The Global Lightening / Whitening Agents Market is expected to record a valuation of USD 3,408.6 million in 2025 and USD 7,803.5 million in 2035, with an increase of USD 4,394.9 million, representing a total growth of 193% over the decade. The overall expansion reflects strong demand from skincare and dermocosmetic applications, underpinned by growing consumer preference for botanical brightening actives, biotechnology-derived whitening ingredients, and clinically validated tyrosinase inhibitors.

Global Lightening / Whitening Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value (2025E) | USD 3,408.6 million |

| Forecast Value (2035F) | USD 7,803.5 million |

| Forecast CAGR (2025 to 2035) | 8.60% |

During the first five-year period from 2025 to 2030, the market increases from USD 3,408.6 million to USD 5,157.4 million, adding USD 1,748.8 million, which accounts for nearly 40% of the total decade growth. This initial phase witnesses steady adoption across facial creams, serums, and spot correctors, driven by brands promoting active-based skin tone correction. Botanical and bio-fermented extracts such as arbutin, licorice root, and kojic acid dominate this phase, as natural-origin safety perception strengthens brand positioning.

The second half, from 2030 to 2035, contributes USD 2,646.1 million, equal to nearly 60% of the total decade growth, as the market jumps from USD 5,157.4 million to USD 7,803.5 million. This acceleration is powered by innovation in encapsulation technologies, sustained-release formulations, and biotechnology-derived actives that enable controlled delivery and enhanced skin compatibility. Long-term performance testing and integration of brightening actives into multifunctional products (such as anti-aging or moisturizing creams) reinforce the premiumization trend. The market also benefits from a rise in dermocosmetic and clinical-grade whitening formulations targeting hyperpigmentation and uneven skin tone across global markets.

From 2020 to 2024, the Global Lightening / Whitening Agents Market expanded significantly as the beauty industry shifted toward dermatologist-endorsed and efficacy-based brightening solutions. During this period, traditional whitening formulations evolved into scientifically backed products focusing on melanin pathway inhibition and cellular renewal. Market leadership was defined by raw material suppliers such as BASF, Clariant, and DSM-Firmenich, which together accounted for a substantial share of global value through their integrated portfolios of actives, peptides, and delivery technologies.

Competitive differentiation in this phase was primarily achieved through ingredient purity, safety, and bioavailability. Synthetic whitening agents like hydroquinone began losing ground due to tightening regulatory frameworks, while plant-based and biotechnology-derived actives gained favor among both consumers and brands. Between 2020 and 2024, most top cosmetic companies partnered with ingredient suppliers to introduce hybrid formulations combining antioxidants, tyrosinase inhibitors, and exfoliating renewal complexes.

By 2025, global demand for lightening and whitening actives is projected to reach USD 3,408.6 million, and the revenue mix is shifting as biotechnology and encapsulated delivery systems grow beyond 45% of total value. Traditional synthetic actives face competition from sustained-release botanical extracts with improved efficacy and minimal irritation profiles. Major ingredient manufacturers are repositioning toward sustainable production and clinically validated brightening peptides, while niche suppliers specialize in encapsulated beads and microemulsions designed for targeted release. The competitive advantage in the coming decade will hinge on scientific substantiation, bioactive stability, and global regulatory compliance rather than cost leadership alone.

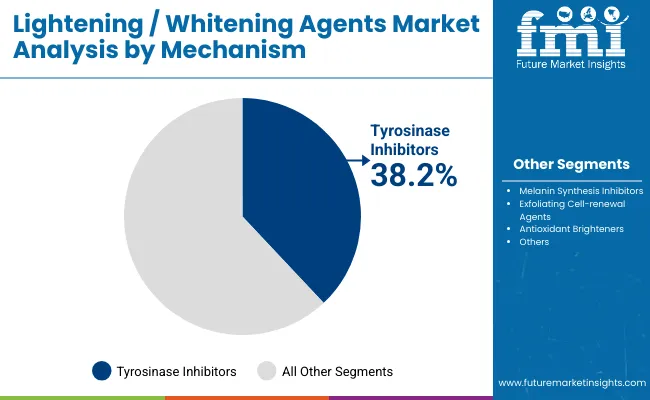

Advancements in skin biology research and melanin pathway understanding have driven innovation in whitening actives. Modern formulations target multiple stages of melanin synthesis c from inhibition of tyrosinase enzyme activity to prevention of melanosome transfer enabling visible brightening without irritation. Among mechanisms, Tyrosinase inhibitors account for 38.2% share (USD 1,302.1 million) in 2025, led by actives like niacinamide, alpha-arbutin, and resorcinol derivatives, which are clinically proven to reduce pigmentation and even skin tone.

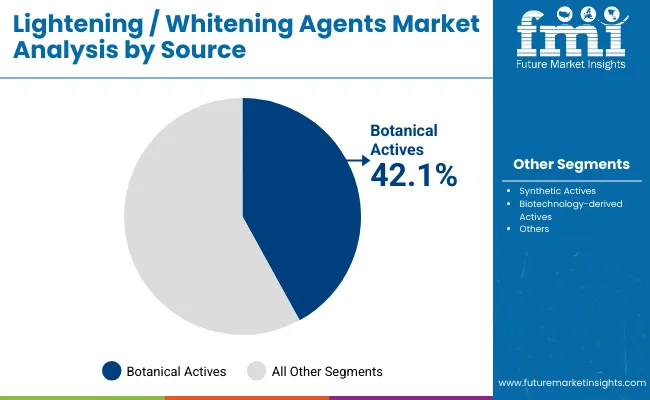

Rising consumer demand for natural and clean-label products has accelerated the adoption of Botanical actives, holding a 42.1% share (USD 1,435.0 million) in 2025. These include licorice, mulberry, bearberry, and green tea extracts, favored for their antioxidant and melanin-regulating properties. Meanwhile, Biotechnology-derived actives such as bio-fermented kojic acid, stabilized vitamin C derivatives, and recombinant peptides are setting new standards in efficacy.

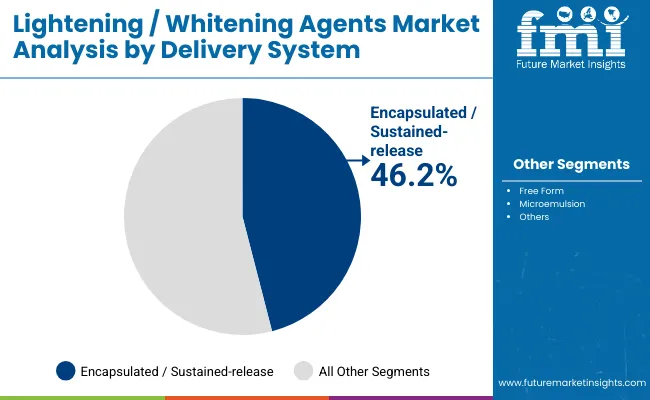

Encapsulated / sustained-release systems command 46.2% market share (USD 1,574.8 million) in 2025, as encapsulation enhances stability and bioavailability, allowing longer-lasting effects and reduced irritation risk. The technology supports inclusion in high-end serums and professional-grade formulations. Furthermore, the expanding use of antioxidants like glutathione, vitamin C, and ascorbyl glucoside in brightening formulations promotes skin health while addressing environmental stressors such as UV exposure and pollution, strengthening market growth.

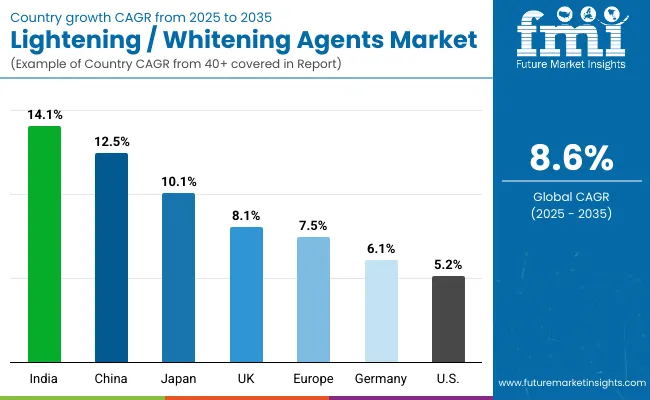

Regionally, Asia dominates demand, with China (CAGR 12.5%), India (CAGR 14.1%), and Japan (CAGR 10.1%) representing the fastest-growing markets due to strong consumer orientation toward whitening skincare. The USA market, valued at USD 679.8 million in 2025, will expand steadily to USD 1,383.4 million by 2035, supported by rising preference for tone-correcting and anti-dark-spot solutions. European markets such as the UK (CAGR 8.1%) and Germany (CAGR 6.1%) show consistent growth led by dermocosmetic product innovation and clinical-grade formulations.

The Global Lightening / Whitening Agents Market demonstrates a structurally diverse segmentation across mechanisms, sources, delivery systems, physical forms, applications, and end uses, each playing a distinct role in shaping long-term value creation. Within mechanisms, Tyrosinase inhibitors dominate with a 38.2% share in 2025, as ingredients like niacinamide, alpha-arbutin, and resorcinol-based complexes remain central to both cosmetic and dermocosmetic formulations due to their clinically verified efficacy in suppressing melanin synthesis. By source, Botanical actives lead with 42.1% share, driven by rising consumer preference for clean-label, nature-derived ingredients sourced through sustainable extraction and biotechnology-based fermentation.

Encapsulated or sustained-release delivery systems with a commanding 46.2% market share are reshaping formulation stability and bioavailability by allowing controlled diffusion and enhanced skin tolerance, particularly in high-concentration brightening serums and professional-grade treatments. Across physical forms, liquid concentrates and microencapsulated beads are gaining traction in advanced skincare and clinical applications. In application terms, Face creams, serums, and spot correctors collectively account for the largest usage share, while professional peels represent a niche but high-growth opportunity in clinical settings. End-use analysis shows that Cosmetic and skincare brands continue to lead overall demand, followed by Dermocosmetic and clinical formulations, reflecting the increasing integration of brightening actives into medical-grade aesthetic care. Regionally, the market’s growth trajectory is anchored by Asiaespecially China, India, and Japan where cultural and beauty perceptions around luminosity continue to drive substantial product innovation and volume expansion, while mature markets such as the USA, UK, and Germany shift toward multifunctional, tone-correcting, and dermatologist-tested whitening products.

| Mechanism | Value Share % 2025 |

|---|---|

| Tyrosinase inhibitors | 38.2% |

| Others | 61.8% |

The Tyrosinase inhibitors segment leads the market with 38.2% share in 2025, driven by active ingredients that interrupt melanin formation. Key molecules include niacinamide, alpha-arbutin, resorcinol derivatives, and stabilized vitamin C. Their clinical validation and compatibility with multiple formulations ensure wide acceptance across both premium and mass-market brands. Continuous innovation in molecular design is reducing irritation potential while enhancing efficacy, leading to high consumer trust and regulatory acceptance.

This segment’s dominance is further reinforced by strategic R&D collaborations between global ingredient suppliers and dermocosmetic brands, integrating tyrosinase-inhibiting complexes with antioxidant co-factors and cellular renewal boosters. As demand for safe and long-term brightening rises, the tyrosinase inhibitor category will continue to anchor the whitening ingredients portfolio through 2035.

| Source | Value Share % 2025 |

|---|---|

| Botanical actives | 42.1% |

| Others | 57.9% |

The Botanical actives segment is expanding rapidly, supported by consumer preference for nature-derived formulations. Extracts like licorice, mulberry, and bearberry demonstrate strong tyrosinase inhibition while offering antioxidant and anti-inflammatory benefits. These actives are often used in synergy with peptides and vitamins to enhance visible skin tone improvement.

The rise of biotechnology-enabled cultivation and green extraction technologies is improving yield, purity, and reproducibility, helping brands meet sustainability and transparency expectations. As natural-origin ingredients become synonymous with skin safety and ethical sourcing, botanical actives are expected to maintain leadership across major skincare and dermocosmetic product lines.

| Delivery System | Value Share % 2025 |

|---|---|

| Encapsulated / sustained-release | 46.2% |

| Others | 53.8% |

Encapsulated and sustained-release systems represent the most technologically advanced delivery formats, commanding 46.2% share in 2025. These systems utilize liposomes, polymeric microspheres, and nanocarriers to stabilize actives and control their release over extended periods, improving bioavailability and efficacy.

Brands increasingly prefer encapsulated ingredients due to their compatibility with premium serums and clinical peels, offering enhanced stability against oxidation and degradation. This segment is pivotal in redefining formulation science, enabling ingredient houses like Croda, Seppic, and Evonik to lead through patented encapsulation platforms. As personalization and efficacy benchmarking evolve, encapsulated delivery is projected to remain central to next-generation brightening product innovation through 2035.

Biotechnology and Encapsulation Redefining Formulation Performance:

One of the strongest drivers of the Global Lightening / Whitening Agents Market is the integration of biotechnology and encapsulation science to achieve superior ingredient stability and efficacy. Ingredient leaders such as DSM-Firmenich, Evonik, and Croda are heavily investing in microencapsulation and sustained-release delivery platforms that stabilize actives like ascorbyl glucoside, resorcinol, and kojic acid against oxidation and degradation. These technologies enable prolonged release, deeper skin penetration, and lower irritation ratescritical advantages for regulatory compliance and sensitive-skin formulations. The result is a marked shift toward biotechnology-derived actives, offering consistent performance and eco-certifiable origins, strengthening brand differentiation in premium dermocosmetic lines.

Rising Clinical and Regulatory Standardization Driving Market Credibility:

Another key growth driver is the increasing clinical validation and standardization of brightening ingredients, which enhances global consumer confidence. Regulatory tightening in the USA, EU, and East Asia against hydroquinone and high-dose corticosteroids has accelerated the replacement with clinically backed alternatives like niacinamide, alpha-arbutin, and resorcinol derivatives. This shift has encouraged brands to pursue transparent efficacy data and peer-reviewed studies, often conducted in collaboration with dermatological institutions. As a result, ingredient suppliers with ISO-certified laboratories and strong regulatory documentation pipelines are capturing higher-value contracts with both multinational beauty houses and emerging clinical skincare brands.

Stringent Global Regulations and Ingredient Bans Impacting Formulation Agility:

Despite the market’s expansion, regulatory volatility remains a critical restraint, particularly in regions enforcing bans or concentration limits on traditional whitening actives such as hydroquinone, mercury derivatives, and untested botanical blends. In the EU and ASEAN regions, stricter cosmetic safety directives require extensive testing and dossier submissions, prolonging product launch cycles. Smaller ingredient suppliers lacking toxicological or clinical data often face commercialization barriers. This results in a fragmented compliance environment where only major players with global regulatory infrastructure like BASF and Givaudan can scale consistently.

Growing Backlash Against ‘Skin Whitening’ Terminology and Shifting Beauty Narratives:

A rising socio-cultural restraint stems from evolving beauty narratives rejecting the concept of “skin whitening.” Global consumers increasingly favor terms like “brightening,” “radiance,” or “tone-evening”, leading to reformulations and rebranding costs for major manufacturers. This perception shift, while positive in inclusivity terms, challenges product messaging and marketing strategies across regions like North America and Western Europe. Companies must navigate a delicate balance between promoting luminosity and avoiding tone-based hierarchies, influencing both product labeling and regulatory claims frameworks.

Hybridization of Brightening with Anti-Aging and Barrier-Repair Functions:

A defining trend shaping the global landscape is the fusion of brightening agents with anti-aging and barrier-repair actives to form multifunctional skincare solutions. Consumers now expect visible brightening coupled with hydration, protection, and rejuvenation. Brands are combining actives such as niacinamide, peptides, and ceramide complexes within single formulations, promoting comprehensive skin health. This hybridization trend not only supports higher price realization but also drives ingredient diversification, with suppliers developing synergistic complexes that target both pigmentation and inflammation pathways simultaneously.

East Asia’s Leadership in Innovation Pipelines and Ingredient Diversification:

East Asiaparticularly China, Japan, and South Koreacontinues to set global innovation standards in the lightening and whitening segment. The region’s high R&D intensity and rapid commercialization cycles result in the fastest CAGR globally (China 12.5%, India 14.1%, Japan 10.1%). Local brands are adopting biotech-fermented brightening actives, enzyme inhibitors, and encapsulated vitamin C analogs to enhance product sophistication. Furthermore, the regulatory openness toward new fermentation-based actives gives East Asian manufacturers a competitive advantage, leading to early adoption of next-generation brightening molecules that later diffuse into Western markets.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 12.5% |

| USA | 5.2% |

| India | 14.1% |

| UK | 8.1% |

| Germany | 6.1% |

| Japan | 10.1% |

| Europe | 7.5% |

The Global Lightening / Whitening Agents Market exhibits strong regional contrasts in growth patterns between emerging and mature economies, reflecting differences in consumer preferences, cultural attitudes toward skin tone, and product innovation intensity. India leads globally with a CAGR of 14.1% from 2025 to 2035, supported by high consumer demand for brightening formulations across mass-market and premium skincare categories. The increasing adoption of herbal, Ayurvedic, and bio-fermented whitening ingredients combined with aggressive brand diversification by both domestic and multinational playerscontinues to fuel expansion. China, following closely with a 12.5% CAGR, benefits from deep-rooted skin-brightening traditions and a thriving cosmeceutical ecosystem, where biotech-derived actives and encapsulated vitamin C complexes are driving rapid innovation. Japan, with a 10.1% CAGR, remains a global benchmark for dermocosmetic precision, focusing on mild yet effective whitening formulations integrating peptides, hyaluronic acid, and antioxidant complexes that align with its “moist-whitening” skincare philosophy.

In contrast, mature Western markets are advancing at moderate yet steady rates, characterized by shifts from traditional whitening to tone-evening and luminosity-enhancing claims. The USA, expanding at 5.2% CAGR, shows rising consumer interest in dark spot correctors, hyperpigmentation serums, and dermatologist-recommended brightening creams, driven by the premium skincare and clinical aesthetic segments. In Europe, the market grows at 7.5% CAGR, led by regulatory-compliant formulations emphasizing safety, clean beauty, and bioactive transparency. Within Europe, the UK (8.1%) shows resilience through growing consumer awareness of niacinamide- and vitamin C-based brightening skincare, while Germany (6.1%) maintains steady progress through its strong dermocosmetic industry, focusing on hypoallergenic and clinically tested whitening products. Overall, Asia’s rapid innovation pace and consumer-led ingredient diversity continue to outstrip Western regions, positioning it as the global growth engine for lightening and whitening actives through 2035.

| Year | USA Lightening / Whitening Agents Market (USD Million) |

|---|---|

| 2025 | 679.80 |

| 2026 | 729.86 |

| 2027 | 783.60 |

| 2028 | 841.30 |

| 2029 | 903.24 |

| 2030 | 969.75 |

| 2031 | 1041.16 |

| 2032 | 1117.82 |

| 2033 | 1200.13 |

| 2034 | 1288.50 |

| 2035 | 1383.38 |

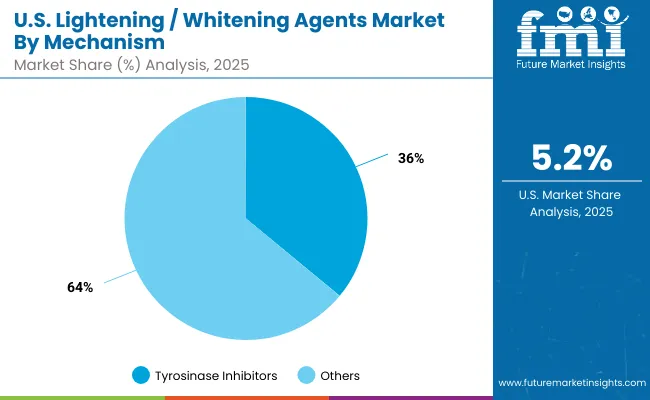

The Lightening / Whitening Agents Market in the United States is projected to grow at a CAGR of 5.2% between 2025 and 2035, supported by increasing adoption of clinical-grade brightening formulations and rising demand for dermatologist-endorsed tone-correcting products. The market is transitioning from traditional whitening concepts to scientifically validated brightening and anti-dark-spot solutions, as consumer awareness shifts toward skin health, radiance, and even tone. The strong performance of Tyrosinase inhibitors, contributing 36.1% of value share in 2025 (USD 245.4 Mn), reflects ongoing interest in efficacious ingredients like niacinamide, alpha-arbutin, and stabilized vitamin C.

Innovation is concentrated among dermocosmetic and cosmeceutical brands, which are expanding portfolios with products that combine brightening with barrier-repair and UV-defense benefits. USA-based skincare companies are integrating sustained-release encapsulation and antioxidant complexes into serums and spot correctors, increasing clinical efficacy and minimizing irritation. The rise of online retail channels and professional skin clinics offering customized brightening treatments has enhanced accessibility. Furthermore, USA consumers’ growing acceptance of biotechnology-derived actives and clean-label transparency continues to fuel product diversification.

The Lightening / Whitening Agents Market in the United Kingdom is expected to expand at a CAGR of 8.1% through 2035, led by increasing integration of brightening complexes in premium skincare and cosmeceutical products. The market’s evolution is shaped by consumer demand for non-irritating, clinically tested ingredients aligned with regulatory standards of the EU and UK cosmetic safety framework. Local and European manufacturers are emphasizing “radiance-enhancing” and “tone-evening” formulations over whitening claims, reflecting a shift toward inclusivity and transparency. The country’s strong network of dermocosmetic laboratories and aesthetic clinics fuels innovation in peptide-based and antioxidant-supported formulations.

UK-based skincare startups and established pharmaceutical-backed beauty brands are prioritizing encapsulated delivery systems for active stabilization. The inclusion of actives such as stabilized ascorbic acid, glutathione, and ferulic acid is reshaping the brightening segment. The retail sector, particularly specialty pharmacy chains and e-commerce platforms, has amplified awareness around skin-brightening routines as part of anti-aging and daily care regimens. Government initiatives encouraging sustainability in cosmetics production also support botanical and biotechnology-derived actives.

India is witnessing the fastest growth globally, with the Lightening / Whitening Agents Market projected to record a CAGR of 14.1% from 2025 to 2035. Rapid urbanization, expanding middle-class consumption, and cultural emphasis on skin tone enhancement continue to drive robust demand across both mass and premium product tiers. Domestic skincare brands are adopting Ayurvedic, botanical, and bio-fermented actives such as turmeric, sandalwood, and kojic acid blends, while multinational players are introducing hybrid formulations combining herbal extracts with clinically validated brightening molecules. The penetration of brightening creams and serums into tier-2 and tier-3 cities has accelerated as pricing becomes more competitive and consumer awareness rises.

Educational marketing, celebrity endorsements, and influencer-led digital campaigns have further normalized brightening products within daily skincare routines. Pharmaceutical companies are collaborating with beauty brands to develop prescription-grade formulations addressing hyperpigmentation, melasma, and post-acne discoloration. This clinicalization of whitening formulations distinguishes India’s market from other Asian peers. Moreover, innovations in microencapsulation and pH-balanced delivery systems are improving the performance of natural actives, allowing local brands to compete with imported premium products.

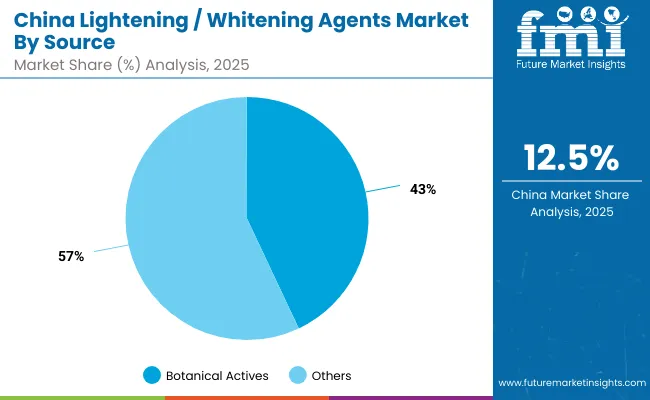

The Lightening / Whitening Agents Market in China is expected to grow at a CAGR of 12.5%, the highest among major global economies, driven by the country’s strong consumer affinity for radiant, even-toned skin and its expanding ecosystem of cosmeceutical innovation and biotech manufacturing. In 2025, Botanical actives account for 43.2% of total value (USD 150.1 Mn), reflecting rapid adoption of herbal and fermentation-based whitening ingredients such as arbutin, licorice, and ginseng derivatives. The increasing popularity of hybrid formulations combining whitening, anti-aging, and hydration further accelerates market performance.

China’s domestic ingredient manufacturers are scaling up bio-fermentation platforms and peptide synthesis for local supply, reducing dependence on imports from Europe and Japan. Municipal and regional R&D clusters in Shanghai, Guangzhou, and Hangzhou are enabling faster ingredient commercialization and consumer testing. E-commerce-driven skincare consumption and influencer-led brand ecosystems have elevated brightening serums and facial essences to top-selling categories. Local brands are emphasizing translucency and glow over whitening, aligning with global inclusivity trends while retaining cultural emphasis on luminosity and youthfulness.

| Country | 2025 Share (%) |

|---|---|

| USA | 19.9% |

| China | 10.2% |

| Japan | 5.9% |

| Germany | 13.1% |

| UK | 6.9% |

| India | 4.2% |

| Europe | 18.8% |

| Country | 2035 Share (%) |

|---|---|

| USA | 17.7% |

| China | 11.0% |

| Japan | 7.2% |

| Germany | 11.4% |

| UK | 6.2% |

| India | 5.1% |

| Europe | 17.2% |

| Mechanism Segment | Market Value Share, 2025 |

|---|---|

| Tyrosinase inhibitors | 36.10% |

| Others | 63.90% |

The Lightening / Whitening Agents Market in the United States is projected at USD 679.8 million in 2025, driven by advanced dermocosmetic innovation, rising adoption of antioxidant-based brightening agents, and increased consumer awareness of hyperpigmentation management. Tyrosinase inhibitors contribute 36.1% of total value, underscoring the dominance of clinically verified actives such as niacinamide, alpha-arbutin, and stabilized vitamin C derivatives. The remaining 63.9% represents a growing mix of exfoliating and antioxidant brighteners incorporated into high-performance facial serums and spot-correcting formulations.

The USA market exhibits a distinct transition from “whitening” to tone-correction and radiance-enhancement, shaped by cultural inclusivity and dermatological efficacy standards. Demand is shifting from traditional hydroquinone-based products toward multifunctional brightening complexes combining melanin inhibition, cell renewal, and barrier repair. A surge in encapsulated and microemulsion delivery systems is reinforcing long-term efficacy, aligning with clinical skincare trends across professional and OTC categories. The dermatology channel, supported by the American Academy of Dermatology’s advocacy for evidence-based pigmentation control, continues to be a key growth driver. Major global suppliers such as BASF, DSM-Firmenich, and Croda are collaborating with USA skincare brands to co-develop safe, sustainable brightening actives that meet FDA and EU standards.

| China By Source | Value Share % 2025 |

|---|---|

| Botanical actives | 43.2% |

| Others | 56.8% |

The Lightening / Whitening Agents Market in China is projected at USD 347.5 million in 2025, representing one of the most dynamic and fastest-expanding segments globally. Botanical actives contribute 43.2% of total value, led by natural-origin ingredients such as licorice extract, arbutin, and ginseng derivatives, which are integral to the cultural preference for holistic and herbal skincare. The remaining 56.8% comprises synthetic and biotechnology-derived actives, increasingly used in professional-grade and high-efficiency formulations.

China’s rapid market growthestimated at a CAGR of 12.5% through 2035is driven by a blend of cultural demand for luminous skin and high domestic innovation capacity. Local biotech firms are scaling up fermentation-based brightening actives such as stabilized kojic acid and recombinant peptides, while cosmetic conglomerates are investing heavily in encapsulated delivery systems that enhance stability and absorption. Cross-border e-commerce platforms are facilitating widespread access to advanced formulations, and government-backed R&D zones in Shanghai and Guangzhou are fostering innovation pipelines that rival Japan and South Korea. As Chinese consumers increasingly prefer transparent, clinical-grade ingredients, the country is becoming a production and innovation hub for global whitening actives.

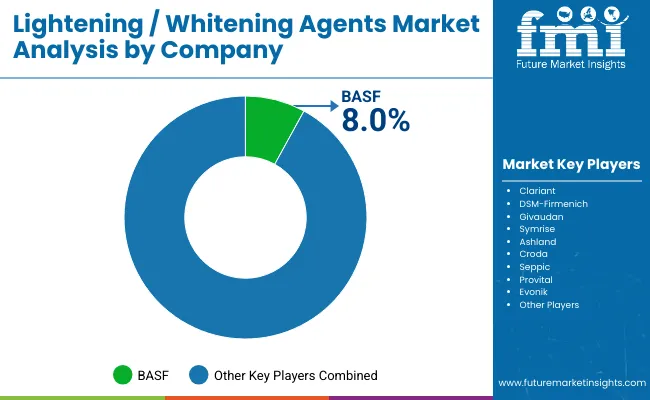

| Company | Global Value Share 2025 |

|---|---|

| BASF | 8.0% |

| Others | 92.0% |

The Global Lightening / Whitening Agents Market is moderately fragmented, comprising multinational ingredient suppliers, dermocosmetic innovators, and niche botanical specialists competing across a broad spectrum of skincare and cosmetic applications. Global leaders such as BASF, DSM-Firmenich, and Givaudan maintain significant value share through their diversified ingredient portfolios, scientific validation platforms, and vertically integrated R&D ecosystems. Their leadership is driven by investments in biotechnology-derived actives, sustainable extraction methods, and encapsulation technologies that enhance ingredient efficacy and formulation stability. These companies are also strengthening partnerships with top skincare and cosmetic brands to co-develop next-generation brightening complexes that address both pigmentation and overall skin health.

Established mid-sized players such as Clariant, Symrise, and Croda are rapidly expanding their dermocosmetic actives portfolio to include botanical brightening agents, stabilized vitamin C derivatives, and biodegradable delivery systems. Their strategies center on green chemistry, skin microbiome safety, and multifunctional formulation design to cater to evolving regulatory and consumer demands. Mid-tier suppliers are also leveraging their global technical centers to support local formulation customization for markets in Asia-Pacific, Europe, and North America.

Niche-focused companies including Seppic, Provital, and Ashland focus on high-performance specialty actives and emulsifiers derived from plant-based or fermentation sources. Their expertise lies in ingredient traceability, sensory innovation, and synergistic formulation capabilities that allow customization for luxury skincare and clinical-grade products. These players are differentiating themselves through skin-friendly, irritation-free actives, designed for sensitive and inclusive skin tones, emphasizing performance validated by in-vitro and clinical studies.

Overall, competitive differentiation in the market is shifting from single-ingredient efficacy to integrated ecosystem innovationwhere sustainability, bioavailability, and digital formulation platforms define long-term leadership. Companies are moving beyond traditional whitening actives toward holistic brightening, combining melanin regulation, antioxidant protection, and barrier restoration within one formulation. Strategic collaborations between ingredient suppliers and beauty brands are becoming more prominent, especially for co-branded ingredient marketing and regulatory transparency. This transition signals a move toward science-backed, inclusive, and sustainability-driven brightening portfolios that reflect modern consumer expectations across both premium and mass-market skincare segments.

Key Developments in Global Lightening / Whitening Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Mechanism | Melanin synthesis inhibitors, Tyrosinase inhibitors, Exfoliating cell-renewal agents, and Antioxidant brighteners |

| Source | Synthetic actives, Botanical actives, Biotechnology-derived actives |

| Delivery System | Encapsulated / sustained-release, Free form, and Microemulsion |

| Physical Form | Liquid concentrates, Powders, and Encapsulated beads |

| Application | Face creams & serums, Spot correctors, Body lotions, and Professional peels |

| End Use | Cosmetic & skincare brands, Dermocosmetic & clinical, and OTC brightening products |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, China, India, Japan, Germany, United Kingdom, France, Brazil, South Korea, and United Arab Emirates |

| Key Companies Profiled | BASF, Clariant, DSM- Firmenich, Givaudan, Symrise, Ashland, Croda, Seppic, Provital, and Evonik |

| Additional Attributes | Dollar sales by mechanism, source, delivery system, and application; rising demand for biotechnology-derived and encapsulated whitening actives; increased preference for botanical and natural-origin brighteners; innovations in sustained-release formulations and antioxidant-infused whitening solutions; growing integration of brightening actives in anti-aging and multifunctional skincare; market expansion in Asia driven by local biotech manufacturing and e-commerce; and global regulatory transitions favoring hydroquinone-free, clinically validated ingredients. |

The Global Lightening / Whitening Agents Market is estimated to be valued at USD 3,408.6 million in 2025.

The market size for the Global Lightening / Whitening Agents Market is projected to reach USD 7,803.5 million by 2035.

The Global Lightening / Whitening Agents Market is expected to grow at a CAGR of 8.6% between 2025 and 2035.

Key segments include Mechanism (Tyrosinase inhibitors, Melanin synthesis inhibitors, Exfoliating agents, and Antioxidant brighteners) and Source (Botanical, Synthetic, and Biotechnology-derived actives).

The Encapsulated / sustained-release segment is expected to command a 46.2% share in the Global Lightening / Whitening Agents Market in 2025, supported by rising adoption of microencapsulation and controlled-release technologies for brightening actives.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lightening and Whitening Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Skin Lightening Product Market Size and Share Forecast Outlook 2025 to 2035

Hair Lightening Products Market Size and Share Forecast Outlook 2025 to 2035

Skin Lightening Lip Balm Market Trends – Demand & Forecast 2024-2034

OLED Lightening Panels Market

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Intimate Lightening Products Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA