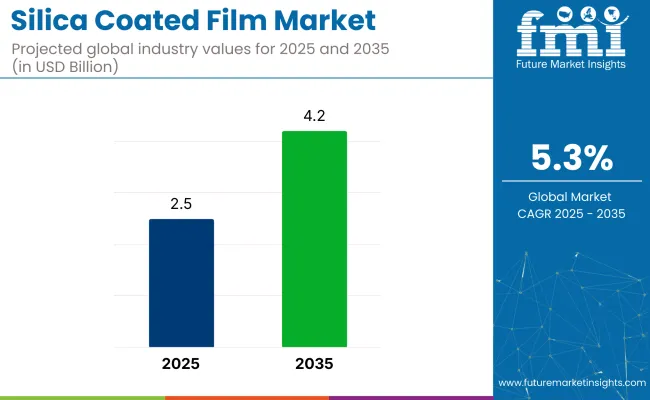

The global silica coated film market is expected to grow from USD 2.5 billion in 2025 to USD 4.2 billion by 2035, at a CAGR of 5.3%. This growth is driven by increasing demand in industries like packaging, electronics, automotive, and construction. Silica coated films are valued for their optical clarity, durability, and enhanced surface properties, making them ideal for high-performance applications. Growing demand for eco-friendly solutions also contributes to their adoption.

Research published in February 2025 highlighted the potential of hydrophobic silica aerogel thin films to improve solar cell efficiency. These films enhance light harvesting and reduce reflection, leading to better performance in photovoltaic applications. The study employed a two-step sol-gel process to create crack-free aerogel films, which resulted in higher output voltage and improved charge transport. This advancement offers promising implications for increasing the efficiency of solar cells, making them more effective in harnessing solar energy for renewable power generation.

The industry holds a specialized share within its parent markets. In the coatings market, it accounts for approximately 2-3%, as silica coated films are a niche technology used for enhancing surface properties like durability and protection. Within the packaging market, the share is around 4-6%, driven by the demand for moisture and oxygen barrier properties in packaging materials, particularly for food and pharmaceuticals.

In the film and foil market, silica coated films represent about 3-4%, as they are one of the advanced film types used in various industrial applications. In the electronics market, the share is around 5-7%, with silica coated films used in displays, touch screens, and protective layers. In the textile and fabrics market, silica coated films account for around 1-2%, primarily used for waterproofing and protective applications in textiles.

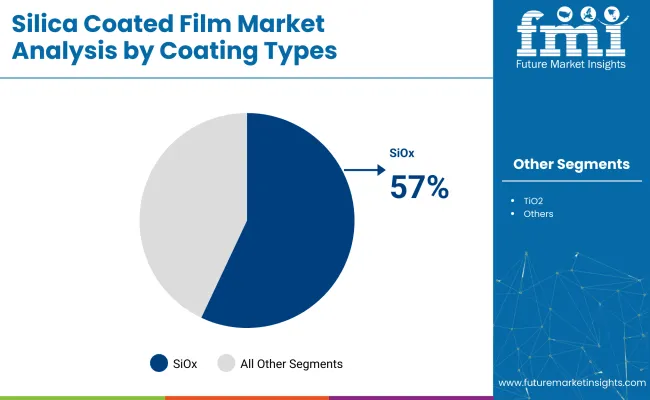

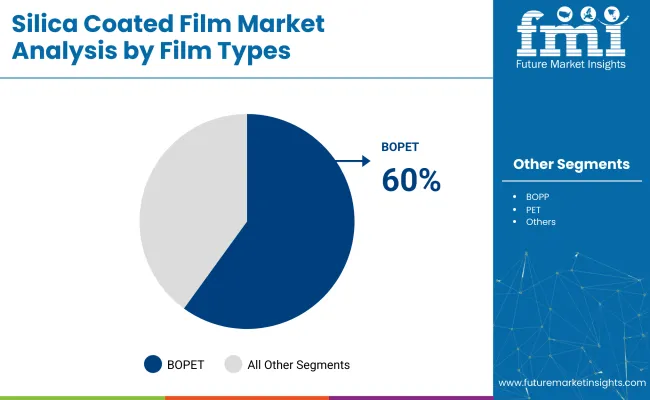

The industry is projected to see strong growth, with SiOx coatings leading demand at 57% of the coating segment in 2025. BOPET films will dominate the substrate segment with a 60% share, while flexible packaging will drive end-use demand with 50% industry share.

SiOx coatings are expected to hold a 57% share of the coatings segment in 2025. These coatings offer transparent barrier protection against oxygen and moisture while maintaining optical clarity, which makes them ideal for food packaging and consumer electronics.

Companies like Wacker Chemie AG and Momentive Performance Materials are advancing SiOx formulations to perform effectively on BOPET and BOPP substrates. Compared to metalized alternatives, SiOx coatings support mono-material structures that align with EU and APAC sustainability standards, offering durability and uniformity through advanced vapor deposition processes for high-performance packaging.

BOPET films are projected to dominate the industry, accounting for 60% of the film type segment. BOPET offers high tensile strength, excellent dimensional stability, and low oxygen permeability, which are essential properties for barrier packaging, electronics, and protective labeling.

Companies like Polyplex Corporation, Toray Plastics, and Cosmo Films Ltd. are heavily investing in the development of multi-layer BOPET films with advanced coatings like SiOx and TiO₂ to enhance performance. The thermal resilience and adaptability in thin-gauge formats, combined with superior print surface clarity, ensure BOPET’s dominance in high-speed processing and meeting both aesthetic and technical requirements.

Flexible packaging is expected to lead the end-use application segment with a 50% industry share in 2025. The shift from rigid to flexible packaging, particularly in food, pharmaceuticals, and personal care, is driving the adoption of high-barrier coated films. Companies like Mondi Group and UFlex Limited are scaling up the use of silica-coated flexible structures to enhance shelf life while maintaining recyclability.

SiOx-coated BOPET films are preferred for their lightweight, puncture resistance, and high-performance sealing properties, meeting the growing demand for portable and resealable formats, especially in response to consumer preferences and e-commerce packaging innovations.

The industry is expanding due to rising demand for recyclable, high-barrier packaging solutions. However, challenges such as complex coating technologies, high capital costs, and operational hurdles, particularly in price-sensitive regions, are limiting scalability and industry participation, especially for mid-sized manufacturers.

Rising Demand for Recyclable High-Barrier Films is Driving Growth

The industry is growing due to the increasing demand for recyclable, high-barrier packaging solutions. SiOx-coated films are replacing metalized films, offering clear barrier protection that supports recycling efforts. With growing consumer and regulatory pressure for eco-friendly packaging, governments in regions like the EU, USA, and Japan are promoting mono-material flexible packaging, making SiOx-coated BOPET and PET films an ideal choice. Companies like Dow Inc. and Evonik are investing in advanced deposition technologies to improve performance and meet circular economy goals.

Coating Technology and Capital Cost Pose Barriers to Industry Scalability

Despite the advantages, the industry faces scalability challenges due to complex coating processes and high capital costs. Techniques such as Plasma Enhanced Chemical Vapor Deposition (PECVD) require sophisticated equipment and precise process control. Consistent adhesion of coatings on various substrates is a technical hurdle that impacts production efficiency. Additionally, companies entering the industry must manage stringent quality control, cleanroom requirements, and fluctuating raw material costs, raising operational expenses and limiting entry, especially in price-sensitive regions like South Asia and Latin America.

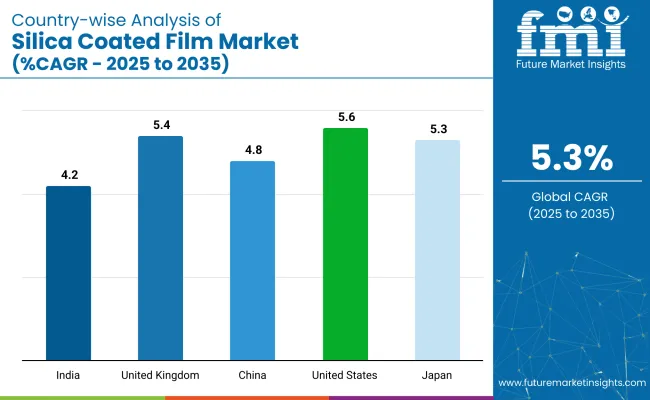

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

| United Kingdom | 5.4% |

| China | 4.8% |

| India | 4.2% |

| Japan | 5.3% |

The industry demand is projected to rise at a 5.3% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, the United States leads at 5.6%, followed by the United Kingdom at 5.4%, and Japan at 5.3%, while China posts 4.8% and India records 4.2%. These rates translate to a growth premium of +6% for the United States, +2% for the United Kingdom, and -9% for China versus the baseline, while India shows slower growth.

Divergence reflects local catalysts: high demand for advanced films in the United States and the United Kingdom, driven by industrial and packaging applications, while slower growth in India and China is influenced by industry maturity and more limited adoption in emerging sectors.

The industry in the United States is set to record a CAGR of 5.6% from 2025 to 2035. Demand originates in high-barrier flexible packaging for food, pharmaceuticals, and printed electronics, where SiOx-coated BOPET increasingly replaces foil to enable mono-material recycling.

3M Company, Rogers Corporation, and Saint-Gobain Performance Plastics operate clean-room vacuum-deposition lines that supply custom oxygen- and moisture-barrier films for vacuum-insulation panels and sterile medical packs. FDA and USDA directives incentivize recyclable laminates, accelerating investment in solvent-free plasma-coating systems across Midwest and Southwest hubs.

Sales of silica coated films in the United Kingdom are projected to grow at a CAGR of 5.4% through 2035. Legislation phasing out non-recyclable plastics drives adoption of SiOx-coated BOPET in meat, cheese, and label face stocks.

Mondi Group and Loparex invest in roll-to-roll plasma systems that deliver ultra-low OTR while remaining detectable in PET recycling streams. Government incentives linked to the circular-economy roadmap support R&D in compostable and smart-indicator films. Post-Brexit trade realignment prompts food brands to shorten local supply chains by sourcing UK-made barrier films.

Demand for the industry in China is estimated to grow at a CAGR of 4.8% between 2025 and 2035. Domestic producers such as Elkem ASA China and Chiripal Poly Films expand high-speed vacuum-deposition capacity to serve booming snack, pharma, and consumer-electronics packaging. “Made in China 2025” targets high-barrier substrates for EV batteries and flexible displays, stimulating multilayer SiOx innovations. National waste-reduction mandates accelerate the shift from solvent coatings to plasma and PECVD processes.

The industry in India is projected to grow at a CAGR of 4.2% through 2035. Rising demand for shelf-stable snacks, e-commerce mailers, and blister overwraps drives investment by UFlex, Cosmo Films, and JPFL in domestic SiOx PET lines. “Make in India” incentives reduce import dependence, yet capital expenditure for vacuum-coaters remains a hurdle for smaller converters. Regulatory focus on single-material recyclability supports water-based primer adoption.

The industry in Japan is expected to grow at a CAGR of 5.3% between 2025 and 2035. Precision applications in OLED displays, lithium-ion batteries, and functional food wraps rely on ultra-thin SiOx layers with haze < 0.5%. Mitsubishi Chemical and Shin-Etsu Chemical deploy multi-chamber vacuum coaters that integrate plasma cleaning for defect control. Strict food-contact and recycling standards drive development of mono-material PET structures.

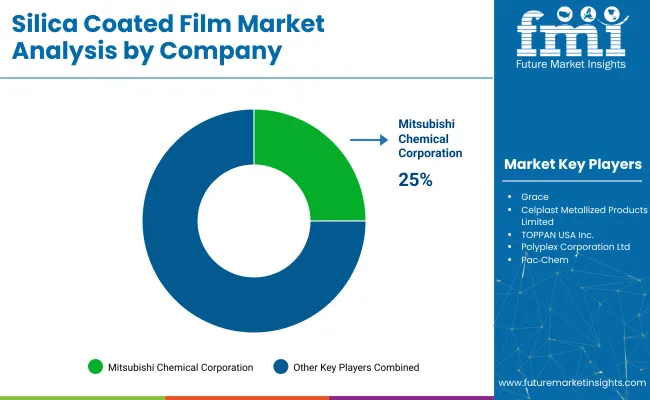

The global industry features a competitive landscape with dominant players, key players, and emerging players. Dominant players such as Mitsubishi Chemical Corporation, Polyplex Corporation Ltd., and Celplast Metallized Products Limited lead the industry with extensive product portfolios, strong R&D capabilities, and robust distribution networks across electronics, packaging, and industrial sectors.

Key players including TOPPAN USA Inc., SUZHOU HSF Electronic Materials Technology Co., and Pac-Chem offer specialized solutions tailored to specific applications and regional industries. Emerging players, such as NEION Film Coatings Corporation, Nanolap Technologies LLC, and DermaMed Coatings Company, LLC, focus on innovative technologies and cost-effective solutions, expanding their presence in the global industry.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 2.5 billion |

| Projected Industry Size (2035) | USD 4.2 billion |

| CAGR (2025 to 2035) | 5.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand tons for volume |

| Coating Types Analyzed | SiOx , TiO2, Others |

| Film Types Analyzed | BOPET ( Biaxially Oriented Polyethylene Terephthalate), BOPP ( Biaxially Oriented Polypropylene), PET (Polyethylene Terephthalate), CPP (Cast Polypropylene), Others |

| End-Use Segmentation | Flexible Packaging, Food Packaging, Medical Packaging, Electronics Packaging, Labels & Tags, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa (MEA) |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Industry | Evonik Industries AG, Wacker Chemie AG, Elkem ASA, Momentive Performance Materials Inc., Dow Inc., Mitsubishi Chemical Corporation, Polyplex Corporation Limited, 3M Company, Shin-Etsu Chemical Co., Ltd., Saint-Gobain Performance Plastics, Rogers Corporation, Trelleborg AB, Silex Silicones Ltd., JPFL Films Private Limited, Loparex, Mondi Group, Toray Plastics (America), Inc., UFlex Limited, Cosmo Films Ltd., Chiripal Poly Films Limited |

| Additional Attributes | Dollar sales by coating type, film type, and end-use, increasing demand for green packaging solutions, growing application in food and medical packaging, techn ological advancements in silica coated film production, regional variations in regulatory compliance for packaging materials. |

By coating, the industry includes SiOx, TiO₂, and others.

By film type, the industry is segmented into BOPET (Biaxially Oriented Polyethylene Terephthalate), BOPP (Biaxially Oriented Polypropylene), PET (Polyethylene Terephthalate), CPP (Cast Polypropylene), and others.

By end-use, the industry constitutes of packaging, food packaging, medical packaging, electronics packaging, labels & tags, and others.

By region, the industry is studied across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, the Middle East and Africa (MEA).

The industry is expected to reach USD 4.2 billion by 2035.

The industry is projected to grow at a CAGR of 5.3%.

SiOx coatings dominate with a 57% industry share.

Flexible packaging is the top end-use, accounting for 50% of the demand.

BOPET films are the most widely used, with a 60% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

AR Coated Film Glass Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

EVA Coated Film Market Size and Share Forecast Outlook 2025 to 2035

PVDC Coated Film Market Growth and Outlook 2025 to 2035

Copper Coated Film Market Size and Share Forecast Outlook 2025 to 2035

Double Coated Film Tapes Market Size and Share Forecast Outlook 2025 to 2035

Super Barrier Coated Film Market Trends & Forecast 2024-2034

Aluminum Oxide Coated Films Market

Top Coated Direct Thermal Printing Films Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Top Coated Direct Thermal Printing Films Providers

Film and TV IP Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Film Wrapped Wire Market Size and Share Forecast Outlook 2025 to 2035

Film-Insulated Wire Market Size and Share Forecast Outlook 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Coated Label Market Size and Share Forecast Outlook 2025 to 2035

Coated Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Silica Sand for Glass Making Market Size and Share Forecast Outlook 2025 to 2035

Film Formers Market Size and Share Forecast Outlook 2025 to 2035

Silica Flour Market Size and Share Forecast Outlook 2025 to 2035

coated-paper-packaging-box-market-market-value-analysis

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA