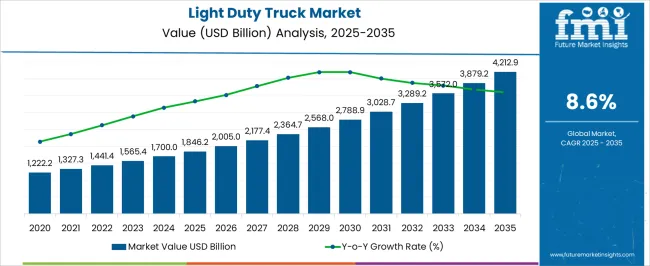

The light duty truck market is estimated to be valued at USD 1846.2 billion in 2025 and is projected to reach USD 4212.9 billion by 2035, registering a compound annual growth rate (CAGR) of 8.6% over the forecast period.

This expansion is expected to be fueled by rising demand for commercial transportation solutions, last-mile logistics, and fleet modernization across multiple regions. Market growth is likely to be reinforced as manufacturers enhance vehicle efficiency, diversify product offerings, and optimize production capacities to meet evolving market requirements. Price adjustments, regional consumption patterns, and adoption of specialized variants are anticipated to influence annual growth and overall market valuation during the forecast period.

During the 2025–2035 period, the light duty truck market is projected to experience consistent annual growth, with incremental revenue gains observed year on year. Adoption is likely to be shaped by increasing freight transport needs, commercial fleet expansion, and replacement cycles in mature markets. Competitive strategies such as enhanced service networks, strategic partnerships, and targeted marketing initiatives are expected to influence market positioning and value capture. Overall, the trajectory of the market suggests sustained growth, driven by both industrial demand and operational efficiency requirements across global logistics and transportation sectors.

| Metric | Value |

|---|---|

| Light Duty Truck Market Estimated Value in (2025 E) | USD 1846.2 billion |

| Light Duty Truck Market Forecast Value in (2035 F) | USD 4212.9 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

The light duty truck market is estimated to hold a notable proportion within its parent markets, representing approximately 25-28% of the commercial vehicle market, around 10-12% of the automotive market, close to 60-65% of the light commercial vehicle market, about 15-18% of the fleet vehicles market, and roughly 8-10% of the automotive manufacturing market. Collectively, the cumulative share across these parent segments is observed in the range of 118-133%, highlighting the central role of light duty trucks in transportation, logistics, and commercial operations. The market has been driven by the increasing demand for versatile, cost-effective vehicles capable of carrying moderate payloads while offering efficiency and reliability in urban and regional transport.

Adoption is influenced by fleet modernization, last-mile delivery requirements, and the need for vehicles that provide low operational costs and ease of maintenance. Market participants have focused on enhancing vehicle performance, fuel efficiency, and durability to meet the demands of logistics companies, SMEs, and service providers. As a result, the light duty truck market has not only captured a significant share within commercial vehicles and light commercial vehicles but has also influenced fleet management, automotive manufacturing, and broader automotive markets, emphasizing its importance in supporting trade, regional transport, and small-scale logistics operations.

The light duty truck market is expanding steadily, supported by increasing urban logistics demand, infrastructure development, and the rising need for flexible mobility solutions across both personal and commercial applications. A shift toward compact utility vehicles for intra-city transport and delivery services has significantly enhanced light duty truck utilization, particularly in emerging markets.

Technological integration, including advanced driver-assistance systems (ADAS) and improved fuel efficiency, continues to elevate vehicle appeal among cost-conscious buyers. Additionally, regulatory incentives and tightening emission norms are pushing manufacturers to diversify their engine offerings and innovate around lightweight design and fuel economy.

With growing e-commerce penetration and last-mile delivery growth, the segment is positioned for continued upward momentum. The market is likely to benefit from fleet modernization programs, the rise of small and medium enterprises, and growing investment in smart transportation infrastructure over the forecast period

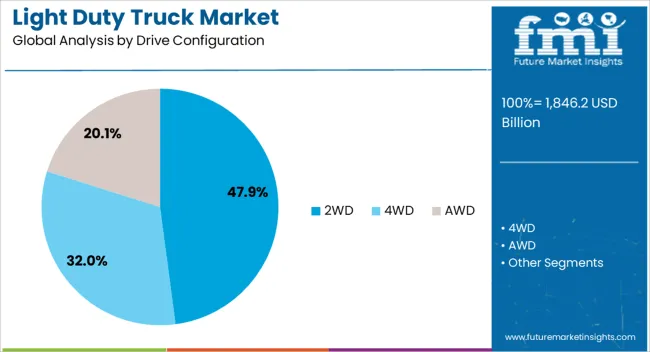

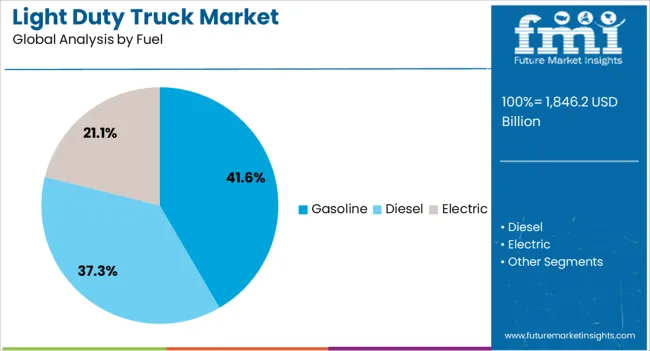

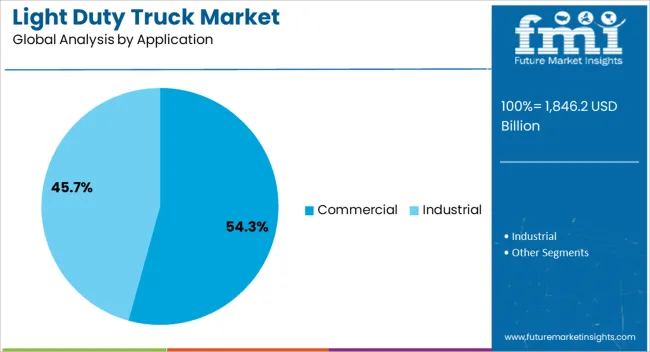

The light duty truck market is segmented by drive configuration, fuel, application, and geographic regions. By drive configuration, light duty truck market is divided into 2WD, 4WD, and AWD. In terms of fuel, light duty truck market is classified into gasoline, diesel, and electric. Based on application, light duty truck market is segmented into commercial and industrial. Regionally, the light duty truck industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 2WD segment leads the drive configuration category with a 47.9% market share, highlighting its popularity for urban and regional transport due to its affordability, lower maintenance costs, and better fuel efficiency. This configuration is widely adopted in areas with well-developed road infrastructure where the additional traction of 4WD is not essential.

The lighter drivetrain and simpler mechanical layout contribute to a reduced total cost of ownership, making 2WD vehicles an attractive option for cost-sensitive fleet operators and individual buyers alike. Increased production of 2WD light trucks by major OEMs, coupled with greater availability of parts and service support, further strengthens the segment’s market presence.

As city-based logistics and light commercial transportation continue to expand, the preference for reliable and economical 2WD configurations is expected to persist, especially in densely populated and urbanized regions

Gasoline-powered vehicles command a 41.6% share in the light duty truck market's fuel segment, maintaining relevance due to widespread fuel availability, lower upfront vehicle costs, and smoother engine performance. Although diesel engines offer greater torque and fuel economy, gasoline engines remain favored for light payload applications and shorter commutes, especially in urban and suburban areas.

The segment continues to grow with the development of fuel-efficient gasoline engines and hybrid variants that align with evolving environmental standards. Additionally, improvements in gasoline combustion technology and emissions control systems have narrowed the performance gap between gasoline and alternative fuel options.

As vehicle electrification accelerates, the gasoline segment is expected to coexist with hybrid and electric models, especially in markets where infrastructure for EVs is still under development. The ease of refueling and established service networks are likely to sustain gasoline’s strong position in the near term

The commercial segment dominates the application category with a 54.3% market share, driven by the increasing demand for efficient cargo transport, service operations, and intra-city deliveries. Light duty trucks are becoming essential assets for a wide array of commercial users, including retail distributors, logistics firms, contractors, and urban service providers.

Their compact size, maneuverability, and cost-efficiency make them ideal for navigating congested urban environments while handling medium-load deliveries. Growth in small and medium-sized enterprises and the expansion of last-mile delivery networks have further accelerated commercial adoption.

Manufacturers are responding with tailored models that meet specific business needs, offering variants with modular cargo solutions, enhanced durability, and technology-driven fleet management capabilities. As commerce shifts toward faster, decentralized supply chains, the role of light duty trucks in supporting flexible and reliable transportation is set to intensify, ensuring continued growth of the commercial application segment

The light duty truck market is expanding due to rising commercial transport demand, fleet modernization, and e-commerce growth. Opportunities lie in electrification, alternative fuels, and connected vehicle technologies, while trends emphasize safety integration and telematics adoption. Challenges include regulatory compliance, supply chain volatility, and cost pressures. Overall, the market is poised for strategic growth, with manufacturers and operators navigating operational, technological, and regulatory dynamics to capture value in an increasingly competitive global transport landscape.

The light duty truck market is experiencing heightened demand due to rapid growth in commercial transport, logistics, and last-mile delivery services. Businesses across retail, e-commerce, and manufacturing sectors are increasingly deploying light trucks to ensure timely distribution and cost-effective operations. Urban and semi-urban infrastructure expansion has reinforced the need for versatile vehicles capable of navigating narrow streets while handling moderate cargo loads. The demand is further influenced by fleet renewal cycles, government incentives for efficient transport, and rising consumer preference for multi-purpose trucks. Manufacturers are responding by enhancing payload capacity, fuel efficiency, and comfort features, thereby boosting market adoption. Regional differences in regulatory standards, road conditions, and vehicle taxation also shape purchasing patterns, making market dynamics highly nuanced. Consequently, the light duty truck segment is becoming a strategic focus for automakers aiming to capture both commercial and private transport markets globally. The ongoing demand is expected to sustain production growth and encourage innovative vehicle designs in the medium term.

Opportunities in the light duty truck market are being driven by electrification initiatives and fleet modernization programs in key regions. Companies are increasingly exploring electric and hybrid variants to reduce operational costs, comply with emissions regulations, and differentiate offerings in a competitive market. Leasing and fleet renewal schemes provide avenues for rapid adoption among commercial operators seeking efficiency and reduced maintenance expenditures. In addition, rising government focus on cleaner transport solutions has encouraged subsidies, tax incentives, and infrastructure support for electric vehicle deployment. Regional markets in North America, Europe, and Asia-Pacific are emerging as prime targets for manufacturers leveraging opportunities in smart fleet integration, connected vehicle technologies, and alternative fuel systems. The focus on product reliability, battery longevity, and charging infrastructure ensures that investments in research, procurement, and partnerships remain lucrative. Consequently, light duty trucks are positioned as a critical segment for capturing growth from evolving commercial transport practices and fleet operational optimization strategies.

Significant trends in the light duty truck market highlight the integration of connected vehicle technologies, telematics, and advanced safety systems. Manufacturers are increasingly equipping trucks with features such as GPS tracking, collision avoidance, lane departure alerts, and adaptive braking systems. The adoption of IoT-enabled fleet management solutions allows operators to monitor fuel consumption, driver behavior, and maintenance schedules remotely, optimizing operational efficiency. In parallel, the market is witnessing an increased focus on ergonomic cabin design, infotainment solutions, and multi-functional dashboards to enhance driver comfort and productivity. Shifts in consumer expectations, coupled with stricter safety regulations in North America and Europe, are encouraging manufacturers to prioritize technology integration while maintaining cost competitiveness. Furthermore, partnerships between OEMs and software solution providers are fostering new service models, including subscription-based telematics and predictive maintenance offerings. These trends reflect a market increasingly driven by digital connectivity, operational efficiency, and enhanced safety standards, reinforcing the value proposition of light duty trucks for commercial operators.

Challenges in the light duty truck market are primarily associated with stringent emissions regulations, fluctuating fuel prices, and supply chain disruptions. Compliance with regional and international standards, such as Euro 6 or equivalent, requires manufacturers to adopt advanced engine technologies, which can increase production costs and affect pricing strategies. Additionally, global supply chain volatility, including semiconductor shortages and raw material price fluctuations, can delay production and reduce vehicle availability. Operators also face challenges related to fleet maintenance costs, insurance premiums, and infrastructure limitations, particularly in emerging markets. Balancing regulatory compliance with cost-efficiency and performance expectations remains critical for manufacturers and fleet operators alike. The volatility in global logistics, trade policies, and raw material sourcing continues to pose risks, necessitating proactive risk management strategies, supplier diversification, and operational flexibility. As a result, the market requires careful navigation of regulatory landscapes, cost pressures, and operational risks to maintain growth momentum.

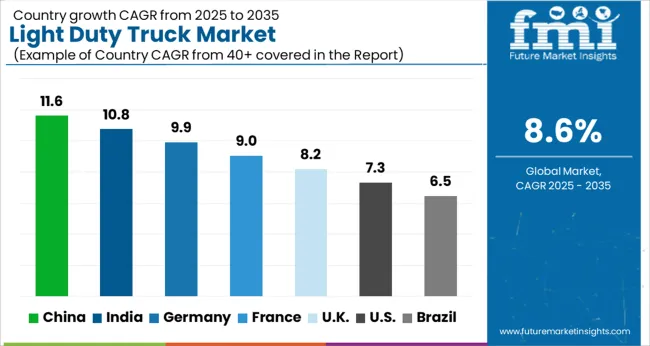

| Country | CAGR |

|---|---|

| China | 11.6% |

| India | 10.8% |

| Germany | 9.9% |

| France | 9.0% |

| UK | 8.2% |

| USA | 7.3% |

| Brazil | 6.5% |

The global light duty truck market is projected to grow at a CAGR of 8.6% from 2025 to 2035. China leads with a growth rate of 11.6%, followed by India at 10.8%, and France at 9%. The United Kingdom records a growth rate of 8.2%, while the United States shows the slowest growth at 7.3%. Increasing demand for commercial transportation, e-commerce logistics, and urban delivery solutions is driving market expansion. Emerging markets like China and India experience faster growth due to rising vehicle ownership, industrial expansion, and government incentives for cleaner transportation. Mature markets such as the USA, UK, and France see steady growth driven by fleet modernization, stricter emission regulations, and adoption of electric or hybrid light duty trucks. This report includes insights on 40+ countries; the top markets are shown here for reference.

The light duty truck market in China is expanding at a CAGR of 11.6%, propelled by strong growth in e-commerce, logistics, and small-scale freight transport. Increasing urbanization and the rise of last-mile delivery services are driving demand for compact and efficient light duty trucks. Additionally, government initiatives promoting energy-efficient and lower-emission vehicles are encouraging manufacturers to adopt hybrid and electric models. Local manufacturers are investing in research, production facilities, and technology upgrades to meet domestic demand and export requirements. The market in China continues to grow steadily due to infrastructure development, urban freight requirements, and an increasing need for reliable commercial transportation solutions.

The light duty truck market in India is growing at a CAGR of 10.8%, fueled by the rapid expansion of e-commerce and small business logistics. Rising urban population and infrastructural development have increased the need for efficient last-mile delivery and intra-city transportation. Government policies supporting electric and hybrid commercial vehicles are encouraging adoption of cleaner and more fuel-efficient models. Indian manufacturers are focusing on scaling production, improving fuel efficiency, and offering technologically advanced vehicles to meet rising demand. The market is also witnessing increasing integration of telematics, fleet management solutions, and digital tracking, which enhances operational efficiency for logistics companies and fleet operators.

The light duty truck market in France is expanding at a CAGR of 9%, driven by urban deliveries, commercial transportation, and stricter emission standards. French businesses are increasingly adopting electric and hybrid trucks to comply with low-emission zone regulations in cities. Market growth is further supported by investments in infrastructure and last-mile delivery solutions to meet rising e-commerce demand. Manufacturers are introducing technologically advanced trucks with improved safety features, fuel efficiency, and connectivity options. The French market continues steady growth due to a combination of regulatory compliance, technological improvements, and growing demand for efficient urban freight solutions.

The light duty truck market in the United Kingdom is growing at a CAGR of 8.2%, supported by rising e-commerce deliveries and urban transportation needs. UK fleet operators are investing in fuel-efficient and low-emission trucks to meet government standards and environmental policies. Market expansion is also driven by technological innovations such as telematics, connected fleet solutions, and route optimization systems. Increasing consumer demand for timely deliveries and logistics efficiency is encouraging businesses to upgrade their fleets. Overall, the UK market is witnessing steady growth due to regulatory compliance, technological integration, and the need for efficient urban freight transport solutions.

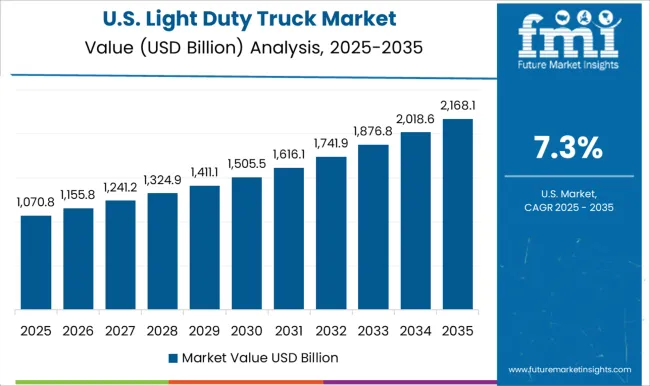

The light duty truck market in the United States is expanding at a CAGR of 7.3%, driven by the need for efficient urban delivery and commercial transportation solutions. Rising consumer demand for e-commerce shipments and last-mile logistics is fueling market growth. US manufacturers are increasingly adopting hybrid and electric technologies to comply with emission standards and reduce operational costs. Additionally, the market benefits from advancements in telematics, fleet management, and connected vehicle technologies. Overall, steady growth in the US light duty truck market is supported by fleet modernization, regulatory compliance, and the increasing importance of efficient and reliable urban freight transport systems.

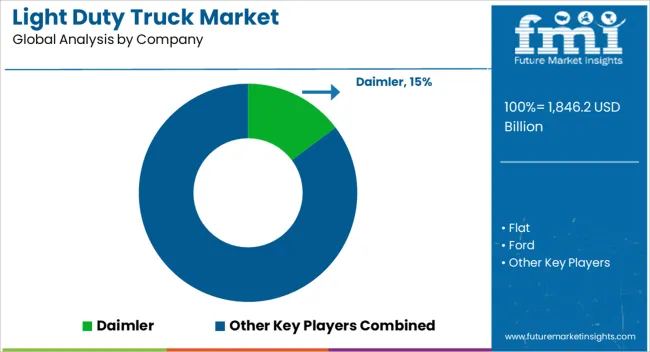

The light duty truck market has experienced notable growth as demand for versatile, fuel-efficient, and cost-effective transportation solutions rises across commercial, logistics, and urban delivery sectors. Key players such as Daimler, Ford, and GM are competing intensely by expanding product portfolios and integrating advanced technologies to enhance performance, safety, and driver comfort. Companies like Hyundai, Isuzu, and Toyota emphasize durability and reliability, targeting emerging markets where commercial vehicle adoption is accelerating. Strategic initiatives such as localized production, strategic alliances, and adoption of alternative fuel technologies are being leveraged to address stringent emissions regulations and evolving customer needs.

Additionally, Renault, Tata, and Volkswagen are investing in electric and hybrid variants to capture market share in regions emphasizing sustainability and carbon reduction. Competitive advantage is increasingly influenced by after-sales support, fuel efficiency, payload capacity, and total cost of ownership, prompting manufacturers to innovate in engine design, lightweight materials, and telematics integration to meet customer expectations. The market landscape is shaped by continuous product development, regional expansion, and digital transformation in sales and fleet management. Companies such as Daimler and Ford are enhancing connectivity features, fleet telematics, and driver-assistance systems to offer value-added solutions for commercial operations. Smaller players and regional manufacturers focus on niche segments, including compact trucks for urban deliveries and specialized vehicles for construction or agriculture.

Strategic partnerships, joint ventures, and acquisitions are widely used to expand geographic presence and strengthen supply chains. The shift toward alternative fuels, including electric and CNG-powered trucks, is influencing design, production, and marketing strategies across the industry. With increasing urbanization, e-commerce growth, and last-mile delivery demands, light duty trucks are becoming an indispensable component of transportation infrastructure. Market players that combine innovation, operational efficiency, and customer-centric solutions are positioned to maintain leadership and drive sustained growth in the evolving global market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1846.2 billion |

| Drive Configuration | 2WD, 4WD, and AWD |

| Fuel | Gasoline, Diesel, and Electric |

| Application | Commercial and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daimler, Flat, Ford, GM, Hyundai, Isuzu, Renault, Tata, Toyota, and Volkswagen |

| Additional Attributes | Dollar sales by truck type (pickup, van, chassis cab) and fuel type (diesel, petrol, electric, hybrid) are key metrics. Trends include rising demand for commercial and fleet applications, growth in last-mile delivery and e-commerce logistics, and increasing adoption of electric and fuel-efficient models. Regional adoption, regulatory standards, and technological advancements are driving market growth. |

The global light duty truck market is estimated to be valued at USD 1,846.2 billion in 2025.

The market size for the light duty truck market is projected to reach USD 4,212.9 billion by 2035.

The light duty truck market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in light duty truck market are 2wd, 4wd and awd.

In terms of fuel, gasoline segment to command 41.6% share in the light duty truck market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Light Pipe Mould Market Size and Share Forecast Outlook 2025 to 2035

Lightning Surge Protector Market Size and Share Forecast Outlook 2025 to 2035

Light Therapy Market Forecast and Outlook 2025 to 2035

Light Rail Traction Converter Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightening and Whitening Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Lightening / Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switch Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Light Setting Spray Market Size and Share Forecast Outlook 2025 to 2035

Light-Activated Anti-Pollution Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Light Emitting Diode (LED) Backlight Display Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switches Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Light Field Market Size and Share Forecast Outlook 2025 to 2035

Lighting Product Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA