The Commercial Light Tower Market is estimated to be valued at USD 4.3 billion in 2025 and is projected to reach USD 7.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period. The gradual increase from USD 4.3 billion to USD 7.9 billion reflects the steady adoption of advanced lighting and power solutions, including LED, metal halide, and hybrid systems.

Among these, LED technology is likely to account for a significant portion of value addition due to its energy efficiency, longer operational life, and lower maintenance costs, which appeal to end-users across construction, mining, and emergency services.

Metal halide towers maintain relevance in scenarios demanding high-intensity illumination for temporary worksites or large-scale events, contributing moderately to the market while gradually being complemented by hybrid solutions that combine fuel-based and solar-powered technologies. The integration of smart control systems and IoT-enabled monitoring enhances operational efficiency and enables predictive maintenance, adding value across the supply chain. The consistent growth from USD 4.3 billion to USD 7.9 billion indicates that technological differentiation is a key driver of adoption, with investments in LED efficiency, portable power sources, and intelligent control systems shaping the market contribution mix.

The market is positioned in a growth phase where technology contributions are defining value creation. LED and hybrid systems are expected to dominate market share, while incremental enhancements in energy management, durability, and automation continue to support sustained adoption and competitive differentiation throughout the forecast period.

| Metric | Value |

|---|---|

| Commercial Light Tower Market Estimated Value in (2025 E) | USD 4.3 billion |

| Commercial Light Tower Market Forecast Value in (2035 F) | USD 7.9 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The commercial light tower market is witnessing growing demand due to rising infrastructure development, increasing mining activities, and the expansion of night-time construction operations. Enhanced focus on worker safety and the need for uninterrupted operations in remote and rugged environments are driving the integration of high-performance lighting systems.

Manufacturers are investing in energy efficient technologies, including hybrid and solar powered models, to meet evolving regulatory and sustainability standards. Additionally, advancements in LED technology, autonomous operation, and telematics integration are improving operational efficiency and remote monitoring capabilities.

The market outlook remains optimistic as industries continue to prioritize reliable illumination solutions that support extended work hours, reduce emissions, and enhance productivity across diverse operational landscapes.

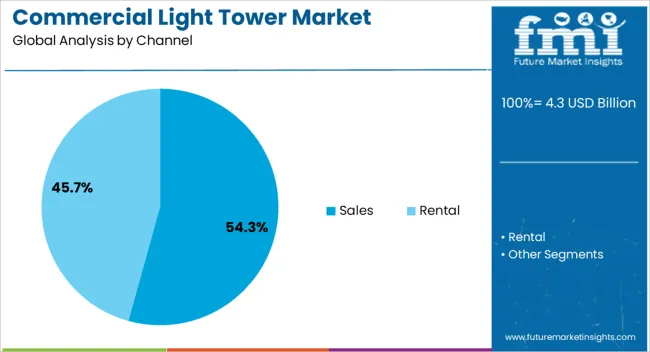

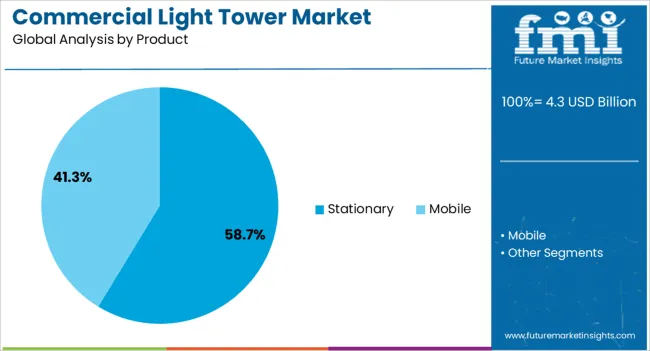

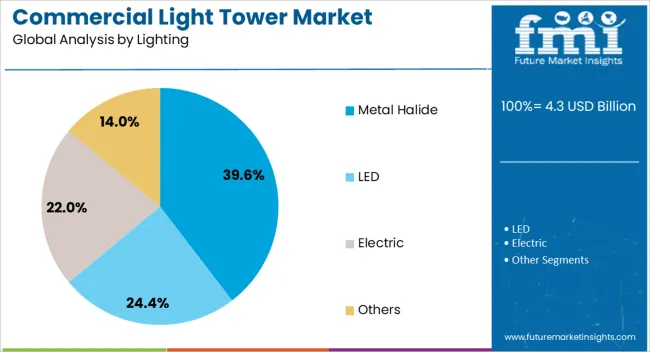

The commercial light tower market is segmented by channel, product, lighting, power source, technology, application, and geographic regions. By channel, the commercial light tower market is divided into Sales and Rental. In terms of the product, the commercial light tower market is classified into Stationary and Mobile. Based on lighting, the commercial light tower market is segmented into Metal Halide, LED, Electric, and Others. By power source, the commercial light tower market is segmented into Diesel, Solar, Direct, and Others.

By technology, the commercial light tower market is segmented into Manual Lifting Systems and Hydraulic Lifting Systems. By application, the commercial light tower market is segmented into Construction, Infrastructure Development, emergency and disaster relief, and Others. Regionally, the commercial light tower industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sales channel segment is projected to account for 54.30% of the total market revenue by 2025, establishing it as the leading channel. This dominance is driven by the growing preference of end users to own equipment for frequent and long-term projects, especially in construction and oil and gas sectors.

Sales channels offer greater customization options, long-term cost advantages, and fleet standardization benefits. Enterprises seeking greater control over asset deployment and maintenance scheduling are increasingly investing in direct purchases.

As demand for permanent or recurring lighting infrastructure grows, the sales channel continues to outperform rental services, reinforcing its leadership in the commercial light tower market.

Within the product category, stationary light towers are anticipated to contribute 58.70% of the total market revenue by 2025. This leading share is attributed to their reliability in fixed installations and large-scale outdoor operations.

Stationary units offer robust illumination capacity and reduced operational complexity in continuous-use environments such as roadworks, mining zones, and event venues. The durability and high power output of these towers make them well suited for prolonged deployment, especially in areas requiring consistent lighting without the need for frequent relocation.

As infrastructure projects scale and demand for stable lighting grows, the stationary segment maintains its prominence in the market.

The metal halide segment is expected to account for 39.60% of total market revenue by 2025 under the lighting category, positioning it as the dominant lighting technology. This can be attributed to its high lumen output, broad beam coverage, and established performance in large-scale illumination applications.

Metal halide lamps are valued for their brightness and color rendering in construction zones, sports arenas, and industrial yards. Despite the rise of LED alternatives, the cost-effectiveness and proven reliability of metal halide systems have continued to sustain their adoption.

The segment continues to lead in legacy infrastructure projects and environments where lighting consistency is prioritized over energy efficiency, securing its role as a major contributor within the commercial light tower market.

The market has been expanding due to increasing demand for temporary and mobile lighting solutions across construction, mining, events, and emergency applications. These towers have been valued for their portability, high-intensity illumination, and energy efficiency. Market growth has been reinforced by innovations in LED technology, hybrid power systems, and remote monitoring capabilities. Rising investments in infrastructure, outdoor activities, and safety compliance have further strengthened adoption. The need for reliable, flexible, and durable lighting equipment has positioned commercial light towers as essential assets for industrial, municipal, and event management applications worldwide.

The market has been primarily driven by construction and mining activities requiring reliable nighttime illumination. Portable towers have been deployed for site safety, operational efficiency, and extended working hours. LED-based light towers have been preferred due to their low energy consumption, longer lifespan, and high luminous output. Hybrid and solar-powered units have reduced fuel dependency and operating costs. Additionally, regulatory mandates on worker safety and on-site lighting standards have reinforced adoption. Remote monitoring and automated control features have further enhanced operational flexibility. Investments in large-scale infrastructure projects and expansion of mining operations across emerging economies have contributed to consistent demand. The combination of safety compliance, operational needs, and technological enhancements has ensured sustained growth of commercial light towers in industrial sectors globally.

Technological innovations have strengthened the market by improving illumination performance, energy efficiency, and operational control. LED technology has been widely adopted, providing higher brightness with lower power consumption compared to conventional metal halide lamps. Hybrid power systems combining diesel, solar, and battery storage have extended operational duration and reduced environmental impact. Remote monitoring, IoT integration, and automated height adjustment features have enabled efficient management of multiple towers from centralized locations. Durability improvements, including corrosion-resistant materials and weatherproof designs, have increased lifespan in harsh industrial environments. These innovations have allowed light towers to operate reliably under diverse conditions, enhancing their attractiveness for construction, mining, outdoor events, and emergency applications, and reinforcing their critical role in temporary lighting solutions.

The market has been influenced by growth in outdoor events, disaster response, and emergency management activities. Light towers have been deployed for sports events, concerts, festivals, and public gatherings to ensure visibility, safety, and security. In emergency scenarios, mobile towers have supported rescue operations, temporary shelters, and night-time recovery work. Rapid deployment capabilities and modular designs have facilitated versatility and flexibility. Energy-efficient lighting and low-noise operation have improved user convenience in densely populated areas. Government agencies, event organizers, and emergency services have increasingly relied on commercial light towers for operational efficiency and compliance with safety standards. This rising adoption outside industrial sectors has expanded the market reach, diversifying demand across commercial, municipal, and humanitarian applications globally.

Despite growth, the market has faced challenges related to high initial investment, fuel dependency, and maintenance requirements. Diesel-powered units have been associated with noise, emissions, and operational costs, affecting adoption in environmentally sensitive regions. Harsh operating conditions, including dust, extreme temperatures, and moisture, have influenced equipment longevity and performance. Integration of remote monitoring and hybrid systems has required additional technical expertise and investment. Supply chain disruptions and fluctuating raw material costs have impacted production and pricing. Manufacturers and service providers have addressed these challenges through modular design, hybrid and solar solutions, preventive maintenance programs, and technical support services. These measures have ensured reliable, energy-efficient, and durable operation, sustaining market growth across industrial, commercial, and emergency applications worldwide.

| Countries | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

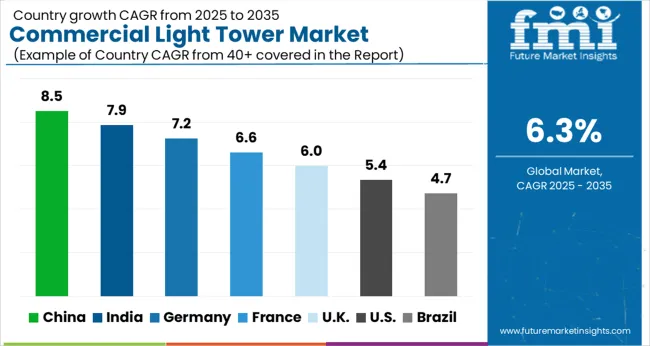

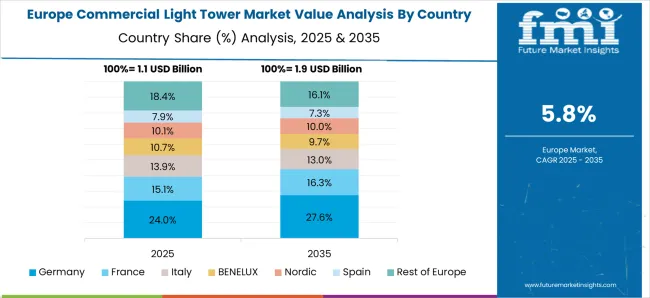

The market is projected to grow at a CAGR of 6.3% between 2025 and 2035, driven by increasing demand in construction, mining, and outdoor events, along with rising adoption of energy-efficient lighting solutions. China leads with an 8.5% CAGR, supported by large-scale infrastructure projects and manufacturing capabilities. India follows at 7.9%, fueled by growing construction activities and portable lighting requirements. Germany, at 7.2%, benefits from advanced industrial applications and renewable energy integration. The UK, growing at 6.0%, focuses on construction and public safety deployment, while the USA, at 5.4%, witnesses steady demand from commercial and industrial sectors. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 8.5% over the forecast period, supported by increasing infrastructure development, mining, and construction activities. Rising demand for portable and energy-efficient lighting solutions for outdoor and remote sites drives market expansion. Manufacturers are focusing on integrating LED technology, diesel-electric hybrid power sources, and smart control systems to enhance performance and efficiency. Government-led urban development projects and industrial modernization programs further boost adoption.

India is forecasted to grow at a CAGR of 7.9%, fueled by expanding construction, mining, and energy sectors. The adoption of portable, durable, and fuel-efficient light towers in remote and temporary work sites accelerates demand. Integration of advanced lighting technologies, such as LED and solar-powered systems, enhances operational efficiency and cost-effectiveness. Rising government investment in infrastructure development and industrial projects strengthens market potential.

Germany is anticipated to grow at a CAGR of 7.2%, driven by increasing demand for mobile lighting in construction, industrial, and outdoor event sectors. Emphasis on energy-efficient lighting and emission-reducing solutions supports adoption of LED and hybrid towers. Strong manufacturing infrastructure and regulatory standards for safe and sustainable lighting systems further strengthen market growth. Collaboration between local manufacturers and international technology providers accelerates innovation in portable lighting solutions.

The United Kingdom is projected to grow at a CAGR of 6.0% owing to increasing demand in construction, outdoor events, and emergency lighting applications. Adoption of portable and high-efficiency lighting towers for temporary and remote projects supports market expansion. Advanced LED and hybrid models improve energy efficiency and operational flexibility. Government investment in infrastructure modernization and renewable energy projects further boosts market potential.

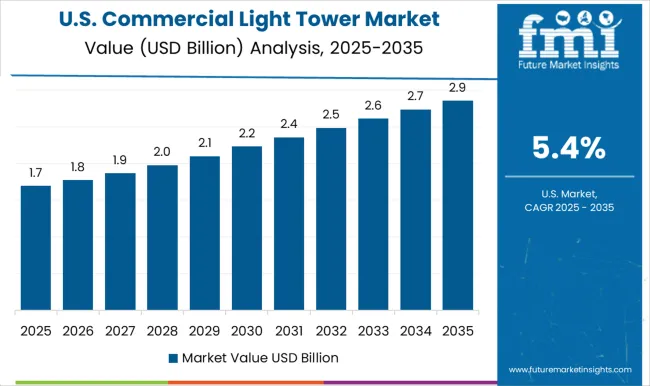

The United States is forecasted to grow at a CAGR of 5.4%, driven by demand in construction, mining, industrial, and emergency sectors. Adoption of portable, durable, and energy-efficient lighting solutions enhances operational efficiency. Integration of LED technology, diesel-electric hybrid systems, and IoT-based monitoring improves performance and reduces maintenance. Rising infrastructure development and industrial activity further accelerate market adoption.

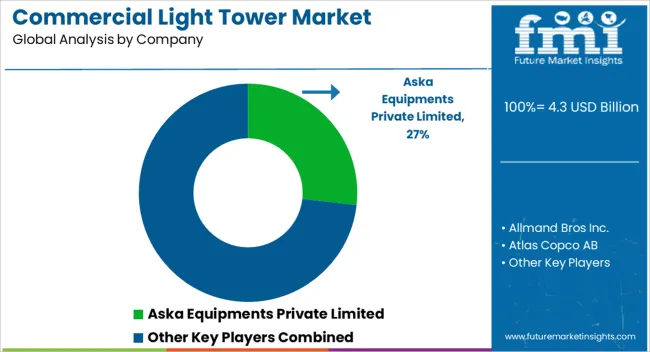

The market is witnessing significant growth due to increased construction, mining, and outdoor event activities requiring reliable, portable lighting solutions. Key players in this market include Aska Equipments Private Limited, Allmand Bros Inc., and Atlas Copco AB, which provide high-quality light towers designed for durability, energy efficiency, and adaptability across various terrains. These companies focus on delivering products that combine robust construction with advanced illumination technologies to ensure consistent performance in challenging environments.

Caterpillar, Chicago Pneumatic, and Doosan Portable Power contribute significantly with versatile and fuel-efficient lighting systems that cater to industrial and commercial applications. Companies such as Generac Power Systems, Inc., HIMOINSA, and Inmesol gensets, S.L.U. offer integrated power solutions with innovative features including LED technology, low-noise operation, and remote monitoring capabilities.

LARSON Electronics, Light Boy Co. Ltd., and Trime S.r.l. further enhance the market with customizable light towers that support rapid deployment and enhanced safety for nighttime operations. Market growth is fueled by increasing infrastructure projects, urban development, and mining operations globally.

Investment in research and development, energy-efficient lighting technologies, and compact, mobile solutions strengthens the competitive positioning of these providers. Collectively, they are driving innovation and providing reliable, high-performance commercial light tower solutions that meet the diverse requirements of various industries worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.3 Billion |

| Channel | Sales and Rental |

| Product | Stationary and Mobile |

| Lighting | Metal Halide, LED, Electric, and Others |

| Power Source | Diesel, Solar, Direct, and Others |

| Technology | Manual Lifting Systems and Hydraulic Lifting Systems |

| Application | Construction, Infrastructure Development, Emergency & Disaster Relief, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aska Equipments Private Limited, Allmand Bros Inc., Atlas Copco AB, Chicago Pneumatic, Caterpillar, Colorado Standby, Doosan Portable Power, DMI, Ecoquip, Generac Power Systems, Inc., HIMOINSA, Inmesol gensets, S.L.U., Light Boy Co. Ltd., LARSON Electronics, LTA Projects, OLIKARA LIGHTING TOWERS PVT LTD, The Will Burt Company, Trime S.r.l., United Rentals, Inc., and Wacker Neuson SE |

| Additional Attributes | Dollar sales by tower type and power source, demand dynamics across construction, mining, and event sectors, regional trends in portable lighting adoption, innovation in energy efficiency and brightness control, environmental impact of fuel consumption and emissions, and emerging use cases in temporary work sites and emergency response operations. |

The global commercial light tower market is estimated to be valued at USD 4.3 billion in 2025.

The market size for the commercial light tower market is projected to reach USD 7.9 billion by 2035.

The commercial light tower market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in commercial light tower market are sales and rental.

In terms of product, stationary segment to command 58.7% share in the commercial light tower market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

LED Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Electric Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Portable Light Towers Market

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Metal Halide Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Solar Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Diesel Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Manual Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Metal Halide Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Manual Lifting Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Tower Vibration Control System Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Light Pipe Mould Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA