The global light rail traction converter market, valued at USD 1,058.3 million in 2025, is projected to reach USD 1,740.3 million by 2035, expanding at a CAGR of 5.1% and recording an absolute increase of USD 682.0 million during the forecast period. This growth reflects a total expansion of 64.4%, with the overall market size expected to grow by nearly 1.64X. The trajectory is underpinned by rapid urban transit development, as metropolitan regions continue investing in light rail as a sustainable and efficient alternative to traditional commuting systems. With urban populations demanding cleaner mobility and governments prioritizing electrified public transport, traction converters are emerging as a critical technology for improving energy efficiency and optimizing rail network performance.

One of the strongest drivers is the growing adoption of regenerative braking technologies. This innovation enables rail systems to capture and reuse braking energy, significantly reducing power consumption and operational costs. Such advancements are transforming converters from passive devices into smart, energy-managing units that integrate seamlessly into electrified transport infrastructure. Lightweight converter designs also enhance efficiency, contributing to lower vehicle weight, improved acceleration, and extended component lifespans, making them a preferred choice among manufacturers and operators. Increasing pressure to reduce emissions in cities is further accelerating the integration of advanced converters in ongoing rail modernization projects.

From 2025 to 2030, the light rail traction converter market is expected to benefit largely from infrastructure expansion projects across Asia-Pacific, where China, India, and Southeast Asia are prioritizing light rail networks to ease congestion in megacities. Demand during this phase will be fueled by volume expansion, with operators focusing on cost-effective yet efficient systems. Europe and North America, with their emphasis on modernization and replacement of aging fleets, will drive adoption through energy-efficient retrofitting initiatives. By 2030 to 2035, technological advancements such as silicon carbide (SiC) and gallium nitride (GaN) power electronics are expected to gain traction, enhancing converter efficiency, reducing size, and enabling better heat management. These material shifts will allow suppliers to differentiate through superior performance and integration capabilities.

Regional growth patterns highlight Asia-Pacific as the largest growth contributor, supported by large-scale investments in urban rail connectivity. Europe is likely to remain at the forefront of sustainable transit, with strong regulatory backing and continued innovation in power conversion systems. North America will witness steady growth through transit electrification programs, while the Middle East and parts of Africa are emerging as potential markets due to ambitious rail infrastructure plans.

Between 2025 and 2030, the light rail traction converter market is projected to expand from USD 1,058.3 million to USD 1,357.1 million, resulting in a value increase of USD 298.8 million, which represents 43.8% of the total forecast growth for the decade. This phase of development will be shaped by increasing urban light rail infrastructure development requiring advanced power conversion systems, rising adoption of silicon carbide semiconductor technologies, and growing demand for regenerative braking converters with enhanced energy recovery characteristics. Transit authorities are expanding their converter sourcing capabilities to address the growing demand for high-efficiency propulsion systems, voltage regulation solutions, and grid integration requirements.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,058.3 million |

| Forecast Value in (2035F) | USD 1,740.3 million |

| Forecast CAGR (2025 to 2035) | 5.1% |

The railway transportation market is the primary contributor, accounting for approximately 35-40%. Traction converters are critical components in light rail systems, as they convert electrical power into the appropriate voltage and current to drive the trains' motors. With increasing urbanization and the expansion of light rail networks globally, the demand for energy-efficient and reliable traction converters has surged. The electric vehicle (ev) infrastructure market holds around 20-25%, as the adoption of electric and hybrid trains shares technological similarities with EV systems. Light rail systems, like evs, require efficient power conversion for operation, further driving the need for advanced converters that ensure smooth and reliable operation.

The energy and power systems market contributes about 15-18%, as traction converters are integral to energy management and power distribution in light rail networks. These systems need to convert and regulate electricity from power sources, ensuring efficient energy consumption and minimizing waste. The automotive components market also plays a significant role, contributing approximately 10-12%, as some automotive technologies are adapted for use in light rail systems, especially in the area of electric power conversion. The smart grid and renewable energy market represents around 8-10%, with traction converters enabling better integration of renewable energy sources into the grid, improving energy efficiency in rail systems.

Market expansion is being supported by the increasing global demand for urban mobility solutions and the corresponding need for power conversion systems that can provide superior energy efficiency and traction control while enabling regenerative energy recovery and grid stability across various metropolitan and regional light rail transportation applications. Modern light rail operators and transit authorities are increasingly focused on implementing power electronics that can optimize energy consumption, improve acceleration performance, and provide consistent traction control throughout complex multi-line transportation networks. Light rail traction converters' proven ability to deliver exceptional motor control precision, enable efficient energy conversion, and support cost-effective operations make them essential power systems for contemporary urban transit and electrified rail distribution operations.

The growing emphasis on energy recovery and operational efficiency is driving demand for converters that can support high-frequency switching requirements, improve power factor correction, and enable automated traction control formats. Manufacturers' preference for power electronics that combines effective motor drive with processing speed and conversion efficiency is creating opportunities for innovative converter implementations. The rising influence of smart city initiatives and electrified public transportation is also contributing to increased demand for converters that can provide grid integration, voltage regulation, and reliable performance across extended operational schedules.

The light rail traction converter market is poised for rapid growth and transformation. As transit authorities across urban rail, metropolitan systems, regional networks, and intercity connections seek power electronics that delivers exceptional energy efficiency, regenerative capabilities, and operational reliability, traction converters are gaining prominence not just as commodity power systems but as strategic enablers of transportation electrification and energy optimization.

Rising urbanization in Asia-Pacific and expanding light rail networks globally amplify demand, while manufacturers are leveraging innovations in silicon carbide semiconductors, advanced control algorithms, and integrated diagnostic systems.

Pathways like wide bandgap semiconductor integration, predictive maintenance solutions, and application-specific customization promise strong margin uplift, especially in high-value segments. Geographic expansion and vertical integration will capture volume, particularly where local manufacturing capabilities and technical support proximity are critical. Regulatory pressures around energy efficiency standards, emissions reduction requirements, transit electrification mandates, and grid integration compliance give structural support.

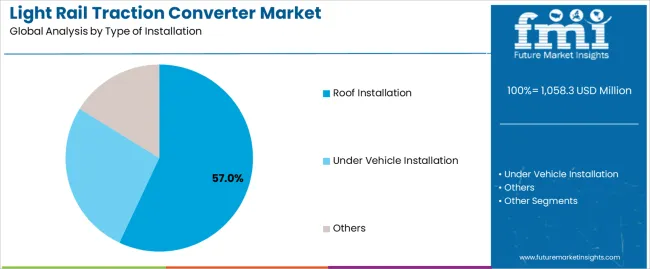

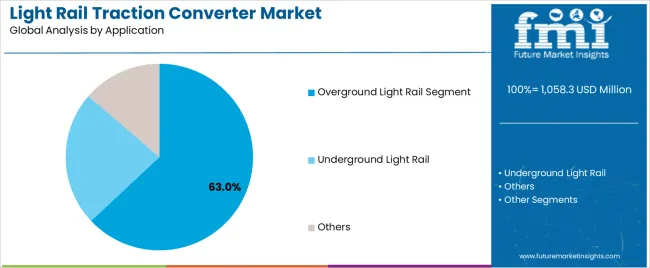

The light rail traction converter market is segmented by type of installation, application, power rating, voltage level, end-use industry, and region. By type of installation, the light rail traction converter market is divided into roof installation, under-vehicle installation, and others. By application, it covers overground light rail, underground light rail, and others. By power rating, the light rail traction converter market is segmented into low power (below 500kW), medium power (500kW-1MW), and high power (above 1MW). The voltage level includes low voltage (below 750V), medium voltage (750V-1.5kV), and high voltage (above 1.5kV). By end-use industry, it is categorized into urban transit, regional rail, freight rail, and others. Regionally, the light rail traction converter market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The roof installation segment is projected to account for 57% of the light rail traction converter market in 2025, reaffirming its position as the leading installation category. Urban transit operators and rail manufacturers increasingly utilize roof-mounted converters for their superior cooling airflow characteristics when integrated with natural ventilation systems, excellent accessibility for maintenance operations, and space optimization in applications ranging from metropolitan light rail vehicles to regional transit systems. Roof installation converter technology's advanced thermal management capabilities and modular mounting configurations directly address the engineering requirements for reliable heat dissipation in high-duty cycle transportation environments.

This installation segment forms the foundation of modern light rail vehicle design, as it represents the converter mounting approach with the greatest versatility and established market acceptance across multiple vehicle platforms and operational categories. Manufacturer investments in weather-resistant enclosures and simplified maintenance access continue to strengthen adoption among transit authorities and rolling stock manufacturers. With operators prioritizing system reliability and maintenance efficiency objectives, roof installation converters align with both thermal performance requirements and operational accessibility standards, making them the central component of comprehensive traction power strategies.

Overground light rail applications are projected to represent 63% of traction converter demand in 2025, underscoring their critical role as the primary transportation consumers of power conversion equipment for surface-level urban transit, street-running operations, and elevated guideway systems. Overground light rail operators prefer converters for their exceptional environmental adaptability, robust weather resistance capabilities, and ability to handle variable loading conditions while ensuring consistent traction performance throughout diverse operational environments. Positioned as essential power electronics for modern surface transit operations, converters offer both efficiency advantages and operational flexibility benefits.

The segment is supported by continuous innovation in environmental protection technologies and the growing availability of specialized converter designs that enable regenerative braking integration with enhanced energy recovery performance and grid power quality management. Overground operators are investing in infrastructure modernization to support large-scale converter deployment and system integration efficiency. As urban density increases and surface transit expansion becomes more prevalent, overground light rail applications will continue to dominate the end-use market while supporting advanced power electronics utilization and transportation electrification strategies.

The light rail traction converter market is advancing rapidly due to increasing demand for urban transit electrification and growing adoption of power electronic solutions that provide superior energy efficiency and motor control while enabling regenerative energy recovery across diverse metropolitan and regional transportation applications. The light rail traction converter market faces challenges, including semiconductor supply chain constraints, thermal management complexity, and the need for specialized power electronics engineering investments. Innovation in wide bandgap semiconductors and integrated control systems continues to influence product development and market expansion patterns.

The growing adoption of silicon carbide power devices, gallium nitride switching elements, and advanced thermal interface materials is enabling manufacturers to produce high-efficiency converters with superior switching frequency capabilities, reduced power losses, and enhanced thermal performance functionalities. Advanced semiconductor systems provide improved conversion efficiency while allowing more compact converter designs and consistent performance across various operational conditions and applications. Manufacturers are increasingly recognizing the competitive advantages of wide bandgap converter capabilities for product differentiation and premium market positioning.

Modern converter producers are incorporating condition monitoring sensors, predictive analytics algorithms, and cloud-connected diagnostic systems to enhance operational reliability, enable proactive maintenance scheduling, and deliver value-added services to transit operators and infrastructure customers. These technologies improve system availability while enabling new service capabilities, including remote diagnostics, performance optimization, and reduced lifecycle costs. Advanced digital integration also allows manufacturers to support large-scale fleet operations and infrastructure modernization beyond traditional reactive maintenance approaches.

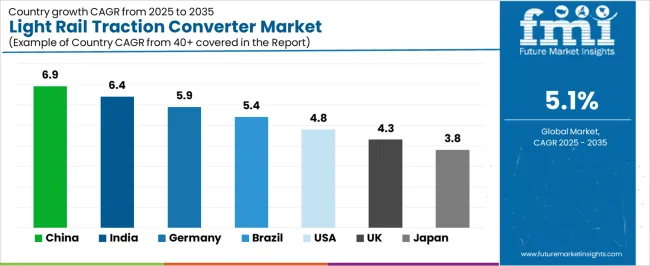

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| USA | 4.8% |

| UK | 4.3% |

| Japan | 3.8% |

The light rail traction converter market is experiencing strong growth globally, with China leading at a 6.9% CAGR through 2035, driven by the massive urban rail expansion program, growing metropolitan light rail networks, and significant investment in electrified transportation infrastructure development. India follows at 6.4%, supported by rapid metro system development, increasing urban transit investments, and growing domestic manufacturing capabilities. Germany shows growth at 5.9%, emphasizing transit system modernization and advanced power electronics innovation. Brazil records 5.4%, focusing on urban mobility improvements and regional rail network expansion. The USA demonstrates 4.8% growth, prioritizing transit infrastructure renewal and energy efficiency standards. The UK exhibits 4.3% growth, emphasizing railway electrification programs and grid integration excellence. Japan shows 3.8% growth, supported by precision engineering standards and high-speed rail technology advancement.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

Revenue from light rail traction converters in China is projected to exhibit exceptional growth with a CAGR of 6.9% through 2035, driven by expanding urban rail networks and rapidly growing metropolitan transit systems supported by government initiatives promoting electrified transportation development. The country's strong position in power electronics manufacturing and increasing investment in smart city infrastructure are creating substantial demand for advanced converter solutions. Major transit authorities and rolling stock manufacturers are establishing comprehensive converter sourcing capabilities to serve both domestic infrastructure demand and export markets.

Demand for light rail traction converters in India is growing at a CAGR of 6.4%, supported by the country's ambitious metro rail development program, expanding urban population, and increasing adoption of electrified public transportation solutions. The country's government initiatives promoting urban mobility and growing middle-class transportation demand are driving requirements for sophisticated power conversion capabilities. International suppliers and domestic manufacturers are establishing extensive production and distribution capabilities to address the growing demand for converter products.

Revenue from light rail traction converters in Germany is expanding at a CAGR of 5.9%, supported by the country's advanced rail technology capabilities, strong emphasis on energy efficiency standards, and robust demand for high-performance power electronics in urban and regional transportation applications. The nation's mature transit sector and innovation-focused operations are driving sophisticated converter systems throughout the rail network. Leading manufacturers and technology providers are investing extensively in semiconductor advancement and integrated control solutions to serve both domestic and international markets.

Demand for light rail traction converters in Brazil is projected to grow at a CAGR of 5.4%, driven by the country's expanding urban transit sector, growing metropolitan populations, and increasing investment in electrified transportation infrastructure development. Brazil's large urban centers and commitment to public transportation expansion are supporting demand for power conversion solutions across multiple transit segments. Manufacturers are establishing comprehensive production capabilities to serve the growing domestic market and regional export opportunities.

Revenue from light rail traction converters in the USA is expected to expand at a CAGR of 4.8%, supported by the country's transit infrastructure modernization programs, advanced regulatory requirements, and strategic focus on energy-efficient transportation systems. The USA's established transit networks and sustainability mandates are driving demand for converters in light rail renewal, system expansion, and electrification applications. Manufacturers are investing in comprehensive domestic capabilities to serve both federal transit programs and state-level infrastructure projects.

Demand for light rail traction converters in the UK is growing at a CAGR of 4.3%, driven by the country's railway electrification programs, emphasis on carbon reduction, and strong position in advanced power electronics and grid integration technologies. The UK's established rail expertise and commitment to decarbonization are supporting investment in advanced converter technologies throughout regional and urban transportation centers. Industry leaders are establishing comprehensive engineering capabilities to serve domestic electrification projects and specialized export markets.

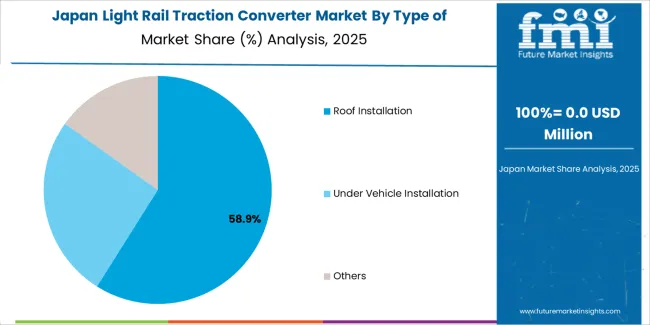

Revenue from light rail traction converters in Japan is expanding at a CAGR of 3.8%, supported by the country's precision manufacturing capabilities, emphasis on technological excellence, and strong position in high-speed rail and urban transit systems. Japan's established transportation technology leadership and commitment to continuous innovation are supporting investment in advanced power electronics throughout major metropolitan and intercity networks. Leading manufacturers are establishing comprehensive quality systems to serve domestic transit authorities and precision technology exporters.

The light rail traction converter market in Europe is projected to grow from USD 318.2 million in 2025 to USD 521.7 million by 2035, registering a CAGR of 5.1% over the forecast period. Germany is expected to maintain its leadership position with a 35.0% market share in 2025, declining slightly to 34.5% by 2035, supported by its strong rail technology industry, advanced power electronics manufacturing capabilities, and comprehensive urban transit sector serving diverse converter applications across Europe.

France follows with a 22.0% share in 2025, projected to reach 22.5% by 2035, driven by robust demand for converters in high-speed rail applications, urban transit expansion, and cross-border transportation systems, combined with established electrical engineering infrastructure and transportation expertise. The United Kingdom holds a 16.0% share in 2025, expected to reach 16.5% by 2035, supported by railway electrification programs and growing transit modernization activities. Italy commands a 12.0% share in 2025, projected to reach 12.3% by 2035, while Spain accounts for 7.0% in 2025, expected to reach 7.2% by 2035. The Netherlands maintains a 3.5% share in 2025, growing to 3.8% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Switzerland, Austria, and other nations, is anticipated to maintain momentum, with its collective share moving from 4.5% to 3.2% by 2035, attributed to increasing urban rail development in Eastern Europe and growing electrification programs in Nordic countries implementing advanced power conversion systems.

The light rail traction converter market is characterized by competition among established power electronics manufacturers, specialized traction system producers, and integrated rail technology solutions providers. Companies are investing in semiconductor technology research, control algorithm optimization, thermal management system development, and comprehensive product portfolios to deliver consistent, high-performance, and application-specific converter solutions. Innovation in wide bandgap semiconductors, integrated diagnostics, and grid integration capabilities is central to strengthening market position and competitive advantage.

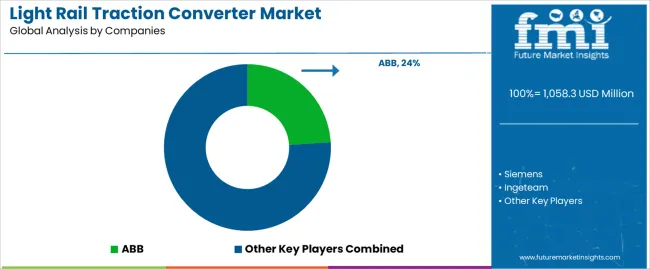

ABB leads the light rail traction converter market with a strong market share, offering comprehensive traction converter solutions with a focus on urban transit and energy efficiency applications. Siemens provides advanced power electronics capabilities with an emphasis on integrated control systems and modular architectures. Ingeteam delivers innovative converter products with a focus on renewable energy integration and grid-connected applications. Medha specializes in traction power systems and propulsion electronics for rail transportation applications. CRRC focuses on integrated rail vehicle systems and traction converter technologies. Toshiba offers specialized power semiconductor solutions with emphasis on high-efficiency power conversion applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,058.3 million |

| Type of Installation | Roof Installation, Under Vehicle Installation, Others |

| Application | Overground Light Rail, Underground Light Rail, Others |

| Power Rating | Low Power (Below 500kW), Medium Power (500kW-1MW), High Power (Above 1MW) |

| Voltage Level | Low Voltage (Below 750V), Medium Voltage (750V-1.5kV), High Voltage (Above 1.5kV) |

| End-Use Industry | Urban Transit, Regional Rail, Freight Rail, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | ABB, siemens, Ingeteam, Medha, CRRC, and Toshiba |

| Additional Attributes | Dollar sales by installation type and application category, regional demand trends, competitive landscape, technological advancements in power semiconductor systems, converter control development, grid integration innovation, and supply chain integration |

The global light rail traction converter market is estimated to be valued at USD 1,058.3 million in 2025.

The market size for the light rail traction converter market is projected to reach USD 1,740.3 million by 2035.

The light rail traction converter market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in light rail traction converter market are roof installation , under vehicle installation and others.

In terms of application, overground light rail segment segment to command 63.0% share in the light rail traction converter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Light Therapy Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightening and Whitening Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Lightening / Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switch Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Light Setting Spray Market Size and Share Forecast Outlook 2025 to 2035

Light-Activated Anti-Pollution Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Light Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Light Emitting Diode (LED) Backlight Display Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switches Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Light Field Market Size and Share Forecast Outlook 2025 to 2035

Lighting Product Market Size and Share Forecast Outlook 2025 to 2035

Light Field Cameras Market Size and Share Forecast Outlook 2025 to 2035

Light Resistant Containers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA