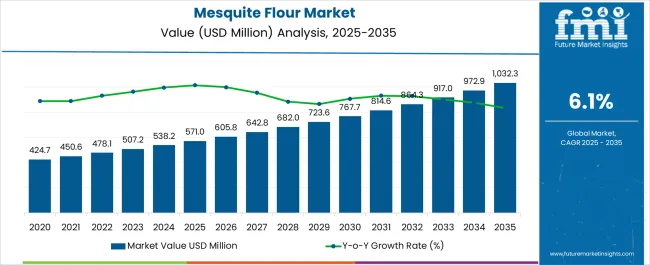

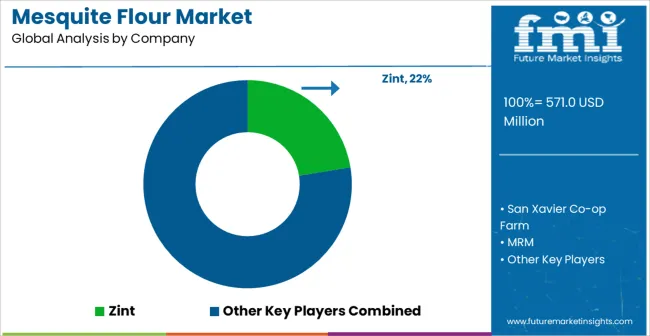

The Mesquite Flour Market is estimated to be valued at USD 571.0 million in 2025 and is projected to reach USD 1032.3 million by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| Mesquite Flour Market Estimated Value in (2025 E) | USD 571.0 million |

| Mesquite Flour Market Forecast Value in (2035 F) | USD 1032.3 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

The Mesquite Flour market is experiencing steady growth driven by increasing awareness of its nutritional benefits, high fiber content, and natural sweetness. The current market scenario reflects growing consumer preference for organic and plant-based food ingredients, which are being incorporated into bakery, snacks, and beverage products. In 2025, the market is being shaped by a rising demand for gluten-free and low-glycemic food options among health-conscious consumers, along with increasing interest from specialty food retailers and supermarkets.

Investments in sustainable agriculture and organic farming are supporting the expansion of mesquite flour production, while regional adoption of alternative flours is facilitating new product development. The future outlook of the market is favorable as consumers continue to seek natural, high-protein, and environmentally sustainable food ingredients.

Growth opportunities are expected to emerge from the inclusion of mesquite flour in ready-to-eat snacks, functional foods, and bakery mixes, driven by the need for healthier alternatives and clean-label products As consumer preferences continue to evolve toward nutrient-dense foods, mesquite flour is poised to maintain a strong presence in both retail and specialty channels.

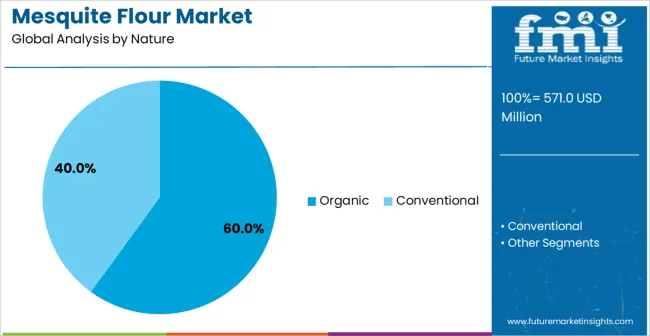

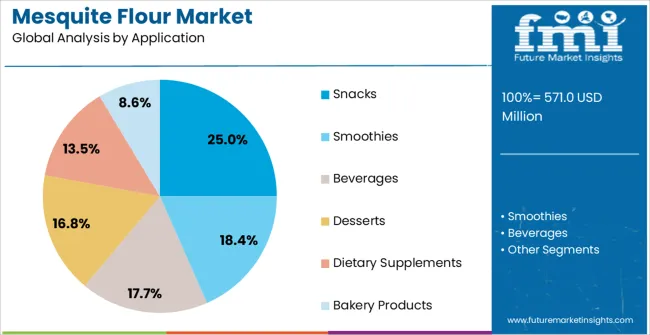

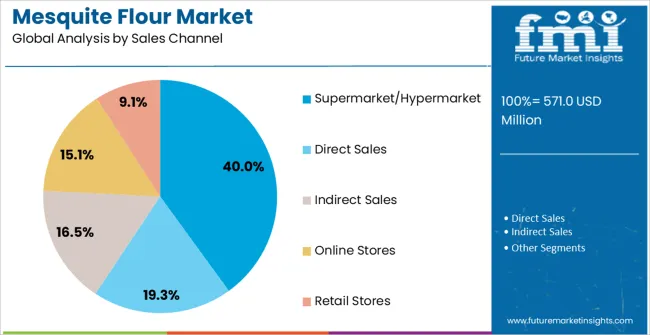

The mesquite flour market is segmented by nature, application, sales channel, and geographic regions. By nature, mesquite flour market is divided into Organic and Conventional. In terms of application, mesquite flour market is classified into Snacks, Smoothies, Beverages, Desserts, Dietary Supplements, and Bakery Products. Based on sales channel, mesquite flour market is segmented into Supermarket/Hypermarket, Direct Sales, Indirect Sales, Online Stores, and Retail Stores. Regionally, the mesquite flour industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The organic nature segment is projected to hold 60.00% of the Mesquite Flour market revenue share in 2025, establishing it as the leading nature-based segment. This dominance is being attributed to consumer demand for foods produced without synthetic chemicals, pesticides, or preservatives, which aligns with the rising health and wellness trends globally. The organic segment benefits from increased adoption in home cooking, baking, and snack formulation due to its perceived safety and superior nutritional profile.

Moreover, the growing preference for sustainable and environmentally friendly products has enhanced the appeal of organically produced mesquite flour. Retailers and distributors are prioritizing organic variants to meet consumer expectations for clean-label ingredients, which has strengthened the segment’s growth.

As supply chains for organic farming improve and certification processes become more accessible, organic mesquite flour continues to capture a larger market share, supporting both premium pricing strategies and widespread consumer acceptance Future growth is expected to be reinforced by continued awareness campaigns and increasing integration of organic ingredients in mainstream food products.

The snacks application segment is expected to account for 25.00% of total Mesquite Flour market revenue in 2025, positioning it as the leading application segment. The growth of this segment is being driven by the incorporation of mesquite flour into health-focused snack products, such as protein bars, cookies, and alternative baked goods.

The functional benefits of mesquite flour, including low glycemic index and high fiber content, are encouraging its use in snack formulations that cater to weight management and dietary-conscious consumers. Consumer demand for innovative, nutrient-dense snack options has facilitated the expansion of this segment, while product developers are leveraging mesquite flour for its natural sweetness and flavor-enhancing properties.

The scalability of snack production and the ability to market clean-label, health-oriented products have further strengthened the position of this segment As consumers increasingly seek convenient, healthy alternatives, the snacks application segment is anticipated to sustain its leadership through continued product innovation and integration into mainstream retail offerings.

The supermarket and hypermarket sales channel segment is projected to hold 40.00% of the Mesquite Flour market revenue share in 2025, making it the dominant distribution channel. This leadership is being driven by the wide accessibility and convenience provided by these retail formats, which allow consumers to easily compare, select, and purchase mesquite flour products. Large retail chains have been emphasizing health and wellness aisles, which include specialty flours such as mesquite, thereby increasing visibility and sales potential.

The growth is also supported by promotional campaigns, private label offerings, and bulk packaging options that attract cost-conscious consumers. The supermarket and hypermarket channel enables consistent supply and reliable distribution, facilitating consumer trust and repeat purchases.

As organized retail continues to expand, particularly in urban areas, this sales channel is expected to remain a key contributor to overall market growth The ability to combine product variety with in-store marketing initiatives ensures continued prominence of supermarkets and hypermarkets in mesquite flour distribution.

Mesquite tree bean pods are harvested, dried, ground, and milled into flour to create mesquite flour, also known as mesquite meal or algarroba. Mesquite flour has a low glycemic index and is high in proteins and the amino acid lysine. Other nutrients found in it also include calcium, magnesium, potassium, iron, and zinc. To give them a healthy seasoning, light natural sweetness, cinnamon-mocha-coconut aroma or nutty flavor, this flour is used to make a variety of culinary items, such as tortillas, breads, pancakes, muffins, cookies, refreshing drinks, mesquite chocolates, candy, chips, and breakfast cereals.

Additionally, it is utilized as a thickening agent in hot cereals, soups, puddings, and beverages. Furthermore, if the mixture is given time to ferment, mesquite flour and water can be utilized to create alcoholic beverages that are effervescent. Additionally, it regulates blood sugar levels, strengthens the immune system, and shields against headaches and migraines.

In our new study, ESOMAR-certified market research and consulting firm Future Market Insights (FMI) offers insights into key factors driving demand for Mesquite Flour.

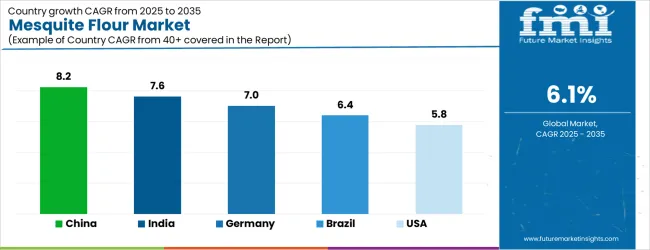

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| Brazil | 6.4% |

| USA | 5.8% |

| UK | 5.2% |

| Japan | 4.6% |

The Mesquite Flour Market is expected to register a CAGR of 6.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.2%, followed by India at 7.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 4.6%, yet still underscores a broadly positive trajectory for the global Mesquite Flour Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.0%. The USA Mesquite Flour Market is estimated to be valued at USD 208.3 million in 2025 and is anticipated to reach a valuation of USD 208.3 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 28.1 million and USD 15.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 571.0 Million |

| Nature | Organic and Conventional |

| Application | Snacks, Smoothies, Beverages, Desserts, Dietary Supplements, and Bakery Products |

| Sales Channel | Supermarket/Hypermarket, Direct Sales, Indirect Sales, Online Stores, and Retail Stores |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zint, San Xavier Co-op Farm, MRM, The Mesquitery, Casa Del Mesquite, Desert Harvesters, Food Conspiracy Co-op, Native Seeds/SEARCH, Skeleton Creek, Z Natural Foods, Health Link, Terrasoul Superfoods, Sunfood Super Foods, and Natava SuperFoods |

The global mesquite flour market is estimated to be valued at USD 571.0 million in 2025.

The market size for the mesquite flour market is projected to reach USD 1,032.3 million by 2035.

The mesquite flour market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in mesquite flour market are organic and conventional.

In terms of application, snacks segment to command 25.0% share in the mesquite flour market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flour Mixes Market Growth – Specialty Baking & Industry Trends 2025 to 2035

Flour Substitutes Market Analysis by Baked Goods, Noodles, Pastry, Fried Food, Pasta, Bread, Crackers Applications Through 2035

Flour Conditioner Market

Flour Improvers Market

Corn Flour Market Size and Share Forecast Outlook 2025 to 2035

Bean Flour Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Bean Flour Manufacturers

Pulse Flours Market Size and Share Forecast Outlook 2025 to 2035

Vegan Flour Market Growth - Plant-Based Innovation & Industry Demand 2025 to 2035

Cereal Flour Market Size and Share Forecast Outlook 2025 to 2035

Silica Flour Market Size and Share Forecast Outlook 2025 to 2035

Banana Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Almond Flour Market Analysis - Size, Share, and Forecast 2025 to 2035

Millet Flour Market Analysis by Pearl Millet, Finger Millet, Foxtail Millet, Proso Millet, Kodo Millet, and Others Through 2035

Konjac Flour Market Analysis by Applications and Functions Through 2025 to 2035

Peanut Flour Market

Sorghum Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Coconut Flour Market Analysis by End-Use, Application, Product Form, Technology, Nature, and Region from 2025 to 2035

Cassava Flour Market Trends – Size, Share & Forecast 2025-2035

Toasted Flour Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA