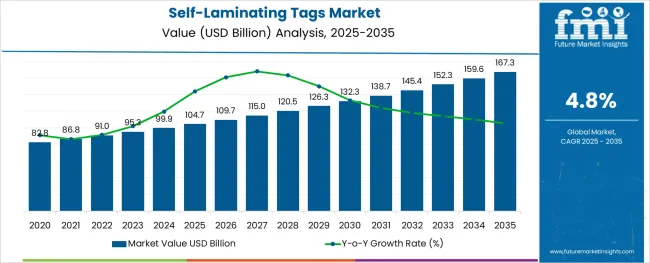

The Self-Laminating Tags Market is estimated to be valued at USD 104.7 billion in 2025 and is projected to reach USD 167.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The self-laminating tags market is witnessing steady growth propelled by the demand for durable, weather-resistant labeling solutions across industries such as logistics, retail, manufacturing, and utilities. Increasing regulatory requirements for product traceability and asset management are fueling adoption of tags that protect printed information from abrasion, moisture, and chemicals.

Innovation in tag materials has enhanced longevity and readability, making these tags essential for harsh outdoor and industrial environments. The surge in e-commerce and digital inventory systems has further accelerated demand, especially for tags that integrate seamlessly with barcode and RFID technologies.

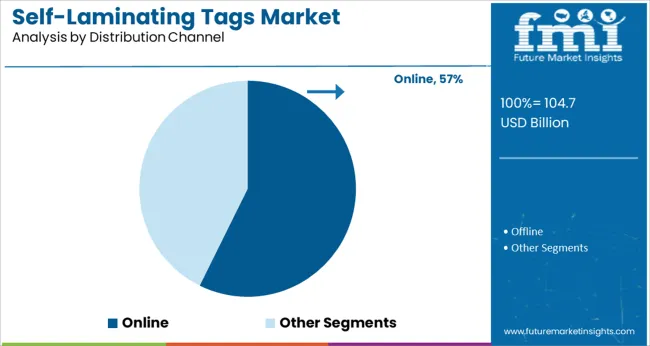

Distribution channels are evolving with growing preference for online procurement, driven by convenience, broad product availability, and streamlined supply chains. As businesses prioritize operational efficiency and compliance, the market is expected to expand with new product variants focusing on sustainability and cost-effectiveness.

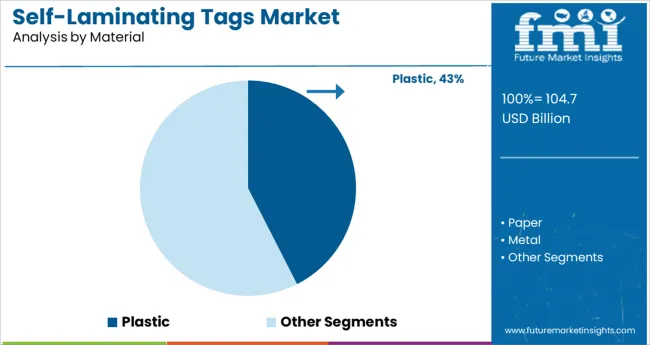

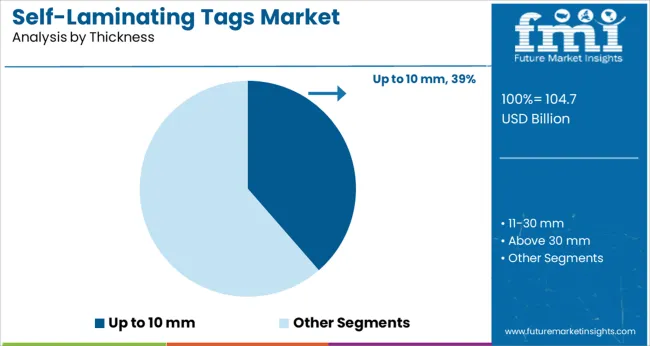

The market is segmented by Material, Thickness, and Distribution Channel and region. By Material, the market is divided into Plastic, Paper, and Metal. In terms of Thickness, the market is classified into Up to 10 mm, 11-30 mm, and Above 30 mm. Based on Distribution Channel, the market is segmented into Online and Offline. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Material, Thickness, and Distribution Channel and region. By Material, the market is divided into Plastic, Paper, and Metal. In terms of Thickness, the market is classified into Up to 10 mm, 11-30 mm, and Above 30 mm. Based on Distribution Channel, the market is segmented into Online and Offline. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic material segment is anticipated to hold 42.5% of the total market revenue in 2025, establishing it as the dominant material type. This dominance stems from plastic’s superior durability, flexibility, and resistance to environmental factors such as UV exposure and chemical contact.

Plastic tags provide long-lasting protection for printed information, ensuring clarity and legibility in demanding industrial and outdoor settings. The ease of customization and cost efficiency of plastic materials have also contributed to their widespread use across multiple end-use sectors.

Furthermore, advances in recyclable and eco-friendly plastic formulations are addressing sustainability concerns without compromising performance, thus reinforcing the segment’s leading position in the self-laminating tags market.

The segment for tags with thickness up to 10 mm is projected to capture 38.6% revenue share in 2025, making it the leading thickness category. This thickness range offers an optimal balance between durability and flexibility, suitable for a wide range of applications from asset tracking to product labeling.

Tags within this thickness are easier to handle and apply, while providing sufficient protection against wear and tear in industrial environments. Manufacturers have focused on refining material properties and lamination techniques in this segment to enhance resistance to impact and environmental degradation.

Its compatibility with standard tagging equipment and cost-effectiveness further supports its widespread adoption, contributing to its dominant market share.

The online distribution channel segment is expected to hold a 57.3% revenue share in 2025, positioning it as the leading channel for self-laminating tag sales. This growth is driven by the convenience of e-commerce platforms, which offer extensive product selections, faster procurement cycles, and competitive pricing.

Online channels facilitate easier comparison shopping and access to technical specifications, enabling buyers to make informed decisions. The increasing digitization of supply chains and the need for just-in-time inventory have also contributed to the preference for online purchasing.

Moreover, manufacturers and distributors are expanding their direct-to-customer online presence, enhancing customer support and customization options. These factors collectively underpin the dominance of the online channel within the self-laminating tags market.

The global self-laminating tags market is anticipated to grow during the forecast period as they are perfect for safety messages or operating instructions because they can be printed or written with valuable information.

Self-laminating tags safeguard the personalized tags by adding an extra layer of protection which is further projected to grow the sales of self-laminating tags.

The demand for self-laminating tags is rising as their laminating layer keeps the text from becoming smudged or smeared in tough situations. Other factors propelling the sales of self-laminating tags include the display of personalized information, barcodes, logos, and so on.

Self-laminating tags are constructed of stiff plastic and provide stability and durability, as well as saving time and labor and being cost-effective. These characteristics are anticipated to be major reasons responsible for the growth of self-laminating tags' market share.

A major factor propelling the growth of self-laminating tags market share as it come in several sizes and colors, making them ideal for colour-coding systems. The polyester laminating layer protects the self-laminating tags from moisture and weather which further boosts the demand for self-laminating tags during the projected period.

The ability to protect against grease, moisture, dirt, and other contaminants is a major reason driving the demand for self-laminating tags. The translucent laminated overlay keeps the message from being obscured.

Throughout the forecast period, the US, France, Italy, and Germany are likely to be mature markets in the global self-laminating tags market due to their developed electronics and automotive industries. The self-laminating tags market is predicted to expand the most in countries such as India, China, and South Korea.

Due to urbanization, India and China's chemical and steel industries are quickly expanding. The self-laminating tags market in GCC countries is also likely to pick up steam over the forecast period. As the market for self-laminating tags matures in Europe, Germany, the United Kingdom, Russia, and France are likely to grow at a slower pace than Asian countries.

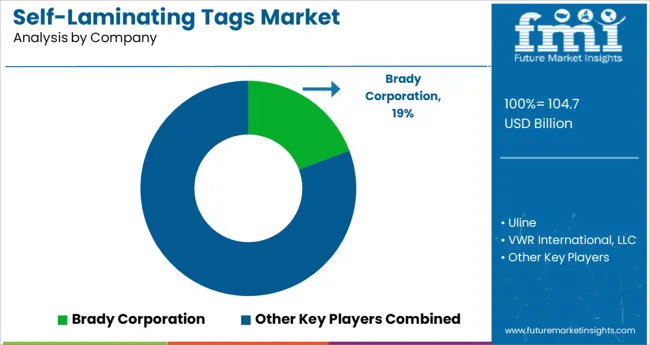

Key players in global self-laminating tags include Avery Dennison, Brady, LEM Products, Inc., Seton Universal Tag, Inc., Badger Tag & Label Corporation, Stranco.

Recent Developments

Coveris bought 100 percent of the shares of Amberley Adhesive Labels Ltd, a company situated in Dorset, UK, in July 2020. Amberley's acquisition supports the goal of looking forward to a successful development of labelling capabilities and further developing the possibilities of the facility.

L'Oréal and Avery Dennison Collaborated to Reduce Label Waste in July 2020. This programme will assist brands in diverting glassine paper liner (waste from the label application process) from landfills and into recycled products. L'Oréal Australia will redirect over six tonnes of glassine paper liner in Australia into recycled paper for use in the recycled paper sector as part of this programme.

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 5% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments covered | Product type, material type, string type, application, region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | US, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Avery Dennison; Brady; LEM Products, Inc.; Seton Universal Tag, Inc.; Badger Tag & Label Corporation; Stranco. |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global self-laminating tags market is estimated to be valued at USD 104.7 billion in 2025.

It is projected to reach USD 167.3 billion by 2035.

The market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types are plastic, paper and metal.

up to 10 mm segment is expected to dominate with a 38.6% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tags Market Insights - Growth & Demand 2025 to 2035

Hang Tags Market Insights – Growth & Trends Forecast 2025 to 2035

Asset Tags Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Asset Tags Sector

Printable Tags Market

Industrial Tags Market

Non-Adhesive Tags Market Growth - Demand & Forecast 2025 to 2035

Wireless Sensor Tags Market Size and Share Forecast Outlook 2025 to 2035

Braille Clothing Tags Market Size and Share Forecast Outlook 2025 to 2035

Heavy Duty Paper Tags Market Insights – Growth & Demand 2025 to 2035

Industry Share Analysis for Braille Clothing Tags Companies

Ultra Wideband Anchor and Tags Market Size and Share Forecast Outlook 2025 to 2035

Medical Device & Equipment Tags Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA