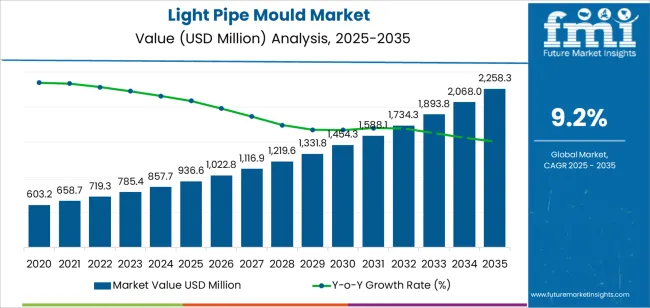

The global light pipe mould market is projected to grow from USD 936.6 million in 2025 to approximately USD 2,258.3 million by 2035, recording an absolute increase of USD 1,321.7 million over the forecast period. This translates into a total growth of 141.1%, with the light pipe mould market forecast to CAGR of 9.2% between 2025 and 2035. The overall market size is expected to grow by nearly 2.4X during the same period, supported by increasing automotive lighting innovation investments, growing demand for precision injection molds in LED lighting component manufacturing, and rising adoption of advanced optical component production technologies across consumer electronics and household appliance industries requiring sophisticated light guide fabrication capabilities.

The light pipe mould market is experiencing robust growth across both developed and emerging manufacturing regions, with automotive applications maintaining a dominant position throughout the forecast period. Growth is particularly pronounced in Asia Pacific markets, where automotive production expansion and consumer electronics manufacturing are establishing a comprehensive plastics tooling infrastructure that requires specialized optical component mould capabilities. North American and European markets continue expanding through automotive lighting technology advancement programs and premium appliance manufacturing investments, while emerging markets in Latin America demonstrate accelerating adoption rates driven by automotive industry localization initiatives and consumer electronics production facility development supporting manufacturing competitiveness objectives.

Light pipe moulds maintain critical positioning within optical component manufacturing through enabling precision fabrication of complex light guide geometries with exceptional surface quality, dimensional accuracy, and optical performance characteristics essential for LED lighting systems. The technology proves indispensable for automotive lighting applications including tail lights, interior illumination, and dashboard displays where light distribution uniformity and aesthetic appearance directly impact product differentiation and consumer acceptance. Market expansion reflects broader trends toward LED lighting proliferation, automotive lighting design sophistication, and consumer electronics miniaturization requiring advanced optical component solutions supporting product innovation objectives.

Technology demands including micro-feature replication, optical surface finishing, and complex geometry formation drive continuous mould design innovation and manufacturing process refinement. The transition from traditional bulb-based lighting to LED systems creates substantial demand for light pipe components directing and distributing LED point source illumination, while automotive styling trends emphasizing distinctive lighting signatures require increasingly complex light guide geometries necessitating advanced mould manufacturing capabilities.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 936.6 million |

| Market Forecast Value (2035) | USD 2,258.3 million |

| Forecast CAGR (2025-2035) | 9.2% |

| LED LIGHTING PROLIFERATION | AUTOMOTIVE LIGHTING INNOVATION | PRECISION MANUFACTURING STANDARDS |

|---|---|---|

| Global LED Adoption Growth Continuous expansion of LED lighting systems across automotive and consumer applications driving demand for light guide component manufacturing capabilities. Light Distribution Requirements Development of sophisticated LED lighting designs requiring precision light pipe components for uniform illumination and aesthetic light distribution. Optical Component Complexity Growing implementation of advanced light guide geometries necessitating specialized mould manufacturing for complex optical features and surface quality. | Automotive Styling Evolution Modern automotive design emphasizes distinctive lighting signatures and sophisticated illumination patterns requiring precision light pipe components and advanced mould capabilities. Interior Lighting Enhancement Vehicle interior lighting sophistication and ambient illumination systems implementing light guide technologies throughout cabin environments requiring specialized manufacturing. Regulatory Compliance Standards Automotive lighting regulations establishing performance benchmarks driving adoption of precision-manufactured light pipe components supporting compliance requirements. | Surface Quality Requirements Manufacturing protocols establishing optical surface finish benchmarks requiring validated mould designs with exceptional polishing and texturing capabilities. Dimensional Tolerance Standards Quality standards demanding precision mould manufacturing supporting tight tolerances for optical component assembly and light distribution performance. Material Processing Expertise Technical requirements for optical-grade plastics processing necessitating specialized mould designs addressing material flow, cooling optimization, and optical clarity preservation. |

| Category | Segments Covered |

|---|---|

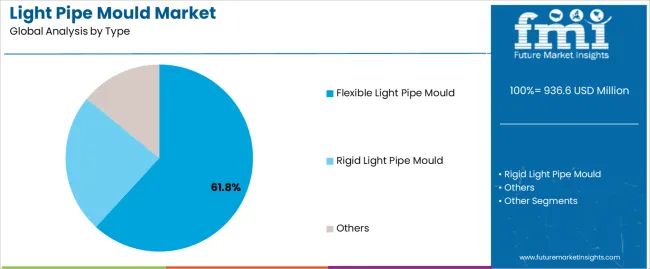

| By Type | Flexible Light Pipe Mould, Rigid Light Pipe Mould, Others |

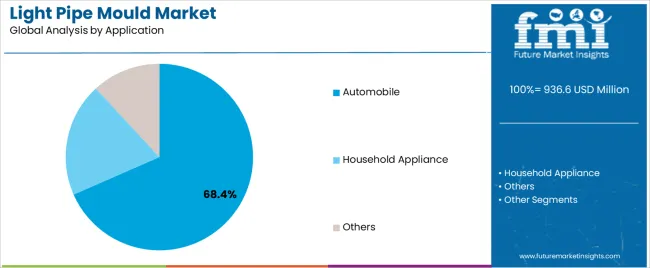

| By Application | Automobile, Household Appliance, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Flexible Light Pipe Mould | Leader in 2025 with 61.8% market share; maintains leadership through 2035. Dominant presence in automotive interior lighting applications, established design methodologies, proven reliability for curved light guide manufacturing. Serves dashboard illumination, ambient lighting systems, and decorative interior lighting requiring flexible light pipe components with complex routing paths. Momentum: strong growth through automotive interior lighting sophistication and premium vehicle content expansion. Design flexibility enables creative lighting solutions following complex vehicle interior geometries. Multi-cavity mould configurations support cost-effective production for high-volume applications. Watchouts: increased complexity for optical surface quality maintenance, material selection constraints for flexibility requirements. |

| Rigid Light Pipe Mould | Significant segment serving exterior automotive lighting, household appliance indicators, and consumer electronics applications. Provides precision manufacturing for straight light guides, simple geometric configurations, and applications prioritizing dimensional stability over flexibility. Momentum: steady growth tied to automotive exterior lighting development and appliance manufacturing expansion. Simplified mould designs enable cost-effective tooling for standard light pipe geometries. Superior dimensional control and optical surface quality achievable through rigid material processing. Applications include tail light components, appliance control panel indicators, and consumer electronics display illumination. |

| Others | Niche segment including specialty mould configurations, hybrid light guide systems, and emerging optical component technologies. Custom tooling addressing unique product requirements and novel lighting applications. Momentum: selective growth driven by innovative lighting concepts requiring specialized manufacturing approaches. Includes experimental designs, prototype tooling, and limited production moulds supporting product development programs. Limited market presence due to flexible and rigid type standardization across mainstream applications. |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Automobile | Dominant application with 68.4% market share in 2025, driven by automotive lighting innovation and LED technology adoption across interior and exterior vehicle lighting systems. Serves tail light assemblies, interior ambient lighting, dashboard illumination, door panel lighting, and decorative accent lighting requiring precision light pipe components. Automotive lighting design complexity and styling differentiation drive continuous demand for advanced mould capabilities. Momentum: strong growth through electric vehicle production ramp-up featuring sophisticated lighting designs and premium interior lighting content expansion across vehicle segments. Automotive manufacturers emphasizing lighting as brand differentiation element. Regulatory requirements and safety standards support continued investment in lighting innovation. Watchouts: automotive industry cyclicality, cost pressures from vehicle manufacturers, design standardization trends potentially limiting customization. |

| Household Appliance | Growing application segment for household appliance status indicators, control panel illumination, and decorative lighting features. Serves refrigerators, washing machines, cooking appliances, and small household products requiring functional and aesthetic lighting components. Light pipe moulds enable cost-effective indicator illumination, control panel backlighting, and decorative accent lighting throughout appliance product lines. Momentum: moderate growth driven by appliance market premiumization and smart appliance adoption featuring enhanced user interface lighting. Consumer preference for sophisticated appliance aesthetics supports lighting feature expansion. Watchouts: intense cost competition in appliance manufacturing, design simplification pressures, LED direct mounting alternatives reducing light pipe requirements in certain applications. |

| Others | Diverse applications including consumer electronics, medical devices, industrial equipment, and specialty lighting products. Serves smartphone components, computer peripherals, medical instrument indicators, and industrial control panel illumination requiring precision light guide components. Momentum: steady demand from diverse manufacturing sectors implementing LED lighting and optical component technologies. Applications span portable electronics, professional equipment, architectural lighting elements, and specialty optical products requiring customized light distribution solutions. Technology benefits including design flexibility and cost-effective illumination support adoption across varied product categories. |

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Automotive Lighting Innovation Continuing evolution of automotive lighting design and LED technology adoption across vehicle segments driving demand for precision light pipe component manufacturing capabilities. LED Lighting Proliferation Expansion of LED lighting systems replacing traditional illumination technologies creating substantial light guide component demand throughout automotive and consumer applications. Premium Product Positioning Increasing emphasis on product aesthetics and lighting sophistication supporting adoption of advanced light pipe components throughout automotive and appliance manufacturing. | Tooling Investment Requirements Substantial initial mould investment costs and precision manufacturing expenses affecting adoption rates in cost-sensitive applications and lower-volume products. Alternative Technology Competition Direct LED mounting solutions and fiber optic alternatives providing competition in applications where light pipe complexity may be avoided. Design Complexity Challenges Optical design expertise and manufacturing precision requirements creating barriers for manufacturers lacking specialized mould engineering capabilities and optical component experience. | Optical Surface Technology Advanced polishing techniques and surface texturing innovations improving light transmission efficiency, distribution uniformity, and aesthetic appearance of light pipe components. Multi-Cavity Optimization High-cavity mould designs enabling cost-effective production for high-volume applications while maintaining optical quality consistency across all cavities. Simulation Integration Computational mould flow analysis and optical simulation tools enabling optimized mould designs, reduced development cycles, and improved component performance predictability. Rapid Prototyping Additive manufacturing and rapid tooling technologies accelerating light pipe design iteration, reducing development costs, and enabling faster product innovation cycles. |

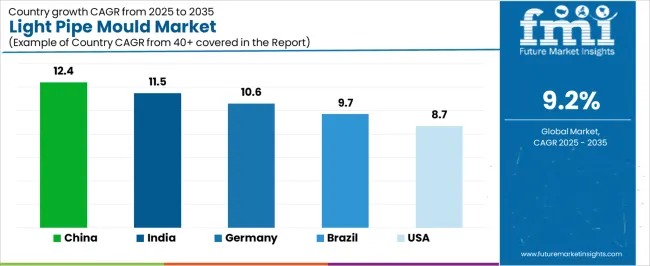

| Country | CAGR (2025-2035) |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| Brazil | 9.7% |

| United States | 8.7% |

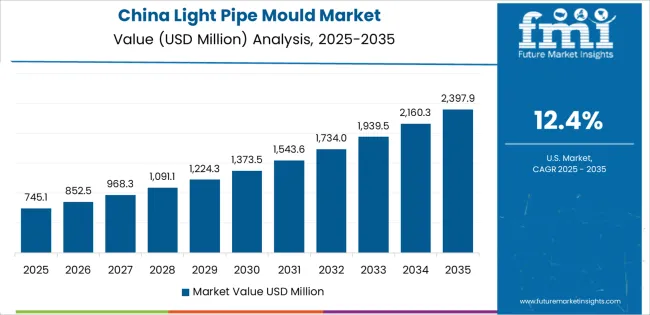

Revenue from light pipe moulds in China is projected to exhibit strong growth with a market value of USD 338.1 million by 2035, driven by expanding automotive production infrastructure and comprehensive consumer electronics manufacturing capability development creating substantial opportunities for precision mould suppliers across automotive lighting manufacturers, appliance producers, and electronics assembly operations requiring advanced optical component fabrication capabilities. The country's dominant automotive production volumes and leadership in consumer electronics manufacturing are creating significant demand for both flexible and rigid light pipe mould systems. Major automotive lighting suppliers and appliance manufacturers are establishing comprehensive tooling capabilities to support product development and meet expanding domestic and export market requirements.

Revenue from light pipe moulds in India is expanding to reach USD 325.4 million by 2035, supported by extensive automotive manufacturing expansion and comprehensive consumer appliance industry development creating sustained demand for reliable mould solutions across diverse product categories and manufacturing applications. The country's growing automotive production capabilities and expanding appliance manufacturing sector are driving demand for tooling solutions that provide consistent optical component quality while supporting cost-effective manufacturing operations. Mould suppliers and tooling manufacturers are investing in market development to support growing automotive supplier capabilities and appliance production requirements.

Demand for light pipe moulds in Germany is projected to reach USD 249.7 million by 2035, supported by the country's leadership in precision mould manufacturing and automotive lighting technology innovation requiring sophisticated tooling capabilities for premium lighting systems and advanced optical component production. German mould manufacturers are implementing high-precision manufacturing technologies that support advanced optical surface finishing, complex geometry replication, and comprehensive quality validation. The light pipe mould market is characterized by focus on engineering excellence, tooling reliability, and compliance with stringent automotive quality and optical performance standards.

Revenue from light pipe moulds in Brazil is growing to reach USD 186.7 million by 2035, driven by automotive manufacturing localization programs and increasing household appliance production creating sustained opportunities for mould suppliers serving both automotive lighting component manufacturers and appliance producers. The country's expanding automotive production base and growing appliance manufacturing awareness are creating demand for mould systems that support diverse product requirements while maintaining quality standards. Mould suppliers and tooling manufacturers are developing distribution strategies to support operational requirements and automotive supplier development programs.

Demand for light pipe moulds in United States is projected to reach USD 219.6 million by 2035, expanding at a CAGR of 8.7%, driven by automotive lighting innovation excellence and premium household appliance manufacturing supporting advanced lighting designs and comprehensive optical component applications. The country's established automotive lighting supplier base and premium appliance manufacturing segments are creating demand for high-quality moulds that support product differentiation and manufacturing capability. Mould manufacturers and tooling suppliers are maintaining comprehensive engineering capabilities to support diverse automotive and appliance requirements.

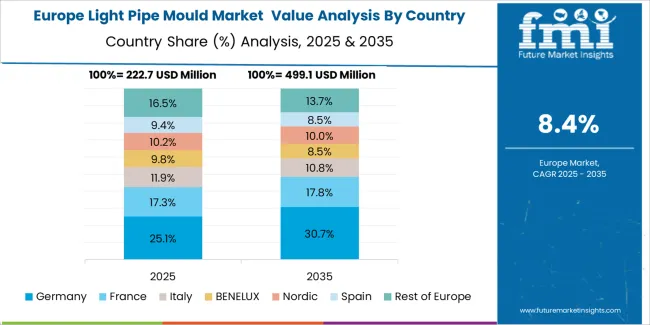

The light pipe mould market in Europe is projected to grow from USD 273.8 million in 2025 to USD 589.7 million by 2035, registering a CAGR of 8.0% over the forecast period. Germany is expected to maintain its leadership position with a 34.2% market share in 2025, increasing to 35.7% by 2035, supported by its advanced precision tooling manufacturing infrastructure and comprehensive automotive lighting technology capabilities.

France follows with a 19.8% share in 2025, projected to reach 20.3% by 2035, driven by automotive lighting innovation and premium appliance manufacturing. Italy holds a 16.4% share in 2025, expected to maintain 16.1% by 2035 through continued automotive component manufacturing and appliance production. The United Kingdom commands a 13.7% share, while Spain accounts for 9.3% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 6.6% to 7.6% by 2035, attributed to increasing automotive supplier development in Eastern European countries and emerging appliance manufacturing operations implementing advanced lighting technologies.

European light pipe mould operations reflect regional precision manufacturing excellence and automotive lighting technology leadership. German mould manufacturers dominate through advanced machining capabilities and comprehensive automotive lighting supplier relationships supporting premium vehicle lighting systems. French automotive lighting specialists and premium appliance manufacturers maintain strong positioning through design innovation requiring specialized mould capabilities.

Italian automotive component manufacturers and appliance producers demonstrate consistent mould adoption supporting product differentiation and quality requirements. United Kingdom automotive lighting suppliers continue substantial tooling investments through lighting technology development and premium vehicle applications. Spanish facilities expand through automotive component manufacturing growth and appliance production modernization. Eastern European operations in Poland, Czech Republic, and Slovakia develop automotive lighting component capabilities and appliance manufacturing supporting emerging supplier ecosystems and cost-competitive production capabilities.

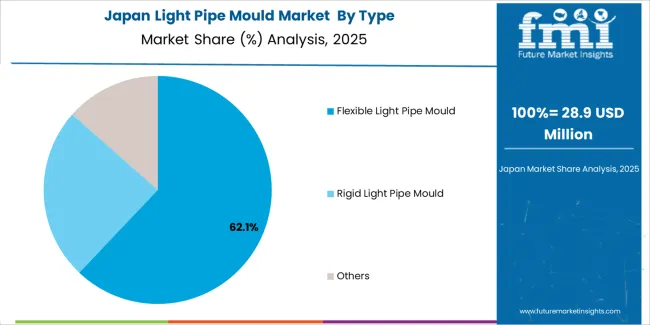

Japanese light pipe mould operations reflect the country's automotive lighting excellence and sophisticated optical component manufacturing requirements. Major automotive lighting manufacturers including Koito Manufacturing, Stanley Electric, and premium appliance producers maintain rigorous mould specification processes that establish industry-leading standards, requiring extensive optical performance validation, surface quality verification, and production capability testing spanning 12-18 months. This creates substantial technical barriers for new mould suppliers but ensures exceptional component quality supporting Japan's automotive lighting reputation and premium product positioning.

The Japanese market demonstrates unique specification preferences, with significant demand for ultra-precise optical surface finishing and specialized coating compatibility tailored to advanced automotive lighting applications. Companies require specific surface roughness measurements and optical transmission characteristics that exceed international standards, driving demand for premium mould manufacturing capabilities and comprehensive quality documentation.

Regulatory oversight through automotive industry associations and lighting standards organizations emphasizes comprehensive optical performance data and component reliability requirements. The automotive lighting supply system requires detailed mould qualification documentation and production capability validation, creating advantages for suppliers with proven Japanese automotive industry experience and comprehensive quality management systems.

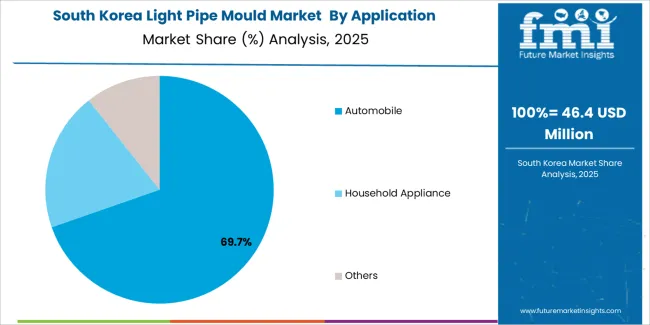

South Korean light pipe mould operations reflect the country's advanced automotive manufacturing sector and premium consumer electronics production capabilities. Major automotive manufacturers including Hyundai Motor Group and lighting suppliers drive sophisticated mould procurement strategies, establishing relationships with proven tooling manufacturers to secure consistent quality for their automotive lighting systems and premium vehicle content requiring advanced optical components.

The Korean market demonstrates particular strength in automotive lighting applications, with manufacturers implementing sophisticated exterior lighting designs and premium interior ambient lighting systems requiring precision light pipe components. This application focus creates demand for moulds supporting complex geometries, exceptional optical surface quality, and high-volume production capabilities throughout intensive manufacturing environments.

Regulatory frameworks emphasize automotive component quality and lighting performance standards, with Korean automotive industry requirements establishing comprehensive specifications for optical component characteristics and manufacturing capabilities. This creates preferences for mould suppliers demonstrating proven automotive lighting experience and comprehensive technical support capabilities supporting component development and production optimization programs.

Profit pools concentrate in precision moulds with proven automotive lighting experience and comprehensive optical engineering capabilities. Value migrates from basic tooling to engineered mould systems offering advanced optical surface finishing, multi-cavity optimization, and integrated design support services. Several competitive archetypes dominate: established mould manufacturers with comprehensive automotive lighting relationships and extensive optical component expertise; specialized precision tooling suppliers offering custom optical surface finishing and application engineering; integrated tooling solution providers bundling moulds with component design optimization and production support; and regional manufacturers serving local automotive suppliers and appliance producers through competitive pricing and responsive service.

Switching costs remain substantial through mould qualification requirements, optical performance validation, and production capability dependencies, stabilizing market positions for established suppliers with proven automotive lighting and optical component experience. New vehicle lighting programs and product development cycles create opportunities for suppliers offering differentiated optical performance, rapid tooling delivery, and comprehensive engineering support capabilities. Market concentration continues as major automotive lighting suppliers standardize mould procurement across multiple production facilities creating strategic supplier relationships and volume leverage opportunities.

Technical capabilities including optical surface engineering, complex geometry manufacturing, and multi-cavity balancing increasingly differentiate competitive positioning as automotive lighting manufacturers pursue distinctive lighting designs and cost-effective production. Suppliers maintaining comprehensive engineering support organizations and rapid prototyping capabilities gain advantages in competitive evaluations. Do now: establish reference installations in major automotive lighting programs with documented optical performance advantages; develop modular mould platforms enabling cost-effective customization while maintaining optical quality consistency; option: pursue vertical integration with optical component design services enabling co-optimized mould and component solutions.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Established mould manufacturers | Comprehensive automotive relationships, proven optical expertise, global support infrastructure | Standardized mould platforms, qualification documentation, strategic lighting supplier partnerships |

| Specialized precision tooling suppliers | Optical surface engineering expertise, customization capability, rapid development cycles | Custom optical finishing, specialized applications, fast prototyping services |

| Integrated tooling solution providers | Comprehensive design services, bundled solutions, component optimization capabilities | Complete development packages, integrated engineering support, turnkey solutions |

| Regional manufacturers | Local market knowledge, cost-competitive positioning, responsive service | Domestic automotive suppliers, standard tooling, rapid delivery capabilities |

| Items | Values |

|---|---|

| Quantitative Units | USD 936.6 million |

| Type | Flexible Light Pipe Mould, Rigid Light Pipe Mould, Others |

| Application | Automobile, Household Appliance, Others |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | United States, Germany, China, India, Brazil, and other 40+ countries |

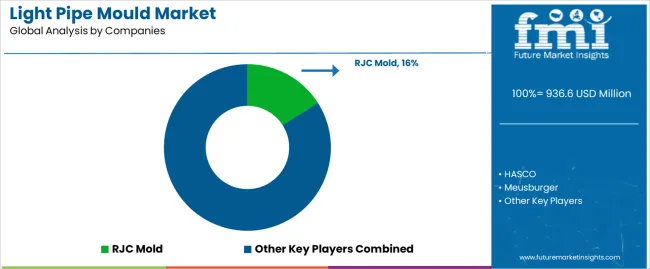

| Key Companies Profiled | RJC Mold, HASCO, Meusburger, Omni Mold, OMC, Zhejiang Saihao Industrial, Chemtech Plastics, Shenzhen Jiehui Chuang Technology, Toolsong, Dianjing Mould, Zhejiang Sibao International, Taizhou Huangyan Sunwin Mould, Ano mould |

| Additional Attributes | Dollar sales by type/application, regional demand (NA, EU, APAC), competitive landscape, automotive vs. household appliance adoption, optical surface specifications and quality standards, and mould manufacturing innovations driving surface finishing excellence, dimensional precision, and production efficiency |

The global light pipe mould market is estimated to be valued at USD 936.6 million in 2025.

The market size for the light pipe mould market is projected to reach USD 2,258.3 million by 2035.

The light pipe mould market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in light pipe mould market are flexible light pipe mould, rigid light pipe mould and others.

In terms of application, automobile segment to command 68.4% share in the light pipe mould market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lightning Surge Protector Market Size and Share Forecast Outlook 2025 to 2035

Light Therapy Market Forecast and Outlook 2025 to 2035

Light Rail Traction Converter Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightening and Whitening Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Lightening / Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switch Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Light Setting Spray Market Size and Share Forecast Outlook 2025 to 2035

Light-Activated Anti-Pollution Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Light Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Light Emitting Diode (LED) Backlight Display Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switches Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Light Field Market Size and Share Forecast Outlook 2025 to 2035

Lighting Product Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA