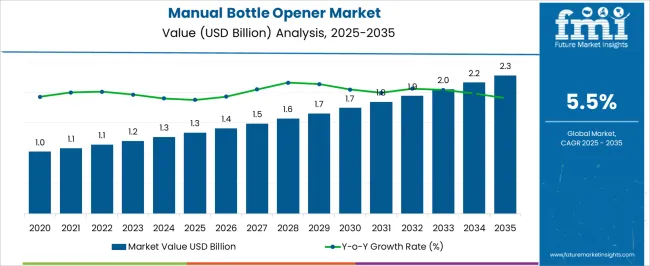

The manual bottle opener market is projected to expand from USD 1.3 billion in 2025 to USD 2.3 billion in 2035, advancing at a CAGR of 5.5%. This trajectory suggests a steady but controlled growth pattern, indicating that the market is situated between the maturity and incremental expansion phases of its adoption lifecycle. During the early years, the market had already passed its introductory stage, as manual bottle openers were established tools with widespread usage across households, hospitality, and commercial segments.

The progression from USD 1.3 billion to 1.7 billion by 2029 reflects a moderate adoption curve where replacement demand, product diversification, and gifting segments play a role rather than new adoption. The slope of the curve shows consistency rather than rapid acceleration, typical of a product that has achieved market penetration and is driven by incremental value additions. By 2030 onward, the values move from USD 1.8 billion to USD 2.3 billion, which highlights a late maturity phase, where adoption rates stabilize and growth primarily comes from niche innovations such as ergonomic designs, premium finishes, or integration into multifunctional tools. The adoption lifecycle thus shows the product past its growth surge, with saturation visible in traditional markets but modest opportunities arising in customization, hospitality expansion, and lifestyle-driven gifting categories. This positions the market in the late majority phase, moving toward saturation.

| Metric | Value |

|---|---|

| Manual Bottle Opener Market Estimated Value in (2025 E) | USD 1.3 billion |

| Manual Bottle Opener Market Forecast Value in (2035 F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

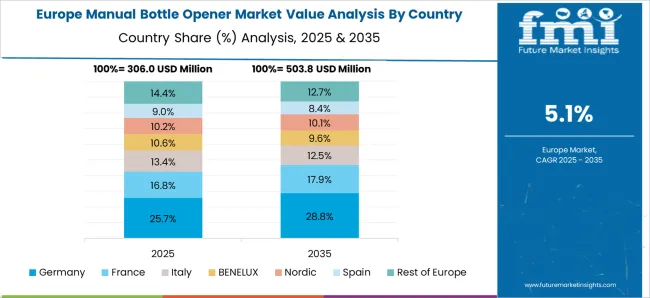

The manual bottle opener market forms a niche segment within the global kitchenware and bar accessories industry, holding about 5.7% of the overall bottle-opening tools market. Within the wider household and commercial beverage accessories space, it represents close to 3.2%, driven by its practicality and cost-effectiveness. Across the restaurant and hospitality equipment segment, the share stands at 2.6%, highlighting its relevance in professional service environments. Within the global consumer durables market, manual bottle openers contribute approximately 1.9%, showing steady demand from households and small businesses. In the personalized and promotional merchandise category, their share is nearly 2.1%, supported by widespread use of customized openers for branding purposes.

Recent industry trends in the manual bottle opener market are shaped by innovation in design, multifunctionality, and sustainable material adoption. Key manufacturers are increasingly using stainless steel, bamboo, and recycled composites to meet evolving consumer preferences for durability and eco-conscious choices. Compact openers with integrated features, such as corkscrew and can-piercing functions, have gained popularity for convenience. Custom printing and laser engraving for brand marketing and promotional gifting have also emerged as impactful strategies.

The ergonomic designs that improve user comfort are being emphasized, particularly in professional food service settings. Partnerships with lifestyle and beverage companies are driving unique co-branded collections.

The market in 2025 is characterized by a preference for durable, ergonomically designed products that combine functionality with aesthetic appeal. Rising disposable incomes, increased dining and hospitality activities, and the expansion of the food and beverage service sector are driving growth.

The market is also benefiting from the growing popularity of home bars and casual entertaining, encouraging consumers to invest in reliable and stylish openers. Manufacturers are focusing on design innovations and premium materials to enhance product longevity and user experience.

Additionally, the shift towards eco-friendly and reusable kitchen tools is further supporting adoption. As retail and e-commerce platforms expand their reach, accessibility to a wide range of manual bottle openers is increasing, positioning the market for continued growth in both developed and emerging regions.

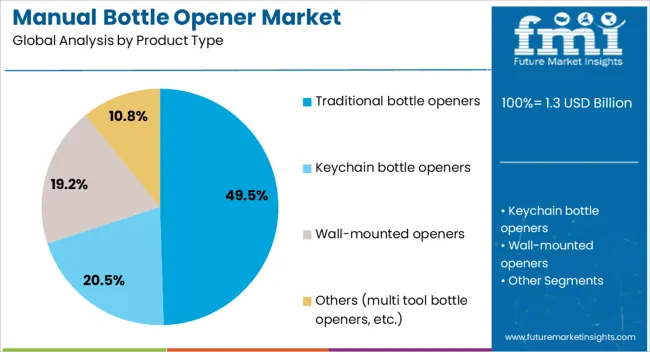

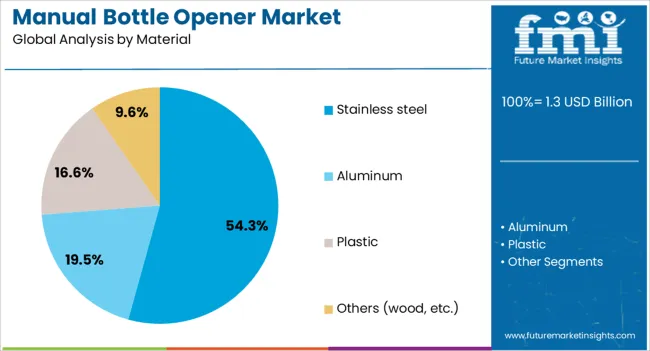

The manual bottle opener market is segmented by product type, material, price range, end-use, distribution channel, and geographic regions. By product type, manual bottle opener market is divided into traditional bottle openers, keychain bottle openers, wall-mounted openers, and others (multi tool bottle openers, etc.). In terms of material, manual bottle opener market is classified into stainless steel, aluminum, plastic, and others (wood, etc.).

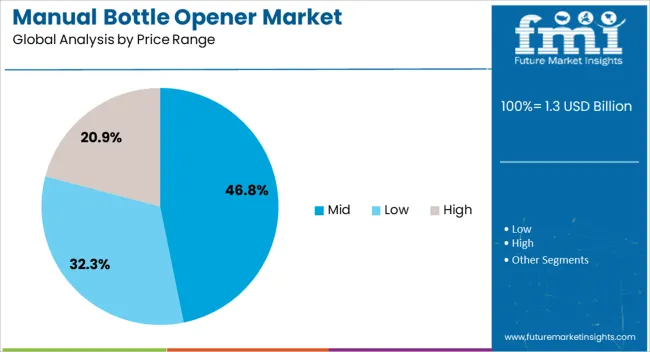

Based on price range, manual bottle opener market is segmented into mid, low, and high. By end-use, manual bottle opener market is segmented into households, bars and restaurants, outdoor enthusiasts, and others (collectors and hobbyists, etc.). By distribution channel, manual bottle opener market is segmented into online and offline. Regionally, the manual bottle opener industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The traditional bottle openers segment is projected to hold 49.5% of the manual bottle opener market revenue in 2025, making it the leading product type. This dominance is being attributed to their simple design, ease of use, and long-standing consumer familiarity.

Traditional openers have maintained strong demand across both domestic and commercial environments due to their affordability and minimal maintenance requirements. Their durability and ability to perform effectively without mechanical components have made them a preferred choice in high-usage settings.

The growth of this segment is further supported by the wide availability of these openers across retail outlets and online channels, ensuring consistent market penetration. The segment also benefits from its compatibility with various bottle types, making it a versatile choice for consumers seeking practicality and reliability in everyday use.

The stainless steel material segment is expected to account for 54.3% of the market revenue in 2025, emerging as the leading material choice. This leadership is being driven by the material’s strength, corrosion resistance, and ability to maintain a polished appearance over time.

Stainless steel openers are preferred in both home and professional environments where hygiene, durability, and aesthetic appeal are valued. The material’s non-reactive properties ensure safety when in contact with beverages, while its resilience to wear supports long-term usage.

Growing consumer preference for premium, long-lasting kitchen tools has further elevated demand for stainless steel variants. Additionally, the segment’s growth is reinforced by the availability of a wide variety of stainless steel designs, ranging from minimalist utility-focused models to decorative and gift-oriented products, catering to a broad spectrum of buyers.

The mid price range segment is anticipated to capture 46.8% of the market revenue in 2025, positioning it as the leading price category. This segment’s prominence is being supported by its balance of affordability and quality, making it accessible to a broad consumer base while delivering durable and aesthetically pleasing products.

Buyers in this range often seek openers that combine robust materials with ergonomic designs without the premium cost associated with luxury items. Retailers and manufacturers have targeted this segment with a wide assortment of designs and styles, ensuring appeal to both practical users and gift buyers.

The growth of e-commerce has also amplified the segment’s reach, enabling competitive pricing and variety. With value-conscious consumers continuing to prioritize products that offer long-term utility and appealing design, the mid price range is expected to sustain its leading position.

The market has been shaped by its strong connection to consumer lifestyle, hospitality, and food service trends. Despite the presence of electric and automated alternatives, manual openers remain widely used because of their portability, reliability, and affordability. They are popular across households, restaurants, bars, and recreational settings, where convenience and tradition hold value. Product innovation in terms of ergonomics, design, and material durability has strengthened consumer interest. The gifting trends, branding opportunities, and collectible editions have supported demand growth.

Consumer lifestyle patterns have significantly impacted the demand for manual bottle openers. These products are often associated with home gatherings, casual dining, and outdoor recreational activities, where convenience and tradition influence purchasing behavior. Unlike automated alternatives, manual openers require no power source, making them ideal for travel and outdoor use. Their simplicity and effectiveness reinforce consumer trust, ensuring their continued presence in households worldwide. Beyond functionality, openers are increasingly viewed as lifestyle accessories, available in customized shapes, premium finishes, and creative designs that appeal to collectors and enthusiasts. This blending of utility and personalization demonstrates how manual bottle openers meet both practical and emotional needs, thereby maintaining relevance across diverse consumer groups.

The hospitality and food service industries have been key drivers in sustaining the manual bottle opener market. Bars, restaurants, hotels, and catering services rely on these tools for efficiency and reliability in beverage service. Manual openers are preferred for their low maintenance requirements and speed of operation compared to electric alternatives. The durability of stainless steel and alloy-based designs makes them suitable for high-frequency usage, ensuring long-term cost effectiveness. Additionally, branding opportunities within hospitality settings, such as customized openers featuring logos, have further strengthened market adoption. The continued growth of global dining establishments and social drinking culture ensures that manual bottle openers remain indispensable within professional service environments.

Advancements in material selection and ergonomic design have played a crucial role in enhancing manual bottle openers. Traditional steel-based models are now supplemented with openers made from zinc alloys, aluminum, wood, and even biodegradable composites. Ergonomic grips, lightweight structures, and safety features have improved consumer usability, particularly among elderly users or individuals with reduced hand strength. Premium finishes such as chrome plating, matte steel, and decorative designs have transformed bottle openers into lifestyle accessories rather than purely functional items. The limited edition and souvenir collections have created niche opportunities for manufacturers. Such product differentiation not only drives consumer interest but also allows companies to target multiple price points within the global market.

The distribution landscape for manual bottle openers has undergone a significant transformation with the rise of e-commerce platforms. Online marketplaces provide customers access to a wide variety of designs, materials, and price ranges, often accompanied by peer reviews that influence purchasing decisions.

Specialty stores, supermarkets, and hospitality suppliers continue to serve traditional buyers, but online retail channels are increasingly dominating sales due to convenience and global reach. Customization options, subscription-based gift services, and cross-selling with kitchenware products further support sales momentum. The ability of manufacturers to leverage both physical retail and digital channels ensures expanded consumer outreach. This omnichannel approach has been critical in driving growth and in sustaining the relevance of manual bottle openers worldwide.

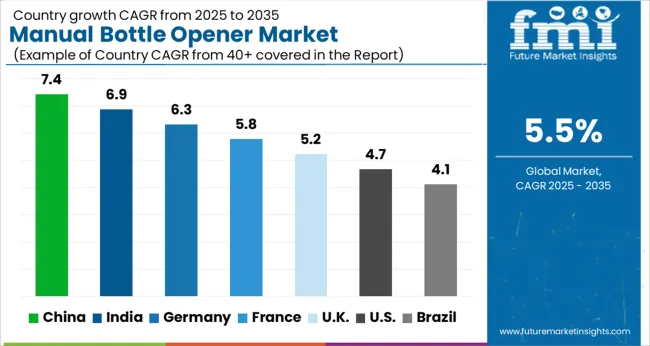

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The market is showing consistent development, supported by consumer demand across both household and commercial segments. India grows at 6.9%, driven by increasing use in restaurants, cafes, and hospitality sectors. Germany records 6.3%, with growth influenced by the popularity of premium kitchen tools and bar accessories. China leads with 7.4%, backed by large-scale manufacturing and high domestic consumption. The United Kingdom stands at 5.2%, reflecting steady demand in lifestyle and leisure markets. The United States follows at 4.7%, where consumer preferences for both traditional and modern opener designs shape the market. This growth outlook indicates a steady expansion in both developed and emerging regions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to increase at a CAGR of 7.4%, supported by strong beverage industry growth and wide consumer base. The expanding consumption of beer and carbonated drinks has been a primary factor in driving demand for openers in both residential and commercial settings. It is observed that gifting culture and household dining patterns have also favored sales of decorative and functional opener designs. Local manufacturers are actively innovating with stainless steel, aluminum, and bamboo-based materials to capture diverse preferences. Export oriented production has provided Chinese suppliers an advantage, as they meet overseas demand through mass manufacturing capabilities. The combination of cultural consumption trends and industrial efficiency ensures that China continues to lead the manual bottle opener market.

The market in India is expected to register a CAGR of 6.9%, influenced by beverage sector expansion and lifestyle changes in urban and semi-urban regions. Rising popularity of craft breweries and packaged drinks has stimulated demand in both hospitality and home consumption categories. Traditional use of openers in household gatherings continues to support steady sales volumes. Indian manufacturers are focusing on affordable stainless steel models while international suppliers are introducing ergonomic designs for premium segments. It is considered that growth is further supported by rising gifting preferences during festivals, where bar accessories are included in packaged offerings. India is positioned to become a fast growing market where functional and decorative openers find equal acceptance.

Germany is anticipated to expand at a CAGR of 6.3%, largely driven by cultural traditions associated with beer consumption. Germany has one of the highest per capita beer consumption rates globally, which translates into steady household and bar level use of openers. Collectible and branded openers associated with breweries have also contributed to market diversity. German manufacturers emphasize durability and design aesthetics, often producing openers integrated with multifunctional tools. The hospitality sector continues to purchase bulk openers, particularly for traditional beer gardens and local breweries. The market in Germany is considered highly competitive, with both domestic producers and imports from Asian suppliers serving consumers.

The market in the United Kingdom is forecasted to expand at a CAGR of 5.2%, supported by steady alcohol consumption trends and popularity of premium bar accessories. British consumers have shown interest in both traditional openers and modern multipurpose variants. Hospitality businesses such as pubs and restaurants remain leading buyers, ensuring recurrent demand. Collectible openers themed around sports clubs and entertainment franchises have further diversified sales channels. Manufacturers and distributors have emphasized online sales platforms, where kitchen accessories including openers are sold extensively. It is judged that design oriented offerings, often marketed as gifts, have secured an important share of market growth in the United Kingdom.

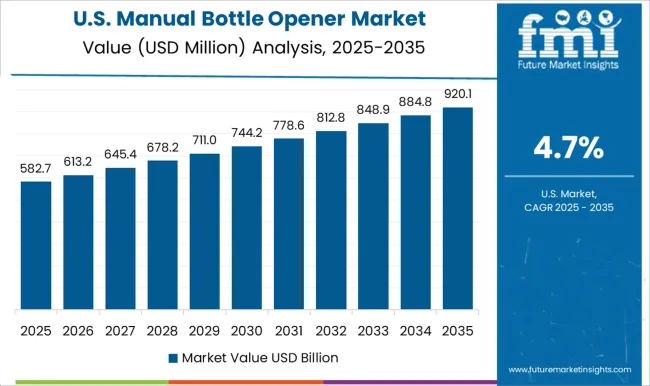

The market in the United States is anticipated to grow at a CAGR of 4.7%, influenced by changing beverage consumption patterns and consumer preference for personalized accessories. Although canned drinks have increased in popularity, bottles still account for a major share in beer and specialty beverage sales, sustaining demand for openers. U S consumers show high interest in novelty and branded openers, often linked with sports teams, breweries, or tourist destinations. Hospitality establishments, including restaurants and bars, remain consistent buyers of durable opener designs. Domestic companies as well as overseas suppliers compete in this market, ensuring a wide range of pricing and style options. The US market is considered mature, but continues to present opportunities through customization and branding.

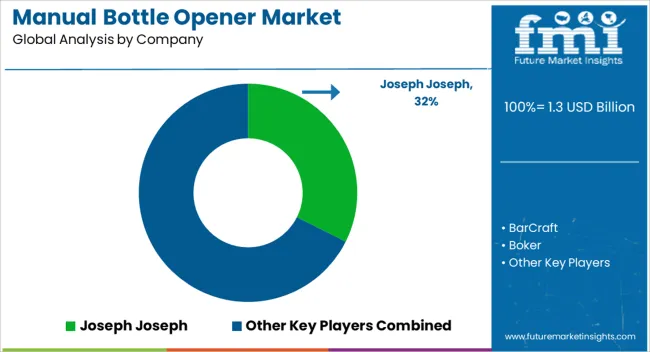

The market features a blend of established kitchenware brands, lifestyle product innovators, and specialized manufacturers offering both functional and design focused solutions. OXO International, Joseph Joseph, and Le Creuset are notable for premium quality openers that combine ergonomic design with durability, appealing to modern households. Oster and Kohler extend the category with products that integrate style and practicality, targeting everyday consumer use. BarCraft, True Fabrications, and The Bottle Opener Company emphasize novelty and gifting solutions, strengthening their presence in hospitality and retail.

Corkcicle and Zoku enhance the lifestyle element by offering contemporary designs that align with modern beverage culture. Motta and Boker, with European craftsmanship, bring professional grade openers to bartenders and collectors. The market is increasingly shaped by consumer preference for aesthetically appealing, long lasting, and easy to use designs, with brands competing on innovation, functionality, and brand heritage. This diverse competitive landscape highlights both global leaders and niche specialists in manual bottle opening solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Product Type | Traditional bottle openers, Keychain bottle openers, Wall-mounted openers, and Others (multi tool bottle openers, etc.) |

| Material | Stainless steel, Aluminum, Plastic, and Others (wood, etc.) |

| Price Range | Mid, Low, and High |

| End-use | Households, Bars and restaurants, Outdoor enthusiasts, and Others (collectors and hobbyists, etc.) |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Joseph Joseph, BarCraft, Boker, Corkcicle, Godinger, Kohler, Le Creuset, Le Creuset Group, Motta, Oster, OXO International, The Bottle Opener Company, Tovolo, True Fabrications, and Zoku |

| Additional Attributes | Dollar sales by opener type and application, demand dynamics across household, commercial, and hospitality sectors, regional trends in kitchenware and bar tool adoption, innovation in ergonomic design, material durability, and multifunctionality, environmental impact of metal and plastic use in production, and emerging use cases in promotional merchandise, travel accessories, and specialty beverage packaging solutions. |

The global manual bottle opener market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the manual bottle opener market is projected to reach USD 2.3 billion by 2035.

The manual bottle opener market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in manual bottle opener market are traditional bottle openers, keychain bottle openers, wall-mounted openers and others (multi tool bottle openers, etc.).

In terms of material, stainless steel segment to command 54.3% share in the manual bottle opener market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Manual Control Valve Market Size and Share Forecast Outlook 2025 to 2035

Manual Lifting Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Manual Wafer Aligner Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Manual Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Manual cutting equipment Market Size and Share Forecast Outlook 2025 to 2035

Manual Transmission Market Size and Share Forecast Outlook 2025 to 2035

Manual Resuscitator Market Growth – Size, Trends & Forecast 2024-2034

Instrument Detergents for Manual Cleaning Market Report – Trends & Innovations 2025 to 2035

Bottle Sealing Wax Market Size and Share Forecast Outlook 2025 to 2035

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Bottle Shippers Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sticker Labelling Machine Market Size and Share Forecast Outlook 2025 to 2035

Bottle Dividers Market Size and Share Forecast Outlook 2025 to 2035

Bottle Jack Market Size and Share Forecast Outlook 2025 to 2035

Bottles Market Analysis - Growth & Forecast 2025 to 2035

Bottle Capping Machine Market Analysis by Automation, Operating Speed, Machine Type, End-use Industry, and Region Forecast Through 2035

Market Share Distribution Among Bottle Dividers Suppliers

Bottle Carrier Market Trends – Growth & Forecast 2024-2034

Bottle Cap Market Analysis & Industry Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA