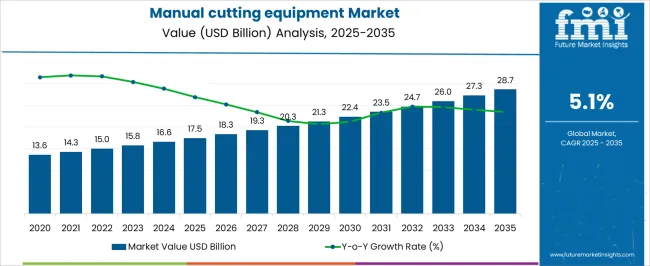

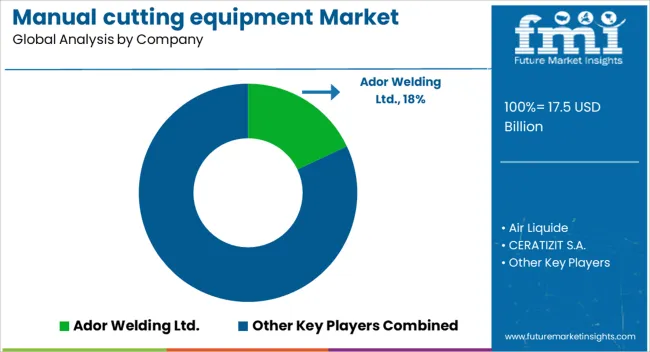

The manual cutting equipment market is estimated to be valued at USD 17.5 billion in 2025 and is projected to reach USD 28.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

Growth is driven by demand across manufacturing, construction, metalworking, and woodworking sectors, where manual cutting tools such as shears, hand saws, and precision knives are essential for shaping, trimming, and finishing materials. Product innovations, including ergonomic designs, lightweight alloys, and enhanced blade durability, are supporting adoption by improving efficiency and reducing operator fatigue. The absolute dollar opportunity of USD 11.2 billion reflects both replacement demand and new installations. Replacement cycles in mature markets such as North America and Europe contribute steadily, as aging equipment is upgraded with improved designs that offer higher precision and longer service life.

Emerging regions, particularly Asia Pacific and Latin America, are expected to account for a larger portion of the opportunity due to rising industrial activity, infrastructure projects, and expanding small- and medium-scale manufacturing operations. The market is also influenced by technological enhancements that complement manual tools, including hybrid systems combining manual and semi-automated functions. Overall, the USD 11.2 billion opportunity highlights the cumulative revenue potential over 2025–2035, underlining the strategic importance of product innovation, regional expansion, and replacement demand in driving growth for the manual cutting equipment market.

| Metric | Value |

|---|---|

| Manual cutting equipment Market Estimated Value in (2025 E) | USD 17.5 billion |

| Manual cutting equipment Market Forecast Value in (2035 F) | USD 28.7 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

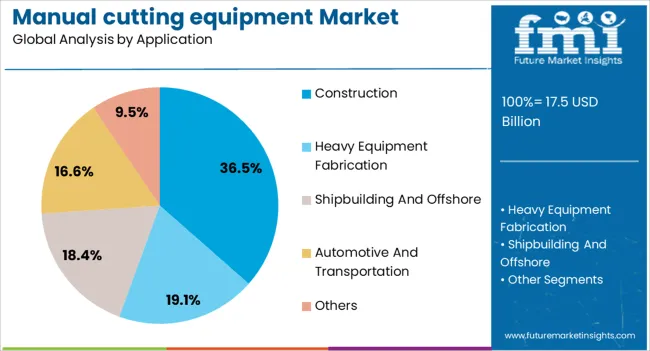

The manual cutting equipment market is primarily driven by the construction and infrastructure sector, which accounts for approximately 35% of the market share. Demand in this sector comes from ongoing construction projects requiring precise cutting of materials such as steel, wood, and concrete. The automotive and transportation industry contributes around 25%, relying on manual cutting tools for vehicle manufacturing, repairs, and maintenance. Metal fabrication accounts for 20%, where cutting equipment is essential for shaping and assembling metal components. Shipbuilding and offshore industries represent 10%, and heavy equipment manufacturing makes up the remaining 10%, both depending on efficient cutting solutions for production and assembly processes.

The manual cutting equipment market is witnessing advancements in design and efficiency. Ergonomically designed tools are gaining popularity to reduce operator fatigue and improve precision. Enhanced blade materials, including high-speed steel and alloy coatings, are increasing durability and cutting performance. Manufacturers are integrating safety features, such as anti-slip grips and protective guards, to meet stricter workplace standards. Portable and lightweight tools are becoming more prevalent to support on-site applications. Companies are investing in research and development to introduce innovative equipment that reduces material waste and improves accuracy. Strategic collaborations and expansion into emerging markets are further driving growth in the sector.

The market is experiencing steady growth, supported by rising industrial activity, infrastructure development, and demand for precise metal fabrication solutions. The current landscape is being shaped by the increasing need for portable and efficient cutting tools across diverse sectors such as construction, shipbuilding, automotive maintenance, and metal workshops.

Growth is further supported by a surge in small and medium enterprises adopting manual solutions due to their cost-effectiveness and minimal setup requirements. Operators are increasingly favoring equipment that enables quick adaptation to on-site conditions without reliance on automation or heavy machinery.

Technological enhancements in cutting technologies are improving accuracy and operational safety, while global investment in public infrastructure and utility upgrades is expanding the scope of application Looking ahead, rising emphasis on energy efficiency, lower material wastage, and increased mobility are expected to fuel future demand for manual cutting tools in both emerging and developed markets.

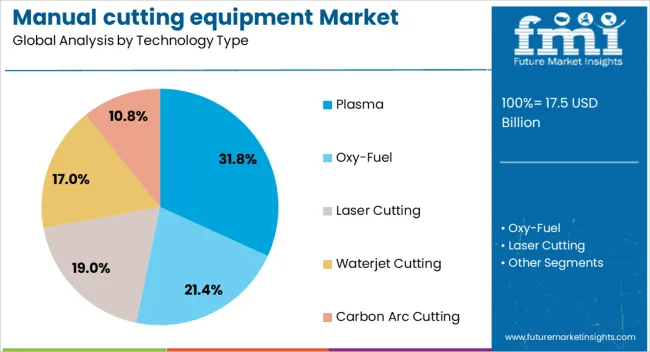

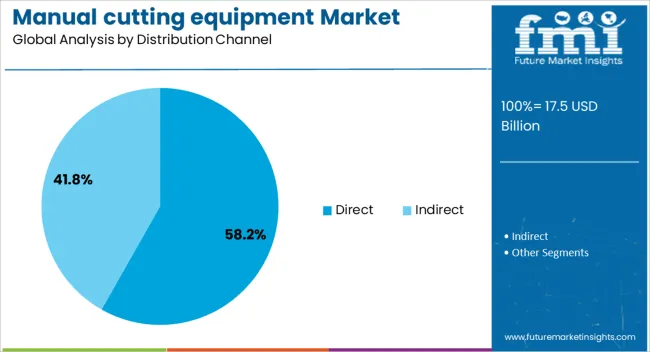

The manual cutting equipment market is segmented by technology type, application, distribution channel, and geographic regions. By technology type, manual cutting equipment market is divided into plasma, oxy-fuel, laser cutting, waterjet cutting, and carbon arc cutting. In terms of application, manual cutting equipment market is classified into construction, heavy equipment fabrication, shipbuilding and offshore, automotive and transportation, and others. Based on distribution channel, manual cutting equipment market is segmented into direct and indirect. Regionally, the manual cutting equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plasma segment is projected to account for 31.8% of the manual cutting equipment market revenue in 2025, making it the dominant technology type. This position is being supported by the segment’s ability to deliver fast, clean, and precise cuts across a wide range of conductive metals.

Operators have preferred plasma technology due to its adaptability to varying thickness levels, ease of use, and consistent performance in both workshop and field environments. The technology’s lower heat-affected zones and reduced edge distortion have contributed to its suitability for both professional and small-scale fabrication.

Over time, cost reductions in plasma systems and the introduction of compact, lightweight models have further improved accessibility Demand for high-speed cutting with minimal surface preparation requirements has positioned plasma as the leading choice among manual cutting solutions, especially in industries where productivity, precision, and portability are prioritized.

The construction segment is expected to hold 36.5% of the market revenue share in 2025, emerging as the largest application segment. This growth is being driven by widespread use of manual cutting equipment in structural steel fabrication, site modifications, and maintenance operations. The sector’s preference for flexible, easy-to-deploy solutions has favored manual systems that can operate in varied and often unpredictable jobsite conditions.

The rise in global infrastructure investments, including transport corridors, urban renewal, and affordable housing programs, has created sustained demand for on-site cutting capabilities. Manual equipment is being chosen due to its ability to handle irregular layouts, limited access spaces, and non-standard components, which are common in construction environments.

Furthermore, its compatibility with varying power sources and rugged use cases has made it a reliable tool in both developing and developed market settings As the pace of construction continues to accelerate globally, the segment is anticipated to retain its leading position.

The direct distribution channel is anticipated to represent 58.2% of the market revenue share in 2025, making it the primary mode of equipment distribution. This dominance is being attributed to manufacturers' focus on building closer customer relationships and offering tailored technical support directly to end users.

The direct model enables better control over pricing, training, warranty management, and product customization, which are critical in the manual equipment space where user preferences vary widely. Commercial buyers and industrial operators have shown a strong preference for direct engagement to ensure equipment compatibility, access to spare parts, and post-sale services.

This approach has also improved brand loyalty and allowed for faster adoption of new technologies As buyers seek more transparent and responsive support ecosystems, the direct distribution segment is expected to continue its growth, reinforced by digital sales platforms, localized service networks, and training programs offered by original equipment manufacturers.

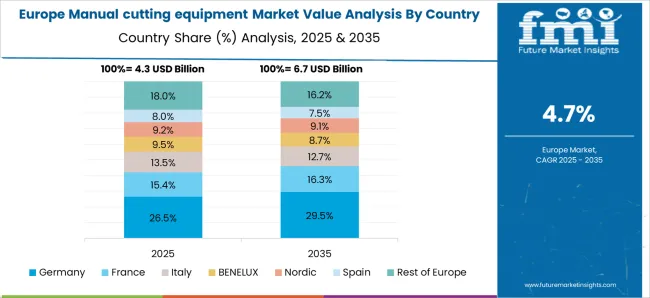

The manual cutting equipment market is growing due to rising demand in manufacturing, construction, woodworking, and metalworking industries. Global revenue exceeded USD 4.2 billion in 2024, with Asia Pacific contributing 40% of consumption, led by China, India, and Southeast Asia, due to large-scale industrial and workshop activities. North America accounts for 30%, driven by maintenance, fabrication, and small-scale manufacturing sectors. Europe contributes 25%, with Germany, UK, and France focusing on precision cutting for construction and furniture industries. Tools such as hand shears, manual guillotines, knives, and snips are widely adopted. Rising small-scale industrial setups, DIY workshops, and urban construction activities are driving adoption. Durability, precision, and portability support market growth globally.

Hand shears and manual guillotines dominate adoption due to precision, versatility, and low operational cost. Asia Pacific leads with 40% market share, driven by industrial fabrication, workshops, and furniture manufacturing. North America accounts for 30%, emphasizing maintenance, repair, and small-scale production activities. Europe contributes 25%, focusing on high-precision cutting for construction and woodworking. Hand tools reduce material wastage by 15–20% while improving accuracy. Guillotine and lever-based cutters allow uniform cuts in metal sheets, wood panels, and plastics. Lightweight and portable designs increase usability in small workshops and field operations. Rising small-scale industrial activities, urban construction projects, and DIY adoption are supporting global market expansion.

Innovations in materials, blade coatings, and ergonomic designs improve durability, cutting accuracy, and user comfort. High-carbon steel, stainless steel, and alloy blades increase tool lifespan by 20–25%. Ergonomic handles reduce operator fatigue by 15–18%. Multi-functional manual cutters allow cutting of metals, plastics, wood, and textiles. Asia Pacific manufacturers focus on cost-effective, durable tools for industrial use. North America emphasizes high-precision and heavy-duty tools for professional workshops. Europe prioritizes corrosion-resistant and long-life cutting tools. Continuous R&D ensures compatibility with modern fabrication standards, enhancing efficiency, precision, and safety. Advanced blade treatments, leverage mechanisms, and portable designs drive adoption in workshops, construction, and small-scale manufacturing globally.

Manual cutting equipment is widely used in construction, woodworking, metal fabrication, and small-scale industrial workshops. Construction applications account for 40% of global adoption due to cutting metal sheets, pipes, and panels. Woodworking and furniture production contribute 30% of demand, requiring high-precision cutting. Metal fabrication, including sheet metal, wire, and tubing, drives 20–25% of adoption. Asia Pacific dominates with 40% of global usage due to industrial expansion and DIY activities. North America focuses on precision maintenance and workshop operations. Europe emphasizes quality and durability for professional applications. Rising infrastructure development, small-scale manufacturing, and DIY trends continue to support global manual cutting equipment demand.

Manual cutting equipment requires frequent blade replacement and sharpening, increasing operational costs by 10–15%. Variability in material hardness, thickness, and user skill affects precision and efficiency. High-quality materials, coatings, and ergonomic designs increase production costs by 20–25%. Heavy-duty or large cutters require skilled operators for safe and effective use. Asia Pacific faces challenges with small workshops adopting premium tools due to cost. Manufacturers address these issues through durable blades, ergonomic designs, and multi-purpose functionality. Despite benefits in portability, precision, and low-energy operation, blade wear, operator skill requirements, and material limitations remain key challenges for manual cutting equipment adoption globally.

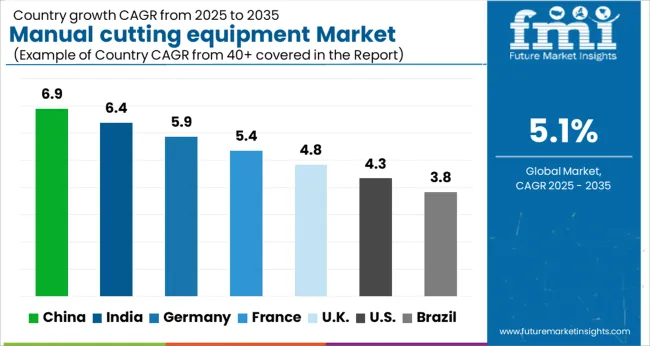

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The manual cutting equipment market is projected to grow at a global CAGR of 5.1% through 2035, driven by rising demand in construction, woodworking, metal fabrication, and industrial applications. China leads at 6.9%, 35% above the global benchmark, supported by BRICS-led expansion in construction, manufacturing, and small- to medium-scale industrial workshops. India follows at 6.4%, 25% above the global average, reflecting increasing adoption in construction, carpentry, and industrial fabrication activities. Germany records 5.9%, 16% above the benchmark, shaped by OECD-driven innovation in high-precision cutting tools, industrial workshops, and specialized applications. The United Kingdom posts 4.8%, 6% below the global rate, influenced by selective uptake in construction projects, woodworking, and industrial maintenance. The United States stands at 4.3%, 16% below the benchmark, with steady demand in industrial fabrication, carpentry, and niche commercial applications. BRICS economies drive volume growth, OECD markets emphasize precision, performance, and quality, while ASEAN nations contribute through expanding construction and industrial fabrication sectors.

The manual cutting equipment market in China is projected to grow at a CAGR of 6.9%, above the global CAGR of 5.1%, driven by expanding demand in small-scale manufacturing, woodworking, and light metalworking industries. In 2024, 45% of newly produced devices consisted of portable shears, hand saws, and precision cutting tools with enhanced durability. Production facilities in Zhejiang, Guangdong, and Jiangsu increased throughput by 16% to meet domestic and regional demand. Adoption of multi-purpose, ergonomically designed tools improved operational efficiency and safety for operators. Leading suppliers including Makita China, Bosch China, and Stanley Black & Decker focused on high-performance designs, wear-resistant coatings, and optimized functionality for industrial applications. Market expansion is further supported by growing urban construction projects and increasing adoption of precision tools across furniture and workshop industries.

The manual cutting equipment market in India is expected to grow at a CAGR of 6.4%, above the global 5.1%, supported by growth in furniture manufacturing, construction, and industrial workshops. In 2024, 42% of new devices were lightweight hand tools, portable saws, and high-durability shears. Production facilities in Maharashtra, Gujarat, and Tamil Nadu scaled capacity by 14% to satisfy domestic and export demand. Adoption of precision-engineered, multi-purpose tools enhanced workflow efficiency and reduced operator fatigue. Key suppliers including Stanley Black & Decker India, Bosch India, and Makita India introduced innovative models with extended service life, improved cutting precision, and ergonomic designs. Demand is further driven by rising small-scale industrial activity and increasing awareness of quality hand tools among workshops.

Germany’s manual cutting equipment sector is projected to grow at a CAGR of 5.9%, above the global CAGR of 5.1%, fueled by high-precision woodworking, industrial metalworking, and maintenance sectors. In 2024, 40% of new devices included high-strength shears, precision hand tools, and multi-purpose cutters. Production facilities in Bavaria and North Rhine-Westphalia increased throughput by 13% to meet domestic and EU-wide demand. Adoption of corrosion-resistant, ergonomically optimized tools improved cutting efficiency and operational reliability. Suppliers such as Bosch Germany, Makita Germany, and Stanley Black & Decker Germany launched advanced models featuring optimized thread design, high durability, and enhanced load-bearing capacity. Market growth is supported by a mature industrial base and increasing adoption of automated quality control systems in production.

The manual cutting equipment market in the United Kingdom is projected to grow at a CAGR of 4.8%, slightly below the global CAGR of 5.1%, influenced by moderate activity in construction, metalworking, and woodworking industries. In 2024, 36% of new devices comprised portable saws, heavy-duty cutters, and ergonomically designed hand shears. Production facilities in the Midlands and South East increased capacity by 11% to meet domestic demand. Adoption of multi-functional tools and batch quality control enhanced operational efficiency and workplace safety. Leading suppliers including Bosch UK, Makita UK, and Stanley Black & Decker UK introduced modular solutions for residential and commercial applications. Growth is supported by rising DIY tool usage and renovation projects across urban centers.

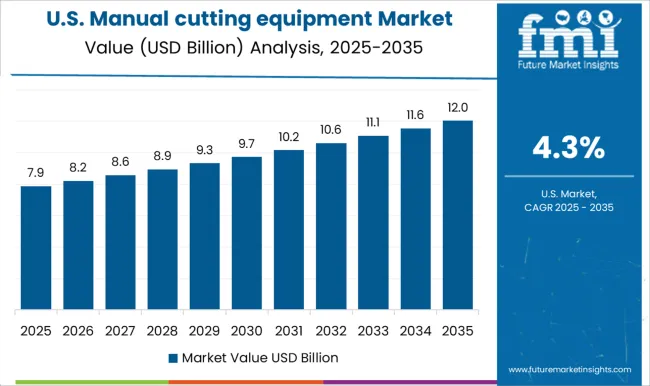

The manual cutting equipment market in the United States is projected to grow at a CAGR of 4.3%, below the global CAGR of 5.1%, due to mature woodworking, metalworking, and light industrial sectors. In 2024, 38% of new devices focused on multi-purpose hand tools, ergonomic shears, and high-precision cutters. Production facilities in California, Texas, and Michigan increased throughput by 10% to meet domestic demand. Adoption of modular kits, precision threading, and ergonomically designed tools enhanced productivity, operator safety, and installation efficiency. Leading suppliers including Stanley Black & Decker, Bosch USA, and Makita USA introduced models optimized for industrial, commercial, and residential applications. Market expansion is influenced by renovation activities, small-scale manufacturing, and demand for professional-grade tools in workshops.

Competition in the manual cutting equipment market is being influenced by precision, durability, and ease of operation. Market positions are being maintained through certified tools, technical support, and distribution networks that ensure availability for industrial, workshop, and craft applications. Companies are being represented with hand-operated shears, cutters, and snips engineered for consistent performance and material versatility. Blades are being applied with high-strength alloys designed for long service life, while tool ergonomics is being emphasized to reduce operator fatigue. Equipment is being showcased with adjustable mechanisms and measurement guides optimized for accuracy across metals, plastics, and composites.

Companies are being promoted with lightweight, portable designs for field use and robust options for heavy-duty applications. Cutting edges are being coated or treated to maintain sharpness, and handles are being designed for grip and safety. Specialty tools are being applied for sheet metal, wiring, and tubing, while multipurpose cutters are being structured to cover diverse workshop requirements. Strategies among these companies are being centered on product development, quality assurance, and service support expansion.

Research and development efforts are being allocated to improve blade durability, cutting efficiency, and operator safety. Product brochures are being structured with technical specifications covering material compatibility, blade type, handle design, and operational limits. Features including portability, adjustability, and safety mechanisms are being emphasized to guide procurement and operational decisions. Each brochure is being arranged to highlight certification compliance, application suitability, and maintenance guidelines. Technical information is being presented in a clear, evaluation-ready format to assist workshop managers, technicians, and purchasing teams in selecting manual cutting equipment that meets performance, reliability, and operational requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.5 billion |

| Technology Type | Plasma, Oxy-Fuel, Laser Cutting, Waterjet Cutting, and Carbon Arc Cutting |

| Application | Construction, Heavy Equipment Fabrication, Shipbuilding And Offshore, Automotive And Transportation, and Others |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ador Welding Ltd., Air Liquide, CERATIZIT S.A., Colfax Corporation, DAIHEN Corporation, Enovis, Fronius International GmbH, GCE Holding AB, GENSTAR TECHNOLOGIES, Hypertherm, Inc., ICS Cutting Tools, Inc., Illinois Tool Works Inc., Jet Edge, Inc., Kennametal Inc., and Koike Aronson, Inc. |

| Additional Attributes | Dollar sales by equipment type and end use, demand dynamics across manufacturing, packaging, and crafts, regional trends in small-scale and industrial applications, innovation in ergonomics and cutting precision, environmental impact of material waste, and emerging use cases in DIY projects and specialty industries. |

The global manual cutting equipment market is estimated to be valued at USD 17.5 billion in 2025.

The market size for the manual cutting equipment market is projected to reach USD 28.7 billion by 2035.

The manual cutting equipment market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in manual cutting equipment market are plasma, oxy-fuel, laser cutting, waterjet cutting and carbon arc cutting.

In terms of application, construction segment to command 36.5% share in the manual cutting equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Manual Control Valve Market Size and Share Forecast Outlook 2025 to 2035

Manual Lifting Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Manual Wafer Aligner Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Manual Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Manual Bottle Opener Market Size and Share Forecast Outlook 2025 to 2035

Manual Transmission Market Size and Share Forecast Outlook 2025 to 2035

Manual Resuscitator Market Growth – Size, Trends & Forecast 2024-2034

Instrument Detergents for Manual Cleaning Market Report – Trends & Innovations 2025 to 2035

Cutting Tool Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cutting Boards Market Size and Share Forecast Outlook 2025 to 2035

Cutting and Bending Machine Market Size and Share Forecast Outlook 2025 to 2035

Cutting Balloons Market Insights – Growth, Demand & Forecast 2025 to 2035

Cutting Fluid Market Growth – Trends & Forecast 2025-2035

Die Cutting Machine Market

Wire-cutting EDM Machines Market Size and Share Forecast Outlook 2025 to 2035

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Fish Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Tire Cutting Machine Market Trends, Outlook & Forecast 2025 to 2035

Laser Cutting Machines Market Size and Share Forecast Outlook 2025 to 2035

Frame Cutting Jib Miner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA