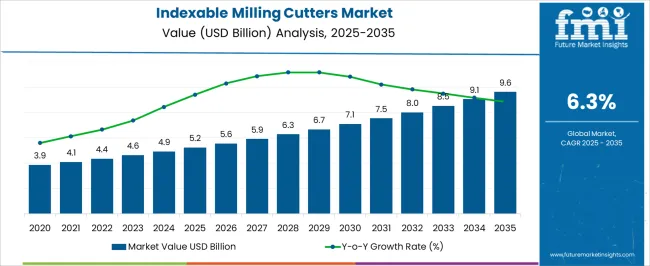

The indexable milling cutters market is valued at USD 5.2 billion in 2025 and will reach USD 9.6 billion by 2035, growing at a CAGR of 6.3%, equal to a multiplying factor of about 1.85x over the decade. A rolling CAGR assessment highlights how growth momentum shifts when observed through overlapping time frames. During the initial half of the period, covering 2026 to 2029, expansion is supported by renewed investment in machining equipment, rising use of CNC systems, and stronger demand for carbide insert tooling that improves productivity and reduces downtime.

In the middle phase, around 2029 to 2032, growth patterns show moderation as replacement demand becomes more dominant and cost pressures increase across end-user industries. Advancements such as multilayer coatings, complex geometries for hard-to-cut materials, and through-coolant designs help sustain consistent performance during this stage. Toward the latter period, 2031 to 2034 and extending to 2035, growth trends strengthen again as aerospace, automotive, and energy sectors increase machining volumes, driving higher insert consumption per spindle. Rolling CAGR analysis underscores that companies with integrated solutions combining cutters, inserts, and process optimization software are better positioned to align with these shifts, ensuring steady progress across each overlapping cycle.

The indexable milling cutters market is shaped by several upstream industries. Metalworking and machining operations contribute about 38%, as these tools are widely used for precision milling and shaping. Automotive manufacturing represents roughly 26%, where high-volume production of engine components, transmissions, and structural parts relies heavily on indexable tooling. Aerospace and defense manufacturing accounts for nearly 18%, requiring advanced cutters for titanium, composites, and heat-resistant alloys. Tooling design and materials development make up around 12%, focusing on carbide, ceramic, and coated inserts for extended tool life. Industrial maintenance and aftermarket services hold the remaining 6%, covering reconditioning, resharpening, and insert replacement.

The market is expanding with rising demand for productivity and precision in manufacturing. Global machine tool consumption surpassed USD 80 billion in 2024, directly boosting the need for advanced cutting tools. Carbide-based inserts account for more than 60% of usage, offering durability and consistent performance in high-speed machining. Adoption of coated inserts, including PVD and CVD technologies, has increased by 14% annually, improving wear resistance and extending tool life by up to 25%. Aerospace applications are driving growth in multi-edge cutters designed for lightweight alloys, while automotive production continues to emphasize cost-efficient, high-throughput tooling. Manufacturers are integrating digital tool management systems, enabling predictive wear monitoring and reducing downtime by an estimated 10-12% per production line.

| Metric | Value |

|---|---|

| Indexable Milling Cutters Market Estimated Value in (2025 E) | USD 5.2 billion |

| Indexable Milling Cutters Market Forecast Value in (2035 F) | USD 9.6 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The indexable milling cutters market is witnessing strong momentum, driven by precision-focused manufacturing, demand for longer tool life, and cost-effective metal cutting solutions. Advancements in material science and machine tooling technology have significantly expanded use cases across automotive, aerospace, and general engineering applications.

Growing preference for interchangeable inserts over solid end mills has resulted from reduced downtime and improved cutting efficiency. Global production recovery and capital investments in CNC and automated machining centers are further fueling demand for adaptable tooling systems.

Sustainability in tooling operations is also gaining attention, with recycling and regrinding practices being integrated into procurement strategies. As industries shift toward high-speed, dry, and near-net-shape machining, indexable milling cutters are expected to remain integral to optimizing process economics and surface finish quality.

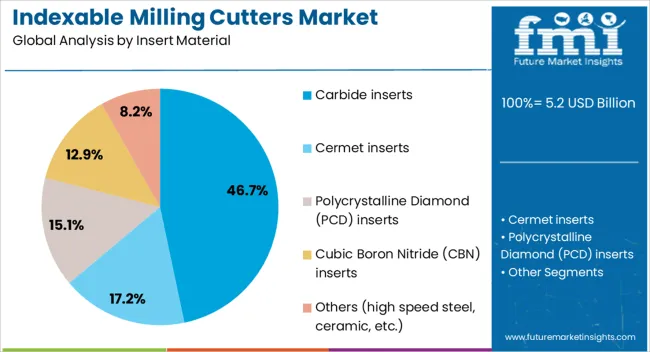

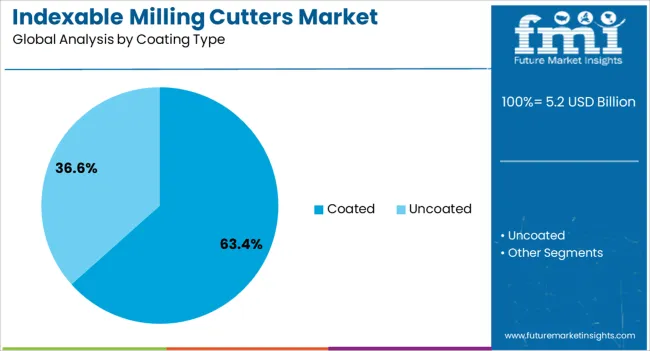

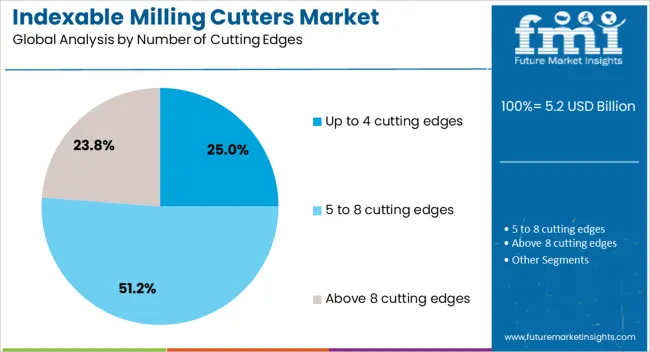

The indexable milling cutters market is segmented by insert material, coating type, number of cutting edges, application, end use, distribution channel, and geographic regions. The indexable milling cutters market is divided into Carbide inserts, Cermet inserts, Polycrystalline Diamond (PCD) inserts, Cubic Boron Nitride (CBN) inserts, and Others (high speed steel, ceramic, etc.). In terms of coating type, the indexable milling cutters market is classified into Coated and Uncoated. Based on the number of cutting edges, the indexable milling cutters market is segmented into up to 4 cutting edges, 5 to 8 cutting edges, and more than 8 cutting edges.

The indexable milling cutters market is segmented into End mills, Face mills, Slab mills, and Others (Bed mills, bridge mills, etc.). The indexable milling cutters market is segmented by end use into Automotive, Aerospace & defense, Energy, Building & construction, General engineering & metal fabrication, Mining, and Others (oil & gas, medical, etc.). The distribution channel of the indexable milling cutters market is segmented into Offline and Online. Regionally, the indexable milling cutters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Carbide inserts are anticipated to account for 46.70% of the total revenue in the indexable milling cutters market in 2025, establishing them as the leading insert material. Their dominance is supported by superior hardness, thermal resistance, and extended wear life compared to conventional materials.

Carbide's ability to maintain edge stability at high cutting speeds enables high-efficiency machining of both ferrous and non-ferrous metals. Reduced insert breakage and extended tool life have made them the preferred choice in high-precision and high-volume environments.

The compatibility of carbide with various coating technologies further enhances performance under dry or near-dry cutting conditions. The material’s versatility across roughing, semi-finishing, and finishing operations positions it as a critical enabler of productivity in automated machining environments.

Coated inserts are projected to capture 63.40% of market revenue in 2025, making them the top coating type in indexable milling cutters. This growth is driven by improved heat resistance, surface hardness, and cutting speed tolerance provided by coatings such as TiN, TiAlN, and AlCrN.

These enhancements reduce friction, minimize built-up edge, and extend insert life, especially in dry or high-speed operations. Coated tools have shown greater resistance to abrasion and oxidation, which is critical in continuous or interrupted cutting cycles.

The advancement of physical vapor deposition (PVD) and chemical vapor deposition (CVD) processes has enabled uniform coating thickness and improved adherence, ensuring consistent performance under high mechanical loads. As manufacturers push for tighter tolerances and faster throughput, coated inserts remain a preferred solution across precision-intensive industries.

Inserts with up to 4 cutting edges are expected to lead the market by 2025, driven by their balance of cutting efficiency and economic value. These inserts allow for multiple indexing, thereby extending tool utilization and reducing replacement frequency.

Their design supports optimal chip evacuation, smoother surface finishes, and stable cutting dynamics across a wide range of materials and feed rates. The use of up to 4 cutting edges has become standard in applications where edge durability and repeatable performance are prioritized over ultra-high-speed machining.

This segment also benefits from simplified tool setup, predictable wear patterns, and minimized risk of insert dislodgement. As machine operators aim for repeatable output and operational cost control, this configuration continues to be favored across small to mid-batch production lines.

Growth is supported by rising demand for precision machining in automotive, aerospace, energy, and construction equipment industries. Indexable cutters are gaining preference because they allow insert replacement, which reduces downtime and operational costs. More than 60% of their usage is in CNC machining centers where consistency and productivity are vital. Heavy-duty milling for aerospace fuselage structures, turbine blades, and automotive castings is growing steadily. Asia Pacific leads the market due to its manufacturing base, while Europe and North America remain strong with continued adoption of high-performance machining tools.

Driving Force Precision Manufacturing and Cost Optimization

Precision machining is an unavoidable requirement for industries producing automotive engine blocks, aerospace turbine components, and defense-grade equipment. Indexable milling cutters provide cost savings of 20 to 30% compared with conventional solid tools while also extending tool life. They reduce tool change frequency which translates into improved throughput and up to 25% faster cycle times. Integration with advanced CNC machining systems delivers repeatability and accuracy in complex operations. In my view, the adoption of these cutters is no longer a choice but a necessity for manufacturers who aim to compete on both quality and efficiency. Their role in modern production is already proving indispensable.

Growth Opportunity Advanced Materials and Specialized Inserts

Strong opportunities are developing in the machining of advanced alloys and composites such as titanium, Inconel, and carbon fiber. These materials are widely used in aerospace and energy applications and demand cutting tools with higher durability. Indexable cutters equipped with carbide, ceramic, or PCD inserts are well-suited for these applications. Customized insert designs for mold machining, turbine finishing, and other specialized tasks are gaining traction. Digital monitoring of tool performance is also becoming a revenue-generating feature, allowing predictive maintenance and operational optimization. From my perspective, growth will be fastest in Asia and Latin America where manufacturing industries are investing heavily in advanced machining equipment.

Emerging Trend Automation and Digital Manufacturing Integration

Manufacturing facilities are adopting automation at scale, which is expanding the role of indexable milling cutters. These tools are increasingly used with robotic machining systems and digitally enabled CNC platforms. IoT-linked tool monitoring provides real-time feedback on tool wear and cutting conditions, helping extend tool life and improve efficiency. Hybrid manufacturing processes where 3D-printed aerospace parts are finished with indexable cutters are also emerging. Multifunctional cutters capable of roughing and finishing in one cycle are reducing production time and tool inventories. In my assessment, manufacturers that do not integrate digital-ready cutting solutions risk falling behind in competitive aerospace and automotive supply chains.

Market Challenge High Upfront Costs and Supply Risks

The high upfront cost of indexable milling cutters remains a barrier, especially for small and medium manufacturers. A set of cutters and inserts can be significantly more expensive than conventional solid tools. Tooling represents about 7 to 10% of machining costs in large production runs, which pressures companies with thin profit margins. Supply chain volatility in tungsten carbide and cobalt, both essential materials for inserts, adds further risk. Delivery delays can extend production cycles and reduce competitiveness. A shortage of skilled machinists who can optimize advanced tooling systems also limits adoption. In my opinion, manufacturers that focus on innovation in insert coatings, tool geometries, and customer support will have the best chance of staying competitive.

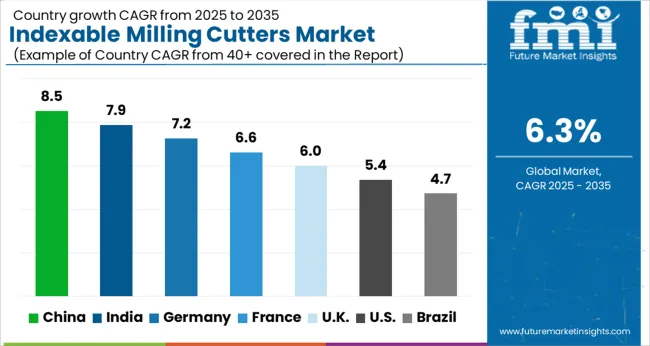

In 2025, the global indexable milling cutters market is growing at a CAGR of 6.3% through 2035. China leads at 8.5%, +35% above the global rate, supported by BRICS-driven industrial expansion and rising domestic manufacturing capacity. India follows at 7.9%, +25% higher than the global average, reflecting BRICS and ASEAN-linked growth in precision engineering and increased demand from automotive and construction sectors. Germany records 7.2%, +14% above the global CAGR, shaped by OECD-backed innovation in advanced tooling solutions and widespread use in high-value manufacturing.

The United Kingdom stands at 6.0%, slightly under the global benchmark, influenced by steady industrial activity and gradual adoption of advanced cutting technologies. The United States posts 5.4%, −14% below the global rate, where mature industrial bases and slower replacement cycles moderate growth. The BRICS nations are fueling strong expansion, while OECD countries emphasize innovation and quality-focused manufacturing efficiency.

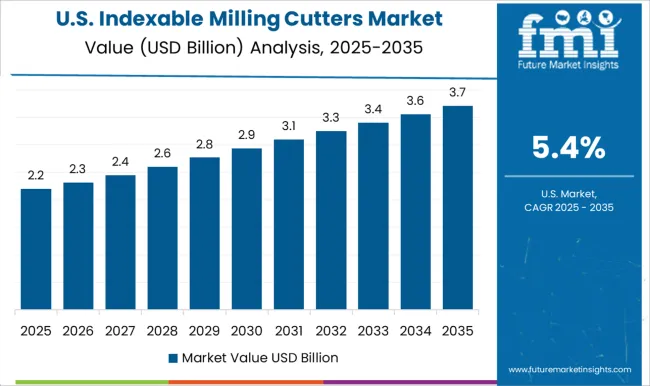

The United States market for indexable milling cutters is projected to expand at a CAGR of 5.4%, which is slower than most other major economies. Growth is shaped by aerospace and defense machining, where titanium and nickel alloys require ceramic and carbide inserts. Automotive machining contributes steadily, particularly in engine blocks and transmission housings. Kennametal and Seco Tools maintain a strong domestic presence, while local workshops are steadily upgrading toward digital-compatible cutters. Productivity gains are realized through CNC-driven operations across aerospace hubs in Texas and automotive clusters in Michigan. Rising demand for lightweight materials increases the use of coated carbide inserts designed for aluminum machining.

The United Kingdom market is forecasted to grow at a CAGR of 6%, supported by industrial applications in automotive, aerospace, and renewable energy. Dormer Pramet and Sandvik Coromant supply modular cutters that optimize cycle times in machining workshops concentrated in the Midlands. Demand is influenced by aerospace machining in Bristol, where titanium and composite materials are extensively processed. Renewable energy projects, particularly offshore wind, also require indexable cutters for large aluminum and steel components. Smaller workshops invest in variable geometry cutters to stabilize performance in long-cycle jobs. Overall, the market shows strong adoption of modular and versatile systems, designed to minimize changeover and extend operating hours.

The demand of indexable milling cutters in China is set to record a CAGR of 8.5%, the fastest among the major economies. Growth is heavily supported by industrial hubs in Jiangsu and Guangdong, where large-scale machining operations demand high-feed and high-durability cutters. Zhuzhou Cemented Carbide competes with international suppliers such as Mitsubishi Materials in automotive and construction machinery production. Aerospace growth further accelerates demand, especially in the machining of superalloys and composites. Integration of smart manufacturing platforms enhances real-time monitoring of cutting performance. Industrial policies encouraging advanced manufacturing sustain demand for high-precision, digital-compatible cutters in mass production.

The market in Germany is forecasted to expand at a CAGR of 7.2%, supported by precision manufacturing in automotive, aerospace, and industrial engineering sectors. Walter AG and MAPAL dominate the local market, providing coated carbide inserts that extend life in high-speed milling. Automotive hubs in Bavaria require advanced shoulder and face milling tools for gearbox and drivetrain production. Industry 4.0 strategies are pushing machine shops toward predictive maintenance and digital-ready tooling systems. Demand for surface finishing at micron-level precision continues to grow in aerospace manufacturing, raising reliance on premium-grade inserts. The market is characterized by higher adoption of coated and multi-edge tools for repeatability and durability.

The Demand of indexable milling cutters in India is projected to grow at a CAGR of 7.9%, supported by automotive, aerospace, and railway industries. Sandvik Coromant and ISCAR remain influential, supplying to hubs in Pune, Bangalore, and Chennai. Automotive machining of chassis, cylinder heads, and crankshafts continues to lead demand, while aerospace machining in Bengaluru accelerates due to titanium and composite processing. Railways increasingly adopt heavy-duty cutters for bogies and wheelset machining. Workshops in India prioritize cost efficiency, with growing interest in cutters designed for longer durability during multi-shift operations. Growing localization of tool production strengthens market competitiveness.

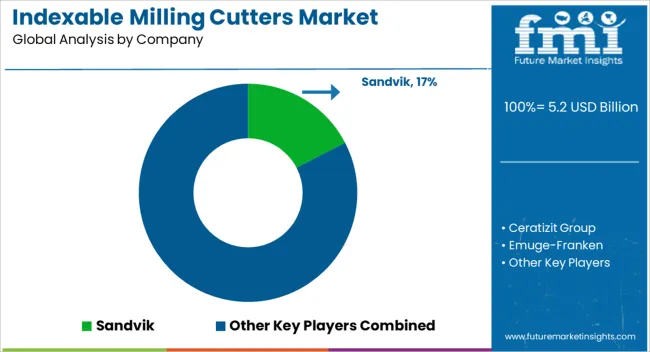

The indexable milling cutters market is dominated by global cutting tool companies supplying precision solutions for automotive, aerospace, construction, and heavy machinery sectors. Sandvik is regarded as the leading player in this industry, supported by its comprehensive product portfolio, innovation in insert technology, and widespread distribution network across multiple regions. The company continues to focus on performance, durability, and cost efficiency, working closely with manufacturers to deliver tools designed for high-speed and heavy-duty machining. Kennametal and Iscar hold significant market presence through their diverse milling cutter systems and geometries that enhance productivity in large-scale operations. Mitsubishi Materials and Kyocera serve industries requiring precision cutting, offering specialized designs suited for challenging machining environments.

Other key players contribute to the competitive balance with strong expertise and regional expansion. Seco Tools and Walter are recognized for their full-scale milling and insert portfolios, while Tungaloy and Ceratizit Group focus on continuous R&D initiatives to extend tool life and improve output. Emuge-Franken strengthens its reputation in high-performance milling, and Korloy provides versatile solutions for manufacturers across Asia. Vargus and Widia maintain their presence with reliable and cost-effective systems, supporting small and mid-scale operations. Together, these companies drive the indexable milling cutters market by combining product reliability, innovative engineering, and global supply capabilities to meet the machining requirements of diverse industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.2 Billion |

| Insert Material | Carbide inserts, Cermet inserts, Polycrystalline Diamond (PCD) inserts, Cubic Boron Nitride (CBN) inserts, and Others (high speed steel, ceramic, etc.) |

| Coating Type | Coated and Uncoated |

| Number of Cutting Edges | Up to 4 cutting edges, 5 to 8 cutting edges, and Above 8 cutting edges |

| Application | End mills, Face mills, Slab mills, and Others (Bed mills, bridge mills, etc.) |

| End Use | Automotive, Aerospace & defense, Energy, Building & construction, General engineering & metal fabrication, Mining, and Others (oil & gas, medical, etc.) |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sandvik, Ceratizit Group, Emuge-Franken, Iscar, Kennametal, Korloy, Kyocera, Mitsubishi Materials, Seco Tools, Tungaloy, Vargus, Walter, and Widia |

| Additional Attributes | Dollar sales by type including face mills, end mills, and shell mills, application across automotive, aerospace, and general engineering industries, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for precision machining, advanced manufacturing technologies, and increasing industrial automation. |

The global indexable milling cutters market is estimated to be valued at USD 5.2 billion in 2025.

The market size for the indexable milling cutters market is projected to reach USD 9.6 billion by 2035.

The indexable milling cutters market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in indexable milling cutters market are carbide inserts, cermet inserts, polycrystalline diamond (pcd) inserts, cubic boron nitride (cbn) inserts and others (high speed steel, ceramic, etc.).

In terms of coating type, coated segment to command 63.4% share in the indexable milling cutters market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Milling Machine Market Growth – Trends & Forecast 2025 to 2035

Indexable Tool Inserts Market

End Milling Machine Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Road Milling Machine Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Rice Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Tree Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Corn Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Maize Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wheat Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Cutters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thread Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Portable Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Corn Wet Milling Services Market Size, Growth, and Forecast for 2025 to 2035

Universal Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Horizontal Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Desktop CNC Milling Machines Market Size and Share Forecast Outlook 2025 to 2035

Flatbed Die Cutters Market Size and Share Forecast Outlook 2025 to 2035

Soluble-Film Cutters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tabletop CNC Milling Machines Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Rotary Knife Cutters Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA