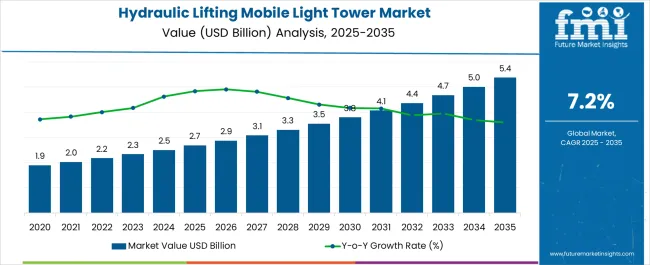

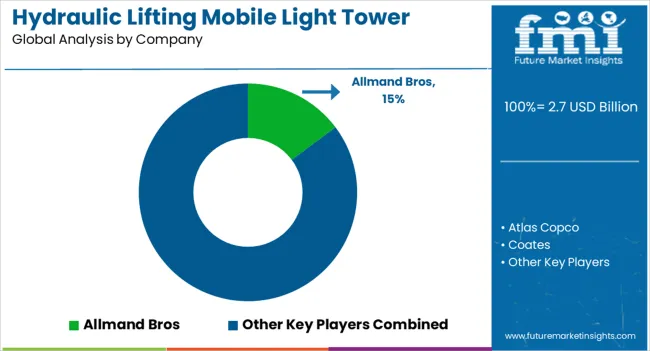

The hydraulic lifting mobile light tower market is expected to grow from USD 2.7 billion in 2025 to USD 5.4 billion by 2035, reflecting a 7.2% CAGR and generating an absolute dollar opportunity of USD 2.7 billion. Growth is driven by increasing demand for portable lighting solutions in construction, mining, road infrastructure, and outdoor events, where flexibility, rapid deployment, and energy-efficient operation are critical. Technological advancements, such as LED lighting, automated mast systems, and integration with renewable energy sources, enhance operational efficiency and support market expansion globally.

Market dynamics show varying growth contributions over the forecast period. From 2025 to 2028, early adoption in North America and Europe drives steady expansion as construction and mining sectors invest in upgraded mobile lighting systems. Between 2029 and 2032, growth accelerates due to large-scale infrastructure projects and industrial expansion in the Asia Pacific and Latin America, contributing significantly to the absolute dollar opportunity.

From 2033 to 2035, growth moderates slightly, with incremental revenue increasingly derived from advanced models, higher-value equipment, and customization options. The USD 2.7 billion opportunity underscores the market’s sustained and compounding expansion, reflecting both early adoption in mature markets and increasing deployment in emerging regions, highlighting the growing relevance of hydraulic lifting mobile light towers across multiple end-use applications.

| Metric | Value |

|---|---|

| Hydraulic Lifting Mobile Light Tower Market Estimated Value in (2025 E) | USD 2.7 billion |

| Hydraulic Lifting Mobile Light Tower Market Forecast Value in (2035 F) | USD 5.4 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The hydraulic lifting mobile light tower market is driven by five primary parent markets with specific shares. Construction leads with 40%, using mobile light towers to illuminate sites during night operations and low-light conditions. Mining and quarrying contribute 25%, providing safety and operational efficiency in remote and underground locations. Events and entertainment represent 15%, offering temporary lighting for outdoor concerts, sports, and festivals. Emergency services and disaster management account for 10%, enabling rapid deployment for rescue, relief, and recovery operations.

Oil and gas exploration holds 10%, supporting lighting in remote drilling and extraction sites. These segments collectively shape global demand for mobile light towers. Recent developments in the hydraulic lifting mobile light tower market focus on energy efficiency, automation, and durability. Manufacturers are introducing LED lighting systems with lower energy consumption and longer operational life. Hybrid and solar-powered towers are gaining traction for eco-friendly and off-grid applications. Hydraulic lifting mechanisms are being optimized for faster deployment, higher reach, and improved stability. Integration with remote monitoring, IoT platforms, and automated controls is enhancing safety and operational management. Growing construction activities, mining projects, outdoor events, and disaster preparedness initiatives are driving adoption. These trends are promoting innovation, sustainability, and expanded market growth globally.

The hydraulic lifting mobile light tower market is experiencing sustained growth, supported by the rising demand for portable, high-intensity lighting solutions in construction, mining, and emergency response operations. Hydraulic mast systems offer quick and effortless deployment, improving operational efficiency on worksites. The market benefits from increasing nighttime infrastructure development and extended shift operations, particularly in emerging economies.

Product innovation, including energy-efficient lighting technologies and enhanced mobility features, has further strengthened adoption. The competitive landscape is characterized by a mix of diesel-powered and hybrid models, catering to diverse user requirements for power autonomy and reduced emissions.

Ongoing investment in rental fleets has expanded product accessibility, while stricter safety and performance regulations are pushing manufacturers toward more robust designs. Looking ahead, continued growth in large-scale outdoor projects and disaster recovery applications will sustain market momentum.

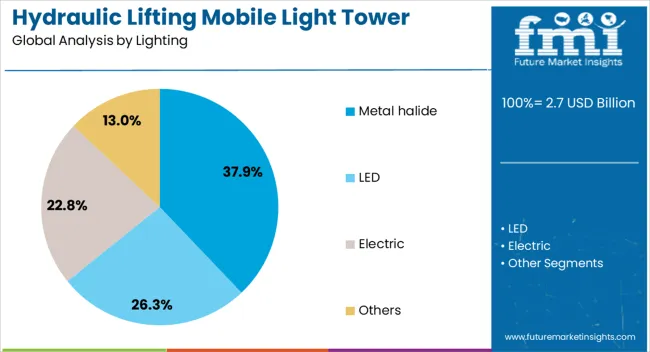

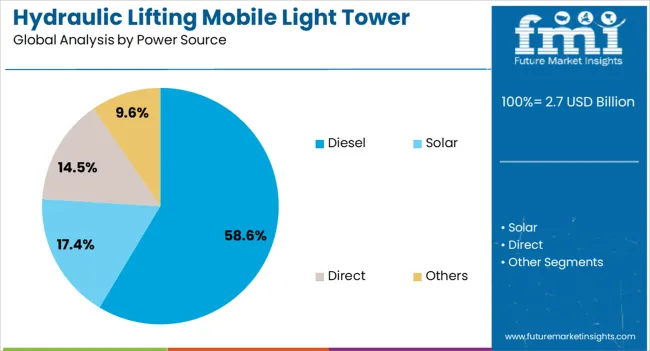

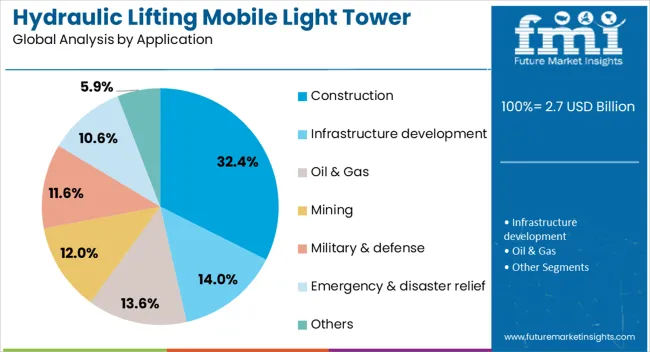

The hydraulic lifting mobile light tower market is segmented by lighting, power source, application, and geographic regions. By lighting, hydraulic lifting mobile light tower market is divided into Metal halide, LED, Electric, and Others. In terms of power source, hydraulic lifting mobile light tower market is classified into Diesel, Solar, Direct, and Others. Based on application, hydraulic lifting mobile light tower market is segmented into Construction, Infrastructure development, Oil & Gas, Mining, Military & defense, Emergency & disaster relief, and Others. Regionally, the hydraulic lifting mobile light tower industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The metal halide segment leads the lighting category with approximately 37.9% share, owing to its high lumen output and ability to provide bright, wide-area illumination for extended durations. Its proven reliability in outdoor environments has made it a standard choice for large construction sites, mining operations, and event lighting.

Despite the growing popularity of LED alternatives, metal halide lighting remains relevant in applications where maximum light intensity is prioritized over energy savings. The segment’s stability is further supported by established supply chains and cost competitiveness for high-output requirements.

Continuous improvements in bulb efficiency and reflector designs have enhanced performance, ensuring its sustained demand. With ongoing reliance on high-intensity lighting in heavy-duty applications, the metal halide segment is expected to retain a considerable market share in the near term.

The diesel segment dominates the power source category with approximately 58.6% share, driven by its ability to provide continuous, independent power in remote and infrastructure-limited locations. Diesel-powered light towers offer long operational runtime, making them suitable for extended nighttime work shifts without frequent refueling.

Their robustness, ease of refueling, and adaptability to various environmental conditions have cemented their position in the market. Rental operators favor diesel models for their reliability and user familiarity, ensuring steady demand.

While hybrid and electric options are gaining traction, diesel remains the preferred choice for large-scale construction and industrial operations where power requirements are substantial. With ongoing infrastructure projects and remote site developments, the diesel segment is likely to sustain its leadership during the forecast period.

The construction segment holds approximately 32.4% share of the application category, reflecting its status as the largest end-use sector for hydraulic lifting mobile light towers. Nighttime and early morning work schedules in road building, bridge construction, and infrastructure upgrades drive continuous demand for portable lighting solutions.

Hydraulic mast systems enable rapid deployment and repositioning, improving worksite productivity and safety. The segment benefits from consistent infrastructure investment in both developed and emerging economies, where round-the-clock operations are common to meet project timelines.

Rental availability has further boosted adoption among contractors, reducing upfront capital expenditure. With the global construction sector projected to maintain robust activity levels, the construction segment is expected to hold its leading position in the years ahead.

The hydraulic lifting mobile light tower market is growing due to increased construction activity, infrastructure development, and outdoor industrial operations. Asia Pacific holds over 40% of adoption, led by China, India, and Southeast Asia. North America focuses on mining, road construction, and emergency services, while Europe emphasizes temporary event lighting and energy-efficient deployment. Key models feature diesel, hybrid, and electric power options with hydraulic mast lifting up to 9–12 meters. Rising demand for portable, high-intensity lighting solutions is driving measurable global market growth.

The primary driver of the hydraulic lifting mobile light tower market is increased demand in construction, industrial, and emergency operations. Asia Pacific leads due to rapid urban infrastructure projects, including highways, industrial parks, and metro rail construction. North America emphasizes mining, oil and gas, and temporary construction site lighting. Hydraulic lifting mechanisms allow fast deployment and adjustable lighting height, improving coverage and safety. Diesel and hybrid power options provide flexibility in areas without grid access. Rising government investments in infrastructure, urban expansion, and safety compliance regulations are fueling adoption of mobile light towers globally across construction, industrial, and emergency service segments.

Opportunities are expanding with the rise of outdoor events, entertainment projects, and renewable energy installations. Europe and North America are investing in temporary lighting solutions for concerts, festivals, and sports arenas, driving demand for mobile light towers with modular and energy-efficient designs. Solar-powered and hybrid units are increasingly adopted to reduce fuel consumption and carbon footprint. Asia Pacific is integrating mobile light towers into large-scale construction and industrial projects, where grid connectivity is limited. Manufacturers offering remote-controlled, lightweight, and energy-optimized towers are well-positioned to capture market growth across commercial, industrial, and entertainment sectors globally.

Key trends include electrification, IoT-enabled monitoring, and compact foldable designs. Electric and hybrid mobile light towers reduce fuel consumption by 20–30%, supporting emission reduction targets. Smart controls with remote operation allow real-time adjustment of lighting intensity and mast height, improving efficiency and safety. Europe leads in adoption of solar hybrid and battery-powered units for event and urban applications. Asia Pacific focuses on ruggedized diesel-electric towers for construction and industrial use. Compact and foldable designs improve transportability and storage. Global trends are moving toward energy-efficient, smart, and easily deployable mobile light towers for diverse outdoor applications.

High upfront costs and maintenance requirements limit the adoption of hydraulic lifting mobile light towers. Diesel-powered units require regular servicing, fuel, and skilled operators, increasing operational expenses. Hybrid and solar units involve higher initial investment, making them less accessible for small-scale projects. Harsh outdoor conditions such as extreme temperatures, wind, and dust impact mast and lighting system durability, requiring additional protective features. In emerging economies, limited availability of spare parts and technical expertise slows adoption. Manufacturers must focus on cost-optimized, low-maintenance, and modular solutions to overcome these barriers and expand global market penetration across construction, industrial, and event applications.

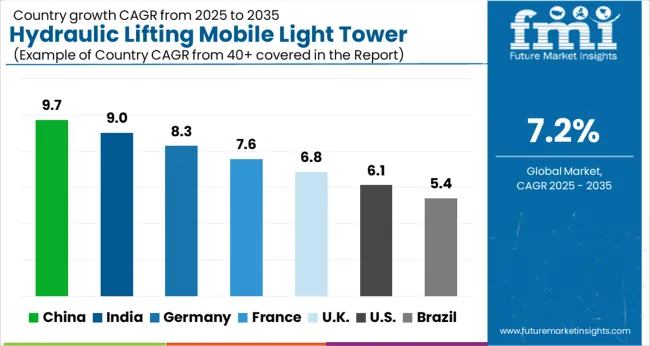

| Countries | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The hydraulic lifting mobile light tower market is projected to grow at a global CAGR of 7.2%, supported by increasing construction, mining, and outdoor event activities requiring portable illumination solutions. China leads at 9.7%, a 1.35× multiple of the global rate, driven by BRICS-backed infrastructure expansion, urban development, and industrial projects. India follows at 9.0%, a 1.25× multiple, reflecting rising demand for temporary lighting in construction, roadworks, and event management. Germany records 8.3%, a 1.15× multiple, influenced by OECD-focused technological advancements, efficiency improvements, and safety regulations. The United Kingdom posts 6.8%, slightly below the global rate, supported by selective industrial and commercial applications. The United States stands at 6.1%, 0.85× the benchmark, with adoption concentrated in construction modernization and outdoor infrastructure projects. BRICS countries drive volume growth, OECD markets prioritize efficiency and safety, and ASEAN contributes through expanding infrastructure and industrial activities. This report includes insights on 40+ countries; the top markets are shown here for reference.

The hydraulic lifting mobile light tower market in China is projected to grow at a CAGR of 9.7%, driven by expanding infrastructure projects, urban construction, and industrial development. Domestic and international suppliers such as SANY, XCMG, and Doosan are providing high-performance light towers with hydraulic lifting systems, LED lighting, and telematics-enabled monitoring. Adoption is concentrated in construction sites, mining operations, and industrial facilities requiring mobile, energy-efficient lighting. Technological trends include solar-assisted power, remote operation controls, and compact designs for versatile deployment. Government investment in infrastructure expansion, urban development projects, and industrial modernization strengthens market growth across China.

The hydraulic lifting mobile light tower market in India is expected to grow at a CAGR of 9.0%, supported by road construction, urban infrastructure projects, and industrial expansion. Key suppliers including JCB, Tata Hitachi, and local specialty equipment providers offer mobile light towers with hydraulic lifting, energy-efficient LEDs, and remote monitoring features. Adoption is concentrated in construction sites, mining operations, and industrial facilities. Technological trends include hybrid power systems, automation, and compact modular designs for enhanced mobility. Government initiatives supporting infrastructure growth, industrial modernization, and rural electrification encourage adoption. Rising demand for mobile, energy-efficient lighting solutions drives steady market growth across India.

The hydraulic lifting mobile light tower market in Germany is projected to grow at a CAGR of 8.3%, driven by industrial infrastructure, construction modernization, and public works projects. Suppliers such as Wacker Neuson, Liebherr, and Atlas Copco provide hydraulic lifting light towers with energy-efficient LEDs, automation features, and telematics-enabled controls. Adoption is concentrated in construction sites, industrial facilities, and municipal infrastructure. Technological trends include hybrid-powered systems, remote operation, and modular designs for urban deployment. Germany’s focus on energy efficiency, construction automation, and industrial modernization strengthens market growth. Industrial projects and infrastructure upgrades reinforce adoption of hydraulic lifting mobile light towers across Germany.

The hydraulic lifting mobile light tower market in the United Kingdom is expected to grow at a CAGR of 6.8%, supported by urban construction, infrastructure projects, and industrial applications. Key suppliers such as JCB, Terex, and Atlas Copco provide hydraulic lifting light towers with advanced LEDs, compact designs, and remote monitoring capabilities. Adoption is concentrated in construction sites, industrial areas, and municipal projects. Technological trends include hybrid power solutions, automated operation, and telematics integration for efficient management. Government infrastructure initiatives and growing demand for mobile and energy-efficient lighting solutions reinforce market expansion in the United Kingdom.

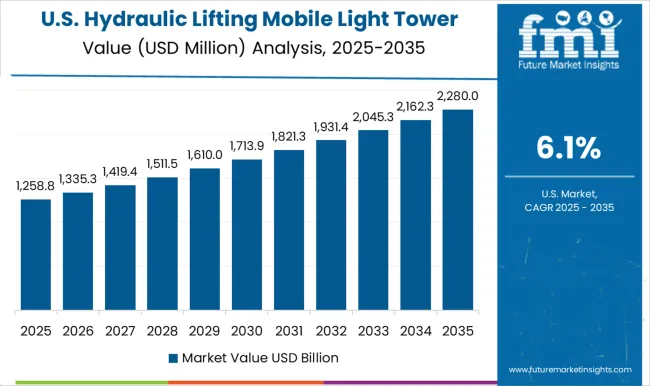

The hydraulic lifting mobile light tower market in the United States is projected to grow at a CAGR of 6.1%, driven by infrastructure development, construction projects, and industrial applications. Leading suppliers such as Caterpillar, Doosan, and Terex provide hydraulic lifting mobile light towers with energy-efficient LED systems, telematics-enabled controls, and hybrid power capabilities. Adoption is concentrated in construction, industrial facilities, and municipal infrastructure projects. Technological trends include automation, remote monitoring, and hybrid power systems for reduced fuel consumption. Government and industrial investment in infrastructure modernization strengthens demand, while the need for mobile and efficient lighting solutions reinforces steady market growth across the United States.

Competition in the hydraulic lifting mobile light tower market is driven by global equipment providers and specialized lighting solutions manufacturers, focusing on illumination efficiency, portability, and durability. Atlas Copco, Doosan Portable Power, and HIMOINSA lead with robust towers suitable for construction, mining, and emergency applications, emphasizing hydraulic lifting mechanisms, energy-efficient lamps, and weather-resistant designs in their brochures. Allmand Bros, GENMAC, and Green Power Systems highlight rapid deployment and long operational hours, targeting large-scale outdoor projects. Coates, J C Bamford Excavators, and Larson Electronics focus on compact and modular designs for versatility and ease of transport.

Midstream, MPMC Powertech, and Robuster Lighting emphasize customization, high-intensity output, and safety features. SINOPRO and Standard Aggregatebau Evers provide specialized solutions for industrial and infrastructure projects, showcasing durability and low maintenance requirements. Brochures detail light output, mast height, fuel type, operational duration, and safety certifications, enabling buyers to evaluate performance and suitability. Marketing materials play a key role in competition, combining technical specifications, deployment guidance, and maintenance instructions.

Frequent updates reflect improvements in lighting technology, hydraulic systems, and energy efficiency. Larger manufacturers leverage global distribution networks and brand recognition, while smaller players emphasize rapid deployment, niche applications, and customized solutions. Market advantage depends on how effectively brochures communicate reliability, operational efficiency, and long-term value in hydraulic lifting mobile light tower solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| Lighting | Metal halide, LED, Electric, and Others |

| Power Source | Diesel, Solar, Direct, and Others |

| Application | Construction, Infrastructure development, Oil & Gas, Mining, Military & defense, Emergency & disaster relief, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Allmand Bros, Atlas Copco, Coates, Doosan Portable Power, GENMAC, Green Power Systems, HIMOINSA, J C Bamford Excavators, Larson Electronics, Midstream, MPMC Powertech, Robuster Lighting, SINOPRO, and Standard Aggregatebau Evers |

| Additional Attributes | Dollar sales by tower type and end use, demand dynamics across construction, mining, and emergency response sectors, regional trends in temporary lighting adoption, innovation in hydraulic lifting, energy efficiency, and LED technology, environmental impact of fuel use and materials, and emerging use cases in smart job sites and mobile event lighting. |

The global hydraulic lifting mobile light tower market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the hydraulic lifting mobile light tower market is projected to reach USD 5.4 billion by 2035.

The hydraulic lifting mobile light tower market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in hydraulic lifting mobile light tower market are metal halide, led, electric and others.

In terms of power source, diesel segment to command 58.6% share in the hydraulic lifting mobile light tower market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydraulic Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Manual Lifting Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Solar Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Manual Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Metal Halide Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Portable Light Towers Market

Commercial Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Metal Halide Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Fully Automatic Hydraulic Lifting Column Market Size and Share Forecast Outlook 2025 to 2035

Mobile Camping Toilet Market Size and Share Forecast Outlook 2025 to 2035

Mobile Phone Screen Underlayer Cushioning Material Market Size and Share Forecast Outlook 2025 to 2035

Tower Vibration Control System Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Anchor Drilling Vehicle for Mining Market Size and Share Forecast Outlook 2025 to 2035

Light Pipe Mould Market Size and Share Forecast Outlook 2025 to 2035

Lightning Surge Protector Market Size and Share Forecast Outlook 2025 to 2035

Mobile Application Store Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA