The USA market for Food Stabilizers is expected to achieve USD 3,261.3 million in 2025, with projections indicating a rise to USD 5,683.8 million by 2035, maintaining a CAGR of 5.7%, as market dynamics are driven by rising consumer demand for clean-label products, enhanced functionality in processed foods, and sustainable ingredient solutions.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025E | USD 3,261.3 million |

| Projected USA Industry Value in 2035F | USD 5,683.8 million |

| Value-based CAGR from 2025 to 2035 | 5.7% |

The USA Food Stabilizers market is expected to experience considerable growth in the next decade, driven primarily by increasing application areas in diverse food categories such as dairy, bakery, beverages, and sauces.

Consumer preferences have progressively moved towards cleaner label products, which has increased demand for plant-based and microbial stabilizers, borne out of their natural origin and therefore a good fit with health-conscious trends. Emerging innovations in texture-enhancing and moisture-retention technologies address evolving needs from premium and convenience food producers and thereby improve the product's performance and shelf life.

The leading players like DuPont, Cargill, and ADM focus on the advancements in formulation as well as enhanced production capacities. At the same time, mid-sized players and new market entrants operate in niche fields, such as gluten-free or allergen-free applications, thanks to their relative agility. So, the market appears moderately concentrated, but it keeps on innovating and expanding as a dynamic segment for all parties involved.

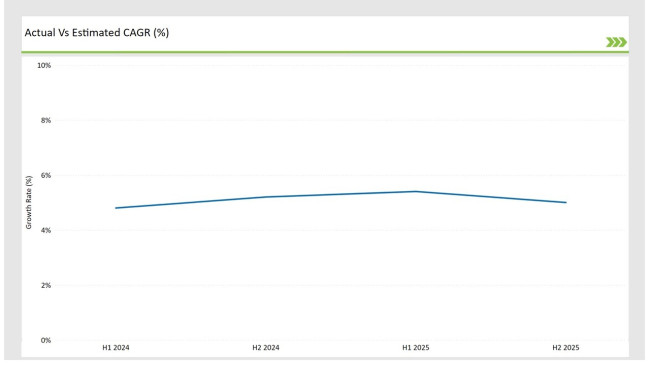

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the USA Food Stabilizers market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Half-Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 4.8% |

| H2 Growth Rate (%) | 5.2% |

| Half-Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 5.4% |

| H2 Growth Rate (%) | 5.0% |

For the USA market, the Food Stabilizers sector is predicted to grow at a CAGR of 4.8% during the first half of 2024, with an increase to 5.2% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 5.4% in H1 and is expected to rise further to 5.0% in H2.

These figures highlight the dynamic nature of the USA Food Stabilizers market, influenced by advancements in ingredient technology, increasing demand for functional foods, and growing consumer preference for clean-label solutions. This semi-annual analysis provides actionable insights for stakeholders to optimize their strategies and leverage emerging opportunities.

| Date | Development/M&A Activity & Details |

|---|---|

| Oct-2024 | DuPont introduced a new plant-based pectin solution tailored for dairy desserts and beverages. |

| Sep-2024 | Cargill launched an innovative seaweed-derived stabilizer targeting clean-label bakery and sauce applications. |

| Jun-2024 | ADM expanded its Xanthan gum production capacity to meet increasing demand in the USA and international markets. |

| Apr-2024 | CP Kelco developed a microbial-derived stabilizer for use in premium plant-based beverages. |

| Jan-2024 | Kerry Group partnered with a leading biotechnology firm to enhance functional attributes of guar gum stabilizers. |

Innovations in Plant-Based Stabilizers

Sustainability-driven and clean label solutions for conscious health consumers drive the food business forward with this new generation of plant-based stabilizers. For a group of natural-origin sources, it includes guar gum, pectin, agar, and presents enhanced functional attributes such as a better viscosity coefficient and moisture control.

DuPont and Cargill are industry leaders in product development for custom solutions in such domains as dairy dessert, beverages, and bakery product lines. Increasing plant-based options is a tendency aligned with growing demand from consumers toward transparent and environmentally friendly production practices in the food industries. As the growth of plant-based stabilizers continues to gain traction, long-term relevance will be secured in the industry for diverse food applications.

Advancements in Microbial and Seaweed-Derived Stabilizers

New developments in microbial and seaweed-derived stabilizers are emerging in the food stabilizers market as increasingly versatile, sustainable solutions. The types of ingredients-such as carrageenan and Xanthan gum-are ever more targeted toward specific functional requirements, such as superior texture, emulsification, and stability.

CP Kelco's innovations in microbial stabilizers paved the way for their application in premium beverages and sauces. It is the same with seaweed-derived stabilizers, as they flow well with trends which are ocean-friendly and natural. Their use in plant-based dairy alternatives, dressings, and functional beverages are driving growth, underlining their importance in modern food innovation.

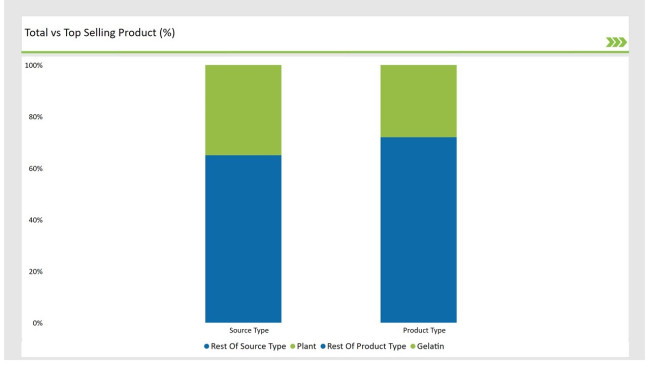

| Product Type | Market Share (2025) |

|---|---|

| Gelatin | 28% |

| Remaining segments | 72% |

The primary market driver of gelatin comes from its application in the broad spectrum of dairy, confectionery, and meat products where gelling and textural properties enhance the final product. Pectin and Xanthan gum closely follow due to their stabilization and thickening effects in beverages and bakery products.

Carrageenan and guar gum are also increasing in demand in plant-based food segments as this area of business expands toward gluten-free and clean-labeling. Agar is emerging as a niche player in the premium dessert application space, further diversifying the product category.

| Source Type | Market Share (2025) |

|---|---|

| Plant | 35% |

| Remaining segments | 65% |

The most prominent source type is plant-based stabilizers due to their natural origin and ability to fit within clean-label requirements. Animal-based stabilizers, however, still hold an important position in applications related to gelation of confectionery and dairy products.

Microbial stabilizers are taking up steam since their production is environment-friendly, and they have a premium usage category in foods. Meanwhile, seaweed-based stabilizers have seen a rising demand due to their multifunctionality and sustainability alignment as they find relevance in the dynamic landscape.

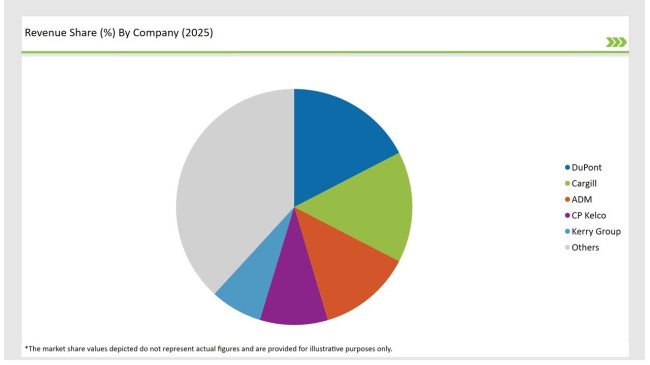

The USA Food Stabilizers market is moderately concentrated, where Tier-1 players like DuPont, Cargill, and ADM hold more than 45% of the market. Such companies hold a formidable position in the market as they possess some of the world's most advanced R&D capabilities, massive production capacities, and vast distribution networks.

For example, the recently innovated pectin solutions by DuPont and seaweed-based innovations by Cargill give them some leading positions in the market.

| Company Name | Market Share (%) |

|---|---|

| DuPont | 17.4% |

| Cargill | 15.2% |

| ADM | 12.8% |

| CP Kelco | 9.3% |

| Kerry Group | 7.1% |

| Others | 38.2% |

Tier-2 companies like Kerry Group and Ingredion have invested efforts in niche innovations, such as organic and allergen-free stabilizers.

Tier-3 companies like Palsgaard and Ashland are developing growth in these specialized applications of plant-based and gluten-free food products. The competitive landscape is one of collaborations and innovation, creating a dynamic ecosystem in which the companies stay abreast with a better offer.

By 2025, the USA Food Stabilizers market is expected to grow at a CAGR of 5.7%.

By 2035, the sales value of the USA Food Stabilizers industry is expected to reach USD 5,683.8 million.

Key factors include rising demand for clean-label products, advancements in plant-based stabilizers, and increasing applications in premium food categories.

Regions such as the Midwest and Southeast, known for their significant processed food production, dominate consumption.

Prominent players include DuPont, Cargill, ADM, CP Kelco, and Kerry Group, noted for their innovation and extensive product portfolios.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA