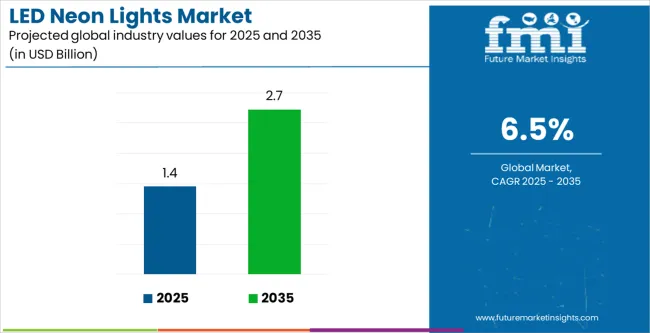

The LED Neon Lights Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period. This expansion reflects a 6.5% CAGR and a 1.93x growth multiple over the decade. Year-on-year (YoY) growth analysis indicates a consistent upward trend, with demand supported by increasing preference for energy-saving, low-maintenance lighting solutions in signage, architectural outlines, and ambient interior designs.

Between 2025 and 2030, the market is projected to reach approximately USD 1.9 billion. During this phase, average annual growth is estimated at around USD 100 million, with YoY increases ranging from 6.2% to 6.7%, reflecting demand stability across both residential and commercial projects. In the 2030 to 2035 window, annual additions are expected to average USD 160 million, marking a moderate acceleration as adoption extends into building façade lighting, automotive custom applications, and hospitality environments.

Suppliers including LED Neon Flex and Jiasheng Lighting have been optimizing product lines for enhanced weather resistance, installation flexibility, and color retention. Growth across years is likely to remain steady rather than cyclical, given the wide applicability of LED neon strips in low-voltage, customizable lighting formats across retrofit and new-build infrastructure.

The LED neon lights market accounts for approximately 45% of the decorative lighting market due to demand in residential, event, and holiday installations. It holds around 38% of the signage and display lighting market, where brands and storefronts use flexible LED neon strips for illuminated signage and window outlines. About 28% of the architectural lighting market is linked to LED neon products that outline buildings, accent outdoor structures, and enhance interior designs. The segment contributes nearly 32% to the retail and commercial lighting market, supporting visual merchandising and interior ambience in hospitality and retail spaces. It captures around 22% of the broader LED lighting market, where adoption is based on low-voltage safety, longevity, and creative flexibility.

The industry is expanding rapidly as businesses and consumers seek energy-efficient alternatives to traditional glass neon. Advances in flexible silicone and PVC casings have improved durability, weather resistance, and ease of installation, making LED neon suitable for both indoor and outdoor use. Programmable lighting systems with remote control features and smart integration are gaining traction in commercial signage, event spaces, and residential decor. The rise of custom lighting through online platforms is driving demand for personalized branding and artistic displays. Asia Pacific and North America are leading market growth, while high input costs and pricing pressure continue to impact profit margins.

| Metric | Value |

|---|---|

| LED Neon Lights Market Estimated Value in (2025E) | USD 1.4 billion |

| LED Neon Lights Market Forecast Value in (2035F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The LED neon lights market is experiencing significant momentum as consumers and businesses increasingly opt for energy-efficient, durable, and aesthetically appealing lighting solutions. LED alternatives are steadily replacing traditional neon lighting due to their lower power consumption, enhanced flexibility, and longer service life.

Market growth is further fueled by the rising adoption of customizable LED neon designs in both commercial and residential settings. Technological advancements in chip efficiency, waterproofing, and color consistency are enhancing product quality and expanding application scope.

The integration of LED neon lighting into interior decor, event setups, and signage continues to grow, particularly among environmentally conscious consumers. As smart lighting technologies and IoT connectivity become more prevalent, the demand for adaptive LED neon systems is also expected to rise. The market outlook remains optimistic, supported by ongoing urban aesthetic trends and increasing preference for low-maintenance, high-impact lighting solutions.

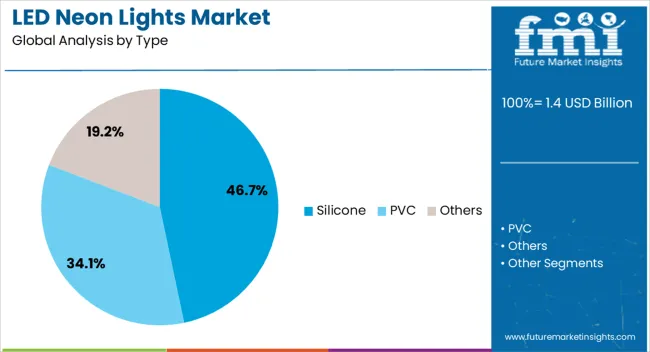

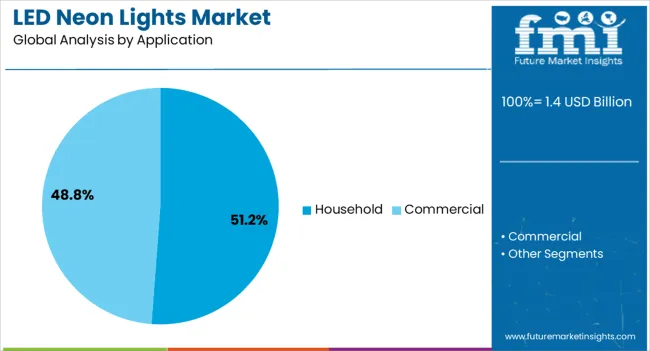

The market is segmented by type, application, and region. By type, it includes silicone, PVC, and other material variants used in different lighting solutions. In terms of application, the segmentation comprises household, commercial, signage, architectural lighting, and decorative lighting, indicating diverse usage across residential and professional settings. Regionally, the market spans North America, Latin America, Western Europe, Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The silicone segment accounts for 46.7% of the LED neon lights market by type, driven by its superior flexibility, weather resistance, and heat dissipation properties. Silicone-based LED neon lights are widely preferred for both indoor and outdoor installations due to their ability to maintain structural integrity under extreme temperatures and environmental conditions.

This material allows for seamless bending and customization, making it ideal for architectural outlines, decorative accents, and signage. The segment’s growth is supported by increased demand from designers and installers seeking high-performance, long-lasting lighting solutions that do not yellow or degrade over time.

Silicone’s compatibility with advanced LED circuitry contributes to enhanced brightness and energy efficiency. As the industry shifts toward eco-friendly and durable materials, the use of silicone in LED neon lighting is expected to expand steadily across both residential and commercial projects.

The household application segment leads the market with a 51.2% share, reflecting the rising popularity of LED neon lighting in interior home decor and ambient lighting setups. Homeowners are increasingly turning to LED neon products for bedroom backdrops, living room accents, kitchen outlines, and DIY projects due to their safety, color variety, and low energy consumption.

The flexibility and ease of installation make these lights accessible for non-professional users, fueling mass-market adoption. This segment benefits from e-commerce growth and social media trends that promote modern, mood-enhancing home aesthetics.

As consumers seek personalized and energy-conscious decor solutions, LED neon lighting aligns well with these expectations. The segment is poised for continued expansion as design-conscious homeowners and renters prioritize lighting that balances visual appeal, efficiency, and affordability.

Rapid adoption of LED neon lighting is transforming architectural signage, interior décor, event production, and retail environments. A growing shift away from traditional glass neon is driven by enhanced energy savings, LED variants use up to 75% less power, and reduced maintenance frequency. Major urban centers across North America, Asia-Pacific, and Europe saw demand increase by 18 % in 2024. Applications range from storefront outlines to textured lighting installations and flexible-touch backlighting. Modular and flexible formats allow rapid customization. Adoption is supported by compatible dimming control standards and plug-and-play strip offerings that shorten installation time and lower field failure rates.

Architectural firms and retail chains increasingly choose LED neon over glass neon to cut both energy and labor costs. Case studies from boutique districts show utility consumption falling by 68 % when switching to LED, while installers report average setup times dropping 22 % thanks to modular bendable strips. Design teams are favoring color calibration accuracy above 95% and CRI levels above 90 in the 2700-5600 K range. Flexible tubing is used in 35 % of recent retail façade lighting projects, enabling dynamic branding features tied to product launches. Interior designers also leverage strip lighting for layered ambient and accent effects in hospitality and residential builds, improving visual impact without heat or fragility concerns.

Despite compelling benefits, growth is dampened by factors related to quality control and logistics. Field audits note breakage rates of up to 13 % in imported flexible tubing, especially in curved custom assemblies. Some markets implemented new UL, CE, or energy-compliance labels in 2024, extending product certification cycles by 4-6 weeks. Import restrictions and glass-tube signage licensing in select cities slowed deployment by 20 % for external projects. Supply chain disruption for silicone encasements and LED chips caused lead times to stretch 30-35 days in North-East Asia and Latin America. These constraints push installers to maintain dual inventory systems-traditional glass neon alongside LED neon-adding complexity and cost.

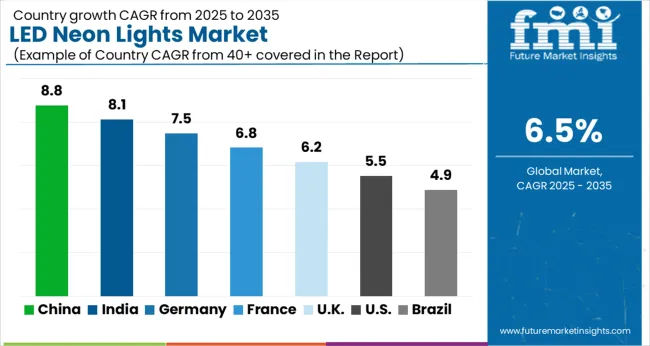

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

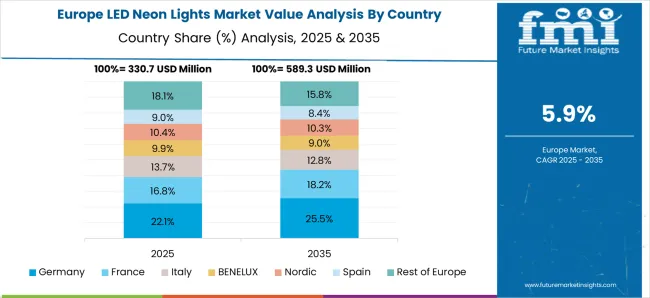

The global LED neon lights market is expected to grow at a CAGR of 6.5% between 2025 and 2035. China records the highest pace at 8.8%, surpassing the global rate by 2.3 percentage points, supported by its export-led production model. India (BRICS) follows at 8.1%, growing 1.6 points above the average due to retail lighting upgrades. Germany (OECD) posts 7.5%, 1.0 point higher than the global rate. France (OECD) closely aligns at 6.8%, just 0.3 points above. The UK (OECD) records 6.2%, falling 0.3 points below. These variations reflect country-level differences in energy codes, urban lighting projects, and manufacturing cost structures. The report features insights from 40+ countries, with the top countries shown below.

China’s LED neon lights market is expected to grow at a CAGR of 8.8% from 2025 to 2035, exceeding the global average by 2.3%. Commercial signage, decorative façades, and themed lighting across urban districts lead demand. Shenzhen and Guangzhou have become the central hubs for production, with vertically integrated supply chains reducing the cost per unit. Exports of flexible LED neon strips have risen sharply, especially to ASEAN and Eastern Europe. Domestic consumption remains strong among retail chains, amusement venues, and hospitality franchises. Miniaturized SMD-based neon products are replacing traditional glass tube neon in low-voltage installations. Government policies favoring low-energy LED alternatives have also pushed up unit sales across municipal lighting contracts.

India’s LED neon lights market is projected to grow at a CAGR of 8.1% between 2025 and 2035, 1.6% above the global benchmark. Retail branding, roadside installations, and event lighting are driving expansion. Tier 2 and Tier 3 cities are seeing rapid uptake, especially in custom signage and decorative applications. Bengaluru and Delhi are leading in the localized manufacturing of cuttable neon rope lights with waterproof casings. LED distributors have begun bundling neon products with standard lighting contracts, improving channel penetration. Event management and religious festivals remain strong volume drivers, with modular lighting kits gaining preference. Import dependence for controllers and silicone housing materials remains high, but assembly is now mostly domestic.

The LED neon lights market in Germany is forecast to grow at a CAGR of 7.5% from 2025 to 2035, outperforming the global average by 1%. Retail zones, transport stations, and commercial architecture are driving demand for bendable LED neon tubes and RGB lighting systems. Berlin and Hamburg continue to lead in procurement for design-focused installations, with energy efficiency regulations accelerating LED neon replacement. Automotive aftermarket usage is growing, especially for custom trim and underbody accents. The market favors premium products with IP67+ ratings, long life cycles, and dynamic control options. Adoption in commercial retrofits is climbing, particularly among retailers replacing fluorescent signage systems with programmable neon solutions.

Demand for LED neon lights in France is projected to grow at a CAGR of 6.8% from 2025 to 2035, slightly ahead of the global pace by 0.3%. Market momentum is driven by interior design, storefront signage, and ambient lighting in hospitality spaces. Paris and Lyon remain key metro areas for commercial neon installations, with demand centered on soft-glow aesthetics and programmable hues. Local manufacturers have expanded capacity for food-safe neon products used in bakeries and restaurants. DIY kits and wall-mounted décor strips are gaining popularity in the consumer market. While imports still account for most controllers and extrusion materials, final assembly is increasingly localized. Building codes favor fire-resistant, low-heat LED types, reinforcing safety-compliant neon adoption.

The UK’s LED neon lights market is forecast to grow at a CAGR of 6.2% between 2025 and 2035, slightly below the global average. Market dynamics are shaped by demand from signage refurbishment, interior styling, and temporary displays at events and festivals. London, Manchester, and Glasgow lead in neon-themed visual retail campaigns. Imports dominate the supply chain, though small-scale assembly and customization services have grown in urban centers. Programmable neon products with Bluetooth or DMX control are increasingly selected for temporary exhibitions and mobile brand activations. E-commerce is playing a major role in distribution, with significant growth in consumer-oriented kits aimed at residential ambient use.

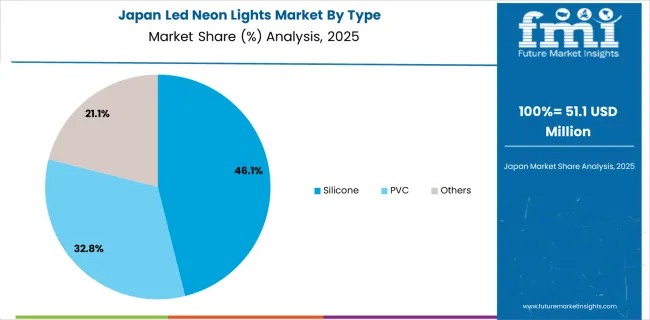

In 2025, the LED neon lights market in Japan is estimated to reach USD 51.1 million, contributing approximately 3.6% to the global market valued at USD 1.4 billion. Silicone-based lights dominate with a 46.1% share, supported by demand for flexible, weather-resistant installations in commercial signage and architectural applications. PVC variants account for 32.8%, primarily adopted in indoor settings due to cost advantages. The remaining 21.1% is captured by other materials used in decorative and niche industrial segments.

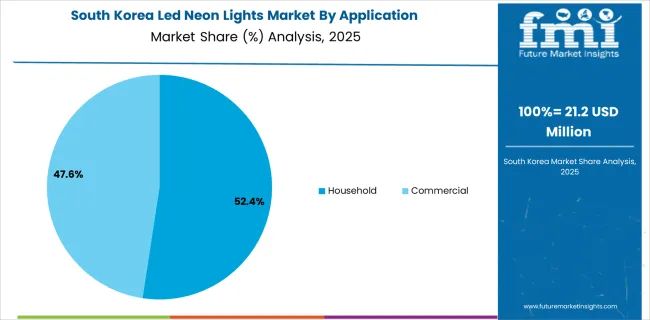

The LED neon lights industry in South Korea is projected to reach USD 21.2 million in 2025, forming approximately 1.5% of the global market valued at USD 1.4 billion. Household usage commands a 52.4% share, attributed to rising interest in decorative lighting, personalized interiors, and home improvement trends. Commercial installations make up 47.6%, supported by demand in restaurants, retail storefronts, and entertainment venues.

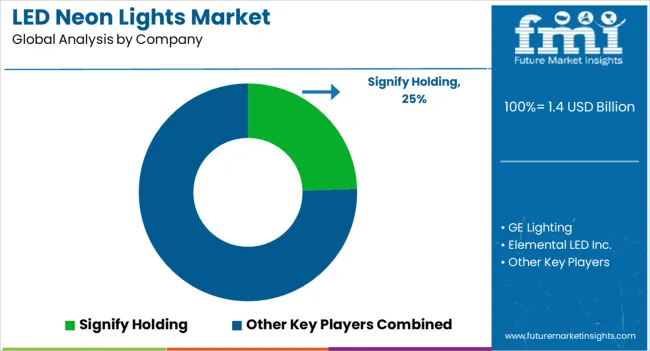

The LED neon lights market features a blend of global innovators, specialized solution providers, and consumer-focused brands, each addressing unique application needs. Signify Holding leads through architectural-grade lighting systems designed for both indoor and outdoor environments, combining energy efficiency with aesthetic flexibility. Its integrated approach aligns with smart building trends and sustainability-driven specifications in commercial projects.

GE Lighting positions itself as a viable replacement for traditional neon in retail and signage, emphasizing durability, low power consumption, and long operational life. This makes its solutions highly appealing for businesses prioritizing operational cost reduction and consistent visual branding. Elemental LED Inc. focuses on modular lighting solutions tailored for hospitality, entertainment, and event installations, offering high customization and easy scalability for dynamic environments.

Emerging players such as INCISEON innovate with shatterproof, flexible alternatives, engineered to replace fragile glass neon in high-traffic areas where safety is critical. On the consumer side, Best Buy Neon Signs capitalizes on direct-to-consumer demand, offering customizable, ready-to-install products driven by e-commerce growth and personalized décor trends.

Market entry remains challenging due to requirements in optical engineering precision, effective heat dissipation design, and stringent UL and IP-rated certifications, favoring established players with advanced R&D capabilities and global compliance expertise.

Key Developments in the LED Neon Lights Market

Key strategies in the LED neon lights market include product differentiation through flexible, shatterproof designs that replace traditional glass neon. Manufacturers focus on energy efficiency and smart integration, enabling remote control and dynamic lighting effects. Customization and modularity remain core strategies to capture demand in hospitality, retail, and home décor segments. Companies are strengthening e-commerce and direct-to-consumer channels to tap personalized lighting trends while investing in certification compliance and thermal engineering to meet safety standards. Strategic partnerships with architects and designers also enhance brand positioning in premium architectural and commercial projects.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Type | Silicone, PVC, and Others |

| Application | Household, Commercial, Signage, Architectural lighting, and Decorative lighting |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Signify Holding, GE Lighting, Elemental LED Inc., Best Buy Neon Signs, and INCISEON |

| Additional Attributes | Dollar sales by mounting type and end-use application, growing demand in architectural accents and commercial signage, stable usage across residential décor and automotive customization, innovations in flexible silicone housings and RGB control systems enhance design versatility and energy efficiency |

The global led neon lights market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the led neon lights market is projected to reach USD 2.7 billion by 2035.

The led neon lights market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in led neon lights market are silicone, pvc and others.

In terms of application, household segment to command 51.2% share in the led neon lights market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LED Light Market Size and Share Forecast Outlook 2025 to 2035

LED Loading Dock Light Market Size and Share Forecast Outlook 2025 to 2035

LED Modules and Light Engines Market Size and Share Forecast Outlook 2025 to 2035

LED Control Unit Market Size and Share Forecast Outlook 2025 to 2035

LED Lamp Market Size and Share Forecast Outlook 2025 to 2035

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

LED Displays, Lighting and Fixtures Market Size and Share Forecast Outlook 2025 to 2035

LED Tube Market Size and Share Forecast Outlook 2025 to 2035

LED Backlight Driver Market Size and Share Forecast Outlook 2025 to 2035

LEDPackaging Market Size and Share Forecast Outlook 2025 to 2035

LED Driver IC Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

LED Backlight Display Driver ICs Market – Growth & Forecast 2025 to 2035

LED Driver for Lighting Market Analysis – Growth & Forecast 2025 to 2035

LED Light Bar Market Analysis - Trends, Growth & Forecast 2025 to 2035

LED and OLED lighting Products and Display Market – Growth & Forecast 2034

LED Phosphor Material Market

LED Driver Market

LED Modular Display Market

LED Tester Market

LED Cable Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA