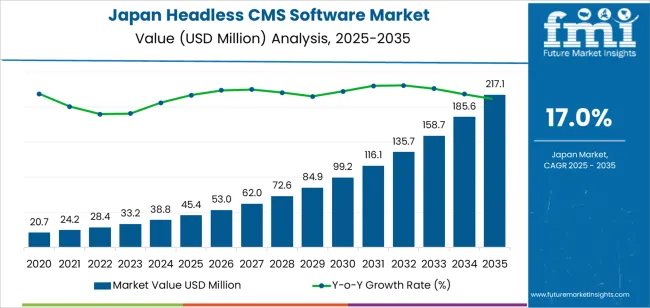

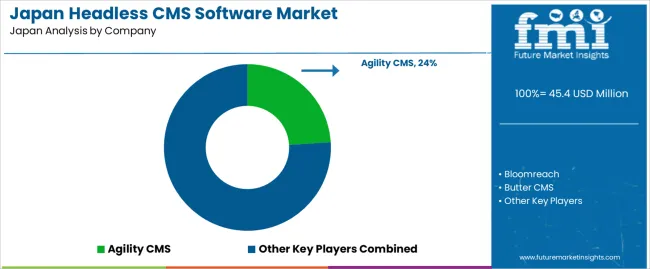

The Japan headless CMS software demand is valued at USD 45.4 million in 2025 and is forecasted to reach USD 217.1 million by 2035, reflecting a CAGR of 17.0%. Demand is driven by the transition toward multi-channel digital content delivery across web, mobile, and connected devices. Headless systems separate content management from front-end frameworks, allowing development teams to deploy content through APIs and maintain consistent output across varied digital interfaces. Adoption is also shaped by the need for scalable architectures as enterprises expand e-commerce operations, digital service platforms, and internal content workflows.

Large enterprises form the leading user segment. Their complex content ecosystems, multi-brand structures, and reliance on omnichannel service delivery create sustained demand for flexible content infrastructures. These organisations benefit from the integration capabilities, security features, and API-driven structures provided by headless CMS platforms, which support high-volume content deployment and continuous site updates.

Kyushu & Okinawa, Kanto, and Kinki demonstrate the strongest regional demand. These regions host major corporate headquarters, technology service providers, and digital agencies that support enterprise content modernisation. Their concentration of financial services, retail groups, and media operators contributes to steady investment in systems that support multilingual, multi-site, and cross-platform publishing. Agility CMS, Bloomreach, Butter CMS, Cockpit, Contentful, and Contentstack are the principal suppliers. Their offerings include API-first architectures, modular content models, and integrations with development frameworks used for enterprise websites, customer portals, and digital commerce platforms.

The acceleration and deceleration pattern shows a strong early lift from 2025 to 2029 as enterprises adopt API-driven content architectures to support multi-device publishing, international site management, and faster development cycles. Early acceleration is reinforced by adoption in e-commerce, media, financial services, and public institutions aiming to separate content management from front-end frameworks. Wider use of JavaScript-based front ends and cloud-native deployment further strengthens early-period momentum.

From 2030 to 2035, the segment enters a moderated but still elevated expansion phase. Most large organisations will have completed the transition from monolithic systems, and adoption begins to stabilise around maintenance, modular upgrades, and multi-channel optimisation. Growth becomes more predictable as procurement shifts from large platform migrations to incremental integrations, composable add-ons, and security enhancements. Expansion remains positive, supported by headless architectures used for mobile, IoT, and interactive service interfaces, but acceleration naturally softens as the user base matures. The pattern reflects a segment moving from rapid architectural transformation to a steadier operational phase shaped by lifecycle upgrades and continued digital-content requirements across Japan’s enterprise ecosystem.

| Metric | Value |

|---|---|

| Japan Headless CMS Software Sales Value (2025) | USD 45.4 million |

| Japan Headless CMS Software Forecast Value (2035) | USD 217.1 million |

| Japan Headless CMS Software Forecast CAGR (2025 to 2035) | 17.0% |

The demand for headless CMS software in Japan is increasing because businesses across e-commerce, media, financial services and manufacturing require content systems that can support multiple digital channels websites, mobile apps, kiosks and IoT devices, efficiently and consistently. Japan’s enterprises are under pressure to localize and personalize content for Japanese and global audiences, which headless CMS platforms support through a single content backend driving multiple front-end interfaces.

Technological trends such as API-first architecture, microservices and cloud-native deployment align with broader IT modernisation efforts in Japanese companies, making headless CMS an attractive option. The growth of digital marketing, interactive experiences and multilingual content further supports uptake of these systems. Constraints include the high cost and complexity of migrating from legacy monolithic CMS platforms, a relative shortage of in-house technical skills for API-driven architectures and the conservative procurement practices typical in some parts of Japan’s IT industry. Some smaller firms may prefer simpler, traditional CMS tools until their content-management needs expand.

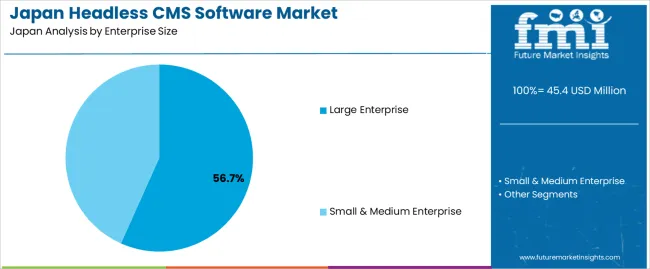

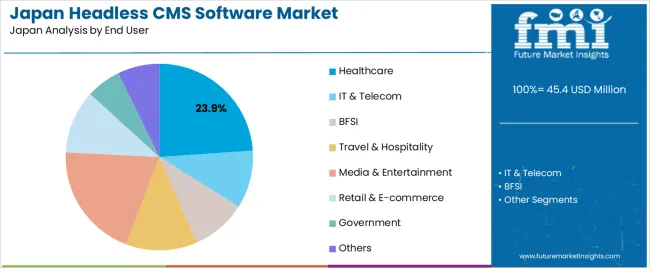

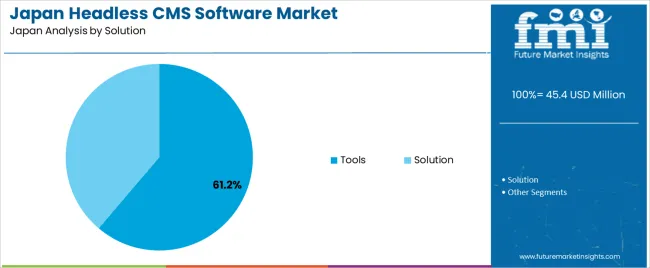

Demand for headless CMS software in Japan reflects adoption of content-management architectures that separate backend infrastructure from frontend delivery. Enterprise-size distribution shows how organisations with differing digital workloads integrate API-driven content frameworks. End-user patterns reveal how industries adopt headless structures to manage omnichannel publishing, regulatory documentation, and user-interface flexibility. Solution-type preferences indicate whether organisations prioritise toolkits for customised development or complete packaged systems that streamline deployment.

Large enterprises hold 56.7% of national demand and represent the leading user group for headless CMS adoption. Their extensive digital infrastructure, multi-platform publishing needs, and internal development teams support the use of modular content frameworks that integrate with custom applications. Small and medium enterprises represent 43.3%, adopting headless systems to improve website performance, enable mobile-first delivery, and reduce dependence on tightly coupled legacy CMS structures. Enterprise-size distribution reflects organisational capacity, API utilisation, and the need to manage content across websites, mobile applications, and digital services within Japan’s expanding digital ecosystem.

Key drivers and attributes:

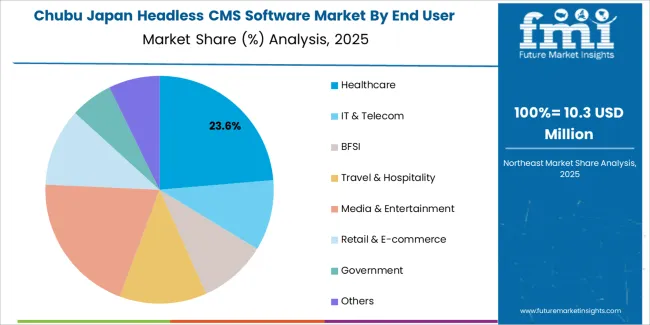

Healthcare organisations hold 23.9% of national demand and form the largest end-user segment. They rely on structured content management for patient communication, medical information, and multi-device access to services. Media and entertainment represent 20.0%, using headless CMS to distribute content across streaming, websites, and mobile applications. Travel and hospitality account for 12.3%, supporting real-time updates across booking and information platforms. Retail and e-commerce hold 11.0%, while IT and telecom represent 10.0% and BFSI 9.6%, each managing regulated and frequently updated digital content. Government accounts for 6.0%, with others at 7.2%, reflecting broader institutional adoption.

Key drivers and attributes:

Tools hold 61.2% of national demand and represent the dominant solution type. These toolkits provide APIs, developer frameworks, and modular components used to build customised content-delivery environments across web and mobile platforms. Solution packages represent 38.8%, offering integrated headless systems with built-in management interfaces suited to organisations seeking quicker deployment with less custom coding. Solution-type distribution reflects the balance between developer-driven architectures and streamlined content-operations workflows across Japanese enterprises transitioning toward multi-channel digital delivery.

Key drivers and attributes:

Growth in digital transformation initiatives, increased multichannel content needs, and rising e-commerce sophistication are driving demand.

In Japan, enterprises across retail, media, manufacturing and financial services are upgrading digital platforms to reach customers via websites, mobile apps, IoT devices and digital signage. A headless CMS architecture supports this by decoupling content creation from presentation and enabling content delivery via APIs to any channel. Companies value faster rollout of campaigns, reusable content assets and support for multilingual and geographically distributed operations. Domestic headless CMS vendors are gaining traction, showing adoption in Japanese corporations and signalling stronger industry recognition of API-first systems. Points of adoption include large publishers and brand owners who want to streamline content workflows across devices.

Legacy CMS investments, cultural preference for integrated systems and shortage of skilled integration resources restrain broader adoption.

Many Japanese organisations have substantial investment in traditional monolithic CMS platforms and may prefer to extend existing systems rather than replace them entirely. The shift to headless architectures often requires stronger coordination between IT, marketing and frontend development teams, which may face skills gaps or integration complexity. A headless approach emphasises APIs, microservices and tech-stack flexibility which can challenge organisations accustomed to all-in-one CMS solutions and slow decision making.

Shift toward hybrid headless models, increased localisation and Japanese-language vendor offerings, and expansion in sectors such as publishing and retail define key trends.

Japanese companies are showing increasing interest in hybrid CMS platforms that combine headless capabilities with familiar editorial and workflow features, which helps balance agile frontend development with ease-of-use for marketing teams. Local vendors offering support in Japanese, regional hosting and native enterprise features are gaining competitive strength. The publishing and media sectors in Japan are early adopters, while retail, e-commerce and manufacturing follow as they demand omnichannel content delivery, dynamic site environments and rapid go-to-market. These trends point to sustained and accelerating demand for headless CMS software in the Japanese industry.

Demand for headless CMS software in Japan is increasing through 2035 as enterprises, digital-commerce operators, media platforms, and public institutions adopt decoupled content-delivery architectures for faster scaling and multi-channel deployment. Headless systems support structured content distribution across websites, mobile apps, IoT interfaces, and in-store displays.

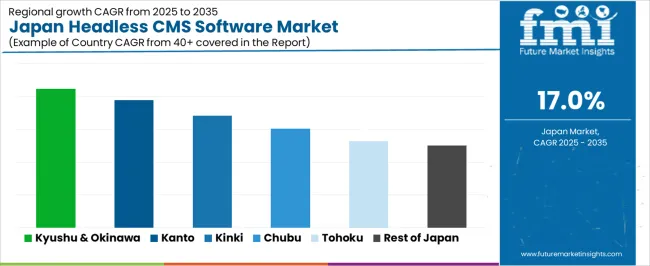

Adoption is reinforced by the need for consistent content governance, API-driven delivery, faster development cycles, and smoother integration with cloud-native services. Growth also reflects modernization of legacy CMS environments and expanding digital-experience programs across regional enterprises. Kyushu & Okinawa lead with 21.2%, followed by Kanto (19.5%), Kinki (17.1%), Chubu (15.1%), Tohoku (13.2%), and the Rest of Japan (12.5%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 21.2% |

| Kanto | 19.5% |

| Kinki | 17.1% |

| Chubu | 15.1% |

| Tohoku | 13.2% |

| Rest of Japan | 12.5% |

Kyushu & Okinawa grow at 21.2% CAGR, supported by rapid digital-commerce expansion, strong adoption of API-based architectures, and increased investment in cloud services across regional enterprises. Retailers and tourism companies migrate to headless systems to manage multi-language content for domestic and international audiences. Universities and public institutions rely on structured content models for mobile-first communication platforms. Technology firms in Fukuoka adopt headless CMS environments to accelerate deployment cycles and support omnichannel interfaces. Regional businesses integrating booking systems, product catalogs, and localized content benefit from improved performance and faster updates enabled by headless frameworks.

Kanto grows at 19.5% CAGR, driven by dense enterprise concentration, large-scale e-commerce operations, and mature digital-transformation programs across Tokyo, Kanagawa, and Saitama. Companies use headless CMS platforms to deliver consistent content across websites, mobile apps, and in-store digital displays. Financial institutions adopt structured content models to manage regulatory updates across multiple front-end interfaces. Media and publishing firms rely on API-driven delivery to improve distribution speed for multi-format content. Technology companies integrate headless CMS with composable digital-experience stacks to streamline development. High volumes of localized and real-time content support ongoing adoption.

Kinki grows at 17.1% CAGR, supported by manufacturing enterprises, retail chains, and digital-service providers across Osaka, Kyoto, and Hyogo. Companies adopt headless CMS solutions to streamline content updates across product pages, service portals, and mobile applications. Retailers use headless environments to synchronize promotions and local store information across digital channels. Universities and cultural institutions adopt structured content models to modernize visitor-information systems. Technology firms integrate headless CMS platforms with microservices-based applications for faster iteration. Although adoption is more gradual than in Kanto, strong interest in flexible digital architecture sustains growth.

Chubu grows at 15.1% CAGR, driven by industrial digitalization, regional e-commerce expansion, and modernization of corporate communication platforms across Aichi, Shizuoka, and Gifu. Manufacturing companies use headless CMS solutions to manage product documentation, technical content, and multi-language pages for export industries. Retail and service providers adopt API-driven delivery for mobile and web applications. Tourism organizations rely on structured content environments to deliver updated information to visitors. Although deployment scales vary, stable enterprise demand and continued platform modernization guide adoption.

Tohoku grows at 13.2% CAGR, supported by regional digital-service improvements, expanding e-commerce ecosystems, and broader use of mobile-first communication platforms across Miyagi, Fukushima, and Akita. Local governments adopt headless CMS systems to manage emergency updates and multilingual information. SMEs use structured content platforms to improve consistency across online storefronts. Educational institutions introduce headless models for student-facing digital services. Although digital-transformation budgets are smaller than in major metropolitan centers, steady modernization ensures continuous uptake.

The Rest of Japan grows at 12.5% CAGR, supported by moderate digital-commerce activity, gradual CMS modernization, and adoption of mobile communication tools across smaller municipalities and regional businesses. Companies replace legacy systems with headless platforms to support simpler content management across web and mobile interfaces. Retailers adopt structured content models for store-level updates and promotional consistency. Public institutions rely on headless environments to streamline information delivery across multiple access points. While deployment scales are smaller, steady modernization ensures ongoing adoption.

Demand for headless CMS software in Japan is shaped by a group of content-management and digital-experience providers supporting enterprises, e-commerce platforms, and omnichannel content operations. Agility CMS holds the leading position with an estimated 24.0% share, supported by controlled content-modelling capability, stable API performance, and long-standing adoption among Japanese organisations seeking flexible cloud-based content delivery. Its position is reinforced by predictable uptime, structured workflow tools, and straightforward integration with frontend frameworks.

Bloomreach and Contentful follow as significant participants. Bloomreach supports content and product-experience management for e-commerce environments, offering consistent API behaviour and strong search-personalisation capability. Contentful provides a widely adopted API-first platform with reliable content-delivery performance suited to enterprise digital teams requiring scalable multi-channel publishing.

Butter CMS maintains a presence in mid-scale deployments, emphasizing predictable API response times, simplified schema management, and rapid integration with web and mobile applications. Contentstack contributes capability through enterprise headless architecture with controlled governance tools and stable performance across distributed content teams. Cockpit supports additional demand through lightweight, self-hosted flexibility used by development teams seeking controlled customisation and direct data-structure management.

Competition across this segment centres on API reliability, content-modelling flexibility, integration depth, latency performance, and lifecycle governance. Demand continues to expand as Japanese enterprises adopt decoupled content delivery, prioritising stable multi-channel publishing, reduced frontend constraints, and consistent content performance across websites, apps, and connected digital interfaces.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Enterprise Size | Large Enterprise, Small & Medium Enterprise |

| End User | Healthcare, IT & Telecom, BFSI, Travel & Hospitality, Media & Entertainment, Retail & E-commerce, Government, Others |

| Solution | Tools, Solution |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Agility CMS, Bloomreach, Butter CMS, Cockpit, Contentful, Contentstack |

| Additional Attributes | Dollar sales by enterprise size, end-user industry, and solution category; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of headless CMS providers; advancements in API-first architecture, omnichannel content delivery, localization workflows, and cloud-native deployment; integration with e-commerce platforms, digital transformation projects, media content pipelines, and enterprise IT infrastructure across Japan. |

The demand for headless CMS software in Japan is estimated to be valued at USD 45.4 million in 2025.

The market size for the headless CMS software in Japan is projected to reach USD 217.1 million by 2035.

The demand for headless CMS software in Japan is expected to grow at a 17.0% CAGR between 2025 and 2035.

The key product types in headless CMS software in Japan are large enterprise and small & medium enterprise.

In terms of end user, healthcare segment is expected to command 23.9% share in the headless CMS software in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA