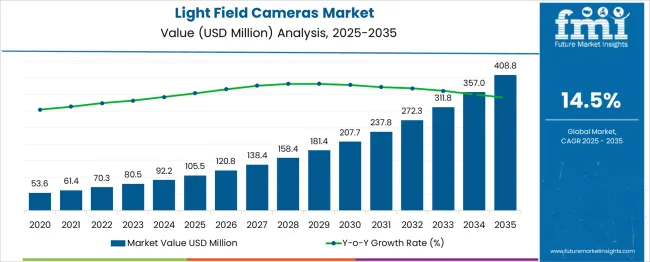

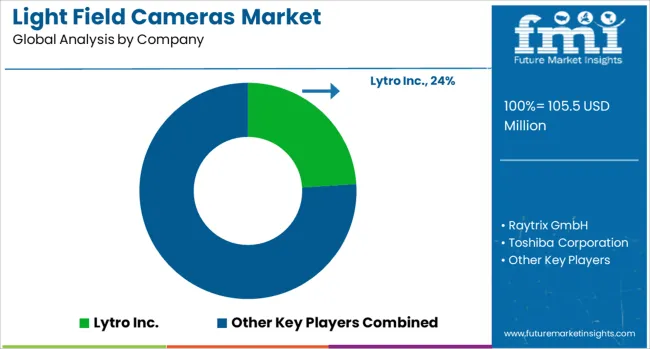

The Light Field Cameras Market is estimated to be valued at USD 105.5 million in 2025 and is projected to reach USD 408.8 million by 2035, registering a compound annual growth rate (CAGR) of 14.5% over the forecast period.

| Metric | Value |

|---|---|

| Light Field Cameras Market Estimated Value in (2025 E) | USD 105.5 million |

| Light Field Cameras Market Forecast Value in (2035 F) | USD 408.8 million |

| Forecast CAGR (2025 to 2035) | 14.5% |

The integration of light field capabilities into consumer electronics, healthcare imaging, and industrial design has driven notable momentum across multiple regions. Growth is being encouraged by the shift toward computational photography, where real-time rendering and depth mapping are now core requirements in high-end imaging systems.

The ability of light field cameras to capture volumetric data and refocus images post-capture is improving their adoption in professional photography, 3D imaging, and augmented reality applications. Market expansion is further supported by the acceleration of innovation in micro-optics, software-defined lenses, and edge AI processing.

With increasing research investments and strategic product development by leading imaging companies, the Light Field Cameras market is projected to grow steadily. Emerging applications in sectors like autonomous systems, virtual content creation, and medical diagnostics are paving the path for future opportunities in this technologically evolving landscape..

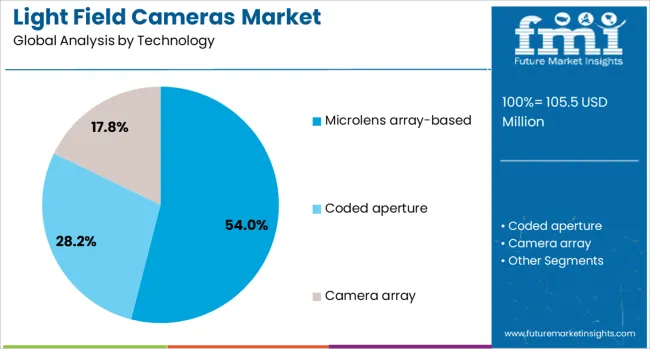

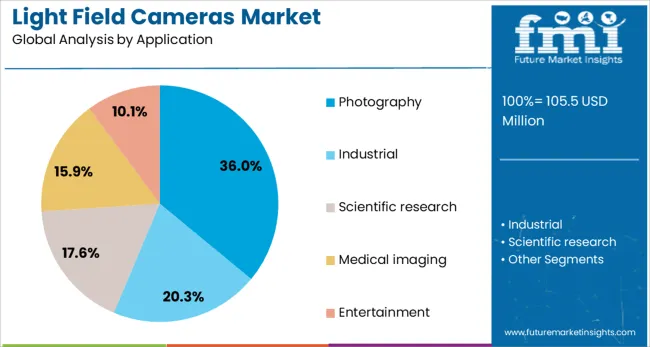

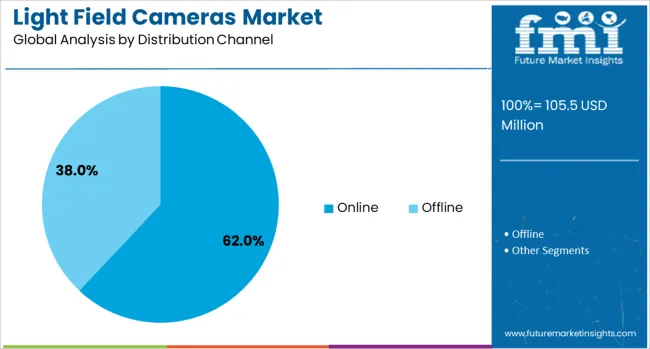

The light field cameras market is segmented by technology, application, distribution channel, end-user, and geographic regions. The technology of the light field cameras market is divided into Microlens array-based and coded aperture Camera arrays. In terms of application, the light field cameras market is classified into Photography, Industrial, Scientific research, Medical imaging, and Entertainment. The distribution channel of the light field cameras market is segmented into online and offline. The end-user of the light field cameras market is segmented into Media & entertainment, Healthcare, Architecture, Industrial, Defense, and others. Regionally, the light field cameras industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The microlens array-based technology segment is projected to account for 54% of the Light Field Cameras market revenue share in 2025, securing its position as the leading technology type. The segment's leadership has been attributed to its unique ability to capture spatial and angular information from a scene in a single exposure. This capability has enabled advanced depth estimation, post-capture focusing, and image reconstruction features, which are not feasible through traditional sensors.

The compact nature of microlens arrays allows seamless integration into portable and handheld devices, enhancing their usability in both professional and consumer-grade equipment. The segment has benefited from growing adoption across fields such as computational imaging, digital cinematography, and augmented reality, where spatial resolution and dynamic refocusing are critical.

The ongoing advancement in nanofabrication and optical component design has further elevated the performance of microlens-based systems. As user expectations for immersive imaging continue to rise, microlens array-based technology is expected to remain central to light field camera innovation..

The photography application segment is expected to represent 36% of the Light Field Cameras market revenue share in 2025, establishing it as the dominant application area. This segment has seen strong momentum due to increasing demand for high-definition, multidimensional content across consumer and professional platforms. The ability of light field cameras to capture depth information and enable post-processing enhancements has elevated their utility in creative and commercial photography.

Software capabilities that allow refocusing, aperture adjustment, and perspective shift after image capture have enhanced artistic flexibility and user control. The rise of social media, content streaming, and digital art has further boosted adoption of advanced imaging systems in photography.

As consumer interest in immersive and interactive visuals continues to expand, light field cameras have been preferred for their unique value in storytelling and visual documentation. Enhanced portability, AI-assisted editing features, and improvements in resolution and depth quality are reinforcing the segment’s sustained growth in both amateur and professional photography markets..

The online distribution channel segment is projected to command 62% of the Light Field Cameras market revenue share in 2025, reflecting its status as the primary sales channel. Growth in this segment has been driven by the increasing reliance on digital platforms for purchasing advanced imaging devices. Consumers and businesses alike have been favoring online channels for their access to a broader product range, transparent pricing, and detailed technical specifications.

The ability to directly compare models, access expert reviews, and utilize AI-driven recommendations has enhanced buyer confidence in high-value purchases such as light field cameras. E-commerce platforms have also enabled direct-to-consumer strategies for manufacturers, improving margins and fostering brand loyalty.

Technological advancements in supply chain logistics and digital payment systems have further simplified the buying process. As end users increasingly turn to virtual shopping environments for high-performance electronics, the online distribution model is expected to maintain its dominant position in delivering light field camera solutions to the global market..

Light field cameras are evolving from niche imaging tools into versatile solutions for entertainment, industrial, and scientific use. With performance improvements, strategic collaborations, and immersive content demand, adoption is on a strong upward trajectory.

Light field cameras are gaining traction in diverse fields ranging from entertainment and virtual production to industrial inspection and scientific imaging. The ability to capture depth information and allow post-capture focus adjustments has positioned them as essential in cinematic projects, gaming, VR/AR environments, and robotics. Film studios and visual effects teams are adopting the technology to achieve lifelike scene rendering, while engineers use it for precision quality checks in manufacturing lines. In scientific domains, these systems enhance microscopy and medical imaging accuracy. The technology’s adaptability across both creative and technical applications is accelerating demand. As more industries recognize their unique imaging capabilities, adoption is expected to move beyond niche use into broader commercial and industrial deployments.

Light field cameras have benefited from rapid sensor optimization, more advanced optics, and AI-driven image reconstruction algorithms. Higher resolution capture, faster processing speeds, and reduced image noise have significantly improved the quality of output, enabling broader use in real-time applications. Integration with compact optics allows incorporation into portable devices without compromising performance. Developers are working on enhancing light field video capabilities, which is expanding possibilities in VR streaming and interactive content experiences. The combination of hardware refinements and software-based depth mapping is making these systems more efficient and versatile. As performance barriers lower, more sectors are finding them practical for both high-end content creation and operational use cases.

Partnerships between camera manufacturers, VR/AR hardware producers, and software developers are fostering wider ecosystem growth for light field imaging. Joint initiatives are focusing on delivering seamless integration with existing production pipelines and content platforms. For example, collaborations with headset makers are optimizing immersive viewing experiences, while alliances with industrial automation companies are enabling more effective machine vision applications. Such cooperation is reducing barriers for end-users by ensuring compatibility and ease of adoption. Additionally, partnerships with academic research institutions are helping explore new use cases in education, medical training, and simulation environments. This ecosystem-building approach is expected to accelerate acceptance and expand commercial deployment opportunities.

The immersive content industry is emerging as a primary growth driver for light field cameras. Production houses are using the technology to create hyper-realistic environments for films, live events, and interactive gaming experiences. In VR and AR, light field capture enables natural parallax and depth cues, significantly enhancing user immersion. Advances in light field video streaming allow real-time playback of high-fidelity scenes, supporting applications in live sports broadcasting and virtual tourism. These developments are encouraging content creators to experiment with more engaging storytelling formats. As the entertainment sector continues to seek audience differentiation through quality and realism, demand for light field-based solutions is set to expand considerably.

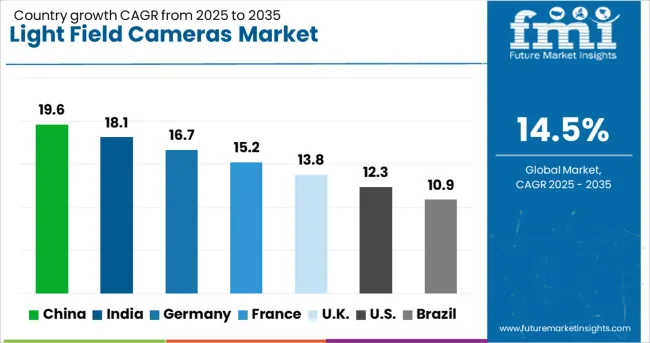

| Country | CAGR |

|---|---|

| China | 19.6% |

| India | 18.1% |

| Germany | 16.7% |

| France | 15.2% |

| UK | 13.8% |

| USA | 12.3% |

| Brazil | 10.9% |

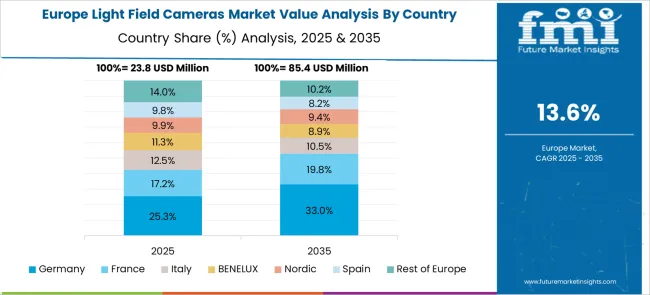

The light field cameras market is projected to expand globally at a CAGR of 14.5% from 2025 to 2035, propelled by demand in immersive media, industrial inspection, and advanced imaging applications. China leads with a CAGR of 19.6%, driven by large-scale adoption in VR/AR content production, robust manufacturing capabilities, and integration into consumer electronics. India follows at 18.1%, supported by growth in 3D imaging, emerging gaming sectors, and increasing uptake of light field technology in education and healthcare visualization. France grows at 15.2%, leveraging its expertise in cinematic production and expanding virtual tourism initiatives. The United Kingdom posts 13.8%, driven by innovation in media tech startups and demand for immersive storytelling platforms, while the United States reaches 12.3% due to continued advancements in medical imaging, industrial inspection, and visual effects. The analysis highlights Asia-Pacific as the dominant growth driver, with Europe and North America remaining competitive through niche innovations and industry-specific adoption.

China is projected to post a 19.6% CAGR during 2025–2035, well above the 14.5% global path for light field imaging. Adoption is rising across virtual production stages, gaming studios, and training simulators that need natural parallax and post-capture refocus. Component ecosystems around lenses, microlens arrays, and stacked sensors are scaling, which lowers unit cost and enables wider deployment in education labs and industrial inspection lines. Film and streaming platforms are funding trials that blend light field capture with volumetric sets to shorten scene setup time. Automotive R&D teams are testing depth-aware cameras for cabin interaction and exterior perception research. Cloud vendors are offering render pipelines that cut post work on depth maps, which helps small studios join pilots. Exports of cost-efficient rigs to Southeast Asia add volume, improving supplier utilization and after-sales coverage.

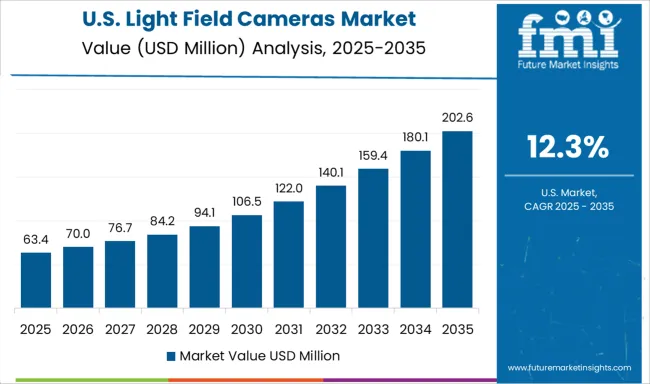

The United States is expected to reach a 12.3% CAGR during 2025–2035. Visual effects houses are integrating light field plates to simplify complex reflections on CG surfaces and to improve foreground-background fusion. Medical device firms are testing depth-rich endoscopy and dental imaging modules that could reduce repeat scans. Industrial integrators see value in metrology use cases where z-axis accuracy improves tolerance checks on high-value parts. Theme parks and live event producers want interactive scenes that respond to viewer position, which fits light field delivery. Universities continue to publish on capture algorithms, de-noising, and view synthesis, feeding open-source tools back to production teams. Rental majors are bundling training with kit hire, increasing crew readiness and reducing mis-shoot risk.

The United Kingdom is projected to grow at 13.8% CAGR during 2025–2035. Using proportional scaling to the 14.5% global path, the 2020–2024 CAGR is estimated at about 11.7%. Earlier growth stayed moderate due to limited rental inventory and cautious studio budgets, which slowed trials beyond advertising and short-form work. The rise to 13.8% is linked to higher use in virtual production volumes around London, Manchester, and Cardiff, where depth-aware capture reduces reshoots and speeds relighting. Universities are funding research chairs focused on light field video compression and multi-view calibration, which nurtures a skilled talent pool. Public broadcasters and event producers are piloting interactive experiences that benefit from true parallax. Supplier lead times have improved through local service partners, raising uptime and encouraging multi-project bookings.

India is forecast to achieve an 18.1% CAGR for 2025–2035. Momentum comes from animation and gaming hubs that want lifelike assets for mobile and console titles, along with engineering firms using depth capture for defect detection on assembly lines. Medical colleges are assessing light field microscopes for micro-surgery training and pathology slides, which broadens institutional orders. Rental providers in Mumbai, Hyderabad, and Chennai are introducing day-rate kits that make trials less risky for crews. Telecom players are evaluating multi-view compression to stream light field clips during live events, adding a new service angle. Startups are building plugins for common DCC tools, easing the switch from multi-camera arrays. Government skill programs that subsidize studio equipment are improving access for mid-tier producers, helping build a local content pool that can recirculate gear and talent across projects.

France is expected to post a 15.2% CAGR during 2025–2035. Cinematic houses in Paris and Occitanie are trialing light field rigs for natural bokeh control and fast relighting in post. Museums and tourism boards are commissioning immersive walkthroughs of heritage sites, where depth-rich assets support virtual tours and education programs. Broadcast crews are testing light field video for live sports replays that allow viewers to pivot viewpoints without motion judder. Optical research clusters supply precision microlens tooling and calibration benches that improve yield and unit consistency. Integrators are pairing capture with holographic displays for premium exhibitions and retail showcases. Public grants that favor cultural digitization are helping finance pilots, while rental fleets adapt packages that fit typical festival and TV budgets, bringing recurring usage and service revenue.

The light field cameras sector is shaped by a mix of pioneering imaging technology firms and diversified electronics companies, including Lytro Inc., Raytrix GmbH, Toshiba Corporation, Ricoh Company, Ltd., Pelican Imaging, and Adobe Systems. Lytro Inc. established early leadership with consumer and professional-grade plenoptic cameras, introducing post-capture refocusing to mainstream markets. Raytrix GmbH focuses on industrial and scientific imaging applications, offering customizable light field solutions for microscopy, inspection, and 3D scanning. Toshiba Corporation leverages its semiconductor and optics expertise to integrate light field capabilities into consumer electronics and medical imaging devices. Ricoh Company, Ltd. builds on its camera heritage to explore immersive and computational photography applications.

Pelican Imaging specializes in depth mapping and computational imaging modules suited for mobile and AR/VR devices. Adobe Systems enhances the ecosystem through advanced light field editing and rendering software, enabling creators to manipulate depth, perspective, and focus with precision. Competitive strategies in this space revolve around improving image resolution, reducing processing latency, and enhancing depth data accuracy, alongside fostering compatibility with VR/AR platforms and industrial automation workflows. Long-term advantage will depend on scalable manufacturing of microlens arrays, efficient multi-view compression algorithms, and the ability to integrate with emerging 3D content creation pipelines

Partnerships with software developers enhance workflow compatibility, while targeted marketing in medical imaging and autonomous systems broadens application scope. Advancements in sensor resolution and multi-aperture optics improve output quality, encouraging adoption in professional and consumer segments. Regional strategies emphasize tapping into the Asia-Pacific’s manufacturing base and North America’s high-value creative industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 105.5 Million |

| Technology | Microlens array-based, Coded aperture, and Camera array |

| Application | Photography, Industrial, Scientific research, Medical imaging, and Entertainment |

| Distribution Channel | Online and Offline |

| End-User | Media & entertainment, Healthcare, Architecture, Industrial, Defense, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lytro Inc., Raytrix GmbH, Toshiba Corporation, Ricoh Company, Ltd., Pelican Imaging, and Adobe Systems |

| Additional Attributes | Dollar sales, share, competitive positioning, emerging application segments, pricing trends, component supply dynamics, R&D focus areas, and regional demand growth forecasts to guide strategic planning. |

The global light field cameras market is estimated to be valued at USD 105.5 million in 2025.

The market size for the light field cameras market is projected to reach USD 408.8 million by 2035.

The light field cameras market is expected to grow at a 14.5% CAGR between 2025 and 2035.

The key product types in light field cameras market are microlens array-based, coded aperture and camera array.

In terms of application, photography segment to command 36.0% share in the light field cameras market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Light Field Market Size and Share Forecast Outlook 2025 to 2035

Time Of Flight Cameras Market Size and Share Forecast Outlook 2025 to 2035

Light Pipe Mould Market Size and Share Forecast Outlook 2025 to 2035

Lightning Surge Protector Market Size and Share Forecast Outlook 2025 to 2035

Light Therapy Market Forecast and Outlook 2025 to 2035

Light Rail Traction Converter Market Size and Share Forecast Outlook 2025 to 2035

Light Management System Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Corrugator Modules Market Size and Share Forecast Outlook 2025 to 2035

Lightening and Whitening Creams Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Field Inspection Tester Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Automotive Body Panels Market Size and Share Forecast Outlook 2025 to 2035

Lightening / Whitening Agents Market Size and Share Forecast Outlook 2025 to 2035

Light Control Switch Market Size and Share Forecast Outlook 2025 to 2035

Lightweight Handheld Cordless Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Light Setting Spray Market Size and Share Forecast Outlook 2025 to 2035

Light-Activated Anti-Pollution Skincare Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Light Duty Truck Market Size and Share Forecast Outlook 2025 to 2035

Field Force Automation Market Size and Share Forecast Outlook 2025 to 2035

Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA