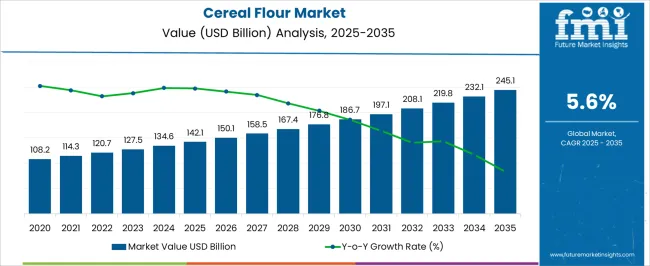

The cereal flour sector is projected to expand from USD 142.1 billion in 2025 to USD 245.1 billion in 2035, advancing at a CAGR of 5.6%. The ten-year growth comparison indicates a steady upward curve, with values climbing from 142.1 billion in 2025 to 167.4 billion in 2028 and 186.7 billion in 2030. This progression reflects the rising use of cereal-based flours in bakery, snacks, and processed food applications.

Analysts argue that the market trajectory demonstrates resilience, supported by changing dietary patterns and increased reliance on ready-to-cook and packaged food categories. Growth remains strongly tied to staple consumption across regions. From 2025 to 2035, the industry shows compound gains of over USD 100 billion, with values advancing to 197.1 billion in 2031, 219.8 billion in 2033, and 245.1 billion by 2035. The growth curve suggests dependable expansion across both developed and emerging markets, where product diversification and fortified blends continue to attract consumer attention.

Industry observers consider this decade-long progression as an indicator of evolving preferences, with demand being reinforced by the versatility of cereal flours in both traditional and modern recipes. The comparison highlights a consistent performance outlook, positioning cereal flour as a foundational ingredient for long-term value creation.

| Metric | Value |

|---|---|

| Cereal Flour Market Estimated Value in (2025 E) | USD 142.1 billion |

| Cereal Flour Market Forecast Value in (2035 F) | USD 245.1 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The cereal flour segment is estimated to account for nearly 15% of the food and beverages market, close to 28% of the bakery ingredients market, about 22% of the grain processing market, nearly 12% of the packaged food market, and around 10% of the functional food ingredients market.

This results in an aggregated share of approximately 87% across its parent sectors. Such a proportion highlights the indispensable position cereal flour occupies in shaping dietary consumption and industrial food processing. It has been central to bread, pasta, cakes, and ready-to-eat meals, which remain among the most widely consumed products globally. Industry specialists view cereal flour not just as a commodity but as the foundation ingredient that defines quality, texture, and nutritional value across a vast range of applications.

Demand has been reinforced by the versatility of wheat, maize, rice, and specialty grains, enabling both traditional recipes and innovation in fortified or gluten-free product ranges. The reliance on cereal flour has been further cemented by its role in driving consumer preference and by supporting the packaged food ecosystem. Its influence is not seen as a short-term driver but as an enduring pillar of the food value chain, ensuring its dominance as a core element within its parent markets while continuing to guide procurement and product development strategies worldwide.

The cereal flour market is experiencing steady expansion, underpinned by rising global consumption of staple food products and an increasing shift towards healthier grain-based diets. Food industry publications and trade data have highlighted that demand growth is being driven by both traditional consumption in staple-heavy diets and the incorporation of cereal flours into value-added bakery, confectionery, and ready-to-eat products.

Advances in milling technologies have improved flour quality, texture, and shelf life, expanding usage across diverse applications. Additionally, evolving consumer preferences toward whole grain and minimally processed flours are influencing product development strategies among major producers.

Economic growth in emerging markets has increased per capita consumption of cereal-based foods, while premiumization trends in developed economies are fostering demand for specialty and fortified flours. As regulatory bodies continue to promote whole grain consumption for better nutrition, market expansion is expected to be supported by product diversification, sustainable sourcing, and innovative processing techniques that align with health and environmental priorities.

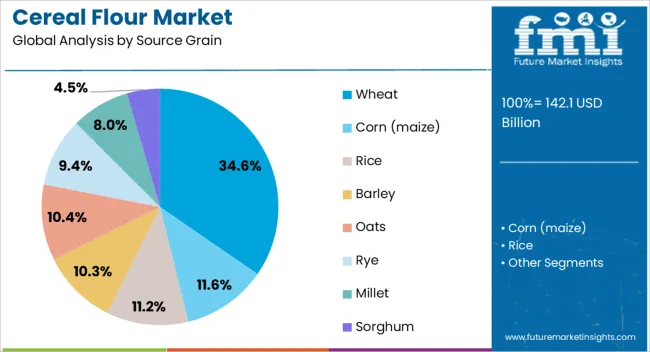

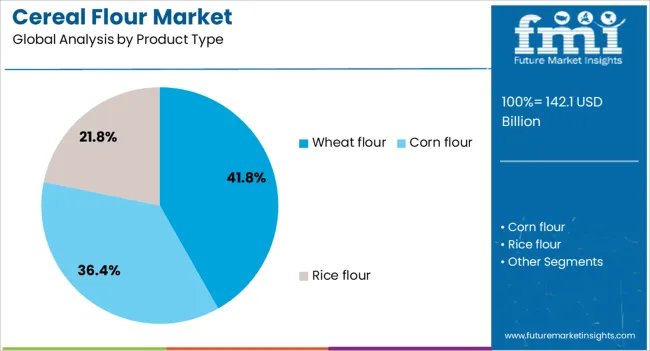

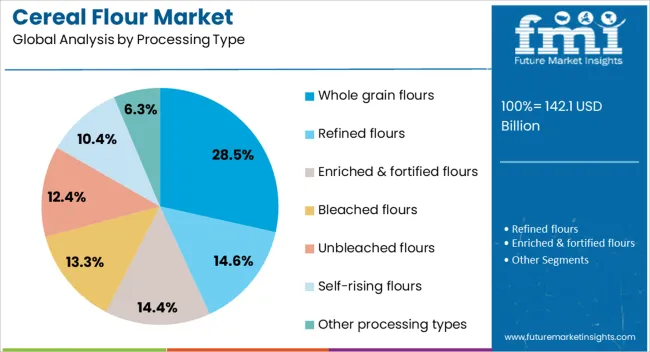

The cereal flour market is segmented by source grain, product type, processing type, application, end use, distribution channel, and geographic regions. By source grain, cereal flour market is divided into Wheat, Corn (maize), Rice, Barley, Oats, Rye, Millet, Sorghum, and Other cereal grains. In terms of product type, cereal flour market is classified into Wheat flour, Corn flour, Rice flour, Barley flour, Oat flour, Rye flour, Millet flour, Sorghum flour, Multi-grain flour blends, and Other cereal flours. Based on processing type, cereal flour market is segmented into Whole grain flours, Refined flours, Enriched & fortified flours, Bleached flours, Unbleached flours, Self-rising flours, and Other processing types.

By application, cereal flour market is segmented into Bakery products, Pasta & noodles, Breakfast cereals, Snack foods, Soups, sauces & gravies, Baby food, Animal feed, and Other applications. By end use, the cereal flour market is segmented into the Food processing industry, the Foodservice industry, the Retail/household consumption, the Animal feed industry, and Other end uses. By distribution channel, cereal flour market is segmented into B2B/direct sales, Retail, Wholesale/distributors, and Other distribution channels. Regionally, the cereal flour industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wheat segment is projected to account for 34.60% of the cereal flour market revenue in 2025, maintaining its leading position in the source grain category. This dominance has been reinforced by wheat’s versatility, favorable functional properties, and global acceptance as a dietary staple.

Food processing industries have consistently relied on wheat for its gluten-forming ability, which supports desirable texture and elasticity in baked goods. Agricultural reports have noted that wheat benefits from an extensive cultivation footprint and well-established supply chains, ensuring consistent availability across markets.

Additionally, the adaptability of wheat to various climatic conditions and its compatibility with both traditional and industrial milling processes have supported its continued prominence. Nutritional fortification programs in several countries have also increased wheat flour consumption, particularly in regions where it is a key component of daily diets. These combined factors are expected to sustain wheat’s leadership as the primary source of grain in the cereal flour market.

The wheat flour segment is projected to contribute 41.80% of the cereal flour market revenue in 2025, holding its position as the leading product type. This segment’s growth is driven by widespread culinary applications, from bread and pasta to snack foods and convenience meals.

Consumer familiarity, consistent quality, and versatile use in both household and commercial kitchens have reinforced wheat flour’s market share. Industry sources have reported increasing demand for differentiated wheat flour varieties, including fortified, enriched, and organic options, catering to health-conscious consumers.

Additionally, large-scale industrial bakeries and food manufacturers have sustained high-volume demand due to wheat flour’s functional consistency and cost-effectiveness. Its role in delivering the desired sensory attributes in a wide range of products, combined with the ease of procurement from established supply networks, is expected to keep wheat flour as the preferred product type in the market.

The whole grain flours segment is projected to hold 28.50% of the cereal flour market revenue in 2025, reflecting a rising consumer preference for nutritionally dense and minimally processed foods. This growth has been fueled by increasing awareness of the health benefits associated with whole grain consumption, including higher fiber content, essential vitamins, and minerals.

Nutrition guidelines from global health organizations have endorsed whole grain intake as part of a balanced diet, prompting both manufacturers and retailers to expand product availability. Food brands have responded by introducing a variety of whole grain flour options tailored for bakery, breakfast cereals, and health-focused snack applications.

Additionally, the clean-label movement and interest in functional foods have supported consumer adoption of whole grain flours over refined alternatives. As dietary trends continue to prioritize natural and nutrient-rich ingredients, the whole grain flours segment is expected to strengthen its position in the cereal flour market.

The cereal flour market is projected to expand steadily as consumer preferences shift toward diversified grain-based products across food and beverage applications. Demand is being reinforced by bakery, confectionery, and snack industries, supported by rising interest in nutritional blends. Opportunities exist in fortified flour, gluten-free alternatives, and ready-to-use mixes catering to health-conscious segments. Trends highlight innovation in ancient grains, clean-label formulations, and specialty flours with regional appeal. Yet, challenges such as volatile grain prices, storage limitations, and regulatory restrictions on food safety continue to shape growth trajectories globally.

Demand for cereal flour has been reinforced by its role as a staple ingredient in bakery, confectionery, and snack applications. Bread, biscuits, noodles, and breakfast cereals have continued to drive high consumption levels, supported by urban food habits and global trade in processed foods. Opinions suggest that demand is being diversified by consumer preference for multigrain blends, whole grain flours, and fortified options, positioning cereal flour as more than a commodity. Quick-service restaurants and packaged food manufacturers rely heavily on consistent flour quality, fueling steady demand. Growth in developing economies with rising middle-class consumption has further strengthened volume sales. With cereal flour serving as a foundation for both traditional and modern food products, demand is expected to maintain resilience, even as consumer preferences evolve toward convenience and nutritional enrichment.

Opportunities in the cereal flour market are being shaped by fortified blends, gluten-free variants, and value-added formulations. Manufacturers are developing fortified flours enriched with vitamins, minerals, and proteins to target malnutrition concerns and premium health markets. Gluten-free flours from rice, corn, and sorghum are creating opportunities among health-conscious consumers and those with dietary sensitivities. Opinions highlight that the greatest opportunities lie in developing innovative mixes for home baking, instant foods, and functional snacks. Regional specialties, such as millet-based or quinoa flours, are gaining global appeal through exports, presenting growth avenues for producers. Demand for clean-label ingredients has also created opportunities to market cereal flours with minimal processing and natural attributes. This diversification shows how cereal flour is transitioning from a traditional commodity into a high-value ingredient with expanding applications.

Trends in the cereal flour market revolve around ancient grains, specialty flours, and clean-label formulations. Growing interest in millet, quinoa, and amaranth has reshaped consumer preferences, as these grains are associated with higher nutrition and authenticity. Regional food cultures have also influenced trends, with wheat dominating in Western countries, while rice and maize flours are favored in Asian and Latin American cuisines. Opinions suggest that artisanal baking, home cooking, and functional snacks are pushing demand for diverse flour varieties. Clean-label trends, emphasizing natural processing and transparency, are driving adoption in premium markets. Online retail platforms have accelerated exposure of niche flours to global consumers, reinforcing these shifts. Collectively, such trends point to a market where tradition and innovation merge, with cereal flour gaining renewed significance as a foundation of diversified diets worldwide.

Challenges in the cereal flour market stem from volatile grain prices, storage limitations, and regulatory hurdles. Climatic fluctuations have caused irregular supply of wheat, maize, and rice, directly affecting production costs and profit margins. Storage and distribution inefficiencies in emerging economies often result in spoilage and wastage, creating a persistent barrier to growth. Opinions highlight that strict food safety regulations regarding contamination and nutritional labeling impose compliance costs, particularly for small-scale millers. Competition from alternative carbohydrate sources, such as processed starches and pseudo-cereals, also challenges market stability. Inconsistent quality standards across regions hinder international trade, limiting the reach of exporters.

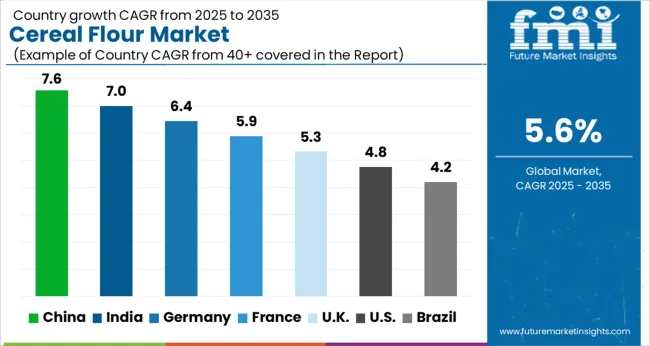

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The global cereal flour market is projected to grow at a CAGR of 5.6% from 2025 to 2035. China leads at 7.6%, followed by India at 7.0% and France at 5.9%. The United Kingdom is expected to post 5.3%, while the United States trails with 4.8%. Growth is driven by rising demand for bakery and convenience foods, diversification into specialty flours, and increasing usage in packaged and ready to eat segments. Asian markets expand faster due to population growth, changing dietary patterns, and government support for agro processing. European markets emphasize premium, organic, and fortified varieties, while the USA records steady growth through gluten free and health focused product innovation. This report includes insights on 40+ countries; the top markets are shown here for reference.

The cereal flour market in China is projected to grow at a CAGR of 7.6%. Rising household consumption, strong demand for bakery and noodles, and government policies supporting grain processing boost growth. Industrial scale milling capacity ensures supply for both domestic and export markets. Expansion of packaged foods and e commerce channels accelerates accessibility across urban and rural areas. Specialty flours, including fortified and whole grain variants, gain popularity among health conscious consumers. With strong processing infrastructure and high consumption, China continues to anchor global cereal flour trade.

The cereal flour market in India is forecast to grow at a CAGR of 7.0%. Expanding population, changing dietary habits, and a shift toward packaged and branded flour drive growth. Increasing demand for wheat and multigrain flours reflects evolving consumer preferences. Domestic milling firms are investing in product differentiation through fortified, organic, and convenience oriented flours. Rising consumption of bakery products and snacks strengthens demand beyond traditional household use. Government initiatives promoting agro processing clusters further support the expansion of branded and value added flour products.

The cereal flour market in France is projected to expand at a CAGR of 5.9%. Demand is supported by strong bakery and patisserie traditions, with artisanal and industrial bakers ensuring consistent consumption. French consumers show rising interest in organic, stone ground, and ancient grain flours, creating room for premium product lines. Milling firms invest in clean label formulations to meet consumer preferences. Export of specialty French flours also adds to market momentum, positioning France as both a producer and influencer in European flour markets.

The cereal flour market in the UK is forecast to grow at a CAGR of 5.3%. Market expansion is driven by demand for healthier flour alternatives and convenience oriented bakery products. Supermarkets and online retail dominate distribution, making packaged flour widely accessible. Consumer interest in gluten free, fortified, and high fiber flours supports diversification. Foodservice demand for bakery, pizza, and quick service outlets further reinforces consumption. Though overall growth is moderate, evolving dietary trends ensure stable expansion for value added and functional flour products.

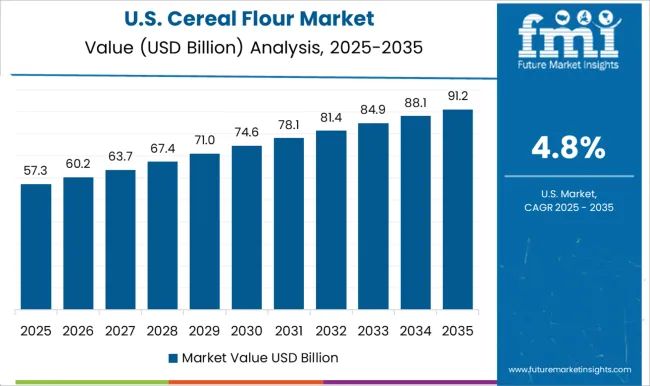

The cereal flour market in the US is expected to expand at a CAGR of 4.8%. Growth is steady, supported by diversification into gluten free, fortified, and alternative grain flours such as quinoa and oats. Consumer demand for functional foods and bakery products continues to shape flour usage. Food manufacturers invest in innovative formulations targeting clean label and allergen free segments. While growth is slower compared to Asia, the USA market remains important for premium, specialty, and convenience oriented flour varieties that meet evolving health and lifestyle needs.

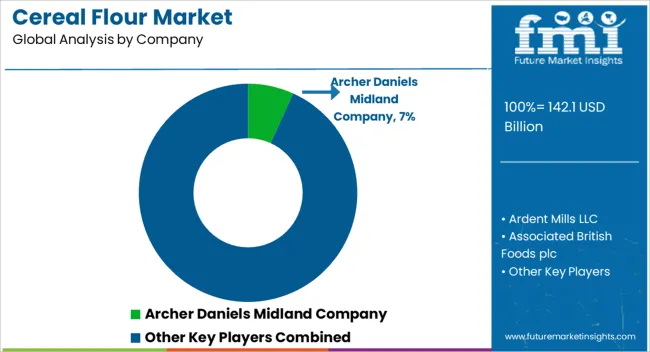

Competition in cereal flour has been staged through dense brochures and spec sheets that let buyers compare on performance, not slogans. Portfolios from Archer Daniels Midland Company, Bunge Limited, Cargill, Wilmar International Limited, and COFCO Corporation have been framed around origination to milling control, then translated into application-grade catalogues for bread, noodles, biscuits, tortillas, and atta. Ardent Mills LLC, Nisshin Seifun Group Inc., Wudeli Flour Mill Group, Interflour Group, Grain Craft, and Bay State Milling Company have competed on granulation control, ash windows, and predictable absorption. Associated British Foods plc and Limagrain Cereales Ingredients have published functional wheat and specialty blends. Ingredion Incorporated has positioned starch and texturizing systems beside flour SKUs.

Consumer facing leaders such as General Mills, Conagra Brands, Grupo Bimbo, Gruma, ITC Limited, Hindustan Unilever Limited, King Arthur Baking Company, Hometown Food Company, The Hain Celestial Group, and Bobs Red Mill Natural Foods have issued B2B ready datasheets that mirror retail strengths. Protein bands, moisture %, ash %, gluten strength, falling number, and farinograph or alveograph profiles have been presented clearly. Selection has been made simple, fast, and evidence-based. Strategy has been executed through product literature that maps flour grades to process yield and finished texture. Brochures from Seaboard Corporation, Manildra Group, Grain Millers, Shri Lal Mahal Group, Flour Mills of Nigeria Plc, and Wilmar have emphasized regional mills, packing formats, and lead time assurance. American Nickeloid is not in scope here, so no mention is made.

| Item | Value |

|---|---|

| Quantitative Units | USD 142.1 Billion |

| Source Grain | Wheat, Corn (maize), Rice, Barley, Oats, Rye, Millet, Sorghum, and Other cereal grains |

| Product Type | Wheat flour, Corn flour, Rice flour, Barley flour, Oat flour, Rye flour, Millet flour, Sorghum flour, Multi-grain flour blends, and Other cereal flours |

| Processing Type | Whole grain flours, Refined flours, Enriched & fortified flours, Bleached flours, Unbleached flours, Self-rising flours, and Other processing types |

| Application | Bakery products, Pasta & noodles, Breakfast cereals, Snack foods, Soups, sauces & gravies, Baby food, Animal feed, and Other applications |

| End Use | Food processing industry, Foodservice industry, Retail/household consumption, Animal feed industry, and Other end-uses |

| Distribution Channel | B2B/direct sales, Retail, Wholesale/distributors, and Other distribution channels |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Archer Daniels Midland Company, Ardent Mills LLC, Associated British Foods plc, Bay State Milling Company, Bob's Red Mill Natural Foods, Bunge Limited, Cargill, Incorporated, COFCO Corporation, Conagra Brands, Inc., Flour Mills of Nigeria Plc, General Mills, Inc., Grain Craft, Grain Millers, Inc., Grupo Bimbo S.A.B. de C.V., Gruma, S.A.B. de C.V., Hindustan Unilever Limited, Hodgson Mill, Inc., Hometown Food Company, Ingredion Incorporated, Interflour Group Pte Ltd., ITC Limited, King Arthur Baking Company, Inc., Limagrain Céréales Ingrédients, Manildra Group, Nisshin Seifun Group Inc., Seaboard Corporation, Shri Lal Mahal Group, The Hain Celestial Group, Inc., Wilmar International Limited, and Wudeli Flour Mill Group |

| Additional Attributes | Dollar sales by cereal type (wheat, rice, corn, barley, oats, others), Dollar sales by application (bakery, confectionery, snacks, beverages, animal feed), Trends in gluten-free and whole grain flour formulations, Role of fortified and enriched flours in addressing nutritional deficiencies, Growth in packaged and convenience food consumption driving flour usage, Regional consumption variations across Asia Pacific, Europe, North America, and Latin America. |

The global cereal flour market is estimated to be valued at USD 142.1 billion in 2025.

The market size for the cereal flour market is projected to reach USD 245.1 billion by 2035.

The cereal flour market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in cereal flour market are wheat, _common wheat (triticum aestivum), _durum wheat (triticum durum), _other wheat varieties, corn (maize), rice, _white rice, _brown rice, _other rice varieties, barley, oats, rye, millet, sorghum and other cereal grains.

In terms of product type, wheat flour segment to command 41.8% share in the cereal flour market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cereal and Dry Food Dispensers Market – Fresh & Convenient Dispensing 2025-2035

Cereal Rolling Machine Market – Growth & Market Trends 2025-2035

Cereal Bars Market Growth - Health & Convenience Food Trends 2025 to 2035

Cereal Flake Market

Instant Cereals Market Growth & Demand Forecast 2025-2035

Extruded Cereals Market

Breakfast Cereal Market Trends – Healthy & Indulgent Options Driving Growth 2025 to 2035

Flour Mixes Market Growth – Specialty Baking & Industry Trends 2025 to 2035

Flour Substitutes Market Analysis by Baked Goods, Noodles, Pastry, Fried Food, Pasta, Bread, Crackers Applications Through 2035

Flour Conditioner Market

Flour Improvers Market

Corn Flour Market Size and Share Forecast Outlook 2025 to 2035

Bean Flour Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Bean Flour Manufacturers

Pulse Flours Market Size and Share Forecast Outlook 2025 to 2035

Vegan Flour Market Growth - Plant-Based Innovation & Industry Demand 2025 to 2035

Silica Flour Market Size and Share Forecast Outlook 2025 to 2035

Banana Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Almond Flour Market Analysis - Size, Share, and Forecast 2025 to 2035

Millet Flour Market Analysis by Pearl Millet, Finger Millet, Foxtail Millet, Proso Millet, Kodo Millet, and Others Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA