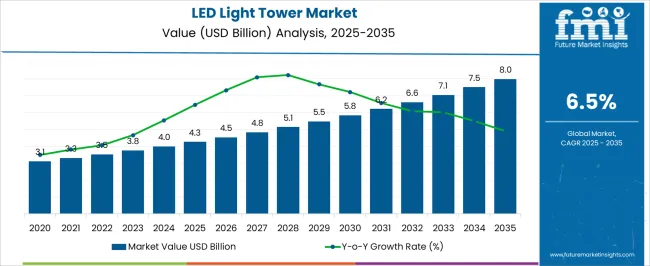

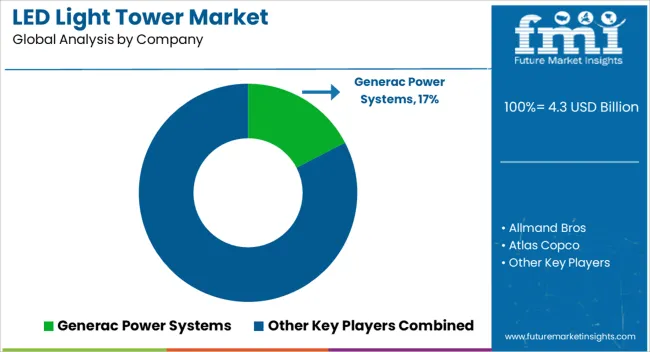

The LED light tower market is projected to reach USD 4.3 billion in 2025 and USD 8.0 billion by 2035, expanding at a CAGR of 6.5% during the forecast period. Breakpoint analysis highlights that the market transitions through distinct growth phases shaped by infrastructure expansion, industrial adoption, and technological refinement. Between 2025 and 2028, the industry will be in a consolidation stage, as demand is anticipated to be largely driven by construction sites, mining operations, and outdoor events requiring portable and energy-efficient lighting.

From 2029 to 2032, growth is expected to accelerate with the adoption of hybrid and solar-powered towers, as rising fuel costs and stricter emission regulations push companies to transition away from conventional diesel-based models.

The final phase, stretching from 2033 to 2035, emphasizes maturity and premiumization, as demand increasingly comes from smart, automated towers with IoT connectivity, remote monitoring, and longer operational lifespans. Market expansion is not only tied to core industrial applications but also to emerging adoption across disaster management, military operations, and large-scale outdoor events.

E-commerce platforms and rental services are enhancing accessibility for SMEs, signaling a shift toward service-based business models. In essence, the LED light tower market moves through a dynamic trajectory, where technological evolution, regulatory compliance, and sustainability-oriented purchasing patterns drive stepwise growth across each breakpoint.

| Metric | Value |

|---|---|

| LED Light Tower Market Estimated Value in (2025 E) | USD 4.3 billion |

| LED Light Tower Market Forecast Value in (2035 F) | USD 8.0 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The LED light tower market derives its demand from five major end-use sectors, each contributing a distinct percentage share to the industry’s overall expansion. The construction and infrastructure sector holds the largest share at 34%, driven by continuous demand for reliable, mobile lighting across roadworks, building sites, and urban projects. The mining and quarrying industry follows with 26%, as large-scale excavation and night-shift operations rely on rugged light towers for safety and productivity in remote, off-grid areas.

The oil, gas, and energy sector contributes 18%, with usage in refineries, drilling sites, and power plants, particularly in regions where uninterrupted lighting is essential for operational safety and compliance. The event and entertainment segment represents 12%, reflecting adoption in outdoor concerts, sports events, and festivals, where rental-based services are a key driver of demand. The remaining 10% comes from emergency and disaster relief applications, where portable light towers play a crucial role in rescue operations, military missions, and recovery efforts in crisis zones.

The market is experiencing significant growth, supported by rising demand for energy-efficient, portable lighting systems across infrastructure development, mining, oil and gas, and emergency services. The shift towards sustainable lighting technologies is driving the replacement of conventional halogen or metal halide units with LED variants due to their superior energy efficiency, longer operational life, and lower maintenance costs.

Governments and the private sector are investing heavily in infrastructure, particularly in remote and underdeveloped areas, which is contributing to increased adoption. Moreover, the ability of LED light towers to operate in off-grid conditions with minimal energy consumption is expanding their utility in disaster response and nighttime operations.

With construction timelines stretching into night shifts and heightened safety protocols in industrial zones, LED light towers are becoming an essential asset. These factors, combined with advancements in lighting control systems and durable modular designs, are expected to sustain long-term demand across multiple end-use scenarios.

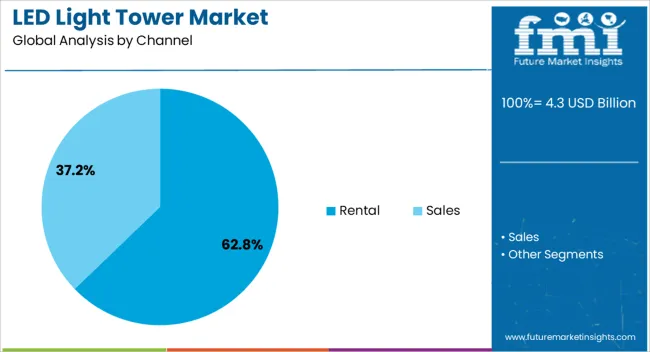

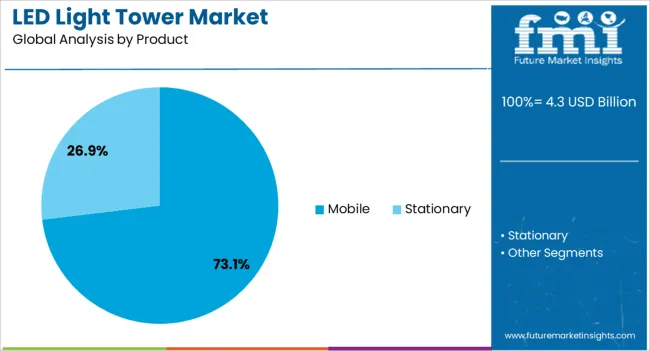

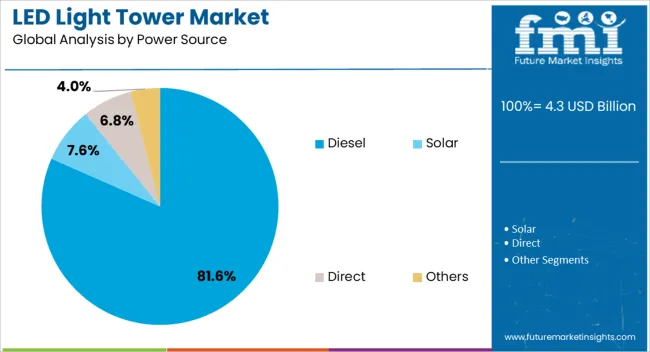

The LED light tower market is segmented by channel, product, power source, technology, application, and geographic regions. By channel, the LED light tower market is divided into Rental and Sales. In terms of product, the LED light tower market is classified into Mobile and Stationary. Based on power source, the LED light tower market is segmented into Diesel, Solar, Direct, and Others.

By technology, the LED light tower market is segmented into Hydraulic lifting systems and Manual lifting systems. By application, the LED light tower market is segmented into Construction, Infrastructure development, Oil & Gas, Mining, Military & defense, Emergency & disaster relief, and Others. Regionally, the LED light tower industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rental segment is anticipated to account for 62.8% of the LED Light Tower market revenue in 2025, establishing itself as the dominant channel. This growth is being attributed to the increasing preference among end users to access light towers on a project basis rather than owning them outright.

Temporary lighting needs for short-term infrastructure, events, emergency relief, and seasonal mining operations have made rentals more cost-effective and operationally efficient. Rental service providers are continuously updating fleets with LED models, which offer better reliability and reduced fuel consumption.

The ability to scale lighting needs quickly without capital expenditure is supporting rental growth, particularly in emerging economies and high-turnover job sites. As companies aim to reduce asset ownership burdens and adopt a more flexible cost model, the rental channel is expected to remain the primary mode of deployment for LED light towers.

The mobile segment is projected to hold 73.1% of the total LED Light Tower market share in 2025, making it the leading product category. The widespread use of mobile LED towers in construction, mining, infrastructure, and emergency response operations has contributed significantly to this dominance.

Their ease of transport, rapid deployment, and ability to operate in diverse terrain conditions have made them the preferred choice across industries. Mobile units equipped with LED technology offer extended runtime, improved visibility, and reduced environmental impact, which aligns with evolving industry standards.

As operational flexibility and quick setup remain critical for temporary and large-scale projects, the mobile segment is expected to continue leading the market. Additionally, rising investments in public infrastructure and disaster preparedness programs are further encouraging the deployment of mobile LED towers in both urban and remote areas.

The diesel-powered segment is expected to represent 81.6% of the LED Light Tower market revenue in 2025, securing its place as the most dominant power source. This segment's leadership is being driven by its ability to deliver consistent and reliable performance in off-grid and remote environments where electrical infrastructure is limited or unavailable.

Diesel units are valued for their long runtime, higher power output, and ability to operate independently for extended durations, making them ideal for construction sites, mining fields, and outdoor events. Despite increasing attention towards hybrid and solar alternatives, diesel-powered LED towers continue to be favored due to their durability and widespread refueling infrastructure.

Their compatibility with high-lumen LED arrays ensures optimal performance even under demanding operational conditions. As large-scale outdoor projects remain reliant on uninterrupted lighting, diesel-powered units are expected to retain their stronghold in the market for the foreseeable future.

The LED light tower market is driven by construction and energy projects, events demand, and strict regulatory frameworks. Dependable, efficient lighting remains the central pillar shaping future adoption.

The LED light tower market is primarily driven by the rising demand across construction and large-scale infrastructure projects worldwide. Continuous investments in roadworks, mining sites, airports, and railways create a consistent need for mobile lighting systems that ensure safety and productivity during night shifts and in poorly lit environments. With increasing emphasis on worker safety regulations, contractors and project managers prefer efficient and durable lighting solutions that meet compliance requirements. The strong adaptability of LED light towers to diverse site conditions, ranging from urban projects to remote mining operations, further enhances their adoption rate. Their longer lifespan and ability to operate under extreme conditions contribute significantly to market growth.

Oil and gas exploration and production sites are another major consumer of LED light towers due to their reliance on round-the-clock operations. From upstream drilling activities to midstream pipeline construction and downstream refining, proper illumination is critical for safety and operational efficiency. As new exploration projects expand into offshore and desert environments, the requirement for rugged, mobile, and high-intensity lighting solutions grows steadily. LED light towers stand out for their lower power consumption, reduced maintenance, and ability to withstand harsh climatic conditions. Energy companies are increasingly deploying these towers to minimize downtime while ensuring workforce safety in hazardous zones, reinforcing their demand globally.

A significant portion of the LED light tower demand also stems from temporary events, entertainment venues, sports tournaments, and outdoor festivals. Organizers prefer LED towers due to their ability to provide uniform, glare-free lighting with minimal noise emissions. Their portability makes them suitable for rapid installation and dismantling, which is vital for short-term use. Seasonal events, including cultural fairs and sporting leagues, further push this demand, particularly in regions like North America and Europe where large outdoor gatherings are common. As safety standards for public events tighten, reliable lighting systems become mandatory, positioning LED towers as a preferred choice for enhancing visibility, crowd safety, and operational convenience.

Government regulations play a critical role in shaping the LED light tower market. Mandatory workplace safety codes in construction, mining, and industrial activities require proper lighting, directly fueling adoption. Additionally, increasing focus on reducing energy consumption and emissions has resulted in stricter efficiency benchmarks for lighting equipment. Manufacturers are compelled to design towers that meet these standards, leading to faster replacement of older diesel-based towers with modern LED alternatives. Subsidies, tax benefits, and incentives offered by some governments for energy-efficient equipment also support this transition. This dynamic regulatory framework ensures consistent demand while also pushing suppliers to innovate in design, durability, and operational efficiency.

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

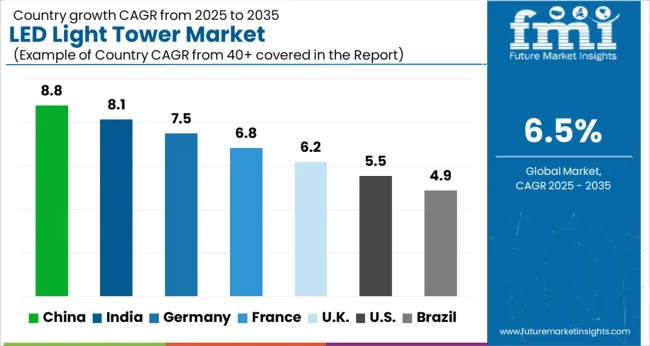

The global LED light tower market is projected to grow at a CAGR of 6.5% from 2025 to 2035. China leads with 8.8%, followed by India at 8.1%, Germany at 7.5%, France at 6.8%, the UK at 6.2%, and the USA at 5.5%. Growth is supported by strong adoption across construction, mining, oil and gas, and event applications. China remains the dominant hub, driven by its vast infrastructure projects, rapid industrial expansion, and government-backed initiatives for energy-efficient equipment. India is emerging as a fast-growing market, fueled by urban infrastructure development, highway projects, and renewable energy sites. Germany and France showcase steady momentum, emphasizing high-quality manufacturing and strict workplace safety standards, while the UK focuses on event-driven demand and construction compliance. The USA market reflects moderate yet steady growth, supported by large-scale construction projects and regulatory compliance in safety lighting. The analysis includes more than 40 countries, with the leading markets highlighted below.

The LED light tower market in China is projected to grow at a CAGR of 8.8% from 2025 to 2035, driven by large-scale infrastructure projects, mining expansion, and government-backed industrial development. China’s rapid urbanization and the execution of megaprojects such as smart cities and transport corridors create consistent demand for energy-efficient lighting solutions. The adoption of LED towers is further supported by stricter safety regulations on construction sites, encouraging the shift from conventional diesel-powered lighting to LED-based systems. Domestic manufacturers are scaling production with improved efficiency, durability, and cost-effectiveness to serve both domestic and export markets. Renewable energy projects, along with nighttime road construction, add to growth opportunities. China will continue to be the global hub for LED light tower manufacturing, combining volume leadership with rising innovation.

The LED light tower market in India is forecasted to grow at a CAGR of 8.1% from 2025 to 2035, supported by expanding infrastructure, road construction, and mining projects. India’s booming highway development under Bharatmala, renewable energy projects, and urban redevelopment are creating steady demand for reliable mobile lighting solutions. The mining sector in states such as Odisha, Chhattisgarh, and Jharkhand increasingly relies on LED towers to enhance safety and improve operational efficiency during nighttime operations. Local manufacturers are strengthening their capabilities to provide cost-competitive products, while international players are forming joint ventures to tap into this high-growth market. Government incentives for energy-efficient technologies are further encouraging adoption. India is set to become one of the fastest-growing markets for LED light towers, reflecting its infrastructure ambitions.

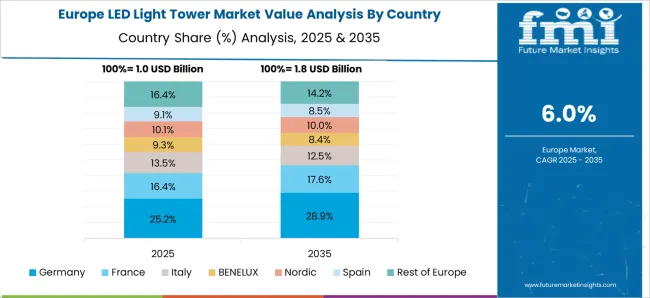

The LED light tower market in France is projected to grow at a CAGR of 6.8% from 2025 to 2035, driven by demand across construction, industrial, and public event applications. France places strong emphasis on worker safety and environmental compliance, which is boosting the transition from conventional lighting to energy-efficient LED solutions. Large-scale construction projects in Paris, Lyon, and Marseille, as well as transport infrastructure expansion, are key demand drivers. France’s vibrant events sector, spanning sports, concerts, and festivals, uses LED towers to provide reliable, low-emission lighting. Domestic and European suppliers are focusing on high-quality, durable, and eco-friendly designs to align with EU regulations. France’s focus on efficiency, compliance, and cultural events ensures stable market growth with a premium edge.

The LED light tower market in the UK is expected to grow at a CAGR of 6.2% from 2025 to 2035, supported by public infrastructure upgrades, construction compliance requirements, and event-related demand. Major urban regeneration projects in London, Birmingham, and Manchester require energy-efficient lighting to maintain safety standards during night operations. The UK’s thriving entertainment and sporting events sector, such as music festivals and Premier League matches, creates consistent demand for mobile LED towers. Adoption is further driven by government regulations emphasizing workplace safety and sustainability. Domestic suppliers are innovating with hybrid and solar-integrated LED towers to meet future requirements. The UK market grows at a steady pace, its emphasis on premium, compliant, and versatile lighting solutions makes it distinctive within Europe.

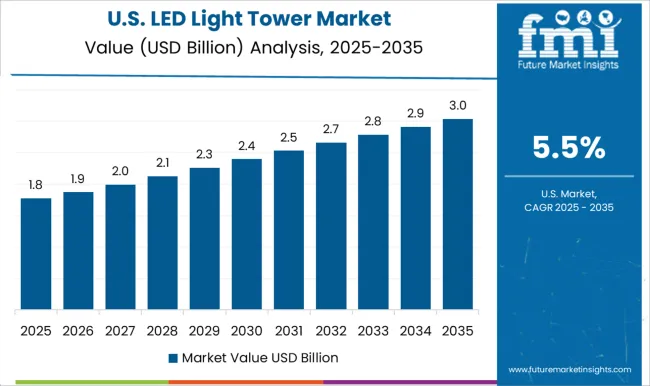

The LED light tower market in the USA is projected to grow at a CAGR of 5.5% from 2025 to 2035, driven by large-scale construction, oil and gas operations, and public infrastructure upgrades. Key projects include highway expansions, airport upgrades, and renewable energy installations, all of which require reliable mobile lighting systems. The USA also has significant demand from emergency response services and disaster recovery operations, where portable LED towers play a vital role. However, the market grows at a moderate pace compared to Asia, as higher equipment costs and longer replacement cycles slightly limit expansion. Leading players are focusing on advanced, fuel-efficient, and hybrid models to improve adoption. The USA will maintain steady growth, backed by infrastructure resilience and industrial applications.

Competition in the LED light tower market is defined by product efficiency, mobility, durability, and compliance with safety regulations across construction, mining, oil and gas, and event applications. Leading players such as Generac Power Systems, Allmand Bros, Atlas Copco, Caterpillar, and Chicago Pneumatic dominate through their broad product portfolios, global service networks, and strong brand credibility. These companies leverage advanced engineering and hybrid power integration to meet the rising demand for sustainable, cost-effective solutions. Regional specialists like Colorado Standby, DMI, and Youngman Richardson serve niche markets with tailored offerings, emphasizing localized support and cost competitiveness. Doosan Portable Power, HIMOINSA, and Inmesol gensets compete with strong diesel-powered and hybrid solutions, integrating reliability and high run-time performance suited for energy-intensive environments.

J C Bamford Excavators (JCB) adds competitive strength by integrating towers with its machinery ecosystem, improving construction site synergies. Mid-tier innovators such as Larson Electronics, Light Boy, Multiquip, and Trime differentiate through specialized designs, lightweight portability, and product adaptability for sectors such as entertainment and emergency response. Rental service providers like United Rentals capitalize on fleet availability, flexible leasing models, and maintenance services to capture temporary-use markets. Wacker Neuson reinforces its global footprint with a diverse mix of LED and hybrid towers, combining European engineering standards with international reach.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.3 Billion |

| Channel | Rental and Sales |

| Product | Mobile and Stationary |

| Power Source | Diesel, Solar, Direct, and Others |

| Technology | Hydraulic lifting system and Manual lifting system |

| Application | Construction, Infrastructure development, Oil & Gas, Mining, Military & defense, Emergency & disaster relief, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Generac Power Systems, Allmand Bros, Atlas Copco, Caterpillar, Chicago Pneumatic, Colorado Standby, DMI, Doosan Portable Power, HIMOINSA, Inmesol gensets, J C Bamford Excavators, Larson Electronics, Light Boy, Multiquip, Trime, United Rentals, Wacker Neuson, and Youngman Richardson |

| Additional Attributes | Dollar sales by region, share of top competitors, rental vs purchase demand trends, regulatory compliance impact, key end-user industries, pricing strategies, and growth opportunities. |

The global LED light tower market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the LED light tower market is projected to reach USD 8.0 billion by 2035.

The LED light tower market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in LED light tower market are rental and sales.

In terms of product, mobile segment to command 73.1% share in the LED light tower market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

LED Lamp Market Size and Share Forecast Outlook 2025 to 2035

LED Tube Market Size and Share Forecast Outlook 2025 to 2035

LEDPackaging Market Size and Share Forecast Outlook 2025 to 2035

LED Driver IC Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

LED Phosphor Material Market

LED Driver Market

LED Modular Display Market

LED Tester Market

LED Cable Market

LED Light Market Size and Share Forecast Outlook 2025 to 2035

LED Light Bar Market Analysis - Trends, Growth & Forecast 2025 to 2035

LED Lighting Controllers Market

LED Backlight Driver Market Size and Share Forecast Outlook 2025 to 2035

LED Backlight Display Driver ICs Market – Growth & Forecast 2025 to 2035

LED Neon Lights Market Size and Share Forecast Outlook 2025 to 2035

LED Grow Lights Market Analysis by Product, Installation Type, Application and Region Through 2035

LED and OLED lighting Products and Display Market – Growth & Forecast 2034

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

LED Driver for Lighting Market Analysis – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA