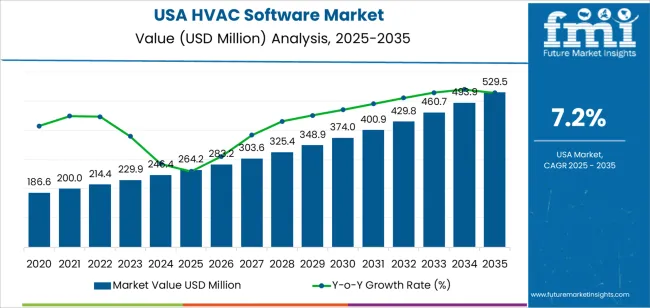

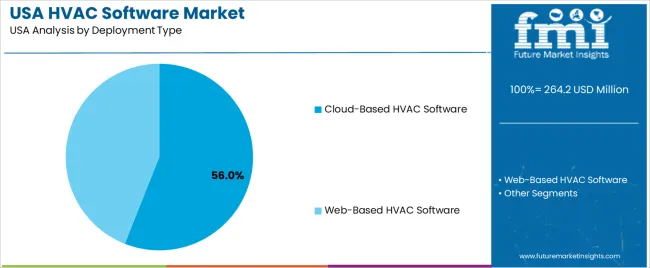

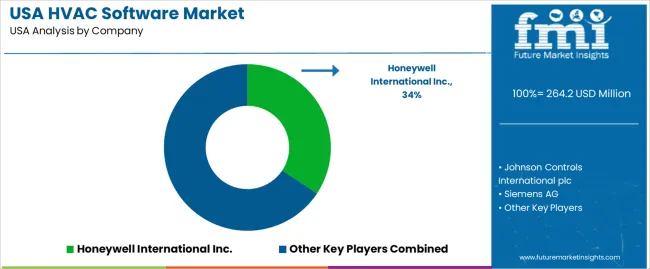

The demand for HVAC software in the USA is projected to rise from USD 264.2 million in 2025 to USD 529.5 million by 2035 at a CAGR of 7.2%. Adoption is being encouraged by the shift toward automated workflows, integrated service management, and digital scheduling platforms that help HVAC contractors improve field operations. A broader move toward remote diagnostics and centralized asset monitoring has supported interest in cloud-based platforms, which are expected to capture a 56 percent share. These tools are seen as essential for managing dispersed service teams, improving technician productivity, and reducing response times across residential, commercial, and industrial service environments.

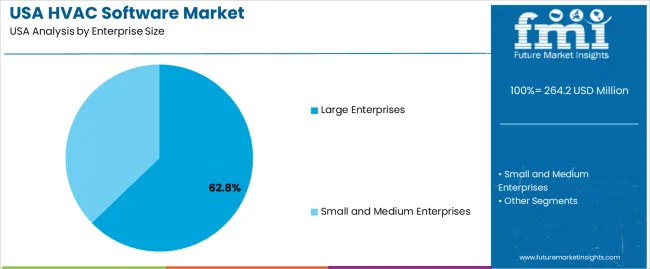

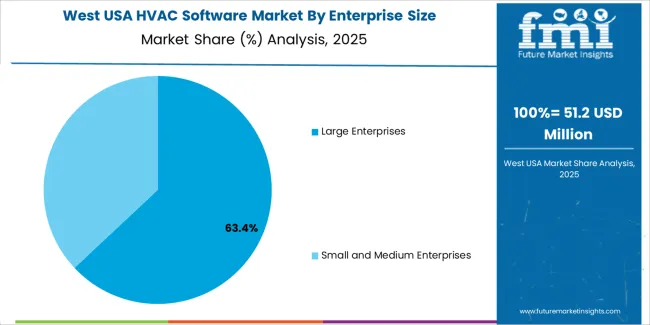

Large enterprises will dominate with a 62.8% share due to their wider infrastructure networks and higher need for multi-location coordination. Such users often prioritise scalable solutions that integrate project tracking, inventory planning, customer portals, and performance dashboards. Smaller contractors are also showing rising adoption as subscription models lower upfront costs. Demand is helped by rising service workloads, ageing HVAC infrastructure, and the requirement for compliance-driven documentation. The USA is witnessing strong interest in platforms that combine job costing, dispatch automation, and maintenance scheduling, which positions HVAC software as a core tool for operational efficiency over the next decade.

| Metric | Value |

|---|---|

| Demand for HVAC Software in USA Value (2025) | USD 264.2 million |

| Demand for HVAC Software in USA Forecast Value (2035) | USD 530.4 million |

| Demand for HVAC Software in USA Forecast CAGR (2025 to 2035) | 7.20% |

The demand for HVAC software in the USA is increasing as building owners and facility managers look for advanced tools to optimise heating, ventilation, and air‑conditioning systems. These software solutions enable real‑time monitoring, data analytics, and predictive maintenance, which help reduce energy use, improve system reliability, and enhance indoor comfort. As commercial buildings, multi‑unit residences, and industrial facilities focus more on operational efficiency, HVAC software becomes a critical component.

Growth in smart building technologies and Internet of Things (IoT) integration is contributing to the rise of HVAC software adoption. IoT‑enabled sensors and connected HVAC systems generate large volumes of data which must be managed and analysed. Software platforms that offer dashboards, automated alerts, and scheduling capabilities allow facility teams to act proactively. Since many buildings are being retrofitted with digital control systems, the role of software in managing and upgrading HVAC infrastructure is becoming more important.

The regulatory environment and rising expectations around indoor air quality are also supporting demand for HVAC software. With updated standards for ventilation, emissions, and energy efficiency, building managers need tools that can track performance and ensure compliance. As energy‑cost pressures rise and building owners seek to extend equipment life while avoiding unplanned downtime, HVAC software offers a compelling return on investment. The trend toward smarter, greener buildings will ensure HVAC software remains a vital investment in the USA through 2035.

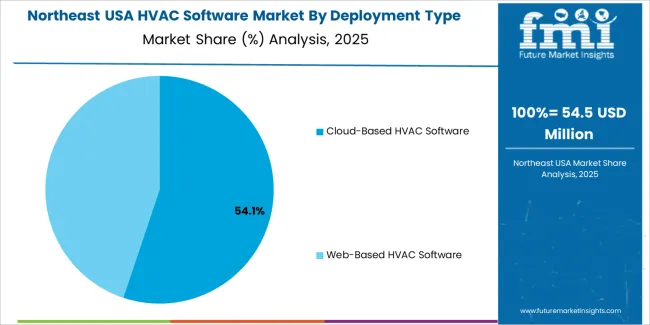

Demand for HVAC (Heating, Ventilation, and Air Conditioning) software in the USA is segmented by enterprise size and deployment type. By enterprise size, demand is divided into large enterprises and small and medium enterprises (SMEs), with large enterprises holding the dominant share. In terms of deployment type, the industry is categorized into cloud-based HVAC software and web-based HVAC software, with cloud-based HVAC software leading the demand. Regionally, demand is divided into West, South, Northeast, and Midwest

Large enterprises account for 63% of the demand for HVAC software in the USA. Large organizations typically operate multiple HVAC systems across several buildings or facilities, necessitating the use of advanced software to manage energy consumption, improve system performance, and ensure compliance with regulations. HVAC software solutions provide centralized control and monitoring, enabling these enterprises to optimize their operations and reduce energy costs across large, complex systems.

The demand for HVAC software in large enterprises is driven by the need for advanced, scalable solutions that can handle the complexities of managing HVAC systems in large facilities, campuses, or industrial settings. Large enterprises often require more sophisticated features such as predictive maintenance, real-time data analytics, energy efficiency optimization, and integration with building management systems (BMS). As these organizations continue to prioritize operational efficiency and sustainability, the demand for HVAC software in large enterprises is expected to remain strong, making it the largest segment in the industry.

Cloud-based HVAC software accounts for 56% of the demand for HVAC software in the USA. Cloud-based solutions offer numerous advantages over traditional on-premises systems, including remote access, scalability, and lower upfront costs. With cloud-based HVAC software, organizations can monitor and control HVAC systems from anywhere, as long as they have an internet connection. This flexibility makes it ideal for enterprises with multiple locations or remote facilities.

The demand for cloud-based HVAC software is driven by the increasing need for real-time data access, remote monitoring, and the ability to integrate with other cloud-based business systems. Cloud solutions enable businesses to collect and analyze large amounts of data on energy consumption, system performance, and maintenance schedules, which can lead to improved decision-making and cost savings. As businesses move toward digital transformation and more companies adopt cloud technologies for operational efficiency, cloud-based HVAC software is expected to maintain its dominance in the industry.

HVAC software solutions combine monitoring, analytics, scheduling, fault detection and remote control functions. Key drivers include stricter energy‑efficiency regulations, adoption of IoT and smart‑building technologies, the growing requirement for predictive maintenance in commercial and industrial assets, and the shift to cloud‑based digital service models among HVAC contractors. Restraints include legacy system inertia (many facilities still rely on manual or simple control systems), integration challenges with heterogeneous HVAC equipment, cybersecurity concerns when connecting building systems to cloud platforms, and cost‑justification hurdles especially for smaller facilities.

Why is Demand for HVAC Software Growing in the USA?

In the USA, growing demand largely reflects the push toward smarter buildings and the drive to reduce operational energy costs. Facility owners and service contractors increasingly recognise that HVAC is one of the largest energy‑consuming subsystems in both commercial and residential buildings; therefore, software that enables remote monitoring, data‑driven optimisation and proactive maintenance provides tangible cost savings and performance gains. The proliferation of occupancy sensors, smart thermostats, connected devices and cloud services makes it easier to deploy HVAC‑specific software and link with broader building management systems. Further, increasing adoption of service‑contract models by HVAC firms means software platforms are becoming central to service delivery, technician scheduling, work‑order management and customer engagement making them more attractive in the USA.

How are Technological Innovations Driving Growth of HVAC Software in USA?

Technological innovation is a strong enabler for HVAC software growth in the USA. Advances include integration of IoT sensors throughout HVAC systems (temperature, humidity, airflow, vibration), cloud‑native analytics platforms for anomaly detection and predictive maintenance, mobile apps that allow technicians or facility managers to monitor systems remotely, and machine learning models that suggest optimal set‑points or maintenance schedules. The rise of edge computing and digital twins for HVAC systems supports real‑time decision‑making and simulation of HVAC performance under varied load profiles. These innovations make HVAC software more capable, more scalable (across multiple sites or units) and increasingly cost‑effective, reinforcing uptake across U.S. commercial buildings, multi‑site real‑estate portfolios and service‑providers.

What are the Key Challenges Limiting Adoption of HVAC Software in USA?

Despite strong momentum, several challenges limit broader adoption of HVAC software in the USA. One major barrier is the complexity and cost of retrofitting existing HVAC systems with sufficient sensors, connectivity and integration capabilities especially in older buildings. Another challenge is data security and privacy: connecting HVAC systems to cloud platforms or networks opens potential vulnerabilities, and many facility‑owners are cautious. The HVAC services industry is fragmented, with many small contractors lacking the IT resources to adopt and support advanced software platforms. Also, demonstrating clear ROI for software deployment (beyond hardware upgrades) can be hard, particularly in smaller or midsize buildings where savings may be incremental. Finally, interoperability issues (different HVAC equipment manufacturers, varying communication protocols) can slow implementation.

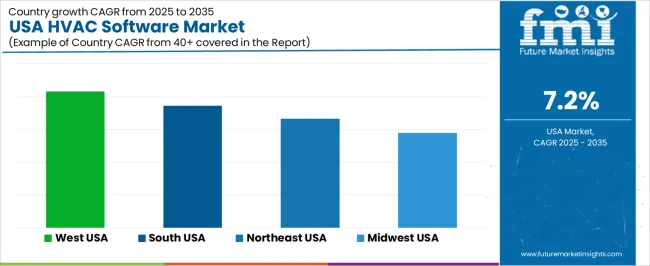

| Region | CAGR (%) |

|---|---|

| West | 8.3% |

| South | 7.4% |

| Northeast | 6.6% |

| Midwest | 5.8% |

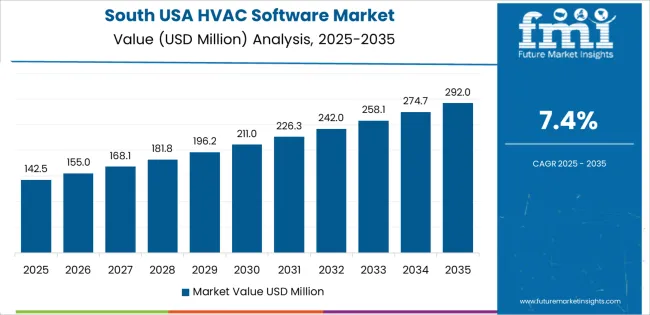

The demand for HVAC software in the USA is increasing across all regions, with the West leading at an 8.3% CAGR. This growth is driven by the region’s expanding construction and energy efficiency initiatives. The South follows with a 7.4% CAGR, supported by strong demand for HVAC solutions in commercial and residential sectors. The Northeast shows a 6.6% CAGR, driven by urban infrastructure projects and an increased emphasis on building efficiency. The Midwest experiences moderate growth at 5.8%, with rising adoption of HVAC software in industries focused on improving operational efficiency.

The West is experiencing the highest demand for HVAC software in the USA, with an 8.3% CAGR. This growth is fueled by the region’s focus on energy efficiency, green building standards, and the large number of construction and real estate development projects in cities like Los Angeles, San Francisco, and Seattle. As the demand for smarter, more efficient building systems grows, HVAC software plays a crucial role in optimizing energy use, ensuring building comfort, and meeting regulatory requirements.

The West’s commitment to sustainability, combined with a strong push towards innovative building technologies, is driving businesses to adopt advanced HVAC software. The growing construction industry and an increasing focus on smart cities and IoT integration have boosted the demand for HVAC software to optimize heating, ventilation, and air conditioning systems. As the West leads the way in energy-efficient solutions and building automation, HVAC software adoption is expected to remain robust.

The South is seeing strong demand for HVAC software, with a 7.4% CAGR. The region’s growth is driven by rapid urbanization, a booming real estate industry, and an increasing focus on energy-efficient solutions. States like Texas, Florida, and Georgia are experiencing significant growth in both residential and commercial construction, which requires advanced HVAC solutions to ensure optimal energy usage, comfort, and compliance with building codes.

The South’s hot climate and high cooling demands in residential and commercial spaces further contribute to the growing need for HVAC software to optimize system performance. There is a growing trend toward smart home technologies, which increases the demand for software that can integrate with HVAC systems. The region’s expanding infrastructure, coupled with the need for more ecological and cost-effective HVAC solutions, ensures that demand for HVAC software will continue to rise.

The Northeast is experiencing steady demand for HVAC software, with a 6.6% CAGR. This growth is largely driven by the region’s urban infrastructure projects, which require advanced HVAC solutions to improve building efficiency and comply with stringent environmental standards. Cities like New York, Boston, and Philadelphia have seen increasing investments in commercial and residential buildings that prioritize energy efficiency and automation.

The growing emphasis on smart building technologies in the Northeast is contributing to the rise of HVAC software. With stricter regulations on energy consumption and a heightened focus on reducing carbon footprints, businesses in the region are turning to HVAC software to optimize heating, cooling, and ventilation systems. As demand for energy-efficient buildings and retrofits grows, the Northeast is expected to continue experiencing steady growth in HVAC software adoption.

The Midwest is seeing moderate growth in demand for HVAC software, with a 5.8% CAGR. The region’s strong industrial base, particularly in cities like Chicago and Detroit, is driving the adoption of HVAC software to improve building operations and system efficiency. As industries focus on optimizing their energy usage and reducing operating costs, HVAC software is becoming a key tool in achieving those goals.

While growth in the Midwest is slower compared to other regions, the demand for HVAC software is supported by increasing awareness of energy efficiency in both residential and commercial sectors. As more businesses and property owners in the region seek to improve the performance and lifespan of their HVAC systems, the demand for software that offers predictive maintenance, remote monitoring, and energy management is rising. The Midwest's steady adoption of HVAC software will continue as industries look to modernize their building systems and improve operational efficiencies.

Demand for HVAC (heating, ventilation, and air‑conditioning) software in the United States is experiencing robust growth as building owners, service providers, and equipment manufacturers seek smarter, more connected solutions to optimize energy use, maintenance workflows, and occupant comfort. As commercial and industrial facilities adopt IoT and digital‑twin capabilities, HVAC software covering system monitoring, predictive maintenance, remote diagnostics, and energy‑management analytics is becoming mission‑critical in modern facility ecosystems.

In the USA landscape of demand, Honeywell International Inc. is estimated to hold approximately 34.3% share, reflecting its strong foothold through integrated hardware‑software HVAC platforms, expansive service networks, and deep customer relationships across commercial building and industrial applications. Other major suppliers catering to this demand include Johnson Controls International plc, Siemens AG, Carrier Global Corporation, Trane Technologies plc, and Lennox International Inc., each offering software modules, cloud platforms, or HVAC‑centric service‑enablement suites that align with USA facility‑management and energy‑efficiency requirements.

Tightening building‑energy codes and sustainability mandates, the rise of smart building and connected‑facility agendas, an increasing need for remote operation and monitoring prompted by hybrid‑work models, and growth in retrofits of aging HVAC stock in commercial, institutional, and data‑centre facilities. On the flip side, barriers such as substantial upfront investment, integration complexity with legacy HVAC systems, and the requirement for skilled facility‑management staff may temper adoption in some segments. The outlook for HVAC software demand in the USA is strongly positive as building owners and operators increasingly view software not just as a nice‑to‑have, but as integral to asset performance, energy savings and operational resilience.

| Items | Values |

|---|---|

| Quantitative Unit | USD million |

| Enterprise Size | Large Enterprises, Small and Medium Enterprises |

| Deployment Type | Cloud-Based HVAC Software, Web-Based HVAC Software |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Honeywell International Inc., Johnson Controls International plc, Siemens AG, Carrier Global Corporation, Trane Technologies plc, Lennox International Inc. |

| Additional Attributes | Dollar sales by enterprise size, deployment type, and regional trends with a focus on cloud and web-based platforms in the commercial and residential HVAC sectors. The growth is driven by the increasing adoption of smart HVAC systems and energy-efficient technologies. |

The global demand for hvac software in USA is estimated to be valued at USD 264.2 million in 2025.

The market size for the demand for hvac software in USA is projected to reach USD 529.5 million by 2035.

The demand for hvac software in USA is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in demand for hvac software in USA are large enterprises and small and medium enterprises.

In terms of deployment type, cloud-based hvac software segment to command 56.0% share in the demand for hvac software in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Software Distribution Market Report – Growth, Demand & Forecast 2025-2035

HVAC Software Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Demand for HVAC Software in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Headless CMS Software in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Food & Beverage OEE Software in USA Size and Share Forecast Outlook 2025 to 2035

HVAC UV Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

HVAC Coil Coating Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

HVAC Control System Market Size and Share Forecast Outlook 2025 to 2035

HVAC Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA