The LED lamp market is projected to increase from USD 40.5 billion in 2025 to USD 115.1 billion in 2035 at a CAGR of 11%. The compound absolute growth curve highlights steady gains, with values rising from 40.5 billion in 2025 to 49.9 billion in 2027 and 61.5 billion in 2029. This upward trajectory shows the accelerated adoption of energy-efficient lighting formats across commercial, residential, and public infrastructure projects. It is a clear indication that LED lamps are surpassing traditional lighting technologies, with buyers favoring long lifespan, lower operating costs, and reliable performance.

Demand consolidation appears inevitable. By 2030, the value touches 68.3 billion, advancing further to 75.8 billion in 2031 and 84.1 billion in 2032. Growth continues at pace with 93.4 billion in 2033 and 103.7 billion in 2034, culminating in 115.1 billion by 2035. This compound expansion underscores rising penetration of smart lighting ecosystems, supported by preference for adaptable and digitally controlled illumination. Absolute growth curve validates LED lamps as a cornerstone in future lighting solutions, where scalability and versatility set the pace for adoption. The pattern suggests a decisive shift, with long-term value anchored in both utility and design.

| Metric | Value |

|---|---|

| LED Lamp Market Estimated Value in (2025 E) | USD 40.5 billion |

| LED Lamp Market Forecast Value in (2035 F) | USD 115.1 billion |

| Forecast CAGR (2025 to 2035) | 11.0% |

The LED lamp segment is estimated to contribute nearly 28% of the global lighting market, about 12% of the electrical equipment market, close to 18% of the residential and commercial building fixtures market, nearly 15% of the automotive lighting market, and around 10% of the consumer electronics lighting components market. Taken together, these proportions represent an aggregated share of roughly 83% across its parent sectors.

Broad replacement demand, infrastructure projects, and the continuous transition from incandescent and fluorescent formats have driven their adoption. Their growing presence across residential, commercial, and automotive sectors is seen as strengthening supply chains for fixture manufacturers and influencing long-term procurement cycles.

This integration has transformed LED lamps into a backbone category, shaping both consumer preference and industrial investment patterns. As a result, their dominance in parent markets is expected to persist, reinforcing their role as a central pillar within lighting ecosystems and a defining element of competitive positioning for manufacturers worldwide.

The LED lamp market is experiencing steady expansion, propelled by the global transition toward energy-efficient lighting solutions and supportive regulatory measures targeting reduced carbon emissions. Industry developments and manufacturer announcements have emphasized technological improvements in LED performance, lifespan, and color rendering, making them a preferred choice over conventional lighting.

Declining production costs, coupled with large-scale manufacturing capabilities, have further enhanced market accessibility across residential, commercial, and industrial sectors. Government-led initiatives, including subsidy programs and phased bans on inefficient lighting, have accelerated adoption.

Consumer preference has also shifted toward LED lamps due to their low energy consumption and long operational life, aligning with broader sustainability goals. In addition, rapid e-commerce growth and improved product availability through online channels have expanded the consumer base. Demand is expected to be led by popular product formats such as A-type, mainstream adoption of standard LED technology, and increasing reliance on online retail platforms for lighting purchases.

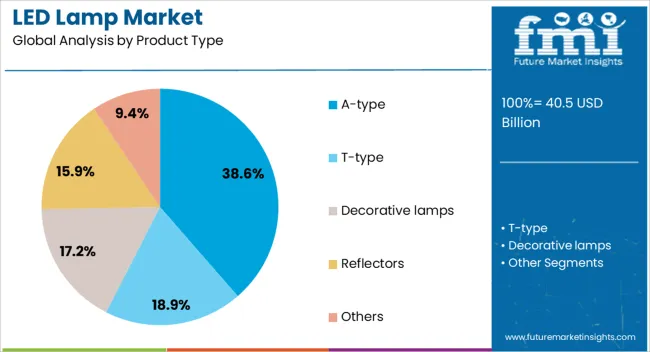

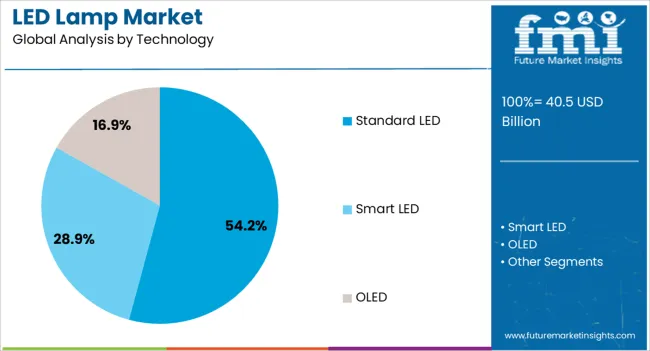

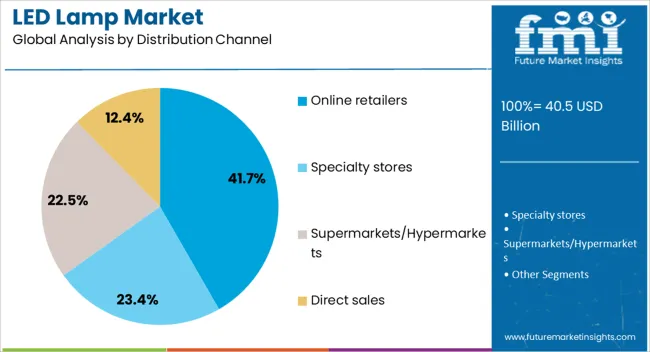

The LED lamp market is segmented by product type, technology, distribution channel, application, end-user, and geographic regions. By product type, the LED lamp market is divided into A-type, T-type, Decorative lamps, Reflectors, and Others. In terms of technology, the LED lamp market is classified into Standard LED, Smart LED, and OLED. Based on distribution channel, the LED lamp market is segmented into Online retailers, Specialty stores, Supermarkets/Hypermarkets, and Direct sales.

By application, the LED lamp market is segmented into Indoor lighting, Outdoor lighting, Automotive lighting, and Others. By end-user, the LED lamp market is segmented into Residential, Commercial, Industrial, and Government/Public. Regionally, the LED lamp industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The A-type segment is projected to hold 38.60% of the LED lamp market revenue in 2025, sustaining its leading position due to its widespread compatibility with existing lighting fixtures and broad application scope. Its dominance has been reinforced by the segment’s suitability for residential, commercial, and hospitality environments, where retrofit solutions are preferred for easy installation.

Lighting manufacturers have focused on producing A-type LEDs with higher lumen efficiency, improved color temperature options, and dimming capabilities, enhancing their appeal to end-users. Furthermore, their resemblance to traditional incandescent bulbs has eased the transition for consumers upgrading to energy-efficient alternatives.

Competitive pricing, frequent promotional offers, and wide availability in both offline and online channels have contributed to consistent demand. As global energy efficiency regulations continue to tighten, the A-type segment is expected to maintain steady growth, driven by its versatility and strong consumer acceptance.

The Standard LED segment is projected to account for 54.20% of the LED lamp market revenue in 2025, maintaining its market leadership through proven performance, cost efficiency, and widespread adoption. These LEDs are favored for general lighting applications due to their balance of brightness, energy efficiency, and affordability.

Advances in manufacturing processes have enabled consistent quality while reducing unit costs, making standard LEDs accessible to a wide consumer base. Industry updates have also highlighted ongoing improvements in luminous efficacy and heat dissipation, enhancing reliability and lifespan.

The scalability of production has allowed standard LEDs to dominate mass-market offerings, while their compatibility with various form factors supports diverse applications. As energy-saving legislation and public awareness drive demand for efficient lighting, the Standard LED segment is expected to remain the primary choice for cost-conscious and environmentally aware consumers.

The Online Retailers segment is projected to contribute 41.70% of the LED lamp market revenue in 2025, leading the distribution channel landscape due to the growing consumer shift toward e-commerce for lighting purchases. The convenience of comparing specifications, prices, and customer reviews online has encouraged higher adoption through digital platforms.

Retailers and manufacturers have expanded their online presence with detailed product listings, promotional discounts, and fast delivery options, catering to both individual consumers and bulk purchasers. Seasonal sales events, loyalty programs, and targeted advertising have further boosted online sales volumes.

Additionally, the rise of smart home integration has led to increased online searches and purchases of compatible LED products. With ongoing digital transformation and the expansion of direct-to-consumer sales models, the Online Retailers segment is expected to retain its dominant position, benefiting from accessibility, variety, and competitive pricing.

The LED lamp market is expected to advance strongly, driven by shifts in consumer preference, energy-efficient lighting policies, and the replacement of conventional lamps. Demand is stimulated by declining prices, enhanced durability, and wide adoption across residential, commercial, and industrial settings.

Opportunities have been created through integration in smart lighting systems, outdoor projects, and automotive applications. Trends point to miniaturization, improved color rendering, and design customization. Yet, challenges such as raw material fluctuations, competitive pricing pressure, and compliance with varied regulatory standards continue to shape the industry landscape.

Demand for LED lamps has been reinforced by their efficiency, longer operational life, and ability to deliver higher lumen output at lower power consumption. Governments promoting energy-efficient lighting adoption have influenced replacement cycles across residential and commercial applications. Industrial facilities and urban infrastructure projects have leaned on LED solutions for reliable illumination and reduced maintenance costs. Consumer acceptance has been accelerated by falling price points and availability of diverse product ranges, from bulbs to panel lights. Decorative applications in hospitality and retail have also strengthened demand, as LEDs offer both aesthetics and performance. With global awareness shifting toward efficiency-driven consumption, LED lamps are positioned as a preferred alternative, gaining steady traction against traditional halogen, fluorescent, and incandescent lighting solutions across multiple regions.

Opportunities in the LED lamp market are expanding as smart lighting and outdoor infrastructure adoption increase. Smart city initiatives, intelligent streetlights, and connected building systems have incorporated LEDs for their controllability and integration with sensors. Automotive manufacturers are integrating LED lamps for headlamps, tail lamps, and interior applications, recognizing both performance and design flexibility.

Opportunities lie in niche segments such as horticultural lighting and healthcare, where spectrum control is highly valued. Rapid growth in construction projects has offered further scope for large-scale LED adoption in commercial and residential complexes. Companies that leverage LEDs for connected ecosystems and advanced design elements are expected to secure a competitive advantage. This diversification of applications underscores why LED lamps are being positioned not merely as replacements but as enablers of future-oriented lighting solutions.

Trends shaping the LED lamp market are characterized by improved color rendering, miniaturization, and design flexibility. Manufacturers are offering tunable white and RGB solutions to enhance visual comfort and aesthetics in residential and commercial interiors. Miniaturized modules are being preferred in retail, automotive, and consumer electronics where sleek design is essential. The trend toward customized luminaires has strengthened brand differentiation as customers seek personalized lighting environments. Connected lighting systems linked with IoT platforms are also gaining visibility, as data-driven control adds efficiency to facility management. Decorative trends such as human-centric lighting and adaptive ambiance in workplaces and hospitality settings have pushed LEDs into premium categories. These evolving trends emphasize the shift from LEDs being evaluated purely on efficiency to being adopted as tools for creativity and experiential design.

Challenges in the LED lamp market arise from pricing pressure, raw material volatility, and regulatory complexities. Declining prices have benefited end-users but have created thin margins for manufacturers, especially smaller players. Volatile costs of rare earth phosphors, semiconductors, and driver components have further constrained profitability.

Compliance with regional standards such as RoHS, CE, and Energy Star has added to operational overheads for global suppliers. Intense competition from both established brands and low-cost regional producers has made differentiation difficult. Supply chain disruptions in semiconductors have highlighted vulnerabilities, restricting timely product availability. These challenges underline a structural issue in balancing affordability with quality and compliance. Without strong cost-control mechanisms and innovation in product positioning, market participants risk being overtaken in a highly commoditized industry landscape.

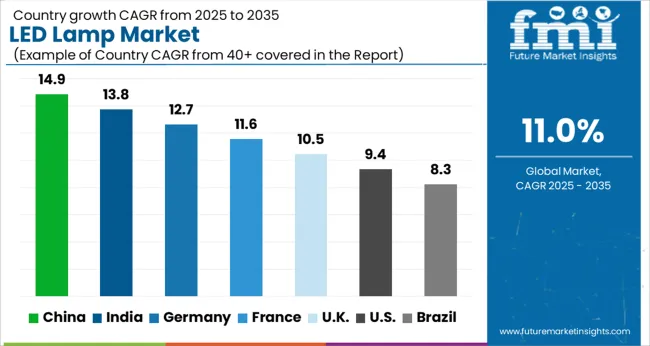

| Country | CAGR |

|---|---|

| China | 14.9% |

| India | 13.8% |

| Germany | 12.7% |

| France | 11.6% |

| UK | 10.5% |

| USA | 9.4% |

| Brazil | 8.3% |

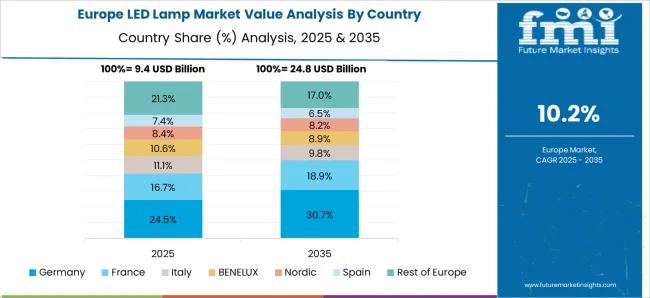

The global LED lamp market is projected to grow at a CAGR of 11% between 2025 and 2035. China leads with a growth rate of 14.9%, followed by India at 13.8% and France at 11.6%. The United Kingdom records 10.5%, while the United States trails at 9.4%. Growth is driven by energy efficiency programs, reduced lifecycle costs, and the replacement of traditional lighting across residential, commercial, and industrial sectors. Asia shows faster adoption due to mass manufacturing capacity, government incentives, and infrastructure upgrades. European countries gain momentum through compliance with energy directives and premium lighting solutions, while the USA market reflects steady growth tied to retrofitting and architectural applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

The LED lamp market in China is projected to grow at a CAGR of 14.9%. Expansion is fueled by the country’s dominance in LED manufacturing, large-scale government procurement programs, and rapid adoption across commercial and urban infrastructure. Mass production advantages lower costs, while integration with smart lighting and IoT platforms strengthens demand. Exports of LED products to Asia, Europe, and North America reinforce China’s leadership in the global supply chain.

The LED lamp market in India is expected to rise at a CAGR of 13.8%. Adoption is propelled by national electrification schemes, replacement of incandescent bulbs, and rural lighting initiatives. Affordable pricing and distribution through both public and private channels increase accessibility. Rapid growth in commercial real estate, hospitality, and industrial sectors further expands the adoption of LED lamps. Domestic manufacturing support and government backed energy efficiency campaigns secure long term growth.

The LED lamp market in France is projected to expand at a CAGR of 11.6%. Growth is underpinned by compliance with EU energy efficiency directives and the adoption of high quality lighting solutions in residential and commercial spaces. French consumers prefer advanced designs and premium fixtures, which support the uptake of LED lamps in architectural and decorative applications. Public sector retrofitting projects further reinforce market growth, with emphasis on cost savings and reduced energy consumption.

The LED lamp market in the UK is forecast to grow at a CAGR of 10.5%. Adoption is driven by urban infrastructure upgrades, strong commercial property development, and energy cost considerations. Consumers prefer LEDs for longer lifespan and reduced maintenance, making them attractive for both residential and institutional use. Retail distribution and online platforms strengthen product accessibility, while ongoing retrofitting programs across public transport facilities and offices sustain momentum.

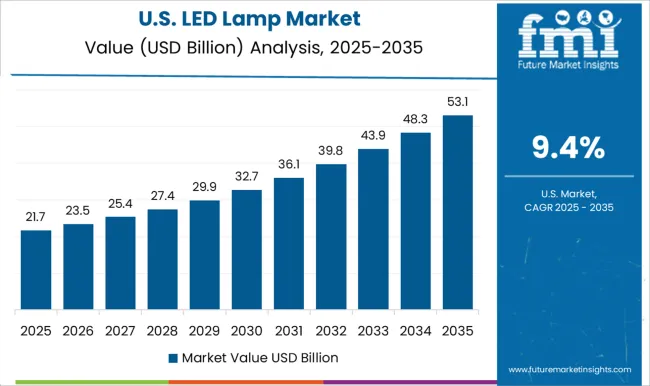

The LED lamp market in the US is expected to grow at a CAGR of 9.4%. Growth is slower than in Asia, reflecting a mature lighting market and widespread early adoption. Demand remains steady in retrofitting of commercial buildings, smart city initiatives, and industrial facilities seeking cost efficiency. Architectural lighting and connected systems further reinforce uptake in high end applications. While imports dominate supply, domestic players focus on design, integration, and smart functionality to capture consumer interest.

The LED lamp market is highly competitive, driven by global lighting manufacturers, regional producers, and emerging smart lighting companies. Leading players such as Philips Lighting (Signify), OSRAM Licht AG, Cree, and GE Lighting maintain strong market positions through extensive product portfolios, advanced technology, and global distribution networks. Competition is largely shaped by product efficiency, lumen output, color rendering, lifespan, and adoption of smart lighting features such as IoT connectivity and dimming capabilities.

Regional manufacturers, particularly in Asia-Pacific, compete by offering cost-effective solutions and localized support to capture growing demand in residential, commercial, and industrial applications. Strategic collaborations with construction firms, electrical contractors, and online retailers enhance market reach and service offerings. Product differentiation is increasingly achieved through energy-efficient designs, innovative form factors, and compliance with international energy standards and certifications. Companies investing in R&D for advanced semiconductor materials, driver technologies, and integrated smart systems are gaining a competitive edge.

| Item | Value |

|---|---|

| Quantitative Units | USD 40.5 Billion |

| Product Type | A-type, T-type, Decorative lamps, Reflectors, and Others |

| Technology | Standard LED, Smart LED, and OLED |

| Distribution Channel | Online retailers, Specialty stores, Supermarkets/Hypermarkets, and Direct sales |

| Application | Indoor lighting, Outdoor lighting, Automotive lighting, and Others |

| End-User | Residential, Commercial, Industrial, and Government/Public |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Philips Lighting (Signify), Osram, GE Lighting, Cree, Inc., Samsung Electronics, LG Innotek, Acuity Brands, and Eaton Corporation |

| Additional Attributes | Dollar sales by product type (bulbs, tubes, spotlights, downlights), Dollar sales by application (residential, commercial, industrial, outdoor), Trends in energy-efficient lighting adoption and smart integration, Role of government regulations and phase-out of incandescent lamps, Growth in connected lighting systems for smart homes and offices, Regional consumption patterns across Asia Pacific, North America, and Europe. |

The global LED lamp market is estimated to be valued at USD 40.5 billion in 2025.

The market size for the LED lamp market is projected to reach USD 115.1 billion by 2035.

The LED lamp market is expected to grow at a 11.0% CAGR between 2025 and 2035.

The key product types in LED lamp market are a-type, t-type, decorative lamps, reflectors and others.

In terms of technology, standard LED segment to command 54.2% share in the LED lamp market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High-Brightness Light-Emitting Diodes (LED) Headlamps Market Size and Share Forecast Outlook 2025 to 2035

LED and OLED lighting Products and Display Market Size and Share Forecast Outlook 2025 to 2035

LED Digital Speed Limit Sign Market Size and Share Forecast Outlook 2025 to 2035

LED Light Market Size and Share Forecast Outlook 2025 to 2035

LED Loading Dock Light Market Size and Share Forecast Outlook 2025 to 2035

LED Modules and Light Engines Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

LED Tube Market Size and Share Forecast Outlook 2025 to 2035

LED Backlight Driver Market Size and Share Forecast Outlook 2025 to 2035

LEDPackaging Market Size and Share Forecast Outlook 2025 to 2035

LED Neon Lights Market Size and Share Forecast Outlook 2025 to 2035

LED Driver IC Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

LED Grow Lights Market Analysis by Product, Installation Type, Application and Region Through 2035

LED Backlight Display Driver ICs Market – Growth & Forecast 2025 to 2035

LED Driver for Lighting Market Analysis – Growth & Forecast 2025 to 2035

LED Light Bar Market Analysis - Trends, Growth & Forecast 2025 to 2035

LED Phosphor Material Market

LED Driver Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA