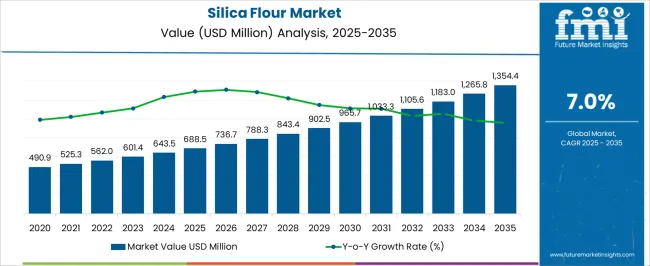

The silica flour market is anticipated to expand from USD 688.5 million in 2025 to USD 1,354.4 million by 2035, reflecting a CAGR of 7.0%. A comparison of the early versus late growth curve reveals distinct phases in market expansion, highlighting the evolution of demand across industrial and construction applications. Between 2025 and 2030, the market grows from USD 688.5 million to USD 965.7 million, representing the early growth phase, characterized by steady adoption of silica flour in specialty cement, refractories, and foundry applications.

During this period, expansion is primarily driven by rising industrial activity, increasing demand for high-performance construction materials, and gradual integration of silica flour in emerging manufacturing processes. From 2030 to 2035, the market further climbs from USD 965.7 million to USD 1,354.4 million, representing the late growth phase, which exhibits a steeper curve due to accelerated adoption in advanced industrial applications, regulatory incentives for high-performance materials, and increasing usage in emerging regions such as Asia-Pacific and Latin America. Technological advancements, including optimized particle size distribution and enhanced purity, also amplify demand. The growth curve demonstrates a transition from moderate early-stage expansion to robust late-stage acceleration, reflecting maturation, broader industrial penetration, and evolving regional demand patterns.

| Metric | Value |

|---|---|

| Silica Flour Market Estimated Value in (2025 E) | USD 688.5 million |

| Silica Flour Market Forecast Value in (2035 F) | USD 1354.4 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

The silica flour market is primarily driven by the foundry and metal casting market, which accounts for approximately 35–40% of total demand, as silica flour is used in molds, cores, and sand casting applications to provide heat resistance, dimensional stability, and superior surface finish. The ceramics and glass manufacturing market contributes around 20–22%, reflecting the use of fine silica in tiles, specialty ceramics, and glass production to enhance quality and durability.

The construction and building materials market holds roughly 15–17%, driven by adoption in concrete, mortar, coatings, and sealants for improved strength, chemical resistance, and long-term performance. The oil and gas industry contributes approximately 12–14%, as silica flour is used in hydraulic fracturing (fracking) and well cementing as a proppant and filler material. Lastly, the paints, coatings, and adhesives market accounts for 5–6%, supported by the use of silica flour as a filler, extender, and reinforcement agent in coatings, sealants, and adhesives.

Demand growth is being reinforced by its critical role in producing glass, ceramics, foundry molds, and various chemical derivatives, with sodium silicate manufacturing serving as a major driver.

Market participants are focusing on process optimization, product purity enhancement, and compliance with safety regulations to secure long-term contracts and expand into high-value end-use segments. Efficient mining operations and improved logistics have influenced price stability, while export opportunities are growing in emerging economies with rising construction and industrial activity.

Over the forecast period, the market is expected to benefit from capacity expansions, ongoing infrastructure investment, and an increasing shift toward high-performance materials. The ability to deliver consistent quality and meet stringent industry standards will remain central to sustaining competitiveness and capturing incremental growth in diverse regional markets.

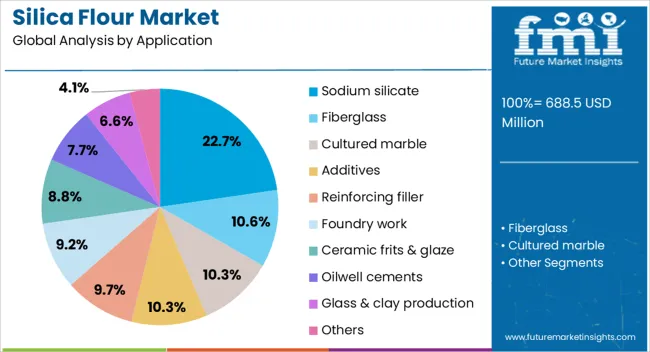

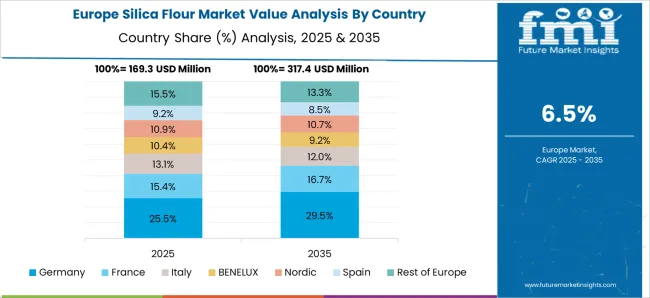

The silica flour market is segmented by application, and geographic regions. By application, silica flour market is divided into Sodium silicate, Fiberglass, Cultured marble, Additives, Reinforcing filler, Foundry work, Ceramic frits & glaze, Oilwell cements, Glass & clay production, and Others. Regionally, the silica flour industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sodium silicate segment, holding 22.7% of the application category, has maintained a leading position due to its extensive usage across detergents, adhesives, catalysts, and water treatment chemicals. Its demand is being supported by steady consumption from the glass and construction industries, where sodium silicate acts as a key binding and processing agent.

Processing advancements have enabled higher purity levels and particle size control, enhancing performance in specialized applications. Stable raw material sourcing from high-grade silica deposits has ensured a consistent supply, while improvements in production efficiency have helped maintain competitive pricing.

Regulatory compliance related to environmental safety and chemical handling has been a focus area, ensuring market acceptance across global regions. Growth prospects remain strong as industrial expansion, urban infrastructure projects, and increasing environmental treatment needs drive further consumption, positioning the sodium silicate application as a critical revenue contributor within the silica flour market landscape.

Silica flour is highly valued for its hardness, chemical inertness, thermal stability, and ability to enhance surface finish and structural integrity. Its applications span refractory castings, mold coatings, abrasives, fillers, and high-performance ceramic components. The market is driven by rapid industrialization, urbanization, and the expansion of construction and manufacturing activities across Asia-Pacific, Europe, and North America.

Suppliers providing consistent particle size distribution, reliable purity levels, and uninterrupted supply chains are best positioned to meet the evolving requirements of industrial end-users. High-quality technical support, timely delivery, and compliance with regulatory standards are increasingly decisive factors for buyers, helping manufacturers optimize operational efficiency and maintain product quality in demanding industrial applications.

Industries are progressively integrating silica flour into their processes to improve mechanical strength, thermal resistance, surface finish, and dimensional stability. In foundries, silica flour is critical for precision casting, reducing defects and ensuring accurate mold performance. In construction and ceramics, it enhances abrasion resistance, hardness, and heat tolerance, making products more durable under rigorous operating conditions. The coatings and polymer industries leverage fine silica to improve texture, flow, and chemical stability, particularly in high-value applications like paints, adhesives, and reinforced polymers. Increasing emphasis on product quality, consistent performance, and compliance with industrial standards is driving adoption. Suppliers offering application-specific grades, in-depth technical support, and quality assurance are best positioned to help manufacturers achieve optimal results, reduce process inefficiencies, and meet regulatory and consumer expectations, especially for high-performance and precision-driven industrial applications.

Achieving uniform particle size, low moisture content, and high chemical purity is technically challenging, requiring advanced milling, classification, and quality control systems. Supply chain disruptions, particularly in bulk powder transport, can delay deliveries and increase logistics expenses. Regulatory requirements related to occupational health and safety, dust control, and environmental compliance add operational complexity. Buyers increasingly demand suppliers that provide certified, high-quality products with complete documentation, technical guidance, and reliable supply schedules. Proven track record in consistency, quality assurance, and compliance support, enabling manufacturers to minimize operational risks, ensure smooth production, and maintain performance standards in demanding industrial and construction applications.

Opportunities in the silica flour market are expanding with demand for specialty grades, including ultra-fine, high-purity, and engineered powders suitable for advanced ceramics, refractories, polymer fillers, high-performance coatings, and abrasive applications. Emerging markets in Asia-Pacific, North America, and Europe are contributing to growth, fueled by infrastructure development, industrial modernization, and higher consumer expectations for durable and high-quality products. Suppliers providing customizable grades, application-specific technical support, and turnkey solutions can gain a competitive edge. Collaboration with industrial end-users for tailored product development allows manufacturers to meet precise performance specifications, increase adoption, and strengthen supplier positioning. These opportunities are further supported by growth in sectors such as electronics, aerospace, and automotive, where engineered silica flour enhances thermal, mechanical, and chemical performance.

Multi-functional grades that improve strength, thermal stability, abrasion resistance, and surface finish are increasingly preferred across foundry, refractory, ceramic, polymer, and coatings applications. Suppliers are emphasizing advanced quality control, precise particle engineering, and documentation to ensure reliability and consistency in industrial processes. Emerging applications in electronics, advanced ceramics, specialty coatings, and high-performance composites are driving demand for engineered silica flour with optimized performance characteristics. Suppliers providing application-ready, technically supported, and reliable products are best positioned to meet evolving industrial needs while helping manufacturers achieve efficiency, durability, and superior product quality across diverse global markets.

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

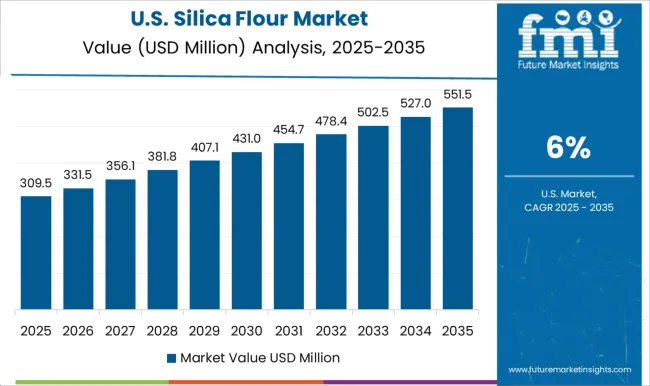

| USA | 6.0% |

| Brazil | 5.3% |

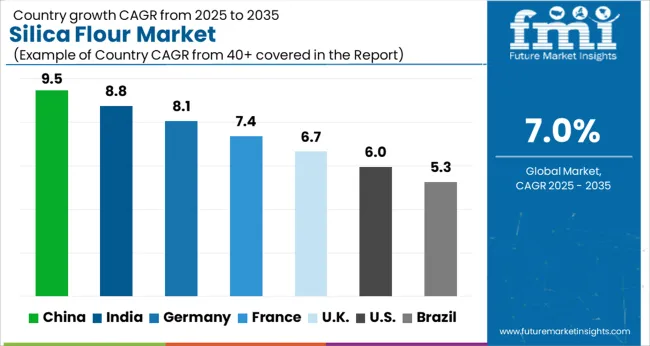

The global silica flour market is expected to grow at a CAGR of 7.0% from 2025 to 2035. China leads at 9.5%, followed by India at 8.8%, Germany at 8.1%, the UK at 6.7%, and the USA at 6.0%. Growth is driven by rising demand in construction, glass, ceramics, coatings, and renewable energy industries. High-purity products, automation in manufacturing, and technological collaborations are key enablers. Expanding infrastructure projects, industrial modernization, and export opportunities further support market development. Focus on quality standards, efficiency, and innovative applications reinforces global silica flour adoption across major regions. The analysis spans over 40+ countries, with the leading markets shown below

The silica flour market in China is projected to grow at a CAGR of 9.5% from 2025 to 2035, driven by rapid industrialization, construction activity, and rising demand in glass, ceramics, and foundry applications. Domestic manufacturers are focusing on high-purity, finely ground silica products to meet stringent quality standards across multiple sectors. Growth is also supported by expansion in electronics, solar panels, and refractory materials industries. Industrial hubs in Jiangsu, Shandong, and Zhejiang facilitate production, R&D, and distribution, enabling large-scale supply. Collaborations with international technology providers enhance particle size control, consistency, and processing efficiency. Increasing investments in high-performance concrete, adhesives, and coatings further boost demand. The market benefits from government initiatives promoting industrial modernization, export competitiveness, and quality compliance standards, reinforcing China’s leading position in global silica flour production.

The silica flour market in India is forecasted to expand at a CAGR of 8.8% between 2025 and 2035, supported by growing construction, glass, and foundry sectors. Domestic manufacturers focus on high-quality silica with controlled particle size and low impurities for applications in concrete, coatings, and industrial abrasives. Key production hubs in Rajasthan, Gujarat, and Tamil Nadu facilitate efficient mining, processing, and distribution. Rising adoption in electronics, solar energy, and refractory industries further drives demand. Collaborations with international technology providers help improve production efficiency, consistency, and product performance. Government initiatives promoting infrastructure development, renewable energy projects, and quality standardization accelerate market growth. Increasing exports of silica-based products create opportunities for scaling manufacturing and enhancing global competitiveness.

The silica flour market in Germany is projected to grow at a CAGR of 8.1% from 2025 to 2035, driven by precision engineering, automotive, and industrial manufacturing sectors. High-quality silica flour is used in glass production, ceramics, and specialty coatings requiring strict purity and particle size control. German manufacturers focus on modular, automated production systems, digital monitoring, and quality compliance with EU standards. Collaboration with research institutes enables innovation in refractory materials, electronics, and solar panel applications. Rising demand for sustainable construction materials, energy-efficient glass, and industrial-grade coatings is creating opportunities for premium silica flour products. Industrial hubs in Bavaria, North Rhine-Westphalia, and Baden-Württemberg provide strong infrastructure and logistics support, enabling efficient deployment across multiple sectors.

The UK silica flour market is expected to grow at a CAGR of 6.7% from 2025 to 2035, supported by construction, glass, and industrial applications. Manufacturers focus on high-purity silica for concrete, ceramics, and coating industries. Automation and digital monitoring improve quality control and operational efficiency. Key production regions in Scotland and Wales enable localized supply and logistics support. Demand is further driven by renewable energy projects, industrial coatings, and specialty ceramics. Collaborations with international suppliers enhance technology adoption and product performance. The market benefits from regulatory compliance, EU standards alignment, and focus on consistent particle size and low impurity content for industrial applications.

The USA silica flour market is projected to grow at a CAGR of 6.0% from 2025 to 2035, driven by construction, glass, foundry, and specialty applications. Manufacturers emphasize high-quality silica with controlled particle size and low impurity levels for use in concrete, coatings, electronics, and refractory industries. Key industrial hubs in Texas, California, and Ohio facilitate production, distribution, and maintenance. The growth of renewable energy, solar panels, and advanced coatings supports demand for high-performance silica. Collaborations with international technology providers improve efficiency, product uniformity, and operational reliability. Regulatory compliance and focus on safety and environmental standards further shape market adoption. Rising exports and infrastructure investments create additional growth opportunities.

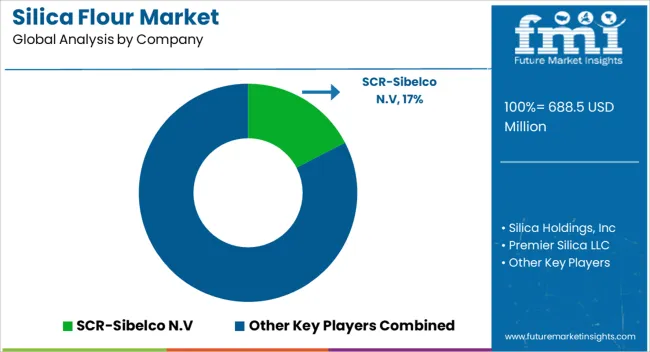

SCR-Sibelco N.V. leads with high-purity silica flour for industrial, glass, and chemical applications, emphasizing consistent granulometry and global distribution networks. Silica Holdings, Inc. and Premier Silica LLC compete through specialty grades for foundry, coatings, and refractory applications, highlighting thermal stability and low impurity content. AGSCO Corp and Delmon Group of Co. focus on regionally tailored supply, ensuring rapid delivery and process-specific particle customization. FINETON Industrial Minerals Ltd. and Saudi Emirates Pulverization Industries Co. differentiate through micronized products and precise mesh sizing for adhesives, paints, and polymer composites. Other players, including Sil Industrial Minerals, Inc., Opta Minerals, Inc., Hoben International Limited, International Silica Industries Company PLC, and Adwan Chemical Industries Co., Ltd., target niche industrial segments, supplying blends optimized for high-temperature stability and low iron content.

Strategies emphasize product standardization, quality certification, and expanding capacity in proximity to key industrial hubs. Production lines are being upgraded for consistent particle size distribution, moisture control, and minimal contamination. Supply chain partnerships with glass, foundry, and chemical manufacturers are leveraged to secure long-term contracts. Specialty grades are promoted for enhanced abrasion resistance, low thermal expansion, and chemical inertness. Technical support, sample testing, and process integration consultation are increasingly used to differentiate in competitive markets. Product brochure content is highly technical. Specifications include mesh size, chemical composition, SiO₂ content, moisture levels, and impurity limits.

| Item | Value |

|---|---|

| Quantitative Units | USD 688.5 Million |

| Application | Sodium silicate, Fiberglass, Cultured marble, Additives, Reinforcing filler, Foundry work, Ceramic frits & glaze, Oilwell cements, Glass & clay production, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SCR-Sibelco N.V, Silica Holdings, Inc, Premier Silica LLC, AGSCO Corp, Delmon Group of Co, FINETON Industrial Minerals Ltd, Saudi Emirates Pulverization Industries Co, Sil Industrial Minerals, Inc, Opta Minerals, Inc., Hoben International Limited, International Silica Industries Company PLC, Premier Silica LLC,, and Adwan Chemical Industries Co., Ltd. |

| Additional Attributes | Dollar sales by product grade (standard, high-purity, ultra-pure), particle size (fine, medium, coarse), and end-use (construction, chemical, foundry, refractory). Demand is driven by industrial expansion, growing construction activity, and increased use in chemical and filler applications. Regional trends highlight strong growth in North America, Europe, and Asia-Pacific, with Asia-Pacific leading due to rapid industrialization and infrastructure development. |

The global silica flour market is estimated to be valued at USD 688.5 million in 2025.

The market size for the silica flour market is projected to reach USD 1,354.4 million by 2035.

The silica flour market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in silica flour market are sodium silicate, fiberglass, cultured marble, additives, reinforcing filler, foundry work, ceramic frits & glaze, oilwell cements, glass & clay production and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Silica Sand for Glass Making Market Size and Share Forecast Outlook 2025 to 2035

Silica Coated Film Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

Silica for S-SBR Market Size & Trends 2025 to 2035

Silica Analyzers Market

Borosilicate Glass Market Trends & Outlook 2025 to 2035

High-Silica Zeolite Market Size and Share Forecast Outlook 2025 to 2035

High-Silica Fiber Market Analysis by Application, Use Case, and Region: Forecast for 2025 to 2035

Fumed Silica Market

Europe Silica Sand for Glass Making Market Analysis for 2025 to 2035

Sodium Silicate Market Growth – Trends & Forecast 2022 to 2032

Calcium Silicate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Calcium Silicate Market

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Pyrogenic Silica Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Sodium Metasilicate Pentahydrate Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Silica Market Insights – Demand & Applications 2025 to 2035

Precipitated Silica Market Size and Share Forecast Outlook 2025 to 2035

Chromatography Silica Resins Market

Sodium Aluminum Silicate Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA