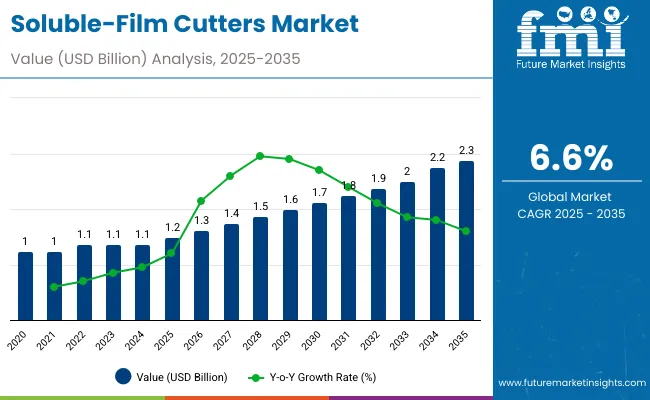

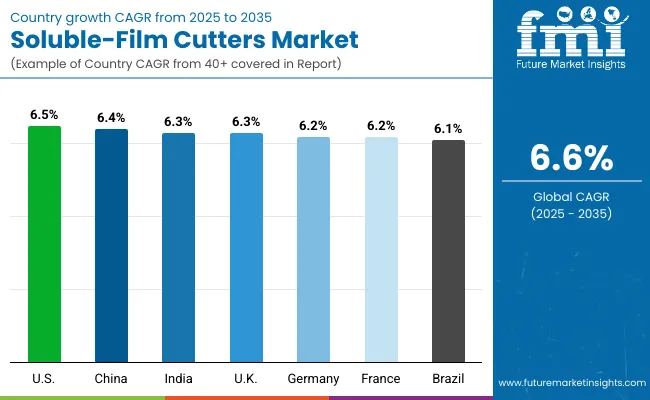

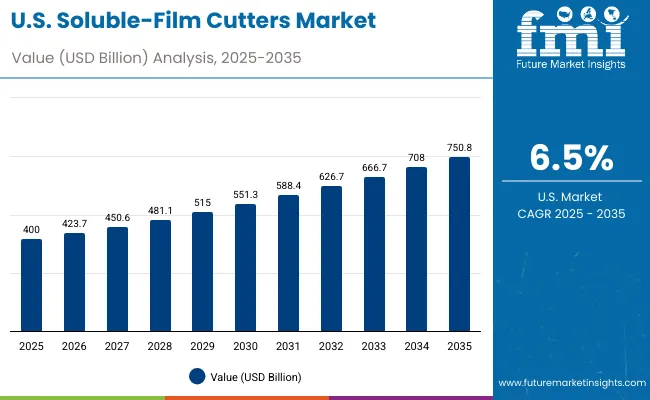

The soluble-film cutters market will expand from USD 1.2 billion in 2025 to USD 2.3 billion by 2035, growing at a CAGR of 6.6%. Growth is supported by sustainability initiatives, automation in packaging, and increasing use of water-soluble films across multiple industries. Polyvinyl alcohol (PVA) films dominate due to superior solubility and barrier performance, while automatic cutters ensure production precision and speed. Home and laundry care remains the primary consumer base, driven by the growing adoption of detergent pods and dissolvable packaging formats in both developed and emerging regions.

Between 2020 and 2024, water-soluble packaging adoption surged, particularly in detergent and healthcare industries. Automation and precision cutting technologies enhanced efficiency and reduced material waste. By 2035, the market will reach USD 2.3 billion, supported by PVA and HPMC film demand and the growth of automated cutting lines. Asia-Pacific will lead production capacity, while Europe remains a hub for high-speed machinery innovation. The U.S. market continues expanding through eco-certified pod packaging.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.2 billion |

| Industry Value (2035F) | USD 2.3 billion |

| CAGR (2025 to 2035) | 6.6% |

Growth is driven by the transition toward sustainable packaging and convenience-driven formats. Soluble films provide clean, single-use packaging solutions that minimize waste and plastic pollution. Automation in cutting systems boosts throughput and product consistency. Expanding homecare, agrochemical, and pharmaceutical applications create cross-sector opportunities.

The market is segmented by film type, machine type, application, end-use industry, and region. Film types include polyvinyl alcohol (PVA), hydroxypropyl methylcellulose (HPMC), starch-based soluble films, and biodegradable polymer films. Machine segmentation covers fully automatic, semi-automatic, and manual cutters. Applications span detergent pods, agrochemical packaging, pharmaceutical doses, and food ingredients. End-use industries include home & laundry care, pharmaceuticals, agriculture, and food processing.

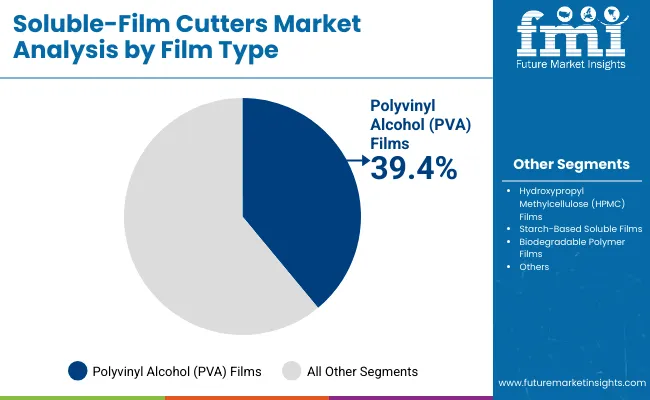

Polyvinyl alcohol (PVA) films are projected to hold 39.4% of the market in 2025, driven by their excellent tensile strength, transparency, and rapid solubility in water. These films provide an eco-friendly solution for packaging detergents, agrochemicals, and pharmaceuticals, ensuring safety and convenience for end users.

Their biodegradability and compatibility with automated cutting systems enhance manufacturing efficiency. As sustainability regulations tighten, PVA films offer an ideal balance between performance and environmental responsibility. With expanding adoption in homecare and healthcare packaging, they remain the leading film type.

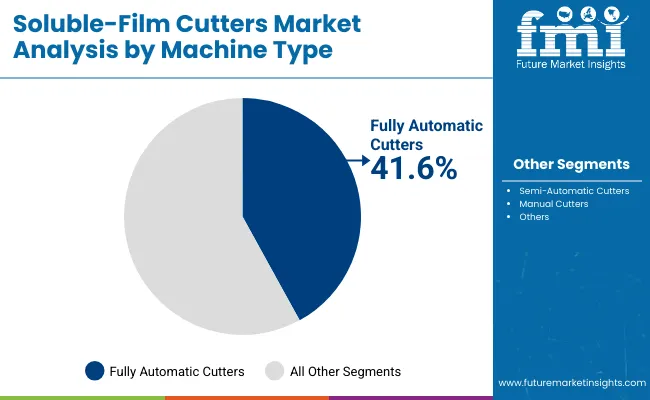

Fully automatic cutters are expected to capture 41.6% of the market in 2025, supported by rising automation across packaging plants. These machines deliver consistent film cutting accuracy, optimize speed, and minimize waste, ensuring maximum operational efficiency.

Advanced servo controls and real-time monitoring systems further enhance precision and productivity. Manufacturers favor automation for improved yield and labor cost reduction. As high-throughput operations become the norm in soluble film production, fully automatic cutters continue to lead market integration.

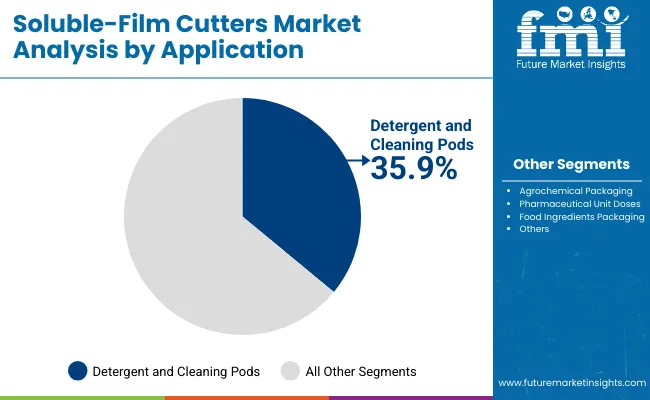

Detergent and cleaning pods are forecast to represent 35.9% of the market in 2025, as consumers increasingly prefer pre-measured, dissolvable packaging for convenience and waste reduction. PVA films provide reliable solubility and protect active ingredients from moisture exposure.

Expansion in private-label and eco-branded cleaning products reinforces adoption across global retail channels. The combination of functional design, biodegradability, and ease of use continues to make detergent pods the dominant application for soluble film cutting technologies.

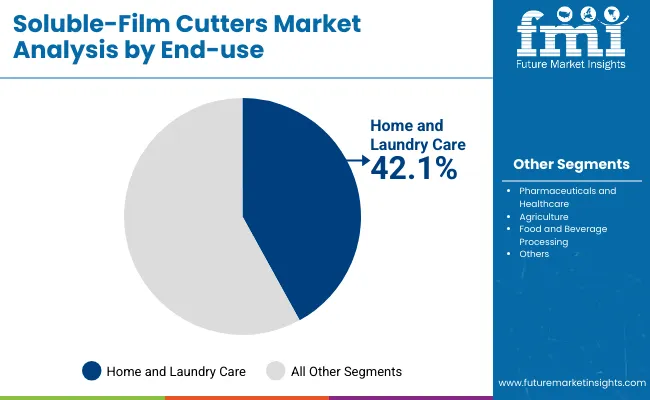

The home and laundry care segment is projected to hold 42.1% of the market in 2025, driven by the shift toward sustainable cleaning product packaging. Soluble film pods are replacing rigid plastic containers to reduce environmental impact and improve product efficiency.

Global brands are adopting water-soluble formats to align with circular economy principles and green labeling initiatives. Automated production lines further enhance scalability. As eco-conscious consumer behavior strengthens, home and laundry care remains the primary growth engine for soluble film cutting technologies.

The market is driven by growing demand for eco-friendly, dissolvable packaging solutions across household and healthcare sectors, emphasizing reduced waste and enhanced safety. However, high raw material costs and inconsistent solubility in humid conditions hinder scalability. Opportunities lie in integrating smart sensors for precision cutting and expanding into edible and agricultural applications. Key trends include bio-based film innovation, automation-led precision systems, and single-dose packaging advancements.

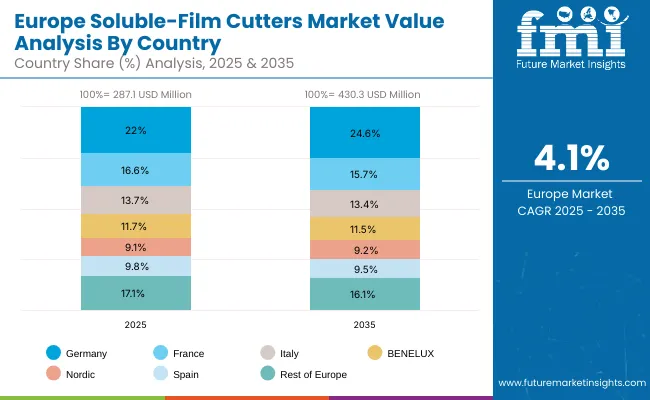

The global soluble-film cutters market is expanding as sustainability and automation redefine the packaging landscape. Asia-Pacific dominates due to high production capacity and cost-efficient PVA film manufacturing. Europe focuses on biodegradable material development aligned with strict eco-packaging standards, while North America drives innovation through automation upgrades and adoption in premium homecare and healthcare applications. Rapid integration of eco-film cutting machinery across detergents, pharmaceuticals, and agricultural packaging continues to support market growth worldwide.

The USA will grow at 6.5% CAGR, driven by the surge in detergent pods, medical packaging, and sustainable homecare products. Manufacturers are investing in eco-friendly film cutting systems that align with circular economy initiatives. Automation upgrades in healthcare packaging and detergent manufacturing plants are expanding national production capacity. The USA continues to lead innovation in precision cutting for eco-soluble films.

Germany will expand at 6.2% CAGR, supported by widespread adoption of biopolymer-based soluble films. Engineering firms are advancing high-speed, automated cutting machinery to meet EU recyclability goals. The integration of smart sensors and digital controls enhances accuracy and reduces waste in production. Germany’s robust R&D ecosystem continues to promote sustainable film innovation across consumer and industrial segments.

The UK will grow at 6.3% CAGR, driven by rising applications in agrochemical and homecare packaging. Private-label brands are increasingly adopting recyclable soluble films to meet sustainability mandates. Investments in R&D and automation are improving productivity for single-dose packaging. The UK remains a growing hub for dissolvable film solutions in cleaning and chemical applications.

China will grow at 6.4% CAGR, fueled by expanding demand in detergent, pharmaceutical, and food packaging. Domestic machinery makers are rapidly upgrading production capacity for soluble film cutters. Government support for sustainable manufacturing encourages R&D investments in bio-based PVA films. China’s dominance in cost-efficient production continues to drive export competitiveness.

India will grow at 6.3% CAGR, propelled by urbanization and the growing household cleaning sector. Local manufacturers are scaling PVA and water-soluble film production to meet rising domestic and export demand. Government-backed sustainability programs are accelerating the adoption of biodegradable packaging. Affordable machinery for mid-scale producers supports rapid market penetration.

Japan will grow at 6.9% CAGR, focusing on precision cutting machinery for pharmaceutical, food, and medical applications. Compact, energy-efficient systems are becoming standard in high-density manufacturing environments. Continuous innovation in automation and hybrid engineering enhances cutting accuracy. The integration of cleanroom-grade technology supports pharmaceutical-grade soluble packaging.

South Korea will lead with 7.0% CAGR, driven by advances in automation and biopolymer film innovation. The country is expanding production of dissolvable packaging for cosmetics and single-dose food applications. Government-led sustainability programs promote the use of eco-friendly film cutters. High exports of advanced automation systems underscore South Korea’s leadership in smart packaging technology.

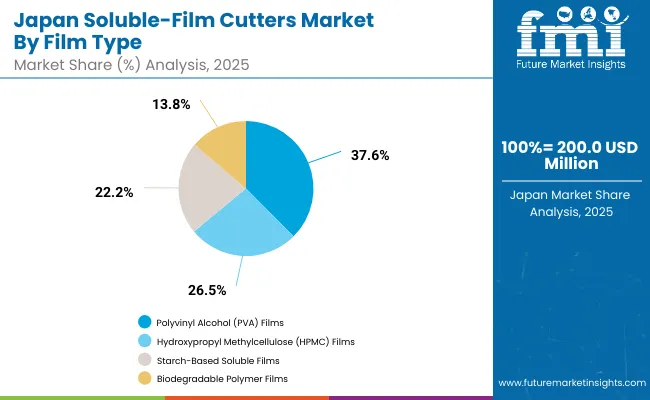

Japan’s soluble-film cutters market, valued at USD 200.0 million in 2025, is dominated by polyvinyl alcohol (PVA) films, accounting for 40.2% share due to their strong solubility, transparency, and mechanical strength. HPMC films are gaining popularity in pharmaceutical packaging, while starch-based films appeal to eco-conscious users. Biodegradable polymer films expand adoption in sustainable cleaning and detergent applications.

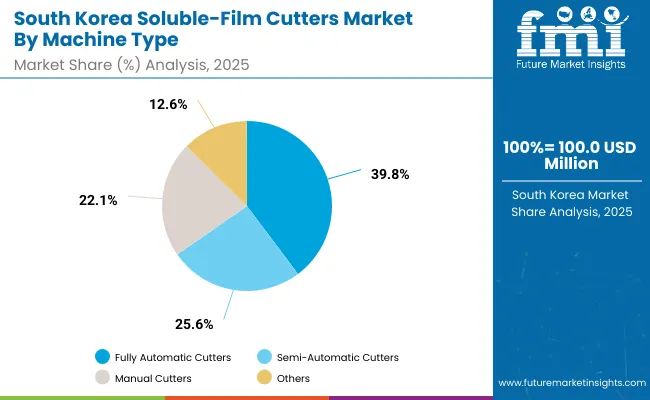

South Korea’s soluble-film cutters market, worth USD 100.0 million in 2025, is led by fully automatic cutters, holding a 42.7% share owing to their precision and compatibility with high-speed production lines. Semi-automatic cutters serve medium-scale industries, while manual cutters remain relevant for prototype runs and laboratory applications requiring customization flexibility.

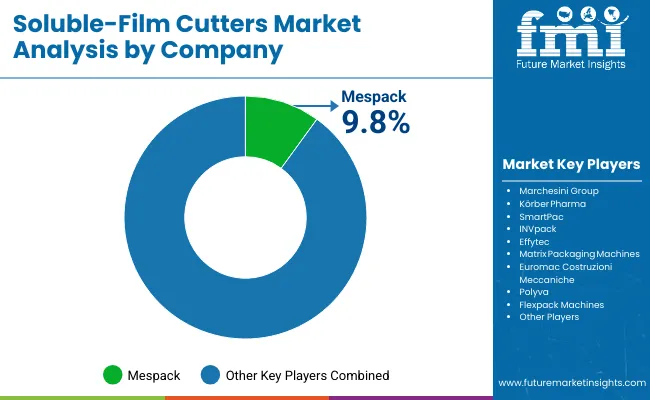

The market is moderately fragmented with major companies such as Mespack, Marchesini Group, Körber Pharma, SmartPac, INVpack, Effytec, Matrix Packaging Machines, EuromacCostruzioniMeccaniche, Polyva, and Flexpack Machines. These companies emphasize automation, bio-film compatibility, and sustainable material integration to improve performance and reduce waste.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| By Film Type | PVA Films, HPMC Films, Starch-Based Soluble Films, Biodegradable Polymer Films |

| By Machine Type | Fully Automatic, Semi-Automatic, Manual Cutters |

| By Application | Detergent & Cleaning Pods, Agrochemical Packaging, Pharmaceutical Unit Doses, Food Ingredients Packaging |

| By End-Use Industry | Home & Laundry Care, Pharmaceuticals & Healthcare, Agriculture, Food & Beverage Processing |

| Key Companies Profiled | Mespack, Marchesini Group, Körber Pharma, SmartPac, INVpack, Effytec, Matrix Packaging Machines, Euromac Costruzioni Meccaniche, Polyva, Flexpack Machines |

| Additional Attributes | Market driven by automation, eco-soluble materials, and single-dose packaging innovation |

The market size of the Soluble-Film Cutters Market in 2025 is USD 1.2 billion.

The market size of the Soluble-Film Cutters Market in 2035 is USD 2.3 billion.

The CAGR of the Soluble-Film Cutters Market during 2025-2035 is 6.6%.

Polyvinyl Alcohol (PVA) Films with 39.4% share leads the market in 2025.

Mespack, Marchesini Group, Körber Pharma, SmartPac, INVpack, Effytec, Matrix Packaging Machines, Euromac Costruzioni Meccaniche, Polyva, and Flexpack Machines.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hybrid Cutters Market Analysis Size and Share Forecast Outlook 2025 to 2035

Flatbed Die Cutters Market Size and Share Forecast Outlook 2025 to 2035

Rotary Knife Cutters Market

Indexable Milling Cutters Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Surgical Cutters Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA