Blade Type, Blade Diameter, End User, and Region Forecast Through 2035

Laser Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Glass Cutting Machine Market Size, Growth, and Forecast 2025 to 2035

Laser Cutting Machine Market Growth – Trends & Forecast 2024-2034

Cloth Cutting Machines Market

Manual cutting equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA