The pyrogenic silica market globally is expected to register a valuation of USD 442.7 million in 2025, likely to grow up to about USD 741.6 million by 2035, with a CAGR of 5.3%. It is fueled by burgeoning applications in coatings, adhesives, elastomers, and drug formulations.

One of the most important drivers of its industry is its extensive application in the paints and coatings industry, where it serves as a thixotropic additive and an anti-settling agent. With the increasing demand for high-performance coatings for automotive, industrial, and architectural applications, the demand for sophisticated rheology modifiers such as pyrogenic silica also increases.

The silicone elastomers and sealants industry also makes a notable contribution. Pyrogenic silica enhances reinforcement, transparency, and dimensional stability in silicone products. With increasing uses in medical devices, electronics, and the construction industry, this industry remains a strong source of demand.

The industry finds application as a free-flow and anti-caking agent in the cosmetics and pharmaceutical industries. It is also used to improve texture and shelf life in creams, powders, and gels. Its chemically inert, non-toxic properties make it suitable for use in sensitive formulations.

3D printing resins, battery separators, and special polymers are new industry areas where its fine particle size and thermal stability are particularly sought after. These newer applications are projected to spur future expansion in the additive manufacturing and electronics sectors. Challenges confront the industry, such as expensive production, energy-hungry processing, and increasing regulatory concern over nanoparticle safety. Handling, storage, and dust control continue to be paramount concerns, particularly in health-sensitive settings.

The industry is seeing tremendous growth fueled by growing demand in a wide range of industries including paints and coatings, adhesives and sealants, pharmaceuticals, and cosmetics. The growth is due to the increasing demand for enhancing product performance, strict government regulations, and the growth in applications in new industries.

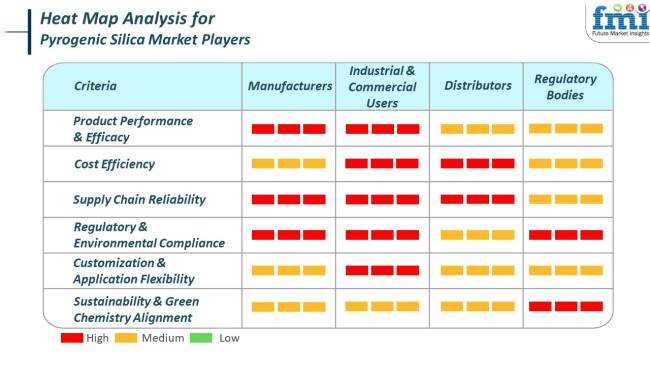

Producers focus on producing high-performance products in accordance with the high standards required by commercial and industrial customers. They are dedicated to using environmentally friendly production processes and aim to establish a secure supply chain to meet the growing global demand. Industrial and commercial users, including industries like paints and coatings, adhesives and sealants, pharmaceuticals, and cosmetics, need cost-effective and high-performance solutions that ensure optimum performance under the broadest range of applications.

They need products that offer maximum efficiency, environmental compliance, and the capability to formulate according to individual operating needs. Distributors emphasize the importance of maintaining a stable supply chain to meet commercial and industrial buyers' needs. They focus on offering various products with different applications while maintaining timely delivery and reasonable prices.

From 2020 to 2024, the industry saw gradual but consistent growth, driven by applications across industries like pharmaceuticals, personal care, coatings and paints, and silicone elastomers. The major trend across this period was that the product was being used with greater frequency as a rheology modifier and thickener.

For the cosmetic industry, consumers' needs for lighter and smoother texture products fueled greater consumption. Supply chain disruption during the global pandemic caused raw material shortages and production and distribution setbacks, at least in the short term. Green issues regarding synthetic additives also began affecting the industry's narrative to prompt consideration of more sustainable forms of silica.

Looking to 2025 to 2035, the industry will look toward environmental consciousness-led innovation and material flexibility. The firms are expected to focus on green synthetic technologies that entail cleaner energy inputs and waste-reducing production lines. Pyrogenic silica used in battery separators, EV components, and 3D printing materials will give rise to new growth opportunities.

Regulatory push for the use of safer, biocompatible ingredients will also propel demand for pharmaceutical excipients and skincare. Evolved nanostructured variants with enhanced dispersion and surface area management are anticipated to become industry game changers.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Cosmetics, pharmaceuticals, silicone elastomers, coatings. | Electric vehicles, nanotechnology, 3D printing, sustainable drug delivery, and cosmetics. |

| Improved thickening efficiency and dispersion in formulas. | Green manufacture, nanostructuring , and development of high-purity grades. |

| Early-stage environmental issues and restricted green synthesis routes. | Transition towards green manufacturing methods and circular economy incorporation. |

| Adherence to industrial safety and product formulation regulations. | Strict eco-regulatory requirements promoting biocompatibility and clean labeling. |

| Application in traditional uses such as coatings and sealants. | Application in advanced technologies such as lithium-ion batteries and medical-grade devices. |

| Demand focused in Asia-Pacific for manufacturing purposes. | Expected growth worldwide, with North America and Europe concentrating on sustainable and high-performance applications. |

The industry is seeing consistent growth owing to its applications in various industries like paints and coatings, adhesives, sealants, cosmetics, pharmaceuticals, and food additives. There are, however, a number of risks currently and expectedly that may affect the path of its growth.

In addition, the industry is vulnerable to volatility in raw material prices, specifically for hydrogen and silicon tetrachloride, which are both key inputs into production. Changes in these input prices have the potential to influence manufacturers' profit margins and pricing models.

In the future, environmental regulations will be becoming increasingly stringent, putting more focus on chemical production process and waste handling. Compliance with these regulations involves making significant investment in green manufacture processes, which include reducing the use of energy and waste production.

Apart from that, the industry can be challenged with technological advancement and shifting consumers trends threats. As new better raw materials and production technologies become available, pyrogenic silica products currently available are exposed to competition, for which there has to be continued investment and research in development in order to stay competitive.

In short, while the industry is vast in terms of potential growth, the firms will have to overcome adversity with respect to high production cost, fluctuating raw material costs, environmental law, technological transformations, and geopolitics. Preventive measures against these risks will be crucial to success in this transforming industry over the long run.

By 2025, the industry hydrophobic fumed silica is estimated to account for 55% of the industry, whereas hydrophilic fumed silica will only constitute about 45%.

A hydrophilic fumed silica, which controls approximately 45% of the industry, finds wide application in coatings, adhesives, sealants, and pharmaceuticals. Water absorbing or binding properties are recognized by hydrophilic silica, which is unique for those formulations needing high viscosity and thixotropy.

Its usage has proved possible in applications demanding good flow properties owing to its highly excellent dispersibility. Among the several players, Evonik Industries captures the demand primarily for hydrophilic fumed silica, and Cabot Corporation also stands on in offering this versatile product to large industries for a reliable recipe with the stability and consistency of end formulations.

Hydrophobic fumed silica type really treats it by water-repellency, which really drives demand in this segment to 55% industry share by 2025. It is highly effective in applications that need enhanced moisture repellency, for example, in the automotive or construction industries. The hydrophobic aspect of this type of silica enables it to be used in even harsher conditions, including outdoor paints, construction sealants, and the electronics industry for applications involving moisture-sensitive components. Evonik Industries and Dow Corning are key players in the industry, providing hydrophobic fumed silica to guarantee high performance in sectors that necessitate advanced moisture resistance and durability.

By the year 2025, paints are expected to contribute nearly 20% of the industry share, while coatings are forecast to possess 18%.

The industry has further distribution in terms of applications, with Paints and Coatings being the major categories. The principal application is within the paints industry, where it imparts viscosity, thixotropy, and flow properties to paint formulations. Such improvements to textural stability and reduction of sagging are an asset to both water- and solvent-based paints. It keeps the paint fluid enough for easy application, thus leading to a smooth even finish of the product.

Manufacturers like Evonik Industries and Cabot Corporation supply pyrogenic silica to the paint industry as end users, from which the performance and endurance of coatings are enhanced. With the growing need for high-quality, long-lasting paints -especially in the building and automotive sector- pyrogenic silica would, among other applications, increase its application in paints.

Pyrogenic silica increases the scratch resistance, UV stability, and thickness uniformity of coatings. This is especially paramount in industries with strict performance requirements for coatings, automotive finishes, and anti-corrosion coatings. Together with its property of controlling rheology and enhancing pigment dispersion in coating formulations, it remains one of the vital ingredients in formulating coatings for harsh environments.

It is manufactured and marketed in various grades as hydrophobic and hydrophilic fumed silica by major suppliers such as Evonik Industries and Dow Corning, which assure durability and performance for coatings used in construction, marine, and automotive applications. The already-high demand in these industries is anticipated to enhance demand for antipyrogenic silica for coatings owing to the rising demand for advanced coatings, especially in infrastructure and automotive and manufacturing industries.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

| UK | 5.1% |

| France | 5.2% |

| Germany | 5.4% |

| Italy | 5.1% |

| South Korea | 5.5% |

| Japan | 5.3% |

| China | 5.7% |

| Australia | 5.2% |

| New Zealand | 5.1% |

The USA industry is anticipated to witness a CAGR of 5.3% from 2025 to 2035, fueled by increasing demand for pharmaceuticals, personal care, adhesives, and sealants. Its use as a rheology modifier and thickener in coatings, cosmetics, and silicone rubber offers a broad base coverage of applications.

Industry leaders such as Cabot Corporation, Wacker Chemical Corporation, and Evonik Industries (USA operations) are focusing on ultra-pure and surface-treated versions for high-performance end-use applications. Pharmaceutical excipients innovation and 3D-printable silicone formulation are expected to fuel long-term growth.

The UK is forecasted to grow at a CAGR of 5.1%. It is driven by demand from the cosmetics, inks, and industrial coatings segments, where the product is applied for anti-settling, thickening, and matting. Its utility across multiple solvent systems and inert properties support its use in specialty products.

Manufacturers and distributors such as Azelis and IMCD UK are expanding portfolios of hydrophobic and hydrophilic silica types. The past emphasis on adhering to EU REACH and UKCA has affected the sourcing strategy and triggered investment in local blend dispersions.

France is poised to register a CAGR of 5.2% from 2025 to 2035. The key areas witnessing growth are silicone elastomers, personal care products, and pharmaceutical formulations. The tensile strength and stability enhancement property, especially in medical and electronic applications, is highly valued.

Producers like Elkem Silicones and regional converters are focusing on reducing dusting properties and optimizing dispersion quality to meet sensitive industries. National medical innovation plans and environmentally friendly formulating practices are still propelling further industry advancement.

Germany is also expected to grow at 5.4% CAGR. The industry benefits from intense demand for cable insulation, adhesives used in the auto sector, and industrial coatings. The functionality in the reinforcement of polymers and heat-resistant reinforcement is aiding its critical usage in electric vehicles (EVs) manufacturing as well as building sealants.

Evonik Industries and Wacker Chemie AG, both German-based companies, dominate innovation in modified grades for thermal interface materials and high-speed inks. National support frameworks for advanced material research boost Germany's competitive standing.

Italy is expected to grow at a CAGR of 5.1%. The paint, building, and cosmetics sectors are fueling demand. The silica is valued for its flow and anti-caking properties, especially in powdered products, high-performance sealants, and decorative coatings.

Local firms like Colorificio San Marco and MAPEI are employing high-dispersion silica systems to improve product performance as well as shelf stability. Green chemistry regulations and circular economy measures are putting the industry on sustainable development goals.

South Korea is projected to experience growth at a CAGR of 5.5%. Demand for high-purity silica is being driven by growth in electronics, battery materials, and specialty silicones. Its application as a thixotropic control agent and reinforcing filler forms the basis for adhesives, encapsulants, and printed electronics.

Companies such as OCI Company Ltd. and DongjinSemichem are expanding their lines with grades based on surface-treated and micro-particle-engineered materials. Publicly funded semiconductor and renewable energy initiatives lend credence to the strategic importance to domestic manufacturing.

Japan is estimated to grow at a CAGR of 5.3%. The product has widespread use in high-end cosmetics formulations, drug delivery systems, and industrial applications requiring extreme chemical stability. The product enhances spreadability, opacity, and viscosity control in sensitive applications.

Major players like Tokuyama Corporation and Fuji Silysia Chemical Ltd. are investing in nanostructured options and solvent-compatibilization dispersions in biotechnology and optoelectric materials. The pressure of regulations intended on product traceability and purity requirements drives the growth of specialty silica segments.

China will be leading the growth with a CAGR of 5.7%, which is the highest among the countries under analysis. Increased industrial activity in paints, adhesives, tires, and electronics is generating high-volume demand. Its high surface area and thermal stability make it suitable for a range of industrial-scale applications.

Producers such as Shandong Doguide Group and Henan Xunyu Chemical are scaling up production lines to meet domestic and global demand. China's emphasis on high-tech manufacturing and eco-friendly building materials in its national development strategy is driving innovation in silica-based technology.

Australia is forecast to grow at a CAGR of 5.2%. The industry is supported by its application in paints, agriculture, and pharmaceuticals. It finds application in livestock feed, crop protection agents, and over-the-counter pharmaceutical preparations due to its thickening and dispersing capability.

Formulators and distributors are teaming up with Asian and European producers to offer food-grade and cosmetic-compliant materials. National environmental law on VOC emissions and packaging demands is driving the transition to optimized, low-environmental-impact formulations.

New Zealand is forecast to grow at a CAGR of 5.1%. Although the industry size remains small, growth is consistent in personal care, veterinary, and coating applications. Demand for domestic brands' eco-formulations is increasing the use of hydrophilic silica grades in emulsions, sunscreens, and lotions.

Domestic formulators and importers are applying high-dispersion silica products to both improve product functionality and comply with global standards. Traceability requirements and sustainability goals in the agricultural and cosmetic supply chains are propelling broader use.

The industry is dominated by several worldwide companies such as Evonik Industries AG, Cabot Corporation, Wacker Chemie AG, Akzo Nobel N.V., and Solvay, all of whom have strong positions in this industry. These companies are expanding their production capabilities vigorously while integrating the latest technologies to advance the product's performance. The competitive landscape is characterized by strategizing partnerships, mergers and acquisitions, and investments in high-performance silica for coatings, adhesives as well as batteries.

The industry leadership remains with Evonik Industries AG, which continues with substantial investments in processes for the production of high-purity silica. Further, the company has recently expanded its silica production facilities in the Asia-Pacific region to meet the accelerating demand primarily in automotive and electronics applications.

Cabot Corporation is promoting its focus on sustainability initiatives as it moves towards a green energy profile in support of its manufacturing processes. In contrast, in the pharmaceutical and personal care sectors, Wacker Chemie AG is intensifying its R&D efforts regarding hydrophobic pyrogenic silica, thus reinforcing its respective industry position.

Akzo Nobel N.V. is investing in silica-based coatings for automotive and industrial applications, exploiting its strong distribution network to penetrate new geographic industries. Solvay has been integrating silica solutions in battery technologies, especially for next-generation lithium-ion batteries, thus positioning itself as a key innovator in the industry. Minor players like PPG Industries and Tokuyama Corporation are focusing on niche application fields like specialty coatings or semiconductor-grade silica.

Despite existing competition in this industry, sustainability, innovation, and regional expansion remain the key strategic focus areas for all involved industries. Remarkable traction is being achieved with low carbon footprint silica production technology, and equally, investment has been made into advanced production technology to maximize efficiency and reduce environmental impact.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Evonik Industries AG | 20-25% |

| Cabot Corporation | 15-20% |

| Wacker Chemie AG | 12-17% |

| Akzo Nobel N.V. | 10-15% |

| Solvay | 8-12% |

| Other Players | 25-30% |

| Company Name | Offerings & Activities |

|---|---|

| Evonik Industries AG | Expanded silica production in Asia-Pacific for automotive & electronics applications. |

| Cabot Corporation | Focus on sustainable production & integration of green energy in manufacturing. |

| Wacker Chemie AG | R&D in hydrophobic silica for pharmaceuticals & personal care. |

| Akzo Nobel N.V. | Investment in silica-based coatings for industrial applications. |

| Solvay | Integration of silica solutions in lithium-ion battery technology. |

By type, the industry is segmented into hydrophilic fumed silica and hydrophobic fumed silica.

By application, the industry is categorized into paints, adhesives, coatings, plastic, toner, cosmetics, food additives, and other.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The industry is estimated to reach USD 442.7 million by 2025.

The industry is projected to grow to USD 741.6 million by 2035.

China is expected to grow at a rate of 5.7%.

Hydrophobic fumed silica is the leading product segment due to its excellent thickening, anti-caking, and moisture-resistant properties, making it ideal for high-performance formulations.

Key players in this industry include Evonik Industries AG, Cabot Corporation, Wacker Chemie AG, Akzo Nobel N.V., Solvay, Tokuyama Corporation, Bayer AG, PPG Industries Inc., Fuji Silysia Chemical Limited, Jilin Shuangji Chemical New Material Co Ltd, Zhejiang Wynca Chemical Industry Group Co Ltd, and Shandong Ruiyang Silicon Industry Technology Co.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Silica Sand for Glass Making Market Size and Share Forecast Outlook 2025 to 2035

Silica Flour Market Size and Share Forecast Outlook 2025 to 2035

Silica Coated Film Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

Silica for S-SBR Market Size & Trends 2025 to 2035

Silica Analyzers Market

Borosilicate Glass Market Trends & Outlook 2025 to 2035

High-Silica Zeolite Market Size and Share Forecast Outlook 2025 to 2035

High-Silica Fiber Market Analysis by Application, Use Case, and Region: Forecast for 2025 to 2035

Fumed Silica Market

Europe Silica Sand for Glass Making Market Analysis for 2025 to 2035

Sodium Silicate Market Growth – Trends & Forecast 2022 to 2032

Calcium Silicate Insulation Market Size and Share Forecast Outlook 2025 to 2035

Calcium Silicate Market

Specialty Silica Market Size and Share Forecast Outlook 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Sodium Metasilicate Pentahydrate Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Silica Market Insights – Demand & Applications 2025 to 2035

Precipitated Silica Market Size and Share Forecast Outlook 2025 to 2035

Chromatography Silica Resins Market

Sodium Aluminum Silicate Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA