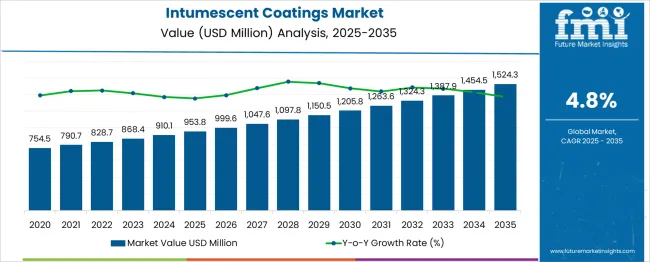

The global intumescent coatings market is projected to grow from USD 953.8 million in 2025 to approximately USD 1524.3 million by 2035, recording an absolute increase of USD 570.5 million over the forecast period. This translates into a total growth of 59.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 4.8% between 2025 and 2035. The overall market size is expected to grow by nearly 1.6X during the same period, supported by the rising adoption of fire safety regulations and increasing demand for passive fire protection solutions following growing awareness of structural fire protection requirements across various industries.

Between 2025 and 2030, the intumescent coatings market is projected to expand from USD 953.8 million to USD 1205.8 million, resulting in a value increase of USD 252.0 million, which represents 44.2% of the total forecast growth for the decade. This phase of growth will be shaped by rising adoption of fire safety regulations in construction projects, increasing awareness of passive fire protection benefits, and growing focus on structural steel protection in commercial and industrial buildings. Construction companies and facility managers are investing in comprehensive fire protection systems to meet evolving safety standards and regulatory requirements.

From 2030 to 2035, the market is forecast to grow from USD 1205.8 million to USD 1524.3 million, adding another USD 318.5 million, which constitutes 55.8% of the overall ten-year expansion. This period is expected to be characterized by expansion of water-based intumescent coating technologies, integration of advanced fire protection systems in smart buildings, and development of specialized coatings for high-temperature industrial applications. The growing complexity of building designs and increasing focus on sustainable fire protection solutions will drive demand for more sophisticated intumescent coating products and specialized application services.

Between 2020 and 2025, the intumescent coatings market experienced steady expansion, driven by increasing implementation of stringent fire safety codes and growing awareness of passive fire protection following high-profile building fires. The market developed as construction professionals recognized the critical role of intumescent coatings in protecting structural elements and maintaining building integrity during fire events. Insurance companies and regulatory authorities began emphasizing comprehensive fire protection systems that include passive fire protection measures to reduce property damage and ensure occupant safety.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 953.8 million |

| Forecast Value (2035) | USD 1,524.3 million |

| Forecast CAGR (2025–2035) | 4.8% |

Market expansion is being supported by the increasing implementation of stringent fire safety regulations and building codes worldwide that mandate passive fire protection systems for structural elements in commercial, industrial, and residential buildings. Modern construction projects require comprehensive fire protection strategies that include intumescent coatings to protect steel structures, wooden elements, and other building materials from fire damage. Regulatory authorities and insurance companies are establishing detailed fire safety requirements that mandate documented fire protection procedures and certified coating applications across various construction sectors.

The growing awareness of fire safety risks and the importance of passive fire protection systems is driving demand for intumescent coatings that provide extended fire resistance ratings for critical structural elements. Building owners and facility managers are implementing comprehensive fire protection programs that include intumescent coatings to maintain structural integrity, protect valuable assets, and ensure occupant safety during fire emergencies. The increasing adoption of steel construction and complex building designs is creating new requirements for specialized fire protection solutions that require advanced intumescent coating technologies.

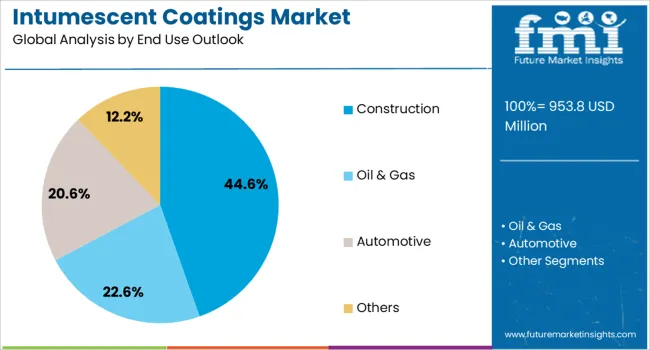

The market is segmented by type outlook, substrate outlook, technology outlook, fire rating outlook, application outlook, application technique outlook, end use outlook, and region. By type outlook, the market includes thin film and thick film coatings. Based on substrate outlook, the market is categorized into structural steel & iron and wood. In terms of technology outlook, the market is segmented into water-based, solvent-based, and epoxy-based formulations. By fire rating outlook, the market is classified into R30 (30 minutes), R60 (60 minutes), R90 (90 minutes), R120 (120 minutes), and R180 (180 minutes) ratings. By application outlook, the market is divided into cellulosic, hydrocarbon, and automotive applications. By application technique outlook, the market includes spray and brush/roller methods. By end use outlook, the market is segmented into construction, oil & gas, and other industries. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

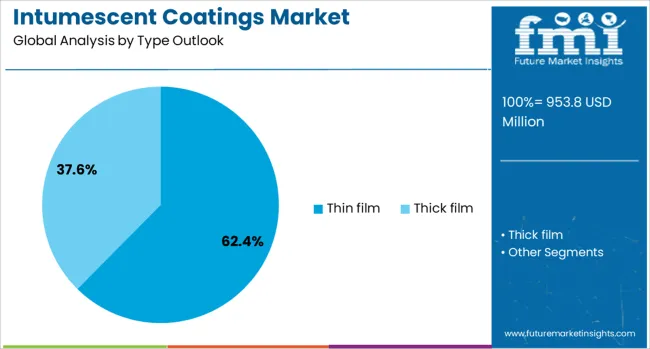

Thin film intumescent coatings are projected to account for 62.4% of the intumescent coatings market in 2025. This leading share is supported by the widespread adoption of thin film solutions for decorative fire protection applications that provide both aesthetic appeal and fire resistance capabilities. Thin film intumescent coatings offer excellent surface finish characteristics and can be applied to visible structural elements without compromising architectural design requirements. The segment benefits from continuous product development and the availability of various color options and surface textures that meet diverse architectural and design specifications.

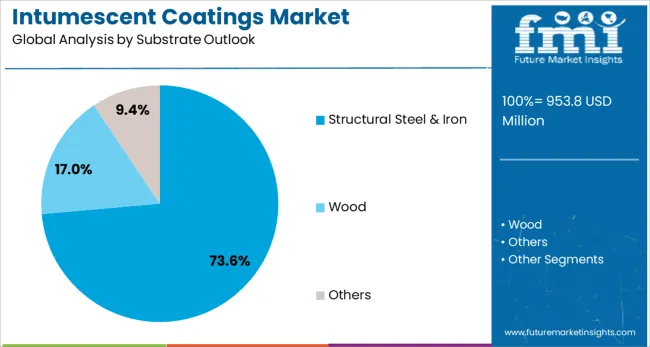

Structural steel & iron applications are expected to represent 73.6% of the intumescent coatings market in 2025. This dominant share reflects the critical importance of protecting steel structural elements from fire damage and the widespread use of steel construction in commercial, industrial, and infrastructure projects. Steel structures require specialized fire protection to maintain load-bearing capacity during fire events and prevent structural failure. The segment benefits from stringent building codes that mandate fire protection for steel structures and the growing adoption of steel construction methods across various building types.

Solvent-based intumescent coatings are projected to contribute 39.2% of the market in 2025, representing the largest technology segment due to their superior durability, rapid drying properties, and proven performance in demanding environments. Solvent-based formulations offer enhanced adhesion, moisture resistance, and long-term stability, making them well-suited for industrial, infrastructure, and high-humidity construction projects. The segment is supported by the continued reliance on robust protective solutions in large-scale commercial and industrial applications, where performance and resilience remain critical.

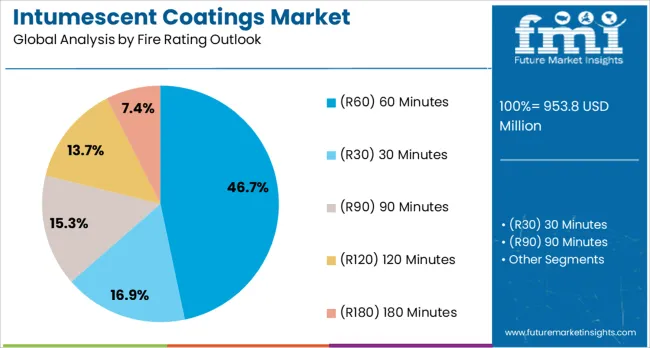

R60 (60 minutes) fire rating intumescent coatings are estimated to hold 46.7% of the market share in 2025. This dominance reflects the common fire resistance requirements for commercial and industrial buildings that typically require 60-minute fire protection for structural elements. R60 ratings provide adequate fire protection for most building applications while balancing cost considerations and regulatory compliance requirements. The segment provides stable demand through standard building code requirements and typical fire safety specifications across various construction projects.

Construction applications are estimated to hold 44.6% of the market share in 2025. This significant share reflects the extensive use of intumescent coatings in commercial buildings, residential projects, and infrastructure construction that require comprehensive fire protection systems. Construction projects typically involve multiple structural elements that require fire protection, creating substantial demand for intumescent coating products and application services. The segment benefits from ongoing construction activity and increasingly stringent fire safety regulations that mandate passive fire protection measures.

The intumescent coatings market is advancing steadily due to increasing fire safety awareness and growing implementation of building fire protection regulations. However, the market faces challenges including higher material costs compared to conventional coatings, need for specialized application expertise and equipment, and varying fire safety requirements across different geographic regions. Technology development and product standardization efforts continue to influence coating performance and market adoption patterns.

The growing development of advanced water-based intumescent coating formulations is enabling improved fire protection performance while reducing environmental impact and application complexity. Modern water-based coatings provide enhanced fire resistance ratings, improved adhesion characteristics, and reduced curing times compared to traditional formulations. These technologies are particularly valuable for indoor applications and projects with stringent environmental requirements where low-emission coatings are mandated by regulations or sustainability objectives.

Modern intumescent coating applications are incorporating smart technologies that provide real-time monitoring of coating condition and fire protection effectiveness. Advanced coating systems can integrate with building fire detection networks to provide early warning of fire events and coating performance status. Smart intumescent coatings offer enhanced fire protection capabilities through improved activation characteristics and integrated monitoring systems that ensure optimal fire protection performance throughout the building lifecycle.

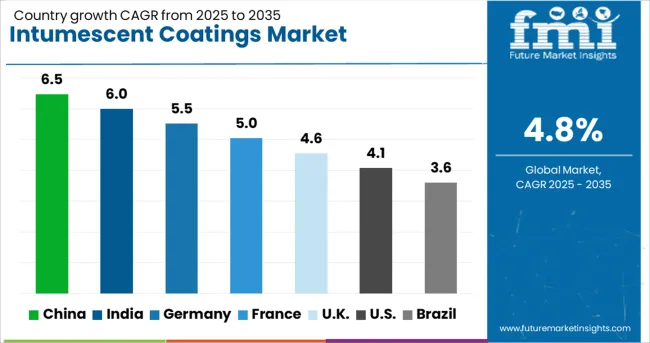

| Countries | CAGR (2025–2035) |

|---|---|

| China | 6.4% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| United Kingdom | 4.6% |

| United States | 4.1% |

| Brazil | 3.6% |

The global intumescent coatings market shows varied growth rates, led by China at 6.4% CAGR through 2035, driven by rapid construction infrastructure expansion, urbanization, and regulatory fire safety compliance. India follows at 6.0%, supported by building code modernization, Smart Cities initiatives, and rising commercial and industrial construction. Germany grows at 5.5%, emphasizing advanced fire protection standards, precision coating applications, and sustainable construction practices. France advances at 5.0%, focusing on infrastructure modernization and regulatory compliance. The UK sees 4.6%, driven by building fire safety regulations and integrated protection systems. The USA records 4.1%, supported by strict fire code adherence and industrial compliance requirements, while Brazil grows steadily at 3.6%, fueled by urban development and infrastructure projects. The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from intumescent coatings in China is projected to exhibit strong growth with a CAGR of 6.4% through 2035, driven by rapid expansion of construction infrastructure and increasing adoption of fire safety regulations across commercial, residential, and industrial building projects. The country's growing construction industry and focus on building safety compliance are creating significant demand for comprehensive fire protection solutions. Major construction companies and building developers are implementing integrated fire protection systems that address structural steel protection, fire rating requirements, and regulatory compliance across urban and rural construction environments.

China's urbanization initiatives and construction modernization programs are supporting the development of advanced fire protection capabilities and building safety frameworks that meet international fire safety standards. Government initiatives emphasizing building safety and fire protection are driving demand for documented fire protection procedures and comprehensive coating application services. The expanding high-rise construction and infrastructure development projects are creating additional opportunities for intumescent coating applications and specialized fire protection consulting services.

Revenue from intumescent coatings in India is expanding at a CAGR of 6.0%, supported by building code modernization and increasing adoption of fire safety standards across major construction projects in metropolitan areas. The country's expanding construction industry and growing focus on building fire protection are driving demand for comprehensive intumescent coating solutions that protect structural elements and ensure regulatory compliance. Construction companies are implementing integrated fire protection frameworks that address diverse fire rating requirements and building safety standards in evolving construction environments.

India's Smart Cities Mission and infrastructure development programs are facilitating adoption of advanced fire protection technologies and professional training initiatives that meet international building safety standards. The growing focus on commercial construction and industrial facility development is creating demand for specialized fire protection systems and comprehensive fire safety assessment capabilities. Professional certification programs and industry standards development are enhancing technical expertise among fire protection professionals and enabling comprehensive coating application services.

Demand for intumescent coatings in Germany is projected to grow at a CAGR of 5.5%, supported by the country's leadership in construction technology innovation and comprehensive fire safety standards for building protection. German construction companies prioritize structural fire protection and regulatory compliance across commercial, industrial, and residential building projects. The market is characterized by a focus on precision fire protection applications, advanced coating technology integration, and compliance with comprehensive building safety regulations and international standards.

Germany's construction industry excellence and building technology innovation require extensive fire protection capabilities to maintain structural safety and regulatory compliance standards across diverse construction applications. Companies are implementing advanced intumescent coating systems that support sustainable building initiatives and provide comprehensive protection for steel structures, wooden elements, and other building materials. Professional certification programs ensure specialized expertise among fire protection professionals, enabling comprehensive coating application services and regulatory compliance support.

Demand for intumescent coatings in France is expanding at a CAGR of 5.0%, driven by the country's well-established construction industry and infrastructure fire protection requirements across commercial and public building projects. French construction companies maintain comprehensive fire protection protocols across major construction projects that require extensive structural protection and regulatory compliance monitoring. The market benefits from regulatory requirements that mandate documented fire protection procedures and ongoing safety compliance across diverse construction sectors.

France's infrastructure development and building modernization sector create a stable demand for specialized intumescent coating solutions that meet international fire safety standards and regulatory requirements. Construction companies are implementing advanced fire protection technologies and comprehensive safety assessment systems that support regulatory compliance and building protection objectives. Professional development programs and industry standards ensure technical expertise among fire protection professionals in specialized applications and regulatory compliance procedures.

Demand for intumescent coatings in the UK is projected to grow at a CAGR of 4.5%, supported by the country's focus on building fire safety following regulatory updates and comprehensive fire protection requirements across construction projects. British construction companies implement extensive fire protection protocols that ensure regulatory compliance and maintain high standards for passive fire protection across commercial and residential building developments. The market is characterized by a focus on comprehensive building safety frameworks and integrated fire protection systems that support occupant safety and regulatory compliance.

The UK's construction industry prioritizes advanced fire protection capabilities through comprehensive regulatory compliance programs and building safety assessment initiatives. Companies are implementing integrated intumescent coating systems and automated application monitoring that enhance building protection and safety reporting capabilities. Professional training and certification programs develop specialized expertise among fire protection professionals, enabling comprehensive coating application services and regulatory compliance support.

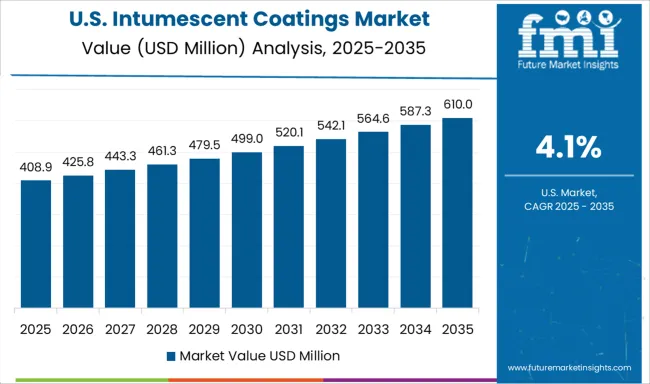

Demand for intumescent coatings in the USA is expanding at a CAGR of 4.1%, driven by comprehensive fire code requirements and focus on building protection standards across commercial, industrial, and residential construction sectors. American construction companies implement extensive fire protection protocols that ensure code compliance and maintain building safety across diverse construction projects and facility types. The market benefits from established fire safety regulations and building code requirements that mandate documented fire protection procedures and certified coating application programs.

The USA construction environment emphasizes comprehensive fire protection capabilities through integrated building safety frameworks and automated compliance monitoring systems. Companies are implementing advanced intumescent coating systems that support fire code compliance, structural protection monitoring, and building safety assessment across diverse construction applications. Professional certification programs and industry standards ensure technical expertise among fire protection professionals in specialized applications and regulatory compliance procedures.

Revenue from intumescent coatings in Brazil is growing at a CAGR of 3.6%, driven by construction sector development and increasing adoption of fire safety standards across major building projects in urban centers. The country's expanding construction industry and growing focus on building safety compliance are creating demand for comprehensive fire protection solutions that protect structural elements and ensure regulatory adherence. Construction companies are implementing integrated fire protection frameworks that address building safety requirements and fire protection standards in evolving construction environments.

Brazil's urban development initiatives and construction modernization programs are facilitating adoption of advanced fire protection technologies and professional training programs that meet international building safety standards. The growing focus on commercial construction development and infrastructure enhancement is creating opportunities for specialized fire protection solutions and comprehensive building safety assessment capabilities. Professional development programs and regulatory enhancement efforts are improving fire protection expertise and enabling comprehensive coating application services.

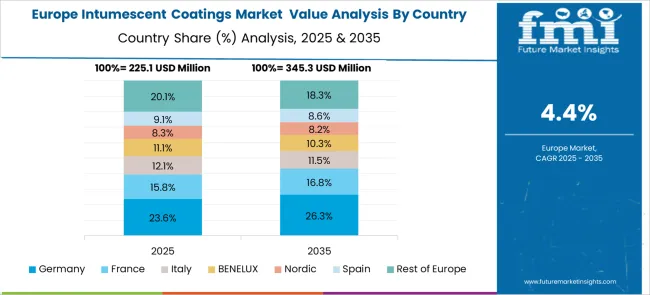

The European intumescent coatings market is projected to grow steadily, driven by stringent fire safety regulations, EN standards, and building code compliance. Germany leads with advanced fire protection protocols across commercial, industrial, and automotive sectors. France emphasizes regulatory compliance in construction, aerospace, and defense. The UK focuses on updated fire safety regulations and integrated protection systems. Italy and Spain grow through construction modernization and infrastructure enhancement. Nordic countries prioritize advanced building safety and passive fire protection. BENELUX supports demand through building modernization programs, while the Rest of Europe expands adoption via standardized fire protection protocols, professional training, and construction infrastructure development.

The intumescent coatings market is defined by competition among established coating manufacturers, specialized fire protection solution providers, and emerging technology developers. Companies are investing in water-based formulation technologies, application technique innovations, comprehensive fire rating capabilities, and professional training services to deliver effective, environmentally-friendly, and cost-efficient intumescent coating solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

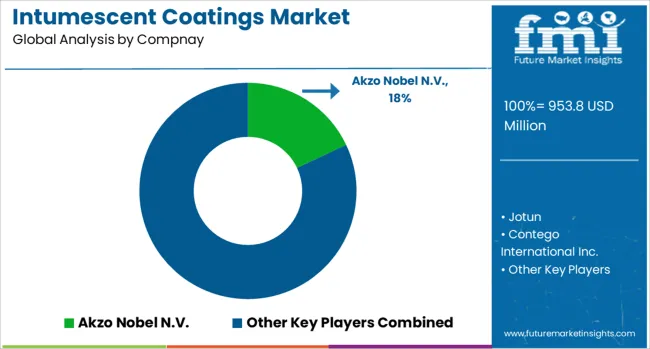

Akzo Nobel N.V., Netherlands-based, offers comprehensive intumescent coating solutions with a focus on decorative fire protection, advanced water-based formulations, and integrated building safety applications. Jotun, operating globally, provides specialized intumescent coatings with a focus on marine and industrial fire protection applications. Contego International Inc. delivers fire protection coating systems with a focus on structural steel protection and comprehensive fire rating solutions. Hempel A/S offers marine and protective intumescent coatings with a focus on industrial applications and harsh environment protection.

No-Burn Inc. provides specialized intumescent coating products with a focus on wood protection and decorative applications. Nullifire delivers comprehensive fire protection coatings with a focus on structural steel and building safety applications. The Sherwin-Williams Company offers extensive intumescent coating solutions with a focus on commercial construction and industrial applications. Carboline, Albi Protective Coatings, Isolatek International, Rudolf Hensel GmbH, PPG Industries Inc., 3M, Sika AG, and Tor Coatings provide specialized fire protection expertise, comprehensive coating solutions, and industry-specific capabilities across global and regional construction markets.

| Items | Values |

|---|---|

| Quantitative Units | USD 953.8 million |

| Type Outlook | Thin Film, Thick Film |

| Substrate Outlook | Structural Steel & Iron, Wood |

| Technology Outlook | Water-Based, Solvent-Based, Epoxy-Based |

| Fire Rating Outlook | R30 (30 Minutes), R60 (60 Minutes), R90 (90 Minutes), R120 (120 Minutes), R180 (180 Minutes) |

| Application Outlook | Cellulosic, Hydrocarbon, Automotive |

| Application Technique Outlook | Spray, Brush/Roller |

| End Use Outlook | Construction, Oil & Gas, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, France, Brazil |

| Key Companies Profiled | Akzo Nobel N.V., Jotun, Contego International Inc., Hempel A/S, No-Burn Inc., Nullifire, The Sherwin-Williams Company, Carboline, Albi Protective Coatings, Isolatek International, Rudolf Hensel GmbH, PPG Industries Inc., 3M, Sika AG, Tor Coatings |

| Additional Attributes | Dollar sales by type outlook, substrate outlook, technology outlook, fire rating outlook, application outlook, application technique outlook, and end use outlook, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established coating manufacturers and specialized fire protection solution providers, construction industry preferences for thin film versus thick film applications, integration with water-based formulation technologies and environmental compliance systems, innovations in advanced fire rating capabilities and application technique improvements, and adoption of integrated fire protection systems with enhanced building safety and regulatory compliance features. |

The global intumescent coatings market is estimated to be valued at USD 953.8 million in 2025.

The market size for the intumescent coatings market is projected to reach USD 1,524.3 million by 2035.

The intumescent coatings market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in intumescent coatings market are thin film and thick film.

In terms of substrate outlook, structural steel & iron segment to command 73.6% share in the intumescent coatings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Smart Coatings Market Size and Share Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Marine Coatings Market Size and Share Forecast Outlook 2025 to 2035

Filter Coatings Market Size and Share Forecast Outlook 2025 to 2035

Rubber Coatings Market Growth - Trends & Forecast 2025 to 2035

Textile Coatings Market Size and Share Forecast Outlook 2025 to 2035

Stealth Coatings Market Size and Share Forecast Outlook 2025 to 2035

Medical Coatings Market Growth & Demand 2025 to 2035

Barrier Coatings for Packaging Market Trends - Growth & Forecast 2025 to 2035

Sputter Coating Market Growth – Trends & Forecast 2022 to 2032

UV Cured Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Ablative Coatings Market Size and Share Forecast Outlook 2025 to 2035

Polyurea Coatings Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA