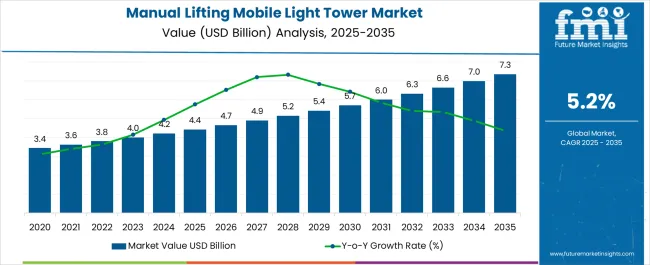

The manual lifting mobile light tower market, valued at USD 4.4 billion in 2025 and forecast to reach USD 7.3 billion by 2035 at a CAGR of 5.2%, exhibits characteristics indicative of a market in the growth-to-maturity phase of its lifecycle. Early adoption has stabilized, as evidenced by steady annual increases from USD 4.4 billion in 2025 to USD 4.9 billion in 2027. The moderate but consistent growth trajectory reflects gradual penetration across construction, industrial, and emergency applications, with adoption influenced by incremental upgrades to mobile lighting solutions rather than disruptive technology shifts.

From 2028 to 2031, the market demonstrates the expansion stage of maturity, with values rising from USD 5.2 billion to USD 6.0 billion. This period indicates wider acceptance in secondary markets and rising replacement cycles of older light towers. The adoption lifecycle suggests that the market is moving toward saturation in core regions, while emerging regions provide incremental growth potential. Post-2032, the market exhibits characteristics of late growth approaching maturity, with incremental increases from USD 6.3 billion in 2032 to USD 7.3 billion by 2035.

Growth is driven primarily by replacement demand and incremental technological enhancements, such as lightweight materials and improved manual lifting mechanisms, rather than first-time adoption. The market demonstrates a controlled and predictable adoption curve, signaling stability and gradual consolidation in the competitive landscape.

| Metric | Value |

|---|---|

| Manual Lifting Mobile Light Tower Market Estimated Value in (2025 E) | USD 4.4 billion |

| Manual Lifting Mobile Light Tower Market Forecast Value in (2035 F) | USD 7.3 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The manual lifting mobile light tower market has been positioned as a functional segment within global construction and industrial equipment, valued for cost efficiency and ease of operation. Within the overall light tower market, manual lifting models hold about 5.2%, largely supported by demand in small and mid-scale construction sites. In the broader mobile lighting equipment sector, the segment represents 4.6%, driven by preference for simple deployment without hydraulic or electric systems. Across the rental construction equipment market, manual lifting towers account for around 3.1%, showing their suitability for short-term use. In the mining and quarry equipment sector, this share is assessed at 2.7%, reflecting usage in low-cost operations.

Within the emergency and disaster relief equipment market, the share is approximately 2.3%, given their portability and minimal maintenance needs. Recent developments in the manual lifting mobile light tower market have been shaped by innovations in durability, fuel efficiency, and lighting performance. Groundbreaking strategies include the adoption of LED-based light heads that improve illumination while lowering fuel consumption. Key manufacturers are integrating hybrid designs with battery support to reduce reliance on diesel engines. The market has also seen design improvements in manual lifting systems, offering enhanced stability and faster setup. Rental companies have played a central role in expanding deployment, targeting cost-sensitive projects in remote areas.

Partnerships between lighting solution providers and construction contractors are emerging to standardize manual towers in temporary work zones. The increasing use of corrosion-resistant materials and compact trailer designs is further extending the appeal of these towers across the construction, infrastructure, and emergency response sectors.

The manual lifting mobile light tower market is growing steadily, supported by the expanding demand for portable lighting solutions in infrastructure development, mining, and emergency response operations. The market benefits from the versatility and cost-efficiency of manual lifting systems, which require minimal maintenance and are easier to deploy compared to automated variants. Current adoption is driven by large-scale construction projects, night-time operations, and outdoor events requiring reliable illumination.

The growing emphasis on operational flexibility and extended working hours in industrial and commercial projects has further reinforced demand. Future growth is expected to be fueled by product innovations aimed at improving durability, light coverage, and fuel efficiency, along with increasing adoption in remote and off-grid applications.

The market is also benefiting from rental service expansion, making mobile light towers more accessible to small and medium-sized contractors. The segment is positioned for sustained growth as industries prioritize reliable and cost-effective lighting solutions.

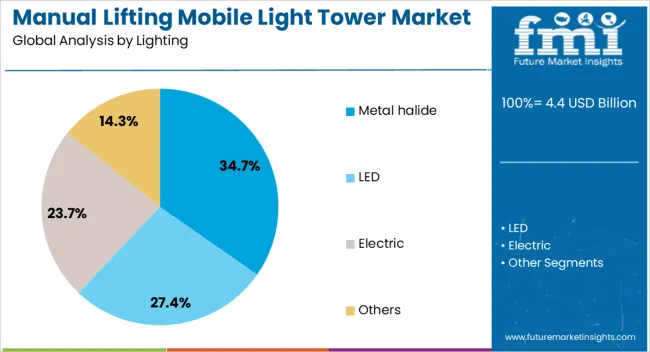

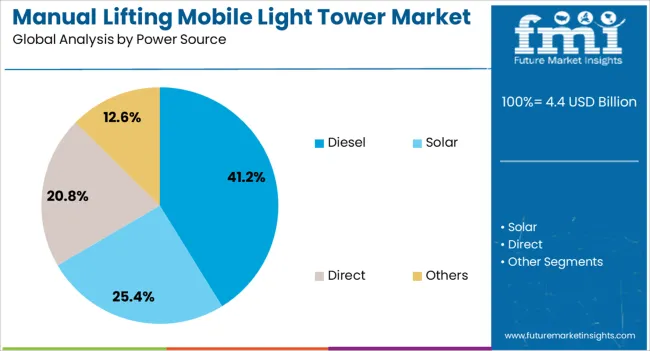

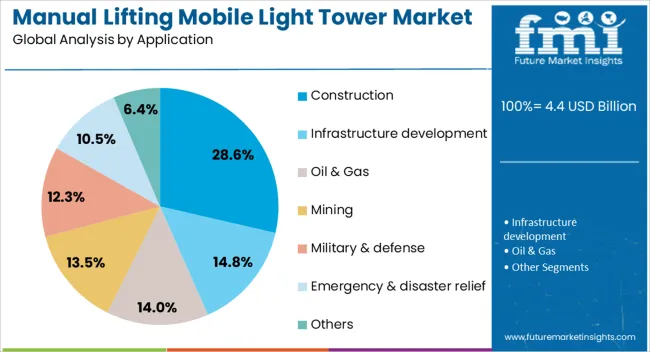

The manual lifting mobile light tower market is segmented by lighting, power source, application, and geographic regions. By lighting, manual lifting mobile light tower market is divided into Metal halide, LED, Electric, and Others. In terms of power source, manual lifting mobile light tower market is classified into Diesel, Solar, Direct, and Others. Based on application, manual lifting mobile light tower market is segmented into Construction, Infrastructure development, Oil & Gas, Mining, Military & defense, Emergency & disaster relief, and Others. Regionally, the manual lifting mobile light tower industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The metal halide segment leads the lighting category, holding approximately 34.7% share of the manual lifting mobile light tower market. Its dominance is attributed to high-intensity illumination, wide beam coverage, and proven reliability in outdoor operations.

Metal halide lamps are widely favored for construction sites, road maintenance, and event lighting due to their ability to deliver bright, uniform light over large areas. The segment’s established supply chain and cost-effective performance have reinforced its adoption across industries, despite increasing competition from LED-based alternatives.

The segment’s growth is supported by its ability to function effectively in diverse weather conditions, making it a dependable choice for critical operations. While gradual shifts toward energy-efficient lighting technologies are evident, the metal halide segment continues to maintain a strong market presence, particularly in applications prioritizing initial cost over long-term energy savings.

The diesel segment dominates the power source category with approximately 41.2% share, owing to its reliability, fuel availability, and ability to operate in remote, off-grid locations. Diesel-powered mobile light towers are preferred in large-scale projects where uninterrupted operation is critical, such as mining, construction, and disaster relief.

The segment’s market position is strengthened by its long runtime, ease of refueling, and compatibility with high-output lighting systems. Its adoption is further supported by a robust global distribution network for diesel fuel and machinery maintenance services.

Despite growing interest in hybrid and solar-powered alternatives, diesel remains the preferred choice for heavy-duty and high-intensity lighting requirements. With sustained demand from industries operating in remote locations, the diesel segment is expected to retain a significant share in the near term.

The construction segment holds approximately 28.6% share in the application category, driven by the sector’s requirement for extended operational hours and reliable lighting in outdoor and remote sites. Manual lifting mobile light towers are extensively used for infrastructure development, road building, and large-scale construction projects, where portability and quick setup are essential.

The segment’s growth is supported by rising urbanization, government investments in public infrastructure, and private sector expansion in commercial and residential projects. Construction applications also benefit from rental availability, allowing smaller contractors to access high-quality lighting without large capital expenditure.

With the sector’s continued growth in emerging markets and the increasing scale of projects, the construction segment is expected to maintain a leading position in the manual lifting mobile light tower market.

The market is gaining traction due to its cost-effectiveness and operational flexibility across construction, mining, oil and gas, and emergency response applications. These towers are designed with a manually operated mast system, making them simple to use and maintain, particularly in regions where automation is less prioritized. Their portability and adaptability in off-grid and remote locations enhance their demand. The market is further supported by increased use in night-time infrastructure projects, outdoor events, and disaster management operations. Rising emphasis on durable, fuel-efficient, and easy-to-operate lighting solutions continues to shape the industry landscape.

The demand for manual lifting mobile light towers is being strongly driven by infrastructure expansion and mining activities that require reliable illumination in remote areas. These towers provide adequate lighting during night shifts, enhancing worker productivity and safety in difficult environments. Their manually operated mast systems keep operational costs lower compared to hydraulic or electric variants. Construction companies often prefer them for roadwork, pipeline installations, and tunnel projects due to their rugged design and ease of deployment. In mining operations, they ensure continuous visibility for extraction processes. With rising global infrastructure projects, construction and mining applications are set to remain vital growth drivers.

Oil and gas exploration sites and industrial facilities are adopting manual lifting mobile light towers for reliable lighting solutions in off-grid areas. Their ability to withstand harsh weather conditions and challenging terrains adds to their utility. Industrial operators prefer manual lifting systems due to low maintenance requirements and reduced mechanical complexity. They are particularly effective in temporary setups such as drilling rigs, refinery expansions, and shutdown maintenance operations. Portability allows rapid relocation within sites, ensuring operational continuity. The global push for enhanced worker safety in oil and gas industries continues to support steady adoption of these towers, strengthening market expansion.

Manual lifting mobile light towers are finding increasing applications in emergency response and disaster relief situations. Their ability to provide rapid illumination during floods, earthquakes, and other crises makes them valuable for rescue teams. They are often used by military units, civil defense organizations, and humanitarian agencies for nighttime operations in disaster zones. Their simple setup and manual mast adjustment make them reliable in regions where technical support is limited. In addition, their durability ensures dependable use during prolonged rescue operations. As global incidents of natural disasters and emergencies rise, demand for portable and quickly deployable light towers is accelerating.

Outdoor events, concerts, and public gatherings are contributing to growing demand for manual lifting mobile light towers. Organizers require cost-effective and flexible lighting systems for temporary setups. These towers are often chosen due to their mobility, ease of assembly, and ability to cover large areas with consistent illumination. Public infrastructure projects such as road maintenance, metro expansions, and airport worksites also rely on these towers for nighttime visibility. Municipal authorities use them for safety during festivals and emergency roadwork. The broadening use across entertainment and public infrastructure projects highlights the versatile role of manual lifting mobile light towers in urban and rural applications.

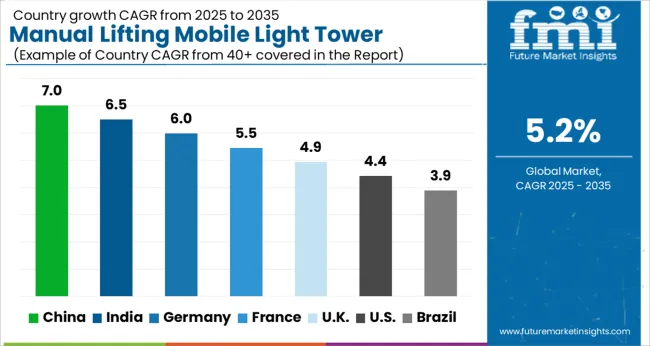

| Countries | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The market is projected to grow at a CAGR of 5.2% during 2025 to 2035, driven by increasing demand for portable and efficient lighting solutions in construction, mining, and outdoor events. China leads with 7.0%, fueled by large-scale infrastructure projects and industrial expansion. India follows at 6.5%, supported by rapid urban development and construction activities. Germany records 6.0%, where safety regulations and industrial efficiency standards drive adoption. The UK stands at 4.9%, while the USA at 4.4% benefits from maintenance-intensive industries and rental services. Rising focus on energy-efficient and easy-to-deploy lighting solutions is expected to sustain growth globally. This report includes insights on 40+ countries; the top markets are shown here for reference.

China registered a 7.0% CAGR, driven by growing demand in construction, mining, and outdoor industrial applications. Manufacturers focused on high durability, portable, and energy-efficient light towers suitable for diverse site conditions. Adoption was highest among construction firms, infrastructure projects, and outdoor event management companies. Competitive strategies emphasized compact designs, rapid deployment, and collaborations with rental service providers. Research and development targeted LED integration, fuel efficiency, and ease of operation. Expanding urban infrastructure and large-scale construction projects further accelerated adoption, while domestic manufacturers strengthened distribution networks to ensure availability across industrial hubs and remote locations.

India progressed with a 6.5% CAGR, supported by increasing construction activities, road projects, and industrial site illumination needs. Manufacturers emphasized lightweight, mobile, and fuel-efficient designs for easy deployment in challenging terrains. Adoption was highest among contractors, event management companies, and mining operators. Competitive strategies included partnerships with rental services, regional distribution networks, and customer training programs for safe operation. Research focused on LED lighting, portability, and energy optimization. Government infrastructure projects, including highways and urban development, further boosted market demand, while manufacturers targeted semi-urban and rural areas with durable and low-maintenance solutions.

Germany advanced at a 6.0% CAGR, driven by industrial construction, event management, and emergency response applications. Manufacturers prioritized compact, durable, and energy-efficient light towers with advanced LED technology. Adoption was highest among construction companies, outdoor events, and municipalities for road and site illumination. Competitive strategies emphasized compliance with EU safety standards, environmental efficiency, and collaboration with rental service providers. Innovation in battery backup, mobility, and ease of assembly improved operational efficiency. Germany’s focus on industrial automation and urban infrastructure projects further promoted adoption of technologically advanced manual lifting mobile light towers.

The United Kingdom recorded a 4.9% CAGR, influenced by construction, maintenance, and outdoor event illumination demand. Manufacturers emphasized mobile, lightweight, and fuel-efficient light towers suitable for urban and rural applications. Adoption was highest among construction firms, municipalities, and event organizers. Competitive strategies focused on product durability, ease of deployment, and collaborations with rental companies. Research targeted LED technology, energy efficiency, and portability improvements. Government initiatives for road safety and urban infrastructure projects further encouraged adoption, while compact and user-friendly designs strengthened market penetration in both public and private sectors.

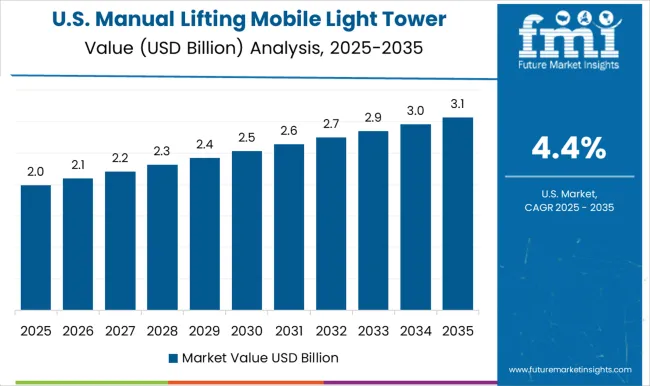

The United States achieved a 4.4% CAGR, driven by construction, emergency response, and outdoor industrial applications. Manufacturers invested in durable, mobile, and energy-efficient designs, integrating LED lighting and fuel-saving technologies. Adoption was highest among contractors, event organizers, and municipalities. Competitive strategies included partnerships with rental service providers, regional distribution, and customer training for safe operation. Research focused on improving portability, battery backup, and deployment speed. Infrastructure expansion, outdoor industrial sites, and event management demand further supported market growth, while compact and easy-to-use designs facilitated adoption across diverse operational environments.

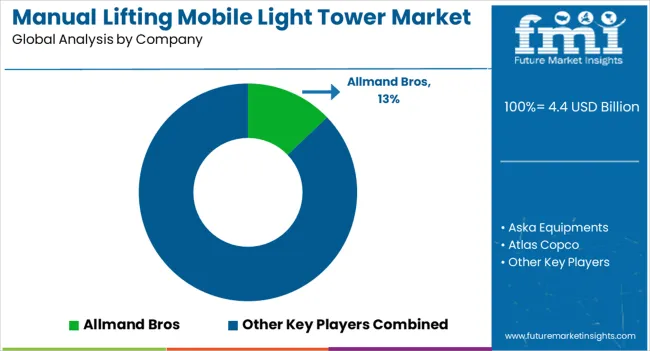

The market has been shaped by global construction equipment leaders and regional specialists, competing on durability, mobility, and illumination efficiency. Allmand Bros, Atlas Copco, and Caterpillar have focused on high performance lighting systems with robust frames, corrosion resistance, and reliable operation under harsh environments. Their strategies emphasize ease of transport, rapid deployment, and low maintenance requirements. Chicago Pneumatic and Doosan Portable Power have targeted industrial and construction applications, highlighting compact designs and fuel-efficient power units.

Regional players, including Aska Equipment, Colorado Standby, DMI, HIMOINSA, Inmesol gensets, and Generac Power Systems, have differentiated themselves through localized manufacturing, cost-effective solutions, and flexible mast designs. Product brochures consistently highlight adjustable height, high lumen output, and battery or diesel-powered operation. Emphasis is placed on quick setup, minimal manpower requirements, and compliance with safety standards. Atlas Copco and Caterpillar emphasize ruggedness and long operational life, while Allmand Bros and Generac focus on portability and rapid deployment for temporary worksites. Competition revolves around illumination efficiency, structural robustness, and operational convenience. HIMOINSA and Inmesol promote energy-efficient lamps and modular power systems. Chicago Pneumatic and DMI emphasize low noise and vibration operation for urban deployment.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.4 Billion |

| Lighting | Metal halide, LED, Electric, and Others |

| Power Source | Diesel, Solar, Direct, and Others |

| Application | Construction, Infrastructure development, Oil & Gas, Mining, Military & defense, Emergency & disaster relief, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Allmand Bros, Aska Equipments, Atlas Copco, Caterpillar, Chicago Pneumatic, Colorado Standby, DMI, Doosan Portable Power, Generac Power Systems, HIMOINSA, and Inmesol gensets |

| Additional Attributes | Dollar sales by tower type and application, demand dynamics across construction, mining, and event management sectors, regional trends in portable lighting adoption, innovation in manual lifting mechanisms, LED integration, and energy efficiency, environmental impact of fuel consumption and emissions, and emerging use cases in temporary work sites, emergency response, and remote outdoor operations. |

The global manual lifting mobile light tower market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the manual lifting mobile light tower market is projected to reach USD 7.3 billion by 2035.

The manual lifting mobile light tower market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in manual lifting mobile light tower market are metal halide, led, electric and others.

In terms of power source, diesel segment to command 41.2% share in the manual lifting mobile light tower market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Manual Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Solar Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Metal Halide Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Portable Light Towers Market

Commercial Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Metal Halide Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Mobile Camping Toilet Market Size and Share Forecast Outlook 2025 to 2035

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

Tower Vibration Control System Market Size and Share Forecast Outlook 2025 to 2035

Light Pipe Mould Market Size and Share Forecast Outlook 2025 to 2035

Lightning Surge Protector Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Manual Control Valve Market Size and Share Forecast Outlook 2025 to 2035

Light Therapy Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA