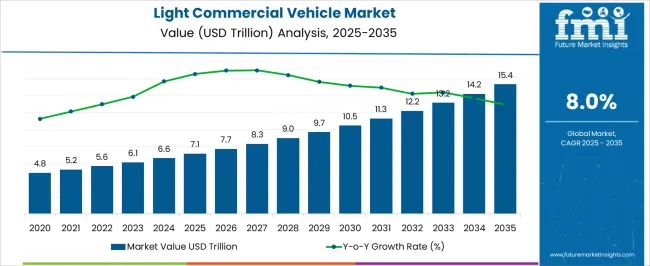

The light commercial vehicle market is anticipated to be USD 7.1 trillion in 2025 and forecasted to reach USD 15.4 trillion by 2035, advancing at a CAGR of 8.0%. Rolling CAGR analysis highlights that the market maintains consistent acceleration throughout the next few years, with earlier years such as 2026 and 2027 posting growth near 7.9–8.1%, while mid-term phases around 2029 and 2030 edge toward 8.2% due to rising adoption in logistics and last-mile delivery.

Growth momentum gains further traction post-2031 as electrification, connected fleet management, and urban mobility requirements reshape demand structures. Rolling CAGR values suggest that expansion does not fluctuate sharply, instead providing a steady compound pace that underlines the resilience of the sector. Gains in dollar sales are particularly evident as annual increments rise from around USD 0.6 trillion in early years to more than USD 1 trillion by 2033, reflecting scale advantages. This trajectory demonstrates a market where steady gains in e-commerce deliveries, infrastructure upgrades, and fleet modernization ensure that the CAGR remains balanced, with rolling averages confirming both stability and adaptability across the 2025–2035 window.

| Metric | Value |

|---|---|

| Light Commercial Vehicle Market Estimated Value in (2025 E) | USD 7.1 trillion |

| Light Commercial Vehicle Market Forecast Value in (2035 F) | USD 15.4 trillion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The light commercial vehicle market is influenced by several interconnected parent markets, each contributing uniquely to demand and expansion. The logistics and e-commerce sector holds the largest share at 38%, driven by the surge in online retail, last-mile delivery, and distribution networks that require efficient, flexible, and cost-effective fleets. The construction and infrastructure segment contributes 25%, as light commercial vehicles are deployed extensively for material transport, site support, and utility services, reinforcing their role in global development projects.

The small and medium enterprise (SME) segment accounts for 15%, where businesses utilize vans, pickups, and minibuses for operations ranging from trade services to passenger transport. The agriculture and rural mobility sector represents 12%, with vehicles being adopted for farm-to-market connectivity, livestock transport, and equipment movement.

The passenger and shared mobility segment makes up 10%, where vans and compact light trucks are integrated into ride-sharing, school transport, and shuttle services. Logistics, construction, and SME segments contribute nearly 80% of global demand, emphasizing that fleet reliability, operating efficiency, and adaptability across industries are the primary growth catalysts.

The light commercial vehicle market is experiencing robust growth driven by increasing demand for versatile and efficient transportation solutions across various industries. The rising need for last-mile delivery, urban logistics, and small-scale cargo transport shapes the current market landscape.

Factors such as expanding e-commerce, infrastructure development, and a focus on reducing the total cost of ownership are influencing market dynamics. Additionally, manufacturers are investing in powertrain innovations and vehicle safety enhancements to meet stringent regulatory standards and customer expectations.

The future outlook is positive, with increasing electrification trends and smart connectivity features expected to create new growth avenues. The market’s expansion is further supported by evolving consumer preferences towards vehicles that offer a balance between payload capacity, fuel efficiency, and operational flexibility.

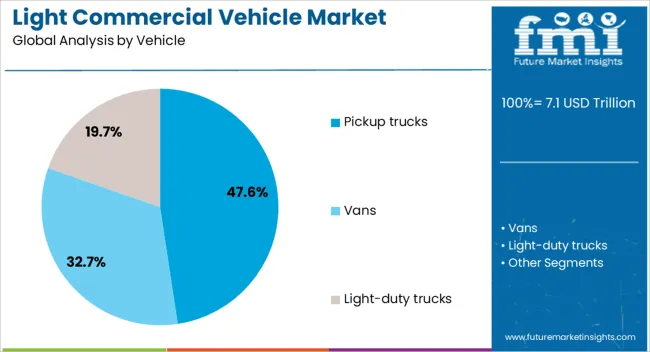

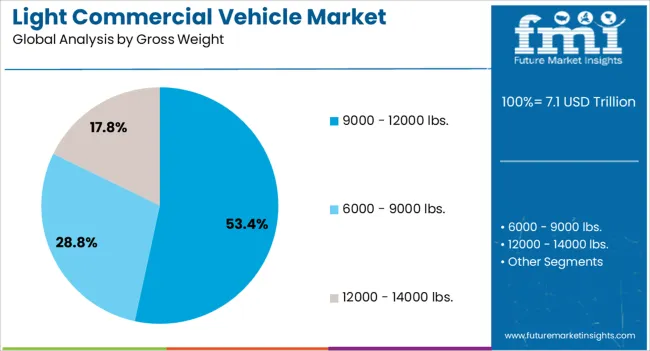

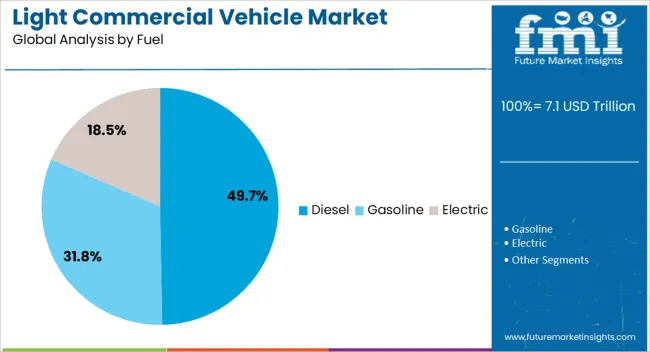

The light commercial vehicle market is segmented by vehicle, gross weight, fuel, application, and geographic regions. By vehicle, light commercial vehicle market is divided into Pickup trucks, Vans, and Light-duty trucks. In terms of gross weight, light commercial vehicle market is classified into 9000 - 12000 lbs., 6000 - 9000 lbs., and 12000 - 14000 lbs.. Based on fuel, light commercial vehicle market is segmented into Diesel, Gasoline, and Electric.

By application, light commercial vehicle market is segmented into Logistics & transportation, Construction & mining, Utility services, and Rental & leasing. Regionally, the light commercial vehicle industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Pickup trucks are estimated to hold 47.6% of the vehicle type revenue share in the Light Commercial Vehicle market in 2025, establishing them as the leading vehicle segment. This prominence is attributed to their adaptability for both commercial and personal use, offering substantial payload capacity alongside maneuverability in urban and rural environments.

The segment’s growth is supported by the rising requirement for multi-purpose vehicles that can cater to small businesses, tradespeople, and service industries. The ability to customize pickups with different bed sizes and cabin configurations has further enhanced their appeal.

Moreover, improvements in fuel efficiency and safety features have strengthened their market position. The growing preference for pickup trucks is also influenced by expanding infrastructure projects that demand reliable transport solutions for goods and equipment.

The gross weight segment of 9000 to 12000 lbs is projected to command 53.4% of the market revenue in 2025, making it the dominant weight category within the Light Commercial Vehicle market. This share is driven by the segment’s optimal balance between payload capacity and regulatory compliance, which suits a wide range of commercial applications, including delivery services, construction, and light manufacturing.

Vehicles in this weight class are favored for their ability to operate efficiently within urban settings while carrying heavier loads than lighter classes. The segment’s growth has been accelerated by increasing demand for vehicles that meet specific gross vehicle weight requirements without incurring higher taxes or operational restrictions.

Enhanced engine performance and durability are further enabling these vehicles to meet the demanding needs of commercial users.

Diesel-powered vehicles are expected to represent 49.7% of the Light Commercial Vehicle market revenue in 2025, making the diesel fuel segment the largest by fuel type. The dominance of diesel is being supported by its superior torque output and fuel efficiency, which are critical for commercial vehicles that require reliable performance over long distances and under heavy loads.

Diesel engines also benefit from a well-established fueling infrastructure and greater durability compared to alternative fuels. Despite the increasing attention to electrification, diesel remains the preferred choice for many fleet operators due to lower total cost of ownership and better suitability for rigorous usage patterns.

Stricter emission standards have led to advancements in diesel technology, improving environmental performance and maintaining the fuel type’s competitive edge within the light commercial vehicle segment.

Light commercial vehicle adoption is reinforced by logistics, construction, SMEs, and agriculture. Each segment ensures consistent growth, with e-commerce and infrastructure fueling rapid expansion while rural and SME demand sustains balance.

The growth of global e-commerce and logistics networks has been identified as a major driver for light commercial vehicle demand. Online retail giants and regional distributors rely heavily on vans, pickups, and compact trucks for last-mile delivery and bulk movement. Fleet operators prioritize efficiency, fuel economy, and adaptability, leading to stronger adoption of multipurpose vehicles. The sector has also benefited from the integration of digital fleet management systems that ensure route optimization and cost reduction. The logistics segment is not just an enabler but the strongest catalyst for continuous fleet renewal, as rising consumer expectations for speed and reliability put pressure on delivery companies to maintain high-performance vehicle bases.

Construction and infrastructure activities are generating steady demand for light commercial vehicles, especially in urban and semi-urban zones where compact transport solutions are required. Builders and contractors depend on these vehicles for moving tools, raw materials, and workforce support. Pickups and light trucks are also preferred for their maneuverability in congested or restricted spaces, making them practical for infrastructure projects. With large-scale housing, road, and energy projects on the rise, demand is expected to stay consistent. The construction segment secures its role as a long-term contributor, since equipment mobility and project timelines rely on reliable transport that light commercial vehicles can provide effectively and economically.

Small and medium enterprises represent an expanding customer base for light commercial vehicles, driven by the need for flexible, affordable, and multipurpose transport solutions. From delivery services to mobile workshops, SMEs use vans, pickups, and minibuses to support daily operations. The availability of financing models, leasing programs, and aftermarket service options influences growth in this segment. SMEs are shaping the diversification of the market by pushing manufacturers to offer compact models, better payload flexibility, and customizable features. This demand ensures that vehicle adoption is not limited to large fleet operators but also remains significant among smaller businesses aiming to expand service reach.

Rural economies and agricultural activities provide another layer of growth for light commercial vehicles. Farmers and cooperatives adopt these vehicles for transporting crops, livestock, and farming equipment, especially in regions lacking advanced logistics systems. Lightweight trucks and utility vans are increasingly preferred for farm-to-market movement due to their cost-efficiency and durability. Growth is also linked to rural infrastructure development, where these vehicles serve as reliable carriers across diverse terrains. Agriculture and rural mobility ensure that the market achieves balanced growth, providing manufacturers with steady revenue streams outside high-demand logistics or construction hubs.

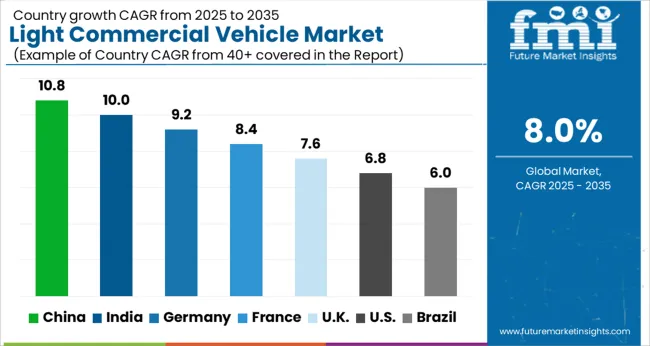

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

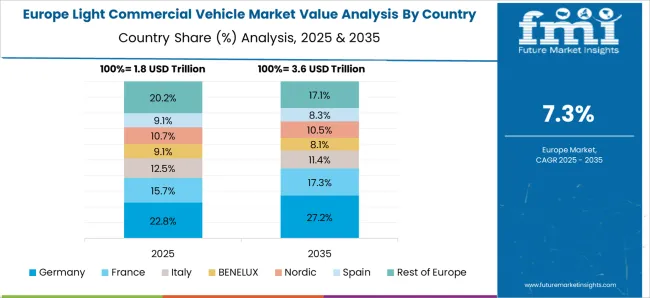

The global light commercial vehicle market is projected to grow at a CAGR of 8.0% from 2025 to 2035. China leads at 10.8%, followed by India at 10.0%, Germany at 9.2%, France at 8.4%, the UK at 7.6%, and the USA at 6.8%. Growth is driven by expanding logistics networks, rapid e-commerce penetration, and the rising need for efficient fleet solutions across both urban and rural applications. Asia, particularly China and India, showcases rapid adoption supported by manufacturing capacity, strong domestic demand, and government-backed mobility initiatives. Germany and France focus on premium vehicles, fleet electrification, and integration with industrial logistics, strengthening their role in Europe. The UK emphasizes efficiency-driven adoption across SMEs and last-mile delivery services, while the USA market grows steadily, supported by construction, agriculture, and regional logistics demand. Dollar sales and share highlight Asia-Pacific dominance, while European and North American markets remain vital through high-value, compliance-driven vehicle adoption. The analysis includes over 40 countries, with the leading markets highlighted above.

The light commercial vehicle market in China is projected to grow at a CAGR of 10.8% from 2025 to 2035, supported by strong logistics networks, expanding e-commerce, and rapid infrastructure development. Adoption is concentrated in urban logistics, construction projects, and agriculture, where light trucks, vans, and pickups serve as critical transport solutions. Government initiatives encouraging electrification and efficient fleet management are further accelerating penetration. Dollar sales and share indicate strong contributions from both last-mile delivery fleets and construction-linked demand. Domestic manufacturers are expanding production capacity, while international brands are investing in joint ventures to capture rising demand. China’s blend of scale, regulatory incentives, and manufacturing strength secures its global leadership in this segment.

The light commercial vehicle market in India is expected to grow at a CAGR of 10.0% from 2025 to 2035, driven by demand from e-commerce, agriculture, and small-scale enterprises. Key adoption areas include intercity transport, rural logistics, and retail distribution, where compact and cost-efficient vehicles dominate. Dollar sales and share highlight strong growth from affordable pickups and vans tailored for small businesses. Government policies promoting rural connectivity and fleet financing support adoption across diverse regions. Manufacturers are focusing on durable, fuel-efficient, and multipurpose vehicles suited to India’s varied terrain and usage patterns. India’s market growth reflects the convergence of SME-driven adoption, rural mobility requirements, and policy-backed infrastructure expansion.

The light commercial vehicle market in France is projected to grow at a CAGR of 8.4% from 2025 to 2035, supported by logistics modernization, urban delivery requirements, and construction demand. Adoption is strongest in urban mobility and regional logistics, where compact vans dominate due to restrictions on larger vehicles. Dollar sales and share growth are also shaped by increasing adoption of electric vans, as France emphasizes emissions compliance and fleet sustainability. Manufacturers are investing in advanced safety features and fleet digitalization to meet customer expectations. France’s market maintains steady growth, blending urban demand with regulatory compliance, which drives innovation in product offerings and contributes to regional leadership in Europe.

The light commercial vehicle market in the UK is expected to grow at a CAGR of 7.6% from 2025 to 2035, shaped by demand from SMEs, construction, and last-mile delivery networks. Adoption is most visible in courier services and urban mobility, where compact vans and pickups dominate. Dollar sales and share growth indicate rising interest in electric light commercial vehicles as regulatory frameworks push for emissions reduction in cities. Manufacturers are introducing fleet service models and digitalized telematics to support business users. The UK market represents steady expansion, balancing SME needs with logistics requirements, while electrification trends reshape long-term adoption patterns.

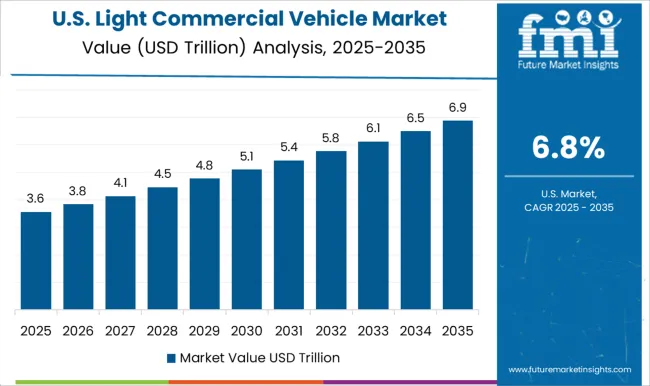

The light commercial vehicle market in the USA is projected to grow at a CAGR of 6.8% from 2025 to 2035, with demand concentrated in construction, agriculture, and regional logistics. Pickup trucks continue to dominate, while vans are gaining popularity for last-mile delivery and SME-driven operations. Dollar sales and share indicate steady contributions from both large-scale fleets and small business users. Adoption is further influenced by rising infrastructure investment and increased logistics demand across suburban and rural areas. Manufacturers emphasize premium, durable vehicles with advanced safety and comfort features, while electrification remains in its early adoption stage. The USA market remains slower in growth but highly stable due to entrenched demand and strong vehicle preferences.

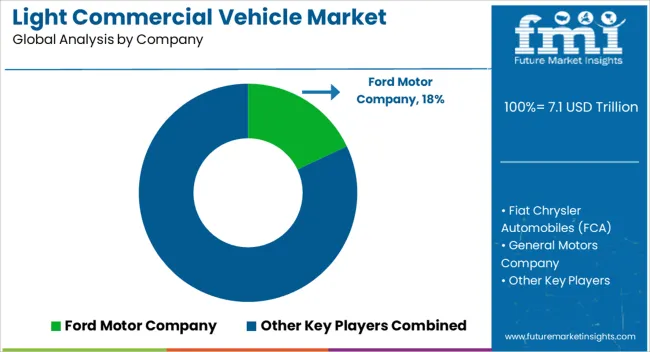

Competition in the light commercial vehicle market is defined by fleet performance, adaptability, fuel efficiency, and regional manufacturing strength. Ford Motor Company and General Motors Company lead with extensive portfolios of pickups, vans, and multipurpose vehicles, emphasizing reliability, payload capacity, and advanced safety features. Fiat Chrysler Automobiles (FCA) and Volkswagen Group compete with versatile product lines, offering compact and mid-sized models that cater to both urban delivery services and regional logistics. Toyota Motor Corporation and Isuzu Commercial Truck of America differentiate with durable and fuel-efficient vehicles tailored for SMEs, agriculture, and rural logistics, leveraging their reputation for long-term reliability.

Mercedes-Benz (Daimler AG) positions itself in the premium segment, focusing on advanced driver assistance, comfort, and fleet service models that appeal to professional operators and high-value transport services. Hino Trucks, backed by Toyota, brings expertise in medium-duty vehicles, providing efficiency and versatility for construction, logistics, and urban applications. Strategies across these players include investment in electrification, connected fleet management, and regional expansion to capture evolving logistics and e-commerce demand.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.1 Trillion |

| Vehicle | Pickup trucks, Vans, and Light-duty trucks |

| Gross Weight | 9000 - 12000 lbs., 6000 - 9000 lbs., and 12000 - 14000 lbs. |

| Fuel | Diesel, Gasoline, and Electric |

| Application | Logistics & transportation, Construction & mining, Utility services, and Rental & leasing |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ford Motor Company, Fiat Chrysler Automobiles (FCA), General Motors Company, Hino Trucks, Isuzu Commercial Truck of America, Mercedes-Benz (Daimler AG), Toyota Motor Corporation, and Volkswagen Group |

| Additional Attributes | Dollar sales, share, regional fleet adoption, e-commerce and logistics demand, electrification trends, competitor strategies, regulatory impacts, financing models, and after-sales service opportunities. |

The global light commercial vehicle market is estimated to be valued at USD 7.1 trillion in 2025.

The market size for the light commercial vehicle market is projected to reach USD 15.4 trillion by 2035.

The light commercial vehicle market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in light commercial vehicle market are pickup trucks, vans and light-duty trucks.

In terms of gross weight, 9000 - 12000 lbs. segment to command 53.4% share in the light commercial vehicle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Light Therapy Market Forecast and Outlook 2025 to 2035

Light Rail Traction Converter Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightening and Whitening Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Lightening / Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switch Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Light Setting Spray Market Size and Share Forecast Outlook 2025 to 2035

Light-Activated Anti-Pollution Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Light Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Light Emitting Diode (LED) Backlight Display Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switches Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Light Field Market Size and Share Forecast Outlook 2025 to 2035

Lighting Product Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA