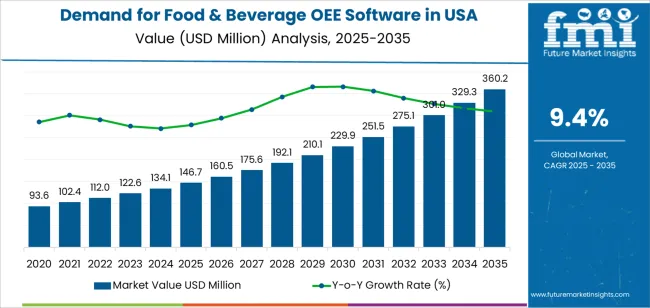

The demand for food & beverage OEE software in USA is projected to grow from USD 146.7 million in 2025 to approximately USD 360.2 million by 2035, recording an absolute increase of USD 199.5 million over the forecast period. This translates into total growth of 136.0%, with demand forecast to expand at a CAGR of 9.4% between 2025 and 2035.

Demand for food and beverage OEE software in the USA is expected to grow by nearly 2.36X during the same period, driven by increased focus on operational efficiency optimization, rising adoption of digital manufacturing solutions across food processing facilities, and growing emphasis on real-time production monitoring systems across manufacturing and processing applications. The USA, characterized by extensive food processing infrastructure and established manufacturing technology capabilities, continues to demonstrate robust growth potential driven by Industry 4.0 implementation requirements and stringent quality compliance standards.

Between 2025 and 2030, demand for food & beverage OEE software in the USA is projected to expand from USD 146.7 million to USD 213.4 million, resulting in a value increase of USD 66.7 million, which represents 33.4% of the total forecast growth for the decade.

This phase of growth will be shaped by rising digital transformation initiatives across USA food manufacturers, particularly in technology centers where cloud-based implementation adoption and production efficiency standards are accelerating OEE software deployment. Increasing integration of automated monitoring systems in commercial food processing applications and growing adoption of advanced analytics technologies continue to drive demand. Food manufacturers are expanding their digital capabilities to address the growing complexity of modern production requirements and performance specifications, with USA operations leading investments in real-time monitoring systems.

From 2030 to 2035, demand is forecast to grow from USD 213.4 million to USD 360.2 million, adding another USD 132.8 million, which constitutes 66.6% of the overall ten-year expansion. This period is expected to be characterized by expansion of artificial intelligence integration, development of predictive analytics capabilities and machine learning networks, and implementation of specialized OEE formulations across different manufacturing applications. The growing adoption of advanced data processing principles and enhanced production control requirements, particularly in Midwest and West Coast regions, will drive demand for more sophisticated software systems and integrated analytical platforms.

Between 2020 and 2025, USA food & beverage OEE software demand experienced steady expansion, driven by rising production efficiency requirements in food processing sectors and growing awareness of the benefits of digital monitoring for yield enhancement and operational reliability. The industry developed as food manufacturers and processing companies, especially in major agricultural and industrial corridors, recognized the need for proven monitoring solutions and reliable data management to achieve operational targets while meeting quality compliance expectations and regulatory requirements. Software suppliers and technology companies began emphasizing proper performance optimization and system integration to maintain operational efficiency and commercial viability.

| Metric | Value |

|---|---|

| USA Food & Beverage OEE Software Sales Value (2025) | USD 146.7 million |

| USA Food & Beverage OEE Software Forecast Value (2035) | USD 360.2 million |

| USA Food & Beverage OEE Software Forecast CAGR (2025-2035) | 9.4% |

Demand expansion is being supported by the accelerating emphasis on production efficiency optimization and digital transformation nationwide, with the USA maintaining its position as a food processing technology and manufacturing innovation leadership region, and the corresponding need for effective real-time monitoring systems for operational management, waste reduction processing, and performance integration. Modern food manufacturers rely on OEE software technologies to ensure operational competitiveness, regulatory compliance, and optimal pathway achievement toward efficiency-focused manufacturing operations. Advanced production requirements necessitate comprehensive monitoring solutions including specialized analytical capabilities, data processing control, and yield enhancement infrastructure to address diverse application needs and performance specifications.

The growing emphasis on Industry 4.0 adoption and increasing federal and state-level food safety regulations, particularly production efficiency commitments across the USA, are driving demand for monitoring software systems from proven technology suppliers with appropriate analytical expertise and quality management capabilities. Food manufacturers and processing companies are increasingly investing in OEE technology sourcing and integrated data management solutions to enhance operational profiles, access efficiency optimization trends, and demonstrate manufacturing leadership in competitive food processing environments. Manufacturing policies and quality compliance requirements are establishing standardized monitoring pathways that require OEE software systems and performance assurance, with USA food operations often pioneering large-scale implementation of advanced monitoring technologies.

The food & beverage OEE software demand in the USA is positioned for robust expansion, growing from USD 146.7 million in 2025 to USD 346.2 million by 2035, reflecting a 9.4% CAGR. Rising adoption of cloud-based monitoring systems in food processing operations, beverage manufacturing facilities, and dairy production is driving growth as manufacturers seek digital solutions that maximize operational efficiency and comply with stringent quality standards. Additionally, demand from automated production lines and predictive maintenance applications strengthens opportunities for both advanced analytics platforms and integrated monitoring solutions.

Manufacturers focusing on cloud-based implementations, artificial intelligence integration, and real-time monitoring capabilities stand to gain from evolving manufacturing standards and customer expectations for data processing, reliability, and operational optimization.

Food manufacturers face increasing demands for scalable monitoring environments in modern production facilities. Cloud-based OEE software enables flexible data processing and enhanced operational visibility without compromising manufacturing performance. Solutions targeting large-scale processors, beverage manufacturers, and dairy facilities can achieve strong adoption rates through cost optimization and scalability improvements. Estimated revenue opportunity: USD 32.1-48.7 million.

The growth in predictive maintenance, automated quality control, and intelligent production optimization creates robust demand for AI-powered OEE software ensuring precision in manufacturing processes. Manufacturers offering machine learning solutions for food processing applications can build relationships with equipment suppliers and technology integrators. Estimated revenue opportunity: USD 26.3-39.8 million.

Food manufacturers are increasingly adopting real-time monitoring systems for consistent production quality. Collaborations with equipment manufacturers for integrated monitoring solutions can unlock large-volume supply contracts and long-term partnerships in precision manufacturing applications. Estimated revenue opportunity: USD 23.4-35.2 million.

Quality requirements and operational flexibility demands are driving preference for mobile-enabled OEE platforms with superior accessibility characteristics. Suppliers offering comprehensive mobile solutions with exceptional user experience can differentiate offerings and attract efficiency-focused manufacturers. Estimated revenue opportunity: USD 28.9-43.6 million.

Critical manufacturing applications require specialized software configurations with optimized food processing features and enhanced analytical properties. Manufacturers investing in industry-specific development can secure advantages in serving performance-critical food processing applications. Estimated revenue opportunity: USD 21.7-32.8 million.

Comprehensive service networks offering implementation, training, and ongoing optimization support create recurring revenue opportunities. Companies building strong technical support capabilities can capture ongoing relationships and enhance customer satisfaction across food manufacturing facilities. Estimated revenue opportunity: USD 18.3-27.6 million.

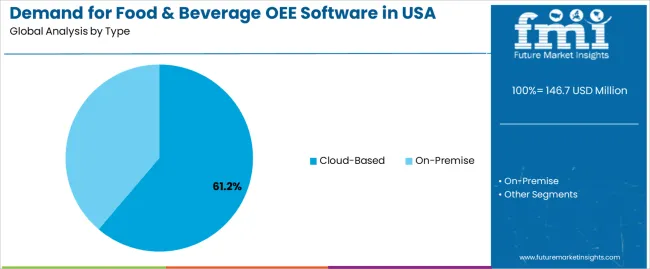

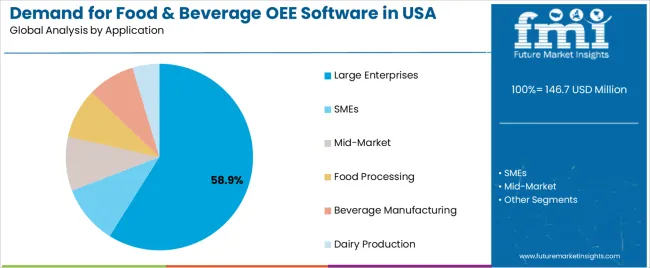

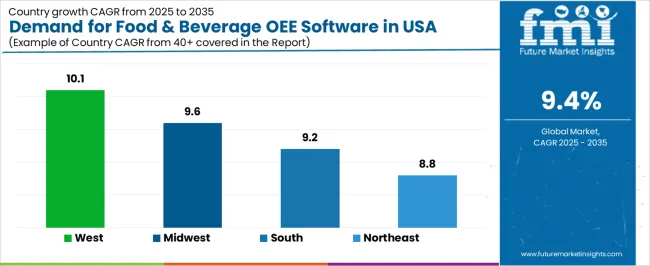

Demand is segmented by type, application, and region. By type, sales are divided into cloud-based and on-premise categories. In terms of application, sales are segmented into large enterprises, SMEs, mid-market, food processing, beverage manufacturing, and dairy production. Regionally, demand is divided into West, Midwest, South, and Northeast, with West representing a key growth and innovation hub for food & beverage OEE software technologies.

The cloud-based segment is projected to account for 61.2% of USA food & beverage OEE software demand in 2025, making it the leading type category across the sector. This dominance reflects the scalability requirements and operational flexibility of cloud-based monitoring systems for existing food processing facilities and modern applications where data accessibility is optimized through remote monitoring capabilities and distributed system architecture.

In the USA, where substantial food manufacturing infrastructure requires monitoring technology integration without complete system replacement, cloud-based platforms provide practical pathways for efficiency enhancement while maintaining operational continuity. Continuous innovations are improving software accessibility, data processing characteristics, and system integration parameters, enabling manufacturers to achieve high performance standards while maximizing operational efficiency. The segment's strong position is reinforced by the extensive existing food processing infrastructure requiring monitoring adoption and growing availability of cloud-based technology suppliers with proven commercial experience.

Large enterprises applications are expected to represent 58.9% of USA food & beverage OEE software demand in 2025, highlighting the critical importance of large-scale food processing requiring comprehensive monitoring solutions. Large manufacturing facilities including major food processors, beverage manufacturers, dairy operations, and commercial production applications generate consistent demand for OEE systems that are technically and economically favorable for enterprise monitoring applications.

The segment benefits from monitoring characteristics that often provide superior operational insights compared to manual tracking alternatives, reducing operational complexity and costs. Large enterprises also access enhanced performance optimization through monitoring positioning that improve production reliability and operational appeal. In the USA, where large-scale food manufacturing represents substantial portions of production industry development, operational monitoring requires OEE software integration across diverse enterprise operations. In West and Midwest regions, where food processing concentrations are significant, OEE software demand is elevated by emphasis on maintaining operational excellence while achieving efficiency optimization integration targets.

USA food & beverage OEE software demand is advancing steadily due to increasing production efficiency requirements and growing recognition of digital monitoring necessity for manufacturing development, with West region serving as a key driver of innovation and application development. The sector faces challenges including competition from legacy monitoring systems, need for specialized integration infrastructure development, and ongoing concerns regarding data security complexity and implementation considerations. Federal food safety guidelines and state-level manufacturing initiatives, particularly efficiency programs in West and Midwest regions, continue to influence software technology selection and deployment timelines.

The enhancement of digital manufacturing regulations, gaining particular significance through food safety industry performance guidelines and efficiency campaigns, is enabling software suppliers to achieve differentiation without prohibitive development costs, providing predictable demand patterns through manufacturing requirements and operational preferences. Enhanced efficiency standards offering substantial opportunities for monitoring software systems and analytical applications provide foundational dynamics while allowing suppliers to secure manufacturing agreements and technology partnerships. These trends are particularly valuable for first-mover suppliers and premium software development that require substantial technology investments without immediate cost advantages.

Modern software suppliers and food manufacturers are establishing advanced monitoring networks and centralized data management facilities that improve operational efficiency through software standardization and economies of scale. Integration of automated monitoring systems, real-time data processing, and coordinated performance management enables more efficient software operation across multiple manufacturing sources. Advanced monitoring concepts also support next-generation manufacturing applications including specialized food processing integration, technology cluster optimization, and regional software supply networks that optimize system-level economics while enabling comprehensive production monitoring across food manufacturing regions, with USA developments increasingly adopting collaborative monitoring models to reduce individual manufacturer costs and accelerate deployment.

| Region | CAGR (2025 to 2035) |

|---|---|

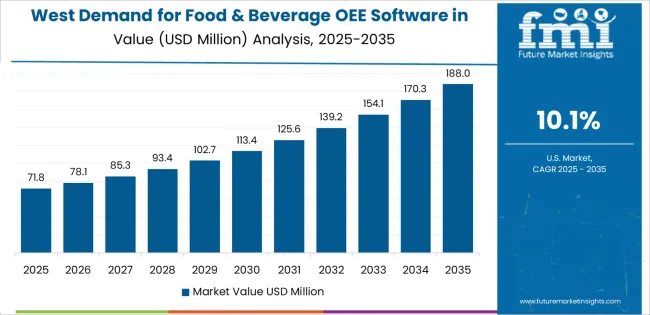

| West | 10.1% |

| Midwest | 9.6% |

| South | 9.2% |

| Northeast | 8.8% |

The USA food & beverage OEE software demand is witnessing robust growth, supported by rising production efficiency requirements, expanding digital transformation initiatives, and the deployment of advanced monitoring technologies across regions. West leads the nation with a 10.1% CAGR, reflecting progressive manufacturing trends, substantial food technology innovation, and early adoption of premium monitoring systems. Midwest follows with a 9.6% CAGR, driven by extensive food processing infrastructure, favorable agricultural demographics, and concentration of large-scale operations that enhance application development. South grows at 9.2%, as manufacturing modernization and technology efficiency opportunities increasingly drive software deployment. Northeast demonstrates growth at 8.8%, supported by expanding specialty food facilities and regional manufacturing initiatives.

Demand for food & beverage OEE software in West is projected to exhibit exceptional growth with a CAGR of 10.1% through 2035, driven by progressive manufacturing preferences, substantial technology development creating premium monitoring opportunities, and concentration of innovation across California and surrounding states. As the dominant region with extensive food processing infrastructure and efficiency-focused operational policies, West's emphasis on comprehensive manufacturing excellence and technology leadership is creating significant demand for advanced OEE software systems with proven performance and reliable application potential. Major food manufacturers and software suppliers are establishing comprehensive monitoring development programs to support technology innovation and premium digital deployment across diverse applications.

Demand for food & beverage OEE software in Midwest is expanding at a CAGR of 9.6%, supported by extensive agricultural processing facilities including large-scale food production, grain processing, and meat operations generating concentrated demand favorable for monitoring software systems. The region's operational characteristics, featuring substantial agricultural infrastructure and processing requirements ideal for OEE integration, provide natural advantages. Food industry expertise concentrated in Illinois, Iowa, and regional agricultural corridors facilitates application development and operational management. Software suppliers and manufacturers are implementing comprehensive monitoring strategies to serve expanding efficiency-focused requirements throughout Midwest.

Demand for food & beverage OEE software in South is growing at a CAGR of 9.2%, driven by substantial food processing facilities from poultry operations, beverage manufacturing, and regional agriculture requiring digital monitoring pathways. The region's manufacturing base, supporting critical food operations, is increasingly adopting software technologies to maintain competitiveness while meeting efficiency expectations. Manufacturers and software suppliers are investing in monitoring integration systems and regional supply infrastructure to address growing data management requirements.

Demand for food & beverage OEE software in Northeast is advancing at a CAGR of 8.8%, supported by expanding specialty food facilities, regional beverage manufacturing including craft brewing operations, and growing emphasis on digital monitoring solutions across the region. Manufacturing modernization and specialty food facility expansion are driving consideration of monitoring systems as operational enhancement pathways. Technology companies and software suppliers are developing regional capabilities to support emerging monitoring deployment requirements.

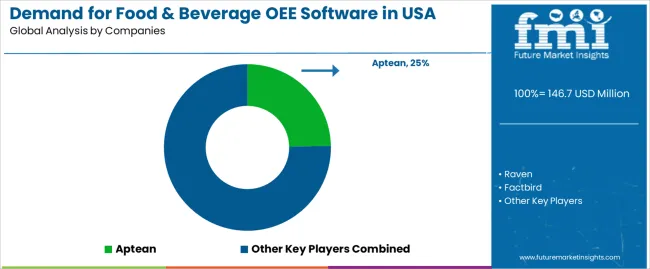

USA food & beverage OEE software demand is defined by competition among specialized software developers, manufacturing technology companies, and digital transformation providers, with major industrial software corporations maintaining significant influence through technology resources and application development capabilities. Companies are investing in software technology advancement, cloud infrastructure optimization, integration network structures, and comprehensive monitoring services to deliver effective, reliable, and scalable production management solutions across USA food processing and manufacturing applications. Strategic partnerships, technology infrastructure development, and first-mover application execution are central to strengthening competitive positioning and presence across food processing, beverage manufacturing, and dairy production monitoring applications.

Aptean, internationally recognized manufacturing software leader, leads with 24.7% share, offering comprehensive OEE software solutions including implementation, technology, and support services with focus on food processing applications, performance reliability, and cost optimization across USA operations. Raven, operating with extensive USA market presence, provides integrated monitoring solutions leveraging software expertise, analytics development, and production management capabilities.

Factbird delivers full-service OEE software implementation including technology development, performance optimization, and data management serving USA and international food processing projects. Evcon emphasizes comprehensive monitoring solutions with integrated analytics, quality control, and reporting capabilities leveraging food industry sector expertise. Lineview Solutions offers OEE software application development and performance optimization operations for manufacturing and processing applications across USA operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 360.2 million |

| Type | Cloud-Based, On-Premise |

| Application | Large Enterprises, SMEs, Mid-Market, Food Processing, Beverage Manufacturing, Dairy Production |

| Regions Covered | West, Midwest, South, Northeast |

| Key Companies Profiled | Aptean, Raven, Factbird, Evcon, Lineview Solutions, OEEsystems, Vorne Industries, Au2mate, Ekhsoft, Shoplogix |

| Additional Attributes | Sales by type and application segment, regional demand trends across West, Midwest, South, and Northeast, competitive landscape with established software suppliers and specialized monitoring developers, food processor preferences for cloud-based versus on-premise technologies, integration with manufacturing efficiency programs and production optimization policies particularly advanced in West region |

The global demand for food & beverage OEE software in USA is estimated to be valued at USD 146.7 million in 2025.

The market size for the demand for food & beverage OEE software in USA is projected to reach USD 360.2 million by 2035.

The demand for food & beverage OEE software in USA is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in demand for food & beverage OEE software in USA are cloud-based and on-premise.

In terms of application, large enterprises segment to command 58.9% share in the demand for food & beverage OEE software in USA in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Avocado Oil in Western europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA