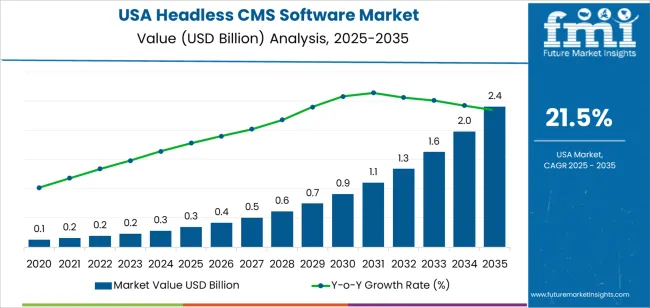

The demand for Headless CMS software in the USA is expected to grow strongly over the forecast period, with a compound annual growth rate (CAGR) of 21.50%. Starting at USD 0.1 billion, the initial stages of adoption remain modest, with the demand remaining at 0.1 billion and rising slowly to 0.2 billion. The next few years will see gradual but steady growth as more businesses and industries adopt headless content management solutions. By Year 3, the demand reaches 0.3 billion, reflecting an emerging trend toward flexible and scalable content management solutions. As digital content creation and distribution become increasingly complex, organizations are recognizing the need for more efficient, customizable CMS solutions that can adapt to various platforms and user demands.

The pace of growth accelerates further in the subsequent years. From Year 4 to Year 7, the demand jumps significantly from 0.3 billion to 0.5 billion, highlighting the early stages of rapid adoption. As companies continue to modernize their digital infrastructures, demand for Headless CMS software expands more quickly. By Year 7, the demand reaches 0.4 billion, signaling that businesses are increasingly implementing headless CMS platforms to better manage their content across various digital touchpoints. The trend continues upward, reaching 0.5 billion in Year 8, marking an inflection point where headless CMS adoption becomes more widespread and essential for businesses focused on omnichannel strategies.

Between Year 9 and Year 13, the demand for Headless CMS software continues to see substantial growth, fueled by a shift in how businesses view content management. By Year 9, the demand rises to 0.6 billion, and by Year 10, it reaches 0.7 billion. The demand continues to climb in Year 11 to 0.9 billion, reflecting the growing recognition of the advantages offered by headless CMS platforms. As organizations strive for greater efficiency and agility in managing their content, the software becomes integral to their digital transformation strategies. By Year 12, the demand grows to 1.1 billion, reaching 1.3 billion by Year 13, signaling that the industry for Headless CMS software is maturing and expanding.

In the final forecast years, the growth trajectory continues to accelerate, reaching 1.6 billion in Year 14 and finally hitting 2.4 billion by Year 16. This robust growth indicates that Headless CMS software is not only becoming more integral to business operations but also maturing into a mainstream solution across industries. As demand rises, it reflects the increasing necessity for flexible content management solutions that can support diverse digital platforms, multi-channel experiences, and evolving customer expectations. This substantial increase in demand shows a promising outlook for Headless CMS software in the USA through 2035, with continued acceleration in adoption across various sectors.

| Metric | Value |

|---|---|

| Demand for Headless CMS Software in USA Value (2025) | USD 0.3 billion |

| Demand for Headless CMS Software in USA Forecast Value (2035) | USD 2.4 billion |

| Demand for Headless CMS Software in USA Forecast CAGR (2025 to 2035) | 21.50% |

The demand in the USA for headless CMS software is rising as businesses seek more flexible and scalable digital content management solutions. Headless CMS systems decouple the backend content repository from the front-end display, allowing content to be delivered seamlessly across various digital platforms, such as websites, mobile apps, and voice assistants. This flexibility is especially important as companies look to provide consistent and personalized content experiences across multiple channels.

The growth in e-commerce, mobile-first strategies, and the increasing use of IoT devices are further fueling the demand for headless CMS. As companies scale their digital operations and look for ways to deliver content faster and more efficiently, headless CMS offers a robust solution that supports rapid updates without impacting the user interface. This also enables better collaboration between marketing and IT teams, as each can focus on their specialized tasks without interfering with the other.

Cloud-based solutions, along with the rise of API-first architectures, are making headless CMS software even more appealing. With the need for omnichannel content management and more agile delivery models, organizations are increasingly adopting headless CMS to stay competitive. As digital transformation continues to accelerate, the demand for headless CMS software in the USA is expected to see steady growth through 2035.

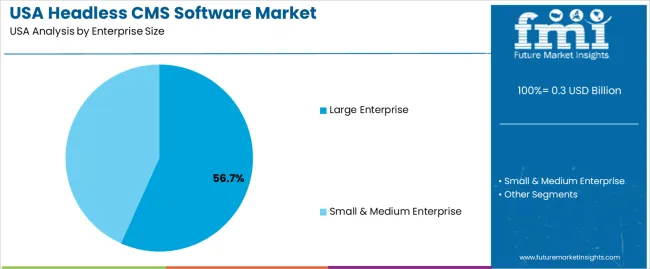

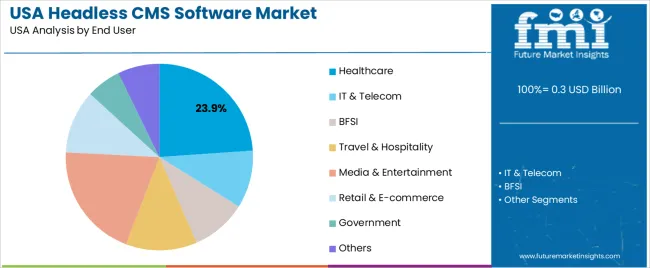

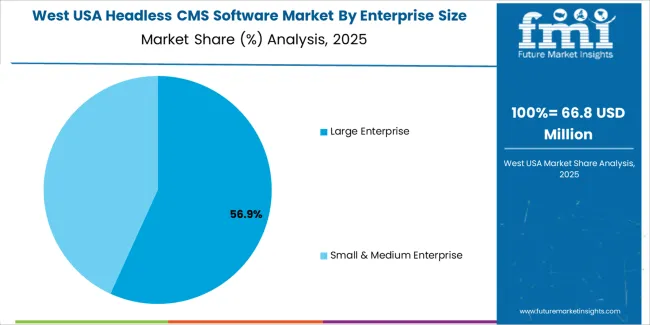

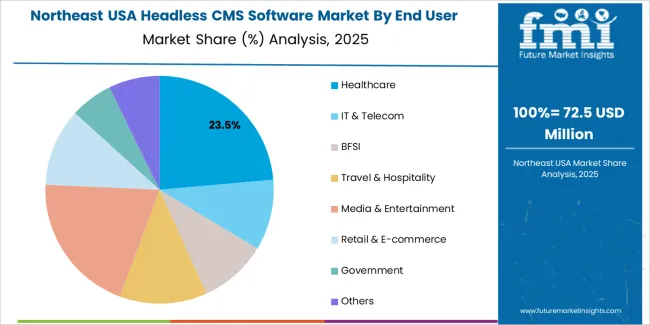

Demand for headless CMS (Content Management System) software in the USA is segmented by enterprise size and end user. By enterprise size, the market is divided into large enterprises and small & medium enterprises (SMEs), with large enterprises holding the dominant share. In terms of end user, demand is categorized into healthcare, IT & telecom, BFSI (banking, financial services, and insurance), travel & hospitality, media & entertainment, retail & e-commerce, government, and others, with healthcare leading the demand. Regionally, demand is divided into West, South, Northeast, and Midwest.

Large enterprises account for 57% of the demand for headless CMS software in the USA. These organizations typically manage vast amounts of digital content across multiple platforms, requiring a robust and scalable content management solution. Headless CMS provides large enterprises with the flexibility to deliver content across different channels, such as websites, mobile apps, and IoT devices, without being tied to a traditional front-end. This makes it an ideal choice for businesses with complex digital needs and a diverse customer base.

The demand for headless CMS software in large enterprises is driven by the need for more customizable and agile content management systems that can handle multiple content formats and distribution channels. As large organizations continue to focus on digital transformation and omnichannel strategies, headless CMS software offers the flexibility and scalability required to manage and deliver content across various platforms efficiently. The ability to integrate with other enterprise systems and scale according to business needs further boosts its demand among large enterprises.

Healthcare accounts for 23.9% of the demand for headless CMS software in the USA. The healthcare industry relies heavily on digital content management for patient portals, medical records, appointment scheduling, and educational content. Headless CMS software is well-suited for healthcare organizations due to its flexibility in delivering content to different digital platforms, including websites, mobile apps, and patient management systems.

The demand for headless CMS in healthcare is driven by the industry's need to provide seamless and secure access to healthcare content across various devices and platforms. As healthcare organizations move towards more patient-centric digital solutions, headless CMS enables them to create and manage content that can be easily integrated into electronic health records (EHR) systems, telemedicine platforms, and other digital tools. The ability to update and distribute content efficiently while ensuring compliance with healthcare regulations, such as HIPAA, makes headless CMS software essential for the healthcare industry. This trend is expected to continue as healthcare providers increasingly focus on improving digital experiences and patient engagement.

Headless CMS software systems disconnect the backend (content repository) from the frontend presentation layer, enabling flexibility, scalability, and multi‑channel delivery. Key drivers include growing e‑commerce and digital‑experience investment, the shift to API‑first architectures, rising demand for personalization and omnichannel content, and cloud‑based SaaS deployment making adoption easier. Restraints include integration complexity with legacy systems, a shortage of skilled developers familiar with headless architectures, higher upfront investment in migration from traditional CMS, and security/compliance concerns when exposing APIs and managing distributed content.

Why is Demand for Headless CMS Software Growing in the USA?

In the USA, demand is growing because enterprises and mid‑sized firms want to deliver content rapidly across multiple touchpoints websites, mobile apps, kiosks, voice interfaces and more and legacy monolithic CMS cannot keep up. The headless architecture enables a single content hub that pushes structured data via APIs to many “heads,” offering speed, flexibility and reuse. As businesses invest heavily in digital‑customer‑experience, personalization and omnichannel marketing, the ability to publish and repurpose content seamlessly becomes a competitive differentiator. The widespread adoption of cloud services and the popularity of SaaS models lower the barrier to deployment in USA organizations, fueling uptake.

How are Technological Innovations Driving Growth of Headless CMS Software in the USA?

Technological innovations are a major enabler for headless CMS growth in the USA by improving capability, integration and developer experience. Advances include powerful REST/GraphQL APIs, micro‑services architecture, and real‑time content delivery. Cloud‑native, SaaS headless CMS platforms make deployment faster and scale easier. Integration with analytics, AI/ML‑driven personalization, preview tools for content authors, and support for new front‑end frameworks (React, Vue, Next.js) enhance value. Moreover, support for omnichannel use mobile, IoT, voice, AR/VR means organizations can future‑proof content delivery. These enhancements make headless CMS systems more compelling to USA companies facing fast‑changing digital‑landscapes.

What are the Key Challenges Limiting Adoption of Headless CMS Software in the USA?

Despite strong momentum, several challenges inhibit broader adoption in the USA. First, migration from traditional CMS requires effort mapping content models, re‑architecting front‑end delivery, training staff and associated cost and business disruption can deter adoption. Second, legacy systems and internal silos may resist change, making decision‑cycles longer. Third, ensuring security, governance and compliance when content is managed centrally but delivered via APIs adds risk, especially for regulated industries. Fourth, the breadth of vendor options and differing architectures (API‑first vs hybrid vs composable DXP) can complicate vendor selection. Smaller organizations may view headless CMS as over‑engineered relative to their needs, favouring simpler, legacy CMS.

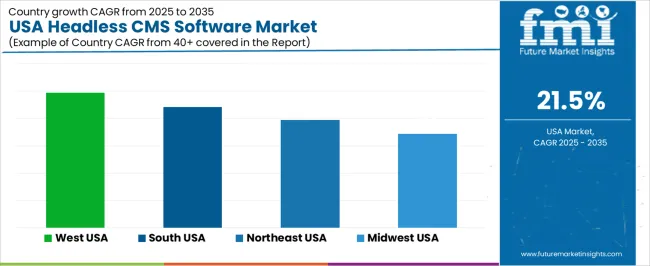

| Region | CAGR (%) |

|---|---|

| West | 24.7% |

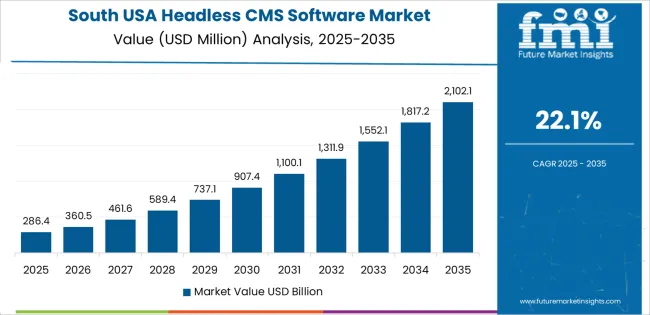

| South | 22.1% |

| Northeast | 19.8% |

| Midwest | 17.2% |

The demand for headless CMS software in the USA is growing rapidly across all regions, with the West leading at a 24.7% CAGR. The West is driven by the region's strong tech sector, growing digital transformation initiatives, and the increasing need for flexible content management solutions. The South follows with a 22.1% CAGR, supported by a thriving tech ecosystem and the growing adoption of digital-first strategies in various industries. The Northeast shows a 19.8% CAGR, driven by strong demand from industries like media, retail, and finance. The Midwest experiences moderate growth at 17.2%, supported by the region’s focus on digital innovation and multi-channel content delivery.

The West is seeing the highest demand for headless CMS software in the USA, with a 24.7% CAGR. The region is home to many tech giants, digital startups, and e-commerce companies that prioritize flexibility and scalability in content management. Cities like San Francisco, Los Angeles, and Seattle are hubs for businesses that rely on delivering consistent content across multiple channels, such as websites, mobile apps, and IoT devices. The ability of headless CMS systems to decouple content creation and presentation enables businesses to scale quickly and meet the growing demand for personalized digital experiences.

The West's strong focus on digital transformation, cloud-based services, and customer-centric content delivery is fueling the adoption of headless CMS solutions. As more businesses in the region embrace omni-channel marketing and online commerce, the need for efficient and flexible CMS systems continues to grow. The West is expected to maintain its leadership in headless CMS software adoption as industries increasingly prioritize digital agility and content optimization.

The South is experiencing strong demand for headless CMS software, with a 22.1% CAGR. This growth is largely driven by the region’s expanding tech sector and the increasing adoption of digital-first strategies in industries such as retail, healthcare, and e-commerce. States like Texas, Georgia, and Florida are seeing significant investment in technology infrastructure, with companies adopting headless CMS solutions to streamline content delivery across multiple digital touchpoints.

The demand for scalable, flexible, and cost-effective content management solutions is growing as businesses in the South increasingly move towards omni-channel marketing, mobile apps, and personalized customer experiences. The rise of e-commerce and mobile commerce in the region is driving businesses to adopt headless CMS systems that can easily integrate with different platforms and deliver content across a wide variety of channels. As the South continues to grow as a tech hub, the demand for headless CMS software will keep rising.

The Northeast is witnessing steady demand for headless CMS software, with a 19.8% CAGR. The region’s strong presence in industries such as media, finance, healthcare, and retail is a significant driver of this demand. Cities like New York, Boston, and Philadelphia are centers for innovation, with businesses adopting headless CMS solutions to enable personalized content delivery and support multi-channel engagement.

The Northeast’s emphasis on digital transformation, including the shift to cloud-based solutions and the rise of mobile-first and e-commerce strategies, is pushing businesses to adopt headless CMS systems. With a large and diverse consumer base, businesses in the Northeast require flexible content management solutions to deliver consistent, high-quality content across various digital platforms. As the region continues to embrace digital experiences, headless CMS software will play an important role in helping companies optimize their content strategies and stay competitive.

The Midwest is experiencing moderate growth in demand for headless CMS software, with a 17.2% CAGR. The region is home to a variety of industries, including manufacturing, agriculture, and healthcare, that are increasingly adopting digital strategies to enhance customer engagement and improve operational efficiency. Cities like Chicago, Detroit, and Minneapolis are seeing the rise of digital transformation initiatives, with companies looking for flexible and scalable CMS solutions to support multi-channel content delivery.

While the Midwest's growth rate is slower compared to the West and South, the demand for headless CMS software is being driven by the region’s evolving focus on digital innovation. The increasing need for personalized, omnichannel content in sectors like healthcare and retail is contributing to the adoption of headless CMS systems. As more companies in the Midwest recognize the benefits of these flexible solutions, the demand for headless CMS software will continue to grow, albeit at a more moderate pace compared to other regions.

The demand for headless CMS software in the USA is rising rapidly as organizations prioritise flexibility in content delivery, omnichannel reach and decoupled architecture. With the surge in digital platforms websites, mobile apps, kiosks, voice interfaces and IoT devices businesses are shifting away from monolithic content management systems toward API‑driven, headless models that allow content to be authored once and distributed everywhere. This transition is especially significant in sectors like e‑commerce, media, technology and enterprise marketing.

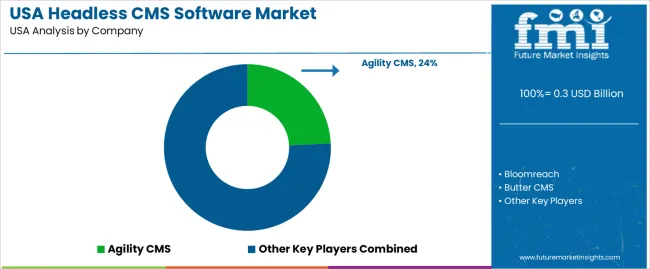

In the USA market landscape, Agility CMS holds an estimated 24.2% share, demonstrating its strong position in supplying headless CMS platforms tailored for USA customers and developers. Other notable providers include Bloomreach, Butter CMS, Cockpit, Contentful, and Contentstack, each offering their own headless solutions or API‑first stacks that cater to content teams, developers and agencies aiming to streamline digital‑experience delivery.

Key drivers of demand include the need for content agility—allowing rapid deployment across digital touchpoints the rise of microservice and modular architecture in enterprise stacks, and the pressure on marketing and IT teams to deliver personalised, consistent experiences at scale. As businesses invest more in digital transformation, headless CMS acts as an enabler for multichannel strategies and developer‑friendly integrations. Challenges remain such as integration complexity, training needs for new content workflows, and ensuring enterprise governance in distributed environments—but the outlook for USA demand remains very positive as content becomes progressively central to digital business models.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Type | Exercise & Weight Loss, Diet & Nutrition, Activity Tracking |

| Platform | iOS, Android, Others |

| Device Type | Wearable Devices, Tablets, Smartphones |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Aaptiv, Adidas, Appinventiv, Applico, Appster, Azumio, Inc. |

| Additional Attributes | Dollar sales by type, platform, device type, and regional trends with a focus on wearable devices, mobile apps, and fitness sectors. Demand is driven by rising health awareness, increasing mobile usage, and the growth of digital fitness platforms. |

The global demand for headless CMS software in USA is estimated to be valued at USD 0.3 billion in 2025.

The market size for the demand for headless CMS software in USA is projected to reach USD 2.4 billion by 2035.

The demand for headless CMS software in USA is expected to grow at a 21.5% CAGR between 2025 and 2035.

The key product types in demand for headless CMS software in USA are large enterprise and small & medium enterprise.

In terms of end user, healthcare segment to command 23.9% share in the demand for headless CMS software in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Headless CMS Software Market - Trends & Forecast 2025 to 2035

Demand for Headless CMS Software in Japan Size and Share Forecast Outlook 2025 to 2035

Cash Management Services Market – Trends & Forecast 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA